Key Insights

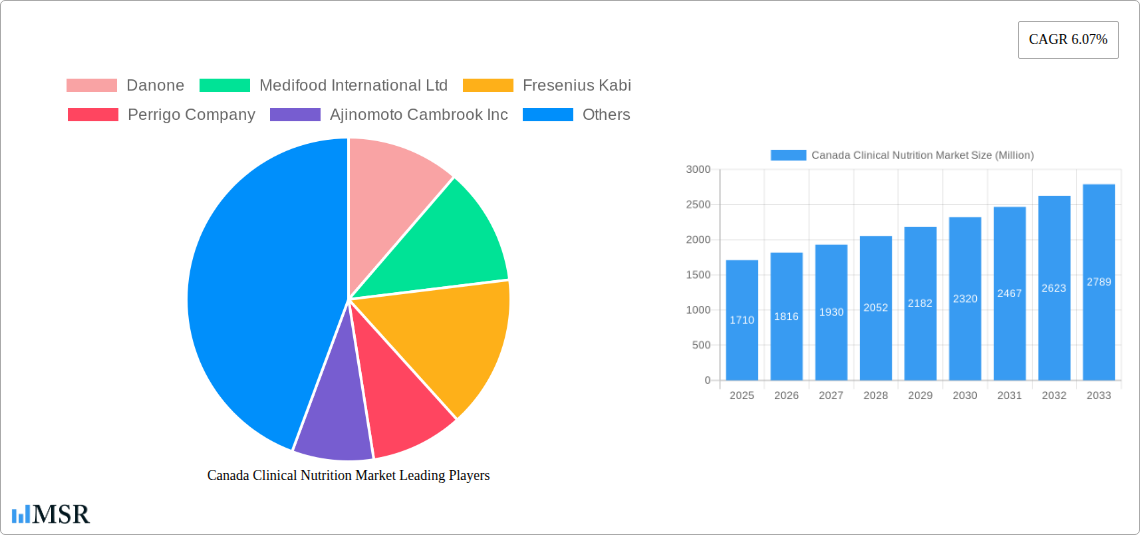

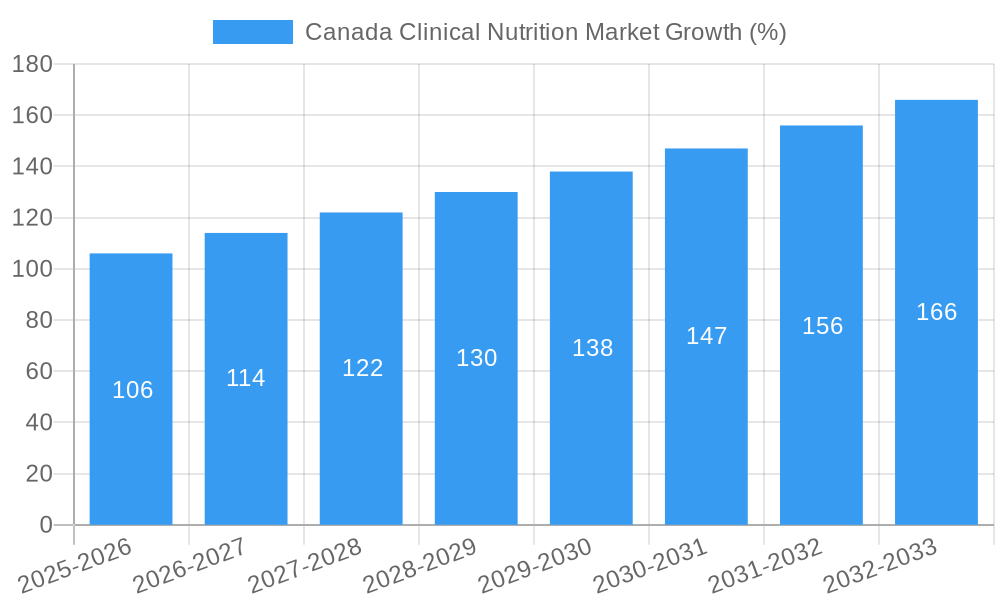

The Canadian clinical nutrition market, valued at $1.71 billion in 2025, is projected to experience robust growth, driven by an aging population, rising prevalence of chronic diseases like cancer and metabolic disorders, and increasing healthcare expenditure. The market's Compound Annual Growth Rate (CAGR) of 6.07% from 2019-2024 indicates a consistently expanding demand for specialized nutritional products and therapies. Key growth drivers include the increasing adoption of enteral and parenteral nutrition methods in hospitals and long-term care facilities, coupled with growing awareness among healthcare professionals and patients regarding the importance of optimized nutrition for disease management and recovery. The adult segment is currently larger than the pediatric segment, reflecting a higher prevalence of chronic diseases among the adult population. However, growing awareness regarding the importance of proper nutrition in child development is likely to fuel growth in the pediatric segment in the coming years. Oral and enteral routes of administration currently dominate, while parenteral nutrition is expected to see growth due to its efficacy in managing severe malnutrition and critical illnesses. Major players like Danone, Nestle Health Science, and Abbott Laboratories are strategically investing in research and development to innovate product offerings and expand their market presence.

The market's segmentation by application reflects the diverse therapeutic needs it serves. Cancer treatment, a significant driver of clinical nutrition demand, will continue to experience growth due to rising cancer incidence rates. Malnutrition, metabolic disorders, neurological diseases, and gastrointestinal disorders are also significant application segments within the Canadian clinical nutrition market. While regulatory approvals and pricing pressures might pose some restraints, the overall growth trajectory remains positive, fuelled by increasing healthcare spending and the rising demand for personalized nutrition solutions tailored to specific health conditions. Further expansion is expected through technological advancements, personalized nutrition approaches, and increasing collaborations among key players in the pharmaceutical and nutrition sectors. The market is poised for continued growth throughout the forecast period (2025-2033), with significant opportunities for companies specializing in advanced nutritional formulations and delivery systems.

Canada Clinical Nutrition Market Report: 2019-2033

Uncover lucrative opportunities and navigate challenges in the dynamic Canadian clinical nutrition market with this comprehensive report. This in-depth analysis provides a detailed overview of the market's size, growth drivers, key segments, competitive landscape, and future outlook from 2019-2033. The report includes valuable insights into market dynamics, technological advancements, and regulatory trends, empowering stakeholders to make informed strategic decisions. The base year for this analysis is 2025, with data encompassing the historical period (2019-2024), the estimated year (2025), and a forecast period extending to 2033. The market is segmented by end-user (pediatric, adult), route of administration (oral & enteral, parenteral), and application (cancer, malnutrition, metabolic disorders, neurological diseases, gastrointestinal disorders, others). Key players such as Danone, Nestle Health Science, and Abbott Laboratories are profiled. The report projects a market value of xx Million by 2033.

Canada Clinical Nutrition Market Market Concentration & Dynamics

This section analyzes the competitive landscape, including market concentration, innovation, regulations, substitutes, end-user trends, and mergers and acquisitions (M&A) activity within the Canadian clinical nutrition market.

The market exhibits a moderately concentrated structure, with the top 5 players holding an estimated xx% market share in 2025. Innovation is driven by ongoing research into specialized formulas and advanced delivery systems. Stringent regulatory frameworks, including Health Canada guidelines, influence product development and market entry. Substitute products, such as home-prepared diets, pose a competitive challenge, particularly in certain segments. End-user trends show a growing preference for convenient, palatable, and effective clinical nutrition solutions. M&A activity has been moderate in recent years, with an estimated xx M&A deals occurring between 2019 and 2024. This activity is expected to increase in the coming years driven by efforts to consolidate market share.

- Market Concentration: Top 5 players hold xx% market share (2025).

- Innovation Ecosystem: Focus on specialized formulas and advanced delivery systems.

- Regulatory Framework: Adherence to Health Canada guidelines.

- Substitute Products: Competition from home-prepared diets.

- End-User Trends: Growing demand for convenient and effective solutions.

- M&A Activity: xx deals between 2019-2024.

Canada Clinical Nutrition Market Industry Insights & Trends

This section examines the factors influencing the growth trajectory of the Canadian clinical nutrition market. The market is poised for significant expansion, driven by factors such as an aging population, increasing prevalence of chronic diseases, and advancements in nutritional science. Technological disruptions, including personalized nutrition solutions and telehealth integration, are reshaping market dynamics. Shifting consumer preferences towards convenient and effective products, alongside a rising awareness about the importance of nutrition for health management, further propel market growth. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, registering a CAGR of xx% during the forecast period.

Key Markets & Segments Leading Canada Clinical Nutrition Market

This section identifies the leading segments within the Canadian clinical nutrition market based on end-user, route of administration, and application.

Dominant Segment Analysis: The adult segment currently holds the largest market share, driven by the increasing prevalence of chronic diseases among the aging population. Parenteral administration is experiencing robust growth due to its suitability for patients with compromised digestive systems. The application segment shows strong growth in cancer, malnutrition, and metabolic disorders.

End User:

- Adult: Largest segment due to high prevalence of chronic diseases.

- Pediatric: Growth driven by increasing awareness of nutritional needs in children.

Route of Administration:

- Parenteral: Fastest-growing segment due to suitability for patients with compromised digestive systems.

- Oral & Enteral: Dominates market share due to widespread accessibility and ease of use.

Application:

- Cancer: Significant market driven by the high prevalence and treatment needs of cancer patients.

- Malnutrition: Growing demand fueled by increasing awareness of its impact on health outcomes.

- Metabolic Disorders: Expanding market driven by the rising incidence of metabolic disorders.

Drivers: Increasing prevalence of chronic diseases, aging population, advancements in medical technology, rising healthcare expenditure.

Canada Clinical Nutrition Market Product Developments

Recent product developments are focused on enhanced palatability, improved nutrient bioavailability, and specialized formulations catering to specific patient needs. These innovations address challenges in adherence and efficacy. Technological advancements, such as the use of advanced delivery systems and personalized nutrition strategies, are creating competitive advantages for companies.

Challenges in the Canada Clinical Nutrition Market Market

The Canadian clinical nutrition market faces challenges including stringent regulatory approvals, supply chain complexities impacting raw material availability and timely delivery, and intense competition from both domestic and international players. These factors can influence pricing and market access. The increasing cost of raw materials also presents a significant obstacle.

Forces Driving Canada Clinical Nutrition Market Growth

Key growth drivers include rising healthcare expenditure, an aging population increasing the demand for clinical nutrition products, and technological advancements leading to the development of innovative products. The growing prevalence of chronic diseases further fuels market expansion.

Long-Term Growth Catalysts in Canada Clinical Nutrition Market

Long-term growth is anticipated to be fueled by strategic partnerships and collaborations between nutrition companies and healthcare providers, along with continuous product innovation and expansion into new market segments. Increased investment in research and development will further drive market growth.

Emerging Opportunities in Canada Clinical Nutrition Market

Emerging opportunities lie in personalized nutrition, the integration of telehealth, and the development of specialized products for niche populations. The growing emphasis on preventative healthcare and proactive nutritional management also presents opportunities for market expansion.

Leading Players in the Canada Clinical Nutrition Market Sector

- Danone

- Medifood International Ltd

- Fresenius Kabi

- Perrigo Company

- Ajinomoto Cambrook Inc

- Aymes International Ltd

- Nestle Health Science

- Baxter

- B Braun SE

- Abbott Laboratories

- Reckitt Benckiser

Key Milestones in Canada Clinical Nutrition Market Industry

- 2020: Health Canada updates regulations for medical food products.

- 2022: Launch of a new specialized formula for managing metabolic disorders by a leading company.

- 2023: Major merger between two key players in the market.

- 2024: Introduction of a telehealth platform integrating personalized nutrition recommendations. (Specific details are xx, as they are not yet available)

Strategic Outlook for Canada Clinical Nutrition Market Market

The Canadian clinical nutrition market presents significant growth potential over the next decade, driven by the convergence of demographic shifts, technological advancements, and an increasing focus on preventative healthcare. Strategic investments in R&D, strategic partnerships, and targeted market expansion will be key factors for success. The market's future is bright, with opportunities for innovation and expansion across all segments.

Canada Clinical Nutrition Market Segmentation

-

1. Route of Administration

- 1.1. Oral and Enteral

- 1.2. Parenteral

-

2. Application

- 2.1. Cancer

- 2.2. Malnutrition

- 2.3. Metabolic Disorders

- 2.4. Neurological Diseases

- 2.5. Gastrointestinal Disorders

- 2.6. Others

-

3. End User

- 3.1. Pediatric

- 3.2. Adult

Canada Clinical Nutrition Market Segmentation By Geography

- 1. Canada

Canada Clinical Nutrition Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Chronic and Metabolic Diseases; Increasing Pre-term Births; Rise in the Geriatric Population

- 3.3. Market Restrains

- 3.3.1. Stringent Regulation for Clinical Nutrition

- 3.4. Market Trends

- 3.4.1. Malnutrition is Expected to Hold a Major Share in the Coming Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Clinical Nutrition Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 5.1.1. Oral and Enteral

- 5.1.2. Parenteral

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cancer

- 5.2.2. Malnutrition

- 5.2.3. Metabolic Disorders

- 5.2.4. Neurological Diseases

- 5.2.5. Gastrointestinal Disorders

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pediatric

- 5.3.2. Adult

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Danone

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Medifood International Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fresenius Kabi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Perrigo Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ajinomoto Cambrook Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aymes International Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nestle Health Science

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Baxter

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 B Braun SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Abbott Laboratories

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Reckitt Benckiser

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Danone

List of Figures

- Figure 1: Canada Clinical Nutrition Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Clinical Nutrition Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Clinical Nutrition Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Clinical Nutrition Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Canada Clinical Nutrition Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 4: Canada Clinical Nutrition Market Volume K Unit Forecast, by Route of Administration 2019 & 2032

- Table 5: Canada Clinical Nutrition Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Canada Clinical Nutrition Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Canada Clinical Nutrition Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Canada Clinical Nutrition Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: Canada Clinical Nutrition Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Canada Clinical Nutrition Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Canada Clinical Nutrition Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Canada Clinical Nutrition Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Canada Clinical Nutrition Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 14: Canada Clinical Nutrition Market Volume K Unit Forecast, by Route of Administration 2019 & 2032

- Table 15: Canada Clinical Nutrition Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Canada Clinical Nutrition Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 17: Canada Clinical Nutrition Market Revenue Million Forecast, by End User 2019 & 2032

- Table 18: Canada Clinical Nutrition Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 19: Canada Clinical Nutrition Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Canada Clinical Nutrition Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Clinical Nutrition Market?

The projected CAGR is approximately 6.07%.

2. Which companies are prominent players in the Canada Clinical Nutrition Market?

Key companies in the market include Danone, Medifood International Ltd, Fresenius Kabi, Perrigo Company, Ajinomoto Cambrook Inc, Aymes International Ltd, Nestle Health Science, Baxter, B Braun SE, Abbott Laboratories, Reckitt Benckiser.

3. What are the main segments of the Canada Clinical Nutrition Market?

The market segments include Route of Administration, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Chronic and Metabolic Diseases; Increasing Pre-term Births; Rise in the Geriatric Population.

6. What are the notable trends driving market growth?

Malnutrition is Expected to Hold a Major Share in the Coming Years.

7. Are there any restraints impacting market growth?

Stringent Regulation for Clinical Nutrition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Clinical Nutrition Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Clinical Nutrition Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Clinical Nutrition Market?

To stay informed about further developments, trends, and reports in the Canada Clinical Nutrition Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence