Key Insights

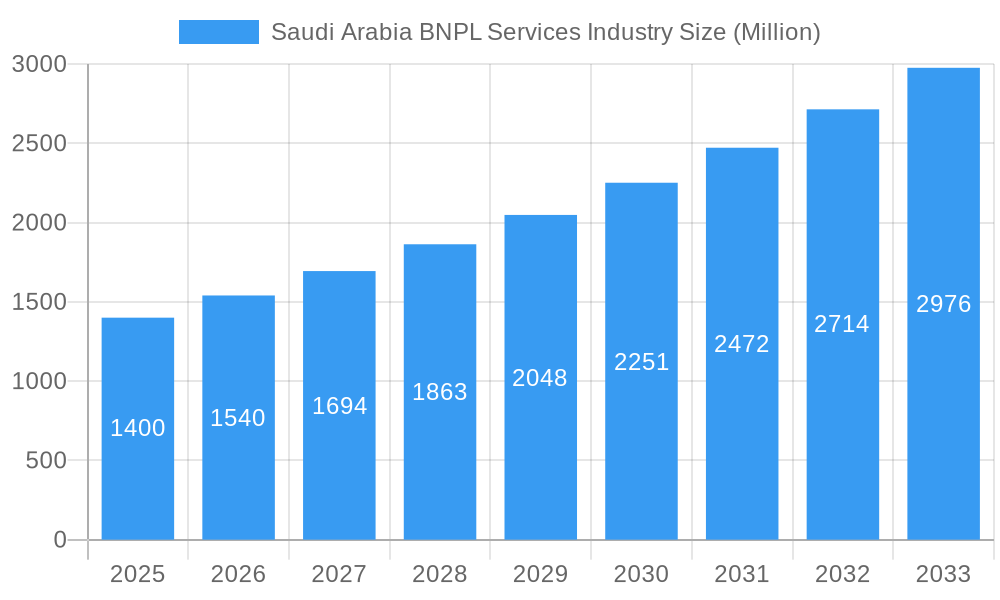

The Saudi Arabian Buy Now, Pay Later (BNPL) services industry is experiencing robust growth, projected to reach a market size of $1.40 billion in 2025, with a Compound Annual Growth Rate (CAGR) exceeding 10% from 2025 to 2033. This expansion is fueled by several key drivers. Rising smartphone penetration and internet usage within the Kingdom have fostered a digitally savvy consumer base receptive to convenient payment options. Furthermore, a burgeoning e-commerce sector and a young, increasingly affluent population are driving demand for flexible financing solutions like BNPL. Government initiatives promoting digital transformation and financial inclusion further contribute to the market's positive trajectory. Competitive intensity is also high, with both established players like Mastercard and Visa and innovative fintech companies such as Tamara, Tabby, and Spotti vying for market share. This competitive landscape fosters innovation and drives the development of diverse BNPL offerings tailored to specific consumer needs. While potential regulatory hurdles and concerns regarding consumer debt management represent potential restraints, the overall outlook for the Saudi Arabian BNPL market remains exceptionally promising.

Saudi Arabia BNPL Services Industry Market Size (In Billion)

The forecast period of 2025-2033 anticipates continued growth, driven by increasing consumer adoption of e-commerce and the ongoing expansion of digital financial services within the Kingdom. Market segmentation, while not explicitly provided, will likely emerge around various factors, including consumer demographics, transaction value ranges, and merchant type. Growth in specific segments will depend upon the effectiveness of targeted marketing strategies by BNPL providers and the evolving preferences of Saudi consumers. Further analysis should focus on understanding the specific value propositions of different BNPL providers, their market penetration strategies, and the emerging regulatory landscape to gain a deeper understanding of the evolving dynamics within this rapidly expanding industry. The continued success of the Saudi Arabian BNPL sector hinges upon balancing rapid growth with responsible lending practices and effective consumer protection measures.

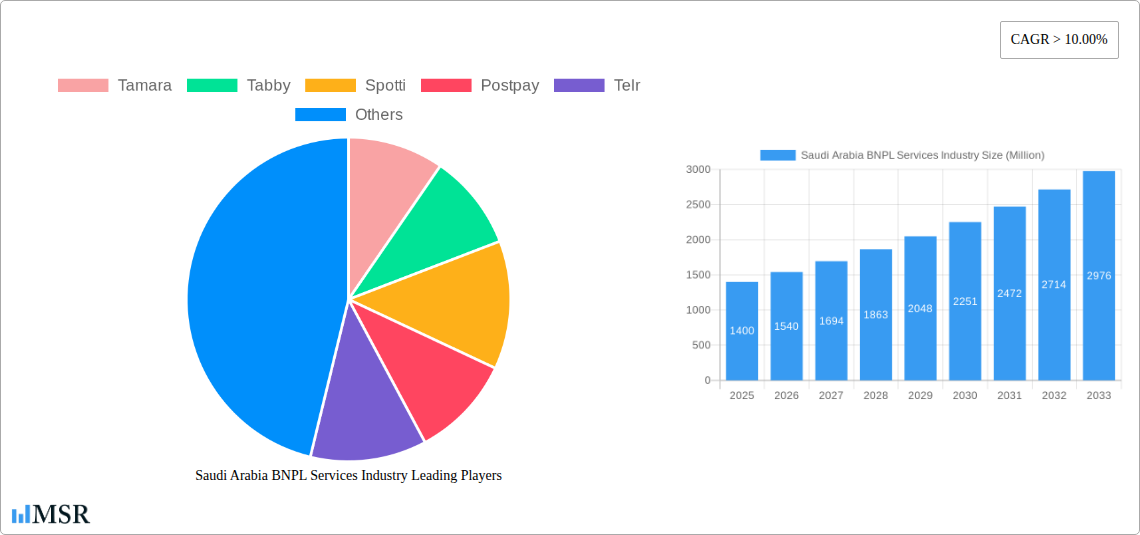

Saudi Arabia BNPL Services Industry Company Market Share

Saudi Arabia BNPL Services Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning Buy Now, Pay Later (BNPL) services market in Saudi Arabia, covering the period 2019-2033. It offers actionable insights for industry stakeholders, investors, and businesses seeking to understand and capitalize on this rapidly expanding sector. The report leverages rigorous market research and data analysis to forecast market growth and identify key trends, challenges, and opportunities. The base year for this report is 2025, with estimations for 2025 and forecasts extending to 2033. The historical period analyzed is 2019-2024.

Saudi Arabia BNPL Services Industry Market Concentration & Dynamics

The Saudi Arabian BNPL market is experiencing rapid growth, characterized by increasing market concentration among key players and a dynamic competitive landscape. While precise market share figures for each player are currently unavailable (xx%), key players like Tamara, Tabby, and Spotti hold significant positions. The market demonstrates a high level of innovation, driven by technological advancements and the evolving needs of Saudi consumers. The regulatory framework is still evolving, presenting both opportunities and challenges for market participants. Substitute products, such as traditional credit cards and personal loans, pose some competitive pressure. However, the convenience and accessibility of BNPL services are driving strong end-user adoption. Recent M&A activity (xx deals in the past 5 years) reflects the consolidating nature of the market and the strategic maneuvering of key players to gain market share. The industry's growth trajectory is closely tied to the broader economic expansion of Saudi Arabia, technological infrastructure development, and supportive government policies.

Saudi Arabia BNPL Services Industry Industry Insights & Trends

The Saudi Arabian BNPL market is experiencing phenomenal growth. The market size in 2025 is estimated at $XX Million, exhibiting a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This robust growth is primarily fueled by several factors. Rising smartphone penetration and internet usage have significantly broadened the reach of BNPL services. Increasing e-commerce adoption, particularly amongst younger demographics, creates a fertile ground for BNPL’s expansion. Changing consumer preferences towards flexible payment options and a growing trend towards impulse online purchases are further strengthening the market. Technological advancements in payment processing, fraud detection, and risk management are improving the efficiency and safety of BNPL services, boosting consumer confidence. Moreover, strategic partnerships between BNPL providers and established e-commerce platforms are exponentially increasing the visibility and accessibility of these services, driving overall market expansion.

Key Markets & Segments Leading Saudi Arabia BNPL Services Industry

Dominant Segment: The e-commerce sector represents the dominant segment within the Saudi Arabian BNPL market. This is fueled by the rapidly increasing penetration of e-commerce across the country.

Growth Drivers:

- Rapid Economic Growth: Saudi Arabia's robust economic growth provides the financial foundation for increased consumer spending and adoption of BNPL services.

- E-commerce Boom: The significant expansion of the e-commerce sector is creating high demand for flexible payment solutions.

- Young and Tech-Savvy Population: A large young population comfortable with technology and online transactions fuels BNPL adoption.

- Government Initiatives: Supportive government policies aimed at fostering digital transformation and financial inclusion are promoting the growth of the BNPL market.

The dominance of e-commerce is expected to continue in the forecast period, driven by a continued increase in online shopping and expanding internet accessibility across different demographics. The market shows high growth potential within specific niches such as travel, electronics, and fashion, indicating a varied and expanding consumer base for BNPL services in the Kingdom.

Saudi Arabia BNPL Services Industry Product Developments

Recent product innovations in the Saudi Arabian BNPL market center on enhanced user experience, improved security features, and wider merchant acceptance. Companies are investing heavily in developing mobile-first applications with seamless integrations across various e-commerce platforms. This includes advanced fraud detection systems and personalized credit scoring models to mitigate risk and improve approval rates. The integration of BNPL services with loyalty programs and reward systems further enhances the value proposition for consumers. The focus on technological advancements, such as AI-powered risk assessment, is enabling providers to offer more tailored and inclusive services, opening new avenues for expansion and market penetration.

Challenges in the Saudi Arabia BNPL Services Industry Market

Significant challenges facing the Saudi Arabian BNPL market include regulatory uncertainty regarding licensing and consumer protection, potential concerns about high interest rates and debt accumulation amongst vulnerable consumer groups, and stiff competition among existing and emerging players. These factors could potentially limit market growth if not addressed proactively. Moreover, supply chain disruptions or fluctuations in the broader economy could negatively affect consumer spending and, consequently, the demand for BNPL services.

Forces Driving Saudi Arabia BNPL Services Industry Growth

Several key factors are driving the growth of the Saudi Arabian BNPL services industry. These include the rapid expansion of e-commerce, increasing smartphone penetration and internet usage, and a growing preference among consumers for flexible payment options. Government initiatives promoting financial inclusion and digital transformation are also playing a significant role. Further, strategic partnerships between BNPL providers and major e-commerce platforms are significantly enhancing market reach and adoption. Technological advancements in fraud prevention and risk management are increasing consumer trust and adoption rates, reinforcing the market's growth trajectory.

Long-Term Growth Catalysts in the Saudi Arabia BNPL Services Industry

Long-term growth in the Saudi Arabian BNPL market is projected to be fueled by several factors, including continuous technological innovation, particularly in areas such as AI-driven risk assessment and personalized financial services. Strategic partnerships and mergers and acquisitions (M&A) will continue to reshape the market, leading to greater market consolidation and improved service offerings. Furthermore, expansion into new market segments and geographical areas, coupled with government support for financial inclusion, will unlock new growth avenues and solidify the BNPL industry's long-term prospects in Saudi Arabia.

Emerging Opportunities in Saudi Arabia BNPL Services Industry

The Saudi Arabian BNPL market presents several promising opportunities. The expansion of BNPL services into underserved markets, such as rural areas with growing internet penetration, represents a substantial growth opportunity. The integration of BNPL with other financial services, such as micro-loans and personal savings, can enhance the value proposition for customers and drive further adoption. Moreover, incorporating innovative technologies, such as blockchain and cryptocurrency, could revolutionize payment processing and further enhance the security and efficiency of BNPL transactions. The focus on sustainability initiatives within the sector by companies could also attract environmentally conscious consumers and influence their adoption choices.

Key Milestones in Saudi Arabia BNPL Services Industry Industry

- June 2022: Postpay partnered with Tap Payments to expand payment method offerings.

- January 2023: ToYou and Tabby launched a joint BNPL service.

Strategic Outlook for Saudi Arabia BNPL Services Industry Market

The future of the Saudi Arabian BNPL market appears exceptionally promising. Continued economic growth, increasing digitalization, and supportive government policies will act as major catalysts for further expansion. Strategic partnerships, technological innovation, and a focus on regulatory compliance will be crucial for companies seeking to thrive in this dynamic market. The increasing sophistication of risk management tools and the growing consumer adoption of BNPL services across various sectors suggest that this market is poised for sustained and substantial growth throughout the forecast period, presenting significant opportunities for both established players and new entrants.

Saudi Arabia BNPL Services Industry Segmentation

-

1. Channel

- 1.1. Online

- 1.2. POS (Point of Sale)

-

2. End User

- 2.1. Kitchen Appliances

- 2.2. Electronic Appliances

- 2.3. Fashion and Personal Care

- 2.4. Healthcare

Saudi Arabia BNPL Services Industry Segmentation By Geography

- 1. Saudi Arabia

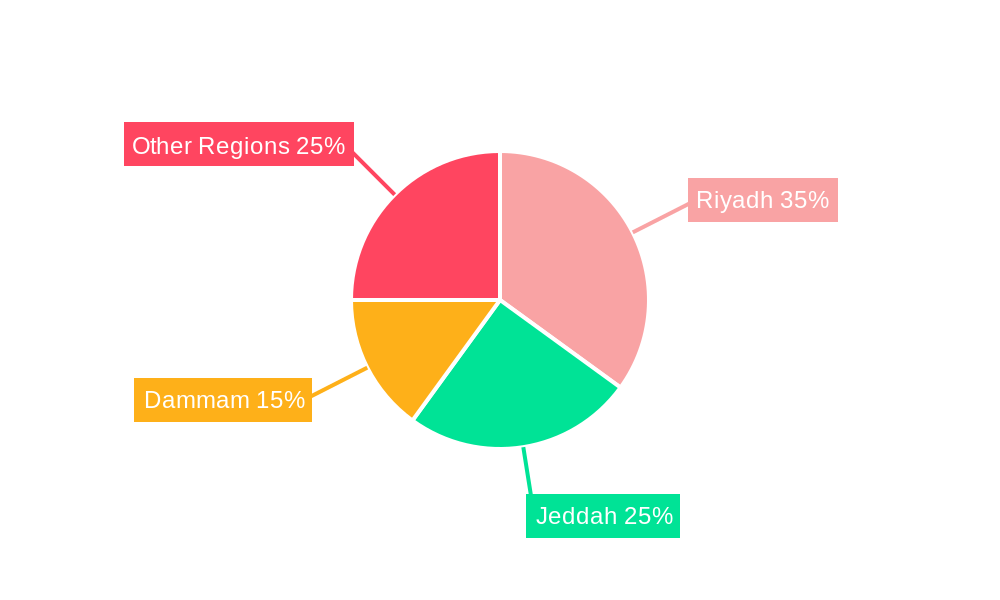

Saudi Arabia BNPL Services Industry Regional Market Share

Geographic Coverage of Saudi Arabia BNPL Services Industry

Saudi Arabia BNPL Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 10.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Flexible Payment Options; Rise in E-commerce and Online Shopping

- 3.3. Market Restrains

- 3.3.1. Increasing Consumer Demand for Flexible Payment Options; Rise in E-commerce and Online Shopping

- 3.4. Market Trends

- 3.4.1. Raising E-Commerce Platforms with Online Payment Methods Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia BNPL Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Online

- 5.1.2. POS (Point of Sale)

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Kitchen Appliances

- 5.2.2. Electronic Appliances

- 5.2.3. Fashion and Personal Care

- 5.2.4. Healthcare

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tamara

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tabby

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Spotti

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Postpay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Telr

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mastercard

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cashew Payments

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 VISA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Affirm Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zippay**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tamara

List of Figures

- Figure 1: Saudi Arabia BNPL Services Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia BNPL Services Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by Channel 2020 & 2033

- Table 2: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by Channel 2020 & 2033

- Table 3: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 5: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by Channel 2020 & 2033

- Table 8: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by Channel 2020 & 2033

- Table 9: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 11: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia BNPL Services Industry?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Saudi Arabia BNPL Services Industry?

Key companies in the market include Tamara, Tabby, Spotti, Postpay, Telr, Mastercard, Cashew Payments, VISA, Affirm Inc, Zippay**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia BNPL Services Industry?

The market segments include Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Flexible Payment Options; Rise in E-commerce and Online Shopping.

6. What are the notable trends driving market growth?

Raising E-Commerce Platforms with Online Payment Methods Drives the Market.

7. Are there any restraints impacting market growth?

Increasing Consumer Demand for Flexible Payment Options; Rise in E-commerce and Online Shopping.

8. Can you provide examples of recent developments in the market?

January 2023: ToYou, a delivery app established in Saudi Arabia, and the shopping and payment app Tabby partnered to create a new BNPL service in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia BNPL Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia BNPL Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia BNPL Services Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia BNPL Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence