Key Insights

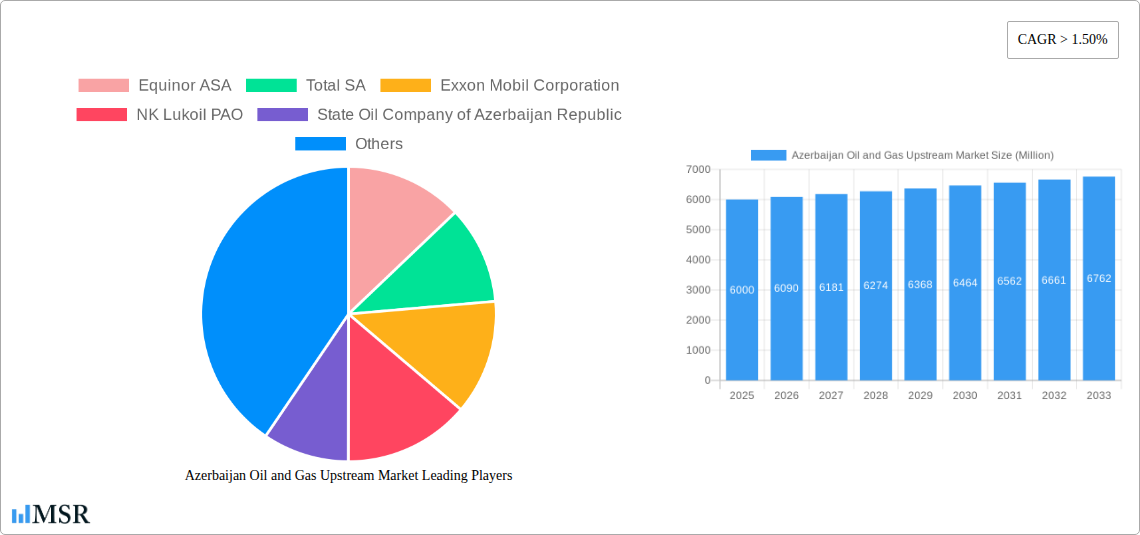

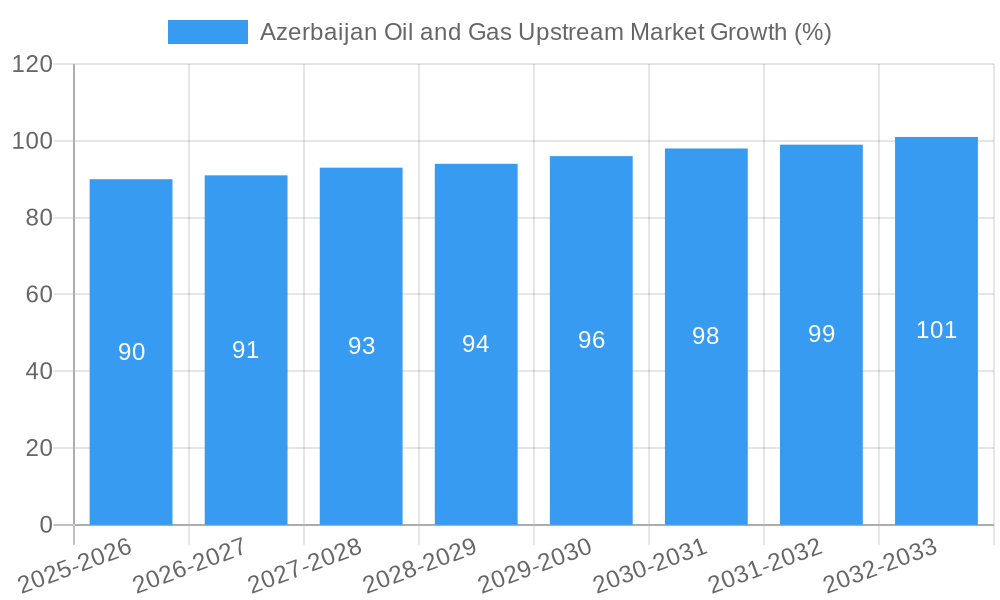

The Azerbaijan oil and gas upstream market, while exhibiting a relatively modest Compound Annual Growth Rate (CAGR) of over 1.5%, presents a compelling investment landscape driven by several key factors. Strategic geographic location, providing access to both European and Asian markets, coupled with existing robust infrastructure, contributes significantly to its appeal. Furthermore, ongoing government initiatives aimed at attracting foreign investment and fostering technological advancements in exploration and production techniques are crucial drivers. The market is segmented geographically into onshore and offshore operations, with exploration, development, and production activities contributing to the overall market value. Major players like Equinor ASA, Total SA, ExxonMobil, and BP PLC, alongside State Oil Company of Azerbaijan Republic (SOCAR), demonstrate significant industry interest and commitment. While the exact market size for 2025 isn’t provided, a reasonable estimate, considering the CAGR and the presence of major international players, could place the value in the range of $5-7 billion. This is based on industry averages and reports for similar economies and oil production environments.

However, the market faces certain restraints. Fluctuations in global oil prices represent a major challenge, impacting investment decisions and profitability. Environmental concerns, including the carbon footprint of oil and gas extraction, are increasingly influential, leading to stricter regulations and a push towards sustainable practices. Furthermore, competition from other oil-producing regions and technological advancements in renewable energy sources pose longer-term challenges to the market's growth trajectory. The forecast period of 2025-2033 anticipates steady growth, largely contingent upon successfully navigating these challenges and maintaining a balanced approach between economic development and environmental sustainability. The onshore segment likely holds a larger market share due to established infrastructure and lower operational costs compared to the offshore segment.

Azerbaijan Oil and Gas Upstream Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Azerbaijan oil and gas upstream market, offering invaluable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this study delves into market dynamics, key players, technological advancements, and future growth prospects. Unlock actionable intelligence to navigate the complexities of this dynamic sector.

Azerbaijan Oil and Gas Upstream Market Market Concentration & Dynamics

The Azerbaijan oil and gas upstream market exhibits a moderately concentrated structure, with key players such as Equinor ASA, TotalEnergies SE, Exxon Mobil Corporation, NK Lukoil PAO, State Oil Company of Azerbaijan Republic (SOCAR), Chevron Corporation, Nobel Oil Group, and BP PLC holding significant market share. The market share of these companies fluctuates based on exploration success, production levels, and M&A activities. The historical period (2019-2024) witnessed xx M&A deals, primarily driven by strategic acquisitions aimed at expanding reserves and production capacity. The regulatory framework, while supportive of foreign investment, is also subject to periodic revisions impacting operational costs. The innovative ecosystem is developing, with increased focus on digitalization and enhanced oil recovery techniques. Substitute products, such as renewable energy sources, pose a long-term threat, albeit a slowly growing one at present. End-user trends demonstrate a continuing, albeit slowly increasing demand for oil and gas, particularly from regional and international markets.

- Market Share (2025): SOCAR (xx%), BP (xx%), Equinor (xx%), Others (xx%)

- M&A Deal Count (2019-2024): xx

- Average Deal Value (2019-2024): xx Million

Azerbaijan Oil and Gas Upstream Market Industry Insights & Trends

The Azerbaijan oil and gas upstream market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033 from xx Million in 2025. Several factors contribute to this growth. Firstly, consistent government support for the industry continues to attract substantial foreign investments. Secondly, the ongoing exploration and development of new oil and gas fields within Azerbaijan significantly contribute to the market’s expansion. Thirdly, advancements in exploration and extraction technologies, such as enhanced oil recovery techniques, are boosting production efficiency and overall output. Technological disruptions, including the adoption of digital technologies in exploration and production, are driving operational improvements and cost optimization. The evolving consumer behavior, characterized by increasing energy demands, fuels the growth of this market, despite the rising global emphasis on renewable energy sources. The historical period (2019-2024) showed an average annual growth of xx%.

Key Markets & Segments Leading Azerbaijan Oil and Gas Upstream Market

The offshore segment dominates the Azerbaijan oil and gas upstream market, accounting for xx% of total production in 2025. This dominance stems from the significant reserves located in the Caspian Sea. The onshore segment, while smaller, contributes significantly to the overall market, especially in established fields.

Drivers for Offshore Segment Dominance:

- Vast Reserves: Significant oil and gas reserves are located in the Caspian Sea.

- Technological Advancements: Improved offshore drilling and production technologies.

- Government Support: Favorable policies and incentives for offshore exploration and development.

Drivers for Onshore Segment Growth:

- Proximity to Infrastructure: Reduced transportation costs compared to offshore operations.

- Established Fields: Production from mature onshore fields continues to contribute significantly.

The Production segment holds the largest share within the operational segments, reflecting the maturity of the Azerbaijani oil and gas industry and its focus on extracting existing reserves. However, the Exploration segment is expected to see increased investment in the coming years due to the ongoing search for new reserves.

Azerbaijan Oil and Gas Upstream Market Product Developments

Recent product innovations include advancements in enhanced oil recovery (EOR) techniques, such as polymer flooding and CO2 injection, aimed at maximizing extraction from existing fields. These technologies improve production efficiency and extend the lifespan of oil and gas fields. Furthermore, investments in digitalization, including the use of artificial intelligence and machine learning, are improving operational efficiency, optimizing production, and reducing environmental impact. The market relevance of these innovations is high, given the ongoing need to enhance productivity and minimize operational costs in a challenging global environment.

Challenges in the Azerbaijan Oil and Gas Upstream Market Market

The Azerbaijan oil and gas upstream market faces several challenges. Fluctuations in global oil and gas prices significantly impact profitability. Geopolitical instability and regulatory uncertainties can impede investment and create operational disruptions. Supply chain disruptions, particularly regarding specialized equipment and skilled labor, can also hinder production. Furthermore, increasing competition from other oil and gas producing regions creates pressure on pricing and market share. These challenges collectively result in a xx Million reduction in potential annual revenue during the forecast period.

Forces Driving Azerbaijan Oil and Gas Upstream Market Growth

Several factors drive the growth of the Azerbaijan oil and gas upstream market. Continued exploration and development of new oil and gas reserves is a key driver, supported by government policies promoting foreign investment. Technological advancements in exploration and production techniques increase efficiency and profitability. Regional economic growth and increasing energy demands in neighboring countries fuel demand for Azerbaijani oil and gas. Government regulations aimed at promoting sustainable energy practices, while posing some challenges, ultimately encourage innovation and responsible resource management.

Long-Term Growth Catalysts in Azerbaijan Oil and Gas Upstream Market

Long-term growth hinges on strategic partnerships to access cutting-edge technology and expertise, while ongoing exploration activities and the development of new oil and gas fields are critical. Government support for innovation and investment in sustainable practices will play a key role. Expanding into new export markets and diversifying the range of products and services offered further stimulate market expansion. These long-term strategies are expected to fuel the market's CAGR in the coming decade.

Emerging Opportunities in Azerbaijan Oil and Gas Upstream Market

Emerging opportunities lie in the exploration and development of unconventional resources, such as shale gas. The increasing adoption of digital technologies presents significant opportunities to enhance operational efficiency and reduce costs. Furthermore, growing regional demand for natural gas coupled with strategic partnerships to build new infrastructure will fuel market growth. Finally, exploring and developing carbon capture and storage (CCS) technologies can enhance the industry's environmental sustainability and attract further investments.

Leading Players in the Azerbaijan Oil and Gas Upstream Market Sector

- Equinor ASA

- TotalEnergies SE

- Exxon Mobil Corporation

- NK Lukoil PAO

- State Oil Company of Azerbaijan Republic (SOCAR)

- Chevron Corporation

- Nobel Oil Group

- BP PLC

Key Milestones in Azerbaijan Oil and Gas Upstream Market Industry

- 2020: Launch of a new offshore exploration project by SOCAR.

- 2022: Completion of a major pipeline expansion project, enhancing export capacity.

- 2023: Successful implementation of a new EOR technique, significantly increasing oil recovery rates in a key field.

- 2024: Strategic partnership between SOCAR and a major international energy company for deepwater exploration.

Strategic Outlook for Azerbaijan Oil and Gas Upstream Market Market

The future of the Azerbaijan oil and gas upstream market is promising, driven by continued exploration activities, technological advancements, and strong government support. The focus will be on sustainable practices, operational efficiency, and strategic partnerships to unlock the full potential of the country's resources. The market's long-term growth trajectory is positive, given its significant reserves, favorable government policies, and ongoing efforts to enhance efficiency and environmental sustainability. This outlook ensures continuous growth and considerable opportunities for investors and industry stakeholders.

Azerbaijan Oil and Gas Upstream Market Segmentation

-

1. Operation

- 1.1. Exploration

- 1.2. Development

- 1.3. Production

-

2. Location

- 2.1. Onshore

- 2.2. Offshore

Azerbaijan Oil and Gas Upstream Market Segmentation By Geography

- 1. Azerbaijan

Azerbaijan Oil and Gas Upstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Wood Pellets in Clean Energy Generation4.; Growing Wood Pellet Manufacturing Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; The Adoption and Increasing Deployment of Alternative Renewable Energy

- 3.4. Market Trends

- 3.4.1. Offshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Azerbaijan Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Operation

- 5.1.1. Exploration

- 5.1.2. Development

- 5.1.3. Production

- 5.2. Market Analysis, Insights and Forecast - by Location

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Azerbaijan

- 5.1. Market Analysis, Insights and Forecast - by Operation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Equinor ASA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Total SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Exxon Mobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NK Lukoil PAO

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 State Oil Company of Azerbaijan Republic

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chevron Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nobel Oil Group*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BP PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Equinor ASA

List of Figures

- Figure 1: Azerbaijan Oil and Gas Upstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Azerbaijan Oil and Gas Upstream Market Share (%) by Company 2024

List of Tables

- Table 1: Azerbaijan Oil and Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Azerbaijan Oil and Gas Upstream Market Revenue Million Forecast, by Operation 2019 & 2032

- Table 3: Azerbaijan Oil and Gas Upstream Market Revenue Million Forecast, by Location 2019 & 2032

- Table 4: Azerbaijan Oil and Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Azerbaijan Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Azerbaijan Oil and Gas Upstream Market Revenue Million Forecast, by Operation 2019 & 2032

- Table 7: Azerbaijan Oil and Gas Upstream Market Revenue Million Forecast, by Location 2019 & 2032

- Table 8: Azerbaijan Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Azerbaijan Oil and Gas Upstream Market?

The projected CAGR is approximately > 1.50%.

2. Which companies are prominent players in the Azerbaijan Oil and Gas Upstream Market?

Key companies in the market include Equinor ASA, Total SA, Exxon Mobil Corporation, NK Lukoil PAO, State Oil Company of Azerbaijan Republic, Chevron Corporation, Nobel Oil Group*List Not Exhaustive, BP PLC.

3. What are the main segments of the Azerbaijan Oil and Gas Upstream Market?

The market segments include Operation, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Wood Pellets in Clean Energy Generation4.; Growing Wood Pellet Manufacturing Infrastructure.

6. What are the notable trends driving market growth?

Offshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Adoption and Increasing Deployment of Alternative Renewable Energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Azerbaijan Oil and Gas Upstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Azerbaijan Oil and Gas Upstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Azerbaijan Oil and Gas Upstream Market?

To stay informed about further developments, trends, and reports in the Azerbaijan Oil and Gas Upstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence