Key Insights

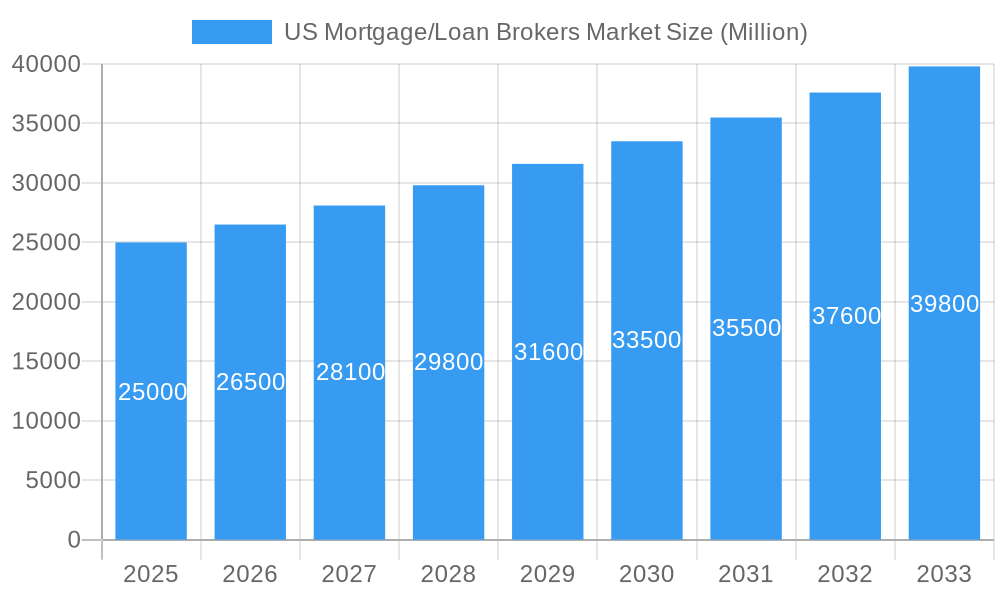

The US Mortgage and Loan Brokerage market is poised for significant expansion, projected to grow at a CAGR of 14.2%. With an estimated market size of $319.39 billion in the base year 2025, the industry is set for substantial growth through 2033. Key growth drivers include rising homeownership demand, navigating complex interest rate environments, and adapting to regulatory changes. Consumers increasingly prefer personalized financial solutions and the convenience of mortgage brokers in managing lending processes. Small and medium-sized enterprises also contribute to growth by leveraging loan brokers for financing needs. The "Products" segment, encompassing diverse loan types and services, is expected to lead market share, driven by consistent refinancing and new loan origination.

US Mortgage/Loan Brokers Market Market Size (In Billion)

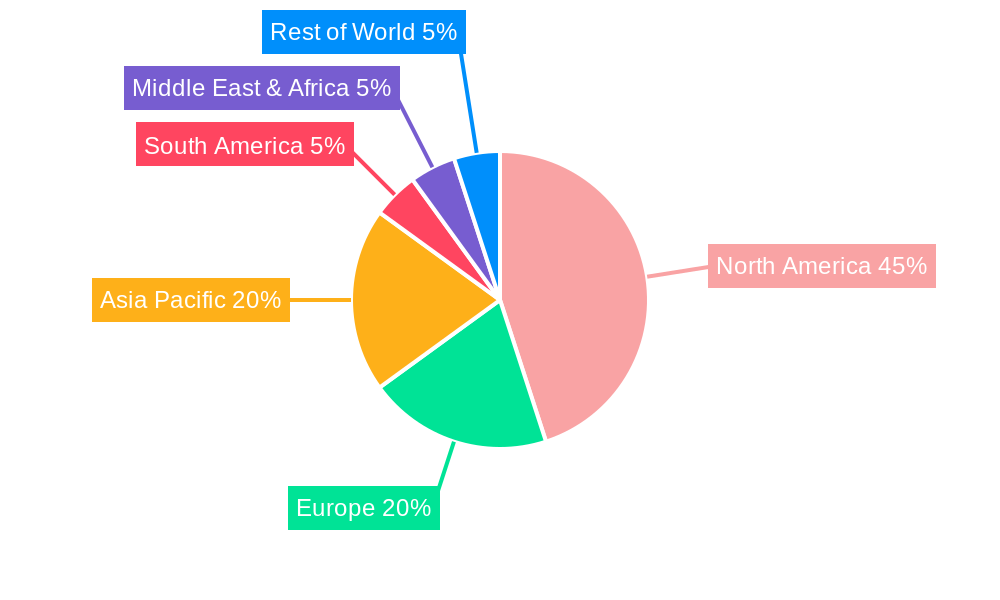

Advancements in financial technology are streamlining brokerage processes and improving customer experience. However, the market faces challenges such as intense competition from direct lenders, the rise of self-service digital platforms, and potential impacts on consumer trust. The "Home Loans" segment is anticipated to remain dominant, reflecting ongoing real estate market activity. The "Services" segment is also projected for strong growth, with brokers offering value-added services like financial planning and credit counseling. North America, particularly the United States, is expected to maintain its leading market position due to its robust financial infrastructure and high borrowing rates. The Asia Pacific region presents considerable growth potential, fueled by expanding economies and improving credit access.

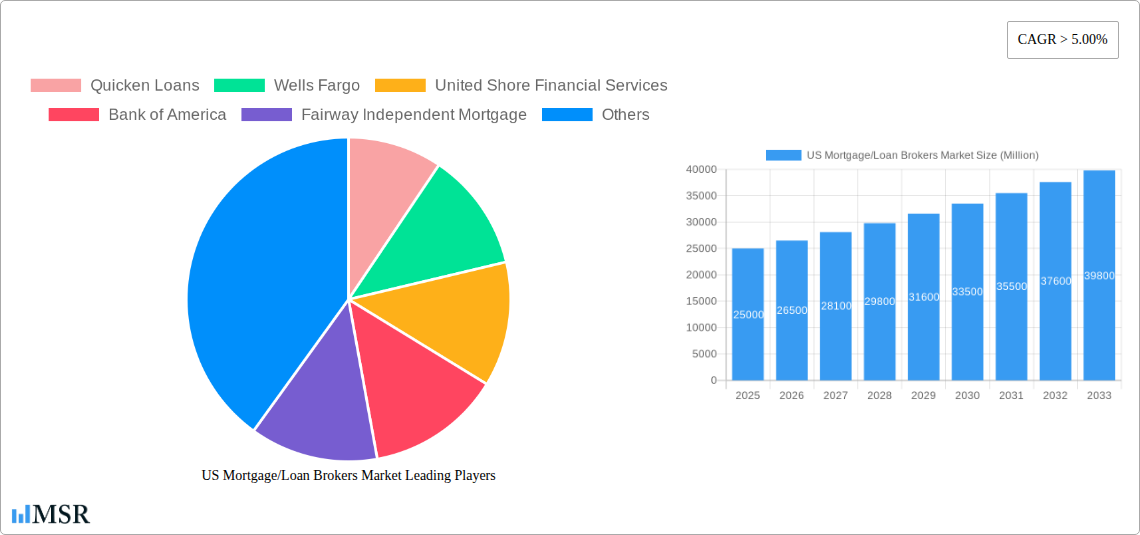

US Mortgage/Loan Brokers Market Company Market Share

Report Overview: This comprehensive research report offers in-depth analysis of the US mortgage and loan broker market from 2019 to 2033. It provides critical insights into market concentration, innovation, regulatory frameworks, and emerging trends. Essential for mortgage lenders, loan originators, financial institutions, and real estate professionals, this analysis forecasts robust market growth driven by technological innovation, evolving consumer needs, and a dynamic housing market. Explore key market segments, product advancements, challenges, and growth catalysts shaping the future of US mortgage brokerage.

US Mortgage/Loan Brokers Market Market Concentration & Dynamics

The US mortgage and loan brokers market exhibits a moderate to high level of concentration, with a few dominant players controlling a significant market share. Key entities like Quicken Loans, Wells Fargo, United Shore Financial Services, Bank of America, and Chase are at the forefront. Innovation within the market is characterized by a strong push towards digital platforms and streamlined application processes, creating an evolving innovation ecosystem. Regulatory frameworks, including those set by the Consumer Financial Protection Bureau (CFPB), play a crucial role in shaping market dynamics and ensuring consumer protection. Substitute products, such as direct lending from banks and online lending platforms, present competitive challenges. End-user trends indicate a growing preference for personalized services and faster loan approvals. Mergers and acquisition (M&A) activities are notable, with an estimated XX M&A deal count in the historical period, as companies consolidate to expand their reach and service offerings. The market share of the top five players is estimated at XX%.

US Mortgage/Loan Brokers Market Industry Insights & Trends

The US mortgage and loan brokers market is poised for significant growth, projected to reach an estimated USD 750 Million by 2025, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is fueled by several key drivers. The robust housing market, characterized by sustained demand for homeownership and a steady pace of new construction, directly translates into a higher volume of home loan applications. Economic recovery and business expansion are also contributing to increased demand for commercial loans and industrial loans, further bolstering the market.

Technological disruptions are fundamentally reshaping the industry. The adoption of Artificial Intelligence (AI) and Machine Learning (ML) is enhancing underwriting processes, risk assessment, and fraud detection, leading to faster loan approvals and improved customer experiences. Digital mortgage platforms and online application portals are becoming standard, catering to the increasing preference of consumers for convenience and accessibility. This shift towards digital transformation is a critical trend, enabling brokers to manage applications more efficiently and provide real-time updates to clients.

Evolving consumer behaviors are also paramount. Today's borrowers, particularly Millennials and Gen Z, are digital-native and expect seamless, technology-driven interactions. They value transparency, speed, and personalized advice. Loan brokers who can effectively leverage technology to offer a superior customer journey, from initial inquiry to loan closing, will gain a competitive advantage. Furthermore, changing economic conditions, including interest rate fluctuations and inflation, influence borrowing decisions and create opportunities for brokers to guide clients through complex financial landscapes with expert advice. The increasing demand for refinancing options due to favorable interest rate environments also contributes to market growth.

Key Markets & Segments Leading US Mortgage/Loan Brokers Market

The US mortgage and loan brokers market is dominated by specific regions and segments, driven by distinct economic and demographic factors. The Home Loans application segment is by far the largest, fueled by the persistent demand for residential real estate across the nation. This dominance is further amplified by strong economic growth, favorable mortgage rates (during certain periods), and a cultural emphasis on homeownership.

- Component: Products: Mortgage products, including fixed-rate, adjustable-rate, and jumbo loans, are the primary revenue generators. The demand for specialized products like FHA and VA loans also contributes significantly.

- Component: Services: Brokerage services, including loan origination, underwriting assistance, and guidance through the application process, are crucial. Value-added services like financial advisory and post-closing support are increasingly sought after.

- Enterprise: Large: Large enterprises, including major financial institutions, hold a significant market share due to their extensive resources, brand recognition, and broad customer base.

- Application: Home Loans: This remains the cornerstone of the market. The continuous need for housing, coupled with investment in real estate, ensures sustained demand.

- End-User: Individuals: Individual homebuyers and homeowners seeking refinancing represent the largest end-user segment. Their purchasing power and life events, such as marriage, growing families, or career changes, drive mortgage demand.

The Southern and Western regions of the US, known for their robust population growth, expanding economies, and active housing markets, are leading geographical segments. Factors such as a lower cost of living (in certain areas), job creation, and attractive lifestyle choices contribute to higher demand for mortgages.

US Mortgage/Loan Brokers Market Product Developments

The US mortgage and loan brokers market is witnessing significant product innovations aimed at enhancing efficiency and customer experience. A prime example is the introduction of digital home equity lines of credit (HELOCs), as demonstrated by loanDepot in November 2022. This innovation caters to the growing consumer need for accessible credit against their home equity, especially in an environment of rising consumer debt. Furthermore, platforms like Pennymac Financial Services' POWER+ (launched in October 2022) represent a leap forward in broker technology, offering enhanced speed, control, and improved client interactions. These developments signify a clear trend towards more intuitive, technology-driven mortgage solutions that empower both brokers and borrowers.

Challenges in the US Mortgage/Loan Brokers Market Market

The US mortgage and loan brokers market faces several challenges that can impact its growth trajectory. Stringent and evolving regulatory frameworks, including compliance requirements and disclosure mandates, can increase operational costs and complexity for brokers. Supply chain issues, particularly concerning the availability of qualified personnel and the efficient processing of loan documentation, can lead to delays. Competitive pressures from direct lenders and fintech companies offering alternative financing solutions also pose a significant challenge, forcing brokers to continuously innovate and differentiate their services. For instance, increased competition from online lenders has an estimated impact of reducing broker margins by up to XX% in certain segments.

Forces Driving US Mortgage/Loan Brokers Market Growth

Several key forces are propelling the growth of the US mortgage and loan brokers market. Economic stability and job growth are fundamental drivers, as they increase consumer confidence and borrowing capacity. Favorable interest rate environments, when they occur, stimulate refinancing and new home purchase activity. Technological advancements, particularly in the realm of digital lending platforms and AI-driven analytics, are streamlining processes and expanding market reach. The increasing demand for personalized financial advice and guidance through complex loan processes also plays a crucial role, as consumers seek expert assistance to navigate their borrowing options. The ongoing demographic shifts, with a large segment of the population reaching prime home-buying age, further fuels demand.

Challenges in the US Mortgage/Loan Brokers Market Market

Long-term growth catalysts for the US mortgage and loan brokers market are rooted in continuous innovation and strategic market expansion. The development of more sophisticated AI-powered underwriting tools and predictive analytics will further enhance efficiency and reduce risk. Partnerships between traditional lenders and innovative fintech companies will create synergistic opportunities, offering a wider range of products and services. Expanding into underserved markets and catering to niche customer segments, such as first-time homebuyers or those with non-traditional credit profiles, will unlock new revenue streams. The growing emphasis on financial literacy and consumer education presents an opportunity for brokers to position themselves as trusted advisors, fostering long-term client relationships.

Emerging Opportunities in US Mortgage/Loan Brokers Market

Emerging opportunities in the US mortgage and loan brokers market are diverse and promising. The increasing demand for sustainable and green financing options presents a new avenue for growth. As more consumers prioritize energy-efficient homes, brokers can specialize in offering mortgages for such properties. The "buy now, pay later" trend, while not directly mortgage-related, is influencing consumer expectations for speed and simplicity in financial transactions, pushing mortgage providers to adopt similar user-friendly interfaces. Furthermore, the aging population presents an opportunity for reverse mortgage and retirement planning-related loan products, requiring specialized knowledge and services. The continued rise of remote work may also lead to new geographic market opportunities for brokers as individuals relocate.

Leading Players in the US Mortgage/Loan Brokers Market Sector

- Quicken Loans

- Wells Fargo

- United Shore Financial Services

- Bank of America

- Fairway Independent Mortgage

- Chase

- J P Morgan

- Morgan Stanley

- Caliber Home Loans

- US Bankcorp

Key Milestones in US Mortgage/Loan Brokers Market Industry

- November 2022: loanDepot introduced a digital home equity line of credit, responding to inflation and rising consumer debt with an innovative credit solution.

- October 2022: Pennymac Financial Services launched POWER+, a next-generation broker technology platform designed to enhance speed, control, and customer experience for mortgage brokers.

Strategic Outlook for US Mortgage/Loan Brokers Market Market

The strategic outlook for the US mortgage and loan brokers market is one of continued digital transformation and customer-centric innovation. Growth accelerators will include the widespread adoption of AI and machine learning for process automation, risk mitigation, and personalized client engagement. Strategic partnerships between traditional financial institutions and agile fintech companies will be crucial for expanding service portfolios and enhancing market reach. Focusing on customer education and providing transparent, accessible financial guidance will solidify the role of brokers as trusted advisors. Furthermore, the market will likely see increased specialization in niche lending areas and a stronger emphasis on offering comprehensive financial solutions beyond just mortgage origination.

US Mortgage/Loan Brokers Market Segmentation

-

1. Component

- 1.1. Products

- 1.2. Services

-

2. Enterprise

- 2.1. Large

- 2.2. Small

- 2.3. Medium-sized

-

3. Application

- 3.1. Home Loans

- 3.2. Commercial Loans

- 3.3. Industrial Loans

- 3.4. Vehicle Loans

- 3.5. Loans to Government

- 3.6. Other Applications

-

4. End - User

- 4.1. Business

- 4.2. Individuals

US Mortgage/Loan Brokers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Mortgage/Loan Brokers Market Regional Market Share

Geographic Coverage of US Mortgage/Loan Brokers Market

US Mortgage/Loan Brokers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Adoption of the New Technologies Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Products

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Enterprise

- 5.2.1. Large

- 5.2.2. Small

- 5.2.3. Medium-sized

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Home Loans

- 5.3.2. Commercial Loans

- 5.3.3. Industrial Loans

- 5.3.4. Vehicle Loans

- 5.3.5. Loans to Government

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End - User

- 5.4.1. Business

- 5.4.2. Individuals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America US Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Products

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Enterprise

- 6.2.1. Large

- 6.2.2. Small

- 6.2.3. Medium-sized

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Home Loans

- 6.3.2. Commercial Loans

- 6.3.3. Industrial Loans

- 6.3.4. Vehicle Loans

- 6.3.5. Loans to Government

- 6.3.6. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by End - User

- 6.4.1. Business

- 6.4.2. Individuals

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. South America US Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Products

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Enterprise

- 7.2.1. Large

- 7.2.2. Small

- 7.2.3. Medium-sized

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Home Loans

- 7.3.2. Commercial Loans

- 7.3.3. Industrial Loans

- 7.3.4. Vehicle Loans

- 7.3.5. Loans to Government

- 7.3.6. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by End - User

- 7.4.1. Business

- 7.4.2. Individuals

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Europe US Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Products

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Enterprise

- 8.2.1. Large

- 8.2.2. Small

- 8.2.3. Medium-sized

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Home Loans

- 8.3.2. Commercial Loans

- 8.3.3. Industrial Loans

- 8.3.4. Vehicle Loans

- 8.3.5. Loans to Government

- 8.3.6. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by End - User

- 8.4.1. Business

- 8.4.2. Individuals

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Middle East & Africa US Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Products

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Enterprise

- 9.2.1. Large

- 9.2.2. Small

- 9.2.3. Medium-sized

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Home Loans

- 9.3.2. Commercial Loans

- 9.3.3. Industrial Loans

- 9.3.4. Vehicle Loans

- 9.3.5. Loans to Government

- 9.3.6. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by End - User

- 9.4.1. Business

- 9.4.2. Individuals

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Asia Pacific US Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Products

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Enterprise

- 10.2.1. Large

- 10.2.2. Small

- 10.2.3. Medium-sized

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Home Loans

- 10.3.2. Commercial Loans

- 10.3.3. Industrial Loans

- 10.3.4. Vehicle Loans

- 10.3.5. Loans to Government

- 10.3.6. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by End - User

- 10.4.1. Business

- 10.4.2. Individuals

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Quicken Loans

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Wells Fargo

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 United Shore Financial Services

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bank of America

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fairway Independent Mortgage

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chase

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 J P Morgan

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Morgan Stanley

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Caliber Home Loans

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 US Bankcorp**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Quicken Loans

List of Figures

- Figure 1: Global US Mortgage/Loan Brokers Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Mortgage/Loan Brokers Market Revenue (billion), by Component 2025 & 2033

- Figure 3: North America US Mortgage/Loan Brokers Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America US Mortgage/Loan Brokers Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 5: North America US Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 6: North America US Mortgage/Loan Brokers Market Revenue (billion), by Application 2025 & 2033

- Figure 7: North America US Mortgage/Loan Brokers Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America US Mortgage/Loan Brokers Market Revenue (billion), by End - User 2025 & 2033

- Figure 9: North America US Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2025 & 2033

- Figure 10: North America US Mortgage/Loan Brokers Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America US Mortgage/Loan Brokers Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America US Mortgage/Loan Brokers Market Revenue (billion), by Component 2025 & 2033

- Figure 13: South America US Mortgage/Loan Brokers Market Revenue Share (%), by Component 2025 & 2033

- Figure 14: South America US Mortgage/Loan Brokers Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 15: South America US Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 16: South America US Mortgage/Loan Brokers Market Revenue (billion), by Application 2025 & 2033

- Figure 17: South America US Mortgage/Loan Brokers Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: South America US Mortgage/Loan Brokers Market Revenue (billion), by End - User 2025 & 2033

- Figure 19: South America US Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2025 & 2033

- Figure 20: South America US Mortgage/Loan Brokers Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America US Mortgage/Loan Brokers Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe US Mortgage/Loan Brokers Market Revenue (billion), by Component 2025 & 2033

- Figure 23: Europe US Mortgage/Loan Brokers Market Revenue Share (%), by Component 2025 & 2033

- Figure 24: Europe US Mortgage/Loan Brokers Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 25: Europe US Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 26: Europe US Mortgage/Loan Brokers Market Revenue (billion), by Application 2025 & 2033

- Figure 27: Europe US Mortgage/Loan Brokers Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Europe US Mortgage/Loan Brokers Market Revenue (billion), by End - User 2025 & 2033

- Figure 29: Europe US Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2025 & 2033

- Figure 30: Europe US Mortgage/Loan Brokers Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe US Mortgage/Loan Brokers Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa US Mortgage/Loan Brokers Market Revenue (billion), by Component 2025 & 2033

- Figure 33: Middle East & Africa US Mortgage/Loan Brokers Market Revenue Share (%), by Component 2025 & 2033

- Figure 34: Middle East & Africa US Mortgage/Loan Brokers Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 35: Middle East & Africa US Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 36: Middle East & Africa US Mortgage/Loan Brokers Market Revenue (billion), by Application 2025 & 2033

- Figure 37: Middle East & Africa US Mortgage/Loan Brokers Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East & Africa US Mortgage/Loan Brokers Market Revenue (billion), by End - User 2025 & 2033

- Figure 39: Middle East & Africa US Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2025 & 2033

- Figure 40: Middle East & Africa US Mortgage/Loan Brokers Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa US Mortgage/Loan Brokers Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific US Mortgage/Loan Brokers Market Revenue (billion), by Component 2025 & 2033

- Figure 43: Asia Pacific US Mortgage/Loan Brokers Market Revenue Share (%), by Component 2025 & 2033

- Figure 44: Asia Pacific US Mortgage/Loan Brokers Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 45: Asia Pacific US Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 46: Asia Pacific US Mortgage/Loan Brokers Market Revenue (billion), by Application 2025 & 2033

- Figure 47: Asia Pacific US Mortgage/Loan Brokers Market Revenue Share (%), by Application 2025 & 2033

- Figure 48: Asia Pacific US Mortgage/Loan Brokers Market Revenue (billion), by End - User 2025 & 2033

- Figure 49: Asia Pacific US Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2025 & 2033

- Figure 50: Asia Pacific US Mortgage/Loan Brokers Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific US Mortgage/Loan Brokers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Component 2020 & 2033

- Table 2: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 3: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by End - User 2020 & 2033

- Table 5: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Component 2020 & 2033

- Table 7: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 8: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by End - User 2020 & 2033

- Table 10: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Component 2020 & 2033

- Table 15: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 16: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by End - User 2020 & 2033

- Table 18: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Component 2020 & 2033

- Table 23: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 24: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 25: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by End - User 2020 & 2033

- Table 26: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Component 2020 & 2033

- Table 37: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 38: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 39: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by End - User 2020 & 2033

- Table 40: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Component 2020 & 2033

- Table 48: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 49: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 50: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by End - User 2020 & 2033

- Table 51: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Mortgage/Loan Brokers Market?

The projected CAGR is approximately 14.2%.

2. Which companies are prominent players in the US Mortgage/Loan Brokers Market?

Key companies in the market include Quicken Loans, Wells Fargo, United Shore Financial Services, Bank of America, Fairway Independent Mortgage, Chase, J P Morgan, Morgan Stanley, Caliber Home Loans, US Bankcorp**List Not Exhaustive.

3. What are the main segments of the US Mortgage/Loan Brokers Market?

The market segments include Component, Enterprise, Application, End - User.

4. Can you provide details about the market size?

The market size is estimated to be USD 319.39 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Adoption of the New Technologies Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: A digital home equity line of credit was introduced by loanDepot, one of the country's biggest non-bank retail mortgage lenders, against the backdrop of inflation and rising consumer debt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Mortgage/Loan Brokers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Mortgage/Loan Brokers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Mortgage/Loan Brokers Market?

To stay informed about further developments, trends, and reports in the US Mortgage/Loan Brokers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence