Key Insights

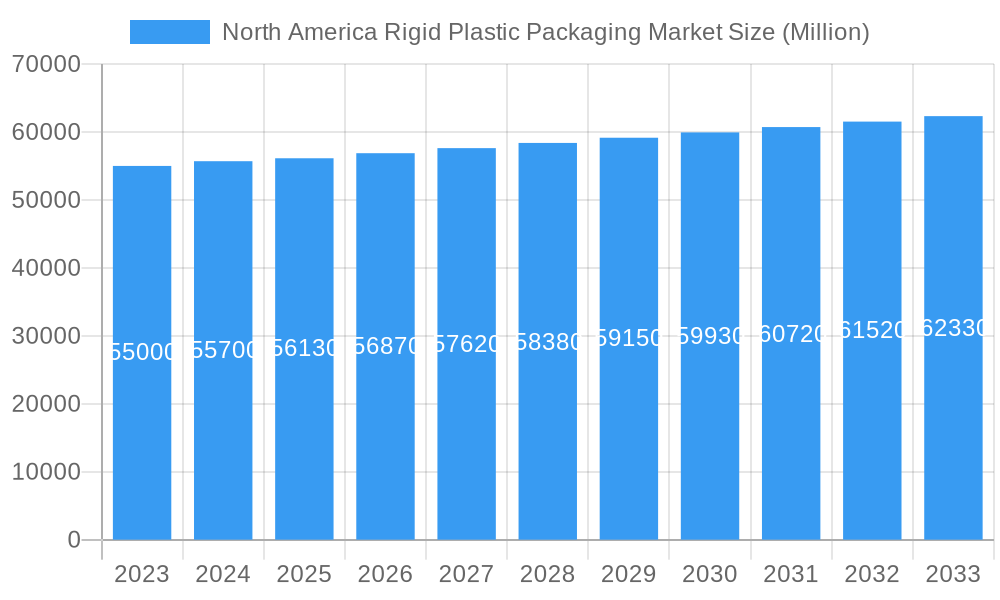

The North America rigid plastic packaging market is a significant and established sector, projected to reach $15.51 million by 2025, with a Compound Annual Growth Rate (CAGR) of 2.13%. This stable expansion is driven by increasing demand for convenient and durable packaging, especially in the food and beverage, healthcare, and cosmetics industries. Rigid plastic's strength, reusability, and aesthetic appeal also contribute to its widespread adoption in industrial applications.

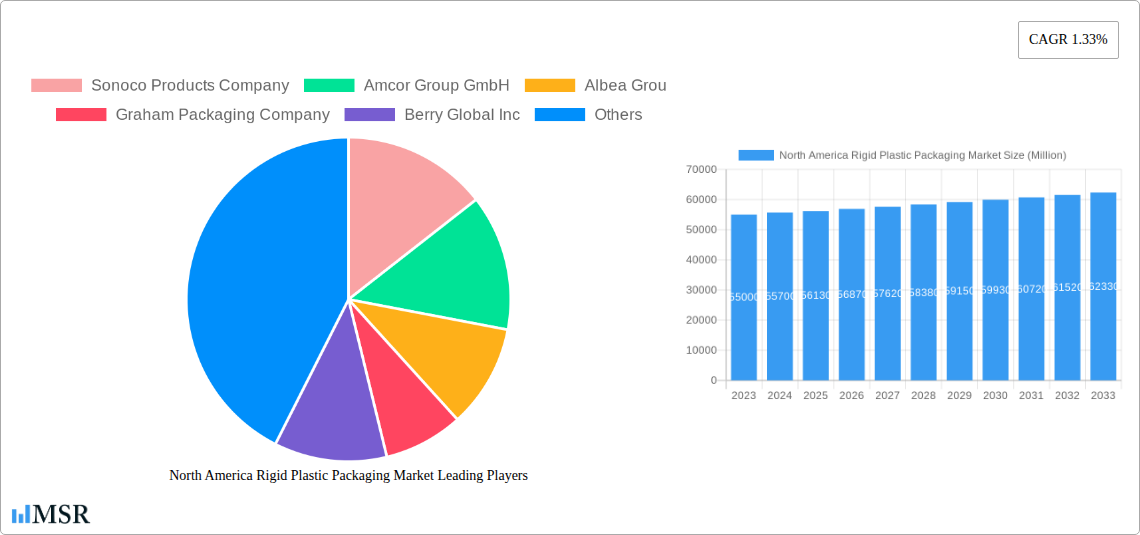

North America Rigid Plastic Packaging Market Market Size (In Million)

However, environmental concerns and regulations regarding plastic waste are driving a shift towards sustainable alternatives, biodegradable materials, and enhanced recycling. The market is actively adapting through technological advancements focused on recyclability and circularity. Key trends include the growth of e-commerce, requiring robust packaging, and ongoing innovation in product design for improved functionality and consumer appeal. Polyethylene (PE) and polypropylene (PP) remain dominant resin types due to their versatility and cost-effectiveness, with bottles, jars, trays, and containers being primary product forms.

North America Rigid Plastic Packaging Market Company Market Share

North America Rigid Plastic Packaging Market: Analysis & Forecast (2025-2033)

Explore the dynamic North America rigid plastic packaging market with this comprehensive industry analysis. Gain actionable insights into market size, segmentation, key trends, competitive landscape, and future projections. This report is your essential guide to understanding growth drivers, challenges, and opportunities in the North American rigid plastic packaging sector.

This report details the North American rigid plastic packaging industry, including market size, share, CAGR, and forecasts through 2033. It analyzes segments such as Polyethylene (PE) packaging, High-Density Polyethylene (HDPE) containers, Polyethylene Terephthalate (PET) bottles, Polypropylene (PP) packaging, and Polystyrene (PS) packaging. Product types like rigid plastic bottles and jars, trays and containers, caps and closures, intermediate bulk containers (IBCs), and drums are examined. Market penetration and trends across critical end-use industries, including food packaging, beverage packaging, healthcare packaging, cosmetics and personal care packaging, and industrial packaging, are thoroughly covered.

The analysis covers the period up to 2033, with a base year of 2025 and a forecast period from 2025 to 2033.

Key players include Sonoco Products Company, Amcor Group GmbH, Albea Grou, Graham Packaging Company, Berry Global Inc, Silgan Holdings Inc, Plastipak Holding Inc, Sealed Air Corporation, Alpla Werke Alwin Lehner GmbH & Co KG, and Huhtamaki Inc.

North America Rigid Plastic Packaging Market Market Concentration & Dynamics

The North America rigid plastic packaging market exhibits a moderately concentrated landscape, characterized by the presence of both large multinational corporations and specialized regional players. Innovation ecosystems are vibrant, driven by a growing demand for sustainable packaging solutions and enhanced product performance. Regulatory frameworks are increasingly emphasizing recyclability, recycled content, and waste reduction, impacting material selection and product design. Substitute products, such as glass, metal, and paperboard packaging, present ongoing competition, particularly in niche applications. End-user trends are shifting towards convenience, shelf-life extension, and aesthetic appeal, directly influencing packaging design and functionality. Mergers and acquisitions (M&A) activities remain a significant factor in market consolidation and expansion, with key deals often focused on acquiring advanced recycling technologies or expanding market reach within specific end-use industries. For instance, the Tesco and Faerch collaboration in April 2023 exemplifies a strategic move towards circular economy principles, involving M&A or partnership to enhance recycled content in food-grade trays. The number of M&A deals in the past two years hovers around xx, indicating a dynamic market where strategic consolidation is paramount for maintaining competitive advantage.

North America Rigid Plastic Packaging Market Industry Insights & Trends

The North America rigid plastic packaging market is poised for robust growth, fueled by a confluence of escalating consumer demand, technological advancements, and evolving industry practices. The market size is projected to reach approximately USD XXX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around XX% during the forecast period (2025-2033). Key growth drivers include the expanding food and beverage sector, a rising demand for convenient and single-serve packaging in foodservice, and the stringent requirements for safe and sterile packaging in the healthcare industry. Technological disruptions, such as advancements in barrier properties, lightweighting, and the development of advanced recycling technologies, are reshaping product offerings and environmental footprints. Evolving consumer behaviors, including a growing awareness of environmental sustainability and a preference for visually appealing and user-friendly packaging, are compelling manufacturers to innovate. The increasing adoption of PET bottles and jars for beverages and personal care products, coupled with the versatility of HDPE containers across diverse applications, underscores their market dominance. Furthermore, the focus on improving the recyclability of PP packaging and exploring new applications for PS and EPS packaging is a significant trend. The overall industry is experiencing a paradigm shift towards a more circular economy, with a strong emphasis on reducing virgin plastic consumption and increasing the use of post-consumer recycled (PCR) materials, as highlighted by the Ecolab and TotalEnergies partnership in February 2023 aimed at introducing plastic packaging with recycled content for heavy-duty applications.

Key Markets & Segments Leading North America Rigid Plastic Packaging Market

The North America rigid plastic packaging market is characterized by significant dominance in specific regions and segments. The United States continues to be the largest market, driven by its vast consumer base, robust industrial infrastructure, and high disposable incomes, closely followed by Canada.

Within Resin Types, Polyethylene Terephthalate (PET) reigns supreme, primarily due to its widespread use in beverage bottles, food containers, and personal care product packaging. Its clarity, strength, and recyclability make it a preferred choice. High-Density Polyethylene (HDPE) holds a strong second position, particularly for bottles and containers in the dairy, household chemicals, and industrial sectors, owing to its excellent chemical resistance and durability. Polypropylene (PP) is experiencing substantial growth, driven by its application in food trays, caps, and closures, and its improving recyclability.

In terms of Product Types, Bottles and Jars constitute the largest segment, a direct reflection of their extensive use in the food, beverage, and personal care industries. Trays and Containers are also a significant segment, especially with the growing demand for ready-to-eat meals and fresh produce packaging. Caps and Closures are essential components and represent a substantial market share due to their necessity across nearly all rigid plastic packaging applications.

The End-use Industries driving this market are predominantly Food and Beverage. Within the Food sector, Dairy Products, Frozen Foods, and Dry Foods are major consumers of rigid plastic packaging, demanding solutions that ensure product safety, shelf-life, and visual appeal. The Beverage industry's reliance on PET bottles for carbonated soft drinks, water, and juices remains a cornerstone of the market. The Healthcare sector, with its strict regulatory demands for sterile and protective packaging for pharmaceuticals and medical devices, also represents a crucial and growing segment. The Cosmetics and Personal Care industry leverages rigid plastics for their aesthetic versatility, enabling attractive product presentation.

North America Rigid Plastic Packaging Market Product Developments

Product developments in the North America rigid plastic packaging market are largely focused on enhancing sustainability, functionality, and consumer convenience. Innovations include the development of advanced barrier technologies to extend product shelf-life, the creation of lightweight yet durable designs to reduce material usage and transportation costs, and the integration of smart packaging features for traceability and consumer engagement. A significant trend is the development of packaging made from mono-materials or enhanced recyclability to improve circularity. For instance, companies are investing in designing PET bottles that are more easily recyclable or developing innovative solutions for hard-to-recycle plastics. The increased use of recycled content, such as post-consumer recycled PET (rPET) and recycled HDPE, in primary packaging is also a prominent development, driven by both regulatory pressures and consumer demand for more sustainable options.

Challenges in the North America Rigid Plastic Packaging Market Market

The North America rigid plastic packaging market faces several significant challenges. Stringent and evolving regulatory landscapes concerning plastic waste, recycling infrastructure limitations, and consumer perception of plastic as an environmental concern pose considerable hurdles. Fluctuations in raw material prices, particularly for crude oil derivatives, can impact production costs and profit margins. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can affect the availability and timely delivery of materials and finished products. Intense competition among manufacturers, coupled with the constant pressure to innovate and offer cost-effective solutions, also presents a challenge to market players. The ongoing push for reduced plastic usage and the development of alternative packaging materials, though an opportunity for innovation, also represents a competitive threat to traditional rigid plastic packaging solutions.

Forces Driving North America Rigid Plastic Packaging Market Growth

Several key forces are propelling the growth of the North America rigid plastic packaging market. The escalating demand for convenience and single-serve packaging across the food, beverage, and foodservice sectors is a primary driver. The expanding healthcare industry, with its unwavering need for sterile, safe, and tamper-evident packaging, significantly contributes to market expansion. Technological advancements in material science and processing, enabling the creation of lighter, stronger, and more sustainable rigid plastic packaging solutions, are also crucial. Furthermore, a growing global emphasis on the circular economy and increasing government initiatives promoting recycling and the use of recycled content are fostering innovation and market opportunities for sustainable rigid plastic packaging. The ability of rigid plastics to offer superior barrier properties, thus extending product shelf-life and reducing food waste, remains a compelling advantage.

Challenges in the North America Rigid Plastic Packaging Market Market

The long-term growth of the North America rigid plastic packaging market is intricately linked to its ability to address persistent challenges and embrace transformative innovations. While plastic offers numerous advantages, its environmental impact remains a significant concern, necessitating a robust shift towards a circular economy. This involves not only enhancing the recyclability of existing packaging formats but also developing novel solutions that minimize waste and maximize resource efficiency. Investments in advanced recycling technologies, such as chemical recycling, are crucial for unlocking the potential of mixed plastic waste and creating high-quality recycled materials for food-grade applications. Furthermore, the development of bio-based and compostable rigid plastics, while still in nascent stages for widespread adoption, presents a future avenue for sustainable growth. Strategic partnerships and collaborations across the value chain, from material suppliers to brand owners and recyclers, will be essential to overcome these challenges and drive the market towards a more sustainable and resilient future.

Emerging Opportunities in North America Rigid Plastic Packaging Market

Emerging opportunities in the North America rigid plastic packaging market are predominantly centered around sustainability, digitalization, and customization. The growing consumer and regulatory demand for eco-friendly packaging is driving innovation in recycled content, mono-material design, and biodegradable/compostable alternatives, creating new market niches. The expansion of e-commerce presents opportunities for more resilient and protective rigid plastic packaging solutions tailored for direct-to-consumer shipping. Furthermore, the integration of smart packaging technologies, such as QR codes and RFID tags, for enhanced traceability, consumer engagement, and supply chain optimization, offers a significant growth avenue. The increasing focus on personalization and on-demand packaging in sectors like cosmetics and food also opens doors for flexible and innovative rigid plastic solutions. Finally, exploring new applications in emerging sectors like renewable energy components and advanced manufacturing can diversify revenue streams.

Leading Players in the North America Rigid Plastic Packaging Market Sector

- Sonoco Products Company

- Amcor Group GmbH

- Albea Grou

- Graham Packaging Company

- Berry Global Inc

- Silgan Holdings Inc

- Plastipak Holding Inc

- Sealed Air Corporation

- Alpla Werke Alwin Lehner GmbH & Co KG

- Huhtamaki Inc

Key Milestones in North America Rigid Plastic Packaging Market Industry

- April 2023: Tesco and Faerch collaborated to create a totally new way to package ready meals - by recycling used plastic trays and turning them into food-grade trays. This is the first of its kind in the industry and will involve collecting PET trays from customers and recycling them back into trays. Tesco's trays already have a minimum recycled tray content of up to 75%, but now the company is getting better - with the help of Faerch, Tesco will use bottles of flake plastic to recycle up to 30% of their tray content. This initiative significantly boosts the circular economy in food packaging and sets a new benchmark for recycled content.

- February 2023: Ecolab and TotalEnergies joined forces to initiate the introduction of plastic packaging containing recycled materials for heavy-duty applications. This marks the conclusion of a long-term partnership to incorporate post-consumer recycled plastic into the primary packaging of highly concentrated cleaning products. This partnership underscores the growing trend of using recycled plastics in industrial and professional applications, highlighting a commitment to sustainability in demanding sectors.

Strategic Outlook for North America Rigid Plastic Packaging Market Market

The strategic outlook for the North America rigid plastic packaging market is one of continuous innovation and adaptation. Manufacturers must prioritize sustainability by investing in advanced recycling technologies, increasing the use of recycled content, and designing for recyclability. Embracing digitalization and Industry 4.0 principles will be crucial for optimizing production processes, enhancing supply chain visibility, and enabling greater customization. Strategic partnerships and collaborations across the value chain will be vital for driving innovation, sharing best practices, and collectively addressing environmental challenges. The market will likely see further consolidation through M&A activities as companies seek to expand their capabilities, product portfolios, and geographical reach. Ultimately, success will hinge on the industry's ability to balance performance, cost-effectiveness, and environmental responsibility to meet the evolving demands of consumers, regulators, and brand owners.

North America Rigid Plastic Packaging Market Segmentation

-

1. Resin Type

-

1.1. Polyethylene (PE)

- 1.1.1. Low-Dens

- 1.1.2. High Density Polyethylene (HDPE)

- 1.2. Polyethylene terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 1.5. Polyvinyl chloride (PVC)

- 1.6. Other Resin Types

-

1.1. Polyethylene (PE)

-

2. Product Type

- 2.1. Bottles and Jars

- 2.2. Trays and Containers

- 2.3. Caps and Closures

- 2.4. Intermediate Bulk Containers (IBCs)

- 2.5. Drums

- 2.6. Pallets

- 2.7. Other Product Types

-

3. End-use Industries

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Food Products

-

3.2. Foodservice

- 3.2.1. Quick Service Restaurants (QSRs)

- 3.2.2. Full-Service Restaurants (FSRs)

- 3.2.3. Coffee and Snack Outlets

- 3.2.4. Retail Establishments

- 3.2.5. Institutional

- 3.2.6. Hospitality

- 3.2.7. Others Foodservice Sectors

- 3.3. Beverage

- 3.4. Healthcare

- 3.5. Cosmetics and Personal Care

- 3.6. Industrial

- 3.7. Building and Construction

- 3.8. Automotive

- 3.9. Other End User Industries

-

3.1. Food

North America Rigid Plastic Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Rigid Plastic Packaging Market Regional Market Share

Geographic Coverage of North America Rigid Plastic Packaging Market

North America Rigid Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand of FMCG Industry to Propel the Market; Cosmetic and Personal Care Sector Witnesses Soaring Demand for Rigid Plastic Packaging

- 3.3. Market Restrains

- 3.3.1. Flexible Plastic Packaging Drive Shift Benefits Over Rigid Plastic Packaging

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET) is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Polyethylene (PE)

- 5.1.1.1. Low-Dens

- 5.1.1.2. High Density Polyethylene (HDPE)

- 5.1.2. Polyethylene terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 5.1.5. Polyvinyl chloride (PVC)

- 5.1.6. Other Resin Types

- 5.1.1. Polyethylene (PE)

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles and Jars

- 5.2.2. Trays and Containers

- 5.2.3. Caps and Closures

- 5.2.4. Intermediate Bulk Containers (IBCs)

- 5.2.5. Drums

- 5.2.6. Pallets

- 5.2.7. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-use Industries

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Food Products

- 5.3.2. Foodservice

- 5.3.2.1. Quick Service Restaurants (QSRs)

- 5.3.2.2. Full-Service Restaurants (FSRs)

- 5.3.2.3. Coffee and Snack Outlets

- 5.3.2.4. Retail Establishments

- 5.3.2.5. Institutional

- 5.3.2.6. Hospitality

- 5.3.2.7. Others Foodservice Sectors

- 5.3.3. Beverage

- 5.3.4. Healthcare

- 5.3.5. Cosmetics and Personal Care

- 5.3.6. Industrial

- 5.3.7. Building and Construction

- 5.3.8. Automotive

- 5.3.9. Other End User Industries

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sonoco Products Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amcor Group GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Albea Grou

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Graham Packaging Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Berry Global Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Silgan Holdings Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Plastipak Holding Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sealed Air Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Alpla Werke Alwin Lehner GmbH & Co KG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Huhtamaki Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sonoco Products Company

List of Figures

- Figure 1: North America Rigid Plastic Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Rigid Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: North America Rigid Plastic Packaging Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 2: North America Rigid Plastic Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: North America Rigid Plastic Packaging Market Revenue million Forecast, by End-use Industries 2020 & 2033

- Table 4: North America Rigid Plastic Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: North America Rigid Plastic Packaging Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 6: North America Rigid Plastic Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: North America Rigid Plastic Packaging Market Revenue million Forecast, by End-use Industries 2020 & 2033

- Table 8: North America Rigid Plastic Packaging Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States North America Rigid Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Rigid Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Rigid Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Rigid Plastic Packaging Market?

The projected CAGR is approximately 2.13%.

2. Which companies are prominent players in the North America Rigid Plastic Packaging Market?

Key companies in the market include Sonoco Products Company, Amcor Group GmbH, Albea Grou, Graham Packaging Company, Berry Global Inc, Silgan Holdings Inc, Plastipak Holding Inc, Sealed Air Corporation, Alpla Werke Alwin Lehner GmbH & Co KG, Huhtamaki Inc.

3. What are the main segments of the North America Rigid Plastic Packaging Market?

The market segments include Resin Type, Product Type, End-use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.51 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand of FMCG Industry to Propel the Market; Cosmetic and Personal Care Sector Witnesses Soaring Demand for Rigid Plastic Packaging.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET) is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Flexible Plastic Packaging Drive Shift Benefits Over Rigid Plastic Packaging.

8. Can you provide examples of recent developments in the market?

April 2023: Tesco and Faerch collaborated to create a totally new way to package ready meals - by recycling used plastic trays and turning them into food-grade trays. This is the first of its kind in the industry and will involve collecting PET trays from customers and recycling them back into trays. Tesco's trays already have a minimum recycled tray content of up to 75%, but now the company is getting better - with the help of Faerch, Tesco will use bottles of flake plastic to recycle up to 30% of their tray content.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Rigid Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Rigid Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Rigid Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the North America Rigid Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence