Key Insights

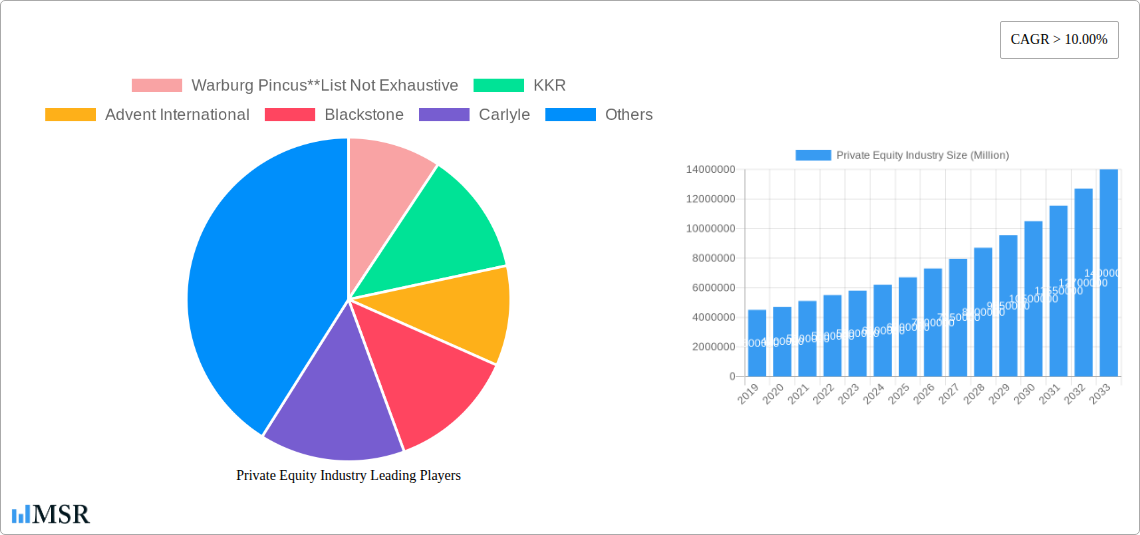

The global Private Equity (PE) industry is poised for substantial expansion, with a projected market size exceeding $XX billion and a robust Compound Annual Growth Rate (CAGR) of over 10.00% through 2033. This significant growth trajectory is primarily fueled by a confluence of potent drivers. The increasing availability of dry powder held by PE firms, coupled with a persistent low-interest-rate environment (though this is evolving, strategic deployment remains key), encourages greater deal-making activity. Furthermore, the ongoing digital transformation across various sectors is creating attractive investment opportunities in technology, healthcare, and financial services, sectors that are experiencing significant PE inflows. The growing trend of large corporations divesting non-core assets also provides PE firms with attractive acquisition targets. Investors are increasingly looking towards private markets for higher potential returns compared to more volatile public markets, further bolstering the industry's appeal.

Private Equity Industry Market Size (In Million)

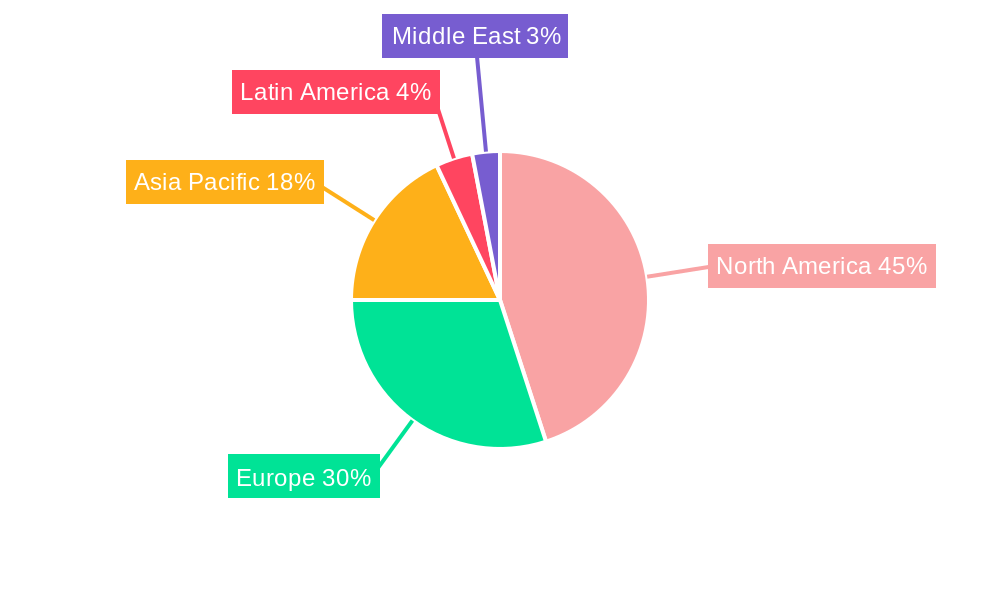

The PE landscape is characterized by a diverse range of fund types, with Buyout, Venture Capital (VCs), and Real Estate funds leading the charge in attracting capital. While technology remains a dominant sector for PE investments, other areas like healthcare, financial services, and industrials are also showing strong momentum. The market is witnessing a strategic shift in investment sizes, with a growing focus on the upper middle market and large-cap deals, although lower middle market opportunities continue to attract significant attention. Geographically, North America and Europe are established strongholds for private equity activity, but the Asia Pacific region is emerging as a critical growth engine, driven by its rapidly expanding economies and burgeoning tech ecosystems. Emerging trends include a heightened focus on ESG (Environmental, Social, and Governance) factors in investment decisions, the rise of specialized funds, and an increasing interest in direct lending and distressed asset opportunities to navigate potential economic headwinds.

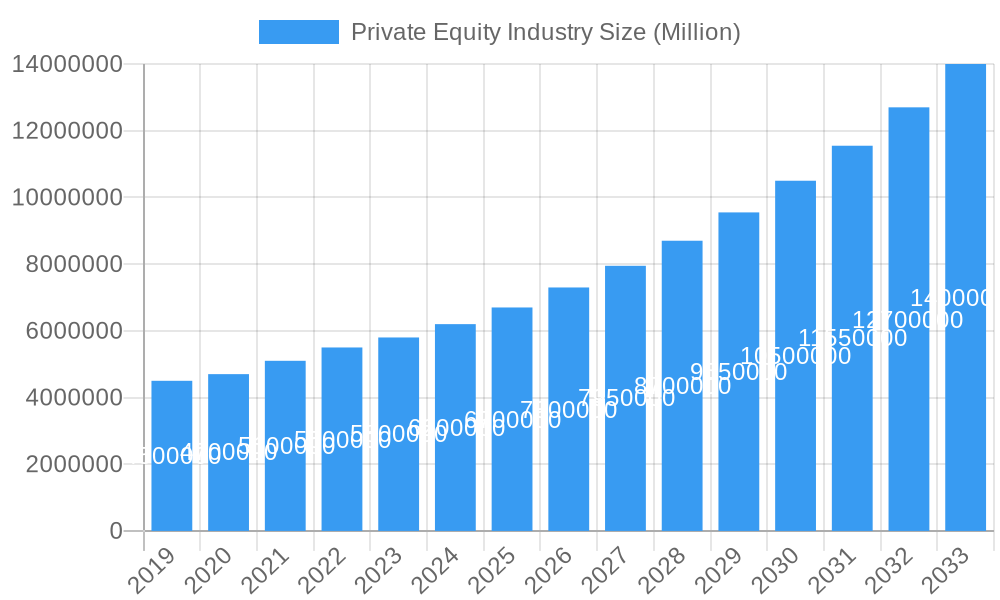

Private Equity Industry Company Market Share

This comprehensive report delves into the dynamic landscape of the Private Equity (PE) industry, providing in-depth analysis and actionable insights for stakeholders. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, this report offers a detailed forecast for the crucial private equity market, covering buyout funds, venture capital (VCs), real estate private equity, and infrastructure investments. We examine key sectors including Technology (Software), Healthcare, Financial Services, Industrials, and Consumer & Retail, analyzing investment strategies across Large Cap, Upper Middle Market, and Lower Middle Market segments. With the global private equity deal volume and fundraising at the forefront, this report is essential for understanding M&A activities, PE investment trends, and the future trajectory of alternative investments.

Private Equity Industry Market Concentration & Dynamics

The Private Equity industry exhibits varying degrees of market concentration across its diverse segments. While large-cap buyout funds often see consolidation among a few dominant players, the venture capital landscape remains more fragmented, fostering significant innovation ecosystems. Regulatory frameworks, such as those impacting financial services private equity, continue to shape deal structures and investor appetite. The identification of substitute products or services is crucial, particularly in sectors undergoing rapid technological disruption. End-user trends, such as the increasing demand for sustainable infrastructure investments and the digital transformation within consumer & retail, significantly influence PE investment strategies. Mergers and Acquisitions (M&A) activities are a constant in this market, with a significant number of PE deals announced regularly. For instance, the Private Equity market share is continuously reshaped by high-profile acquisitions and fund deployments. The M&A deal count serves as a key indicator of market health and investor confidence.

- Market Concentration: Dominated by a few large firms in specific segments, yet fragmented in others like early-stage VC.

- Innovation Ecosystems: Thriving, particularly in technology and healthcare, driven by VC funding.

- Regulatory Frameworks: Evolving globally, impacting compliance and deal structuring.

- Substitute Products: Constant threat and opportunity across all sectors, especially with technological advancements.

- End-User Trends: Shift towards digital, sustainable, and specialized solutions influencing investment focus.

- M&A Activities: Continuous driver of market dynamics, with significant private equity deal volume in the historical period.

Private Equity Industry Industry Insights & Trends

The Private Equity industry is experiencing robust growth, driven by several key factors. Market size is projected to reach an estimated USD 15 Trillion by 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately 12% during the forecast period of 2025–2033. Technological disruptions are profoundly reshaping investment opportunities, particularly in the Technology (Software) sector, where PE firms are actively seeking disruptive innovations and scalable business models. Evolving consumer behaviors, characterized by a growing preference for personalized experiences and sustainable products, are compelling private equity investors to re-evaluate their portfolios in the Consumer & Retail and Healthcare sectors. The influx of capital into real estate private equity and infrastructure funds reflects a sustained demand for tangible assets and long-term yield. Furthermore, the increasing sophistication of direct lending and distressed PE strategies offers alternative avenues for capital deployment, especially during economic recalibrations. The historical period (2019–2024) has witnessed significant PE fundraising and deployment, setting a strong foundation for future expansion. The trend of PE firms actively seeking add-on acquisitions to existing portfolio companies also contributes to the sustained growth.

Key Markets & Segments Leading Private Equity Industry

The Private Equity industry's dominance is currently observed in North America, with the United States consistently leading in deal activity and fundraising. Within this region, the Technology (Software) sector continues to be a prime target for venture capital and buyout funds, driven by innovation and the growing demand for digital solutions. Healthcare is another robust segment, fueled by an aging population and advancements in medical technology. Real Estate and Financial Services also represent significant investment arenas, with private equity real estate funds and distressed PE strategies finding fertile ground.

Fund Type Dominance:

- Buyout Funds: Lead in terms of sheer capital deployed and M&A activity, particularly in the Upper Middle Market and Large Cap segments.

- Venture Capital (VCs): Crucial for early-stage innovation, heavily focused on Technology (Software) and Healthcare.

- Real Estate: Continues to attract substantial investment for its tangible asset value and income-generating potential.

- Infrastructure: Growing in importance due to global infrastructure needs and demand for stable, long-term returns.

- Other (Distressed PE, Direct Lending): Offer alternative strategies, gaining traction during economic uncertainties.

Sector Dominance:

- Technology (Software): Driven by digital transformation and SaaS models.

- Healthcare: Supported by demographic shifts and ongoing medical advancements.

- Real Estate and Services: Benefiting from urbanization and evolving commercial/residential needs.

- Financial Services: Adapting to FinTech and regulatory changes.

- Industrials: Experiencing renewed interest driven by reshoring and supply chain modernization.

Investment Size Dominance:

- Large Cap: Characterized by mega-deals and significant consolidation opportunities.

- Upper Middle Market: A sweet spot for many PE firms, offering growth potential with less competition than large-cap.

- Lower Middle Market: Increasing focus from specialized funds seeking niche opportunities and operational improvements.

Private Equity Industry Product Developments

The Private Equity industry is continuously evolving its product offerings and investment vehicles to meet the demands of sophisticated investors and capitalize on emerging market opportunities. Innovations in fund structures, such as evergreen funds and thematic funds, are gaining traction. Technology advancements are enabling more sophisticated data analytics for due diligence and portfolio management. The increasing focus on ESG (Environmental, Social, and Governance) factors is leading to the development of specialized impact investing funds.

Challenges in the Private Equity Industry Market

The Private Equity industry faces several hurdles that can impact its growth trajectory. Regulatory scrutiny remains a significant concern, with evolving compliance requirements and potential for increased taxation. Competitive pressures are intense, especially in sought-after sectors, driving up valuations and potentially compressing returns. Supply chain disruptions, though easing, can still affect the operational performance of portfolio companies. The sheer volume of dry powder (uninvested capital) also presents a challenge, as PE firms race to deploy funds efficiently and effectively.

- Regulatory Hurdles: Evolving compliance, tax laws, and antitrust regulations.

- Competitive Pressures: Intensified competition for deals and talent.

- Supply Chain Issues: Lingering effects on portfolio company operations.

- Valuation Premiums: Overpaying for assets due to high competition and abundant capital.

Forces Driving Private Equity Industry Growth

Several potent forces are propelling the Private Equity industry forward. The persistent low-interest-rate environment historically encouraged capital allocation into alternative assets. Technological advancements continue to unlock new investment avenues, particularly in sectors like Technology (Software) and Healthcare. Global economic growth, albeit with regional variations, fuels corporate expansion and M&A opportunities. Favorable demographic trends, such as an aging population requiring enhanced healthcare services, also drive investment. The increasing sophistication of private equity firms in operational value creation and specialized strategies further bolsters growth.

Challenges in the Private Equity Industry Market

Long-term growth catalysts for the Private Equity industry are rooted in its adaptability and innovation. The continued digital transformation across industries presents perpetual opportunities for investment in technology-enabled solutions. Strategic partnerships and co-investment opportunities with institutional investors and sovereign wealth funds are becoming more prevalent. Market expansion into emerging economies offers new frontiers for PE investment. The ongoing consolidation within various sectors also creates opportunities for buyout firms to drive efficiency and scale.

Emerging Opportunities in Private Equity Industry

Emerging opportunities in the Private Equity industry are abundant and diverse. The burgeoning fields of Artificial Intelligence (AI) and Machine Learning (ML) offer significant potential for venture capital and growth equity investments. The global transition towards renewable energy and sustainable practices is creating a massive demand for infrastructure investments and related technologies. Shifting consumer preferences towards personalized and on-demand services present opportunities in niche consumer & retail segments. Furthermore, the ongoing digital transformation of traditional industries, from manufacturing to logistics, provides fertile ground for PE firms to drive operational efficiencies and innovation.

Leading Players in the Private Equity Industry Sector

- Warburg Pincus

- KKR

- Advent International

- Blackstone

- Carlyle

- EnCap Investments

- CVC Capital Partners

- TPG Capital

- Neuberger Berman

- Apollo Global Management

Key Milestones in Private Equity Industry Industry

- September 2022: Nonantum Capital Partners, a middle-market private equity firm, announced the acquisition of LJP Waste Solutions ("LJP") from Aperion Management. LJP is a leading regional provider of non-hazardous solid waste and recycling services specializing in zero landfill and waste-to-energy solutions. This acquisition highlights the growing interest in the waste management and sustainability sector within the middle-market private equity space.

- August 2022: Indian firm Trilegal acted as the sole advisor to global consumer internet group and technology investor Prosus Ventures and PayU India for the acquisition of IndiaIdeas.com Limited (BillDesk). It is the largest-ever acquisition in the digital payments space in India, and the deal is valued at USD 4.7 billion. This monumental PE deal underscores the rapid growth and increasing deal sizes in India's burgeoning digital payments sector, showcasing the strategic focus of global investors on emerging markets.

Strategic Outlook for Private Equity Industry Market

The strategic outlook for the Private Equity industry remains exceptionally positive, fueled by a confluence of factors including ongoing innovation, economic resilience, and evolving investor appetites. Growth accelerators include the continued digitalization of businesses, the global push for sustainability driving infrastructure investments, and the increasing demand for specialized healthcare solutions. Private equity firms are strategically focusing on sectors with high growth potential, leveraging their expertise in operational improvements and strategic expansion. The ability to adapt to macroeconomic shifts and identify undervalued assets will be crucial. Emerging markets and niche investment strategies are expected to offer significant future potential, ensuring the continued dynamism and profitability of the alternative investment landscape.

Private Equity Industry Segmentation

-

1. Fund Type

- 1.1. Buyout

- 1.2. Venture Capital (VCs)

- 1.3. Real Estate

- 1.4. Infrastructure

- 1.5. Other (Distressed PE, Direct Lending, etc.)

-

2. Sector

- 2.1. Technology (Software)

- 2.2. Healthcare

- 2.3. Real Estate and Services

- 2.4. Financial Services

- 2.5. Industrials

- 2.6. Consumer & Retail

- 2.7. Energy & Power

- 2.8. Media & Entertainment

- 2.9. Telecom

- 2.10. Others (Transportation, etc.)

-

3. Investments

- 3.1. Large Cap

- 3.2. Upper Middle Market

- 3.3. Lower Middle Market

- 3.4. Real Estate

Private Equity Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Private Equity Industry Regional Market Share

Geographic Coverage of Private Equity Industry

Private Equity Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 10.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Innovative Tracking Technologies

- 3.3. Market Restrains

- 3.3.1. Rising Competition of Banks with Fintech and Financial Services

- 3.4. Market Trends

- 3.4.1. Growth Investments Have Become Larger and More Complex

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Private Equity Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 5.1.1. Buyout

- 5.1.2. Venture Capital (VCs)

- 5.1.3. Real Estate

- 5.1.4. Infrastructure

- 5.1.5. Other (Distressed PE, Direct Lending, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Sector

- 5.2.1. Technology (Software)

- 5.2.2. Healthcare

- 5.2.3. Real Estate and Services

- 5.2.4. Financial Services

- 5.2.5. Industrials

- 5.2.6. Consumer & Retail

- 5.2.7. Energy & Power

- 5.2.8. Media & Entertainment

- 5.2.9. Telecom

- 5.2.10. Others (Transportation, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Investments

- 5.3.1. Large Cap

- 5.3.2. Upper Middle Market

- 5.3.3. Lower Middle Market

- 5.3.4. Real Estate

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 6. North America Private Equity Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 6.1.1. Buyout

- 6.1.2. Venture Capital (VCs)

- 6.1.3. Real Estate

- 6.1.4. Infrastructure

- 6.1.5. Other (Distressed PE, Direct Lending, etc.)

- 6.2. Market Analysis, Insights and Forecast - by Sector

- 6.2.1. Technology (Software)

- 6.2.2. Healthcare

- 6.2.3. Real Estate and Services

- 6.2.4. Financial Services

- 6.2.5. Industrials

- 6.2.6. Consumer & Retail

- 6.2.7. Energy & Power

- 6.2.8. Media & Entertainment

- 6.2.9. Telecom

- 6.2.10. Others (Transportation, etc.)

- 6.3. Market Analysis, Insights and Forecast - by Investments

- 6.3.1. Large Cap

- 6.3.2. Upper Middle Market

- 6.3.3. Lower Middle Market

- 6.3.4. Real Estate

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 7. Europe Private Equity Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 7.1.1. Buyout

- 7.1.2. Venture Capital (VCs)

- 7.1.3. Real Estate

- 7.1.4. Infrastructure

- 7.1.5. Other (Distressed PE, Direct Lending, etc.)

- 7.2. Market Analysis, Insights and Forecast - by Sector

- 7.2.1. Technology (Software)

- 7.2.2. Healthcare

- 7.2.3. Real Estate and Services

- 7.2.4. Financial Services

- 7.2.5. Industrials

- 7.2.6. Consumer & Retail

- 7.2.7. Energy & Power

- 7.2.8. Media & Entertainment

- 7.2.9. Telecom

- 7.2.10. Others (Transportation, etc.)

- 7.3. Market Analysis, Insights and Forecast - by Investments

- 7.3.1. Large Cap

- 7.3.2. Upper Middle Market

- 7.3.3. Lower Middle Market

- 7.3.4. Real Estate

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 8. Asia Pacific Private Equity Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 8.1.1. Buyout

- 8.1.2. Venture Capital (VCs)

- 8.1.3. Real Estate

- 8.1.4. Infrastructure

- 8.1.5. Other (Distressed PE, Direct Lending, etc.)

- 8.2. Market Analysis, Insights and Forecast - by Sector

- 8.2.1. Technology (Software)

- 8.2.2. Healthcare

- 8.2.3. Real Estate and Services

- 8.2.4. Financial Services

- 8.2.5. Industrials

- 8.2.6. Consumer & Retail

- 8.2.7. Energy & Power

- 8.2.8. Media & Entertainment

- 8.2.9. Telecom

- 8.2.10. Others (Transportation, etc.)

- 8.3. Market Analysis, Insights and Forecast - by Investments

- 8.3.1. Large Cap

- 8.3.2. Upper Middle Market

- 8.3.3. Lower Middle Market

- 8.3.4. Real Estate

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 9. Latin America Private Equity Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 9.1.1. Buyout

- 9.1.2. Venture Capital (VCs)

- 9.1.3. Real Estate

- 9.1.4. Infrastructure

- 9.1.5. Other (Distressed PE, Direct Lending, etc.)

- 9.2. Market Analysis, Insights and Forecast - by Sector

- 9.2.1. Technology (Software)

- 9.2.2. Healthcare

- 9.2.3. Real Estate and Services

- 9.2.4. Financial Services

- 9.2.5. Industrials

- 9.2.6. Consumer & Retail

- 9.2.7. Energy & Power

- 9.2.8. Media & Entertainment

- 9.2.9. Telecom

- 9.2.10. Others (Transportation, etc.)

- 9.3. Market Analysis, Insights and Forecast - by Investments

- 9.3.1. Large Cap

- 9.3.2. Upper Middle Market

- 9.3.3. Lower Middle Market

- 9.3.4. Real Estate

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 10. Middle East Private Equity Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 10.1.1. Buyout

- 10.1.2. Venture Capital (VCs)

- 10.1.3. Real Estate

- 10.1.4. Infrastructure

- 10.1.5. Other (Distressed PE, Direct Lending, etc.)

- 10.2. Market Analysis, Insights and Forecast - by Sector

- 10.2.1. Technology (Software)

- 10.2.2. Healthcare

- 10.2.3. Real Estate and Services

- 10.2.4. Financial Services

- 10.2.5. Industrials

- 10.2.6. Consumer & Retail

- 10.2.7. Energy & Power

- 10.2.8. Media & Entertainment

- 10.2.9. Telecom

- 10.2.10. Others (Transportation, etc.)

- 10.3. Market Analysis, Insights and Forecast - by Investments

- 10.3.1. Large Cap

- 10.3.2. Upper Middle Market

- 10.3.3. Lower Middle Market

- 10.3.4. Real Estate

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Warburg Pincus**List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 KKR

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Advent International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Blackstone

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Carlyle

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 EnCap Investments

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CVC Capital Partners

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TPG Capital

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Neuberger Berman

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Apollo Global Management

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Warburg Pincus**List Not Exhaustive

List of Figures

- Figure 1: Global Private Equity Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Private Equity Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 3: North America Private Equity Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 4: North America Private Equity Industry Revenue (Million), by Sector 2025 & 2033

- Figure 5: North America Private Equity Industry Revenue Share (%), by Sector 2025 & 2033

- Figure 6: North America Private Equity Industry Revenue (Million), by Investments 2025 & 2033

- Figure 7: North America Private Equity Industry Revenue Share (%), by Investments 2025 & 2033

- Figure 8: North America Private Equity Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Private Equity Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Private Equity Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 11: Europe Private Equity Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 12: Europe Private Equity Industry Revenue (Million), by Sector 2025 & 2033

- Figure 13: Europe Private Equity Industry Revenue Share (%), by Sector 2025 & 2033

- Figure 14: Europe Private Equity Industry Revenue (Million), by Investments 2025 & 2033

- Figure 15: Europe Private Equity Industry Revenue Share (%), by Investments 2025 & 2033

- Figure 16: Europe Private Equity Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Private Equity Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Private Equity Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 19: Asia Pacific Private Equity Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 20: Asia Pacific Private Equity Industry Revenue (Million), by Sector 2025 & 2033

- Figure 21: Asia Pacific Private Equity Industry Revenue Share (%), by Sector 2025 & 2033

- Figure 22: Asia Pacific Private Equity Industry Revenue (Million), by Investments 2025 & 2033

- Figure 23: Asia Pacific Private Equity Industry Revenue Share (%), by Investments 2025 & 2033

- Figure 24: Asia Pacific Private Equity Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Private Equity Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Private Equity Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 27: Latin America Private Equity Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 28: Latin America Private Equity Industry Revenue (Million), by Sector 2025 & 2033

- Figure 29: Latin America Private Equity Industry Revenue Share (%), by Sector 2025 & 2033

- Figure 30: Latin America Private Equity Industry Revenue (Million), by Investments 2025 & 2033

- Figure 31: Latin America Private Equity Industry Revenue Share (%), by Investments 2025 & 2033

- Figure 32: Latin America Private Equity Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Private Equity Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Private Equity Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 35: Middle East Private Equity Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 36: Middle East Private Equity Industry Revenue (Million), by Sector 2025 & 2033

- Figure 37: Middle East Private Equity Industry Revenue Share (%), by Sector 2025 & 2033

- Figure 38: Middle East Private Equity Industry Revenue (Million), by Investments 2025 & 2033

- Figure 39: Middle East Private Equity Industry Revenue Share (%), by Investments 2025 & 2033

- Figure 40: Middle East Private Equity Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Private Equity Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Private Equity Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 2: Global Private Equity Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 3: Global Private Equity Industry Revenue Million Forecast, by Investments 2020 & 2033

- Table 4: Global Private Equity Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Private Equity Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 6: Global Private Equity Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 7: Global Private Equity Industry Revenue Million Forecast, by Investments 2020 & 2033

- Table 8: Global Private Equity Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Private Equity Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 10: Global Private Equity Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 11: Global Private Equity Industry Revenue Million Forecast, by Investments 2020 & 2033

- Table 12: Global Private Equity Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Private Equity Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 14: Global Private Equity Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 15: Global Private Equity Industry Revenue Million Forecast, by Investments 2020 & 2033

- Table 16: Global Private Equity Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Private Equity Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 18: Global Private Equity Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 19: Global Private Equity Industry Revenue Million Forecast, by Investments 2020 & 2033

- Table 20: Global Private Equity Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Private Equity Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 22: Global Private Equity Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 23: Global Private Equity Industry Revenue Million Forecast, by Investments 2020 & 2033

- Table 24: Global Private Equity Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Private Equity Industry?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Private Equity Industry?

Key companies in the market include Warburg Pincus**List Not Exhaustive, KKR, Advent International, Blackstone, Carlyle, EnCap Investments, CVC Capital Partners, TPG Capital, Neuberger Berman, Apollo Global Management.

3. What are the main segments of the Private Equity Industry?

The market segments include Fund Type, Sector, Investments.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Innovative Tracking Technologies.

6. What are the notable trends driving market growth?

Growth Investments Have Become Larger and More Complex.

7. Are there any restraints impacting market growth?

Rising Competition of Banks with Fintech and Financial Services.

8. Can you provide examples of recent developments in the market?

September 2022: Nonantum Capital Partners, a middle-market private equity firm, today announced the acquisition of LJP Waste Solutions ("LJP") from Aperion Management. LJP is a leading regional provider of non-hazardous solid waste and recycling services specializing in zero landfill and waste-to-energy solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Private Equity Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Private Equity Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Private Equity Industry?

To stay informed about further developments, trends, and reports in the Private Equity Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence