Key Insights

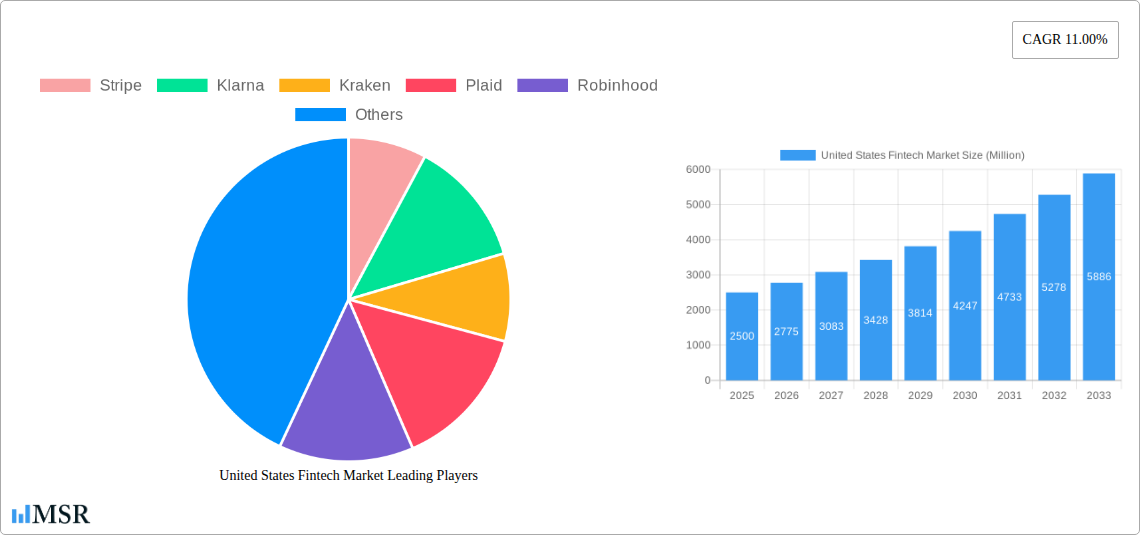

The United States Fintech market is poised for substantial expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 13.8%. This robust growth is propelled by escalating smartphone adoption and enhanced internet connectivity, democratizing access to financial technology services. The increasing consumer preference for digital banking and personalized financial management tools further fuels market penetration. The ongoing shift towards cashless transactions and the burgeoning trend of embedded finance, seamlessly integrating financial services into non-financial platforms, are critical accelerators. Leading innovators such as Stripe, Klarna, and Robinhood, alongside adaptive established entities like Visa, are instrumental in defining the market's trajectory through pioneering solutions and strategic alliances. Evolving regulatory frameworks, while introducing complexities, also serve as catalysts for innovation and responsible market development.

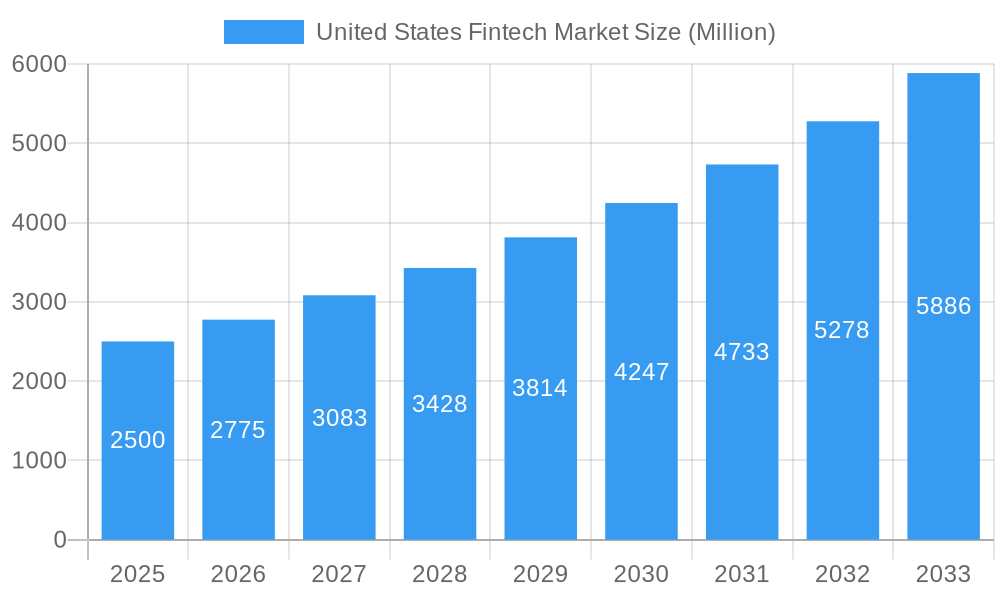

United States Fintech Market Market Size (In Billion)

Despite significant growth prospects, the market confronts certain constraints. Paramount among these are persistent concerns surrounding data security and privacy, amplified by the sensitive nature of financial data. The financial implications of regulatory compliance and the potential for disruptive technological shifts also present growth challenges. Nevertheless, advancements in cybersecurity and the adaptable regulatory environment are expected to mitigate these hurdles, fostering a balance between innovation and consumer protection. The market is segmented across diverse verticals including payments, lending, investing, and personal finance management, each offering distinct avenues for specialized growth. The dynamic interplay between incumbent financial institutions and agile fintech startups stimulates intense competition and continuous innovation. While a precise market valuation for 2025 is forthcoming, the projected CAGR of 13.8% indicates a significant market size, estimated at 60.4 billion, from the base year.

United States Fintech Market Company Market Share

United States Fintech Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Fintech market, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. Discover key trends, growth drivers, challenges, and opportunities shaping this dynamic market, including detailed analysis of leading players like Stripe, Klarna, Kraken, Plaid, Robinhood, Brex, Chime, NYDIG, VISA, and iTrustCapital (list not exhaustive). The report quantifies market size and CAGR, providing actionable intelligence for navigating the complexities of the US Fintech landscape.

United States Fintech Market Concentration & Dynamics

The US Fintech market exhibits a dynamic interplay of concentration and fragmentation. While a few giants dominate specific segments, a vibrant ecosystem of startups and niche players fuels innovation. Market share is constantly shifting due to mergers and acquisitions (M&A), technological advancements, and evolving regulatory frameworks. The number of M&A deals in the Fintech sector has seen a significant increase in recent years, with an estimated xx number of deals in 2024, reflecting the intense competitive landscape and the consolidation of market power. This has a direct impact on market share distribution, with larger players often acquiring smaller, innovative companies to expand their product portfolios and capabilities.

- Market Concentration: High concentration in payments processing, moderate concentration in lending and investing.

- Innovation Ecosystems: Strong presence in Silicon Valley and New York, with emerging hubs in other major cities.

- Regulatory Frameworks: Complex and evolving, impacting various Fintech segments differently.

- Substitute Products: Traditional financial services pose a constant competitive threat.

- End-User Trends: Increasing adoption of digital financial services, particularly among younger demographics.

- M&A Activity: A significant number of M&A deals in the past five years, driving market consolidation.

United States Fintech Market Industry Insights & Trends

The US Fintech market experienced robust growth during the historical period (2019-2024), with a market size reaching USD xx Million in 2024. The market is projected to continue its upward trajectory, exhibiting a CAGR of xx% during the forecast period (2025-2033), reaching an estimated USD xx Million by 2033. Several factors fuel this growth, including the increasing adoption of mobile banking, the rise of digital payments, and the growing demand for personalized financial services. Technological disruptions, such as the rise of blockchain technology and artificial intelligence, are also transforming the industry landscape. Evolving consumer behaviors, with a preference for convenience, transparency, and personalized experiences, are driving innovation and competition within the sector. Furthermore, the increasing penetration of smartphones and internet connectivity is enhancing the accessibility and convenience of Fintech services. This is particularly noticeable in underserved communities, increasing financial inclusion.

Key Markets & Segments Leading United States Fintech Market

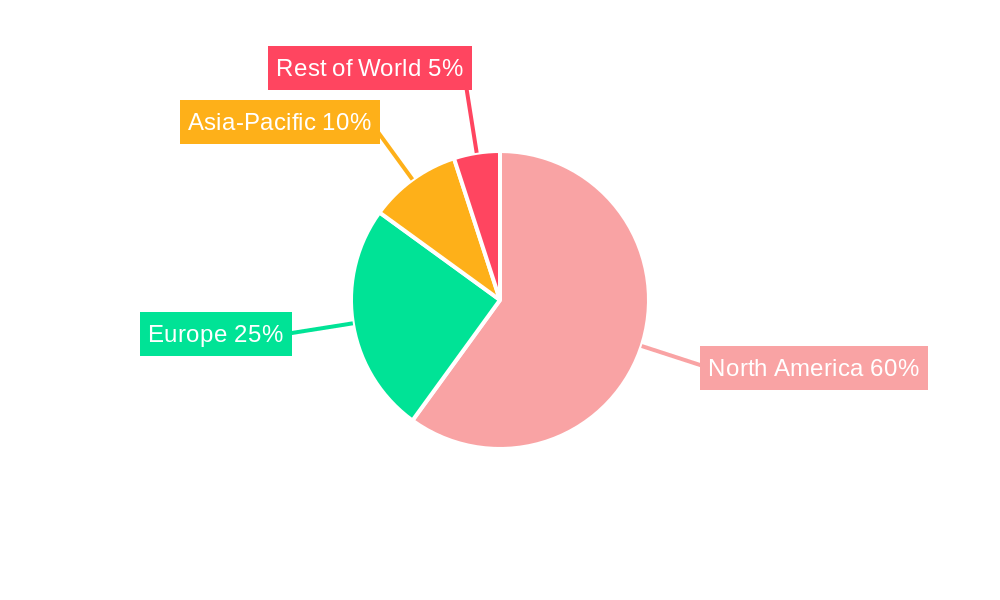

While the entire US represents a significant market, specific regions and segments are experiencing disproportionately higher growth. California's Silicon Valley and New York City remain dominant due to their established technology infrastructure and talent pools. The payments segment currently holds the largest market share, driven by the increasing preference for digital transactions and the emergence of new payment technologies.

- Drivers for Dominance:

- California (Silicon Valley): Strong technological infrastructure, access to venture capital, highly skilled workforce.

- New York City: Established financial center, proximity to key financial institutions.

- Payments Segment: High adoption of digital payments, innovative payment solutions.

The dominance of these regions and segments is expected to continue throughout the forecast period, further fueled by increasing investment and technological advancements. However, other regions and segments, such as lending and investing, are also showing robust growth, driven by favorable economic conditions and the increasing demand for innovative financial products.

United States Fintech Market Product Developments

The US Fintech market is characterized by continuous product innovation. New payment methods, lending platforms, investment apps, and personal finance management tools are constantly emerging. These innovations leverage technologies like AI, machine learning, and blockchain to enhance efficiency, security, and user experience. This constant drive for innovation fosters competitive differentiation and attracts both consumers and investors, further accelerating market growth.

Challenges in the United States Fintech Market Market

The US Fintech market faces several challenges, including stringent regulatory compliance requirements which can increase operational costs and limit market expansion. Supply chain disruptions can impact the availability of essential technologies and infrastructure. Intense competition from both established players and new entrants requires continuous innovation and adaptability. These factors collectively impose significant restraints on market growth and profitability.

Forces Driving United States Fintech Market Growth

Several factors drive the growth of the US Fintech market. Technological advancements, such as AI and blockchain, enhance efficiency and offer innovative solutions. Favorable economic conditions boost consumer spending and investment. Government initiatives promoting financial inclusion and digitalization create a supportive environment for Fintech growth. The increasing adoption of mobile and online banking enhances the accessibility and convenience of financial services.

Long-Term Growth Catalysts in the United States Fintech Market

Long-term growth in the US Fintech market will be propelled by continuous innovation in areas like embedded finance and open banking. Strategic partnerships between Fintech companies and traditional financial institutions will accelerate adoption and expand market reach. Expansion into underserved markets and the development of new financial products catering to evolving consumer needs will further fuel long-term growth.

Emerging Opportunities in United States Fintech Market

Emerging opportunities include the expansion of Fintech services into underserved communities, the development of innovative solutions leveraging AI and blockchain, and the growing adoption of embedded finance. The increasing demand for personalized financial products and services will also create new opportunities for Fintech companies to cater to diverse consumer needs.

Key Milestones in United States Fintech Market Industry

- January 2022: iTrustCapital established its new corporate headquarters in Irvine with USD 125 Million in funding, following a USD 125 Million Series A investment. This signifies significant growth and expansion plans.

- February 2022: Fireblocks announced plans to invest USD 100 Million in a cryptocurrency payment network, shortly after raising USD 550 Million in Series E funding. This highlights the increasing investment in cryptocurrency infrastructure.

Strategic Outlook for United States Fintech Market Market

The US Fintech market presents significant long-term growth potential. Continued innovation, strategic partnerships, and expansion into new markets will drive future success. Companies that adapt to evolving regulatory landscapes and consumer preferences will be best positioned to capitalize on the substantial opportunities within this dynamic sector. The market's trajectory indicates a bright future, emphasizing the importance of agile strategies and a focus on technological advancement.

United States Fintech Market Segmentation

-

1. Service Proposition

-

1.1. Digital Payments

- 1.1.1. Mobile POS Payments

- 1.1.2. Digital Remittance

- 1.1.3. Digital Commerce

-

1.2. Digital Investments

- 1.2.1. Neo-brokers

- 1.2.2. Robo-Advisors

- 1.3. Alternative Lending

-

1.4. Alternative Financing

- 1.4.1. Crowd Investing

- 1.4.2. Crowd Funding

- 1.5. Neo-banking

- 1.6. Online Insurance and insurance Marketplaces

-

1.1. Digital Payments

United States Fintech Market Segmentation By Geography

- 1. United States

United States Fintech Market Regional Market Share

Geographic Coverage of United States Fintech Market

United States Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growth of the E- Commerce Industry is Propelling the Fintech Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 5.1.1. Digital Payments

- 5.1.1.1. Mobile POS Payments

- 5.1.1.2. Digital Remittance

- 5.1.1.3. Digital Commerce

- 5.1.2. Digital Investments

- 5.1.2.1. Neo-brokers

- 5.1.2.2. Robo-Advisors

- 5.1.3. Alternative Lending

- 5.1.4. Alternative Financing

- 5.1.4.1. Crowd Investing

- 5.1.4.2. Crowd Funding

- 5.1.5. Neo-banking

- 5.1.6. Online Insurance and insurance Marketplaces

- 5.1.1. Digital Payments

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Stripe

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Klarna

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kraken

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Plaid

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Robinhood

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Brex

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Chime

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NYDIG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 VISA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 iTrustCapital**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Stripe

List of Figures

- Figure 1: United States Fintech Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Fintech Market Share (%) by Company 2025

List of Tables

- Table 1: United States Fintech Market Revenue billion Forecast, by Service Proposition 2020 & 2033

- Table 2: United States Fintech Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: United States Fintech Market Revenue billion Forecast, by Service Proposition 2020 & 2033

- Table 4: United States Fintech Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Fintech Market?

The projected CAGR is approximately 13.8%.

2. Which companies are prominent players in the United States Fintech Market?

Key companies in the market include Stripe, Klarna, Kraken, Plaid, Robinhood, Brex, Chime, NYDIG, VISA, iTrustCapital**List Not Exhaustive.

3. What are the main segments of the United States Fintech Market?

The market segments include Service Proposition.

4. Can you provide details about the market size?

The market size is estimated to be USD 60.4 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growth of the E- Commerce Industry is Propelling the Fintech Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2022: iTrustCapital established its new corporate headquarters in Irvine with funding of USD 125 million. The news was released two months after the company received a USD 125 million Series A growth equity investment from Left Lane Capital of New York City. The money will be used to enhance the company's offerings, grow the customer support and development teams, investigate possible strategic partnerships, and introduce new marketing avenues.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Fintech Market?

To stay informed about further developments, trends, and reports in the United States Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence