Key Insights

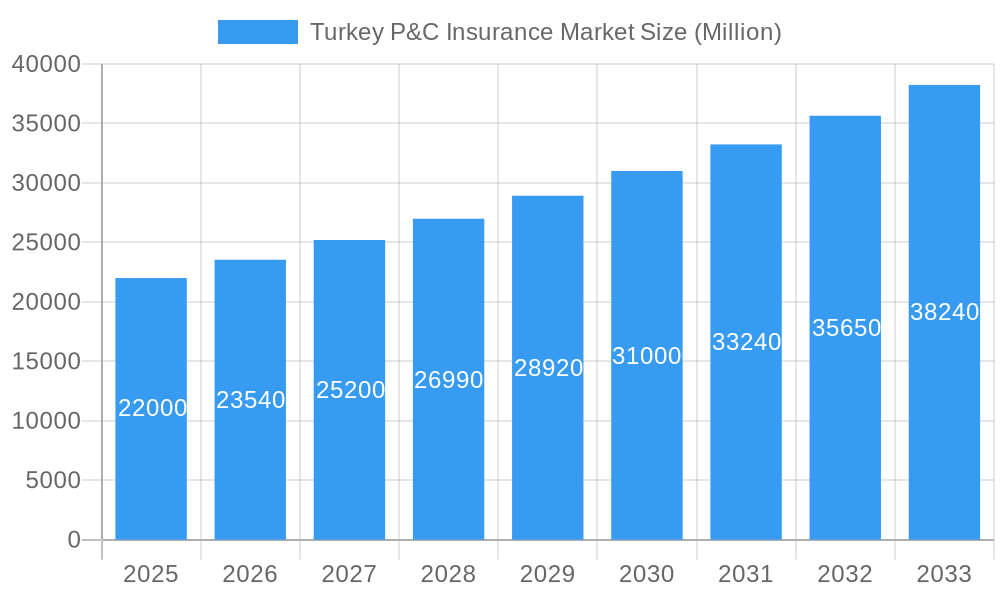

The Turkish Property & Casualty (P&C) insurance market exhibits robust growth potential, driven by increasing urbanization, rising middle-class disposable incomes, and a growing awareness of insurance products. The period between 2019 and 2024 witnessed considerable expansion, laying a strong foundation for future development. While precise figures for the market size in 2019-2024 aren't provided, a reasonable estimation, considering the global P&C insurance market trends and Turkey's economic growth during this period, would place the market size in the range of $15 billion to $20 billion in 2024. This signifies a significant market base on which future growth projections can be built. The forecast period (2025-2033) anticipates continued expansion, fueled by government initiatives promoting financial inclusion and the evolving needs of a dynamic economy. Factors such as increasing vehicle ownership, infrastructure development necessitating construction insurance, and the growing prevalence of natural disasters contribute to the sustained demand for P&C insurance products.

Turkey P&C Insurance Market Market Size (In Billion)

The estimated market size for 2025 serves as a crucial benchmark. Assuming a reasonably conservative CAGR (Compound Annual Growth Rate) of 7% for the forecast period (2025-2033), based on regional trends and economic projections for Turkey, the market is projected to experience consistent expansion. The inclusion of various insurance segments – motor, home, commercial, and liability – contributes to this diversified growth. Regulatory developments and the introduction of innovative insurance products and distribution channels will likely influence market dynamics throughout the forecast period. The market’s susceptibility to economic fluctuations and geopolitical factors remains a key consideration when analyzing long-term growth trajectories. However, overall, the Turkish P&C insurance market presents a compelling investment opportunity with substantial growth prospects.

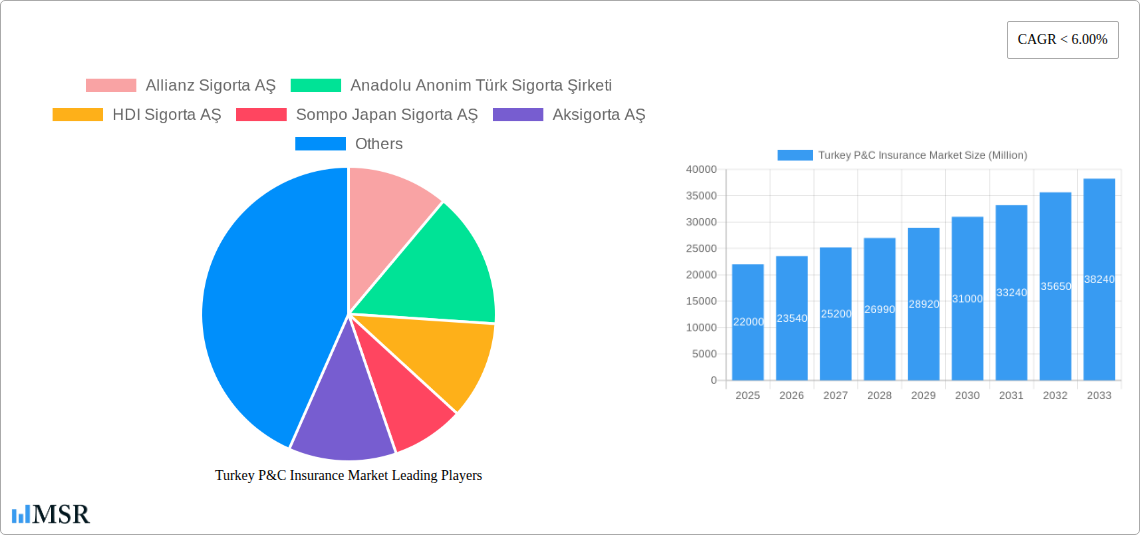

Turkey P&C Insurance Market Company Market Share

Unlock Growth Opportunities in Turkey's Thriving P&C Insurance Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Turkey P&C insurance market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, key segments, leading players, and emerging opportunities. The report leverages extensive data analysis to project a market size of xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Turkey P&C Insurance Market Concentration & Dynamics

This section analyzes the competitive landscape of Turkey's P&C insurance market, assessing market concentration, innovation, regulatory frameworks, and M&A activities. The market exhibits a moderately concentrated structure, with several major players holding significant market share. Allianz Sigorta AŞ, Anadolu Anonim Türk Sigorta Şirketi, and Aksigorta AŞ are amongst the leading players, each commanding a substantial portion of the market. However, several mid-sized and smaller insurers also contribute to the market's dynamism.

- Market Share: The top 5 players account for approximately xx% of the total market share in 2025.

- M&A Activity: The past five years have witnessed xx M&A deals within the Turkish P&C insurance sector, indicating a trend towards consolidation and expansion.

- Regulatory Framework: The regulatory environment plays a crucial role in shaping market dynamics, with ongoing reforms impacting pricing, product offerings, and distribution channels.

- Innovation Ecosystem: The market showcases a growing focus on digitalization and technological innovation, with insurers increasingly adopting Insurtech solutions to enhance customer experience and operational efficiency.

- Substitute Products: The availability of alternative risk mitigation strategies and financial products indirectly impacts the P&C insurance market's growth.

- End-User Trends: The increasing awareness of insurance needs among Turkey's population and the changing consumer preferences drive market growth.

Turkey P&C Insurance Market Industry Insights & Trends

The Turkish P&C insurance market demonstrates robust growth, driven by a combination of factors including rising disposable incomes, increasing vehicle ownership, urbanization, and a growing awareness of insurance products. Technological advancements, especially within digital insurance platforms, are further fueling market expansion. The shift towards digital channels and personalized insurance products is also influencing consumer behavior. The market is witnessing a notable increase in demand for motor and home insurance. The significant growth is further fueled by government initiatives promoting insurance penetration. The market size, estimated at xx Million in 2025, is projected to reach xx Million by 2033.

Key Markets & Segments Leading Turkey P&C Insurance Market

The Turkish P&C insurance market is geographically diverse, with key segments exhibiting varying growth trajectories.

By Channel of Distribution:

- Agency: The agency channel remains dominant, leveraging established agent networks and personalized services. Drivers include widespread agent presence and trusted relationships with customers.

- Direct: The direct channel, propelled by digital platforms and online distribution, is experiencing rapid growth. Drivers include convenience, cost-effectiveness, and accessibility.

- Bank: Bank insurance partnerships contribute significantly, leveraging bank customer bases and cross-selling opportunities. Drivers include wide customer reach and established trust.

- Others: This segment, encompassing brokers and other intermediaries, holds a steady market share.

By Insurance Type:

- Motor: The motor insurance segment dominates, driven by rising vehicle ownership and stricter regulatory requirements.

- Home: Home insurance demonstrates consistent growth, fueled by increasing property values and consumer awareness.

- Others: This segment encompasses a range of products like commercial insurance and liability insurance which continue to exhibit moderate growth.

Turkey P&C Insurance Market Product Developments

The Turkish P&C insurance market is witnessing the integration of innovative products, such as usage-based insurance (UBI) and telematics-based solutions, aimed at providing tailored coverage and risk assessment. Insurers are also focusing on developing comprehensive product offerings to address the evolving needs of diverse customer segments, and digital distribution channels are becoming increasingly prevalent.

Challenges in the Turkey P&C Insurance Market Market

The Turkish P&C insurance market faces several challenges, including high inflation, fluctuating currency exchange rates, economic instability, and regulatory hurdles, impacting investment decisions and pricing strategies. Intense competition and the need for continuous innovation pose further hurdles.

Forces Driving Turkey P&C Insurance Market Growth

Key growth drivers include increased consumer awareness of insurance products, rising disposable incomes, government initiatives promoting insurance penetration, and the increasing adoption of digital technologies. Favorable demographic trends and expanding infrastructure also contribute to market growth.

Long-Term Growth Catalysts in the Turkey P&C Insurance Market

Long-term growth is expected to be fueled by strategic partnerships, technological advancements, and expansion into underpenetrated insurance segments. Government support for the sector also plays a vital role in accelerating the market's growth.

Emerging Opportunities in Turkey P&C Insurance Market

Opportunities exist in expanding microinsurance offerings, leveraging big data analytics for risk assessment, developing specialized products for niche customer segments, and expanding into rural areas.

Leading Players in the Turkey P&C Insurance Market Sector

- Allianz Sigorta AŞ

- Anadolu Anonim Türk Sigorta Şirketi

- HDI Sigorta AŞ

- Sompo Japan Sigorta AŞ

- Aksigorta AŞ

- Mapfre Sigorta AŞ

- Axa Sigorta AŞ

- Ziraat Sigorta AŞ

- Güneş Sigorta AŞ

- Halk Sigorta AŞ

Key Milestones in Turkey P&C Insurance Market Industry

- 2020: Implementation of new regulatory guidelines on digital insurance distribution.

- 2022: Launch of several Insurtech platforms, offering innovative insurance solutions.

- 2023: Significant increase in investment in digital insurance technologies by major players.

- 2024: Merger of two mid-sized insurance companies, leading to greater market consolidation.

Strategic Outlook for Turkey P&C Insurance Market Market

The Turkish P&C insurance market holds significant potential for growth, driven by favorable economic conditions, increasing insurance awareness, and technological advancements. Strategic investments in digital infrastructure and product innovation will be crucial for capturing market share and achieving long-term success. Companies focusing on customer centricity and data-driven decision-making are well-positioned to thrive.

Turkey P&C Insurance Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Turkey P&C Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

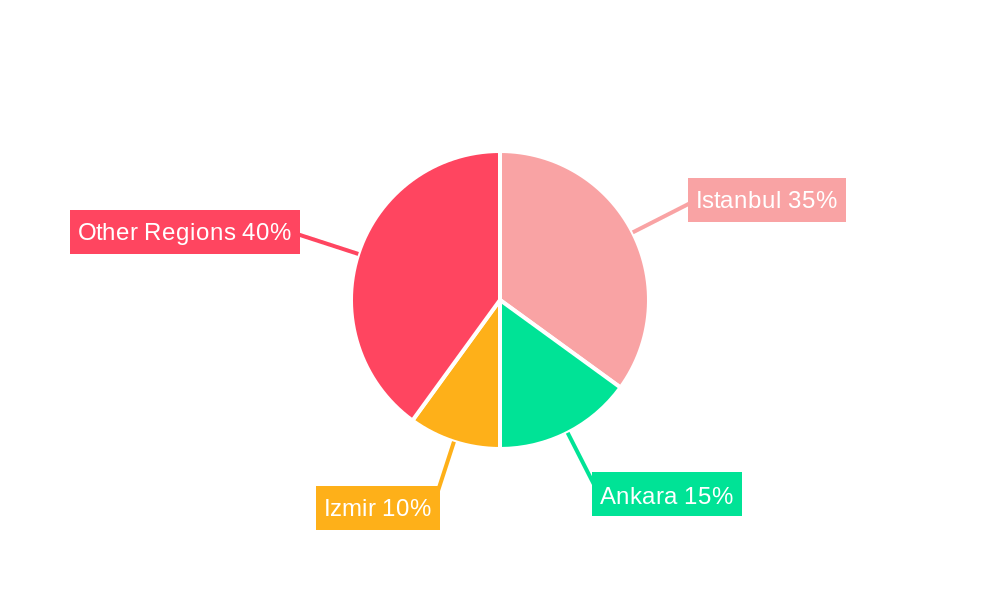

Turkey P&C Insurance Market Regional Market Share

Geographic Coverage of Turkey P&C Insurance Market

Turkey P&C Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Cars in Europe Drives The Market; Increase in Road Traffic Accidents Drives The Market

- 3.3. Market Restrains

- 3.3.1. Increase in Cost of Claims Made; Increase in False Claims and Scams

- 3.4. Market Trends

- 3.4.1. Non-Life insurance market is the high in the Turkish insurance industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey P&C Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Turkey P&C Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Turkey P&C Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Turkey P&C Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Turkey P&C Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Turkey P&C Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Allianz Sigorta AŞ

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Anadolu Anonim Türk Sigorta Şirketi

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HDI Sigorta AŞ

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sompo Japan Sigorta AŞ

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aksigorta AŞ

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mapfre Sigorta AŞ

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Axa Sigorta AŞ

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ziraat Sigorta AŞ

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Güneş Sigorta AŞ*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Halk Sigorta AŞ

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Allianz Sigorta AŞ

List of Figures

- Figure 1: Turkey P&C Insurance Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Turkey P&C Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Turkey P&C Insurance Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Turkey P&C Insurance Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Turkey P&C Insurance Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Turkey P&C Insurance Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Turkey P&C Insurance Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Turkey P&C Insurance Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Turkey P&C Insurance Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Turkey P&C Insurance Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Turkey P&C Insurance Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Turkey P&C Insurance Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Turkey P&C Insurance Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Turkey P&C Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United States Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Canada Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Mexico Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Turkey P&C Insurance Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 17: Turkey P&C Insurance Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Turkey P&C Insurance Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Turkey P&C Insurance Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Turkey P&C Insurance Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Turkey P&C Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Brazil Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Argentina Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Turkey P&C Insurance Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 26: Turkey P&C Insurance Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Turkey P&C Insurance Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Turkey P&C Insurance Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Turkey P&C Insurance Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Turkey P&C Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: France Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Italy Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Spain Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Russia Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Benelux Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Nordics Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Turkey P&C Insurance Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 41: Turkey P&C Insurance Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Turkey P&C Insurance Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Turkey P&C Insurance Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Turkey P&C Insurance Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Turkey P&C Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: Turkey Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Israel Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: GCC Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: North Africa Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: South Africa Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Turkey P&C Insurance Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 53: Turkey P&C Insurance Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Turkey P&C Insurance Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Turkey P&C Insurance Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Turkey P&C Insurance Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Turkey P&C Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 58: China Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 59: India Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Japan Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 61: South Korea Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 63: Oceania Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Turkey P&C Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey P&C Insurance Market?

The projected CAGR is approximately 6.79%.

2. Which companies are prominent players in the Turkey P&C Insurance Market?

Key companies in the market include Allianz Sigorta AŞ, Anadolu Anonim Türk Sigorta Şirketi, HDI Sigorta AŞ, Sompo Japan Sigorta AŞ, Aksigorta AŞ, Mapfre Sigorta AŞ, Axa Sigorta AŞ, Ziraat Sigorta AŞ, Güneş Sigorta AŞ*List Not Exhaustive, Halk Sigorta AŞ.

3. What are the main segments of the Turkey P&C Insurance Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Cars in Europe Drives The Market; Increase in Road Traffic Accidents Drives The Market.

6. What are the notable trends driving market growth?

Non-Life insurance market is the high in the Turkish insurance industry:.

7. Are there any restraints impacting market growth?

Increase in Cost of Claims Made; Increase in False Claims and Scams.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey P&C Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey P&C Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey P&C Insurance Market?

To stay informed about further developments, trends, and reports in the Turkey P&C Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence