Key Insights

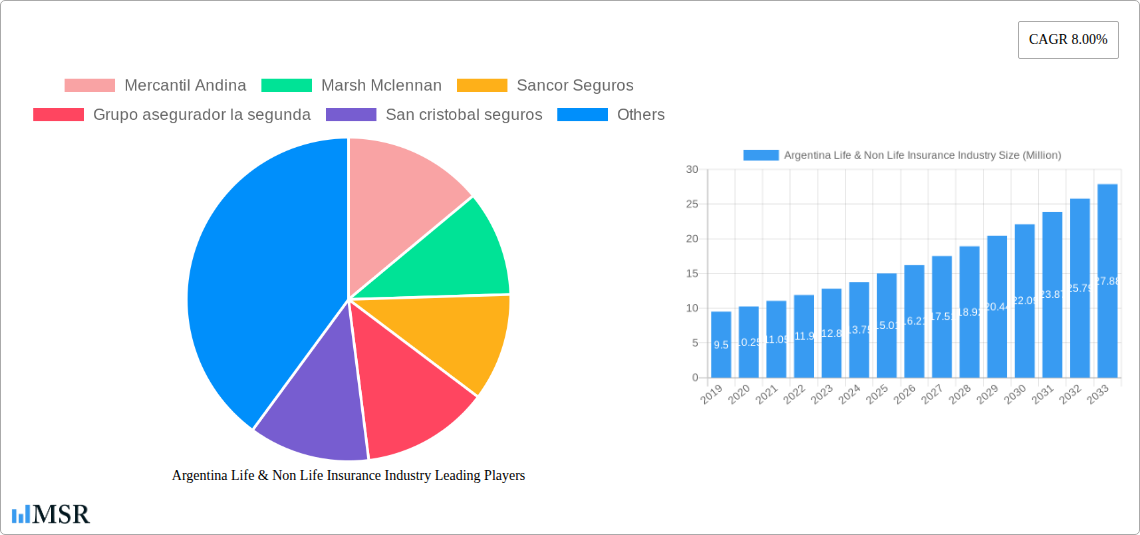

The Argentinian Life & Non-Life Insurance industry is poised for robust expansion, projecting a market size of 15.01 Million in 2025 and a Compound Annual Growth Rate (CAGR) of 8.00% through 2033. This significant growth is fueled by several key drivers, including a rising middle class with increasing disposable income, a growing awareness of financial security and risk management, and favorable regulatory environments that encourage insurance penetration. The demand for life insurance, particularly individual policies, is expected to surge as more Argentinians prioritize long-term financial planning for retirement, education, and legacy. Simultaneously, the non-life insurance segment will witness sustained demand driven by expanding automotive sales and stringent regulations for vehicle insurance, alongside a growing need for comprehensive home and health coverage due to increasing urbanization and a greater focus on well-being. The "Rest of Non-Life Insurance" segment, encompassing business interruption, cyber insurance, and specialized commercial lines, is also anticipated to grow as businesses seek to mitigate emerging risks in an increasingly complex economic landscape.

Argentina Life & Non Life Insurance Industry Market Size (In Million)

The market's trajectory will be further shaped by evolving consumer preferences and technological advancements. The increasing adoption of digital platforms and online channels for policy purchase and claims processing is a significant trend, offering greater convenience and accessibility. Insurers are investing in digital transformation to enhance customer experience and streamline operations. However, the industry faces certain restraints, including economic volatility and inflation in Argentina, which can impact consumer purchasing power and insurance affordability. Nevertheless, the strategic importance of insurance in providing financial resilience is likely to outweigh these challenges. Key players like Mercantil Andina, Marsh McLennan, and Sancor Seguros are actively innovating and expanding their offerings to capitalize on these growth opportunities across diverse segments such as motor, home, and health insurance. The distribution landscape is also diversifying, with banks and direct sales channels complementing traditional agent networks to reach a broader customer base.

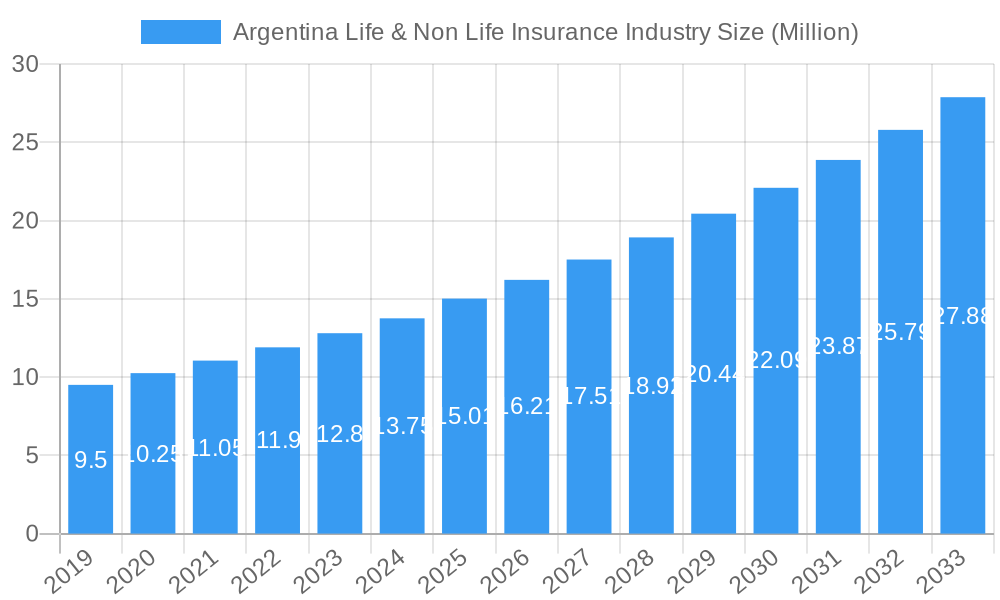

Argentina Life & Non Life Insurance Industry Company Market Share

Unlock critical insights into the dynamic Argentina life insurance market and Argentina non-life insurance market with this in-depth industry report. Covering the study period 2019–2033, with a base year and estimated year of 2025, this report provides a granular analysis of market concentration, key trends, segment dominance, product developments, challenges, growth drivers, emerging opportunities, and leading players. Essential for insurance companies in Argentina, reinsurers, brokers, investors, and regulatory bodies, this report offers actionable intelligence to navigate the evolving landscape of Argentine insurance.

Argentina Life & Non Life Insurance Industry Market Concentration & Dynamics

The Argentina insurance industry exhibits a moderate to high level of market concentration, with several key players dominating both life and non-life segments. Mercantil Andina, Marsh Mclennan, Sancor Seguros, Grupo asegurador la segunda, San Cristobal Seguros, Chubb, and Seguros Sura are among the prominent entities shaping market dynamics. Innovation ecosystems are increasingly driven by InsurTech adoption, with a focus on AI-powered pricing and automated claims processing. Regulatory frameworks, overseen by the Superintendencia de Seguros de la Nación (SSN), are crucial in shaping market entry, product offerings, and capital requirements. The availability of substitute products, such as savings accounts and investment funds for life insurance, and self-insurance mechanisms for non-life risks, influences demand. End-user trends indicate a growing preference for personalized products and seamless digital experiences. Mergers and Acquisitions (M&A) activities, while not consistently high, play a role in consolidating market share and expanding product portfolios. In the historical period (2019-2024), M&A deal counts averaged approximately 2-4 significant transactions annually, impacting market share by an estimated 5-10% for acquiring entities.

Argentina Life & Non Life Insurance Industry Industry Insights & Trends

The Argentina insurance market is poised for significant growth, driven by increasing financial literacy, rising disposable incomes, and a growing awareness of risk management. The market size for Argentina's insurance sector is projected to reach $18,000 Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 7.5% over the forecast period (2025–2033). Technological disruptions are revolutionizing the industry, with InsurTech startups and established players investing heavily in artificial intelligence (AI), big data analytics, and blockchain technology to enhance underwriting, claims processing, and customer service. Evolving consumer behaviors are characterized by a demand for personalized insurance solutions, digital-first interactions, and transparent pricing. The economic landscape of Argentina, including inflation rates and currency fluctuations, presents both challenges and opportunities, influencing the demand for inflation-linked insurance products and the affordability of premiums. The penetration of insurance, currently at around 3.5% of GDP, is expected to increase as economic stability improves. The pandemic further accelerated the adoption of digital channels and highlighted the importance of comprehensive health and life insurance coverage.

Key Markets & Segments Leading Argentina Life & Non Life Insurance Industry

Non-life insurance segments are expected to lead the Argentina insurance market growth, particularly the Motor Insurance and Health Insurance categories. The Motor Insurance segment is driven by a large vehicle fleet and mandatory insurance regulations, estimated to account for 30% of the non-life market share by 2025, valued at $5,400 Million. Economic growth and infrastructure development are crucial drivers for this segment. Health Insurance, representing approximately 25% of the non-life market by 2025, valued at $4,500 Million, is propelled by an increasing demand for private healthcare services and a growing health-conscious population.

- Dominant Segments (Non-Life):

- Motor Insurance: Driven by vehicle ownership, mandatory coverage requirements, and increasing accident rates.

- Health Insurance: Fueled by rising healthcare costs, demand for specialized treatments, and employer-provided benefits.

- Home Insurance: Benefiting from urbanization and increased property ownership, though penetration remains lower than in developed markets.

Life insurance, particularly Individual Life Insurance, is also a significant contributor, projected to hold 35% of the overall market by 2025, valued at $6,300 Million. This segment is influenced by rising financial awareness, retirement planning needs, and the desire for family protection.

- Dominant Segments (Life):

- Individual Life Insurance: Driven by demographic shifts, long-term financial planning, and increasing awareness of financial security.

- Group Life Insurance: Primarily driven by employer mandates and benefits packages for employees.

Distribution channels are evolving, with Agents remaining a strong presence, particularly for complex products. However, Online and Direct channels are gaining traction, especially for simpler policy purchases and renewals. Banks also play a crucial role as bancassurance partners.

Argentina Life & Non Life Insurance Industry Product Developments

Product innovation in the Argentina insurance industry is increasingly focused on customization and digital integration. Companies are developing flexible life insurance products that adapt to changing life stages and economic conditions, often incorporating investment components. For non-life insurance, there's a growing emphasis on parametric insurance for specific risks like agriculture (as seen with La Segunda's crop protection features) and usage-based insurance for vehicles. Seguros Sura's collaboration with Akur8 signifies a push towards AI-driven pricing for life insurance products, enabling more precise risk assessment and competitive premium setting, which ultimately harmonizes practices and enhances product appeal across markets. The integration of IoT devices for risk monitoring in home and commercial insurance is also an emerging trend, offering proactive risk mitigation and potential premium reductions.

Challenges in the Argentina Life & Non Life Insurance Industry Market

The Argentina insurance market faces several significant challenges that temper growth. Macroeconomic volatility, including high inflation and currency devaluation, impacts premium affordability and profitability, leading to an estimated 15-20% reduction in real insurance spending during periods of severe economic downturn. Stringent regulatory compliance and evolving legal frameworks can increase operational costs. Intense competition from both local and international players, coupled with the threat of disintermediation from digital-only providers, puts pressure on profit margins. Furthermore, a persistent perception of insurance as a complex or low-priority expense for a segment of the population hinders market penetration, estimated at a 5% gap compared to regional averages.

Forces Driving Argentina Life & Non Life Insurance Industry Growth

Several key factors are propelling the growth of the Argentina insurance industry. A rising middle class with increasing disposable income is driving demand for enhanced financial protection. Growing awareness of the importance of risk management, spurred by climate-related events and economic uncertainties, is boosting the uptake of both life and non-life insurance products. Technological advancements, particularly the adoption of InsurTech solutions for enhanced customer experience and operational efficiency, are creating new avenues for growth. Favorable regulatory initiatives aimed at promoting financial inclusion and deepening insurance penetration also contribute significantly.

Challenges in the Argentina Life & Non Life Insurance Industry Market

Long-term growth catalysts in the Argentina insurance market lie in fostering greater financial literacy and trust in insurance products. Continuous investment in digital transformation and InsurTech integration is crucial to meet evolving consumer expectations and improve operational efficiencies. Strategic partnerships between insurers, banks, and technology providers can unlock new distribution channels and customer segments. Furthermore, developing innovative insurance solutions tailored to the specific needs of SMEs and emerging sectors can drive sustained market expansion and increase the overall penetration rate of insurance in the Argentine economy.

Emerging Opportunities in Argentina Life & Non Life Insurance Industry

Emerging opportunities within the Argentina insurance industry are abundant, particularly in niche markets and through technological innovation. The demand for specialized cyber insurance is rising with increased digitalization of businesses. The agricultural sector presents significant opportunities for innovative crop insurance solutions that mitigate the impact of extreme weather events. The aging population is creating a growing market for long-term care insurance and retirement solutions. Furthermore, the potential for parametric insurance, triggered by pre-defined events, offers a more efficient and transparent claims process, particularly for natural disaster coverage. Leveraging data analytics to offer personalized and usage-based insurance products is another key avenue for growth.

Leading Players in the Argentina Life & Non Life Insurance Industry Sector

- Mercantil Andina

- Marsh Mclennan

- Sancor Seguros

- Grupo asegurador la segunda

- San Cristobal Seguros

- Chubb

- Parana Seguros

- Holando Seguros

- Experta Aseguradora de Riesgos del Trabajo S A

- Federacion Patronal Seguros

- Orbis Seguros

- Seguros Sura

Key Milestones in Argentina Life & Non Life Insurance Industry Industry

- June 2022: Seguros Sura collaborated with Akur8, an AI pricing platform, to boost its insurance pricing process across Argentina, Chile, and Colombia. This partnership will help Seguros Sura to automate the pricing process of their life insurance products to harmonize practices.

- October 2022: La Segunda announced three new features to protect crops for the 2022/23 campaign, focusing on late corn: coverage of replanting expenses, extension of insurance against hail and fire, and discounts on policies. La Segunda insurer offers to pay 100% for replanting and extends coverage for fires.

Strategic Outlook for Argentina Life & Non Life Insurance Industry Market

The strategic outlook for the Argentina life and non-life insurance industry is optimistic, driven by a combination of evolving consumer needs and technological advancements. Focus on digitalization and customer-centricity will be paramount for sustained growth. Insurers should explore innovative product development, particularly in the areas of parametric insurance, cyber risk, and customized life solutions. Strategic partnerships and collaborations, including those with InsurTech firms and financial institutions, will be critical for expanding market reach and enhancing service delivery. A proactive approach to navigating regulatory changes and economic volatility, coupled with a commitment to building customer trust, will pave the way for long-term success in the dynamic Argentine insurance landscape.

Argentina Life & Non Life Insurance Industry Segmentation

-

1. Type

-

1.1. Life insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non- life insurance

- 1.2.1. Motor

- 1.2.2. Home

- 1.2.3. Marine

- 1.2.4. Health

- 1.2.5. Rest of Non-Life Insurance

-

1.1. Life insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agents

- 2.3. Banks

- 2.4. Online

- 2.5. Other Distribution Channels

Argentina Life & Non Life Insurance Industry Segmentation By Geography

- 1. Argentina

Argentina Life & Non Life Insurance Industry Regional Market Share

Geographic Coverage of Argentina Life & Non Life Insurance Industry

Argentina Life & Non Life Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Focus Towards Digitization in the Life Insurance and Non-life Insurance Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Life & Non Life Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Life insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non- life insurance

- 5.1.2.1. Motor

- 5.1.2.2. Home

- 5.1.2.3. Marine

- 5.1.2.4. Health

- 5.1.2.5. Rest of Non-Life Insurance

- 5.1.1. Life insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agents

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mercantil Andina

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Marsh Mclennan

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sancor Seguros

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Grupo asegurador la segunda

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 San cristobal seguros

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chubb

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Parana Seguros

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Holando Seguros

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Experta Aseguradora de Riesgos del Trabajo S A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Federacion Patronal Seguros

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Orbis Seguros

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Seguros Sura**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Mercantil Andina

List of Figures

- Figure 1: Argentina Life & Non Life Insurance Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Argentina Life & Non Life Insurance Industry Share (%) by Company 2025

List of Tables

- Table 1: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Life & Non Life Insurance Industry?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Argentina Life & Non Life Insurance Industry?

Key companies in the market include Mercantil Andina, Marsh Mclennan, Sancor Seguros, Grupo asegurador la segunda, San cristobal seguros, Chubb, Parana Seguros, Holando Seguros, Experta Aseguradora de Riesgos del Trabajo S A, Federacion Patronal Seguros, Orbis Seguros, Seguros Sura**List Not Exhaustive.

3. What are the main segments of the Argentina Life & Non Life Insurance Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.01 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Focus Towards Digitization in the Life Insurance and Non-life Insurance Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2022: Seguros Sura collaborated with Akur8, an AI pricing platform, to boost its insurance pricing process across Argentina, Chile, and Colombia. This partnership will help Seguros Sura to automate the pricing process of their life insurance products to harmonize practices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Life & Non Life Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Life & Non Life Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Life & Non Life Insurance Industry?

To stay informed about further developments, trends, and reports in the Argentina Life & Non Life Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence