Key Insights

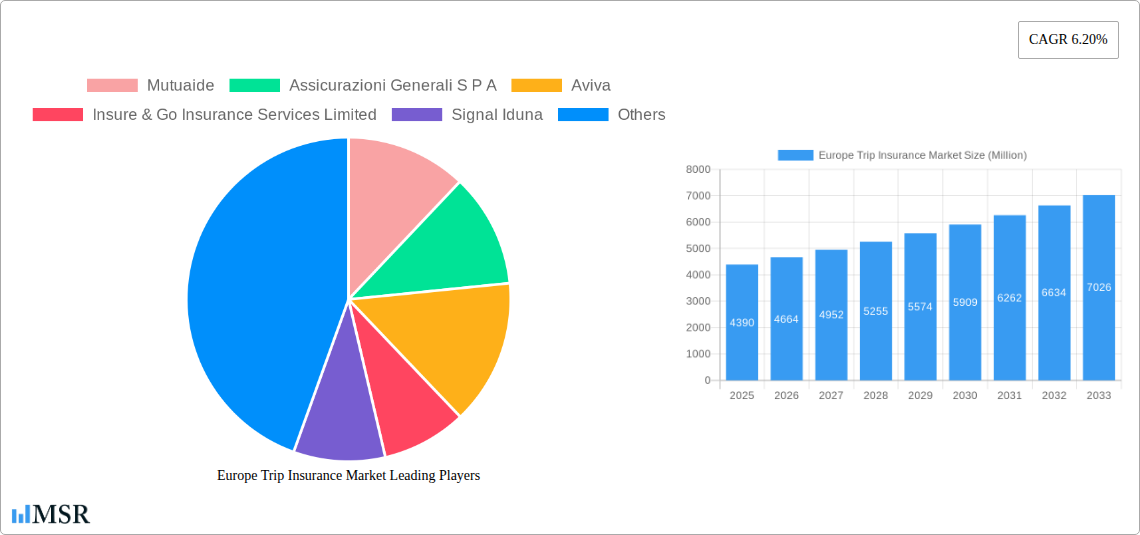

The Europe Trip Insurance Market is poised for robust expansion, currently valued at an estimated $4.39 billion and projected to grow at a Compound Annual Growth Rate (CAGR) of 6.20% through 2033. This growth is fueled by several key drivers, including increasing international travel participation, heightened awareness of travel-related risks, and the growing demand for comprehensive protection among diverse traveler segments. Senior citizens, recognizing the importance of medical coverage and assistance during their travels, represent a significant and expanding end-user group. Similarly, family travelers increasingly prioritize robust insurance policies to safeguard against unforeseen circumstances like trip cancellations or medical emergencies, especially with the rise of longer and more complex family vacations. Educational travelers, encompassing students studying abroad and organized school trips, also contribute to the market's buoyancy due to inherent risks associated with international educational pursuits. The market is segmented into distinct offerings such as single-trip and annual multi-trip policies, catering to varied travel frequencies and durations.

Europe Trip Insurance Market Market Size (In Billion)

The distribution landscape for Europe trip insurance is multifaceted, with insurance companies, insurance intermediaries, banks, and insurance brokers all playing crucial roles in reaching consumers. Banks, in particular, are leveraging their existing customer relationships to offer bundled insurance products alongside travel bookings or financial services, enhancing accessibility. The competitive environment features established players like AXA, Allianz, and American International Group Inc. (AIG), alongside specialized providers such as Mutuaide and Insure & Go Insurance Services Limited, all vying for market share. Key trends shaping the market include the increasing adoption of digital platforms for policy purchase and claims processing, offering greater convenience and efficiency. Personalization of insurance products to meet specific traveler needs, incorporating add-ons for adventure sports or pre-existing medical conditions, is also gaining traction. While the market enjoys strong growth, potential restraints could include price sensitivity among budget-conscious travelers and evolving regulatory landscapes across different European nations that may impact policy offerings and pricing structures.

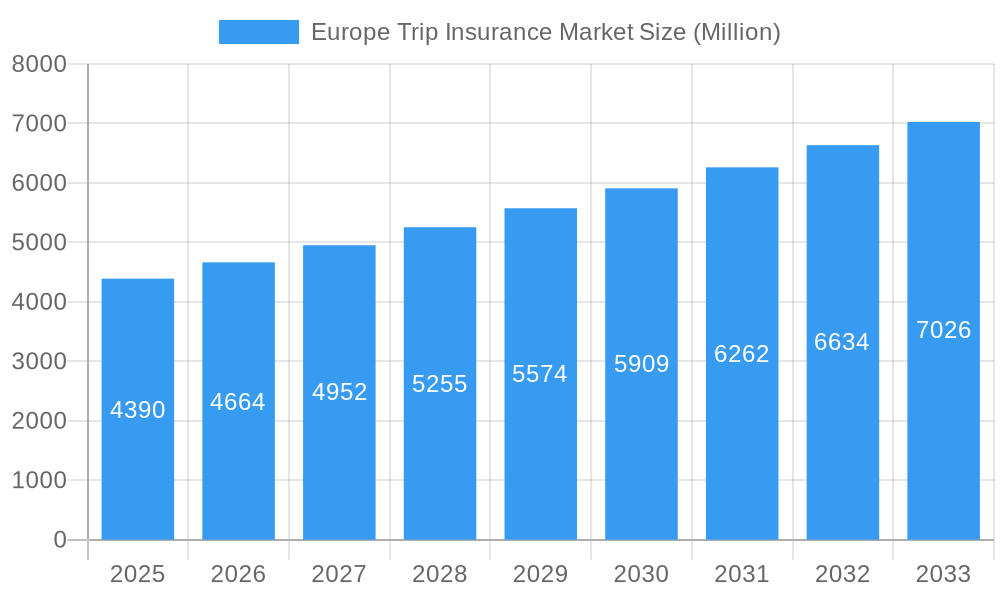

Europe Trip Insurance Market Company Market Share

Unlock critical insights into the Europe Trip Insurance Market with this in-depth report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this research provides a detailed examination of market dynamics, growth drivers, segmentation, competitive landscape, and future opportunities. Discover key trends in single-trip travel insurance and annual multi-trip travel insurance, analyze distribution channels including insurance companies, insurance intermediaries, banks, and insurance brokers, and understand the needs of senior citizens, education travelers, and family travelers.

Europe Trip Insurance Market Market Concentration & Dynamics

The Europe Trip Insurance Market exhibits a moderate to high level of concentration, with key players like Mutuaide, Assicurazioni Generali S.P.A., Aviva, Insure & Go Insurance Services Limited, Signal Iduna, AXA, American International Group Inc, and Zurich holding significant market share. Innovation ecosystems are thriving, driven by advancements in digital platforms and a growing demand for personalized travel insurance solutions. Regulatory frameworks across European nations influence product offerings and distribution strategies, with a focus on consumer protection and solvency requirements. The prevalence of substitute products, such as credit card insurance benefits, remains a consideration, yet the comprehensive coverage offered by dedicated trip insurance continues to drive its relevance. End-user trends indicate a growing preference for flexible and easily accessible policies, particularly among family travelers and senior citizens planning extended trips. Merger and acquisition (M&A) activities, though not extensively reported, are anticipated to play a role in shaping market consolidation and expanding service portfolios. The market is characterized by a continuous drive for enhanced customer experience and competitive pricing strategies.

Europe Trip Insurance Market Industry Insights & Trends

The Europe Trip Insurance Market is experiencing robust growth, projected to reach an estimated €38 Billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.8% from 2019 to 2033. This expansion is significantly fueled by the post-pandemic resurgence in international travel, heightened awareness of travel risks, and an increasing demand for comprehensive travel insurance coverage. Technological disruptions are transforming the market landscape. The widespread adoption of AI-powered chatbots and online comparison platforms has streamlined the purchasing process for single-trip travel insurance and annual multi-trip travel insurance, offering greater transparency and convenience to consumers. Insurers are leveraging big data analytics to personalize policy offerings and improve risk assessment. Evolving consumer behaviors are also playing a crucial role. Travelers are becoming more discerning, seeking policies that cater to specific needs, such as adventure sports coverage, pre-existing medical conditions, and extended trip durations. The rise of digital nomads and remote workers further necessitates flexible and adaptable travel insurance solutions. The market is also witnessing a growing trend towards bundled offerings, where trip insurance is integrated with other travel-related services, enhancing customer value and loyalty. The increasing affordability and accessibility of travel, coupled with a desire for secure and worry-free journeys, are underpinning the sustained upward trajectory of the Europe Trip Insurance Market.

Key Markets & Segments Leading Europe Trip Insurance Market

The Europe Trip Insurance Market is experiencing significant leadership from several key regions and segments.

Dominant Region: Western Europe, particularly countries like the United Kingdom, Germany, France, and Spain, currently dominates the market. This dominance is attributed to:

- Higher disposable incomes and a propensity for international leisure and business travel.

- Well-established financial services sectors and a mature insurance distribution network.

- Strong consumer awareness regarding the importance of travel insurance.

- Robust tourism infrastructure and a high volume of outbound travelers.

Insurance Coverage:

- Annual Multi-trip Travel Insurance is emerging as a leading segment, driven by frequent travelers, business professionals, and families who undertake multiple trips annually. The convenience and cost-effectiveness of an annual policy make it highly attractive.

- Single-Trip Travel Insurance continues to hold a substantial market share, catering to sporadic travelers and specific vacation plans.

Distribution Channel:

- Insurance Companies remain the primary distribution channel, leveraging direct sales and established brand trust.

- Insurance Intermediaries and Insurance Brokers are crucial for providing personalized advice and access to specialized travel insurance products, particularly for complex travel needs.

- Banks are increasingly offering trip insurance as a value-added service to their customers, often bundled with travel credit cards or premium accounts.

- Online Travel Agencies (OTAs) and Other Distribution Channels (e.g., comparison websites, aggregators) are rapidly gaining traction due to their convenience and competitive pricing.

End-User:

- Family Travelers constitute a significant segment, seeking comprehensive coverage for all family members, including medical emergencies, trip cancellations, and lost baggage. The desire for peace of mind during family vacations drives demand.

- Senior Citizens are another key demographic, increasingly prioritizing travel and requiring travel insurance that addresses age-related health concerns and provides robust medical assistance.

- Education Travelers (students on study abroad programs or gap years) also represent a growing segment, requiring specialized coverage for medical emergencies, academic interruptions, and repatriation.

Europe Trip Insurance Market Product Developments

Product innovations in the Europe Trip Insurance Market are focused on enhancing customer value and competitive positioning. Insurers are developing more adaptable policies that cater to evolving travel patterns, including coverage for remote working disruptions and extended stays. The integration of digital tools, such as mobile apps for policy management and claims processing, is becoming standard. Advanced data analytics enable personalized pricing and customized coverage options for single-trip travel insurance and annual multi-trip travel insurance. Emphasis is also placed on offering comprehensive medical coverage, including provisions for pre-existing conditions and mental health support during travel, reflecting a growing consumer concern.

Challenges in the Europe Trip Insurance Market Market

The Europe Trip Insurance Market faces several challenges. Regulatory complexities and varying consumer protection laws across different European countries can hinder seamless cross-border policy offerings. The increasing incidence of travel disruptions due to geopolitical events, pandemics, and natural disasters poses a significant underwriting challenge and can lead to higher claims. Intense price competition, especially from online aggregators, puts pressure on profit margins. Furthermore, low consumer awareness regarding the nuances of travel insurance can lead to underinsurance or the purchase of inadequate coverage, creating potential dissatisfaction and impacting the market's reputation.

Forces Driving Europe Trip Insurance Market Growth

Several key forces are driving the growth of the Europe Trip Insurance Market. The continuous recovery and expansion of international tourism, spurred by increased disposable incomes and a desire for experiential travel, are fundamental drivers. Growing awareness of the financial and health risks associated with travel, amplified by recent global events, has elevated the perceived value of travel insurance. Technological advancements, including the proliferation of online comparison platforms and digital claims processing, are enhancing accessibility and customer experience, making policies for single-trip travel insurance and annual multi-trip travel insurance more appealing. Favorable regulatory environments in some regions, coupled with initiatives promoting financial literacy and consumer protection, also contribute to market expansion.

Challenges in the Europe Trip Insurance Market Market

Long-term growth catalysts for the Europe Trip Insurance Market are intrinsically linked to innovation and strategic partnerships. The development of more sophisticated, usage-based insurance models, leveraging IoT devices and real-time data, presents a significant opportunity. Insurers are exploring collaborations with airlines, hotel chains, and online travel agencies to embed travel insurance seamlessly into the booking journey. The growing demand for niche travel, such as adventure tourism and eco-tourism, requires specialized insurance products. Furthermore, addressing the evolving needs of younger generations and digital-native travelers through intuitive digital platforms and flexible policy structures will be crucial for sustained growth.

Emerging Opportunities in Europe Trip Insurance Market

Emerging opportunities in the Europe Trip Insurance Market are diverse and promising. The increasing trend of 'bleisure' travel (combining business and leisure) necessitates flexible policies that cater to extended durations and varied activities. The growing popularity of sustainable and responsible tourism opens avenues for insurance products that cover environmental impact and ethical travel practices. The burgeoning gig economy and the rise of digital nomads create a demand for on-demand or short-term trip insurance solutions. Furthermore, expanding offerings to include mental well-being support and crisis management assistance during travel will resonate with an increasingly health-conscious traveler demographic.

Leading Players in the Europe Trip Insurance Market Sector

- Mutuaide

- Assicurazioni Generali S.P.A.

- Aviva

- Insure & Go Insurance Services Limited

- Signal Iduna

- AXA

- American International Group Inc

- Zurich

- The April Group

- Allianz

Key Milestones in Europe Trip Insurance Market Industry

- August 2022: French insurance giant Axa reported an uptick in earnings, with higher income from its investment portfolio offsetting a €300 Million hit from the war in Ukraine. Axa's decision to launch a €1 Billion share buyback scheme led to a nearly five percent surge in its shares, with plans to complete the buyback by February 2023, subject to market conditions. This demonstrates Axa's financial resilience and strategic capital management, positively impacting its market presence and investor confidence in its travel insurance offerings.

- April 2022: AXA Partners, a key business unit within AXA offering assistance services, travel, and specialized insurance solutions, collaborated again with Trip.com. This partnership aims to further expand their range of travel insurance products across Europe, enhancing accessibility and product diversity for consumers booking through Trip.com. This strategic alliance underscores AXA's commitment to growth in the European trip insurance market through key distribution channels.

Strategic Outlook for Europe Trip Insurance Market Market

The strategic outlook for the Europe Trip Insurance Market is one of sustained growth and innovation. Key accelerators include the ongoing digitalization of insurance services, enabling seamless online policy acquisition and claims processing for both single-trip travel insurance and annual multi-trip travel insurance. Partnerships with travel providers will be crucial for embedding insurance into the customer journey, increasing market penetration. Insurers focusing on tailored products for specific demographics, such as senior citizens and family travelers, and those addressing emerging travel trends like 'bleisure' and sustainable tourism, are well-positioned for success. The emphasis on comprehensive medical coverage and robust customer support will remain paramount in building trust and loyalty in this dynamic market.

Europe Trip Insurance Market Segmentation

-

1. Insurance Coverage

- 1.1. Single-Trip Travel Insurance

- 1.2. Annual Multi-trip Travel Insurance

-

2. Distribution Channel

- 2.1. Insurance Companies

- 2.2. Insurance Intermediaries

- 2.3. Banks

- 2.4. Insurance Brokers

- 2.5. Other Distribution Channels

-

3. End-User

- 3.1. Senior Citizens

- 3.2. Education Travelers

- 3.3. Family Travelers

- 3.4. Other End Users

Europe Trip Insurance Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Trip Insurance Market Regional Market Share

Geographic Coverage of Europe Trip Insurance Market

Europe Trip Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitalization of the Insurance Industry; Surge in Regulatory Reforms and Mandates

- 3.3. Market Restrains

- 3.3.1. Data Privacy and Security Concerns; Rising Multiple Sizable Natural Catastrophes

- 3.4. Market Trends

- 3.4.1. Artificial Intelligence in Insurance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Trip Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 5.1.1. Single-Trip Travel Insurance

- 5.1.2. Annual Multi-trip Travel Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Insurance Companies

- 5.2.2. Insurance Intermediaries

- 5.2.3. Banks

- 5.2.4. Insurance Brokers

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Senior Citizens

- 5.3.2. Education Travelers

- 5.3.3. Family Travelers

- 5.3.4. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mutuaide

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Assicurazioni Generali S P A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aviva

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Insure & Go Insurance Services Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Signal Iduna

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AXA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 American International Group Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zurich**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The April Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Allianz

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mutuaide

List of Figures

- Figure 1: Europe Trip Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Trip Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Trip Insurance Market Revenue Million Forecast, by Insurance Coverage 2020 & 2033

- Table 2: Europe Trip Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Trip Insurance Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Europe Trip Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Trip Insurance Market Revenue Million Forecast, by Insurance Coverage 2020 & 2033

- Table 6: Europe Trip Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Europe Trip Insurance Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Europe Trip Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Trip Insurance Market?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Europe Trip Insurance Market?

Key companies in the market include Mutuaide, Assicurazioni Generali S P A, Aviva, Insure & Go Insurance Services Limited, Signal Iduna, AXA, American International Group Inc, Zurich**List Not Exhaustive, The April Group, Allianz.

3. What are the main segments of the Europe Trip Insurance Market?

The market segments include Insurance Coverage, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Digitalization of the Insurance Industry; Surge in Regulatory Reforms and Mandates.

6. What are the notable trends driving market growth?

Artificial Intelligence in Insurance.

7. Are there any restraints impacting market growth?

Data Privacy and Security Concerns; Rising Multiple Sizable Natural Catastrophes.

8. Can you provide examples of recent developments in the market?

In August 2022, French insurance giant Axa said an uptick in earnings, driven by higher incomes from its investment portfolio, offset the €300m (£251m) hit to its business arising from the war in Ukraine. Axa's decision to launch its €1bn share buyback scheme saw shares in the insurance giant surge by almost five percent in the early morning trading session, as the firm set out plans to complete its buyback by February 2023, subject matter to market conditions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Trip Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Trip Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Trip Insurance Market?

To stay informed about further developments, trends, and reports in the Europe Trip Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence