Key Insights

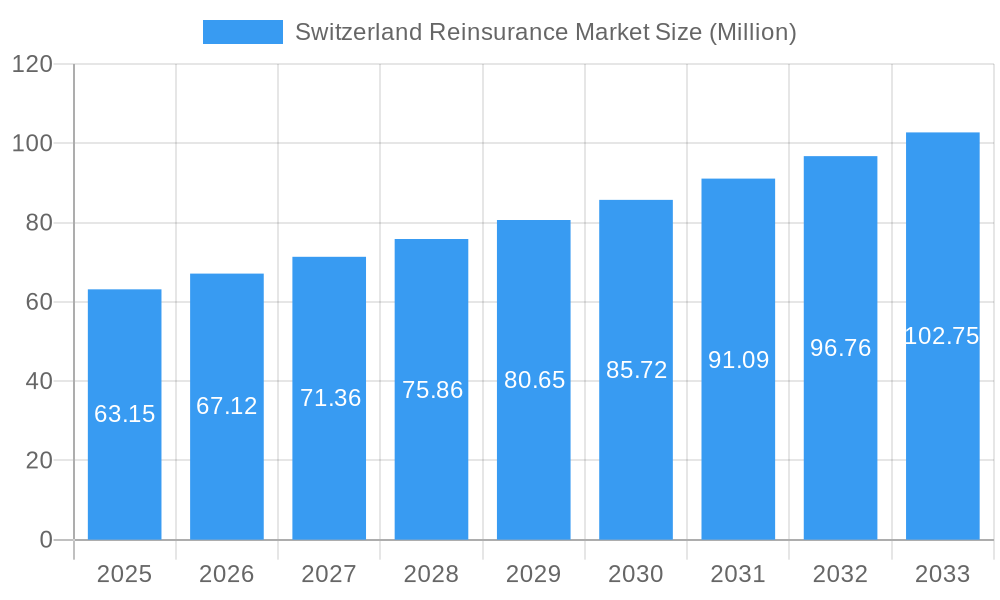

The Switzerland reinsurance market, valued at $63.15 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.23% from 2025 to 2033. This expansion is driven by several key factors. Increasing frequency and severity of catastrophic events globally necessitate robust risk transfer mechanisms, bolstering demand for reinsurance solutions. Furthermore, the stringent regulatory environment in Switzerland, coupled with the country's position as a major financial hub, encourages the adoption of sophisticated reinsurance strategies by both domestic and international insurers. The growing complexity of insurance risks, including cyber threats and climate change-related perils, further fuels market expansion. This growth is also supported by advancements in technology, leading to improved risk assessment models and more efficient reinsurance operations. Competitive pressures amongst established players like Swiss Re, Zurich Insurance Group, and other international firms will continue shaping the market landscape. While specific segment breakdowns and regional data are unavailable, it's reasonable to infer that the market likely benefits from robust financial markets in Switzerland and high levels of insurance penetration.

Switzerland Reinsurance Market Market Size (In Million)

The market's growth, however, may face certain headwinds. The global economic climate and potential fluctuations in investment returns can impact the profitability of reinsurance businesses. Furthermore, intense competition from both domestic and international reinsurers may suppress pricing and profit margins. Despite these challenges, the long-term outlook for the Switzerland reinsurance market remains positive. The increasing demand for risk mitigation solutions, the sophistication of insurance products, and the country’s robust financial infrastructure position the market for continued growth. The presence of major players such as Swiss Re, Allianz SE Reinsurance, and SCOR, among others, underscores the market's significance in the global reinsurance landscape. Further research into specific segment performance and regional contributions would provide a more granular understanding of this dynamic sector.

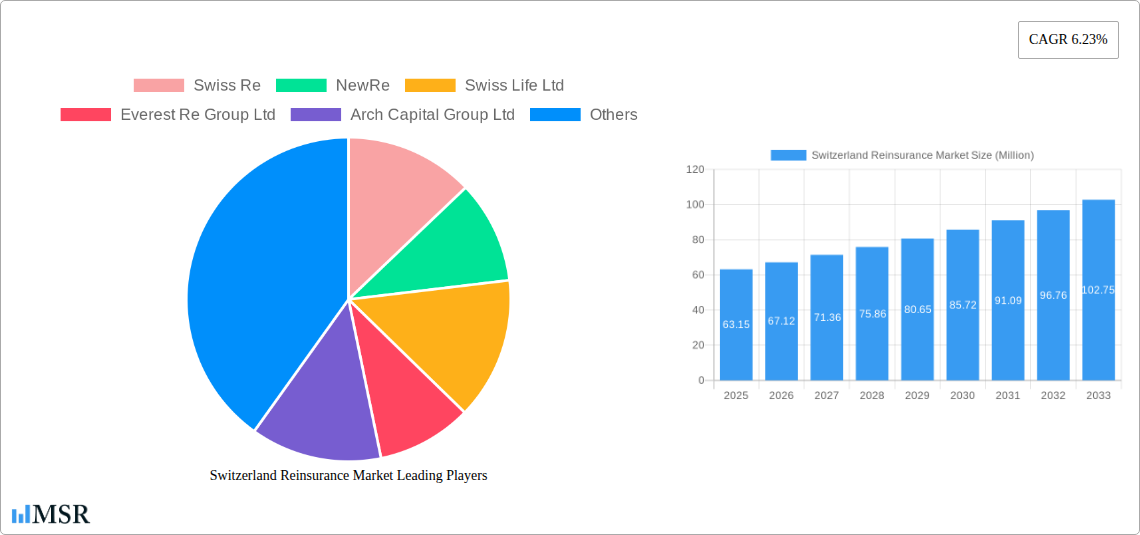

Switzerland Reinsurance Market Company Market Share

Switzerland Reinsurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Switzerland reinsurance market, offering valuable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unravels market dynamics, key players, and future growth opportunities. The market size is estimated to reach xx Million in 2025, exhibiting a CAGR of xx% during the forecast period.

Switzerland Reinsurance Market Market Concentration & Dynamics

The Switzerland reinsurance market exhibits a moderately concentrated landscape, with key players like Swiss Re, Swiss Re, NewRe, Swiss Life Ltd, Everest Re Group Ltd, Arch Capital Group Ltd, RenaissanceRe, EUROPA Re Ltd, Allianz SE Reinsurance, and SCOR holding significant market share. Precise market share data for each player is unavailable and requires further specific research, but Swiss Re and other large global players are expected to maintain leading positions, estimated to collectively hold around xx% of the market in 2025. The market is characterized by a dynamic innovation ecosystem, driven by technological advancements in risk assessment and modelling. The regulatory framework, primarily governed by the Swiss Financial Market Supervisory Authority (FINMA), is robust, ensuring stability and consumer protection. Substitute products are limited, with traditional reinsurance remaining the primary risk transfer mechanism. End-user trends are shifting towards more customized and sophisticated reinsurance solutions, catering to evolving risk profiles. M&A activity, as evidenced by recent deals like the Arch Capital Group's acquisition of RMIC (November 2023) and Swiss Life's acquisition of elipsLife (July 2022), underscores the ongoing consolidation within the sector. The number of M&A deals in the past five years is estimated to be around xx, indicating a moderate level of consolidation.

Switzerland Reinsurance Market Industry Insights & Trends

The Switzerland reinsurance market is witnessing robust growth, fueled by several factors. Increasing global interconnectedness and the rise of complex risks, such as cyber threats and climate change, are driving demand for reinsurance solutions. The market’s growth is also propelled by the stringent regulatory environment promoting financial stability and fostering investor confidence. Technological advancements, including the use of big data analytics and artificial intelligence, are enhancing risk assessment and pricing models, leading to improved efficiency and profitability. Evolving consumer behavior toward more customized and proactive risk management strategies is also shaping the market landscape. The market's growth is expected to be influenced by factors like macroeconomic conditions, global insurance market trends, and advancements in risk modeling techniques. The total market size is expected to reach xx Million in 2025, growing to xx Million by 2033.

Key Markets & Segments Leading Switzerland Reinsurance Market

While granular data on specific regional or segment dominance within Switzerland is unavailable, it is expected that the dominant segment is likely property and casualty reinsurance, driven by the high concentration of international insurance and reinsurance businesses within Switzerland. Drivers for growth include:

- Robust Swiss economy: Switzerland's strong economic performance and high per capita income contribute to a large pool of insurable assets.

- Established financial sector: Switzerland's well-developed financial sector provides a solid foundation for the reinsurance industry.

- Attractive regulatory environment: A stable and predictable regulatory environment makes Switzerland an attractive location for reinsurance businesses.

A detailed analysis is needed to pinpoint the precise dominant segment and geographic area within Switzerland, however, the above factors suggest strong growth potential across several segments.

Switzerland Reinsurance Market Product Developments

Recent product developments in the Swiss reinsurance market reflect a focus on leveraging technology to enhance risk management capabilities. This includes the implementation of advanced analytics and machine learning algorithms to better assess and price risks. New parametric insurance products tailored to specific catastrophic events are also gaining traction. These innovations provide insurers and reinsurers with more sophisticated risk transfer mechanisms and improve efficiency.

Challenges in the Switzerland Reinsurance Market Market

The Switzerland reinsurance market faces several challenges, including intense competition from both domestic and international players. Regulatory changes and compliance costs can also pose significant challenges. The increasing frequency and severity of natural catastrophes exert pressure on profitability. Successfully navigating these challenges requires a robust risk management strategy, efficient operations, and a focus on innovation. The precise quantifiable impact of these challenges on market growth requires further specific research.

Forces Driving Switzerland Reinsurance Market Growth

The growth of the Switzerland reinsurance market is propelled by several key factors: Increasing global interconnectedness and cross-border risks, technological advancements such as AI and big data analytics leading to better risk assessment and efficient operations, and robust regulatory environment that enhances financial stability. The increasing demand for customized and sophisticated reinsurance solutions also contributes to market growth.

Challenges in the Switzerland Reinsurance Market Market

Long-term growth catalysts include strategic partnerships and collaborations, further technological innovations, expansion into new markets, and development of innovative reinsurance products tailored to address emerging risks such as cyber risks and climate change. These initiatives are crucial for sustaining long-term growth within the market.

Emerging Opportunities in Switzerland Reinsurance Market

Emerging opportunities lie in leveraging Insurtech innovations to enhance risk assessment and management, expanding into niche markets, and developing sustainable reinsurance solutions that cater to the growing concerns about climate change. These opportunities require proactive adaptation and strategic investments.

Leading Players in the Switzerland Reinsurance Market Sector

- Swiss Re

- NewRe

- Swiss Life Ltd

- Everest Re Group Ltd

- Arch Capital Group Ltd

- RenaissanceRe

- EUROPA Re Ltd

- Allianz SE Reinsurance

- SCOR

- List Not Exhaustive

Key Milestones in Switzerland Reinsurance Market Industry

- November 2023: Arch U.S. MI Holdings, a subsidiary of Arch Capital Group Ltd., acquired RMIC Companies, Inc., expanding its run-off mortgage insurance business. This acquisition signifies consolidation within the market.

- July 2022: Swiss Life International completed the acquisition of elipsLife, strengthening its institutional client base and expanding its product offerings. This reflects the trend towards strategic acquisitions to enhance market share.

Strategic Outlook for Switzerland Reinsurance Market Market

The Switzerland reinsurance market holds significant future potential, driven by the enduring demand for risk mitigation and the ongoing evolution of risk landscapes. Strategic partnerships, technological innovation, and expansion into emerging markets present lucrative opportunities for market players. Focusing on sustainable and responsible reinsurance solutions is vital for long-term success.

Switzerland Reinsurance Market Segmentation

-

1. Type

- 1.1. Facultative Reinsurance

- 1.2. Treaty Reinsurance

-

2. Application

- 2.1. Property & Casualty Reinsurance

- 2.2. Life & Health Reinsurance

-

3. Distribution Channel

- 3.1. Direct

- 3.2. Broker

-

4. Mode

- 4.1. Online

- 4.2. Offline

Switzerland Reinsurance Market Segmentation By Geography

- 1. Switzerland

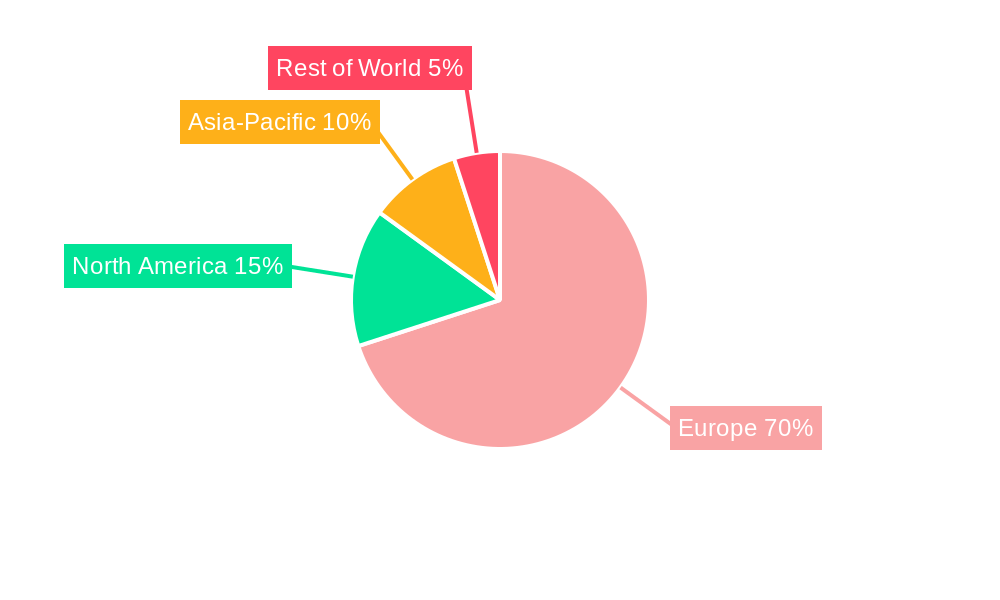

Switzerland Reinsurance Market Regional Market Share

Geographic Coverage of Switzerland Reinsurance Market

Switzerland Reinsurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements are Driving the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Technological Advancements are Driving the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Growing Claim Paid by Insurance Companies Increased the Need of Reinsurance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Reinsurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Facultative Reinsurance

- 5.1.2. Treaty Reinsurance

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Property & Casualty Reinsurance

- 5.2.2. Life & Health Reinsurance

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct

- 5.3.2. Broker

- 5.4. Market Analysis, Insights and Forecast - by Mode

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Swiss Re

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NewRe

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Swiss Life Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Everest Re Group Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arch Capital Group Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 RenaissanceRe

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 EUROPA Re Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Allianz SE Reinsurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SCOR**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Swiss Re

List of Figures

- Figure 1: Switzerland Reinsurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Switzerland Reinsurance Market Share (%) by Company 2025

List of Tables

- Table 1: Switzerland Reinsurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Switzerland Reinsurance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Switzerland Reinsurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Switzerland Reinsurance Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Switzerland Reinsurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Switzerland Reinsurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Switzerland Reinsurance Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 8: Switzerland Reinsurance Market Volume Billion Forecast, by Mode 2020 & 2033

- Table 9: Switzerland Reinsurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Switzerland Reinsurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Switzerland Reinsurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Switzerland Reinsurance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 13: Switzerland Reinsurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Switzerland Reinsurance Market Volume Billion Forecast, by Application 2020 & 2033

- Table 15: Switzerland Reinsurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Switzerland Reinsurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 17: Switzerland Reinsurance Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 18: Switzerland Reinsurance Market Volume Billion Forecast, by Mode 2020 & 2033

- Table 19: Switzerland Reinsurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Switzerland Reinsurance Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Reinsurance Market?

The projected CAGR is approximately 6.23%.

2. Which companies are prominent players in the Switzerland Reinsurance Market?

Key companies in the market include Swiss Re, NewRe, Swiss Life Ltd, Everest Re Group Ltd, Arch Capital Group Ltd, RenaissanceRe, EUROPA Re Ltd, Allianz SE Reinsurance, SCOR**List Not Exhaustive.

3. What are the main segments of the Switzerland Reinsurance Market?

The market segments include Type, Application, Distribution Channel, Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements are Driving the Growth of the Market.

6. What are the notable trends driving market growth?

Growing Claim Paid by Insurance Companies Increased the Need of Reinsurance.

7. Are there any restraints impacting market growth?

Technological Advancements are Driving the Growth of the Market.

8. Can you provide examples of recent developments in the market?

November 2023: Arch U.S. MI Holdings, a wholly owned subsidiary of Arch Capital Group Ltd., announced it has entered into a definitive agreement to acquire RMIC Companies, Inc. (RMIC) and its subsidiaries that together comprise the run-off mortgage insurance business of Old Republic International Corporation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Reinsurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Reinsurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Reinsurance Market?

To stay informed about further developments, trends, and reports in the Switzerland Reinsurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence