Key Insights

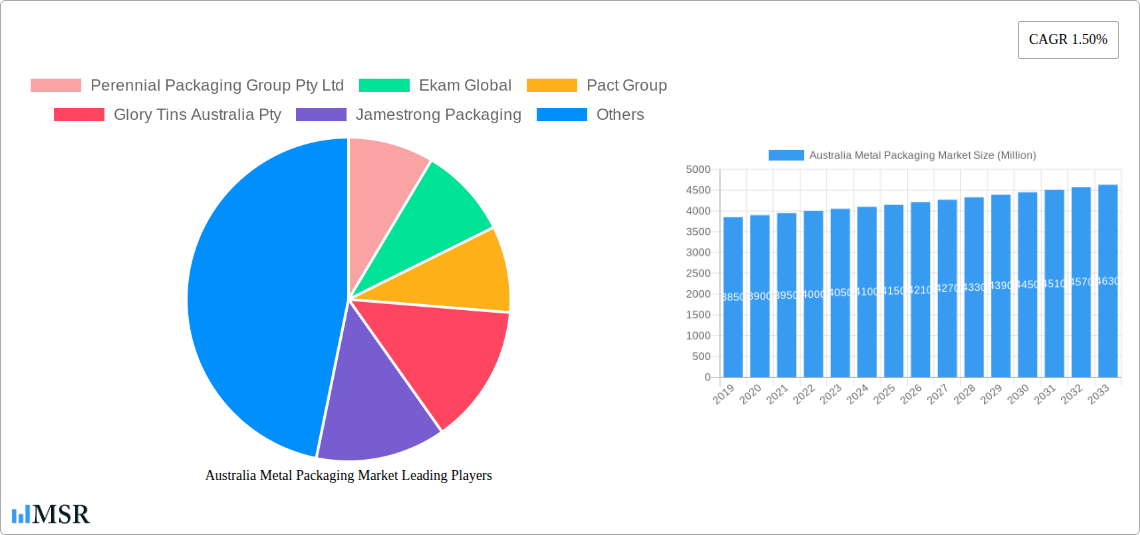

The Australian metal packaging market is projected to achieve a valuation of $38.61 billion by 2025, driven by a compound annual growth rate (CAGR) of 1.1% from 2019 to 2033. This consistent expansion is fueled by the inherent sustainability and recyclability of metal, aligning with rising consumer preference for eco-conscious packaging. Key sectors, particularly food and beverage, rely on metal cans for superior product protection and extended shelf-life. Australia's strong industrial base, coupled with demands for product preservation and safe transportation, further stimulates metal packaging adoption. Innovations in design and manufacturing, alongside a growing demand for premium and durable packaging, also contribute to market growth.

Australia Metal Packaging Market Market Size (In Billion)

While metal packaging offers significant advantages, it faces competition from alternative materials such as plastic and glass, which may present lower cost options for specific applications. Fluctuations in raw material costs for aluminum and steel can impact manufacturer profitability and pricing strategies. Supply chain volatility and energy costs for manufacturing also pose potential restraints. Nevertheless, the market is expected to benefit from trends like the growth of e-commerce, requiring robust packaging, and the expansion of the processed food and beverage industry. Leading companies are focusing on operational efficiency, innovation, and meeting evolving consumer and regulatory sustainability expectations. The market's future trajectory depends on continued advancements in material science and manufacturing to maintain cost-competitiveness and address environmental concerns.

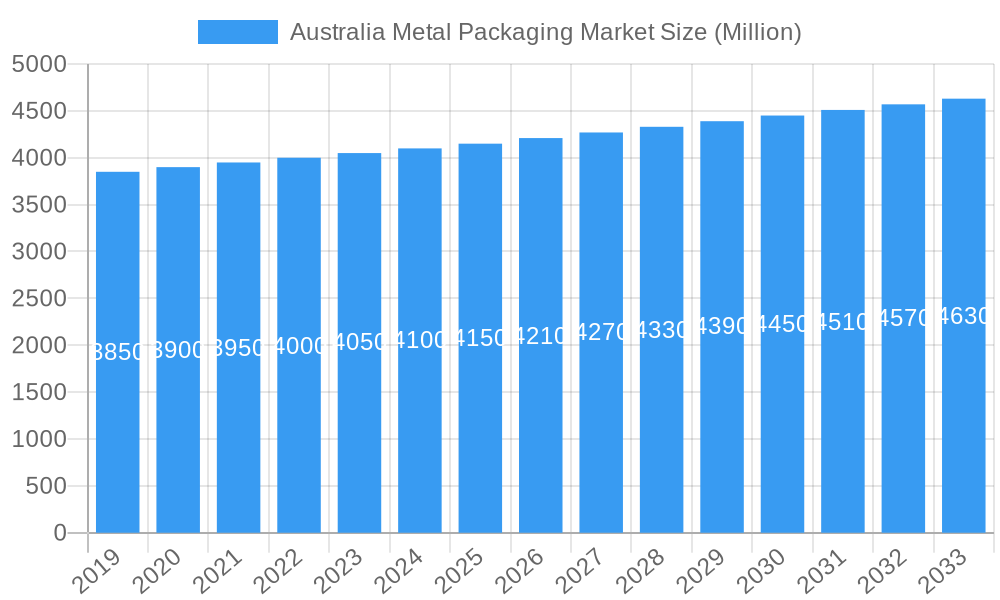

Australia Metal Packaging Market Company Market Share

Australia Metal Packaging Market: Strategic Analysis & Forecast (2019-2033)

Gain comprehensive insights into the dynamic Australian metal packaging market from 2019 to 2033, with a base year of 2025. This report provides in-depth analysis of the metal can market, tin can industry, and aluminum packaging trends across Australia. It examines production, consumption, trade flows, and pricing dynamics, offering actionable intelligence for stakeholders looking to capitalize on the increasing demand for sustainable and innovative metal packaging solutions.

Australia Metal Packaging Market Market Concentration & Dynamics

The Australian metal packaging market exhibits a moderate to high concentration, with key players like Pact Group and Orora Packaging Australia Pty Ltd holding significant market share. Innovation remains a critical driver, seen in advancements in lightweighting, enhanced barrier properties, and sustainable coating technologies. The regulatory landscape, particularly concerning recycling and environmental impact, is increasingly influencing material choices and production processes. While plastic packaging poses a substitute threat, metal's superior recyclability and durability continue to solidify its position, especially in food, beverage, and pharmaceutical applications. End-user preferences are shifting towards convenience, sustainability, and premium branding, directly impacting packaging design and material selection. Mergers and acquisitions (M&A) are a notable aspect of market dynamics, with strategic consolidations aimed at expanding capabilities, market reach, and technological portfolios. For instance, the acquisition of smaller regional players by larger entities has been observed, contributing to market consolidation and enhanced operational efficiencies. The overall M&A deal count in the last five years indicates a strategic push for growth and competitive advantage.

Australia Metal Packaging Market Industry Insights & Trends

The Australian metal packaging market is poised for robust growth, driven by a confluence of economic, technological, and consumer-driven factors. The market size is projected to reach an estimated AUD XXX Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately XX.XX% during the forecast period of 2025–2033. A significant catalyst for this expansion is the increasing consumer preference for sustainable packaging options. Metal, being infinitely recyclable, aligns perfectly with Australia's growing environmental consciousness and circular economy initiatives. The beverage sector, encompassing beer, soft drinks, and ready-to-drink (RTD) products, remains a dominant segment, fueled by evolving lifestyle trends and demand for convenient, on-the-go consumption. The food packaging segment is also witnessing substantial growth, driven by innovations in canned food preservation techniques and the demand for shelf-stable, high-quality products. Technological advancements in can manufacturing, such as advanced printing techniques for enhanced branding and lightweighting technologies to reduce material usage and transportation costs, are further propelling market expansion. The proliferation of energy drinks and specialty beverages also contributes to the demand for various can formats and sizes. The focus on premiumization in consumer goods is leading to an increased demand for visually appealing and high-quality metal packaging that can effectively communicate brand value. This trend encourages manufacturers to invest in innovative design and finishing capabilities, further stimulating market growth. The consistent upward trajectory in per capita consumption of packaged goods in Australia underscores the sustained demand for reliable and efficient packaging solutions like metal cans.

Key Markets & Segments Leading Australia Metal Packaging Market

The dominance within the Australian metal packaging market is multifaceted, with specific segments and analyses showcasing key growth areas.

Production Analysis:

- Dominant Material: Aluminum cans are leading the production landscape, driven by their lightweight properties, recyclability, and widespread adoption in the beverage industry.

- Key Manufacturing Hubs: The eastern seaboard of Australia, particularly New South Wales and Victoria, houses the majority of metal packaging manufacturing facilities due to proximity to major consumption centers and established logistics networks.

- Growth Drivers: Increasing domestic manufacturing capabilities, government initiatives promoting local production, and technological upgrades in existing facilities are significant drivers.

Consumption Analysis:

- Leading End-Use Segment: The beverage sector, including beer, soft drinks, energy drinks, and wine, is the largest consumer of metal packaging.

- Emerging Consumption Trends: A growing demand for convenient, single-serving formats, and a preference for canned beverages due to their rapid chilling capabilities and portability.

- Drivers: Growing urbanization, an expanding middle-class demographic, and the sustained popularity of ready-to-drink (RTD) alcoholic and non-alcoholic beverages.

Import Market Analysis (Value & Volume):

- Key Import Categories: While domestic production is strong, specialized metal packaging components and certain types of processed metal sheets for packaging may still be imported to meet specific industry needs.

- Dominant Importing Regions: Imports are typically sourced from regions with specialized manufacturing capabilities or cost advantages.

- Drivers: Demand for niche packaging solutions, specialized coatings, or raw materials not readily available domestically.

Export Market Analysis (Value & Volume):

- Emerging Export Destinations: Australia’s high-quality metal packaging, particularly for premium beverages and food products, has potential export markets in the Asia-Pacific region.

- Key Exported Products: Finished metal containers for food, beverages, and potentially aerosol cans for specific export markets.

- Drivers: Growing demand for Australian brands in international markets, and the country's reputation for quality and adherence to high manufacturing standards.

Price Trend Analysis:

- Influencing Factors: Fluctuations in global commodity prices for aluminum and steel, energy costs for manufacturing, and currency exchange rates significantly impact domestic pricing.

- Observed Trends: A general upward trend in pricing over the historical period due to inflationary pressures and raw material volatility, with periods of stabilization or slight decreases influenced by market supply and demand dynamics.

- Drivers: Raw material cost volatility, energy prices, and the overall supply-demand balance in the metal packaging industry.

Australia Metal Packaging Market Product Developments

Recent product innovations in the Australian metal packaging market highlight a strong focus on enhanced functionality and consumer convenience. A significant development from December 2022 saw Wallaby, an Australian canned water manufacturer, introduce a novel resealable aluminum container. This innovation was backed by a substantial AUD 500,000 investment in specialized capping machinery, enabling the adoption of wide-mouth ROPP (roll-on pilfer-proof) 38-mm aluminum closures. This move addresses a key consumer demand for reusability and extended freshness. Another notable advancement from July 2022 was the nationwide rollout of Yerbi, a new energy drink from Bickford's Group, packaged in a standard 250ml can. Yerbi's formulation, high in natural caffeine and featuring unique ingredients, underscores the versatility of metal cans in accommodating diverse beverage types and catering to evolving consumer preferences for functional drinks. These developments showcase the industry's responsiveness to market trends, driving both technological adoption and product differentiation.

Challenges in the Australia Metal Packaging Market Market

The Australian metal packaging market faces several challenges that could impede its growth trajectory.

- Raw Material Volatility: Significant price fluctuations in aluminum and steel, the primary raw materials, create unpredictability in production costs and profitability.

- Energy Costs: High and often volatile energy prices directly impact the energy-intensive manufacturing processes, affecting overall competitiveness.

- Supply Chain Disruptions: Global and domestic supply chain issues, including shipping delays and raw material availability, can lead to production slowdowns and increased lead times.

- Competition from Alternatives: While metal boasts sustainability advantages, lightweight plastics and emerging biodegradable packaging materials continue to present a competitive threat across certain applications.

- Regulatory Compliance: Evolving environmental regulations and increasing pressure for enhanced recyclability and circular economy integration require continuous investment in technology and process adaptation.

Forces Driving Australia Metal Packaging Market Growth

Several key forces are propelling the growth of the Australian metal packaging market. The escalating consumer demand for sustainable packaging solutions is a primary driver, with metal's high recyclability aligning perfectly with environmental consciousness. Technological advancements in manufacturing, such as lightweighting and improved barrier coatings, enhance efficiency and product appeal. Furthermore, the expanding beverage industry, particularly the growth of RTD products, energy drinks, and craft beers, directly fuels the demand for metal cans. Government initiatives promoting domestic manufacturing and the circular economy also provide a supportive environment for growth. The increasing popularity of premium and specialty food products, which benefit from metal packaging's protective qualities and shelf appeal, further contributes to market expansion.

Challenges in the Australia Metal Packaging Market Market

Long-term growth catalysts for the Australian metal packaging market lie in continued innovation and strategic market expansion. The industry's ability to invest in advanced recycling technologies and closed-loop systems will be crucial in solidifying its position as a leader in sustainable packaging. Partnerships between packaging manufacturers, brand owners, and waste management companies can foster greater collection and recycling rates, reinforcing the circular economy model. Expanding into new product categories beyond traditional beverages and food, such as pharmaceuticals or cosmetics, presents significant untapped potential. Furthermore, continued efforts in lightweighting and material efficiency will not only reduce costs but also enhance the environmental profile of metal packaging, making it an even more attractive option for a wider range of applications.

Emerging Opportunities in Australia Metal Packaging Market

Emerging opportunities in the Australian metal packaging market are significant and diverse. The growing demand for functional beverages, such as health drinks and adaptogen-infused beverages, presents a strong avenue for innovation in can design and functionality. The increasing trend towards convenience and on-the-go consumption will continue to drive demand for single-serving and easily portable metal packaging solutions. Furthermore, the push for premiumization across various consumer goods sectors opens doors for customized and aesthetically superior metal packaging that enhances brand value. The burgeoning e-commerce sector also offers opportunities for robust and protective metal packaging that can withstand the rigors of online distribution. Sustainability-focused innovations, such as enhanced recyclability and the development of packaging from recycled materials, will continue to be a key differentiator.

Leading Players in the Australia Metal Packaging Market Sector

- Perennial Packaging Group Pty Ltd

- Ekam Global

- Pact Group

- Glory Tins Australia Pty

- Jamestrong Packaging

- Crown Holdings Inc

- Vic Cans Australia

- Irwin Packaging Pty Ltd

- NCI Packaging

- Orora Packaging Australia Pty Ltd

Key Milestones in Australia Metal Packaging Market Industry

- December 2022: Wallaby, an Australian manufacturer of canned water, introduced a new resealable aluminum container, investing AUD 500,000 in specialist capping machinery for wide-mouth ROPP 38-mm aluminum closures.

- July 2022: Yerbi, a new energy drink from Bickford's Group, rolled out Australia-wide in a 250ml can size.

Strategic Outlook for Australia Metal Packaging Market Market

The strategic outlook for the Australian metal packaging market is exceptionally positive, driven by a confluence of sustained consumer preference for sustainability, ongoing technological innovation, and expanding end-use applications. Growth accelerators include the industry's commitment to circular economy principles, evidenced by investments in advanced recycling infrastructure and material efficiency. Strategic partnerships between manufacturers, brand owners, and recyclers will be pivotal in maximizing the lifecycle of metal packaging. Furthermore, exploring niche markets and expanding into new product categories beyond traditional beverages and food will unlock significant future potential. The continuous development of lightweight, high-performance metal packaging solutions will ensure its continued relevance and competitiveness in the evolving market landscape.

Australia Metal Packaging Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Australia Metal Packaging Market Segmentation By Geography

- 1. Australia

Australia Metal Packaging Market Regional Market Share

Geographic Coverage of Australia Metal Packaging Market

Australia Metal Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Demand is Expected to Increase Owing to the Advantages such as Stability

- 3.2.2 Rigidity

- 3.2.3 and High Barrier Qualities.

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulations on the Usage of Plastic Bottles

- 3.4. Market Trends

- 3.4.1. Aluminum is Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Metal Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Perennial Packaging Group Pty Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ekam Global

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pact Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Glory Tins Australia Pty

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jamestrong Packaging

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Crown Holdings Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vic Cans Australia

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Irwin Packaging Pty Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 NCI Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Orora Packaging Australia Pty Lt

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Perennial Packaging Group Pty Ltd

List of Figures

- Figure 1: Australia Metal Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia Metal Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Metal Packaging Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Australia Metal Packaging Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Australia Metal Packaging Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Australia Metal Packaging Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Australia Metal Packaging Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Australia Metal Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Australia Metal Packaging Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Australia Metal Packaging Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Australia Metal Packaging Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Australia Metal Packaging Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Australia Metal Packaging Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Australia Metal Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Metal Packaging Market?

The projected CAGR is approximately 1.1%.

2. Which companies are prominent players in the Australia Metal Packaging Market?

Key companies in the market include Perennial Packaging Group Pty Ltd, Ekam Global, Pact Group, Glory Tins Australia Pty, Jamestrong Packaging, Crown Holdings Inc, Vic Cans Australia, Irwin Packaging Pty Ltd, NCI Packaging, Orora Packaging Australia Pty Lt.

3. What are the main segments of the Australia Metal Packaging Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.61 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand is Expected to Increase Owing to the Advantages such as Stability. Rigidity. and High Barrier Qualities..

6. What are the notable trends driving market growth?

Aluminum is Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

; Stringent Regulations on the Usage of Plastic Bottles.

8. Can you provide examples of recent developments in the market?

December 2022: Wallaby, an Australian manufacturer of canned water, introduced a new resealable aluminum container to the market. To cap the bottles, Wallaby invested AUD 500,000 in specialist capping machinery. The closures are wide-mouth ROPP (roll-on pilfer-proof) 38-mm aluminum closures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Metal Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Metal Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Metal Packaging Market?

To stay informed about further developments, trends, and reports in the Australia Metal Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence