Key Insights

The pharmaceutical packaging machinery market is poised for substantial growth, driven by escalating pharmaceutical production, stringent regulatory mandates for drug safety and traceability, and the increasing demand for innovative packaging solutions. The market, valued at $6.62 billion in 2025, is projected to expand at a compound annual growth rate (CAGR) of 7.74% from 2025 to 2033. This expansion is underpinned by several key drivers. The rising global prevalence of chronic diseases is augmenting demand for pharmaceutical products, thereby increasing the need for efficient and reliable packaging machinery. Moreover, advancements in packaging technologies, including serialization and track-and-trace capabilities, are crucial for ensuring product authenticity and combating counterfeiting, further stimulating market growth. The growing adoption of automation in pharmaceutical manufacturing processes is also a significant contributor, enhancing productivity and reducing operational costs. The market is segmented by machinery type, encompassing primary packaging (e.g., blister packs, bottles), secondary packaging (e.g., cartons, cases), and labeling and serialization equipment, reflecting the diverse needs of pharmaceutical manufacturers across various drug delivery formats. Key industry leaders, including Marchesini Group, Ishida, and Syntegon Technology, are spearheading innovation and expanding their market presence through strategic collaborations, acquisitions, and technological breakthroughs.

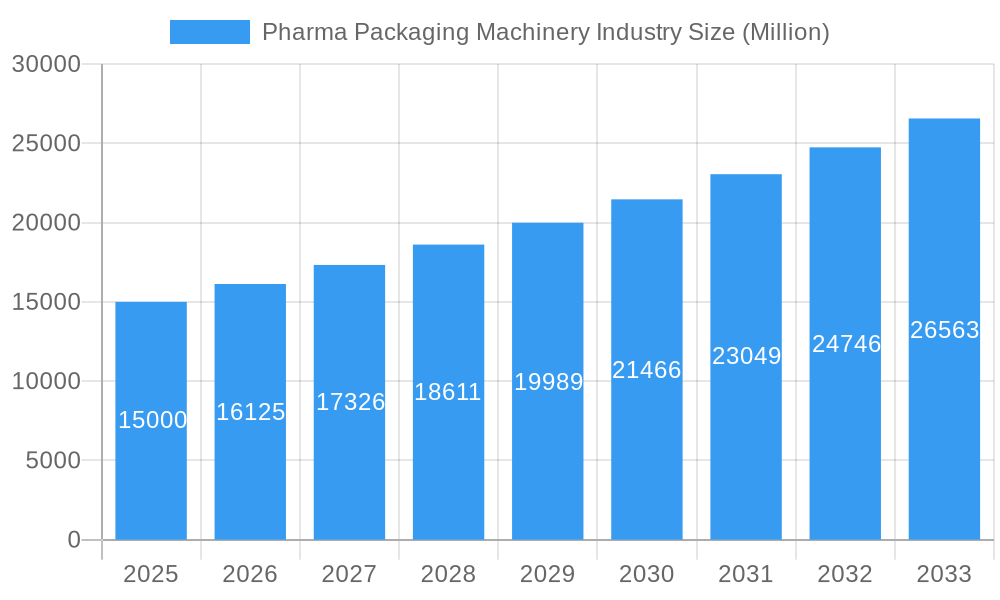

Pharma Packaging Machinery Industry Market Size (In Billion)

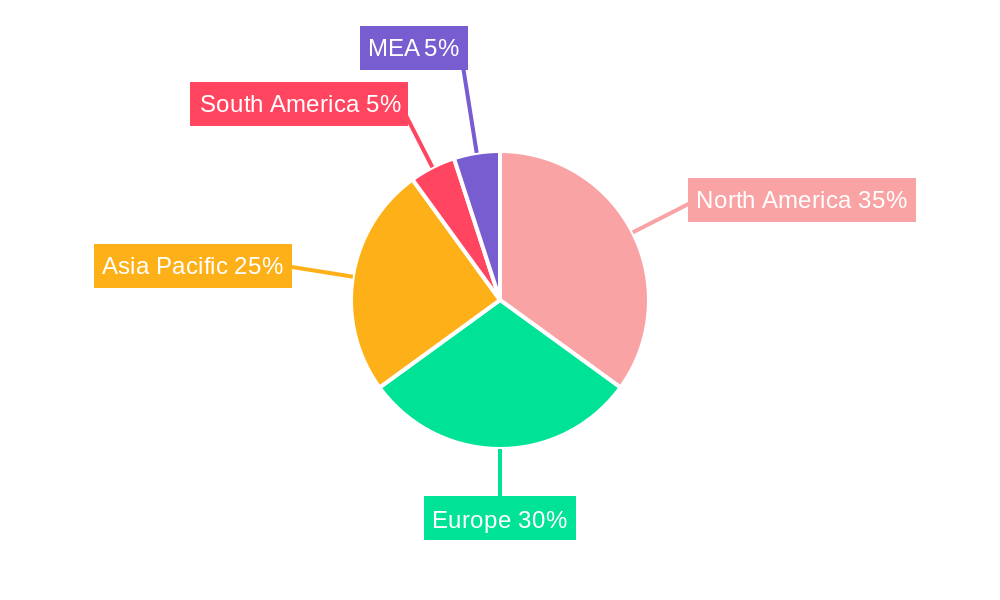

Geographical analysis indicates significant market opportunities across North America, Europe, and Asia Pacific. North America currently commands a substantial market share, attributed to the presence of major pharmaceutical corporations and a robust regulatory framework. However, the Asia Pacific region is anticipated to experience the most rapid growth in the coming years, propelled by the expanding pharmaceutical industries in China and India. Europe, with its established pharmaceutical manufacturing base, continues to be a vital market. Despite challenges such as the high cost of advanced machinery and the complexities of regulatory compliance, the overall outlook for the pharmaceutical packaging machinery market remains optimistic, promising considerable growth potential throughout the forecast period. The market's continuous evolution towards advanced automation, enhanced security features, and sustainable packaging solutions will shape its future trajectory.

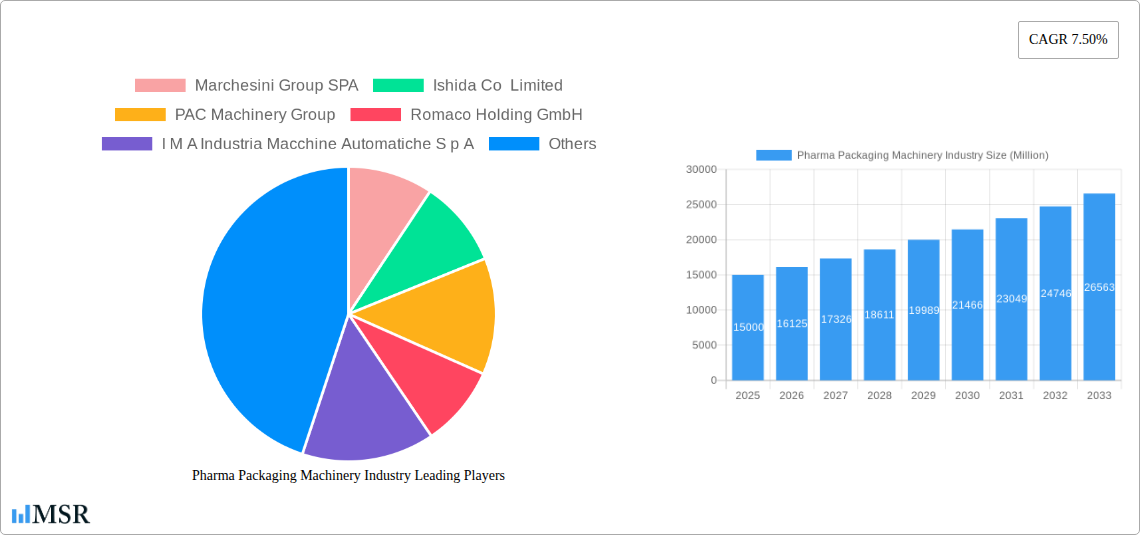

Pharma Packaging Machinery Industry Company Market Share

Pharma Packaging Machinery Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the global Pharma Packaging Machinery Industry, offering invaluable insights for stakeholders, investors, and industry professionals. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report meticulously analyzes market dynamics, key segments (Primary Packaging, Secondary Packaging, Labelling and Serialization), leading players (including Marchesini Group SPA, Ishida Co Limited, and Syntegon Technology GmbH), and emerging trends, projecting a market value exceeding xx Million by 2033.

Pharma Packaging Machinery Industry Market Concentration & Dynamics

The Pharma Packaging Machinery industry exhibits a moderately concentrated market structure, with several key players holding significant market share. Marchesini Group SPA, Ishida Co Limited, and Syntegon Technology GmbH are among the leading companies, collectively commanding approximately xx% of the global market in 2025. The industry is characterized by a dynamic innovation ecosystem, driven by continuous advancements in automation, serialization technologies, and sustainable packaging solutions. Stringent regulatory frameworks, particularly concerning drug safety and traceability, heavily influence industry practices. Substitute products are limited, mainly focusing on alternative packaging materials rather than complete machinery replacements. End-user trends lean towards increased automation, enhanced security features (e.g., anti-counterfeiting measures), and environmentally friendly packaging.

M&A activity has been significant, with xx major deals recorded between 2019 and 2024, primarily driven by companies seeking to expand their product portfolios and geographical reach. The average deal size during this period was approximately xx Million. This consolidation is expected to continue, further shaping the competitive landscape.

- Market Share: Marchesini Group SPA (xx%), Ishida Co Limited (xx%), Syntegon Technology GmbH (xx%), Others (xx%) (2025 Estimates)

- M&A Deal Count: xx (2019-2024)

- Average Deal Size: xx Million (2019-2024)

Pharma Packaging Machinery Industry Industry Insights & Trends

The global Pharma Packaging Machinery market is experiencing robust growth, driven by a multitude of factors. The market size reached xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Rising pharmaceutical production, stringent regulatory compliance needs, and increasing demand for advanced packaging solutions are key growth catalysts. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Industry 4.0 principles, are transforming manufacturing processes, leading to improved efficiency and reduced operational costs. Evolving consumer behaviors, demanding safer and more convenient packaging, are pushing the industry to innovate in areas like tamper-evident closures and sustainable packaging materials. Growth is further fueled by the expansion of the pharmaceutical industry in emerging economies, particularly in Asia-Pacific and Latin America.

Key Markets & Segments Leading Pharma Packaging Machinery Industry

The North American region currently holds a dominant position in the Pharma Packaging Machinery market, accounting for approximately xx% of global revenue in 2025. This dominance stems from strong pharmaceutical industry growth, robust regulatory frameworks, and high levels of technological adoption. Europe follows closely, with a market share of approximately xx%. Within segments, the Primary Packaging machinery segment leads with a xx% share of the overall market in 2025, driven by the fundamental need for packaging pharmaceuticals for safety and efficacy. Secondary Packaging and Labelling & Serialization segments are also experiencing significant growth, propelled by the rising demand for tamper-evident packaging, enhanced product traceability, and serialization compliance.

- Dominant Region: North America (xx% market share in 2025)

- Key Segment: Primary Packaging (xx% market share in 2025)

Drivers for North American Dominance:

- Strong pharmaceutical industry growth.

- Robust regulatory environment promoting advanced packaging technologies.

- High levels of technological adoption and innovation.

- Well-established infrastructure and supply chains.

Drivers for Primary Packaging Segment Dominance:

- Essential for drug safety and efficacy.

- Fundamental requirement for pharmaceutical production.

- Ongoing innovation in materials and design.

Pharma Packaging Machinery Industry Product Developments

Recent product innovations have focused on enhancing automation, improving efficiency, and incorporating advanced features like serialization and track-and-trace capabilities. Integration of robotics, AI, and machine learning are key technological advancements, enabling faster and more precise packaging processes. These developments provide manufacturers with competitive edges by improving throughput, reducing operational costs, and ensuring compliance with stringent regulations. The market is witnessing increased demand for flexible and adaptable machinery capable of handling diverse product formats and batch sizes.

Challenges in the Pharma Packaging Machinery Industry Market

The Pharma Packaging Machinery industry faces several challenges, including stringent regulatory hurdles, complex supply chain dynamics and intense competition. Regulatory compliance (e.g., serialization standards) requires significant investment and expertise, potentially delaying product launches. Supply chain disruptions, especially in the procurement of crucial components, can lead to production delays and cost overruns. The highly competitive market, with numerous established and emerging players, necessitates continuous innovation and aggressive pricing strategies to maintain market share. These challenges combined contribute to a xx% reduction in estimated profit margin for several companies in 2024.

Forces Driving Pharma Packaging Machinery Industry Growth

Several key factors are driving the growth of the Pharma Packaging Machinery industry. Technological advancements such as AI-powered automation and advanced robotics significantly increase efficiency and reduce operational costs. The growing demand for pharmaceuticals globally, particularly in emerging markets, fuels the need for increased packaging capacity. Moreover, stringent regulatory requirements related to drug safety and traceability are driving adoption of advanced packaging technologies. For example, the implementation of serialization standards in various countries is creating a substantial demand for serialization-enabled packaging machinery.

Challenges in the Pharma Packaging Machinery Industry Market

Long-term growth will be propelled by continued innovation in packaging technologies, strategic partnerships and collaborations among manufacturers, and market expansion into new geographical regions and therapeutic areas. Investments in R&D, specifically focusing on sustainable and smart packaging solutions, will be crucial for maintaining a competitive edge. Strategic alliances with pharmaceutical companies will allow for tailored packaging solutions, strengthening the relationship with key clients. Expanding into high-growth markets with emerging pharmaceutical industries presents significant opportunities for revenue generation.

Emerging Opportunities in Pharma Packaging Machinery Industry

Emerging opportunities include the growing demand for sustainable and eco-friendly packaging solutions, the increasing adoption of digital technologies like cloud computing and the Internet of Things (IoT), and the expansion of personalized medicine requiring customized packaging solutions. The development of innovative packaging materials with enhanced barrier properties to extend shelf-life is also a key opportunity area. Furthermore, catering to the personalized medicine market by designing packaging for individualized therapies presents substantial growth potential.

Leading Players in the Pharma Packaging Machinery Industry Sector

- Marchesini Group SPA

- Ishida Co Limited

- PAC Machinery Group

- Romaco Holding GmbH

- I M A Industria Macchine Automatiche S p A

- Uhlmann Group

- MG2 s r l

- Syntegon Technology GmbH (Robert Bosch GmbH)

- MULTIVAC Group

- Accutek Packaging Equipment Companies Inc

- Mesoblast Limited

- Vanguard Pharmaceutical Machinery Inc

- Optima Packaging Group GmbH

Key Milestones in Pharma Packaging Machinery Industry Industry

- 2020: Increased adoption of serialization technologies driven by regulatory mandates.

- 2021: Several key players launched new lines of automated packaging machines.

- 2022: Significant investments in R&D focusing on sustainable packaging materials.

- 2023: Several mergers and acquisitions reshaped the competitive landscape.

- 2024: Focus on Industry 4.0 principles and integration of AI.

Strategic Outlook for Pharma Packaging Machinery Industry Market

The Pharma Packaging Machinery market is poised for continued growth, driven by technological advancements, regulatory changes, and the expanding pharmaceutical industry. Strategic opportunities exist in developing sustainable packaging solutions, integrating digital technologies, and expanding into emerging markets. Companies focusing on innovation, strategic partnerships, and a strong understanding of regulatory compliance will be well-positioned to capture significant market share in the coming years. The overall market outlook remains positive, projecting substantial growth and value creation for key players.

Pharma Packaging Machinery Industry Segmentation

-

1. Machinery Type

-

1.1. Primary Packaging

- 1.1.1. Aseptic Filling and Sealing Equipmen

- 1.1.2. Bottle Filling and Capping Equipment

- 1.1.3. Blister Packaging Equipment

- 1.1.4. Others

-

1.2. Secondary Packaging

- 1.2.1. Cartoning Equipment

- 1.2.2. Case Packaging Equipment

- 1.2.3. Wrapping Equipment

- 1.2.4. Tray Packing Equipment

-

1.3. Labelling and Serialization

- 1.3.1. Bottle a

- 1.3.2. Carton Labelling and Serialization Equipment

-

1.1. Primary Packaging

Pharma Packaging Machinery Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Pharma Packaging Machinery Industry Regional Market Share

Geographic Coverage of Pharma Packaging Machinery Industry

Pharma Packaging Machinery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; High Demand in Key End-user Markets; Ongoing Technological Developments; Impact of Safety Standards & Regulations in the Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. ; High Costs and Import Duties Pose a Challenge for New Customers; Capital Intensive Manufacturing Process

- 3.4. Market Trends

- 3.4.1. The Presence of Safety Standards & Regulations in the Pharmaceutical Industry Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharma Packaging Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Primary Packaging

- 5.1.1.1. Aseptic Filling and Sealing Equipmen

- 5.1.1.2. Bottle Filling and Capping Equipment

- 5.1.1.3. Blister Packaging Equipment

- 5.1.1.4. Others

- 5.1.2. Secondary Packaging

- 5.1.2.1. Cartoning Equipment

- 5.1.2.2. Case Packaging Equipment

- 5.1.2.3. Wrapping Equipment

- 5.1.2.4. Tray Packing Equipment

- 5.1.3. Labelling and Serialization

- 5.1.3.1. Bottle a

- 5.1.3.2. Carton Labelling and Serialization Equipment

- 5.1.1. Primary Packaging

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. North America Pharma Packaging Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6.1.1. Primary Packaging

- 6.1.1.1. Aseptic Filling and Sealing Equipmen

- 6.1.1.2. Bottle Filling and Capping Equipment

- 6.1.1.3. Blister Packaging Equipment

- 6.1.1.4. Others

- 6.1.2. Secondary Packaging

- 6.1.2.1. Cartoning Equipment

- 6.1.2.2. Case Packaging Equipment

- 6.1.2.3. Wrapping Equipment

- 6.1.2.4. Tray Packing Equipment

- 6.1.3. Labelling and Serialization

- 6.1.3.1. Bottle a

- 6.1.3.2. Carton Labelling and Serialization Equipment

- 6.1.1. Primary Packaging

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7. Europe Pharma Packaging Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7.1.1. Primary Packaging

- 7.1.1.1. Aseptic Filling and Sealing Equipmen

- 7.1.1.2. Bottle Filling and Capping Equipment

- 7.1.1.3. Blister Packaging Equipment

- 7.1.1.4. Others

- 7.1.2. Secondary Packaging

- 7.1.2.1. Cartoning Equipment

- 7.1.2.2. Case Packaging Equipment

- 7.1.2.3. Wrapping Equipment

- 7.1.2.4. Tray Packing Equipment

- 7.1.3. Labelling and Serialization

- 7.1.3.1. Bottle a

- 7.1.3.2. Carton Labelling and Serialization Equipment

- 7.1.1. Primary Packaging

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8. Asia Pacific Pharma Packaging Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8.1.1. Primary Packaging

- 8.1.1.1. Aseptic Filling and Sealing Equipmen

- 8.1.1.2. Bottle Filling and Capping Equipment

- 8.1.1.3. Blister Packaging Equipment

- 8.1.1.4. Others

- 8.1.2. Secondary Packaging

- 8.1.2.1. Cartoning Equipment

- 8.1.2.2. Case Packaging Equipment

- 8.1.2.3. Wrapping Equipment

- 8.1.2.4. Tray Packing Equipment

- 8.1.3. Labelling and Serialization

- 8.1.3.1. Bottle a

- 8.1.3.2. Carton Labelling and Serialization Equipment

- 8.1.1. Primary Packaging

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9. Latin America Pharma Packaging Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9.1.1. Primary Packaging

- 9.1.1.1. Aseptic Filling and Sealing Equipmen

- 9.1.1.2. Bottle Filling and Capping Equipment

- 9.1.1.3. Blister Packaging Equipment

- 9.1.1.4. Others

- 9.1.2. Secondary Packaging

- 9.1.2.1. Cartoning Equipment

- 9.1.2.2. Case Packaging Equipment

- 9.1.2.3. Wrapping Equipment

- 9.1.2.4. Tray Packing Equipment

- 9.1.3. Labelling and Serialization

- 9.1.3.1. Bottle a

- 9.1.3.2. Carton Labelling and Serialization Equipment

- 9.1.1. Primary Packaging

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10. Middle East Pharma Packaging Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10.1.1. Primary Packaging

- 10.1.1.1. Aseptic Filling and Sealing Equipmen

- 10.1.1.2. Bottle Filling and Capping Equipment

- 10.1.1.3. Blister Packaging Equipment

- 10.1.1.4. Others

- 10.1.2. Secondary Packaging

- 10.1.2.1. Cartoning Equipment

- 10.1.2.2. Case Packaging Equipment

- 10.1.2.3. Wrapping Equipment

- 10.1.2.4. Tray Packing Equipment

- 10.1.3. Labelling and Serialization

- 10.1.3.1. Bottle a

- 10.1.3.2. Carton Labelling and Serialization Equipment

- 10.1.1. Primary Packaging

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Marchesini Group SPA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ishida Co Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PAC Machinery Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Romaco Holding GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 I M A Industria Macchine Automatiche S p A

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Uhlmann Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MG2 s r l *List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Syntegon Technology GmbH (Robert Bosch GmbH)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MULTIVAC Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Accutek Packaging Equipment Companies Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mesoblast Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Vanguard Pharmaceutical Machinery Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Optima Packaging Group GmbH

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Marchesini Group SPA

List of Figures

- Figure 1: Global Pharma Packaging Machinery Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Pharma Packaging Machinery Industry Revenue (billion), by Machinery Type 2025 & 2033

- Figure 3: North America Pharma Packaging Machinery Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 4: North America Pharma Packaging Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Pharma Packaging Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Pharma Packaging Machinery Industry Revenue (billion), by Machinery Type 2025 & 2033

- Figure 7: Europe Pharma Packaging Machinery Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 8: Europe Pharma Packaging Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Pharma Packaging Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Pharma Packaging Machinery Industry Revenue (billion), by Machinery Type 2025 & 2033

- Figure 11: Asia Pacific Pharma Packaging Machinery Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 12: Asia Pacific Pharma Packaging Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Pharma Packaging Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Pharma Packaging Machinery Industry Revenue (billion), by Machinery Type 2025 & 2033

- Figure 15: Latin America Pharma Packaging Machinery Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 16: Latin America Pharma Packaging Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Pharma Packaging Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Pharma Packaging Machinery Industry Revenue (billion), by Machinery Type 2025 & 2033

- Figure 19: Middle East Pharma Packaging Machinery Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 20: Middle East Pharma Packaging Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East Pharma Packaging Machinery Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 2: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 4: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 6: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 8: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 10: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 12: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharma Packaging Machinery Industry?

The projected CAGR is approximately 7.74%.

2. Which companies are prominent players in the Pharma Packaging Machinery Industry?

Key companies in the market include Marchesini Group SPA, Ishida Co Limited, PAC Machinery Group, Romaco Holding GmbH, I M A Industria Macchine Automatiche S p A, Uhlmann Group, MG2 s r l *List Not Exhaustive, Syntegon Technology GmbH (Robert Bosch GmbH), MULTIVAC Group, Accutek Packaging Equipment Companies Inc, Mesoblast Limited, Vanguard Pharmaceutical Machinery Inc, Optima Packaging Group GmbH.

3. What are the main segments of the Pharma Packaging Machinery Industry?

The market segments include Machinery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.62 billion as of 2022.

5. What are some drivers contributing to market growth?

; High Demand in Key End-user Markets; Ongoing Technological Developments; Impact of Safety Standards & Regulations in the Pharmaceutical Industry.

6. What are the notable trends driving market growth?

The Presence of Safety Standards & Regulations in the Pharmaceutical Industry Expected to Drive the Market.

7. Are there any restraints impacting market growth?

; High Costs and Import Duties Pose a Challenge for New Customers; Capital Intensive Manufacturing Process.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharma Packaging Machinery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharma Packaging Machinery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharma Packaging Machinery Industry?

To stay informed about further developments, trends, and reports in the Pharma Packaging Machinery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence