Key Insights

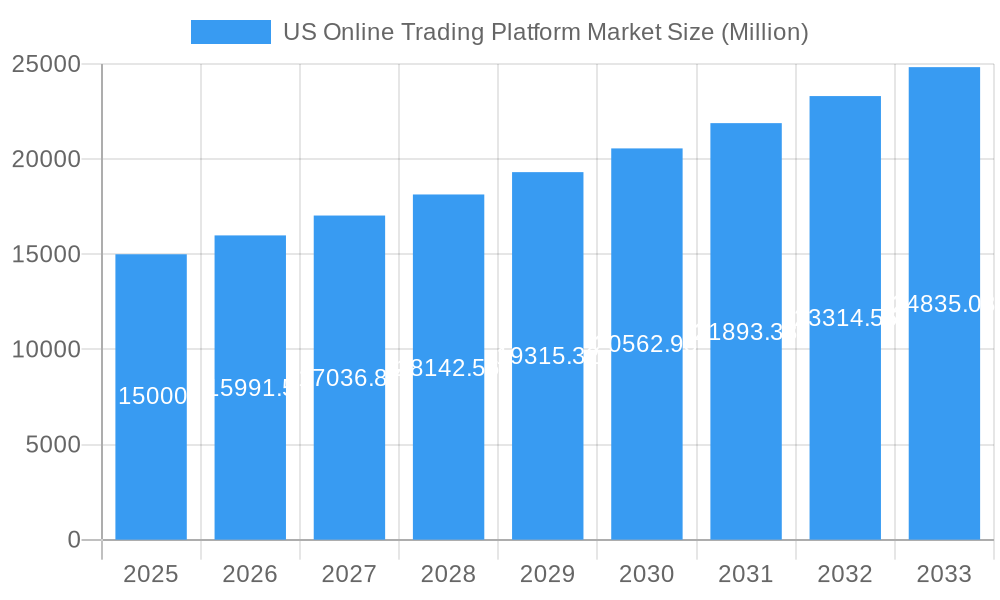

The US online trading platform market is experiencing significant expansion, propelled by escalating digital engagement, the convenience of mobile trading applications, and a notable increase in retail investor involvement, especially among younger demographics. The market's projected Compound Annual Growth Rate (CAGR) of 6.11% underscores its healthy expansion trajectory. Key growth drivers include the proliferation of intuitive platforms offering commission-free trading and sophisticated charting tools, thereby lowering entry barriers for individual investors. Enhanced financial literacy is fostered by readily available educational content and integrated investment tools, encouraging greater market participation. The market is segmented, accommodating both novice and experienced traders, utilizing diverse deployment models (on-premises and cloud), and serving both institutional and retail clienteles.

US Online Trading Platform Market Market Size (In Billion)

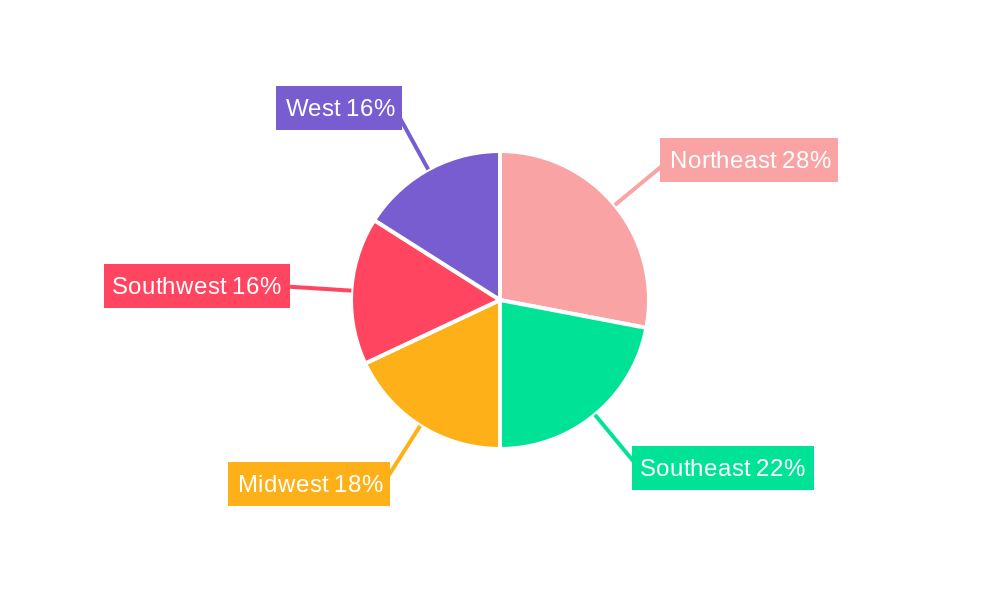

Despite robust growth, the market confronts challenges including evolving regulatory landscapes and escalating cybersecurity threats. Platform providers must prioritize investor trust and data security to sustain market momentum. Intense competition demands continuous innovation, including the integration of emerging technologies like Artificial Intelligence (AI) and Machine Learning (ML) to refine trading experiences. Geographically, the United States dominates, with concentrated activity in tech-savvy regions like the Northeast and West Coast. Future growth hinges on adeptly navigating regulatory complexities, embracing technological advancements, and maintaining a steadfast focus on user experience and security. The market size is projected to reach $3.48 billion in 2025, with consistent annual growth anticipated throughout the forecast period.

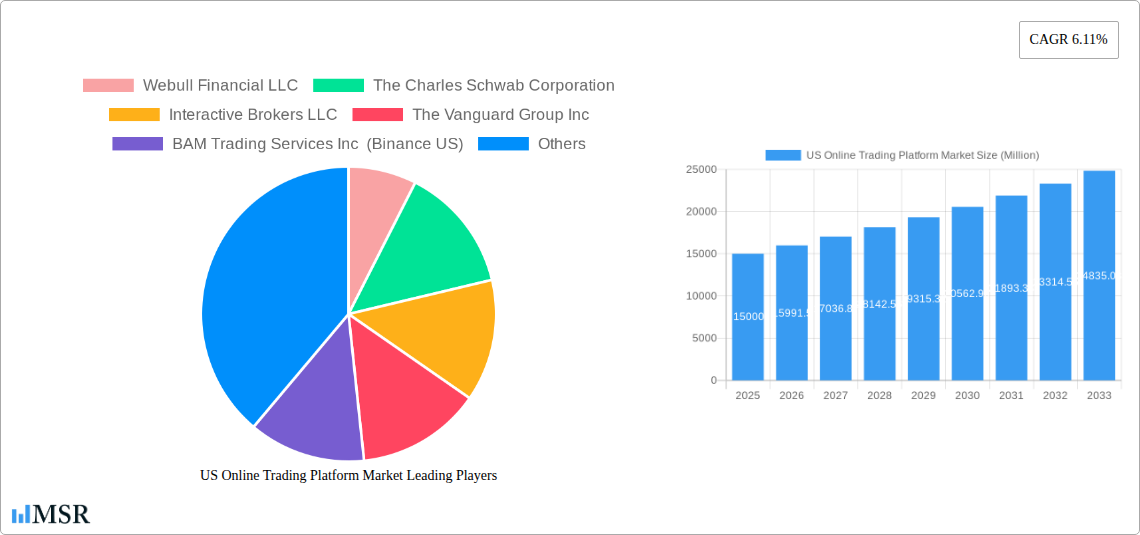

US Online Trading Platform Market Company Market Share

US Online Trading Platform Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the US online trading platform market, covering the period 2019-2033. It offers valuable insights into market dynamics, key players, emerging trends, and future growth prospects, equipping stakeholders with actionable intelligence to navigate this dynamic landscape. The report leverages extensive data analysis and incorporates expert opinions to deliver a holistic perspective on this rapidly evolving sector. The Base Year is 2025, the Estimated Year is 2025, and the Forecast Period spans 2025-2033, with the Historical Period covering 2019-2024. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

US Online Trading Platform Market Concentration & Dynamics

The US online trading platform market is characterized by a mix of established giants and agile newcomers, resulting in a moderately concentrated landscape. Market share is largely driven by brand recognition, technological capabilities, and regulatory compliance. While a few dominant players command significant market share, the presence of numerous smaller players fosters competition and innovation.

- Market Concentration: The top 5 players (Schwab, Fidelity, Interactive Brokers, Vanguard, and Robinhood) collectively hold approximately xx% of the market share in 2025, indicating a moderately concentrated market.

- Innovation Ecosystems: The market is witnessing rapid technological advancements, fueled by advancements in AI, machine learning, and blockchain technology. This drives the development of sophisticated trading platforms and services.

- Regulatory Frameworks: Stringent regulations from bodies like the SEC shape market dynamics, impacting compliance costs and operational strategies for market participants. Compliance is a significant factor affecting smaller entrants.

- Substitute Products: Traditional brokerage services pose some level of competition, though the convenience and accessibility of online platforms continue to drive market growth.

- End-User Trends: Retail investors increasingly embrace online trading due to its convenience and accessibility. Institutional investors also leverage online platforms for efficient portfolio management.

- M&A Activities: The past five years witnessed xx M&A deals, mainly focused on consolidating market share and expanding service offerings. Consolidation is anticipated to continue, driven by a desire for scale and enhanced technological capabilities.

US Online Trading Platform Market Industry Insights & Trends

The US online trading platform market is experiencing robust growth, driven by several key factors. The increasing adoption of online trading by both retail and institutional investors is a primary growth engine. Technological advancements such as mobile-first trading platforms and AI-driven analytical tools are further enhancing user experience and driving market expansion. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033. This growth reflects a shift towards digital finance and an increasing demand for sophisticated and accessible trading tools. The growth is also fueled by factors like increased financial literacy among retail investors, the rise of fractional share trading, and the expansion of cryptocurrency trading options. The average user is increasingly tech-savvy and demands user-friendly platforms with advanced analytics and integrated tools.

Key Markets & Segments Leading US Online Trading Platform Market

The US online trading platform market is dominated by the Retail Investors segment. The Cloud deployment mode is increasingly popular due to its scalability and cost-effectiveness. The Platforms and Services offerings both experience strong demand.

- By Offerings: The market is evenly divided between Platforms (providing trading infrastructure) and Services (offering research, analysis, and advisory).

- By Deployment Mode: Cloud deployment mode is gaining traction, surpassing On-premises deployments due to flexibility and cost-effectiveness.

- By Type: Both Beginner and Advanced platforms are essential, catering to a wide spectrum of user expertise. The market caters to sophisticated institutional investors and novice individual traders, which leads to a healthy growth of both segments.

- By End-user: Retail Investors dominate the market due to increased accessibility and a growing population of young and tech-savvy investors. Institutional investors contribute significantly, though their trading activities differ in scale and sophistication.

Drivers:

- Economic Growth: A robust economy drives investor confidence and participation in the market.

- Technological Advancements: The continuous development of user-friendly platforms and analytical tools.

- Regulatory Environment: A supportive regulatory environment fosters market trust and encourages participation.

- Financial Literacy: Growing financial literacy and digital familiarity encourage broader participation.

US Online Trading Platform Market Product Developments

Recent product innovations focus on enhancing user experience, expanding service offerings, and integrating AI and machine learning capabilities. These include mobile-first platforms, advanced charting tools, AI-powered investment recommendations, and the integration of cryptocurrency trading. This enhances accessibility, improves analysis and expands investment options, establishing competitive advantages.

Challenges in the US Online Trading Platform Market Market

The market faces challenges such as: increased regulatory scrutiny, heightened cybersecurity threats, intense competition, and the need to constantly adapt to evolving technological landscapes. These factors influence operational costs and impact profitability. Data breaches can also significantly impact reputation and lead to regulatory penalties, hindering growth.

Forces Driving US Online Trading Platform Market Growth

The market's growth is fueled by increased digital adoption, favorable regulatory environments, and advancements in AI and machine learning. The rising popularity of mobile trading and cryptocurrency trading further enhances market growth and generates high revenue streams. Furthermore, financial literacy initiatives contribute to increasing participation from a broader base of investors.

Long-Term Growth Catalysts in the US Online Trading Platform Market

Long-term growth will be driven by technological innovation, strategic partnerships, and market expansion into underserved segments. The development of advanced trading algorithms, integration with wealth management platforms and continued expansion into new financial instruments (like NFTs) will significantly propel market growth in the next decade.

Emerging Opportunities in US Online Trading Platform Market

Emerging opportunities include the expansion of fractional share trading, the growing popularity of social trading features, and the integration of alternative investment options. These factors create new avenues for revenue generation and attract a wider range of investors. Moreover, developing personalized financial advice features will boost the appeal to retail investors.

Leading Players in the US Online Trading Platform Market Sector

- Webull Financial LLC

- The Charles Schwab Corporation

- Interactive Brokers LLC

- The Vanguard Group Inc

- BAM Trading Services Inc (Binance US)

- Merrill Lynch Pierce Fenner & Smith Incorporated (Bank of America Corporation)

- ETrade (Morgan Stanley)

- Fidelity Investments Institutional Operations Company Inc

- Robinhood Markets Inc

- Coinbase Global Inc

- eToro

- Tradestation Group Inc

- Trading Technologies International Inc

Key Milestones in US Online Trading Platform Market Industry

- April 2023: Twitter partnered with eToro, enabling users to trade stocks and cryptocurrencies directly on the Twitter platform. This integration significantly expanded eToro's reach and facilitated increased user acquisition.

- May 2023: eToro launched InsuranceWorld, a portfolio providing retail investors with long-term exposure to the insurance sector. This diversified investment options and broadened the appeal of eToro's platform.

Strategic Outlook for US Online Trading Platform Market Market

The US online trading platform market exhibits robust growth potential. Strategic opportunities include technological innovation, expansion into new asset classes, and the development of tailored solutions for specific investor segments. Focusing on enhancing user experience and maintaining regulatory compliance will be crucial for long-term success in this competitive landscape. The market is poised for continued growth, driven by technological advancements and changing investor preferences.

US Online Trading Platform Market Segmentation

-

1. Offerings

- 1.1. Platforms

- 1.2. Services

-

2. Deployment Mode

- 2.1. On-Premises

- 2.2. Cloud

-

3. Type

- 3.1. Beginner

- 3.2. Advanced

-

4. End-user

- 4.1. Institutional Investors

- 4.2. Retail Investors

US Online Trading Platform Market Segmentation By Geography

- 1. United States

US Online Trading Platform Market Regional Market Share

Geographic Coverage of US Online Trading Platform Market

US Online Trading Platform Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Accessibility and the Rise in the Adoption of Smartphones; Integration of AI Technology and Robo Advisors to Update on Real-Time Updates; Capabilities Such as Trade Order and Investment Management Integrated into a Single Platform

- 3.3. Market Restrains

- 3.3.1. Increasing Risk of Counterfeits

- 3.4. Market Trends

- 3.4.1. Increasing Accessibility and the Rise in the Adoption of Smartphones is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. US Online Trading Platform Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offerings

- 5.1.1. Platforms

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.2.1. On-Premises

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Beginner

- 5.3.2. Advanced

- 5.4. Market Analysis, Insights and Forecast - by End-user

- 5.4.1. Institutional Investors

- 5.4.2. Retail Investors

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Offerings

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Webull Financial LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Charles Schwab Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Interactive Brokers LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Vanguard Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BAM Trading Services Inc (Binance US)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Merrill Lynch Pierce Fenner & Smith Incorporated (Bank of America Corporation)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ETrade (Morgan Stanley)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fidelity Investments Institutional Operations Company Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Robinhood Markets Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Coinbase Global Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 eToro

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Tradestation Group Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Trading Technologies International Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Webull Financial LLC

List of Figures

- Figure 1: US Online Trading Platform Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: US Online Trading Platform Market Share (%) by Company 2025

List of Tables

- Table 1: US Online Trading Platform Market Revenue billion Forecast, by Offerings 2020 & 2033

- Table 2: US Online Trading Platform Market Revenue billion Forecast, by Deployment Mode 2020 & 2033

- Table 3: US Online Trading Platform Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: US Online Trading Platform Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 5: US Online Trading Platform Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: US Online Trading Platform Market Revenue billion Forecast, by Offerings 2020 & 2033

- Table 7: US Online Trading Platform Market Revenue billion Forecast, by Deployment Mode 2020 & 2033

- Table 8: US Online Trading Platform Market Revenue billion Forecast, by Type 2020 & 2033

- Table 9: US Online Trading Platform Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 10: US Online Trading Platform Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Online Trading Platform Market?

The projected CAGR is approximately 6.11%.

2. Which companies are prominent players in the US Online Trading Platform Market?

Key companies in the market include Webull Financial LLC, The Charles Schwab Corporation, Interactive Brokers LLC, The Vanguard Group Inc, BAM Trading Services Inc (Binance US), Merrill Lynch Pierce Fenner & Smith Incorporated (Bank of America Corporation), ETrade (Morgan Stanley), Fidelity Investments Institutional Operations Company Inc, Robinhood Markets Inc, Coinbase Global Inc, eToro, Tradestation Group Inc, Trading Technologies International Inc .

3. What are the main segments of the US Online Trading Platform Market?

The market segments include Offerings, Deployment Mode, Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.48 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Accessibility and the Rise in the Adoption of Smartphones; Integration of AI Technology and Robo Advisors to Update on Real-Time Updates; Capabilities Such as Trade Order and Investment Management Integrated into a Single Platform.

6. What are the notable trends driving market growth?

Increasing Accessibility and the Rise in the Adoption of Smartphones is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Increasing Risk of Counterfeits.

8. Can you provide examples of recent developments in the market?

May 2023 - Etoro announced the launch of InsuranceWorld, a portfolio offering retail investors long-term exposure to the insurance sector. InsuranceWorld is a new addition to eToro's existing offering of portfolios, which already provides exposure to traditional financial sectors, such as private equity, big banks, and real estate trusts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Online Trading Platform Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Online Trading Platform Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Online Trading Platform Market?

To stay informed about further developments, trends, and reports in the US Online Trading Platform Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence