Key Insights

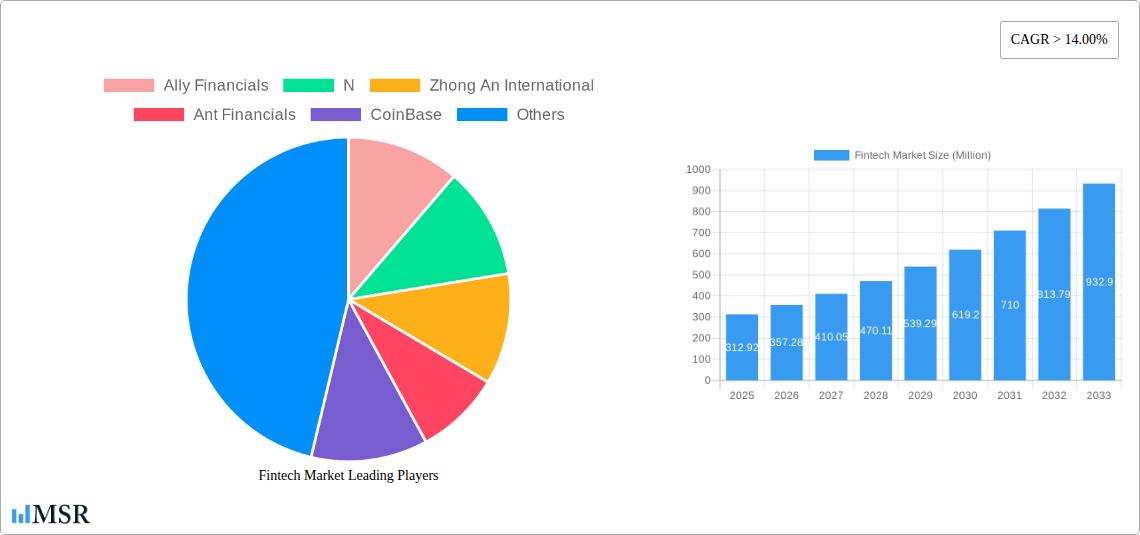

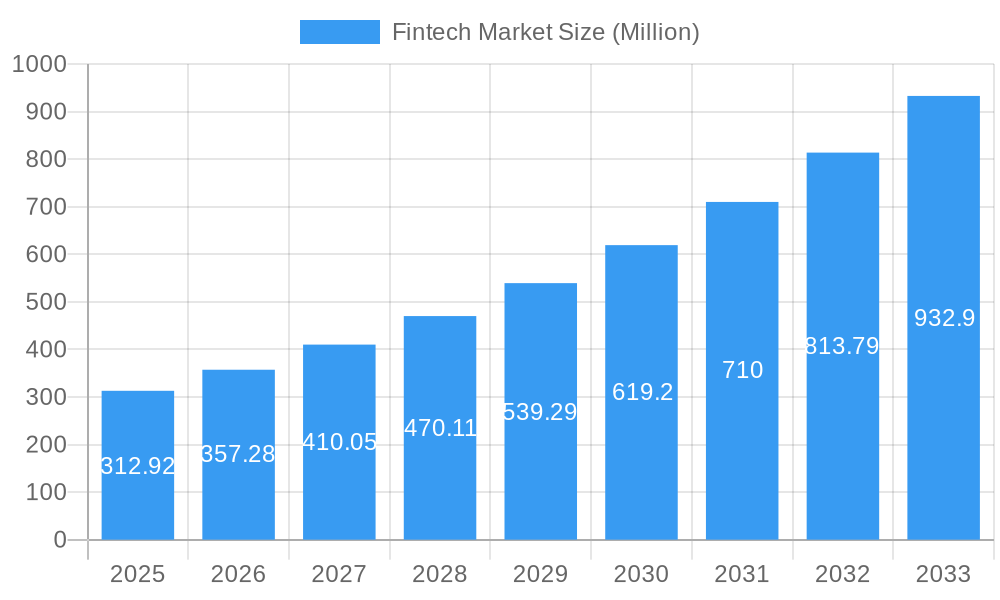

The global Fintech market is poised for explosive growth, projected to reach $312.92 million with a robust Compound Annual Growth Rate (CAGR) exceeding 14.00% from 2025 to 2033. This remarkable expansion is fueled by a confluence of powerful drivers, including the escalating adoption of digital payment solutions, the increasing demand for personalized financial services, and the persistent innovation in blockchain and artificial intelligence technologies. The market is witnessing a significant shift towards mobile-first banking and the proliferation of peer-to-peer lending platforms. Furthermore, the growing penetration of smartphones and widespread internet connectivity, particularly in emerging economies, is democratizing access to financial services, thereby accelerating market adoption. Regulatory frameworks are also evolving to support fintech innovation, creating a more conducive environment for growth. The COVID-19 pandemic has acted as a significant catalyst, accelerating the digital transformation of financial services and reinforcing consumer trust in online platforms for their financial needs.

Fintech Market Market Size (In Million)

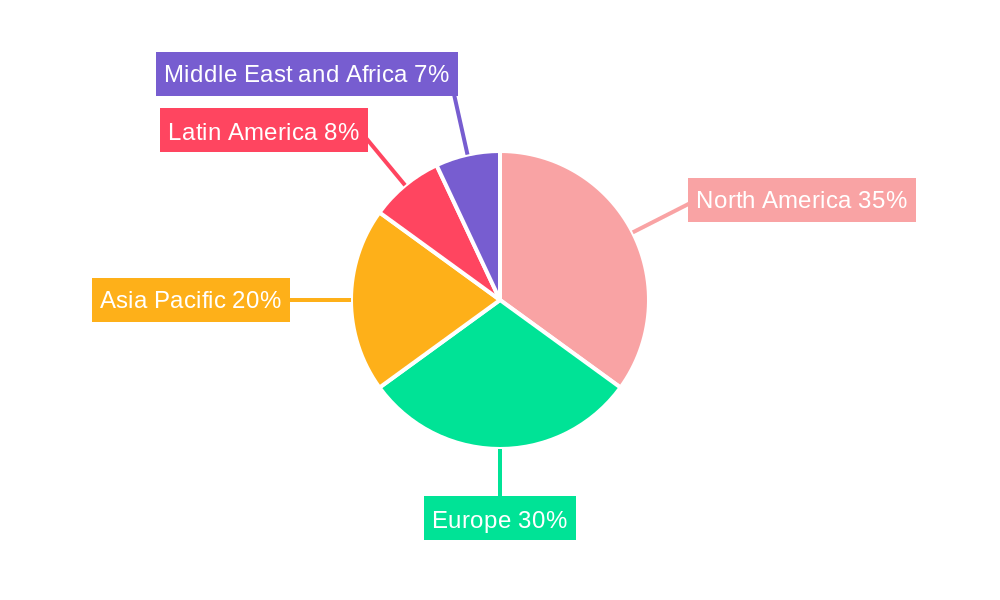

The market landscape is characterized by intense competition and strategic collaborations among established financial institutions and agile fintech startups. Key segments such as Money Transfer and Payments, Savings and Investments, and Digital Lending are experiencing substantial traction. Companies like Ant Financials, PayPal, Adyen, and Klarna are at the forefront, offering innovative solutions that cater to diverse consumer and business needs. The emergence of neobanks and insurtech companies like Atom Bank and Oscar Health further signifies the market's dynamism. Geographically, North America and Europe currently lead the market, driven by advanced technological infrastructure and high consumer adoption rates. However, the Asia Pacific region, particularly China and India, is expected to witness the fastest growth due to its large unbanked population and rapid digitalization. The market, while promising, faces restraints such as stringent regulatory compliance, data security concerns, and the need for greater financial literacy among some user segments. Addressing these challenges will be crucial for sustained and inclusive market expansion.

Fintech Market Company Market Share

Unlocking the Future of Finance: Comprehensive Fintech Market Report (2019-2033)

This in-depth Fintech Market report provides a strategic roadmap for navigating the rapidly evolving financial technology landscape. Covering the historical period of 2019-2024 and forecasting growth through 2033, with a base and estimated year of 2025, this comprehensive analysis delves into market dynamics, industry insights, key segments, and emerging opportunities. Discover actionable intelligence on market concentration, innovation, regulatory frameworks, and M&A activities, crucial for stakeholders including Ant Financials, PayPal, CoinBase, Klarna, Robinhood, SoFi, Adyen, Ally Financials, Zhong An International, Atom Bank, Oscar Health, Avant, and MANGOPAY.

Fintech Market Market Concentration & Dynamics

The Fintech market is characterized by a dynamic interplay of established financial institutions and agile disruptors, leading to moderate to high market concentration in certain segments. Innovation ecosystems are flourishing, driven by venture capital funding and strategic partnerships. Regulatory frameworks are continuously evolving to accommodate new technologies and business models, influencing market entry and operational strategies. Substitute products, ranging from traditional banking services to emerging decentralized finance (DeFi) solutions, are present, compelling fintech companies to differentiate through superior user experience, cost-effectiveness, and specialized offerings. End-user trends are shifting towards digital-first, mobile-centric financial solutions, demanding seamless integration and personalized services. Mergers and Acquisitions (M&A) activity is a significant driver of consolidation and growth, with deal counts indicating a trend towards strategic acquisitions to gain market share, acquire technological capabilities, and expand service portfolios. Key players are actively engaging in M&A to bolster their competitive positions.

Fintech Market Industry Insights & Trends

The global Fintech market is poised for substantial growth, projected to reach USD 3,500,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 20.5% during the forecast period of 2025-2033. This expansion is fueled by a confluence of factors, including the accelerating adoption of digital payment systems, the increasing demand for personalized savings and investment solutions, and the proliferation of digital lending platforms. Technological disruptions, such as Artificial Intelligence (AI), blockchain, and cloud computing, are revolutionizing service delivery, enhancing efficiency, and creating new revenue streams. Evolving consumer behaviors, characterized by a preference for convenience, transparency, and mobile-first experiences, are compelling traditional financial institutions to embrace fintech innovations. The burgeoning unbanked and underbanked populations globally represent a significant growth opportunity, as fintech solutions offer accessible and affordable financial services. Furthermore, the increasing integration of embedded finance within non-financial platforms is driving the adoption of fintech services across diverse industries. The market size in the base year of 2025 is estimated to be USD 1,000,000 Million.

Key Markets & Segments Leading Fintech Market

The Money Transfer and Payments segment is a dominant force within the Fintech market, driven by the relentless global demand for efficient, secure, and low-cost cross-border transactions and domestic payment solutions. Economic growth and increasing internet and smartphone penetration, particularly in emerging economies, serve as significant drivers for this segment. The rise of e-commerce and the growing adoption of mobile payments by consumers and businesses alike have propelled this segment to the forefront.

- Money Transfer and Payments:

- Drivers: Global e-commerce expansion, increasing smartphone adoption, demand for real-time international remittances, growth of contactless payments.

- Dominance Analysis: This segment benefits from network effects and a large existing user base. Companies like PayPal and Adyen have established robust infrastructure and partnerships, facilitating seamless transactions for millions worldwide. The convenience and speed offered by digital payment solutions have made them indispensable for both individuals and businesses.

The Savings and Investments segment is also experiencing significant traction, fueled by a growing awareness of financial planning and the accessibility of digital investment platforms.

- Savings and Investments:

- Drivers: Increased financial literacy, demand for personalized wealth management, proliferation of robo-advisors, and accessible low-cost investment options.

- Dominance Analysis: Fintech platforms are democratizing investment, making it accessible to a broader audience through user-friendly interfaces and fractional share trading. Companies like SoFi and Robinhood have disrupted traditional brokerage models, attracting a new generation of investors.

Fintech Market Product Developments

Fintech companies are continuously innovating, launching advanced products and applications that redefine financial services. Key developments include AI-powered credit scoring for Digital Lending and Lending Marketplaces, enhanced fraud detection in Money Transfer and Payments, and personalized investment algorithms in Savings and Investments. The integration of blockchain technology is enabling secure and transparent transactions, while insurtech platforms are leveraging data analytics for more accurate risk assessment in Online Insurance and Insurance Marketplaces. These innovations are driven by a focus on improving customer experience, operational efficiency, and expanding market reach, creating significant competitive edges.

Challenges in the Fintech Market Market

The Fintech market faces several challenges that can impede growth. Regulatory Hurdles remain a significant concern, with varying compliance requirements across jurisdictions impacting scalability. Cybersecurity Threats pose a constant risk, necessitating robust security measures to protect sensitive financial data and maintain customer trust. Intense Competitive Pressures from both established players and emerging startups require continuous innovation and differentiation. Supply Chain Issues, particularly for hardware-dependent fintech solutions, can also create delays and cost escalations.

Forces Driving Fintech Market Growth

The Fintech market's growth is propelled by powerful forces. Technological Advancements like AI, blockchain, and cloud computing are enabling new service offerings and operational efficiencies. Increasing Internet and Smartphone Penetration, especially in emerging economies, expands the addressable market for digital financial services. Evolving Consumer Preferences for convenience, personalization, and digital-first solutions are driving adoption. Supportive Government Initiatives and Regulatory Sandboxes in many regions are fostering innovation and market entry.

Challenges in the Fintech Market Market

Long-term growth catalysts for the Fintech market lie in fostering greater financial inclusion and expanding into underserved markets. Strategic partnerships between traditional financial institutions and fintech startups are crucial for leveraging existing infrastructure and expertise. Continued investment in research and development for cutting-edge technologies like quantum computing and advanced AI will unlock new possibilities. Furthermore, the development of interoperable payment systems and open banking frameworks will facilitate seamless integration and enhance user experience, driving sustained growth.

Emerging Opportunities in Fintech Market

Emerging opportunities in the Fintech market are abundant. The burgeoning Decentralized Finance (DeFi) space presents a transformative avenue for financial services, offering greater transparency and user control. The increasing demand for Sustainable and ESG-focused Investments is creating a niche for green fintech solutions. The expansion of Embedded Finance within non-financial platforms, such as retail and healthcare, opens up new distribution channels. Furthermore, the untapped potential of Emerging Markets in Africa and Southeast Asia, with their rapidly growing digital populations, represents significant growth prospects for accessible fintech services.

Leading Players in the Fintech Market Sector

- Ant Financials

- PayPal

- CoinBase

- Klarna

- Robinhood

- SoFi

- Adyen

- Ally Financials

- Zhong An International

- Atom Bank

- Oscar Health

- Avant

- MANGOPAY

Key Milestones in Fintech Market Industry

- March 2023: MANGOPAY and PayPal expanded their long-term strategic collaboration to give marketplaces instant access to PayPal's international payment capabilities.

- May 2022: Mastercard announced cooperation with Synctera, a renowned FinTech banking service. The firms collaborated to supply account validation solutions for Synctera-powered FinTechs using Mastercard's open banking platform.

- March 2022: Envestnet partnered up with Productfy, a developer of a business-to-business fintech platform. With this collaboration, fintech creators using Productfy's platform would have direct access to Envestnet via a single interface.

Strategic Outlook for Fintech Market Market

The strategic outlook for the Fintech market remains exceptionally bright, driven by ongoing digital transformation and evolving consumer expectations. Future market potential will be unlocked through continued innovation in AI, blockchain, and open banking, enabling more personalized and efficient financial services. Strategic opportunities lie in expanding into new geographies, particularly emerging markets, and catering to niche segments like sustainable finance and embedded finance. Collaboration and partnerships will be key to navigating regulatory complexities and accelerating market penetration. The convergence of traditional finance and technology will lead to hybrid models, offering the best of both worlds.

Fintech Market Segmentation

-

1. Service Proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending and Lending Marketplaces

- 1.4. Online Insurance and Insurance Marketplaces

- 1.5. Other Service Propositions

Fintech Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Latin America

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Mexico

- 3.4. Rest of Latin America

-

4. Asia Pacific

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. South Korea

- 4.5. Rest of Asia Pacific

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Fintech Market Regional Market Share

Geographic Coverage of Fintech Market

Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 14.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of Digital Payments; Rising Investments in FinTech Firms

- 3.3. Market Restrains

- 3.3.1. Intense Competition; Increasing Cybersecurity Risks

- 3.4. Market Trends

- 3.4.1. Surging Adoption of Digital Payments is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending and Lending Marketplaces

- 5.1.4. Online Insurance and Insurance Marketplaces

- 5.1.5. Other Service Propositions

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Latin America

- 5.2.4. Asia Pacific

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6. North America Fintech Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6.1.1. Money Transfer and Payments

- 6.1.2. Savings and Investments

- 6.1.3. Digital Lending and Lending Marketplaces

- 6.1.4. Online Insurance and Insurance Marketplaces

- 6.1.5. Other Service Propositions

- 6.1. Market Analysis, Insights and Forecast - by Service Proposition

- 7. Europe Fintech Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Proposition

- 7.1.1. Money Transfer and Payments

- 7.1.2. Savings and Investments

- 7.1.3. Digital Lending and Lending Marketplaces

- 7.1.4. Online Insurance and Insurance Marketplaces

- 7.1.5. Other Service Propositions

- 7.1. Market Analysis, Insights and Forecast - by Service Proposition

- 8. Latin America Fintech Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Proposition

- 8.1.1. Money Transfer and Payments

- 8.1.2. Savings and Investments

- 8.1.3. Digital Lending and Lending Marketplaces

- 8.1.4. Online Insurance and Insurance Marketplaces

- 8.1.5. Other Service Propositions

- 8.1. Market Analysis, Insights and Forecast - by Service Proposition

- 9. Asia Pacific Fintech Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Proposition

- 9.1.1. Money Transfer and Payments

- 9.1.2. Savings and Investments

- 9.1.3. Digital Lending and Lending Marketplaces

- 9.1.4. Online Insurance and Insurance Marketplaces

- 9.1.5. Other Service Propositions

- 9.1. Market Analysis, Insights and Forecast - by Service Proposition

- 10. Middle East and Africa Fintech Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Proposition

- 10.1.1. Money Transfer and Payments

- 10.1.2. Savings and Investments

- 10.1.3. Digital Lending and Lending Marketplaces

- 10.1.4. Online Insurance and Insurance Marketplaces

- 10.1.5. Other Service Propositions

- 10.1. Market Analysis, Insights and Forecast - by Service Proposition

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ally Financials

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 N

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Zhong An International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ant Financials

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CoinBase

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Klarna

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Robinhood

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SoFi

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Oscar Health

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Adyen

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Avant**List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Paypal

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Atom Bank

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Ally Financials

List of Figures

- Figure 1: Global Fintech Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Fintech Market Revenue (Million), by Service Proposition 2025 & 2033

- Figure 3: North America Fintech Market Revenue Share (%), by Service Proposition 2025 & 2033

- Figure 4: North America Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Fintech Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Fintech Market Revenue (Million), by Service Proposition 2025 & 2033

- Figure 7: Europe Fintech Market Revenue Share (%), by Service Proposition 2025 & 2033

- Figure 8: Europe Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Fintech Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Latin America Fintech Market Revenue (Million), by Service Proposition 2025 & 2033

- Figure 11: Latin America Fintech Market Revenue Share (%), by Service Proposition 2025 & 2033

- Figure 12: Latin America Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Latin America Fintech Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Fintech Market Revenue (Million), by Service Proposition 2025 & 2033

- Figure 15: Asia Pacific Fintech Market Revenue Share (%), by Service Proposition 2025 & 2033

- Figure 16: Asia Pacific Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Asia Pacific Fintech Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Fintech Market Revenue (Million), by Service Proposition 2025 & 2033

- Figure 19: Middle East and Africa Fintech Market Revenue Share (%), by Service Proposition 2025 & 2033

- Figure 20: Middle East and Africa Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Fintech Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 2: Global Fintech Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 4: Global Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 9: Global Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: United Kingdom Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Germany Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Europe Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 16: Global Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Brazil Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Argentina Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Mexico Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Latin America Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 22: Global Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 29: Global Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: United Arab Emirates Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Saudi Arabia Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Middle East and Africa Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fintech Market?

The projected CAGR is approximately > 14.00%.

2. Which companies are prominent players in the Fintech Market?

Key companies in the market include Ally Financials, N, Zhong An International, Ant Financials, CoinBase, Klarna, Robinhood, SoFi, Oscar Health, Adyen, Avant**List Not Exhaustive, Paypal, Atom Bank.

3. What are the main segments of the Fintech Market?

The market segments include Service Proposition.

4. Can you provide details about the market size?

The market size is estimated to be USD 312.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of Digital Payments; Rising Investments in FinTech Firms.

6. What are the notable trends driving market growth?

Surging Adoption of Digital Payments is Driving the Market.

7. Are there any restraints impacting market growth?

Intense Competition; Increasing Cybersecurity Risks.

8. Can you provide examples of recent developments in the market?

March 2023: MANGOPAY and PayPal expanded their long-term strategic collaboration to give marketplaces instant access to PayPal's international payment capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fintech Market?

To stay informed about further developments, trends, and reports in the Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence