Key Insights

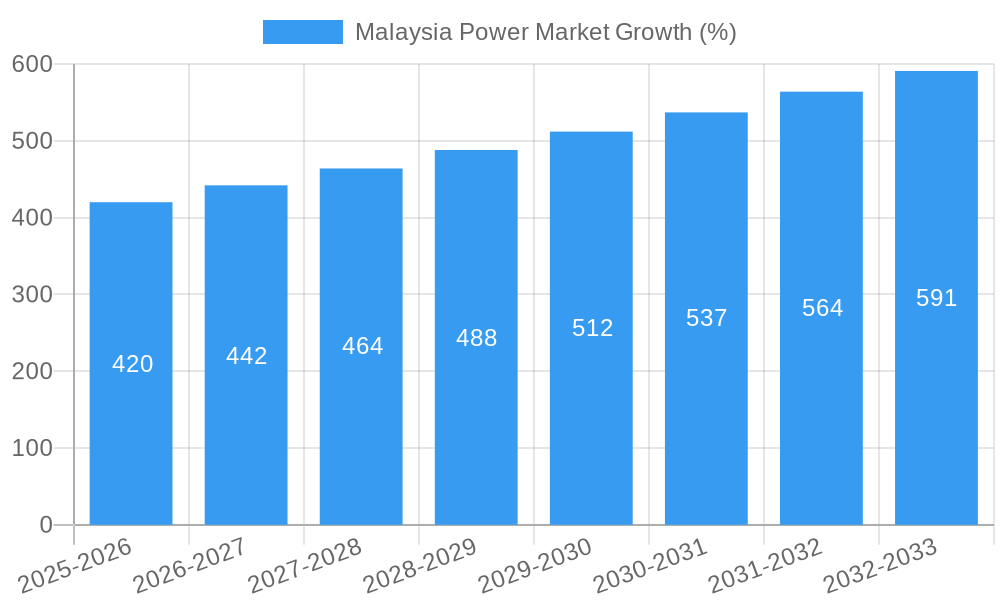

The Malaysian power market, valued at approximately [Estimate based on market size XX and value unit Million, assuming a reasonable figure for XX. For example, if XX represents "10 Billion," the market size in 2025 would be 10,000 million]. in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 4.20% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing industrialization and urbanization are fueling significant electricity demand across residential, commercial, and industrial sectors. The burgeoning transportation sector, particularly in the rapidly developing cities, is also a major contributor to rising energy consumption. Furthermore, the Malaysian government's commitment to renewable energy targets and supportive policies, like feed-in tariffs and incentives for solar and other renewable energy projects, are stimulating investment in renewable power generation sources. This shift towards renewable energy is partially offset by continued reliance on traditional sources such as natural gas and coal, reflecting the nation's ongoing energy transition.

However, the market faces certain constraints. The intermittent nature of renewable energy sources presents challenges related to grid stability and reliability. Furthermore, the high upfront capital costs associated with renewable energy infrastructure can hinder wider adoption, particularly for smaller-scale projects. Nevertheless, technological advancements, such as improved battery storage solutions and smart grids, are gradually addressing these challenges. The market segmentation reveals a significant portion of demand from the industrial sector, followed by the residential and commercial sectors. Within power generation sources, natural gas currently holds a substantial share, but renewables, especially solar, are witnessing a rapid increase in adoption, fuelled by supportive government policies and declining technology costs. Key players such as Tenaga Nasional Berhad, Sarawak Electricity Supply Corporation, and several renewable energy developers are shaping the market dynamics through their investments and expansion strategies. The competitive landscape is characterized by both large established utilities and smaller renewable energy independent power producers (IPPs), fostering innovation and contributing to market growth.

Malaysia Power Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Malaysia power market, offering invaluable insights for industry stakeholders, investors, and policymakers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, industry trends, key players, and future opportunities within the Malaysian power sector. The report leverages a wealth of data to provide actionable intelligence, enabling informed decision-making in this rapidly evolving landscape.

Malaysia Power Market Market Concentration & Dynamics

The Malaysian power market exhibits a moderately concentrated structure, with Tenaga Nasional Berhad (TNB) holding a significant market share. However, the emergence of independent power producers (IPPs) and increasing renewable energy investments are gradually shifting the landscape. Innovation within the sector is driven by government initiatives promoting renewable energy integration and energy efficiency improvements. The regulatory framework, while supportive of market liberalization, still faces challenges in streamlining approval processes and ensuring transparency. Substitute products, particularly in the renewable energy segment, pose both a threat and an opportunity. End-user trends show a growing demand for reliable and sustainable energy sources across residential, commercial, and industrial sectors.

- Market Concentration: TNB holds a dominant position, but IPPs are gaining traction. Exact market share figures for 2024 are xx%, but the trend is towards a more diversified market.

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals, primarily focused on renewable energy projects. The forecast period anticipates a surge in M&A activity driven by consolidation and the expansion of renewable energy capacity.

- Innovation Ecosystem: Government support for R&D and the rise of renewable energy technologies are driving innovation.

- Regulatory Framework: Malaysia's regulatory framework is evolving to encourage competition and the adoption of renewable energy sources. Improvements are needed to reduce bureaucratic delays and enhance transparency.

Malaysia Power Market Industry Insights & Trends

The Malaysian power market is projected to experience significant growth, driven by increasing energy demand fueled by economic expansion and population growth. The market size in 2024 was estimated at RM xx Million, and is expected to reach RM xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. Technological disruptions are largely centered around the integration of renewable energy sources, such as solar and wind power. This is influenced by government policies promoting sustainable energy and reducing reliance on fossil fuels. Consumer behavior is shifting towards greater awareness of environmental sustainability, influencing demand for green energy solutions.

Key Markets & Segments Leading Malaysia Power Market

The Malaysian power market is dominated by the Peninsular Malaysia region, with significant growth potential in East Malaysia. While natural gas currently leads power generation, a substantial increase in renewable energy capacity is transforming the landscape.

Power Generation Sources:

- Natural Gas: Remains the dominant source, benefiting from existing infrastructure. However, its share is projected to decrease as renewables gain traction.

- Renewables: Rapid expansion driven by government initiatives and decreasing renewable energy costs. Solar and wind are experiencing the fastest growth.

- Coal: Its share is declining due to environmental concerns and government policies shifting towards cleaner energy sources.

- Oil: Plays a minor role in power generation.

- Other: Includes biomass and other emerging technologies.

End-Users:

Industrial: The industrial sector is the largest consumer, driven by manufacturing and resource extraction activities.

Commercial: The commercial sector is growing steadily, driven by economic activity and urbanization.

Residential: Residential consumption is increasing, reflecting rising living standards and household appliance usage.

Transport & Agriculture: These sectors represent smaller yet growing segments of energy consumption.

Drivers: Economic growth, urbanization, industrialization, and supportive government policies are key growth drivers. Infrastructure development, particularly in East Malaysia, presents significant opportunities for expansion.

Malaysia Power Market Product Developments

The Malaysian power market is witnessing significant product innovations, including advanced grid technologies, smart meters, and energy storage solutions to facilitate the integration of renewable energy sources. These advancements are enhancing grid stability, improving energy efficiency, and providing consumers with greater control over their energy consumption. Companies are increasingly focusing on developing competitive solutions that align with Malaysia's sustainability goals and the demands of a changing energy landscape.

Challenges in the Malaysia Power Market Market

The Malaysian power market faces several challenges, including:

- Regulatory Hurdles: Navigating complex permitting and approval processes can impede project development, especially for large-scale renewable energy initiatives.

- Supply Chain Issues: Securing necessary equipment and materials, particularly for renewable energy projects, can be challenging.

- Competition: Increased competition from IPPs and international players is intensifying.

- Transmission & Distribution infrastructure: Further investments are required to improve grid infrastructure and accommodate the integration of renewable energy.

Forces Driving Malaysia Power Market Growth

Key growth drivers include:

- Government support for renewable energy: Policies promoting the adoption of renewable energy are accelerating the growth of this segment.

- Economic growth: Rising energy demand due to expanding industrialization and urbanization fuels market expansion.

- Technological advancements: Innovations in renewable energy technologies and energy storage solutions are driving down costs and improving efficiency.

Long-Term Growth Catalysts in the Malaysia Power Market

Long-term growth will be driven by continued investment in renewable energy, smart grid technologies, and energy storage solutions. Strategic partnerships between local and international companies will play a crucial role in fostering technological advancement and infrastructure development. Expansion into underserved regions and the integration of advanced energy management systems will also significantly contribute to growth.

Emerging Opportunities in Malaysia Power Market

Significant opportunities exist in developing innovative energy solutions, exploring new renewable energy sources, and improving energy efficiency. Demand for energy storage systems and smart grid technologies will grow rapidly as the country transitions to a more sustainable and reliable energy system. The focus on microgrids and decentralized power generation presents significant opportunities for smaller players in the market.

Leading Players in the Malaysia Power Market Sector

- Korea Electric Power Corporation

- Solarvest Holdings Bhd

- Pathgreen Energy Sdn Bh

- Sarawak Electricity Supply Corporation

- Cutech Green Ventures

- Verdant Solar Inc

- ERS Energy Sdn Bhd

- Sunway Construction Group Bhd

- LYS Energy Group

- Tenaga Nasional Berhad

Key Milestones in Malaysia Power Market Industry

- August 2021: Tenaga Nasional Bhd (TNB) signs a 21-year PPA for 10 solar power plants (50 MWac each), significantly boosting solar capacity.

- March 2021: Suruhanjaya Tenaga completes the bidding process for 823 MW of large-scale solar photovoltaic (LSSPV) projects, accelerating renewable energy adoption.

Strategic Outlook for Malaysia Power Market Market

The Malaysian power market presents a significant growth opportunity, driven by increasing energy demand, government support for renewable energy, and technological advancements. Strategic investments in renewable energy infrastructure, smart grid technologies, and energy storage solutions will be crucial for unlocking long-term growth potential. The market's future is bright, shaped by a commitment to sustainability and a dynamic energy landscape.

Malaysia Power Market Segmentation

-

1. Power Generation Source

- 1.1. Oil

- 1.2. Natural Gas

- 1.3. Coal

- 1.4. Renewables

- 1.5. Other Power Generation Sources

- 2. Transmission and Distribution

-

3. End User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

- 3.4. Transport

- 3.5. Agriculture

Malaysia Power Market Segmentation By Geography

- 1. Malaysia

Malaysia Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources

- 3.3. Market Restrains

- 3.3.1. 4.; The Recycling Rate of Waste in Germany

- 3.4. Market Trends

- 3.4.1. Natural Gas Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 5.1.1. Oil

- 5.1.2. Natural Gas

- 5.1.3. Coal

- 5.1.4. Renewables

- 5.1.5. Other Power Generation Sources

- 5.2. Market Analysis, Insights and Forecast - by Transmission and Distribution

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.3.4. Transport

- 5.3.5. Agriculture

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Korea Electric Power Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Solarvest Holdings Bhd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pathgreen Energy Sdn Bh

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sarawak Electricity Supply Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cutech Green Ventures

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Verdant Solar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ERS Energy Sdn Bhd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sunway Construction Group Bhd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 LYS Energy Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tenaga Nasional Berhad

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Korea Electric Power Corporation

List of Figures

- Figure 1: Malaysia Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Power Market Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Power Market Revenue Million Forecast, by Power Generation Source 2019 & 2032

- Table 3: Malaysia Power Market Revenue Million Forecast, by Transmission and Distribution 2019 & 2032

- Table 4: Malaysia Power Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Malaysia Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Malaysia Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Malaysia Power Market Revenue Million Forecast, by Power Generation Source 2019 & 2032

- Table 8: Malaysia Power Market Revenue Million Forecast, by Transmission and Distribution 2019 & 2032

- Table 9: Malaysia Power Market Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Malaysia Power Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Power Market?

The projected CAGR is approximately > 4.20%.

2. Which companies are prominent players in the Malaysia Power Market?

Key companies in the market include Korea Electric Power Corporation, Solarvest Holdings Bhd, Pathgreen Energy Sdn Bh, Sarawak Electricity Supply Corporation, Cutech Green Ventures, Verdant Solar Inc, ERS Energy Sdn Bhd, Sunway Construction Group Bhd, LYS Energy Group, Tenaga Nasional Berhad.

3. What are the main segments of the Malaysia Power Market?

The market segments include Power Generation Source, Transmission and Distribution, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources.

6. What are the notable trends driving market growth?

Natural Gas Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Recycling Rate of Waste in Germany.

8. Can you provide examples of recent developments in the market?

In August 2021, Malaysian power utility Tenaga Nasional Bhd (TNB) entered a 21-year PPA (Power Purchase Agreement) with 10 solar power plants to be commissioned in four Malaysian states by 2023. Each solar project has a capacity of 50 MWac.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Power Market?

To stay informed about further developments, trends, and reports in the Malaysia Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence