Key Insights

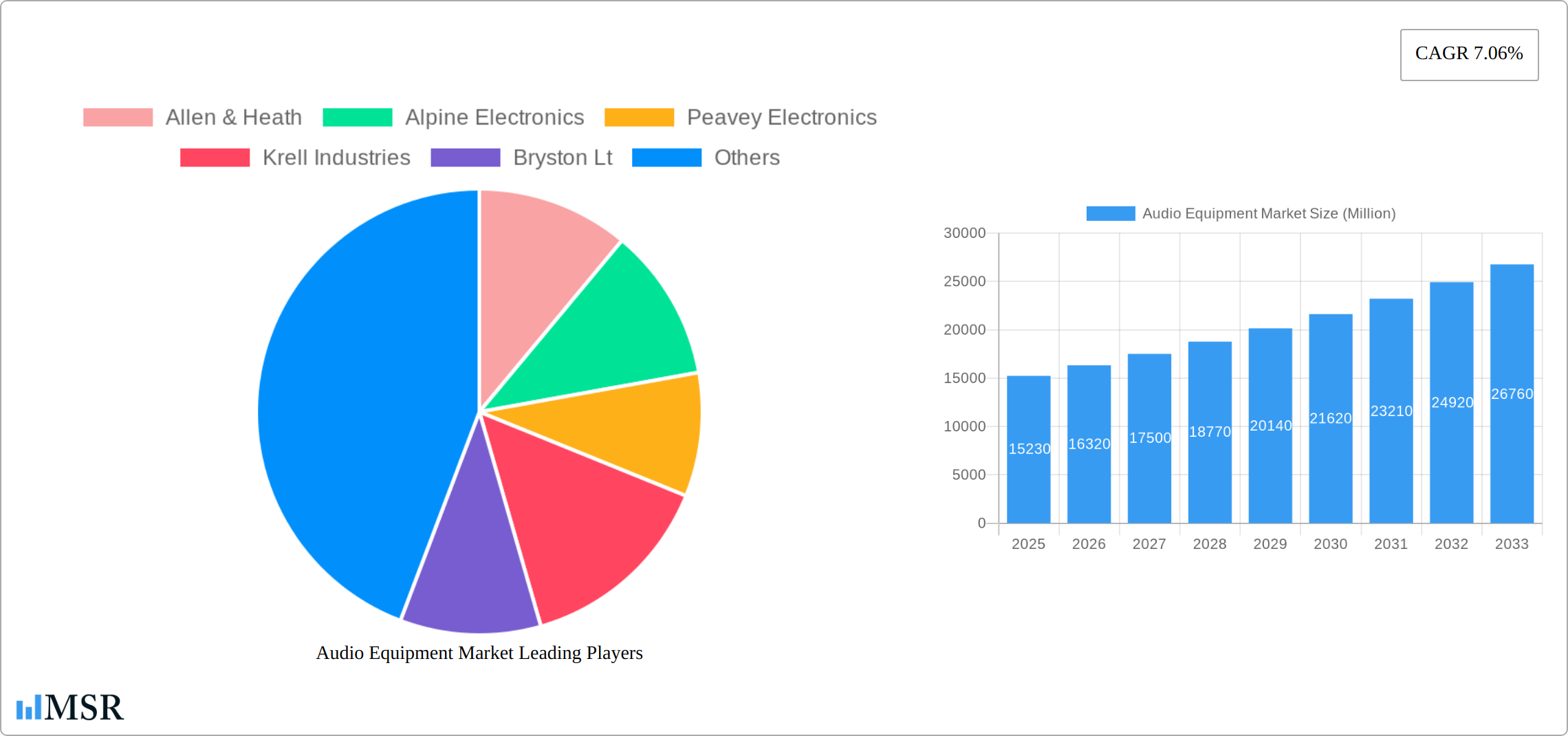

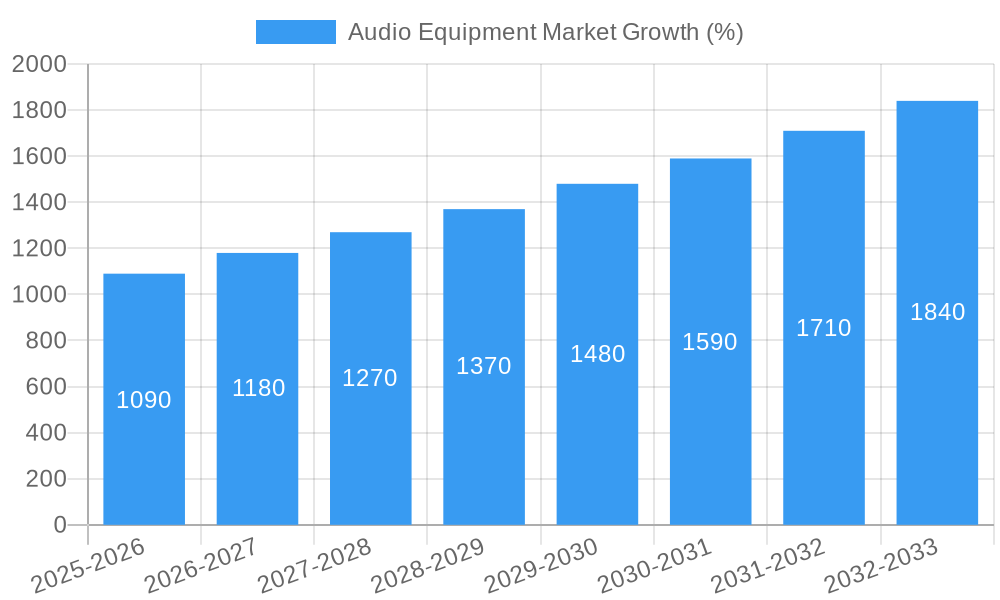

The global audio equipment market, valued at $15.23 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing demand for high-quality audio in home entertainment systems, fueled by the rise of streaming services and smart speakers, is a significant contributor. Simultaneously, the automotive sector's integration of advanced audio technologies, such as premium sound systems and noise cancellation features, is further boosting market expansion. The professional audio segment, encompassing live sound reinforcement and studio recording, also contributes substantially, driven by the resurgence of live events and music production. Technological advancements, such as the development of more efficient and powerful amplifiers, miniaturized microphones with enhanced sound capture capabilities, and sophisticated digital signal processing (DSP) technologies, are further fueling market growth. While potential restraints like fluctuating component costs and increasing competition might pose challenges, the overall market outlook remains positive, driven by innovation and rising consumer demand across various segments.

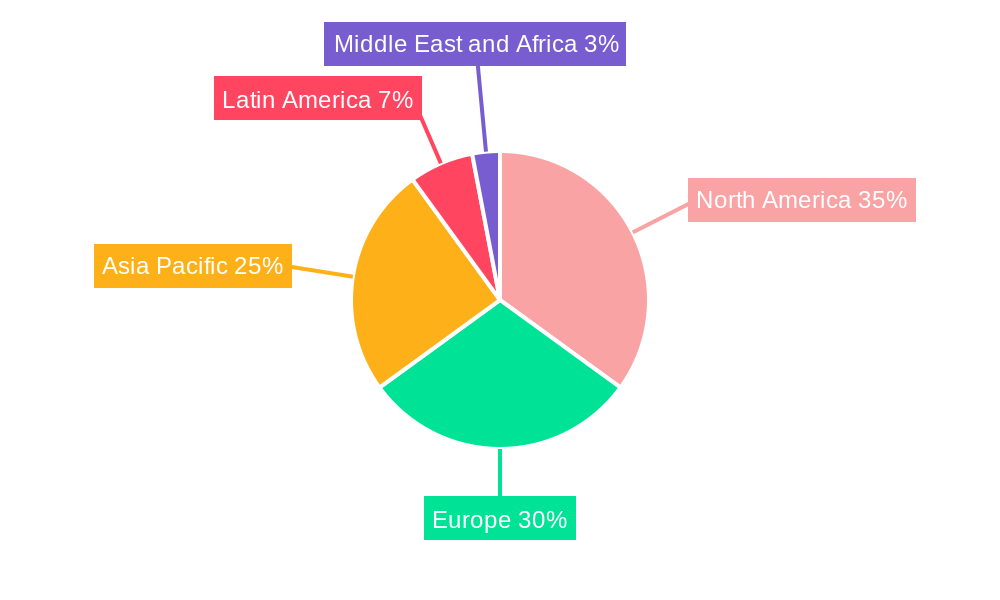

Market segmentation reveals a diverse landscape. Mixers and amplifiers dominate the product type segment, reflecting their essential role in professional and consumer audio applications. The end-user segment is led by commercial applications (e.g., live events, studios), followed by automotive and home entertainment. Geographical analysis suggests strong growth in the Asia-Pacific region, driven by rising disposable incomes and increasing adoption of advanced audio technologies. North America and Europe maintain significant market shares, but the Asia-Pacific region's rapid expansion is a defining trend. The consistent 7.06% CAGR indicates sustained and predictable market expansion over the forecast period (2025-2033). This suggests a significant opportunity for market players to capitalize on the growing demand for diverse and high-quality audio solutions. The competitive landscape is characterized by established players like Yamaha, Bose and others, alongside emerging companies offering innovative and cost-effective solutions.

Audio Equipment Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Audio Equipment Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's dynamics, growth drivers, and future potential. The global audio equipment market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Audio Equipment Market Market Concentration & Dynamics

The audio equipment market exhibits a moderately concentrated landscape, with a few dominant players and a large number of smaller niche players. Market share is heavily influenced by brand recognition, technological innovation, and distribution networks. The market is characterized by a dynamic innovation ecosystem, with ongoing advancements in digital signal processing (DSP), wireless technologies, and miniaturization driving product development. Regulatory frameworks, particularly concerning safety and electromagnetic compatibility (EMC), play a significant role in shaping market dynamics. Substitute products, such as software-based audio solutions, pose a competitive challenge, while the rising popularity of personalized audio experiences is reshaping end-user trends. M&A activities have been relatively moderate in recent years, with xx deals recorded between 2019 and 2024, indicating a focus on organic growth and strategic partnerships.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of the market share in 2024.

- Innovation Ecosystem: Highly active, driven by advancements in DSP, wireless audio, and AI-powered features.

- Regulatory Landscape: Influenced by safety standards and EMC regulations, varying across regions.

- Substitute Products: Software-based audio solutions are emerging as competitive alternatives.

- End-User Trends: Growing demand for personalized and immersive audio experiences.

- M&A Activity: xx deals recorded between 2019 and 2024.

Audio Equipment Market Industry Insights & Trends

The audio equipment market is experiencing significant growth, propelled by several key factors. The rising adoption of high-fidelity audio systems in both home and professional settings fuels demand. Technological disruptions, such as the proliferation of wireless audio technologies (Bluetooth, Wi-Fi), high-resolution audio formats, and the integration of smart features, are transforming the market landscape. Evolving consumer behaviors, including increased streaming consumption and a preference for portable and convenient audio solutions, significantly impact market dynamics. The market is segmented by product type (mixers, amplifiers, microphones, audio monitors, and other product types) and end-user (commercial, automotive, home entertainment, and other end users).

The global market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a healthy CAGR of xx%. This growth is fueled by increasing disposable incomes, particularly in emerging economies, and rising demand for premium audio experiences. The increasing adoption of smart speakers and other smart home devices is also contributing to the market's expansion. However, challenges such as economic downturns, fluctuations in raw material prices, and intensifying competition pose potential risks to market growth.

Key Markets & Segments Leading Audio Equipment Market

The home entertainment segment currently dominates the audio equipment market, driven by the rising popularity of high-quality home theater systems and the growing demand for premium sound quality in residential spaces. The North American and European markets represent significant revenue contributors, owing to strong consumer spending and the presence of established audio brands. However, the Asia-Pacific region is poised for rapid growth, fueled by increasing disposable incomes and a burgeoning middle class.

- Dominant Segment: Home entertainment, accounting for xx% of the market revenue in 2024.

- Leading Region: North America, followed by Europe and the Asia-Pacific region.

- Key Drivers:

- Home Entertainment: Rising demand for premium home theater systems and high-fidelity audio.

- Commercial: Growth in the professional audio industry, including live events, broadcasting, and studios.

- Automotive: Increased integration of advanced audio systems in automobiles.

- Economic Growth: Rising disposable incomes in key markets, driving premium product adoption.

Audio Equipment Market Product Developments

Recent innovations in the audio equipment sector include advancements in noise cancellation technology, the development of high-resolution audio codecs, and the integration of smart features in audio devices. These advancements improve audio quality, enhance user experience, and create new market opportunities. Companies are focusing on developing compact, portable, and versatile audio equipment. The integration of wireless connectivity and voice control is also gaining traction. These developments are enhancing the competitive landscape by offering superior audio experiences and creating new applications for audio equipment.

Challenges in the Audio Equipment Market Market

The audio equipment market faces several challenges, including rising raw material costs, intensifying competition from both established and emerging players, and concerns over supply chain disruptions. The market is also subject to technological obsolescence and changing consumer preferences. Stringent regulatory requirements in some regions can add to manufacturing costs and complexity. These factors collectively impact profitability and hinder market expansion. Specifically, raw material price volatility impacted margins by approximately xx% in 2024.

Forces Driving Audio Equipment Market Growth

The market is driven by several factors, including technological advancements leading to better sound quality and functionality, rising disposable incomes in emerging economies leading to increased consumer spending, and growing demand for personalized audio experiences through streaming services and smart speakers. Favorable government policies in some regions supporting the electronics industry also contribute to market growth. The increasing integration of audio equipment into smart homes and automobiles is another major driver.

Challenges in the Audio Equipment Market Market

Long-term growth hinges on ongoing innovation, strategic partnerships to access new markets, and expansion into emerging economies. Continued investment in R&D to enhance audio quality, develop new functionalities, and create innovative products is crucial for sustainable growth. Collaborations with technology companies for seamless integration into smart home and automotive systems will further enhance market penetration. Expanding into under-penetrated markets in developing countries with a focus on affordable, high-quality audio products is vital for long-term success.

Emerging Opportunities in Audio Equipment Market

Emerging trends include the growth of personalized audio experiences tailored to individual preferences, the rise of immersive audio technologies such as spatial audio, and the integration of artificial intelligence for enhanced audio processing and personalization. The increasing popularity of wireless earbuds and headphones presents significant opportunities. New markets, particularly in developing economies, offer substantial growth potential. The expansion of the metaverse and its demand for high-quality audio create further opportunities for market growth.

Leading Players in the Audio Equipment Market Sector

- Allen & Heath

- Alpine Electronics

- Peavey Electronics

- Krell Industries

- Bryston Lt

- Behringer

- AKG Acoustics (Harman International)

- NXP Semiconductors

- Yamaha Corporation

- Kenwood Corporation

Key Milestones in Audio Equipment Market Industry

- February 2023: Pioneer DJ launched the DJM-A9, a new 4-channel mixer with enhanced features like Center Lock for Sound Color FX, improved Beat FX and mic, and Bluetooth input. This launch significantly impacts the professional DJ equipment segment.

- February 2023: Cherry Americas announced a new product line of computer microphones and accessories, expanding its audio portfolio and targeting a broad consumer base, including home users and streaming professionals. This expansion strengthens the computer peripherals market segment.

Strategic Outlook for Audio Equipment Market Market

The audio equipment market shows strong potential for continued growth, fueled by ongoing technological advancements, expanding consumer base in emerging markets, and the increasing integration of audio into various aspects of daily life. Strategic opportunities lie in developing innovative products with enhanced features, focusing on sustainability and eco-friendly designs, and leveraging digital marketing channels to reach a broader audience. Partnerships and collaborations within the broader technology ecosystem will be crucial to capture growth opportunities in emerging sectors such as the metaverse and immersive audio experiences.

Audio Equipment Market Segmentation

-

1. Product Type

- 1.1. Mixers

- 1.2. Amplifiers

- 1.3. Microphones

- 1.4. Audio Monitors

- 1.5. Other Product Types

-

2. End User

- 2.1. Commercial

- 2.2. Automotive

- 2.3. Home Entertainment

- 2.4. Other End Users

Audio Equipment Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Audio Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.06% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Tendency of Increased Expenditures on Global Festivals and Music Concerts; Rise of Audio Equipment in Automobiles; Increasing Demand for HD and Ultra HD Sound Quality

- 3.3. Market Restrains

- 3.3.1. Design and Complexity Challenges for the Development of High-Efficiency Audio Equipment

- 3.4. Market Trends

- 3.4.1. Microphones Segment is Expected to Register the Fastest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Audio Equipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Mixers

- 5.1.2. Amplifiers

- 5.1.3. Microphones

- 5.1.4. Audio Monitors

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Commercial

- 5.2.2. Automotive

- 5.2.3. Home Entertainment

- 5.2.4. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Audio Equipment Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Mixers

- 6.1.2. Amplifiers

- 6.1.3. Microphones

- 6.1.4. Audio Monitors

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Commercial

- 6.2.2. Automotive

- 6.2.3. Home Entertainment

- 6.2.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Audio Equipment Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Mixers

- 7.1.2. Amplifiers

- 7.1.3. Microphones

- 7.1.4. Audio Monitors

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Commercial

- 7.2.2. Automotive

- 7.2.3. Home Entertainment

- 7.2.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Audio Equipment Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Mixers

- 8.1.2. Amplifiers

- 8.1.3. Microphones

- 8.1.4. Audio Monitors

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Commercial

- 8.2.2. Automotive

- 8.2.3. Home Entertainment

- 8.2.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia and New Zealand Audio Equipment Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Mixers

- 9.1.2. Amplifiers

- 9.1.3. Microphones

- 9.1.4. Audio Monitors

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Commercial

- 9.2.2. Automotive

- 9.2.3. Home Entertainment

- 9.2.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Latin America Audio Equipment Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Mixers

- 10.1.2. Amplifiers

- 10.1.3. Microphones

- 10.1.4. Audio Monitors

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Commercial

- 10.2.2. Automotive

- 10.2.3. Home Entertainment

- 10.2.4. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Middle East and Africa Audio Equipment Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Mixers

- 11.1.2. Amplifiers

- 11.1.3. Microphones

- 11.1.4. Audio Monitors

- 11.1.5. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Commercial

- 11.2.2. Automotive

- 11.2.3. Home Entertainment

- 11.2.4. Other End Users

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. North America Audio Equipment Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Audio Equipment Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Pacific Audio Equipment Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Latin America Audio Equipment Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Middle East and Africa Audio Equipment Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Allen & Heath

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Alpine Electronics

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Peavey Electronics

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Krell Industries

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Bryston Lt

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Behringer

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 AKG Acoustics (Harman International)

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 NXP Semiconductors

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Yamaha Corporation

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Kenwood Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Allen & Heath

List of Figures

- Figure 1: Global Audio Equipment Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Audio Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Audio Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Audio Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Audio Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Audio Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Audio Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Audio Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Audio Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Audio Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Audio Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Audio Equipment Market Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America Audio Equipment Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Audio Equipment Market Revenue (Million), by End User 2024 & 2032

- Figure 15: North America Audio Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America Audio Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Audio Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Audio Equipment Market Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Europe Audio Equipment Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Europe Audio Equipment Market Revenue (Million), by End User 2024 & 2032

- Figure 21: Europe Audio Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 22: Europe Audio Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Audio Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Audio Equipment Market Revenue (Million), by Product Type 2024 & 2032

- Figure 25: Asia Audio Equipment Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Asia Audio Equipment Market Revenue (Million), by End User 2024 & 2032

- Figure 27: Asia Audio Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 28: Asia Audio Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Audio Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Australia and New Zealand Audio Equipment Market Revenue (Million), by Product Type 2024 & 2032

- Figure 31: Australia and New Zealand Audio Equipment Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: Australia and New Zealand Audio Equipment Market Revenue (Million), by End User 2024 & 2032

- Figure 33: Australia and New Zealand Audio Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 34: Australia and New Zealand Audio Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Australia and New Zealand Audio Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Audio Equipment Market Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Latin America Audio Equipment Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Latin America Audio Equipment Market Revenue (Million), by End User 2024 & 2032

- Figure 39: Latin America Audio Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 40: Latin America Audio Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Latin America Audio Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Middle East and Africa Audio Equipment Market Revenue (Million), by Product Type 2024 & 2032

- Figure 43: Middle East and Africa Audio Equipment Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 44: Middle East and Africa Audio Equipment Market Revenue (Million), by End User 2024 & 2032

- Figure 45: Middle East and Africa Audio Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 46: Middle East and Africa Audio Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 47: Middle East and Africa Audio Equipment Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Audio Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Audio Equipment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Audio Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Audio Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Audio Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Audio Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Audio Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Audio Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Audio Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Audio Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Audio Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Audio Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Audio Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Audio Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Audio Equipment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Global Audio Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 17: Global Audio Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Audio Equipment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Global Audio Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 20: Global Audio Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Audio Equipment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: Global Audio Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 23: Global Audio Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Audio Equipment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 25: Global Audio Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 26: Global Audio Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Audio Equipment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 28: Global Audio Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 29: Global Audio Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global Audio Equipment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Global Audio Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 32: Global Audio Equipment Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Audio Equipment Market?

The projected CAGR is approximately 7.06%.

2. Which companies are prominent players in the Audio Equipment Market?

Key companies in the market include Allen & Heath, Alpine Electronics, Peavey Electronics, Krell Industries, Bryston Lt, Behringer, AKG Acoustics (Harman International), NXP Semiconductors, Yamaha Corporation, Kenwood Corporation.

3. What are the main segments of the Audio Equipment Market?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Tendency of Increased Expenditures on Global Festivals and Music Concerts; Rise of Audio Equipment in Automobiles; Increasing Demand for HD and Ultra HD Sound Quality.

6. What are the notable trends driving market growth?

Microphones Segment is Expected to Register the Fastest Growth.

7. Are there any restraints impacting market growth?

Design and Complexity Challenges for the Development of High-Efficiency Audio Equipment.

8. Can you provide examples of recent developments in the market?

February 2023: Pioneer DJ announced introducing a new 4-channel mixer, the DJM-A9. The new unit has many features, including the Center Lock feature for Sound Color FX and a new layout with more space around the EQ controls. The Beat FX section and mic have also been improved and have Bluetooth input that can be routed to any channel. Compatible with both Rekordboxand Serato.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Audio Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Audio Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Audio Equipment Market?

To stay informed about further developments, trends, and reports in the Audio Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence