Key Insights

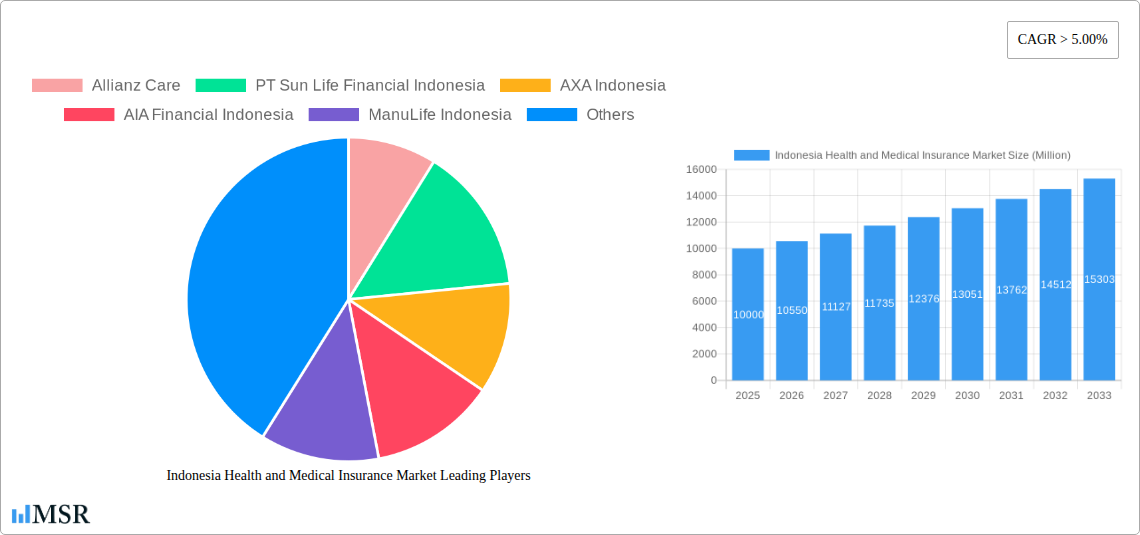

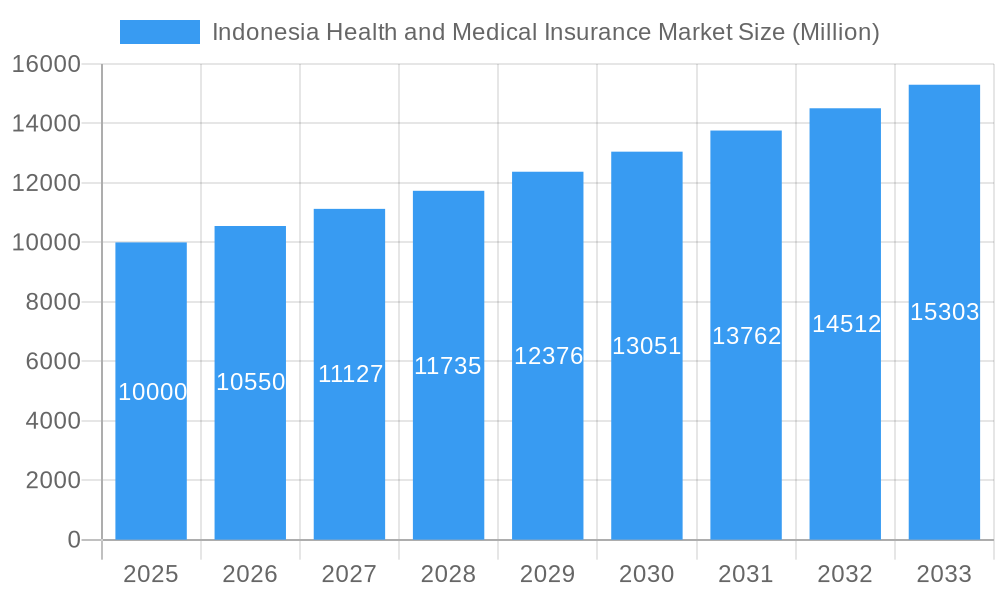

The Indonesian health and medical insurance market, currently experiencing robust growth with a CAGR exceeding 5%, presents a lucrative opportunity for investors and stakeholders. Driven by factors such as rising disposable incomes, increasing health awareness, and government initiatives promoting health insurance coverage, the market is projected to reach significant value over the forecast period (2025-2033). The market is segmented by product type (individual and group health insurance), provider (public and private insurers), and distribution channel (agents, brokers, online sales, etc.). The dominance of private insurers like Allianz Care, AXA Indonesia, and AIA Financial Indonesia, alongside public providers, reflects the diverse landscape. Significant growth is anticipated in individual health insurance products, fueled by a growing middle class and increased demand for personalized healthcare plans. Online sales channels are experiencing rapid expansion, mirroring global trends towards digital insurance solutions. However, challenges such as affordability concerns among lower-income segments and the need for improved insurance literacy act as potential restraints on market expansion. The geographical distribution of market share will likely see concentration in urban areas initially, with gradual penetration into rural regions as infrastructure and awareness improve.

Indonesia Health and Medical Insurance Market Market Size (In Billion)

The forecast period (2025-2033) will witness continued expansion. Assuming a conservative CAGR of 5.5% (slightly above the given 5%), and a 2025 market size of, for example, $10 billion (a reasonable estimate given the size and growth of comparable markets), the market value would exceed $14 billion by 2033. This growth will be propelled by continuous improvements in healthcare infrastructure, government-led health insurance initiatives, and strategic partnerships between insurers and healthcare providers. The increasing focus on preventative healthcare and the growing prevalence of chronic diseases further fuels market growth. Competition among providers will intensify, leading to innovation in product offerings, pricing strategies, and distribution channels. Therefore, understanding and adapting to the changing dynamics within this market is crucial for long-term success.

Indonesia Health and Medical Insurance Market Company Market Share

Indonesia Health and Medical Insurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Indonesia health and medical insurance market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key segments, leading players, and emerging opportunities. The report leverages extensive data analysis to forecast market growth and identify key trends shaping the future of this dynamic sector.

Indonesia Health and Medical Insurance Market Concentration & Dynamics

The Indonesian health and medical insurance market exhibits a moderately concentrated landscape, with several large players dominating the private sector. Market share is primarily distributed among established international and domestic insurers. However, the market is witnessing increased competition from new entrants and innovative business models. The innovation ecosystem is driven by technological advancements, particularly in telehealth and digital insurance platforms. Indonesia's regulatory framework is evolving to support greater market penetration and consumer protection. Substitute products, including traditional medicine and self-funded healthcare, exist but generally serve niche segments. End-user trends reveal a growing demand for comprehensive health insurance coverage, fuelled by rising health awareness and disposable incomes. M&A activity has been moderate in recent years, primarily involving strategic partnerships and acquisitions aimed at expanding distribution networks and product offerings. For example, the number of M&A deals in the health insurance sector between 2019 and 2024 averaged xx per year. The market share of the top 5 players in 2024 is estimated at xx%.

- Market Concentration: Moderately concentrated, with several dominant players.

- Innovation Ecosystem: Driven by technological advancements in telehealth and digital platforms.

- Regulatory Framework: Evolving to support greater market penetration.

- Substitute Products: Traditional medicine and self-funded healthcare, limited impact.

- End-User Trends: Growing demand for comprehensive coverage.

- M&A Activity: Moderate, focused on distribution and product expansion.

Indonesia Health and Medical Insurance Market Industry Insights & Trends

The Indonesian health and medical insurance market is experiencing robust growth, driven by several factors including rising disposable incomes, increasing health awareness, and government initiatives promoting health insurance coverage. The market size in 2024 is estimated at xx Million USD, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). Technological disruptions, such as the adoption of telemedicine and digital insurance platforms, are transforming the industry, enhancing efficiency and expanding access to healthcare services. Evolving consumer behaviors indicate a preference for personalized and digitally enabled insurance solutions. Factors such as rising healthcare costs and an aging population further contribute to the market's expansion. The forecasted market size for 2025 is xx Million USD, and a projected CAGR of xx% from 2025 to 2033 suggests continued robust growth.

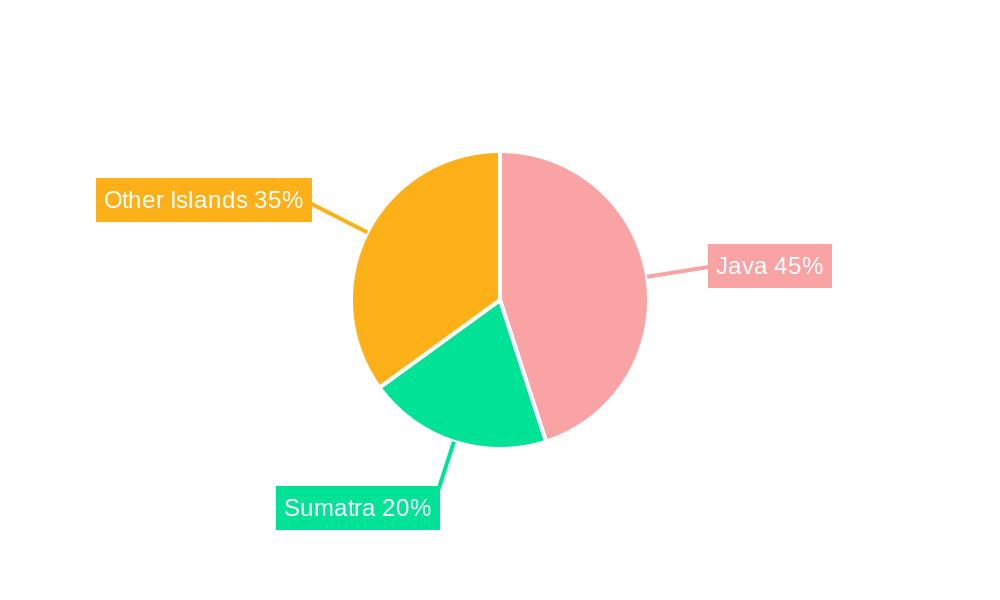

Key Markets & Segments Leading Indonesia Health and Medical Insurance Market

The Indonesian health and medical insurance market is segmented by product type (single/individual and group health insurance), provider (public/social and private), and distribution channel (agents, brokers, banks, online sales, and others). Private health insurance dominates the market due to greater affordability and wider coverage options compared to the public system. The group health insurance segment is experiencing rapid growth, driven by increasing corporate adoption of employee benefit plans. Agents and brokers remain the primary distribution channels, however, online sales are rapidly gaining traction. Java, as the most populous island, represents the largest market.

- By Product Type:

- Individual Health Insurance: Driven by increasing health awareness and rising disposable incomes.

- Group Health Insurance: Rapid growth due to increasing corporate adoption.

- By Provider:

- Private Health Insurance: Dominates the market due to affordability and coverage options.

- Public/Social Health Insurance: Expanding coverage but faces challenges in capacity and access.

- By Distribution Channel:

- Agents and Brokers: Remain primary channels.

- Online Sales: Rapidly growing.

- Banks: Increasing significance as a distribution partner.

Regional Dominance: Java Island dominates due to its high population density and economic activity.

Indonesia Health and Medical Insurance Market Product Developments

Significant advancements are shaping product offerings. Insurers are integrating telehealth platforms, offering virtual consultations and remote monitoring capabilities. Data analytics and AI are used to personalize risk assessment and improve claim processing. These innovations aim to enhance customer experience and improve operational efficiency, providing a competitive edge.

Challenges in the Indonesia Health and Medical Insurance Market Market

The Indonesian health and medical insurance market faces challenges including regulatory complexities, limited health infrastructure in certain regions, and a large uninsured population. These factors contribute to low insurance penetration rates and hinder market growth. Furthermore, competition among insurers remains intense, putting pressure on pricing and profitability. The impact of these challenges on market growth is estimated to reduce the CAGR by approximately xx% in the forecast period.

Forces Driving Indonesia Health and Medical Insurance Market Growth

Key growth drivers include rising disposable incomes, increasing health awareness, government initiatives promoting health insurance coverage, and the adoption of advanced technologies. These factors fuel demand for comprehensive health insurance products and services. The government's focus on expanding healthcare access also contributes to market expansion.

Challenges in the Indonesia Health and Medical Insurance Market Market

Long-term growth will be catalyzed by further technological advancements, strategic partnerships that expand access to underserved populations, and innovative insurance product offerings designed to meet evolving customer preferences.

Emerging Opportunities in Indonesia Health and Medical Insurance Market

Emerging opportunities arise from expanding the reach of health insurance to underserved populations, developing specialized insurance products for chronic diseases, and utilizing digital technologies to enhance customer experience. Growing demand for preventative healthcare and wellness programs presents further growth opportunities.

Leading Players in the Indonesia Health and Medical Insurance Market Sector

- Allianz Care

- PT Sun Life Financial Indonesia

- AXA Indonesia

- AIA Financial Indonesia

- ManuLife Indonesia

- Prudential Indonesia

- Cigna Insurance

- PT Reasuransi Indonesia Utama (Persero)

- AVIVA

- PT Great Eastern Life Indonesia

- BNI Life

- BCA Life

Key Milestones in Indonesia Health and Medical Insurance Market Industry

- June 2022: Allianz Asia Pacific and HSBC signed a 15-year strategic partnership extension, significantly expanding Allianz's distribution network.

- April 2022: PT Sun Life Financial Indonesia partnered with PT Bank CIMB Niaga Tbk, providing access to a vast customer base of 7 Million.

Strategic Outlook for Indonesia Health and Medical Insurance Market Market

The Indonesian health and medical insurance market presents substantial long-term growth potential. Strategic opportunities lie in leveraging technological advancements, forming strategic partnerships, and tailoring product offerings to the unique needs of the Indonesian population. Focusing on expanding coverage to underserved segments and promoting preventative healthcare will be crucial for sustained growth.

Indonesia Health and Medical Insurance Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Health and Medical Insurance Market Segmentation By Geography

- 1. Indonesia

Indonesia Health and Medical Insurance Market Regional Market Share

Geographic Coverage of Indonesia Health and Medical Insurance Market

Indonesia Health and Medical Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitalization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Economic Disparities are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Public Health Insurance is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Allianz Care

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT Sun Life Financial Indonesia

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AXA Indonesia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AIA Financial Indonesia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ManuLife Indonesia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Prudential Indonesia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cigna Insurance

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Reasuransi Indonesia Utama (Persero)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AVIVA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Great Eastern Life Indonesia**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BNI Life

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BCA Life

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Allianz Care

List of Figures

- Figure 1: Indonesia Health and Medical Insurance Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Indonesia Health and Medical Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Health and Medical Insurance Market?

The projected CAGR is approximately 4.19%.

2. Which companies are prominent players in the Indonesia Health and Medical Insurance Market?

Key companies in the market include Allianz Care, PT Sun Life Financial Indonesia, AXA Indonesia, AIA Financial Indonesia, ManuLife Indonesia, Prudential Indonesia, Cigna Insurance, PT Reasuransi Indonesia Utama (Persero), AVIVA, PT Great Eastern Life Indonesia**List Not Exhaustive, BNI Life, BCA Life.

3. What are the main segments of the Indonesia Health and Medical Insurance Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Digitalization is Driving the Market.

6. What are the notable trends driving market growth?

Public Health Insurance is Dominating the Market.

7. Are there any restraints impacting market growth?

Economic Disparities are Restraining the Market.

8. Can you provide examples of recent developments in the market?

June 2022: Allianz Asia Pacific and HSBC have signed a 15-year extension of their strategic partnership. As part of the partnership, HSBC will be distributing Allianz insurance products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Health and Medical Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Health and Medical Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Health and Medical Insurance Market?

To stay informed about further developments, trends, and reports in the Indonesia Health and Medical Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence