Key Insights

The Middle East and Africa (MEA) Private Equity (PE) fund industry is projected for significant expansion, with an estimated market size of $21063.4 million by 2025, and a Compound Annual Growth Rate (CAGR) of 6.41% through 2033. Growth is propelled by government economic diversification initiatives, a thriving entrepreneurial ecosystem, and increasing institutional investor interest in alternative assets. The region's strategic location and global financial integration enhance its appeal. Key sectors attracting PE investment include Utilities, Oil & Gas, Financials, Technology, and Healthcare, driven by digital transformation, renewable energy, and evolving consumer demands. Venture Capital and Growth investment types are expected to lead, focusing on high-potential early-stage and expansion-stage businesses. Saudi Arabia and the United Arab Emirates are central to PE activity, benefiting from favorable regulations and substantial capital.

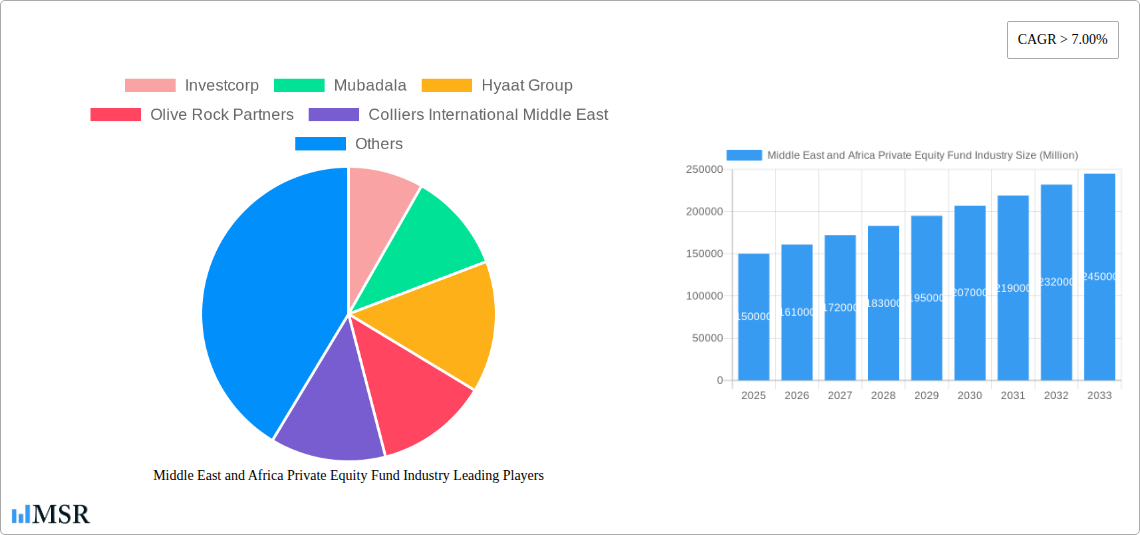

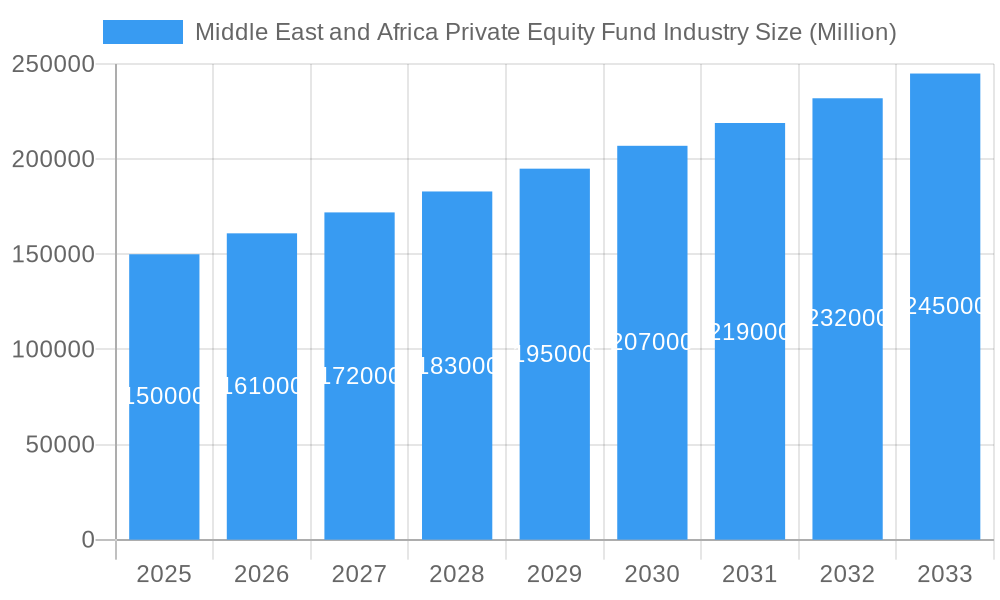

Middle East and Africa Private Equity Fund Industry Market Size (In Billion)

The MEA PE landscape sees a rise in strategic buyouts alongside venture capital investments in innovative startups, indicating a maturing market. Challenges include evolving regulations, geopolitical uncertainties, and the need for enhanced transparency. Despite these, the long-term outlook is strong. Leading firms like Investcorp, Mubadala, and Hyaat Group are actively investing, reflecting confidence in the region's economic potential. The forecast period (2025-2033) anticipates continued deal flow, emphasizing sectors supporting economic diversification and sustainable development. PE firms are increasingly focused on value creation aligned with MEA's economic transformation agenda.

Middle East and Africa Private Equity Fund Industry Company Market Share

MEA Private Equity Fund Industry: Market Size, Growth, and Forecast 2025-2033

Explore the dynamic Middle East and Africa (MEA) Private Equity Fund Industry with this comprehensive, data-driven report. Covering 2019–2033, with a base and estimated year of 2025, this analysis provides key insights into the region's growing private equity sector. Identify growth drivers, emerging opportunities, and strategic imperatives for investors and stakeholders. This report delivers actionable intelligence on market shifts and investment avenues across diverse sectors and geographies.

Middle East and Africa Private Equity Fund Industry Market Concentration & Dynamics

The MEA Private Equity Fund Industry exhibits a moderate to high market concentration, with a few dominant players controlling a significant portion of assets under management. Innovation ecosystems are rapidly maturing, particularly in technology hubs within the UAE and South Africa, fostering a conducive environment for venture capital and growth equity investments. Regulatory frameworks are evolving, with governments actively encouraging foreign direct investment and private equity participation through incentives and streamlined processes. While substitute products are limited in the direct private equity fund space, the availability of alternative investment vehicles presents a competitive consideration. End-user trends indicate a strong preference for investments aligned with regional economic diversification agendas, focusing on sectors like technology, healthcare, and renewable energy. M&A activities are on an upward trajectory, driven by consolidation opportunities and the pursuit of strategic market expansion. The historical period (2019–2024) saw approximately 500 M&A deals, with an estimated average market share for the top 5 firms at around 65%.

Middle East and Africa Private Equity Fund Industry Industry Insights & Trends

The Middle East and Africa Private Equity Fund Industry is poised for substantial expansion, projected to reach a market size of approximately $500 Billion by 2033, exhibiting a compelling Compound Annual Growth Rate (CAGR) of 18% from the base year of 2025. This growth is primarily fueled by robust economic development across the region, significant infrastructure investments, and increasing venture capital deployment in nascent industries. Technological disruptions are a major catalyst, with a surge in digital transformation initiatives creating fertile ground for Venture Capital and Growth investment in sectors such as fintech, e-commerce, and AI-driven solutions. Evolving consumer behaviors, characterized by a growing middle class with increasing disposable income and a demand for diversified goods and services, are also stimulating private equity interest. For instance, the Consumer Goods & Services sector is witnessing significant inbound interest, mirroring the demographic shifts. Furthermore, the ongoing commitment to economic diversification away from traditional sectors like Oil & Gas is creating new investment frontiers in manufacturing, logistics, and sustainable technologies. The historical period saw a CAGR of 15%, highlighting a sustained upward trend.

Key Markets & Segments Leading Middle East and Africa Private Equity Fund Industry

The United Arab Emirates (UAE) and South Africa consistently emerge as dominant markets within the MEA Private Equity Fund Industry. Their leadership is underpinned by sophisticated financial infrastructure, favorable regulatory environments, and a strong pipeline of investable companies. The Technology sector is a leading segment, experiencing exponential growth driven by digitalization trends and a burgeoning startup ecosystem. Healthcare is another high-potential segment, spurred by increasing healthcare expenditure, an aging population, and a growing demand for advanced medical services and infrastructure.

Dominant Segments:

- Technology: Driven by digitalization, e-commerce growth, and a vibrant startup scene.

- Healthcare: Fueled by rising healthcare expenditure, population growth, and demand for quality medical services.

- Financials: Benefiting from economic growth, digital banking adoption, and regulatory reforms.

- Consumer Goods & Services: Catering to a growing middle class and evolving consumer preferences.

Dominant Investment Types:

- Growth Equity: Capitalizing on established businesses seeking to scale operations and expand market reach.

- Venture Capital: Investing in early-stage companies with high growth potential, particularly in technology and innovation.

- Buyout: Acquiring mature companies with the aim of operational improvements and value creation.

The dominance of these segments and investment types is directly correlated with the region's economic diversification strategy and its embrace of technological advancements. For example, government initiatives promoting innovation and entrepreneurship in the UAE have created a fertile ground for venture capital, while the increasing need for improved healthcare infrastructure in many African nations presents significant opportunities for growth and buyout strategies.

Middle East and Africa Private Equity Fund Industry Product Developments

Product developments in the MEA Private Equity Fund Industry are increasingly focused on specialized funds targeting specific sectors and investment strategies. This includes the emergence of Sharia-compliant funds, impact investment vehicles focused on Environmental, Social, and Governance (ESG) principles, and funds dedicated to supporting small and medium-sized enterprises (SMEs). Technological advancements are also influencing product development, with a rise in data-driven investment platforms and a greater emphasis on portfolio management technologies to enhance efficiency and returns. The market relevance of these developments lies in their ability to cater to diverse investor preferences and address the unique economic and social landscapes of the MEA region.

Challenges in the Middle East and Africa Private Equity Fund Industry Market

Despite robust growth, the MEA Private Equity Fund Industry faces several challenges. Regulatory hurdles and complexities across different countries can create operational friction. Limited availability of skilled talent in specialized investment roles can hinder deal execution and portfolio management. Macroeconomic volatility and geopolitical instability in certain sub-regions can pose significant risks. Furthermore, insufficient deal flow in specific emerging markets and liquidity challenges for certain asset classes remain persistent concerns. Quantifiable impacts include an estimated 5% increase in deal completion times due to regulatory navigation and an average of 10% higher operational costs associated with navigating disparate legal frameworks.

Forces Driving Middle East and Africa Private Equity Fund Industry Growth

Several key forces are propelling the growth of the MEA Private Equity Fund Industry. Favorable demographic trends, including a young and growing population, translate to increasing consumer demand and a robust labor force. Significant government initiatives focused on economic diversification, infrastructure development, and attracting foreign investment are creating a more conducive business environment. The increasing adoption of technology and digitalization across various sectors is unlocking new investment opportunities and driving innovation. Furthermore, the growing maturity of capital markets and a rise in local institutional investor participation are providing a more stable funding base.

Challenges in the Middle East and Africa Private Equity Fund Industry Market

The long-term growth catalysts for the MEA Private Equity Fund Industry are deeply rooted in sustained innovation and strategic market expansion. The ongoing digital transformation across industries is creating a perpetual pipeline of disruptive businesses ripe for investment. Furthermore, increasing cross-border collaboration and the development of regional economic blocs are fostering greater market integration and economies of scale. Partnerships between local and international private equity firms are crucial for knowledge transfer and accessing global best practices. The continuous refinement of regulatory frameworks to further attract and protect private equity capital will also be a significant long-term growth accelerator.

Emerging Opportunities in Middle East and Africa Private Equity Fund Industry

Emerging opportunities in the MEA Private Equity Fund Industry are abundant, particularly in sectors aligned with sustainable development and technological advancement. The burgeoning renewable energy sector, driven by government commitments to clean energy transitions, presents a significant opportunity for investment. The increasing demand for affordable housing and infrastructure development in rapidly urbanizing areas also offers substantial potential. Furthermore, the rapid growth of e-commerce and digital services across Africa is creating a fertile ground for venture capital and growth equity. Emerging market nuances, such as the potential for first-mover advantage in less saturated markets, are also attracting strategic investors.

Leading Players in the Middle East and Africa Private Equity Fund Industry Sector

- Investcorp

- Mubadala

- Hyaat Group

- Olive Rock Partners

- Colliers International Middle East

- Ascension Capital Partners

- Saint Capital Fund

- BluePeak Private Capital

- Sigma Capital Holding

- Vantage Capital

Key Milestones in Middle East and Africa Private Equity Fund Industry Industry

- January 2022: Colliers, a services and investment management firm, enhanced its presence in the Middle East and North Africa (MENA) through Eltizam Asset Management Group's (Eltizam) acquisition of Falcon Investments LLC, an associate partner operating as Colliers since 1995. This strategic move leverages Eltizam's expertise in core real estate transactions and advisory services alongside its asset management capabilities, strengthening Colliers' regional footprint.

- January 2022: BluePeak Private Capital, an asset management firm, announced a significant investment in Grit Real Estate Income Group Limited (Grit), a key pan-African real estate company. This investment supports Grit's ambitious development plans to expand industrial and health facilities in East Africa, aiming to improve access to essential goods and enhance the quality of healthcare services across the region.

Strategic Outlook for Middle East and Africa Private Equity Fund Industry Market

The strategic outlook for the MEA Private Equity Fund Industry remains exceptionally positive, driven by ongoing economic reforms, a young and dynamic population, and a growing appetite for innovation. Future growth will be accelerated by continued diversification into technology-driven sectors, renewable energy, and essential services like healthcare and logistics. Strategic opportunities lie in leveraging the region's unique position at the crossroads of global trade and in capitalizing on the increasing demand for ESG-compliant investments. Collaboration between governments, private equity firms, and local businesses will be crucial in navigating complex markets and unlocking sustainable, long-term value creation. The forecast indicates a sustained period of robust deal activity and fundraisings.

Middle East and Africa Private Equity Fund Industry Segmentation

-

1. Industry / Sector

- 1.1. Utilities

- 1.2. Oil & Gas

- 1.3. Financials

- 1.4. Technology

- 1.5. Healthcare

- 1.6. Consumer Goods & Services

- 1.7. Others

-

2. Investment Type

- 2.1. Venture Capital

- 2.2. Growth

- 2.3. Buyout

- 2.4. Others

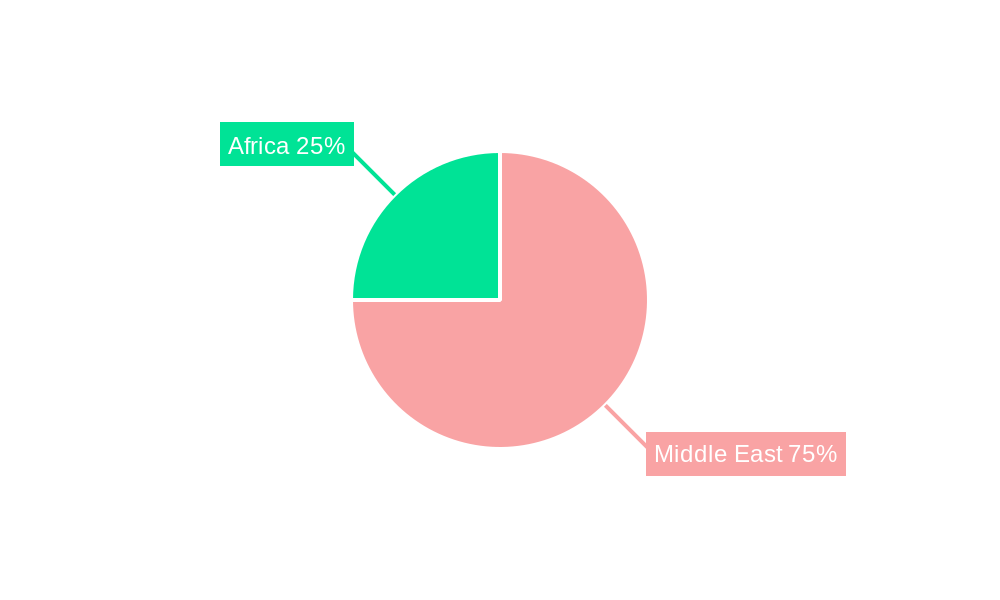

Middle East and Africa Private Equity Fund Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Private Equity Fund Industry Regional Market Share

Geographic Coverage of Middle East and Africa Private Equity Fund Industry

Middle East and Africa Private Equity Fund Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Capital Deployment in Africa

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Private Equity Fund Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Industry / Sector

- 5.1.1. Utilities

- 5.1.2. Oil & Gas

- 5.1.3. Financials

- 5.1.4. Technology

- 5.1.5. Healthcare

- 5.1.6. Consumer Goods & Services

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Investment Type

- 5.2.1. Venture Capital

- 5.2.2. Growth

- 5.2.3. Buyout

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Industry / Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Investcorp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mubadala

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyaat Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Olive Rock Partners

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Colliers International Middle East

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ascension Capital Partners

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Saint Capital Fund

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BluePeak Private Capital

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sigma Capital Holding

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vantage Capital**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Investcorp

List of Figures

- Figure 1: Middle East and Africa Private Equity Fund Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Private Equity Fund Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Private Equity Fund Industry Revenue million Forecast, by Industry / Sector 2020 & 2033

- Table 2: Middle East and Africa Private Equity Fund Industry Revenue million Forecast, by Investment Type 2020 & 2033

- Table 3: Middle East and Africa Private Equity Fund Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Middle East and Africa Private Equity Fund Industry Revenue million Forecast, by Industry / Sector 2020 & 2033

- Table 5: Middle East and Africa Private Equity Fund Industry Revenue million Forecast, by Investment Type 2020 & 2033

- Table 6: Middle East and Africa Private Equity Fund Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Private Equity Fund Industry?

The projected CAGR is approximately 6.41%.

2. Which companies are prominent players in the Middle East and Africa Private Equity Fund Industry?

Key companies in the market include Investcorp, Mubadala, Hyaat Group, Olive Rock Partners, Colliers International Middle East, Ascension Capital Partners, Saint Capital Fund, BluePeak Private Capital, Sigma Capital Holding, Vantage Capital**List Not Exhaustive.

3. What are the main segments of the Middle East and Africa Private Equity Fund Industry?

The market segments include Industry / Sector, Investment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 21063.4 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Capital Deployment in Africa.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In Jan 2022, Colliers, a services and investment management firm, improved its footprint in the Middle East and North Africa (MENA) with Eltizam Asset Management Group's (Eltizam) acquisition of Falcon Investments LLC, an associate partner that has been doing business in the region as Colliers since 1995. Colliers benefits from the competence in core real estate transactions and advisory services offered by Eltizam and the asset management services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Private Equity Fund Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Private Equity Fund Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Private Equity Fund Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Private Equity Fund Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence