Key Insights

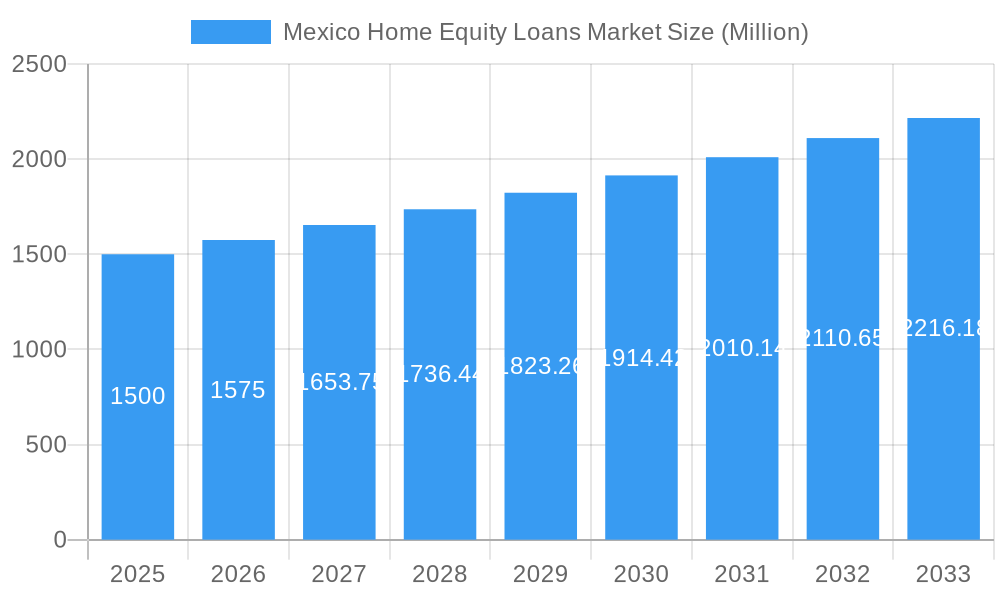

The Mexico home equity loan market is poised for significant expansion, driven by increasing homeownership, rising property values, and a growing middle class. This positive trend is further supported by government initiatives promoting housing and credit access. Despite potential challenges from economic volatility and interest rate fluctuations, the market is projected to maintain robust growth. Key market players, including national and regional institutions, are intensifying competition, necessitating strategic product development and customer service enhancements. The market segmentation by loan type, amount, and borrower demographics highlights diverse opportunities. Analysis indicates sustained growth through 2033, contingent on macroeconomic stability.

Mexico Home Equity Loans Market Market Size (In Million)

The projected positive market trajectory is underpinned by the increasing availability and customization of financial products catering to Mexican homeowners. While economic conditions may introduce headwinds, the fundamental strength of the housing sector and sustained demand for home equity solutions indicate a continued upward trend. Lenders prioritizing tailored offerings, superior customer experiences, and robust risk management frameworks are best positioned to capitalize on this expanding market. Regional market performance is expected to align with concentrations of homeownership and economic activity across Mexico.

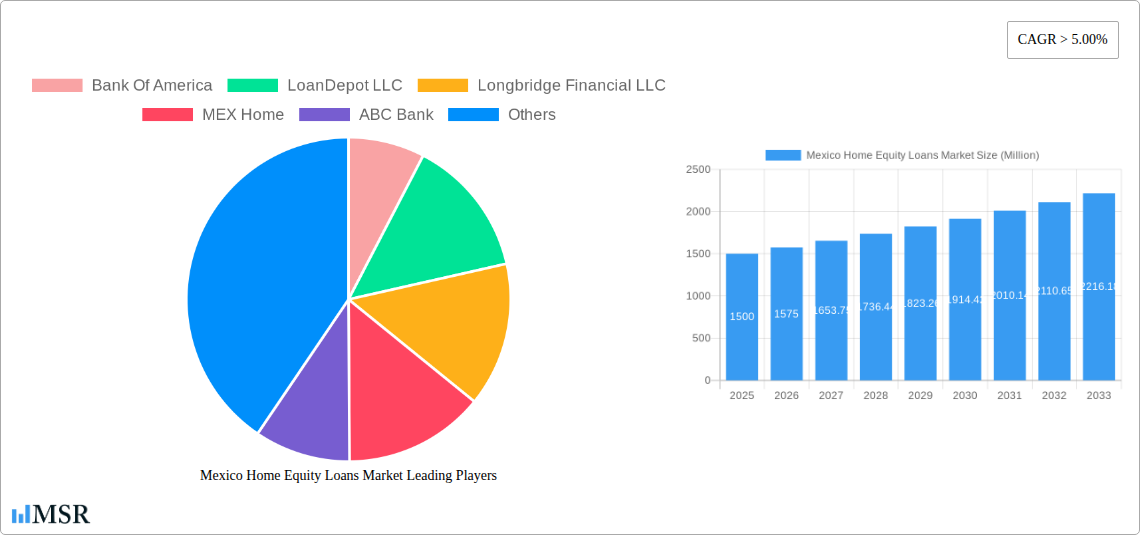

Mexico Home Equity Loans Market Company Market Share

Unlock Growth Opportunities in the Dynamic Mexico Home Equity Loans Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico Home Equity Loans Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. Discover key trends, challenges, and opportunities shaping this evolving market, including a detailed competitive landscape featuring prominent players like Bank of America, LoanDepot LLC, Longbridge Financial LLC, MEX Home, ABC Bank, WaFd Bank, Bank of Albuquerque, Mexlend, Pinnacle Bank, and New Mexico Bank and Trust. This is not an exhaustive list. The report projects a market valued at xx Million in 2025, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

Mexico Home Equity Loans Market Market Concentration & Dynamics

The Mexico Home Equity Loans Market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the market is also characterized by a dynamic competitive landscape with considerable room for new entrants and expansion by existing players. Innovation is driven by technological advancements in lending platforms and risk assessment models. The regulatory framework, while evolving, presents both challenges and opportunities for market players. Substitute products, such as personal loans and credit cards, exert competitive pressure. End-user trends favor digital convenience and personalized financial solutions. Recent M&A activity has been notable, with several deals aimed at expanding market reach and product offerings.

- Market Share: Top 5 players hold approximately xx% of the market (2024 estimate).

- M&A Deal Count: An estimated xx M&A deals occurred between 2019 and 2024, primarily focused on consolidation and regional expansion.

- Innovation Ecosystem: Strong focus on digitalization and fintech integration, leading to streamlined processes and improved customer experiences.

- Regulatory Landscape: Moderate regulatory oversight, with ongoing changes impacting lending practices and compliance requirements.

Mexico Home Equity Loans Market Industry Insights & Trends

The Mexico Home Equity Loans Market is experiencing robust growth, driven by several factors. Rising homeownership rates, increasing disposable incomes, and the need for debt consolidation are fueling demand for home equity loans. Technological disruptions, such as the adoption of online lending platforms and AI-powered risk assessment tools, are transforming the industry, improving efficiency and expanding market access. Evolving consumer behaviors, favoring digital interactions and personalized financial advice, further shape market trends. The market size in 2024 is estimated at xx Million, exhibiting a CAGR of xx% from 2019 to 2024. This robust growth is anticipated to continue throughout the forecast period. Factors like increasing interest rates may impact growth, but the underlying demand is projected to remain strong.

Key Markets & Segments Leading Mexico Home Equity Loans Market

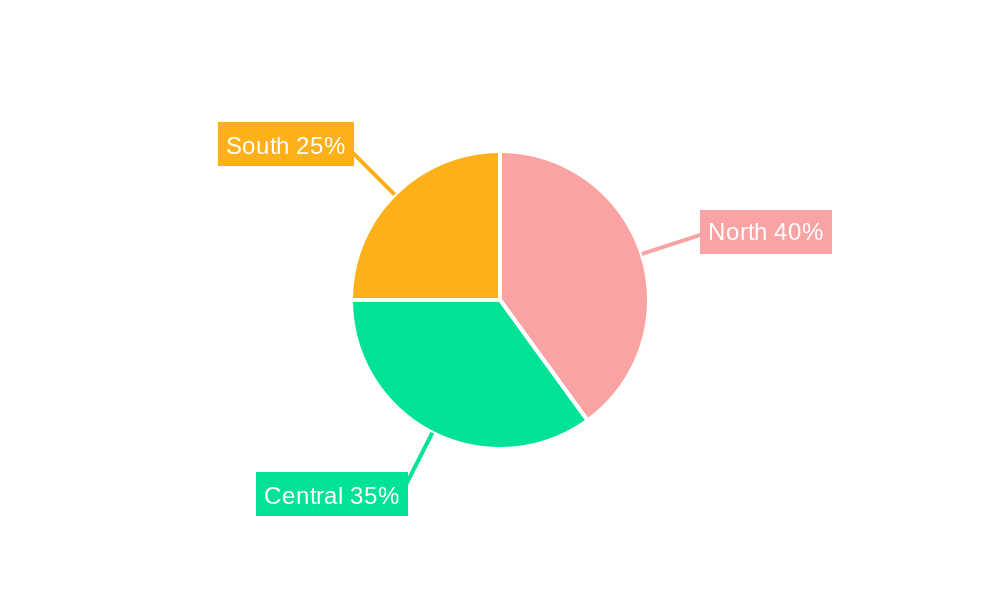

While a precise breakdown by region or segment isn't fully available for Mexico, analysis suggests that the largest segments are likely those with higher homeownership rates and greater disposable income. Specific regional dominance would require further localized market research.

- Growth Drivers:

- Rising homeownership rates

- Increasing disposable income levels within specific demographics

- Favorable government policies (if any) supporting homeownership

- Infrastructure development in key areas

- Dominance Analysis: The market is likely fragmented across different regions, with major players targeting specific geographic areas based on market potential and regulatory frameworks. A detailed regional analysis would require additional data.

Mexico Home Equity Loans Market Product Developments

Recent years have seen significant product innovations in the Mexico Home Equity Loans Market. Lenders are increasingly adopting digital platforms, offering online applications, faster processing times, and improved customer experiences. Technological advancements in risk assessment and fraud detection have also enhanced lending capabilities. These improvements aim to provide borrowers with more competitive interest rates and flexible repayment options, strengthening market competitiveness.

Challenges in the Mexico Home Equity Loans Market Market

The Mexico Home Equity Loans Market faces several challenges, including fluctuating interest rates, potential regulatory changes affecting lending practices, and the need for robust risk management systems, especially given economic volatility. Competition from other financial products and potential economic downturns could further impact market growth. These challenges require proactive strategies to mitigate their impact.

Forces Driving Mexico Home Equity Loans Market Growth

Key growth drivers include increasing homeownership rates, rising disposable incomes among target demographics, and the expanding adoption of technology in the lending process. Government policies supporting homeownership (if any) can also significantly contribute to market growth. These factors create a positive environment for the continued expansion of the Mexico Home Equity Loans Market.

Challenges in the Mexico Home Equity Loans Market Market

Long-term growth hinges on continued technological innovation, strategic partnerships to expand reach, and successful navigation of regulatory changes. Expansion into underserved markets and the development of innovative financial products will be crucial for sustained growth.

Emerging Opportunities in Mexico Home Equity Loans Market

Emerging opportunities include the expansion into underserved segments of the population, the development of innovative products like green home equity loans, and the utilization of data analytics for better risk assessment and customer targeting. Further leveraging technology for efficient processes and personalized experiences will also offer significant opportunities for growth.

Leading Players in the Mexico Home Equity Loans Market Sector

- Bank of America

- LoanDepot LLC

- Longbridge Financial LLC

- MEX Home

- ABC Bank

- WaFd Bank

- Bank of Albuquerque

- Mexlend

- Pinnacle Bank

- New Mexico Bank And Trust

Key Milestones in Mexico Home Equity Loans Market Industry

- August 2022: Rocket Mortgage launches a home equity loan in Mexico, significantly impacting the market with its digital-driven approach.

- February 2023: Guild Mortgage acquires Legacy Mortgage, expanding its presence and product offerings in the Southwest region, potentially increasing competition.

Strategic Outlook for Mexico Home Equity Loans Market Market

The Mexico Home Equity Loans Market holds significant future potential. Strategic opportunities lie in embracing technological advancements, focusing on customer experience, and adapting to evolving regulatory landscapes. By leveraging innovation and expanding into new markets, companies can capture a larger share of this dynamic and growing market.

Mexico Home Equity Loans Market Segmentation

-

1. Types

- 1.1. Fixed Rate Loans

- 1.2. Home Equity Line of Credit

-

2. Service Provider

- 2.1. Commercial Banks

- 2.2. Financial Institutions

- 2.3. Credit Unions

- 2.4. Other Creditors

-

3. Mode

- 3.1. Online

- 3.2. Offline

Mexico Home Equity Loans Market Segmentation By Geography

- 1. Mexico

Mexico Home Equity Loans Market Regional Market Share

Geographic Coverage of Mexico Home Equity Loans Market

Mexico Home Equity Loans Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk

- 3.3. Market Restrains

- 3.3.1. Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk

- 3.4. Market Trends

- 3.4.1. Financial And Socioeconomic Factors Favouring The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Home Equity Loans Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Types

- 5.1.1. Fixed Rate Loans

- 5.1.2. Home Equity Line of Credit

- 5.2. Market Analysis, Insights and Forecast - by Service Provider

- 5.2.1. Commercial Banks

- 5.2.2. Financial Institutions

- 5.2.3. Credit Unions

- 5.2.4. Other Creditors

- 5.3. Market Analysis, Insights and Forecast - by Mode

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Types

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bank Of America

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LoanDepot LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Longbridge Financial LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MEX Home

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ABC Bank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 WaFd Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bank of Albuquerque

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mexlend

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pinnacle Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 New Mexico Bank And Trust**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bank Of America

List of Figures

- Figure 1: Mexico Home Equity Loans Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Mexico Home Equity Loans Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Home Equity Loans Market Revenue million Forecast, by Types 2020 & 2033

- Table 2: Mexico Home Equity Loans Market Revenue million Forecast, by Service Provider 2020 & 2033

- Table 3: Mexico Home Equity Loans Market Revenue million Forecast, by Mode 2020 & 2033

- Table 4: Mexico Home Equity Loans Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Mexico Home Equity Loans Market Revenue million Forecast, by Types 2020 & 2033

- Table 6: Mexico Home Equity Loans Market Revenue million Forecast, by Service Provider 2020 & 2033

- Table 7: Mexico Home Equity Loans Market Revenue million Forecast, by Mode 2020 & 2033

- Table 8: Mexico Home Equity Loans Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Home Equity Loans Market?

The projected CAGR is approximately 4.56%.

2. Which companies are prominent players in the Mexico Home Equity Loans Market?

Key companies in the market include Bank Of America, LoanDepot LLC, Longbridge Financial LLC, MEX Home, ABC Bank, WaFd Bank, Bank of Albuquerque, Mexlend, Pinnacle Bank, New Mexico Bank And Trust**List Not Exhaustive.

3. What are the main segments of the Mexico Home Equity Loans Market?

The market segments include Types, Service Provider, Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 747.9 million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk.

6. What are the notable trends driving market growth?

Financial And Socioeconomic Factors Favouring The Market.

7. Are there any restraints impacting market growth?

Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk.

8. Can you provide examples of recent developments in the market?

On August 2022, Rocket Mortgage, Mexico's largest mortgage lender and a part of Rocket Companies introduced a home equity loan to give Americans one more way to pay off debt that has risen along with inflation. Detroit-based Rocket Mortgage is enabling the American Dream of homeownership and financial freedom through its obsession with an industry-leading, digital-driven client experience

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Home Equity Loans Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Home Equity Loans Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Home Equity Loans Market?

To stay informed about further developments, trends, and reports in the Mexico Home Equity Loans Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence