Key Insights

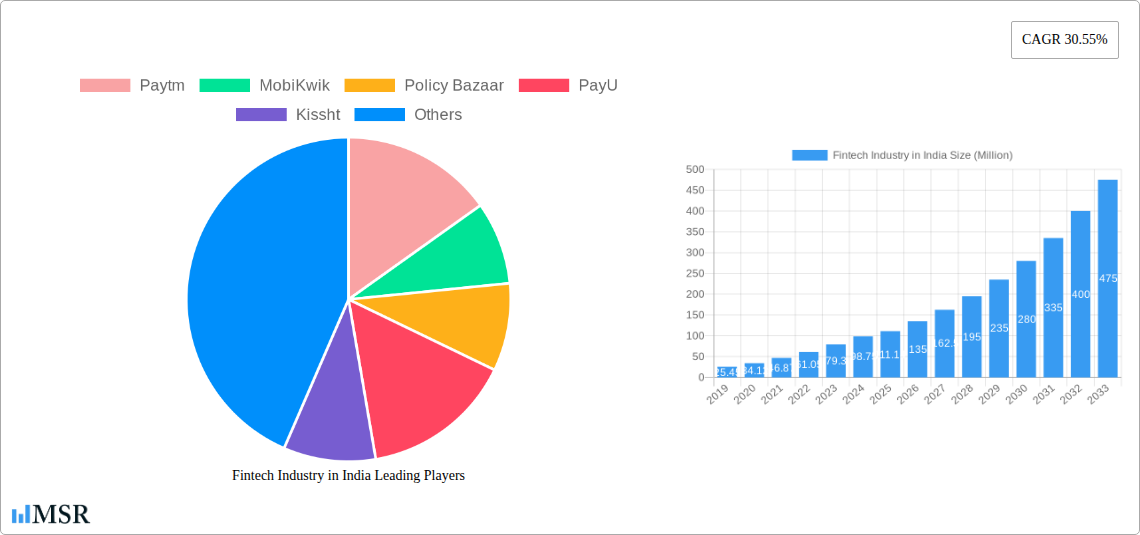

The Indian Fintech Industry is poised for explosive growth, projected to reach a substantial market size of approximately USD 111.14 billion by 2025. This impressive expansion is fueled by a phenomenal Compound Annual Growth Rate (CAGR) of 30.55%, indicating a rapidly evolving and dynamic sector. Key drivers behind this surge include the increasing digital adoption across the nation, a growing smartphone user base, and a burgeoning young, tech-savvy population actively seeking convenient and accessible financial solutions. The "Digital India" initiative and government push for financial inclusion have further catalyzed this growth, creating a fertile ground for innovative fintech offerings. The market's robust performance is also attributed to the widespread availability of affordable internet services and the rising disposable incomes, empowering more individuals to engage with digital financial platforms.

Fintech Industry in India Market Size (In Million)

The industry's expansion is further propelled by significant trends such as the seamless integration of AI and machine learning in financial services, offering personalized experiences and enhanced fraud detection. The rise of Buy Now Pay Later (BNPL) services, the increasing popularity of digital payments, and the democratization of investment platforms are also key indicators of this transformative period. While challenges like evolving regulatory landscapes and cybersecurity concerns exist, the sheer market opportunity, coupled with a strong entrepreneurial spirit, positions India as a global leader in fintech innovation. The diverse service propositions, ranging from money transfer and payments to savings, investments, digital lending, and insurance marketplaces, cater to a wide spectrum of consumer needs, with e-commerce, utilities, and travel being dominant application areas. Leading companies such as Paytm, Phonepe, and MobiKwik are at the forefront, driving adoption and shaping the future of financial services in India.

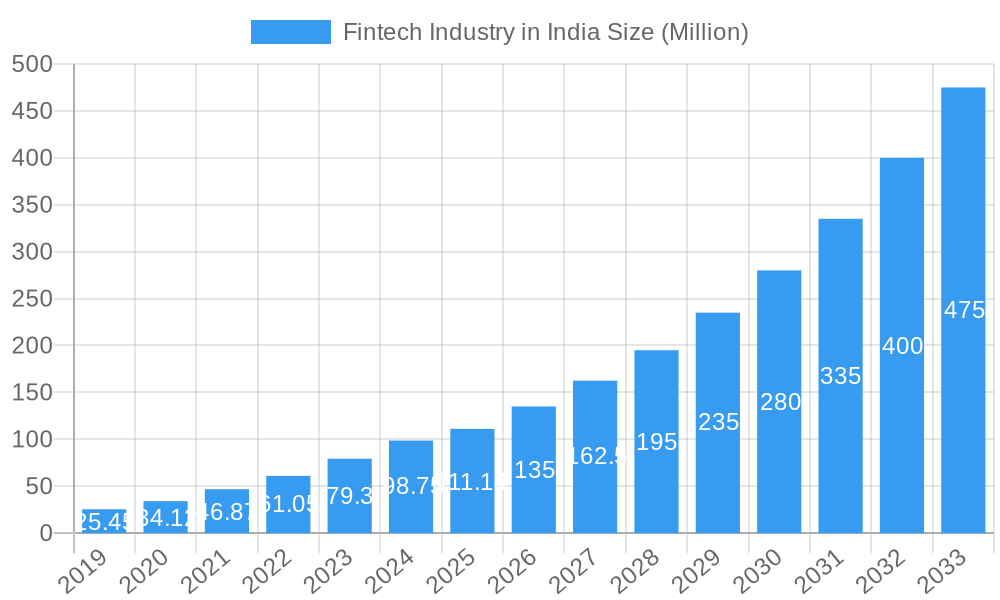

Fintech Industry in India Company Market Share

Dive deep into the explosive growth and transformative landscape of the Indian Fintech industry. This in-depth report provides actionable insights and high-impact data for Fintech investors, startups, financial institutions, and policymakers. Explore the dynamic market concentration, emerging trends, and key players shaping India's digital financial future. With a base year of 2025 and a forecast period extending to 2033, gain a competitive edge through expert analysis of India's digital lending, payments, insurtech, and wealthtech sectors.

Fintech Industry in India Market Concentration & Dynamics

The Indian Fintech market, while witnessing rapid expansion, exhibits a moderate to high concentration, with a few dominant players commanding significant market share. Paytm and PhonePe lead in the money transfer and payments segment, each holding an estimated 40% and 35% market share respectively in 2023, reflecting their early mover advantage and extensive user base. Digital lending and lending marketplaces showcase a more fragmented landscape, with companies like Lendingkart and Kissht carving out niches, though large banks increasingly offer digital loan products, increasing competition. The online insurance and insurance marketplaces segment is seeing a rise in aggregators like Policybazaar, which has captured an estimated 60% of the online insurance premium aggregation market. M&A activities are on the rise, signaling consolidation and strategic expansion. In 2023, we've seen 15 M&A deals valued at over $500 Million in total, driven by a desire to acquire technology, talent, or expand market reach. The innovation ecosystem is thriving, fueled by a young, tech-savvy population and government initiatives like Digital India. However, the regulatory framework, while evolving, can present hurdles, particularly concerning data privacy and compliance for digital lending and lending marketplaces. End-user trends indicate a strong preference for convenience, affordability, and personalized financial solutions across all segments.

Fintech Industry in India Industry Insights & Trends

The Indian Fintech industry is poised for phenomenal growth, with an estimated market size of $150 Billion in 2025, projected to reach $400 Billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 15%. This surge is primarily driven by the increasing digital adoption, a burgeoning middle class, and favorable government policies promoting financial inclusion. Technological disruptions, such as the widespread adoption of Unified Payments Interface (UPI), have revolutionized the money transfer and payments segment, making transactions seamless and instant. The rise of Artificial Intelligence (AI) and Machine Learning (ML) is enhancing personalized financial advice in savings and investments and enabling more accurate risk assessment in digital lending. Evolving consumer behaviors are characterized by a demand for end-to-end digital experiences, intuitive interfaces, and personalized financial products. For instance, the penetration of smartphones and affordable data plans has unlocked access to financial services for previously unbanked and underbanked populations, significantly expanding the customer base for digital lending and lending marketplaces and online insurance. The insurtech sector is witnessing innovative product designs and distribution channels, catering to specific demographic needs. The overall trend points towards greater integration of financial services into daily life, with Fintech solutions becoming indispensable for managing finances, from everyday transactions to long-term wealth creation. The forecasted market size for Digital Lending alone is expected to cross $100 Billion by 2028.

Key Markets & Segments Leading Fintech Industry in India

The money transfer and payments segment is currently the most dominant force within the Indian Fintech industry, driven by the unparalleled success of UPI. This segment is experiencing a CAGR of 20%, a testament to its widespread adoption across all demographics. The primary drivers for this dominance include:

- Ubiquitous Smartphone Penetration: Over 600 Million active smartphone users in India facilitate easy access to digital payment applications.

- Government Initiatives: Schemes like Digital India and the promotion of a less-cash economy have created a conducive environment.

- E-commerce Integration: The seamless integration of payment gateways into the booming e-commerce sector, which is projected to reach $350 Billion by 2028, further fuels transaction volumes.

Following closely, digital lending and lending marketplaces are rapidly gaining traction, with a projected market size of $120 Billion by 2030. Key drivers include:

- Rising Credit Demand: A growing aspirational population and increasing need for quick access to capital for personal and business needs.

- Fintech Innovations: Platforms like Lendingkart and Kissht are leveraging technology to assess creditworthiness for thin-file customers, expanding financial inclusion.

- MSME Growth: The substantial MSME sector, contributing over 30% to India's GDP, represents a significant untapped market for digital lending solutions.

The savings and investments segment, while still maturing, is showing impressive growth, with platforms like ET Money and Faircent attracting a younger demographic interested in wealth management. The online insurance and insurance marketplaces segment, led by Policybazaar, is also on an upward trajectory, driven by increased awareness and the convenience of digital policy acquisition. Applications in e-commerce, utilities, and travel are becoming increasingly embedded with Fintech solutions, showcasing a cross-sectoral integration that further amplifies the reach and impact of the industry. The utility payment segment alone is expected to grow to $70 Billion by 2027.

Fintech Industry in India Product Developments

Product innovation in India's Fintech sector is characterized by a relentless focus on user experience and accessibility. Companies are developing sophisticated yet user-friendly platforms that integrate multiple financial services. From AI-powered robo-advisors for personalized investment strategies offered by players like ET Money, to seamless buy-now-pay-later (BNPL) solutions embedded within e-commerce checkouts by companies like PayU, the emphasis is on convenience and choice. Digital lending platforms are leveraging advanced analytics for faster loan approvals, while insurtech startups are introducing micro-insurance products and parametric insurance for specific risks. The integration of blockchain technology for enhanced security and transparency is also a burgeoning area of exploration. These advancements are crucial for maintaining a competitive edge and capturing a larger share of India's growing digital economy.

Challenges in the Fintech Industry in India Market

Despite the rapid growth, the Indian Fintech market faces several critical challenges. Regulatory ambiguity and evolving compliance requirements can create uncertainty, particularly for innovative business models in digital lending and lending marketplaces. Cybersecurity threats and data privacy concerns remain paramount, necessitating robust security infrastructure and constant vigilance. The digital divide, while narrowing, still presents a barrier to reaching the most remote populations. Intense competition among a growing number of players, coupled with the need for significant investment in technology and customer acquisition, puts pressure on profitability. Furthermore, building trust and financial literacy among a diverse user base requires continuous effort, especially for complex financial products. The cost of acquiring and retaining customers can be substantial, estimated at an average of $10 per customer acquisition for many digital platforms.

Forces Driving Fintech Industry in India Growth

Several powerful forces are propelling the growth of the Indian Fintech industry. Demographic shifts, with a large, young, and digitally native population, are a primary catalyst. Government support and digital infrastructure development, including initiatives like the Jan Dhan Yojana and widespread internet penetration, have created a fertile ground for Fintech adoption. Technological advancements, such as AI, ML, and blockchain, enable the creation of innovative and personalized financial solutions. The increasing disposable incomes and aspirational consumption patterns of the Indian middle class are driving demand for financial services. Moreover, the ease and affordability of digital transactions have fundamentally altered consumer behavior, making digital channels the preferred mode of financial engagement. The huge unbanked and underbanked population presents a significant opportunity for Fintech to drive financial inclusion.

Challenges in the Fintech Industry in India Market

Long-term growth in the Indian Fintech market will be shaped by overcoming persistent challenges and capitalizing on emerging opportunities. Scaling operations efficiently while maintaining regulatory compliance will be crucial. Building sustainable business models beyond customer acquisition will require a focus on monetization and profitability. Addressing the trust deficit associated with digital financial services, especially among older demographics, will be an ongoing effort. Furthermore, managing talent acquisition and retention in a highly competitive landscape will be essential for sustained innovation. The ability to adapt to changing consumer preferences and technological disruptions will determine long-term success. The government's continued commitment to digital infrastructure and policy reforms will also play a pivotal role.

Emerging Opportunities in Fintech Industry in India

The Indian Fintech landscape is ripe with emerging opportunities. The penetration of financial services into rural and semi-urban areas remains a significant untapped market. Embedded finance, where financial services are integrated into non-financial platforms (e.g., e-commerce, social media), is set to explode. The growth of WealthTech, catering to the burgeoning affluent population and new investors, presents substantial potential. Insurtech innovation, particularly in offering personalized and affordable insurance solutions for gig workers and the informal sector, is gaining momentum. The adoption of Decentralized Finance (DeFi) concepts and Central Bank Digital Currencies (CBDCs), once fully rolled out, could reshape payment systems. There is also a significant opportunity in providing cross-border payment solutions for remittances and international trade.

Leading Players in the Fintech Industry in India Sector

- Paytm

- MobiKwik

- Policy Bazaar

- PayU

- Kissht

- Shubh Loans

- Lending Kart

- PhonePe

- Faircent

- ET Money

Key Milestones in Fintech Industry in India Industry

- September 2023: PayU, an Indian payments company, partnered with WhatsApp to considerably improve Indians' purchasing experience.

- November 2022: The Hyderabad-based SaaS business CreditVidya was acquired by Bengaluru-based financial unicorn CRED in a deal that included cash and stock. The value of the agreement has not been made public by the companies.

Strategic Outlook for Fintech Industry in India Market

The strategic outlook for the Indian Fintech industry is exceptionally bright, characterized by continued robust growth and innovation. The expansion of digital payments infrastructure, coupled with increasing consumer adoption, will remain a core growth accelerator. Government focus on financial inclusion and digital transformation will continue to provide a supportive policy environment. The ongoing digital lending boom, driven by unmet credit needs and technological advancements in risk assessment, is expected to sustain its momentum. Furthermore, the insurtech sector's evolution towards personalized and accessible products will unlock new market segments. Strategic partnerships between traditional financial institutions and Fintech companies will become increasingly common, fostering collaboration and innovation. The future of the Indian Fintech market lies in deeper integration, hyper-personalization, and a relentless pursuit of financial inclusion, promising immense opportunities for stakeholders.

Fintech Industry in India Segmentation

-

1. Service Proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending and Lending Marketplaces

- 1.4. Online Insurance and Insurance Marketplaces

-

2. Application

- 2.1. E-Commerce

- 2.2. Utilities

- 2.3. Travel

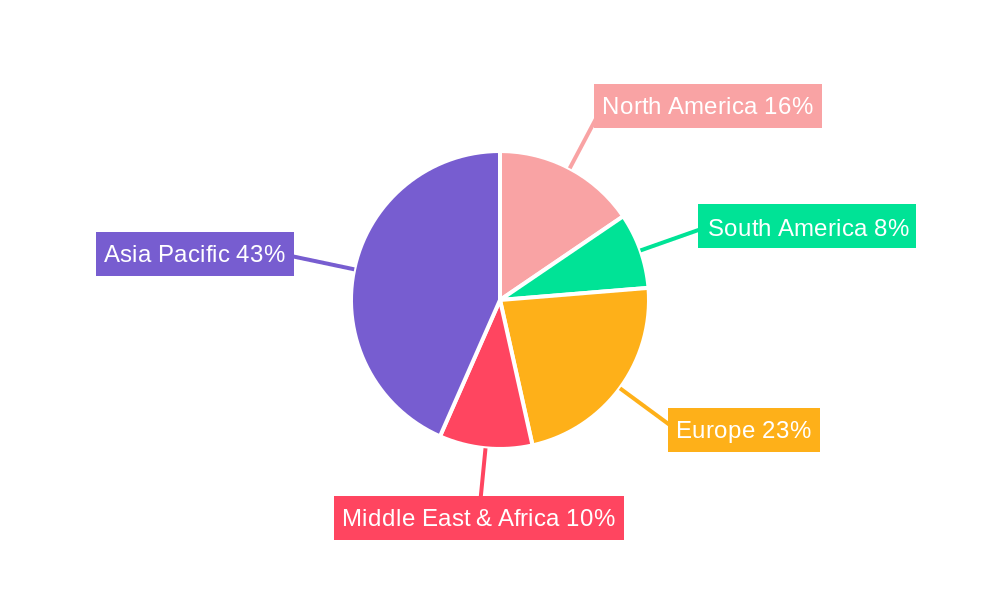

Fintech Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fintech Industry in India Regional Market Share

Geographic Coverage of Fintech Industry in India

Fintech Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 30.55% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Digital Services; Rapid Advancement in Technology is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Digital Services; Rapid Advancement in Technology is Driving the Market

- 3.4. Market Trends

- 3.4.1. Increase in Mobile Banking Payments is Surging the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fintech Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending and Lending Marketplaces

- 5.1.4. Online Insurance and Insurance Marketplaces

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. E-Commerce

- 5.2.2. Utilities

- 5.2.3. Travel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6. North America Fintech Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6.1.1. Money Transfer and Payments

- 6.1.2. Savings and Investments

- 6.1.3. Digital Lending and Lending Marketplaces

- 6.1.4. Online Insurance and Insurance Marketplaces

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. E-Commerce

- 6.2.2. Utilities

- 6.2.3. Travel

- 6.1. Market Analysis, Insights and Forecast - by Service Proposition

- 7. South America Fintech Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Proposition

- 7.1.1. Money Transfer and Payments

- 7.1.2. Savings and Investments

- 7.1.3. Digital Lending and Lending Marketplaces

- 7.1.4. Online Insurance and Insurance Marketplaces

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. E-Commerce

- 7.2.2. Utilities

- 7.2.3. Travel

- 7.1. Market Analysis, Insights and Forecast - by Service Proposition

- 8. Europe Fintech Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Proposition

- 8.1.1. Money Transfer and Payments

- 8.1.2. Savings and Investments

- 8.1.3. Digital Lending and Lending Marketplaces

- 8.1.4. Online Insurance and Insurance Marketplaces

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. E-Commerce

- 8.2.2. Utilities

- 8.2.3. Travel

- 8.1. Market Analysis, Insights and Forecast - by Service Proposition

- 9. Middle East & Africa Fintech Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Proposition

- 9.1.1. Money Transfer and Payments

- 9.1.2. Savings and Investments

- 9.1.3. Digital Lending and Lending Marketplaces

- 9.1.4. Online Insurance and Insurance Marketplaces

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. E-Commerce

- 9.2.2. Utilities

- 9.2.3. Travel

- 9.1. Market Analysis, Insights and Forecast - by Service Proposition

- 10. Asia Pacific Fintech Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Proposition

- 10.1.1. Money Transfer and Payments

- 10.1.2. Savings and Investments

- 10.1.3. Digital Lending and Lending Marketplaces

- 10.1.4. Online Insurance and Insurance Marketplaces

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. E-Commerce

- 10.2.2. Utilities

- 10.2.3. Travel

- 10.1. Market Analysis, Insights and Forecast - by Service Proposition

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Paytm

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MobiKwik

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Policy Bazaar

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PayU

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kissht

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shubh Loans

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lending Kart

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Phonepe

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Faircent

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ET money**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Paytm

List of Figures

- Figure 1: Global Fintech Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Fintech Industry in India Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Fintech Industry in India Revenue (Million), by Service Proposition 2025 & 2033

- Figure 4: North America Fintech Industry in India Volume (Billion), by Service Proposition 2025 & 2033

- Figure 5: North America Fintech Industry in India Revenue Share (%), by Service Proposition 2025 & 2033

- Figure 6: North America Fintech Industry in India Volume Share (%), by Service Proposition 2025 & 2033

- Figure 7: North America Fintech Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Fintech Industry in India Volume (Billion), by Application 2025 & 2033

- Figure 9: North America Fintech Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Fintech Industry in India Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Fintech Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Fintech Industry in India Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Fintech Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Fintech Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Fintech Industry in India Revenue (Million), by Service Proposition 2025 & 2033

- Figure 16: South America Fintech Industry in India Volume (Billion), by Service Proposition 2025 & 2033

- Figure 17: South America Fintech Industry in India Revenue Share (%), by Service Proposition 2025 & 2033

- Figure 18: South America Fintech Industry in India Volume Share (%), by Service Proposition 2025 & 2033

- Figure 19: South America Fintech Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 20: South America Fintech Industry in India Volume (Billion), by Application 2025 & 2033

- Figure 21: South America Fintech Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Fintech Industry in India Volume Share (%), by Application 2025 & 2033

- Figure 23: South America Fintech Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 24: South America Fintech Industry in India Volume (Billion), by Country 2025 & 2033

- Figure 25: South America Fintech Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Fintech Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Fintech Industry in India Revenue (Million), by Service Proposition 2025 & 2033

- Figure 28: Europe Fintech Industry in India Volume (Billion), by Service Proposition 2025 & 2033

- Figure 29: Europe Fintech Industry in India Revenue Share (%), by Service Proposition 2025 & 2033

- Figure 30: Europe Fintech Industry in India Volume Share (%), by Service Proposition 2025 & 2033

- Figure 31: Europe Fintech Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 32: Europe Fintech Industry in India Volume (Billion), by Application 2025 & 2033

- Figure 33: Europe Fintech Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe Fintech Industry in India Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe Fintech Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Fintech Industry in India Volume (Billion), by Country 2025 & 2033

- Figure 37: Europe Fintech Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Fintech Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Fintech Industry in India Revenue (Million), by Service Proposition 2025 & 2033

- Figure 40: Middle East & Africa Fintech Industry in India Volume (Billion), by Service Proposition 2025 & 2033

- Figure 41: Middle East & Africa Fintech Industry in India Revenue Share (%), by Service Proposition 2025 & 2033

- Figure 42: Middle East & Africa Fintech Industry in India Volume Share (%), by Service Proposition 2025 & 2033

- Figure 43: Middle East & Africa Fintech Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 44: Middle East & Africa Fintech Industry in India Volume (Billion), by Application 2025 & 2033

- Figure 45: Middle East & Africa Fintech Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East & Africa Fintech Industry in India Volume Share (%), by Application 2025 & 2033

- Figure 47: Middle East & Africa Fintech Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa Fintech Industry in India Volume (Billion), by Country 2025 & 2033

- Figure 49: Middle East & Africa Fintech Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Fintech Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Fintech Industry in India Revenue (Million), by Service Proposition 2025 & 2033

- Figure 52: Asia Pacific Fintech Industry in India Volume (Billion), by Service Proposition 2025 & 2033

- Figure 53: Asia Pacific Fintech Industry in India Revenue Share (%), by Service Proposition 2025 & 2033

- Figure 54: Asia Pacific Fintech Industry in India Volume Share (%), by Service Proposition 2025 & 2033

- Figure 55: Asia Pacific Fintech Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 56: Asia Pacific Fintech Industry in India Volume (Billion), by Application 2025 & 2033

- Figure 57: Asia Pacific Fintech Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 58: Asia Pacific Fintech Industry in India Volume Share (%), by Application 2025 & 2033

- Figure 59: Asia Pacific Fintech Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Fintech Industry in India Volume (Billion), by Country 2025 & 2033

- Figure 61: Asia Pacific Fintech Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Fintech Industry in India Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fintech Industry in India Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 2: Global Fintech Industry in India Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 3: Global Fintech Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Fintech Industry in India Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Global Fintech Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Fintech Industry in India Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Fintech Industry in India Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 8: Global Fintech Industry in India Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 9: Global Fintech Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Fintech Industry in India Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Global Fintech Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Fintech Industry in India Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Global Fintech Industry in India Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 20: Global Fintech Industry in India Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 21: Global Fintech Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Fintech Industry in India Volume Billion Forecast, by Application 2020 & 2033

- Table 23: Global Fintech Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Fintech Industry in India Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Brazil Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Argentina Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Global Fintech Industry in India Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 32: Global Fintech Industry in India Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 33: Global Fintech Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Fintech Industry in India Volume Billion Forecast, by Application 2020 & 2033

- Table 35: Global Fintech Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Fintech Industry in India Volume Billion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Germany Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: France Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Italy Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Spain Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Russia Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Benelux Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Nordics Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Global Fintech Industry in India Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 56: Global Fintech Industry in India Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 57: Global Fintech Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 58: Global Fintech Industry in India Volume Billion Forecast, by Application 2020 & 2033

- Table 59: Global Fintech Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Fintech Industry in India Volume Billion Forecast, by Country 2020 & 2033

- Table 61: Turkey Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Israel Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: GCC Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: North Africa Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: South Africa Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Global Fintech Industry in India Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 74: Global Fintech Industry in India Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 75: Global Fintech Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 76: Global Fintech Industry in India Volume Billion Forecast, by Application 2020 & 2033

- Table 77: Global Fintech Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Fintech Industry in India Volume Billion Forecast, by Country 2020 & 2033

- Table 79: China Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: India Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Japan Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 85: South Korea Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 89: Oceania Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Fintech Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Fintech Industry in India Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fintech Industry in India?

The projected CAGR is approximately 30.55%.

2. Which companies are prominent players in the Fintech Industry in India?

Key companies in the market include Paytm, MobiKwik, Policy Bazaar, PayU, Kissht, Shubh Loans, Lending Kart, Phonepe, Faircent, ET money**List Not Exhaustive.

3. What are the main segments of the Fintech Industry in India?

The market segments include Service Proposition, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 111.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Digital Services; Rapid Advancement in Technology is Driving the Market.

6. What are the notable trends driving market growth?

Increase in Mobile Banking Payments is Surging the Growth of the Market.

7. Are there any restraints impacting market growth?

Increasing Demand for Digital Services; Rapid Advancement in Technology is Driving the Market.

8. Can you provide examples of recent developments in the market?

September 2023: PayU, an Indian payments company, partnered with WhatsApp to considerably improve Indians' purchasing experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fintech Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fintech Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fintech Industry in India?

To stay informed about further developments, trends, and reports in the Fintech Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence