Key Insights

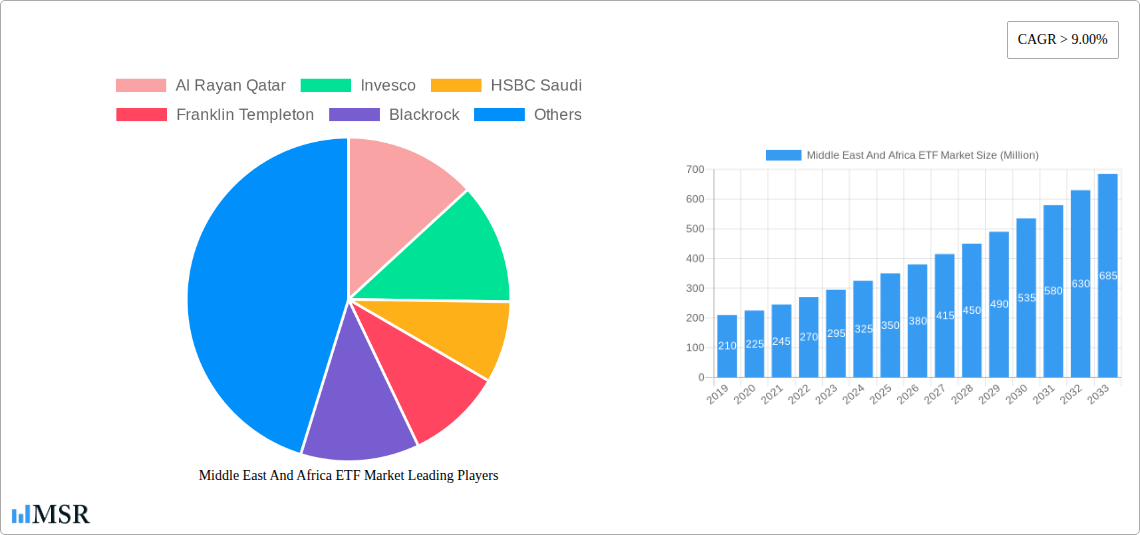

The Middle East and Africa (MEA) ETF market is poised for significant expansion, projected to surpass USD 350 Million by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 9.00% through 2033. This rapid ascent is fueled by a confluence of dynamic drivers, including increasing investor appetite for diversified and accessible investment products, a growing awareness of passive investing strategies, and the strategic initiatives undertaken by regional governments to foster financial market development. Key trends underpinning this growth include the rising adoption of equity ETFs, as investors seek exposure to burgeoning regional stock markets, and a steady increase in fixed-income ETFs, driven by demand for stable yield-generating instruments. Furthermore, the burgeoning real estate and commodity ETF segments are capturing investor interest, reflecting a diversified investment approach across asset classes. The MEA region, particularly the GCC countries like Saudi Arabia and the UAE, is emerging as a hub for ETF innovation and adoption, supported by regulatory frameworks that encourage foreign investment and the listing of new ETF products.

Middle East And Africa ETF Market Market Size (In Million)

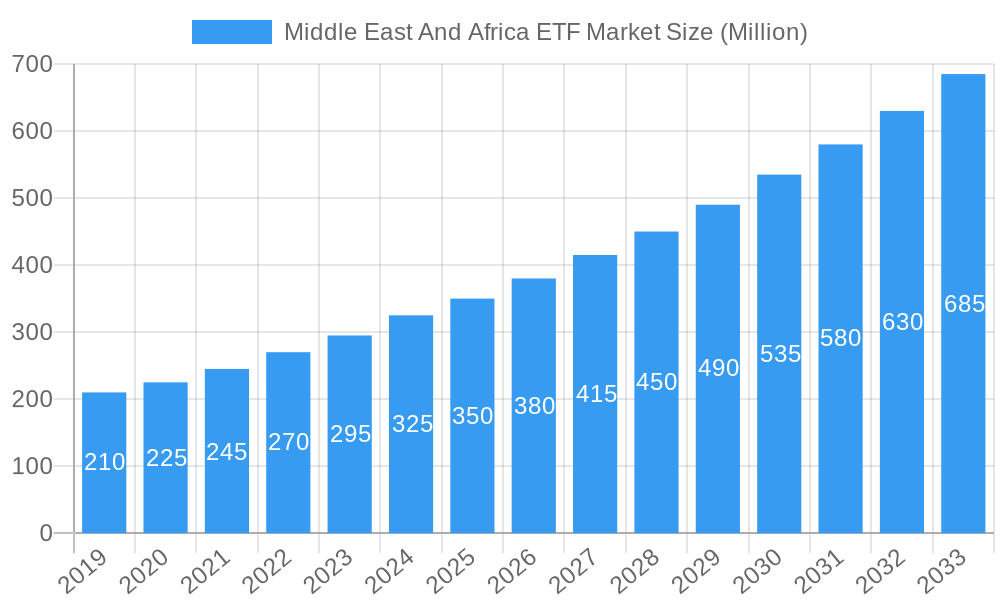

The market is experiencing a notable shift towards passively managed ETFs, which offer cost-effectiveness and transparency, aligning with the evolving preferences of both retail and institutional investors. While actively managed ETFs are also gaining traction, particularly for niche strategies, the cost advantage of passive options is a significant differentiator. Key restraints, such as limited ETF liquidity in certain sub-regions and a relatively nascent understanding of ETF benefits among a portion of the investor base, are being systematically addressed through educational initiatives and increased product offerings. Major players like Blackrock, Invesco, and HSBC Saudi are actively investing in expanding their ETF portfolios and distribution networks across the MEA, further stimulating market growth. The region's young and increasingly tech-savvy population, coupled with the growing disposable income and a desire for sophisticated investment tools, creates a fertile ground for the sustained growth of the ETF landscape in the Middle East and Africa.

Middle East And Africa ETF Market Company Market Share

Unlocking the Potential: Middle East & Africa ETF Market Report 2024-2033

This comprehensive report delves deep into the burgeoning Middle East & Africa ETF Market, offering unparalleled insights and actionable strategies for investors, asset managers, and financial institutions. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study navigates the dynamic landscape of ETFs in one of the world's most promising financial frontiers. Explore pivotal trends, emerging opportunities, and competitive dynamics shaping the Middle East and Africa ETF market, a key destination for global investment.

Middle East And Africa ETF Market Market Concentration & Dynamics

The Middle East and Africa ETF market is characterized by a moderate level of concentration, with a few dominant players holding significant market share, alongside a growing number of innovative niche providers. The Equity ETF segment, in particular, shows robust activity driven by strong economic growth and expanding stock exchanges. Innovation ecosystems are rapidly developing, fueled by government initiatives aimed at financial liberalization and technological adoption. Regulatory frameworks, while evolving, are generally becoming more conducive to ETF growth, with a focus on investor protection and market integrity. Substitute products, such as mutual funds, remain prevalent but are facing increasing competition from the cost-effectiveness and flexibility of ETFs. End-user trends indicate a rising demand for diversified investment options, particularly among younger demographics and institutional investors seeking efficient market access. Mergers and acquisitions (M&A) activities are anticipated to increase as larger players seek to consolidate their positions and smaller firms aim for strategic partnerships or exits, with an estimated xx M&A deal counts over the forecast period. The market share for the top 5 players is approximately xx%.

Middle East And Africa ETF Market Industry Insights & Trends

The Middle East and Africa ETF market is poised for substantial growth, driven by a confluence of powerful economic, technological, and demographic factors. The estimated market size for 2025 is xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This expansion is largely attributable to increasing investor appetite for liquid, diversified, and cost-effective investment vehicles. The rise of passively managed ETFs continues to dominate, mirroring global trends, but there is a growing interest in actively managed ETFs as investors seek alpha generation within the ETF structure. Technological disruptions, such as the integration of blockchain for settlement and the development of digital assets, are revolutionizing market infrastructure. For instance, the March 2024 partnership between the Abu Dhabi Securities Exchange (ADX) and HSBC Bank signifies a major step towards expanding the availability of digital fixed-income securities, potentially paving the way for tokenized ETFs. Evolving consumer behaviors, including a greater emphasis on financial literacy and a preference for accessible investment platforms, are further fueling ETF adoption. The increasing wealth across key markets in the Middle East, coupled with a growing middle class in Africa, presents a vast, untapped investor base. Furthermore, government initiatives promoting financial inclusion and the development of robust capital markets are creating a fertile ground for ETF innovation and growth, making the Middle East and Africa ETF market a compelling focus for global financial players.

Key Markets & Segments Leading Middle East And Africa ETF Market

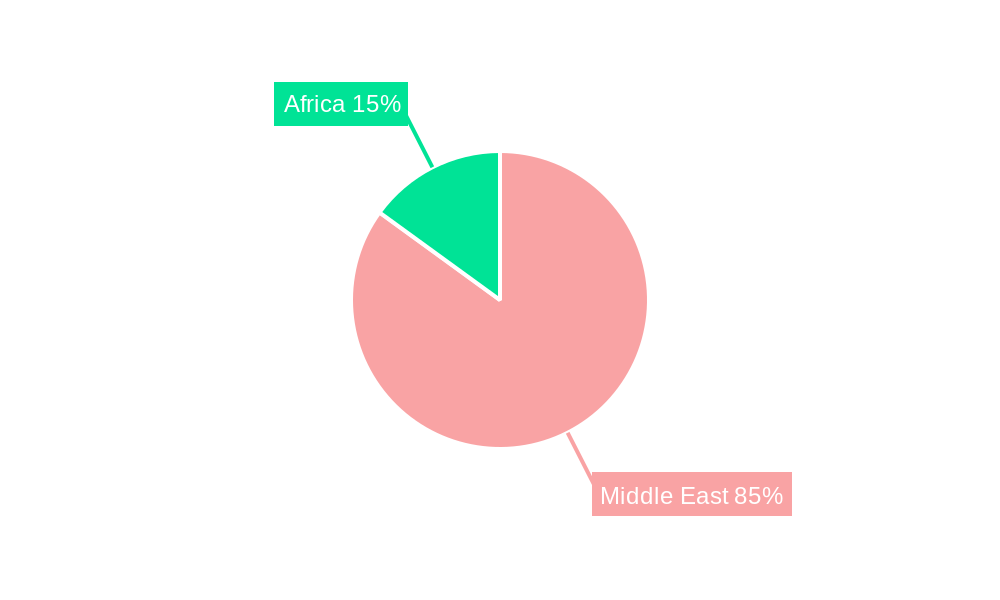

The Middle East and Africa ETF market's dominance is currently concentrated in the Middle East, with countries like Saudi Arabia and the UAE spearheading growth, though Sub-Saharan African markets are showing significant nascent potential.

- Equity ETFs: This segment is the primary driver of market growth, reflecting strong performance in regional stock markets and investor demand for broad market exposure. The increasing availability of ETFs tracking regional indices, such as those in the Gulf Cooperation Council (GCC), further bolsters this segment.

- Drivers: Robust economic diversification initiatives, significant foreign direct investment, and a growing pool of retail and institutional investors actively seeking equity exposure.

- Fixed Income ETFs: While currently smaller than equity ETFs, the fixed income segment is experiencing rapid expansion, particularly following recent industry developments.

- Drivers: The growing issuance of sovereign and corporate bonds, coupled with increasing investor demand for stable income streams and diversification away from equities. The partnership between ADX and HSBC for digital fixed-income securities is a significant catalyst.

- Commodity ETFs: This segment is vital, given the region's strong reliance on commodities, particularly oil and gas.

- Drivers: Global commodity price fluctuations and regional economic policies aimed at leveraging natural resources.

- Real Estate ETFs: Emerging interest is observed in this segment as REITs and real estate development projects gain traction.

- Drivers: Urbanization, infrastructure development, and a growing need for diversified real estate investment avenues.

- Currency ETFs: While less developed, currency ETFs offer potential for hedging and speculative plays in a region with diverse economic conditions.

- Drivers: Exchange rate volatility and the need for currency risk management.

- Other ETFs: This broad category includes thematic ETFs and smart-beta strategies, which are gaining traction as investors seek more sophisticated investment approaches.

The passively managed ETF approach continues to be the most prevalent due to its cost-efficiency and transparency, however, the exploration of actively managed ETFs is a growing trend, especially in more developed markets within the region.

Middle East And Africa ETF Market Product Developments

Product innovation in the Middle East and Africa ETF market is accelerating, driven by a desire to cater to specific regional investment needs and capitalize on emerging trends. We are witnessing an increase in the development of Equity ETFs that focus on specific sectors, such as technology or renewable energy, and also ETFs tracking Sharia-compliant indices. Furthermore, the groundwork laid for digital fixed-income securities, as evidenced by the ADX and HSBC partnership, signals a future where Fixed Income ETFs could be more efficiently managed and accessible. The integration of ESG (Environmental, Social, and Governance) factors into ETF product design is also becoming a significant differentiator, appealing to a growing segment of socially conscious investors.

Challenges in the Middle East And Africa ETF Market Market

Despite the promising outlook, the Middle East and Africa ETF market faces several challenges. Regulatory fragmentation across different countries can create complexities for market participants. Liquidity remains a concern in some of the smaller markets, potentially impacting trading efficiency. The educational gap regarding ETF structures and benefits among retail investors in certain regions necessitates targeted outreach. Additionally, the operational infrastructure for ETF creation and redemption, while improving, may not yet be as robust as in more developed markets, leading to higher operational costs and potential delays.

Forces Driving Middle East And Africa ETF Market Growth

Several forces are propelling the growth of the Middle East and Africa ETF market. Economic diversification initiatives across countries like Saudi Arabia and the UAE are creating new investment opportunities and a need for diversified investment vehicles. The increasing adoption of digital technologies in finance is enhancing market access and operational efficiency. Furthermore, growing wealth accumulation and a rising middle class are expanding the investor base. Favorable government policies aimed at developing capital markets and attracting foreign investment are also significant growth accelerators, making the Middle East and Africa ETF market an attractive proposition.

Challenges in the Middle East And Africa ETF Market Market

Long-term growth catalysts in the Middle East and Africa ETF market are underpinned by ongoing digital transformation and strategic partnerships. The development of robust digital asset frameworks, as exemplified by the ADX-HSBC collaboration, promises to enhance liquidity and innovation in fixed-income and potentially other ETF segments. Continued investment in financial infrastructure and the fostering of cross-border investment flows will be crucial. The expansion of ETF product offerings to include more thematic and ESG-focused strategies will also appeal to evolving investor preferences, driving sustained market expansion.

Emerging Opportunities in Middle East And Africa ETF Market

Emerging opportunities in the Middle East and Africa ETF market are abundant, particularly in tapping into underserved demographics and specialized investment themes. The growing demand for Sharia-compliant ETFs presents a significant opportunity, especially in countries with large Muslim populations. The expansion of thematic ETFs focusing on sectors like renewable energy, technology, and healthcare aligns with regional development goals and global investment trends. Furthermore, the digitalization of finance opens doors for blockchain-enabled ETFs and more accessible retail investment platforms across Africa, creating new avenues for growth and market penetration.

Leading Players in the Middle East And Africa ETF Market Sector

- Al Rayan Qatar

- Invesco

- HSBC Saudi

- Franklin Templeton

- Blackrock

- Alinma Investment

- Xtracker

- Alkhabeer Capital

- Chimera Capital LLC

- Al Bilad Capital

Key Milestones in Middle East And Africa ETF Market Industry

- March 2024: Abu Dhabi Securities Exchange (ADX) and HSBC Bank entered into a partnership to expand the availability of digital fixed-income securities, investigating a framework for digital bonds on ADX via HSBC Orion.

- September 2023: The Ministry of Investment signed agreements with Al-Rajhi Bank, Alinma Bank, and Banque Saudi Fransi to strengthen the digital banking industry and improve investor services.

Strategic Outlook for Middle East And Africa ETF Market Market

The strategic outlook for the Middle East and Africa ETF market is exceptionally positive, driven by a clear trajectory of economic development, technological adoption, and increasing investor sophistication. Future market potential lies in further expanding the range of ETF products, particularly in fixed income and thematic segments, and fostering greater cross-border accessibility. Strategic opportunities include leveraging digital platforms to enhance investor education and onboarding, and collaborating with regulatory bodies to streamline the ETF ecosystem. Continued innovation in product development and distribution channels will be key to unlocking sustained growth and solidifying the region's position in the global ETF landscape.

Middle East And Africa ETF Market Segmentation

-

1. ETF Type

- 1.1. Equity ETF

- 1.2. Fixed Income ETF

- 1.3. Commodity ETF

- 1.4. Real Estate ETF

- 1.5. Currency ETF

- 1.6. Other ETFs

-

2. Management Type

- 2.1. Actively Managed ETF

- 2.2. Passively Managed ETF

Middle East And Africa ETF Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East And Africa ETF Market Regional Market Share

Geographic Coverage of Middle East And Africa ETF Market

Middle East And Africa ETF Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 9.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decline in Cost of Service Providers; Availiblity of New distribution platform in the region

- 3.3. Market Restrains

- 3.3.1 Market Saturation (lack of Availiblity of new asset class); Extreme market events increasing risk associate with ETF

- 3.3.2 dampening their demand.

- 3.4. Market Trends

- 3.4.1. Equity ETFs a Gateway to Diversified Exposure in the Region's Stock Markets

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East And Africa ETF Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by ETF Type

- 5.1.1. Equity ETF

- 5.1.2. Fixed Income ETF

- 5.1.3. Commodity ETF

- 5.1.4. Real Estate ETF

- 5.1.5. Currency ETF

- 5.1.6. Other ETFs

- 5.2. Market Analysis, Insights and Forecast - by Management Type

- 5.2.1. Actively Managed ETF

- 5.2.2. Passively Managed ETF

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by ETF Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Al Rayan Qatar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Invesco

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HSBC Saudi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Franklin Templeton

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Blackrock

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alinma Investment

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Xtracker

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alkhabeer Capital

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Chimera Capital LLC**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Al Bilad Capital

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Al Rayan Qatar

List of Figures

- Figure 1: Middle East And Africa ETF Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East And Africa ETF Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East And Africa ETF Market Revenue Million Forecast, by ETF Type 2020 & 2033

- Table 2: Middle East And Africa ETF Market Revenue Million Forecast, by Management Type 2020 & 2033

- Table 3: Middle East And Africa ETF Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Middle East And Africa ETF Market Revenue Million Forecast, by ETF Type 2020 & 2033

- Table 5: Middle East And Africa ETF Market Revenue Million Forecast, by Management Type 2020 & 2033

- Table 6: Middle East And Africa ETF Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East And Africa ETF Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East And Africa ETF Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East And Africa ETF Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East And Africa ETF Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East And Africa ETF Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East And Africa ETF Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East And Africa ETF Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East And Africa ETF Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East And Africa ETF Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East And Africa ETF Market?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the Middle East And Africa ETF Market?

Key companies in the market include Al Rayan Qatar, Invesco, HSBC Saudi, Franklin Templeton, Blackrock, Alinma Investment, Xtracker, Alkhabeer Capital, Chimera Capital LLC**List Not Exhaustive, Al Bilad Capital.

3. What are the main segments of the Middle East And Africa ETF Market?

The market segments include ETF Type, Management Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Decline in Cost of Service Providers; Availiblity of New distribution platform in the region.

6. What are the notable trends driving market growth?

Equity ETFs a Gateway to Diversified Exposure in the Region's Stock Markets.

7. Are there any restraints impacting market growth?

Market Saturation (lack of Availiblity of new asset class); Extreme market events increasing risk associate with ETF. dampening their demand..

8. Can you provide examples of recent developments in the market?

In March 2024, Abu Dhabi Securities Exchange and HSBC Bank have entered into a partnership to expand the availability of digital fixed-income securities in the capital markets of the region. In collaboration with HSBC, ADX will investigate a framework that would allow digital assets, such digital bonds, to be listed on ADX and accessible via HSBC Orion, the bank's digital assets platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East And Africa ETF Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East And Africa ETF Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East And Africa ETF Market?

To stay informed about further developments, trends, and reports in the Middle East And Africa ETF Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence