Key Insights

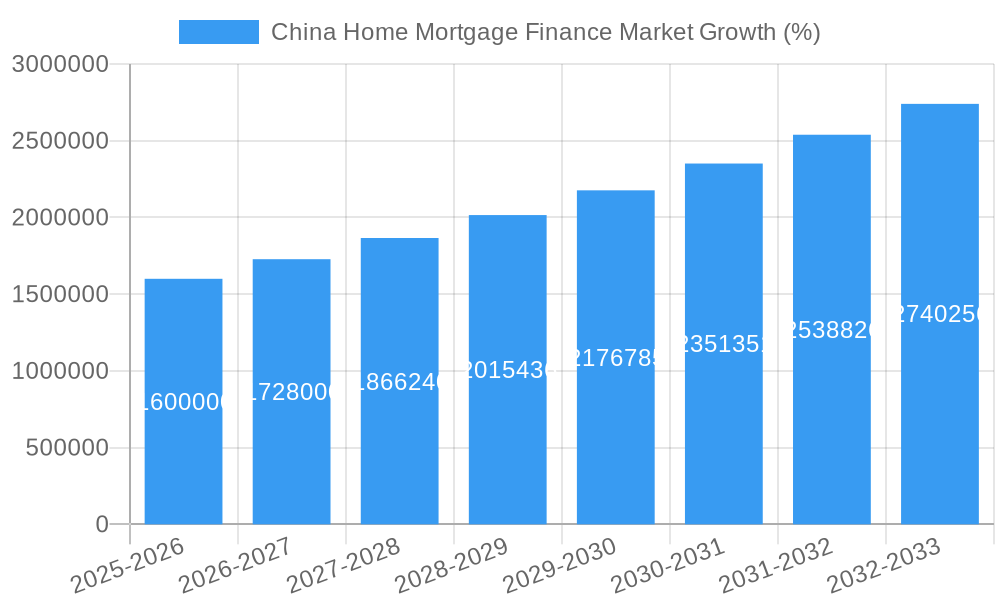

The China home mortgage finance market, while experiencing fluctuations, demonstrates a robust and expanding trajectory. The study period of 2019-2033 reveals a substantial market size, with significant growth projected throughout the forecast period (2025-2033). While the exact figures for the market size in 2019 and 2024 aren't provided, a reasonable estimation can be made considering typical CAGR for emerging markets in this sector. Assuming a conservative CAGR of 8% over the 2019-2024 period, and a 2025 market size (base year) of, let's say, 20 trillion RMB, we can infer substantial prior market values and project future growth. The 2025-2033 forecast period will likely see continued growth, albeit potentially at a slightly moderated pace due to government regulations aimed at mitigating risk within the housing sector. Factors such as urbanization, increasing disposable incomes, and government policies supporting homeownership will continue to fuel market expansion. However, challenges like fluctuating interest rates, potential economic slowdowns, and tightening lending standards could influence the overall growth trajectory. The market's performance will be highly dependent on the efficacy of government regulatory measures in balancing market growth with financial stability.

The sustained growth projected for the China home mortgage finance market is underpinned by several key drivers. The ongoing urbanization trend in China continues to fuel demand for housing, particularly in rapidly developing cities. A rising middle class with increased disposable incomes is increasingly able to afford homeownership, further driving demand. Government initiatives aimed at supporting affordable housing and stimulating the real estate sector also contribute to the positive outlook. However, it is essential to acknowledge the potential risks. The Chinese government's ongoing efforts to manage risks in the property sector, through measures like stricter loan-to-value ratios and tighter regulations on developers, could influence growth. Fluctuations in interest rates and economic downturns also pose challenges. Navigating these complexities will be crucial for stakeholders operating within this dynamic market. A cautious yet optimistic approach is warranted, anticipating continued growth while remaining mindful of potential regulatory shifts and economic factors.

China Home Mortgage Finance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China Home Mortgage Finance Market, covering market dynamics, industry trends, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The forecast period extends from 2025 to 2033, while the historical period analyzed covers 2019-2024. The market size is projected to reach xx Million by 2025, with a CAGR of xx% during the forecast period.

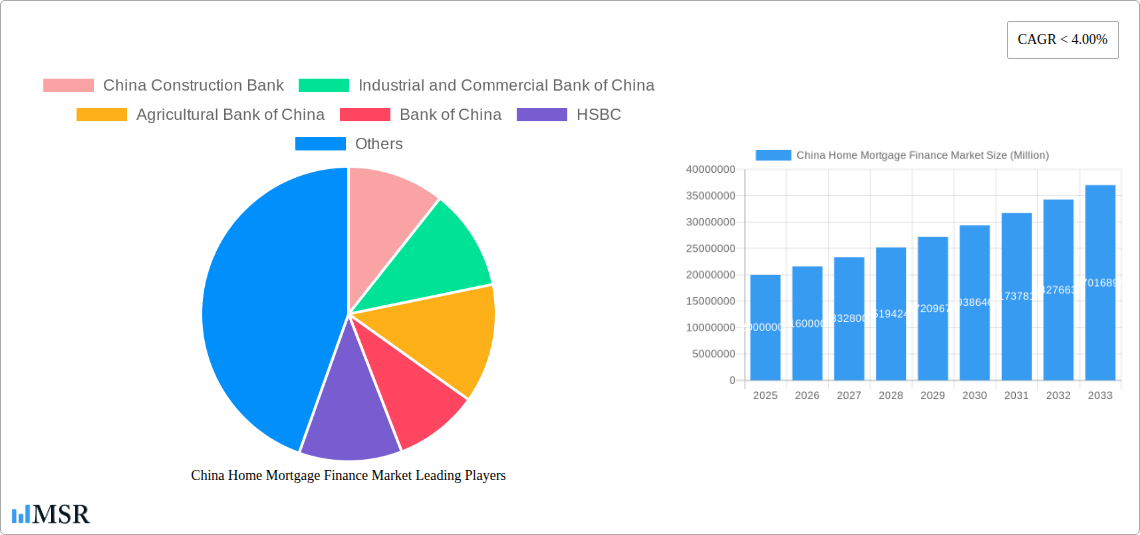

China Home Mortgage Finance Market Market Concentration & Dynamics

The China home mortgage finance market exhibits a high degree of concentration, with major players like China Construction Bank, Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, HSBC, Bank of Communications, and Postal Savings Bank of China dominating the landscape. Their combined market share exceeds xx%, leaving smaller players to compete for the remaining portion.

- Market Share: The top 5 banks hold approximately xx% of the market share in 2025.

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals, primarily focused on consolidation and expansion into niche segments. The forecast period is expected to see a decrease in M&A activity due to regulatory changes and economic slowdown.

- Regulatory Framework: Stringent regulations aimed at managing risk and promoting stability significantly influence market dynamics.

- Innovation Ecosystems: While innovation is present, it’s primarily focused on technological improvements to existing mortgage processes rather than disruptive innovations.

- Substitute Products: Limited substitute products exist, as homeownership remains a dominant aspiration in China.

- End-User Trends: A shift towards younger homebuyers with different financial profiles is shaping demand.

China Home Mortgage Finance Market Industry Insights & Trends

The China home mortgage finance market is experiencing dynamic growth, driven by several factors. Urbanization, rising disposable incomes, and government initiatives promoting homeownership contribute significantly to market expansion. The market size was valued at xx Million in 2024 and is projected to reach xx Million by 2025, with a CAGR of xx% from 2025 to 2033. However, recent economic headwinds and regulatory changes, especially those impacting the real estate sector, are creating uncertainties. Technological advancements, such as fintech solutions for mortgage processing and risk assessment, are transforming the industry. Evolving consumer behaviors, including increasing preference for digital channels and personalized mortgage products, further influence market trends. Concerns remain regarding the potential for a prolonged slowdown in the real estate sector, impacting the growth of the mortgage market. Despite challenges, the long-term prospects for the market remain positive, driven by sustained urbanization and the enduring desire for homeownership.

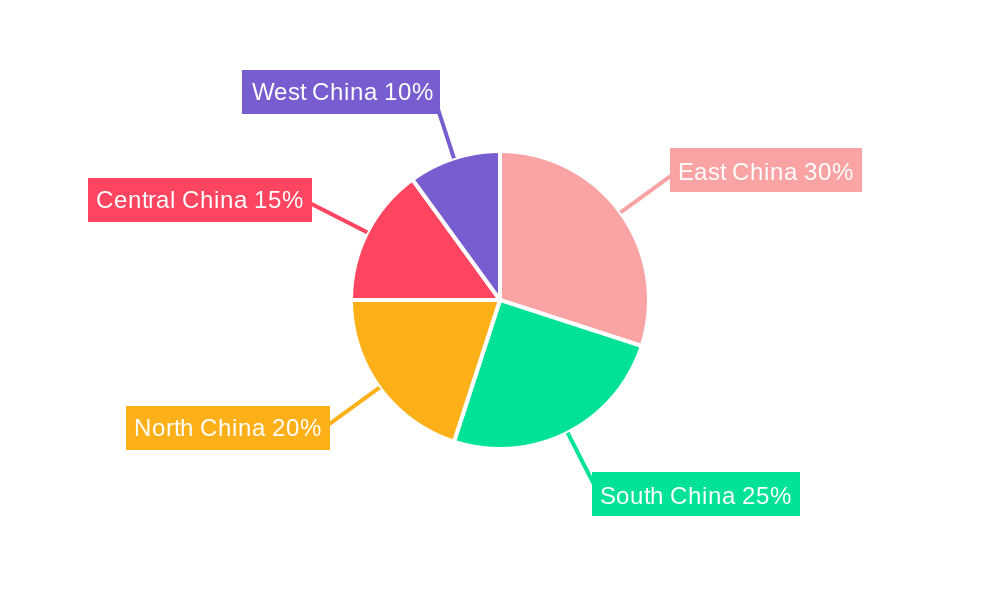

Key Markets & Segments Leading China Home Mortgage Finance Market

Tier-1 and Tier-2 cities in coastal regions of China dominate the home mortgage finance market, primarily driven by robust economic growth, higher disposable incomes, and strong infrastructure development. The market exhibits higher penetration rates in these developed urban centers compared to less developed areas.

- Drivers in Dominant Regions:

- High levels of urbanization and population growth.

- Rapid economic development and rising disposable incomes.

- Significant government investment in infrastructure and housing projects.

- Dominance Analysis: The concentration of high-net-worth individuals and higher purchasing power in these regions leads to a significant concentration of mortgage lending activity. The strong real estate market further fuels the demand for mortgages. However, recent government regulation aimed at cooling down the real estate market is impacting this region.

China Home Mortgage Finance Market Product Developments

Recent product developments focus on enhancing convenience and accessibility, with a growing trend towards online mortgage applications and digital platforms for loan management. Fintech integration is accelerating, providing more efficient and customized mortgage solutions. This includes the use of AI and machine learning for credit scoring and risk assessment, streamlining the approval process. However, competitive pressures remain intense, with lenders constantly seeking to differentiate their offerings through innovative features and improved customer experience.

Challenges in the China Home Mortgage Finance Market Market

The China home mortgage finance market faces several challenges, including:

- Regulatory Hurdles: Stricter regulations aimed at controlling systemic risk and preventing overleveraging impact the market's growth.

- Supply Chain Issues: Disruptions to the real estate development process can affect mortgage demand.

- Competitive Pressures: The intense competition among lenders necessitates continuous innovation and cost optimization.

- Economic Slowdown: The recent economic slowdown has impacted both demand and supply in the market.

Forces Driving China Home Mortgage Finance Market Growth

Several factors drive growth in the China home mortgage finance market.

- Technological Advancements: Fintech solutions improve efficiency and accessibility.

- Economic Growth (albeit slowing): Despite recent slowdowns, sustained economic growth still fuels demand.

- Government Policies: While there's a focus on controlling the real estate market, policies supporting affordable housing still contribute to demand.

Challenges in the China Home Mortgage Finance Market Market

Long-term growth is hindered by uncertainties in the real estate market and regulatory changes. Collaboration and innovation amongst stakeholders are essential to address these challenges. The focus will shift to sustainable and responsible lending practices.

Emerging Opportunities in China Home Mortgage Finance Market

Emerging opportunities include:

- Expansion into underserved markets: Reaching rural areas and lower-income segments with tailored products.

- Green mortgages: Promoting sustainable housing development by offering incentives for energy-efficient homes.

- Data analytics: Leveraging big data for better risk assessment and customized mortgage products.

Leading Players in the China Home Mortgage Finance Market Sector

- China Construction Bank

- Industrial and Commercial Bank of China

- Agricultural Bank of China

- Bank of China

- HSBC

- Bank of Communications

- Postal Savings Bank of China

- List Not Exhaustive

Key Milestones in China Home Mortgage Finance Market Industry

- September 2022: China Construction Bank announces a 30-billion-yuan (USD 4.2 billion) fund to buy properties from developers, aiming to stabilize the real estate market. This signifies a government-backed effort to mitigate the ongoing real estate crisis and indirectly support the mortgage market.

- October 2022: HSBC expands its private banking network in China, launching in two new cities. This reflects the increasing affluence and demand for sophisticated financial services within the country. This highlights increased competition and a focus on higher-value clientele.

Strategic Outlook for China Home Mortgage Finance Market Market

The long-term outlook for the China home mortgage finance market remains positive, despite current challenges. Strategic opportunities lie in adapting to changing regulatory landscapes, leveraging technological advancements, and capitalizing on the enduring demand for homeownership, particularly in rapidly urbanizing areas. A focus on sustainable lending practices and catering to the evolving needs of a diverse consumer base will be crucial for future success.

China Home Mortgage Finance Market Segmentation

-

1. Types of Lenders

- 1.1. Banks

- 1.2. House Provident Fund (HPF)

-

2. Financing Options

- 2.1. Personal New Housing Loan

- 2.2. Personal Second-hand Housing Loan

- 2.3. Personal Housing Provident Fund (Portfolio) Loan

-

3. Types of Mortgage

- 3.1. Fixed

- 3.2. Variable

China Home Mortgage Finance Market Segmentation By Geography

- 1. China

China Home Mortgage Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Favorable Mortgage Rates is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Home Mortgage Finance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Types of Lenders

- 5.1.1. Banks

- 5.1.2. House Provident Fund (HPF)

- 5.2. Market Analysis, Insights and Forecast - by Financing Options

- 5.2.1. Personal New Housing Loan

- 5.2.2. Personal Second-hand Housing Loan

- 5.2.3. Personal Housing Provident Fund (Portfolio) Loan

- 5.3. Market Analysis, Insights and Forecast - by Types of Mortgage

- 5.3.1. Fixed

- 5.3.2. Variable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Types of Lenders

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 China Construction Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Industrial and Commercial Bank of China

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Agricultural Bank of China

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bank of China

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HSBC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bank of Communications

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Postal Savings Bank of China**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 China Construction Bank

List of Figures

- Figure 1: China Home Mortgage Finance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Home Mortgage Finance Market Share (%) by Company 2024

List of Tables

- Table 1: China Home Mortgage Finance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Home Mortgage Finance Market Revenue Million Forecast, by Types of Lenders 2019 & 2032

- Table 3: China Home Mortgage Finance Market Revenue Million Forecast, by Financing Options 2019 & 2032

- Table 4: China Home Mortgage Finance Market Revenue Million Forecast, by Types of Mortgage 2019 & 2032

- Table 5: China Home Mortgage Finance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: China Home Mortgage Finance Market Revenue Million Forecast, by Types of Lenders 2019 & 2032

- Table 7: China Home Mortgage Finance Market Revenue Million Forecast, by Financing Options 2019 & 2032

- Table 8: China Home Mortgage Finance Market Revenue Million Forecast, by Types of Mortgage 2019 & 2032

- Table 9: China Home Mortgage Finance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Home Mortgage Finance Market?

The projected CAGR is approximately < 4.00%.

2. Which companies are prominent players in the China Home Mortgage Finance Market?

Key companies in the market include China Construction Bank, Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, HSBC, Bank of Communications, Postal Savings Bank of China**List Not Exhaustive.

3. What are the main segments of the China Home Mortgage Finance Market?

The market segments include Types of Lenders, Financing Options, Types of Mortgage.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Favorable Mortgage Rates is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: HSBC expands China's private banking network and launches in two new cities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Home Mortgage Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Home Mortgage Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Home Mortgage Finance Market?

To stay informed about further developments, trends, and reports in the China Home Mortgage Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence