Key Insights

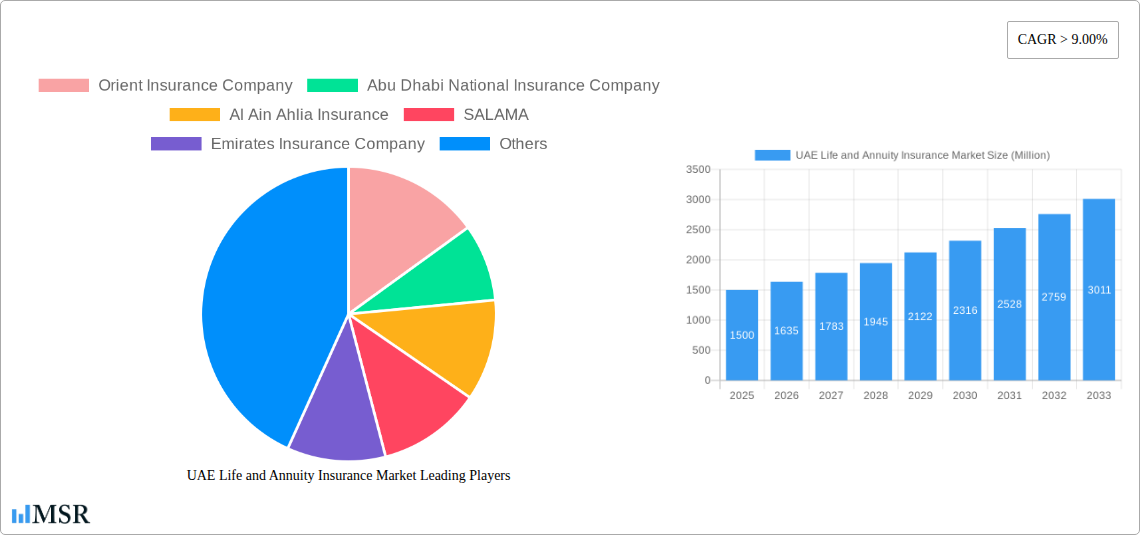

The UAE life and annuity insurance market is experiencing significant expansion, driven by a growing population, increasing disposable incomes, and a heightened demand for financial security. The market is projected to grow at a CAGR of 7.4%, reaching a size of $3.92 billion by 2025. Key growth drivers include government initiatives supporting financial inclusion, the widespread adoption of digital insurance solutions, and a proactive approach to financial planning among younger demographics. A stable economic climate and supportive regulatory environment further bolster market growth.

UAE Life and Annuity Insurance Market Market Size (In Billion)

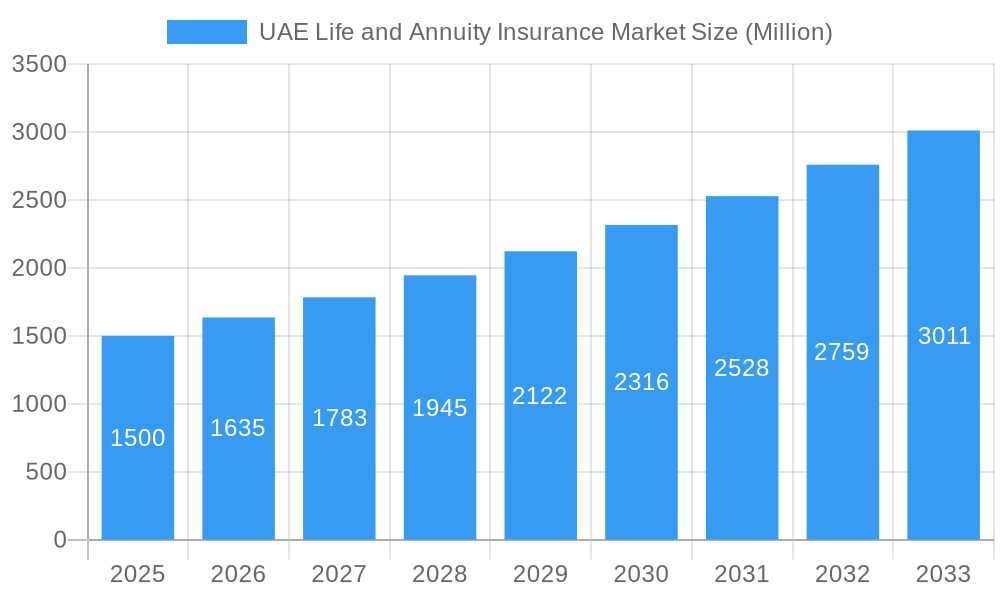

Intense competition among established insurers, including Orient Insurance Company, Abu Dhabi National Insurance Company, and Emirates Insurance Company, alongside the influx of international players, is fostering product innovation, superior customer service, and competitive pricing. This dynamic landscape is expected to benefit consumers with a broader range of insurance options and more advantageous terms.

UAE Life and Annuity Insurance Market Company Market Share

Looking towards 2033, the market is anticipated to sustain its growth trajectory, supported by the UAE's ongoing economic development and commitment to a diversified financial sector. Increased penetration of life and annuity insurance products across individual and corporate segments will be instrumental. Future market analyses should explore the impact of emerging technologies like AI and big data analytics on product development and customer engagement.

UAE Life and Annuity Insurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UAE life and annuity insurance market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, emerging trends, and future growth prospects. The study period (2019-2024) and forecast period (2025-2033) ensure a robust understanding of historical performance and future potential. The estimated year is 2025 and the base year is 2025. Expect detailed analysis of market size (in Millions), CAGR, and key performance indicators.

UAE Life and Annuity Insurance Market Concentration & Dynamics

This section analyzes the competitive landscape of the UAE life and annuity insurance market, exploring market concentration, innovation, regulatory frameworks, substitute products, end-user trends, and M&A activity. The market is characterized by a mix of established players and new entrants, resulting in a dynamic competitive environment.

- Market Concentration: The market exhibits a moderate level of concentration, with a few major players holding significant market share. The precise market share distribution will be detailed in the full report, but key players like Orient Insurance Company, Abu Dhabi National Insurance Company, and Emirates Insurance Company are expected to hold substantial portions.

- Innovation Ecosystems: The UAE insurance sector is actively fostering innovation through technological advancements and strategic partnerships. The adoption of Insurtech solutions and digitalization initiatives are driving efficiency and enhancing customer experience.

- Regulatory Frameworks: The regulatory environment plays a significant role in shaping the market. Recent collaborations, such as the September 2022 agreement between the UAE Central Bank and Sama to enhance sector supervision, indicate a focus on strengthening regulatory oversight and promoting market stability. This includes collaborative efforts on solvency rules, technical allocations, and investment policies.

- Substitute Products: The availability of alternative investment options and financial products presents a competitive challenge to life and annuity insurance.

- End-User Trends: Growing awareness of financial planning and retirement security among the UAE population is driving demand for life and annuity products. The increasing adoption of online platforms and digital channels for insurance purchase is also influencing market dynamics.

- M&A Activities: The recent acquisition of ASCANA by Oman Insurance Company (Sukoon) in May 2023 highlights the ongoing M&A activity in the market. The report will provide a detailed analysis of the number and value of M&A deals over the study period, offering insights into consolidation trends. The report will provide more data on the number of M&A deals over the studied period.

UAE Life and Annuity Insurance Market Industry Insights & Trends

This section delves into the key trends shaping the UAE life and annuity insurance market, including market growth drivers, technological disruptions, and evolving consumer behaviors. The market has witnessed significant growth in recent years, driven by factors such as economic expansion, increasing disposable incomes, and rising awareness of the importance of insurance. The report will provide quantified data on market size (in Millions) and compound annual growth rate (CAGR) throughout the forecast period.

Key Markets & Segments Leading UAE Life and Annuity Insurance Market

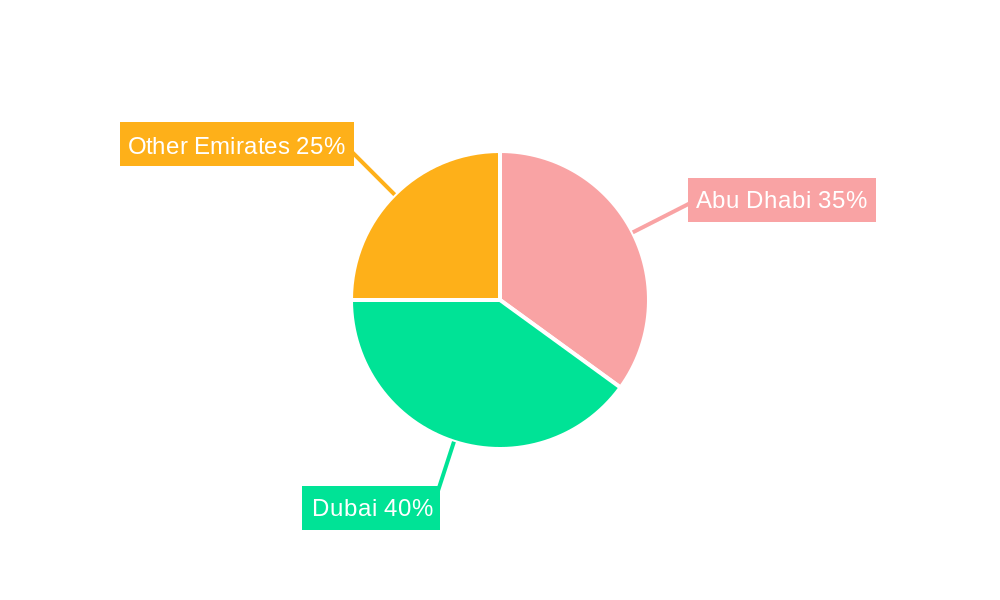

This section identifies the dominant regions, countries, and segments within the UAE life and annuity insurance market. While detailed data within the full report will provide granular level insights, the following presents a high level overview:

- Dominant Regions/Segments: The report will identify the regions and segments demonstrating the highest growth and market share. Detailed analysis of this will be presented in the full report.

- Growth Drivers: The key drivers for growth in these segments include:

- Economic growth in the UAE.

- Increasing urbanization and a growing middle class.

- Government initiatives to promote financial inclusion.

- Infrastructure development.

- Dominance Analysis: The full report will provide a comprehensive analysis explaining the reasons behind the dominance of specific segments and regions.

UAE Life and Annuity Insurance Market Product Developments

The UAE life and annuity insurance market is witnessing significant product innovations driven by technological advancements and changing customer needs. The introduction of customized and digital solutions that offer a more personalized insurance experience represents a key innovation to note. These include online platforms for policy purchasing, mobile-based applications for claims management, and the use of AI for risk assessment and pricing. The adoption of such technologies allows insurers to enhance efficiency and provide enhanced customer satisfaction, resulting in a stronger competitive edge.

Challenges in the UAE Life and Annuity Insurance Market

The UAE life and annuity insurance market faces several challenges, including stringent regulatory requirements, intense competition, and evolving customer expectations. The regulatory landscape is dynamic, necessitating ongoing compliance efforts, while competition from both established players and new entrants demands ongoing innovation. Further, effectively managing increasing customer expectations for efficient and personalized service present ongoing strategic challenges. The report will quantify the impact of these challenges on market growth.

Forces Driving UAE Life and Annuity Insurance Market Growth

Several factors contribute to the growth of the UAE life and annuity insurance market. Technological advancements, such as the use of AI and big data analytics, are enhancing risk management and pricing strategies. Moreover, strong economic growth is driving increased demand for insurance products as consumer incomes rise. Finally, favorable government policies that promote financial inclusion and support for the insurance sector further strengthen this growth trajectory.

Long-Term Growth Catalysts in the UAE Life and Annuity Insurance Market

The long-term growth of the UAE life and annuity insurance market will be fueled by continued innovation in product offerings, strategic partnerships between insurers and technology providers, and expansion into new market segments, and expanding digital capabilities. These combined factors ensure a robust trajectory for continued growth.

Emerging Opportunities in UAE Life and Annuity Insurance Market

Emerging opportunities lie in the expansion of digital distribution channels, the development of niche insurance products tailored to specific customer segments, and the adoption of innovative technologies, such as blockchain and IoT, to enhance operational efficiency and customer experience. Further, the development of tailored products for the burgeoning expatriate population within the UAE holds immense potential.

Leading Players in the UAE Life and Annuity Insurance Market Sector

- Orient Insurance Company

- Abu Dhabi National Insurance Company

- Al Ain Ahlia Insurance

- SALAMA

- Emirates Insurance Company

- Dubai Insurance Company

- Union Insurance Company

- Dubai National Insurance & Reinsurance PSC

- AXA Green Crescent Insurance

- Oman Insurance Company

Key Milestones in UAE Life and Annuity Insurance Market Industry

- May 2023: Oman Insurance Company P.S.C. ('Sukoon') completed the acquisition of 93.0432% of the share capital of Arabian Scandinavian Insurance Company P.S.C. (ASCANA). This significant acquisition reshapes the market landscape and demonstrates continued consolidation within the sector.

- September 2022: The UAE Central Bank and Sama signed a preliminary agreement to jointly supervise the insurance sector. This collaboration enhances regulatory oversight and promotes greater market stability and transparency, setting a stage for future growth.

Strategic Outlook for UAE Life and Annuity Insurance Market

The UAE life and annuity insurance market presents substantial growth potential. Continued technological advancements, supportive government policies, and the rising demand for financial security among the UAE population create a strong foundation for continued expansion. Strategic partnerships, product diversification, and investments in digital capabilities will be key to success in this evolving market. The report provides a detailed strategic roadmap for success.

UAE Life and Annuity Insurance Market Segmentation

-

1. Insurance Type

- 1.1. Individual Insurance

- 1.2. Annuity Insurance

- 1.3. Endowment Insurance

- 1.4. Whole Life Insurance

- 1.5. Other Insurance Types

UAE Life and Annuity Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Life and Annuity Insurance Market Regional Market Share

Geographic Coverage of UAE Life and Annuity Insurance Market

UAE Life and Annuity Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Awareness of Insurance; Expanding Distribution Channels

- 3.3. Market Restrains

- 3.3.1. Increased Awareness of Insurance; Expanding Distribution Channels

- 3.4. Market Trends

- 3.4.1. COVID-19 Impact Driving the Market to New Flexible Business Models

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Life and Annuity Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Individual Insurance

- 5.1.2. Annuity Insurance

- 5.1.3. Endowment Insurance

- 5.1.4. Whole Life Insurance

- 5.1.5. Other Insurance Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. North America UAE Life and Annuity Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6.1.1. Individual Insurance

- 6.1.2. Annuity Insurance

- 6.1.3. Endowment Insurance

- 6.1.4. Whole Life Insurance

- 6.1.5. Other Insurance Types

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7. South America UAE Life and Annuity Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7.1.1. Individual Insurance

- 7.1.2. Annuity Insurance

- 7.1.3. Endowment Insurance

- 7.1.4. Whole Life Insurance

- 7.1.5. Other Insurance Types

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8. Europe UAE Life and Annuity Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8.1.1. Individual Insurance

- 8.1.2. Annuity Insurance

- 8.1.3. Endowment Insurance

- 8.1.4. Whole Life Insurance

- 8.1.5. Other Insurance Types

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9. Middle East & Africa UAE Life and Annuity Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9.1.1. Individual Insurance

- 9.1.2. Annuity Insurance

- 9.1.3. Endowment Insurance

- 9.1.4. Whole Life Insurance

- 9.1.5. Other Insurance Types

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10. Asia Pacific UAE Life and Annuity Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10.1.1. Individual Insurance

- 10.1.2. Annuity Insurance

- 10.1.3. Endowment Insurance

- 10.1.4. Whole Life Insurance

- 10.1.5. Other Insurance Types

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Orient Insurance Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Abu Dhabi National Insurance Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Al Ain Ahlia Insurance

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SALAMA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Emirates Insurance Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dubai Insurance Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Union Insurance Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dubai National Insurance & Reinsurance PSC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AXA Green Crescent Insurance

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Oman Insurance Company**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Orient Insurance Company

List of Figures

- Figure 1: Global UAE Life and Annuity Insurance Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UAE Life and Annuity Insurance Market Revenue (billion), by Insurance Type 2025 & 2033

- Figure 3: North America UAE Life and Annuity Insurance Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 4: North America UAE Life and Annuity Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America UAE Life and Annuity Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America UAE Life and Annuity Insurance Market Revenue (billion), by Insurance Type 2025 & 2033

- Figure 7: South America UAE Life and Annuity Insurance Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 8: South America UAE Life and Annuity Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 9: South America UAE Life and Annuity Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe UAE Life and Annuity Insurance Market Revenue (billion), by Insurance Type 2025 & 2033

- Figure 11: Europe UAE Life and Annuity Insurance Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 12: Europe UAE Life and Annuity Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe UAE Life and Annuity Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa UAE Life and Annuity Insurance Market Revenue (billion), by Insurance Type 2025 & 2033

- Figure 15: Middle East & Africa UAE Life and Annuity Insurance Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 16: Middle East & Africa UAE Life and Annuity Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa UAE Life and Annuity Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific UAE Life and Annuity Insurance Market Revenue (billion), by Insurance Type 2025 & 2033

- Figure 19: Asia Pacific UAE Life and Annuity Insurance Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 20: Asia Pacific UAE Life and Annuity Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific UAE Life and Annuity Insurance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 2: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 4: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 9: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 14: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 25: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 33: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Life and Annuity Insurance Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the UAE Life and Annuity Insurance Market?

Key companies in the market include Orient Insurance Company, Abu Dhabi National Insurance Company, Al Ain Ahlia Insurance, SALAMA, Emirates Insurance Company, Dubai Insurance Company, Union Insurance Company, Dubai National Insurance & Reinsurance PSC, AXA Green Crescent Insurance, Oman Insurance Company**List Not Exhaustive.

3. What are the main segments of the UAE Life and Annuity Insurance Market?

The market segments include Insurance Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.92 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Awareness of Insurance; Expanding Distribution Channels.

6. What are the notable trends driving market growth?

COVID-19 Impact Driving the Market to New Flexible Business Models.

7. Are there any restraints impacting market growth?

Increased Awareness of Insurance; Expanding Distribution Channels.

8. Can you provide examples of recent developments in the market?

May 2023: Oman Insurance Company P.S.C. ('Sukoon') completed the acquisition of 93.0432% of the share capital of Arabian Scandinavian Insurance Company P.S.C. (ASCANA) by way of the special deal through Dubai Clear. Sukoon signed a share purchase agreement in December 2022 to acquire a majority stake of more than 93% in the DFM-listed takaful insurer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Life and Annuity Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Life and Annuity Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Life and Annuity Insurance Market?

To stay informed about further developments, trends, and reports in the UAE Life and Annuity Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence