Key Insights

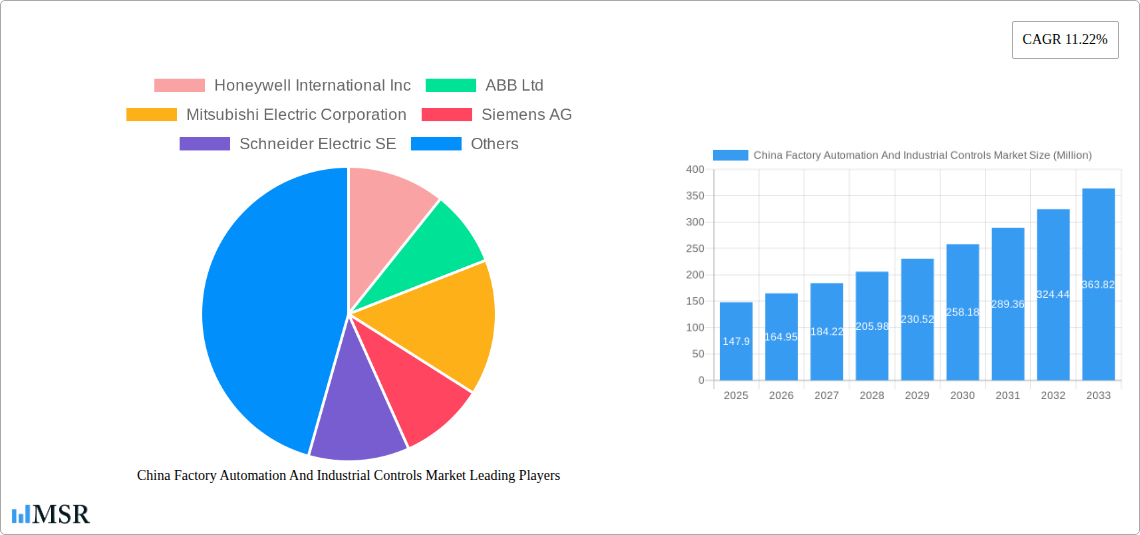

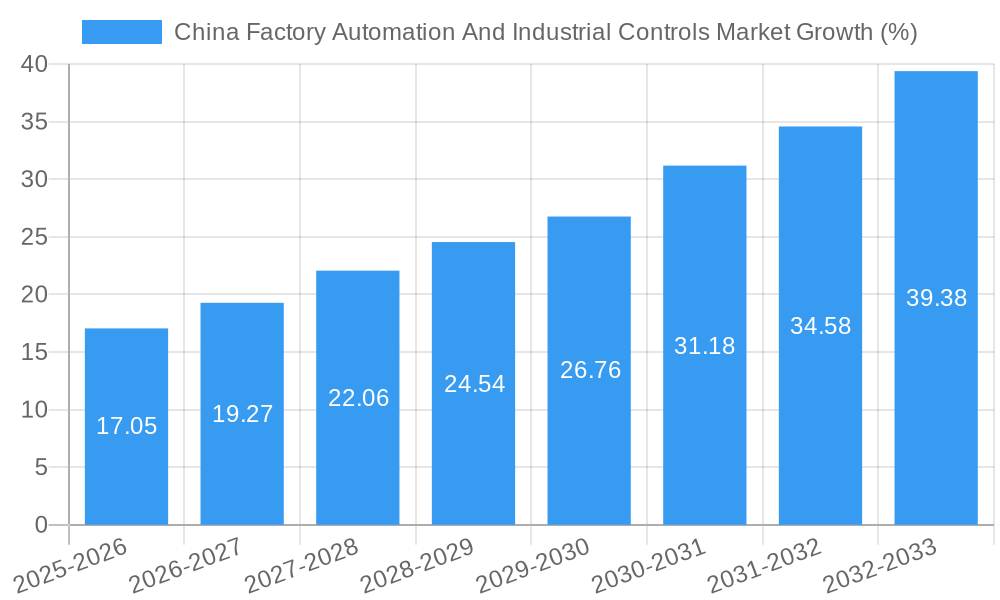

The China Factory Automation and Industrial Controls market is experiencing robust growth, projected to reach a market size of $147.90 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 11.22% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the ongoing industrialization and modernization efforts within China necessitate significant investments in advanced automation technologies to enhance productivity and efficiency across various sectors. The increasing adoption of Industry 4.0 principles, emphasizing interconnected systems and data-driven decision-making, fuels this demand. Specifically, sectors like oil and gas, chemical and petrochemical, and power and utilities are leading adopters, driven by the need for improved safety, process optimization, and remote monitoring capabilities. The growth is also fueled by government initiatives promoting technological advancement and automation within manufacturing, creating a favorable regulatory environment. Furthermore, the rising demand for sophisticated industrial control systems, particularly field devices for enhanced process control and data acquisition, is a significant contributor to market expansion. Competition amongst major players like Honeywell, ABB, Siemens, and others fosters innovation and drives down costs, further accelerating market penetration.

While the market shows strong potential, certain challenges exist. The high initial investment cost associated with implementing factory automation systems can be a barrier for smaller enterprises. Furthermore, the reliance on sophisticated technologies and skilled labor to maintain and operate these systems might present some constraints to wider adoption. However, ongoing technological advancements, such as the development of more user-friendly interfaces and the emergence of cost-effective solutions, are expected to mitigate these challenges in the long term. The continued focus on improving energy efficiency and reducing operational costs will also serve as a long-term driver for the market's sustained growth within the Chinese industrial landscape. The dominance of specific segments, like industrial control systems, indicates a strong focus on core automation infrastructure, pointing towards further expansion in connected technologies and integrated solutions in the future.

China Factory Automation And Industrial Controls Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning China Factory Automation and Industrial Controls Market, offering invaluable insights for stakeholders across the industrial automation landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers crucial data-driven predictions for informed decision-making. The market is segmented by end-user industry (Oil and Gas, Chemical and Petrochemical, Power and Utilities, Automotive and Transportation, Pharmaceuticals, Food and Beverage, Other End-user Industries) and by type (Industrial Control Systems, Other Industrial Control Systems: Field Devices). Key players analyzed include Honeywell International Inc, ABB Ltd, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Omron Corporation, Yokogawa Electric Corporation, Rockwell Automation Inc, General Electric Company, and Emerson Electric Company. The report's projected market size (in Million) for 2025 is xx Million, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

China Factory Automation And Industrial Controls Market Market Concentration & Dynamics

The China factory automation and industrial controls market exhibits a moderately concentrated structure, with a few global giants and several strong domestic players vying for market share. While precise market share figures for individual companies require detailed proprietary data, the landscape suggests that multinational corporations like Siemens AG, ABB Ltd, and Honeywell International Inc hold significant positions. However, domestic Chinese companies are rapidly gaining ground, leveraging their understanding of local market needs and government support. This competitive dynamic fosters innovation, driving the development of advanced technologies and solutions tailored to the unique demands of the Chinese manufacturing sector.

The regulatory framework in China plays a crucial role, with government initiatives promoting industrial upgrades and digital transformation significantly influencing market growth. The ongoing push towards Industry 4.0 and smart manufacturing is creating a favorable environment for automation adoption across various sectors. However, regulatory complexities and evolving standards can present challenges for market participants.

Substitute products, such as legacy control systems, pose limited competition as the market progressively shifts towards advanced automation technologies. End-user trends indicate a strong preference for flexible, scalable, and interconnected systems capable of integrating seamlessly with existing infrastructure. Mergers and acquisitions (M&A) activity in this sector is robust. The number of significant M&A deals in the last five years has averaged around xx annually, reflecting the consolidation and expansion strategies of key players seeking to enhance their market position and technological capabilities.

China Factory Automation And Industrial Controls Market Industry Insights & Trends

The China factory automation and industrial controls market is experiencing robust growth, driven by several key factors. The country's ongoing industrialization and the government's ambitious "Made in China 2025" initiative are major catalysts. The rising labor costs and the need for enhanced efficiency are further fueling the adoption of automation technologies. The market size in 2024 was approximately xx Million, and is projected to reach xx Million by 2033, indicating a significant growth trajectory. This growth is underpinned by technological advancements in areas like Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT), which are transforming industrial operations and enabling greater levels of automation and data-driven decision-making. The increasing demand for enhanced production efficiency, improved product quality, and reduced operational costs across diverse industries, including automotive, electronics, and food and beverage, is further boosting market expansion. Evolving consumer behavior, particularly the growing preference for customized products and faster delivery times, are putting pressure on manufacturers to adopt more agile and flexible automation solutions.

Key Markets & Segments Leading China Factory Automation And Industrial Controls Market

The Chinese factory automation and industrial controls market is geographically diverse, with significant opportunities across multiple regions. However, coastal provinces, particularly those with established manufacturing hubs such as Guangdong, Jiangsu, and Zhejiang, tend to be the most dominant. These regions benefit from strong infrastructure, a skilled workforce, and proximity to key supply chains.

- By End-user Industry: The automotive and transportation sector demonstrates substantial growth potential, driven by the rapid expansion of the electric vehicle (EV) industry and the increasing adoption of automation in assembly and manufacturing processes. The chemical and petrochemical sector also presents significant opportunities due to the need for process optimization and safety improvements.

- By Type: Industrial control systems, including programmable logic controllers (PLCs) and supervisory control and data acquisition (SCADA) systems, constitute the largest market segment due to their widespread application across various industrial processes. The field device segment is also experiencing strong growth, driven by the increasing demand for advanced sensors and actuators capable of providing real-time data and enabling enhanced process control.

China Factory Automation And Industrial Controls Market Product Developments

Recent advancements focus on integrating AI and ML into industrial control systems, enabling predictive maintenance, optimized process control, and autonomous operations. The emergence of edge computing and cloud-based solutions facilitates real-time data analytics and improved decision-making. Companies are also developing more user-friendly interfaces and intuitive software solutions to make automation technologies more accessible to a wider range of users, regardless of technical expertise. This focus on user-friendliness, coupled with improved scalability and connectivity, is driving broader adoption across various industry segments.

Challenges in the China Factory Automation And Industrial Controls Market Market

Several factors pose challenges to market expansion. These include the integration complexities associated with legacy systems, the high initial investment costs involved in automation upgrades, and concerns surrounding data security and cybersecurity vulnerabilities. Supply chain disruptions and the availability of skilled labor are also potential hurdles. The regulatory landscape, while supportive of automation in general, can present specific compliance challenges for certain applications. The overall impact of these challenges on market growth is estimated to be a reduction of approximately xx Million in market value annually.

Forces Driving China Factory Automation And Industrial Controls Market Growth

Several key drivers propel the market's growth. Firstly, the government's continued push for industrial upgrading and smart manufacturing provides a significant impetus. Secondly, the increasing labor costs in China make automation an increasingly attractive solution for manufacturers. Thirdly, technological innovation in areas like AI, IoT, and cloud computing provides advanced solutions that enhance efficiency and productivity. Finally, growing demand for higher quality products, faster delivery times, and increased flexibility are creating strong demand for sophisticated automation systems.

Long-Term Growth Catalysts in the China Factory Automation And Industrial Controls Market

Long-term growth will be fueled by increased investments in R&D, fostering innovations in areas such as robotics, machine vision, and advanced process control. Strategic partnerships between technology providers and end-users will facilitate the seamless integration of automation systems, accelerating market adoption. Furthermore, expanding automation into new sectors and regions within China, coupled with the ongoing drive toward Industry 4.0, will unlock significant growth opportunities over the next decade.

Emerging Opportunities in China Factory Automation And Industrial Controls Market

The integration of 5G technology promises to further enhance data transfer speeds and connectivity, creating new opportunities for real-time monitoring and control. The increasing use of digital twins for simulating and optimizing industrial processes is also opening up new avenues for efficiency gains. Finally, the growing focus on sustainability and energy efficiency is driving demand for automation solutions that can minimize environmental impact.

Leading Players in the China Factory Automation And Industrial Controls Market Sector

- Honeywell International Inc

- ABB Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- Omron Corporation

- Yokogawa Electric Corporation

- Rockwell Automation Inc

- General Electric Company

- Emerson Electric Company

Key Milestones in China Factory Automation And Industrial Controls Market Industry

- April 2024: Valmet launched its next-generation distributed control system (DCS), Valmet DNAe, furthering digitalization and autonomous operations.

- November 2023: Nio announced plans to significantly reduce its workforce by 2027, accelerating the adoption of robotics in its manufacturing processes.

Strategic Outlook for China Factory Automation And Industrial Controls Market Market

The China factory automation and industrial controls market presents significant long-term growth potential, driven by technological advancements, favorable government policies, and the increasing need for enhanced efficiency and productivity across various sectors. Strategic opportunities exist for companies that can offer innovative, scalable, and user-friendly solutions, integrating seamlessly with existing infrastructure and addressing the unique challenges and opportunities presented by the Chinese market. Focusing on digitalization, sustainability, and partnerships will be key to capturing this significant market potential.

China Factory Automation And Industrial Controls Market Segmentation

-

1. Type

-

1.1. Industrial Control Systems

- 1.1.1. Distributed Control System (DCS)

- 1.1.2. PLC (Programmable Logic Controller)

- 1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 1.1.4. Product Lifecycle Management (PLM)

- 1.1.5. Human Machine Interface (HMI)

- 1.1.6. Manufacturing Execution System (MES)

- 1.1.7. Enterprise Resource Planning (ERP)

- 1.1.8. Other Industrial Control Systems

-

1.2. Field Devices

- 1.2.1. Sensors and Transmitters

- 1.2.2. Electric Motors and Drives

- 1.2.3. Industrial Robotics

- 1.2.4. Machine Vision Systems

- 1.2.5. Other Field Devices

-

1.1. Industrial Control Systems

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Chemical and Petrochemical

- 2.3. Power and Utilities

- 2.4. Automotive and Transportation

- 2.5. Pharmaceuticals

- 2.6. Food and Beverage

- 2.7. Other End-user Industries

China Factory Automation And Industrial Controls Market Segmentation By Geography

- 1. China

China Factory Automation And Industrial Controls Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.22% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Prominence of Automation Technologies Due to Declining Workforce

- 3.3. Market Restrains

- 3.3.1. High Initial Cost in Implementing Geospatial Analytics Solutions

- 3.4. Market Trends

- 3.4.1. The Distributed Control System Segment is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Factory Automation And Industrial Controls Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Industrial Control Systems

- 5.1.1.1. Distributed Control System (DCS)

- 5.1.1.2. PLC (Programmable Logic Controller)

- 5.1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 5.1.1.4. Product Lifecycle Management (PLM)

- 5.1.1.5. Human Machine Interface (HMI)

- 5.1.1.6. Manufacturing Execution System (MES)

- 5.1.1.7. Enterprise Resource Planning (ERP)

- 5.1.1.8. Other Industrial Control Systems

- 5.1.2. Field Devices

- 5.1.2.1. Sensors and Transmitters

- 5.1.2.2. Electric Motors and Drives

- 5.1.2.3. Industrial Robotics

- 5.1.2.4. Machine Vision Systems

- 5.1.2.5. Other Field Devices

- 5.1.1. Industrial Control Systems

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Chemical and Petrochemical

- 5.2.3. Power and Utilities

- 5.2.4. Automotive and Transportation

- 5.2.5. Pharmaceuticals

- 5.2.6. Food and Beverage

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mitsubishi Electric Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Schneider Electric SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Omron Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yokogawa Electric Corporatio

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rockwell Automation Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 General Electric Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Emerson Electric Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: China Factory Automation And Industrial Controls Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Factory Automation And Industrial Controls Market Share (%) by Company 2024

List of Tables

- Table 1: China Factory Automation And Industrial Controls Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Factory Automation And Industrial Controls Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: China Factory Automation And Industrial Controls Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: China Factory Automation And Industrial Controls Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Factory Automation And Industrial Controls Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Factory Automation And Industrial Controls Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: China Factory Automation And Industrial Controls Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: China Factory Automation And Industrial Controls Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Factory Automation And Industrial Controls Market?

The projected CAGR is approximately 11.22%.

2. Which companies are prominent players in the China Factory Automation And Industrial Controls Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Omron Corporation, Yokogawa Electric Corporatio, Rockwell Automation Inc, General Electric Company, Emerson Electric Company.

3. What are the main segments of the China Factory Automation And Industrial Controls Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 147.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Prominence of Automation Technologies Due to Declining Workforce.

6. What are the notable trends driving market growth?

The Distributed Control System Segment is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

High Initial Cost in Implementing Geospatial Analytics Solutions.

8. Can you provide examples of recent developments in the market?

April 2024 - Valmet announced the launch of the next-generation distributed control system (DCS), the Valmet DNAe. It provides a solid platform for moving toward more digitalized, autonomous operations, helping customers thrive in the changing business environment. The system provides a familiar user interface for controls, analytics, configuration, and maintenance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Factory Automation And Industrial Controls Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Factory Automation And Industrial Controls Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Factory Automation And Industrial Controls Market?

To stay informed about further developments, trends, and reports in the China Factory Automation And Industrial Controls Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence