Key Insights

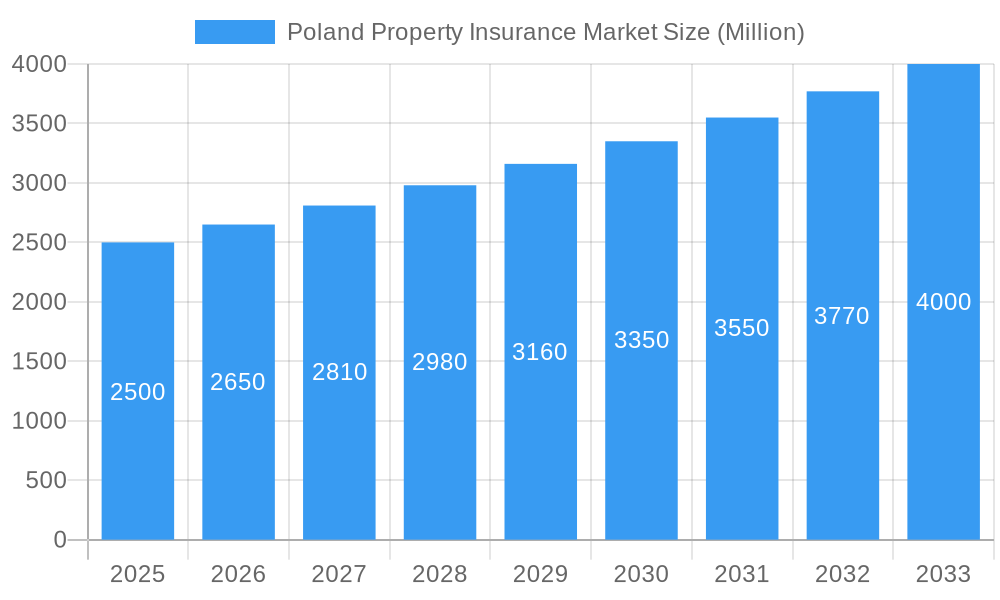

The Poland property insurance market, valued at approximately €2.5 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 6% from 2025 to 2033. This growth is fueled by several key factors. Rising construction activity and increasing urbanization are driving demand for property insurance coverage, as more individuals and businesses invest in real estate. Moreover, heightened awareness of potential risks, including natural disasters and climate change-related events, is prompting greater adoption of insurance policies. Government regulations promoting financial stability and consumer protection also contribute to market expansion. Competitive dynamics among major players like PZU, ERGO Hestia, Warta, Uniqua, Compensa, Allianz, Generali, InterRisk, AXA, and Wiener Insurance (though the list is not exhaustive) further shape the market landscape. While precise regional breakdowns are unavailable, it’s likely that larger urban centers and economically active regions experience higher insurance penetration.

Poland Property Insurance Market Market Size (In Billion)

However, certain challenges persist. Economic fluctuations can influence consumer spending on non-essential insurance products. Intense competition among insurers may lead to price wars, affecting profitability. Additionally, the market faces the challenge of effectively communicating the value proposition of insurance to segments with limited financial literacy. Overcoming these hurdles, through targeted marketing campaigns, and offering flexible and affordable insurance products will be crucial for sustained market growth. Furthermore, technological advancements in risk assessment and claims processing can improve efficiency and customer satisfaction, contributing positively to market expansion. The market's future trajectory will depend significantly on the success of insurers in adapting to evolving customer needs and leveraging technological innovations.

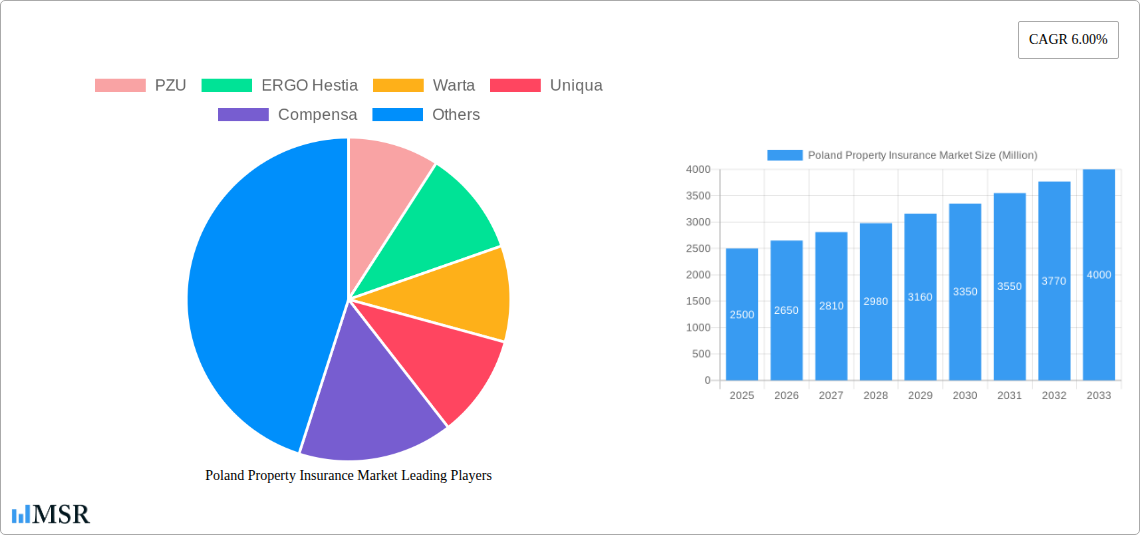

Poland Property Insurance Market Company Market Share

Poland Property Insurance Market Report: 2019-2033

This comprehensive report offers an in-depth analysis of the Poland Property Insurance Market, providing crucial insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report projects market trends and growth opportunities through 2033. The report covers key segments, competitive dynamics, and emerging opportunities within the Polish property insurance landscape. The market size in 2025 is estimated at XX Million, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033).

Poland Property Insurance Market Concentration & Dynamics

The Polish property insurance market exhibits a moderately concentrated structure, with several major players dominating the landscape. Key players include PZU, ERGO Hestia, Warta, Uniqua, Compensa, Allianz, Generali, InterRisk, AXA, and Wiener Insurance (list not exhaustive). While precise market share data for each company fluctuates year-on-year, PZU and ERGO Hestia consistently hold significant portions. The market concentration ratio (CR4) is estimated to be around XX% in 2025.

The market's dynamics are shaped by several factors:

- Innovation Ecosystems: The level of innovation varies across insurers, with some adopting advanced technologies like AI for risk assessment and claims processing more readily than others.

- Regulatory Frameworks: The Polish Financial Supervision Authority (KNF) plays a crucial role, influencing market practices and product offerings. Changes in regulations often impact competition and market stability.

- Substitute Products: Limited substitutes directly compete with traditional property insurance; however, self-insurance and risk mitigation strategies act as indirect competitors.

- End-User Trends: Increasing awareness of property risks and growing demand for customized insurance solutions drive market growth. The shift towards online insurance purchasing further shapes market dynamics.

- M&A Activities: The recent acquisition of MJM by Corsair Capital (January 2024) highlights the ongoing consolidation within the brokerage sector, indirectly affecting the broader insurance market. The number of M&A deals in the sector averaged approximately XX per year during the historical period (2019-2024).

Poland Property Insurance Market Industry Insights & Trends

The Poland Property Insurance Market experienced a period of growth during the historical period (2019-2024), driven by factors including steady economic growth and increasing urbanization leading to a greater demand for property insurance. The market size increased from XX Million in 2019 to an estimated XX Million in 2024. This growth is expected to continue, though at a potentially moderated pace compared to previous years. Technological advancements, such as the increased use of telematics and data analytics for risk assessment, are reshaping market dynamics. Consumer behavior is evolving with a greater preference for online insurance purchasing and personalized insurance solutions. Rising consumer awareness of risk management and the increasing penetration of insurance products among younger demographics are additional significant factors. Market expansion into underserved segments also offers considerable potential.

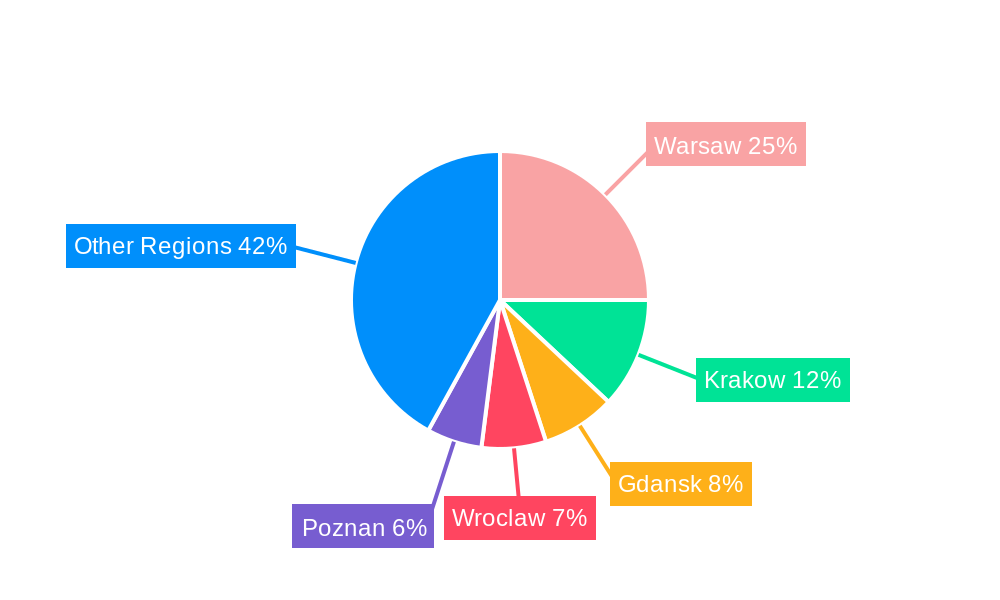

Key Markets & Segments Leading Poland Property Insurance Market

While detailed regional breakdowns require specific data, the major urban centers (Warsaw, Krakow, etc.) likely represent the most significant segments of the Polish property insurance market. These regions benefit from higher property values, increased construction activity, and a concentrated population base.

- Drivers of Dominance:

- Economic Growth: Stronger economic regions directly correlate with higher property values and insurance premiums.

- Infrastructure Development: Areas with significant infrastructure projects inherently increase the demand for property insurance.

- Population Density: Highly populated urban centers naturally have a larger customer base.

Dominance analysis reveals a strong correlation between the geographic distribution of wealth and property values and the concentration of insurance premiums within specific regions. Further research is necessary to pinpoint precise market share percentages for individual regions or cities.

Poland Property Insurance Market Product Developments

Recent product developments in the Polish property insurance market have focused on enhancing customer experience through digital platforms, integrating advanced analytics for more precise risk assessment, and offering customized insurance packages tailored to specific client needs. Insurers are increasingly integrating telematics and IoT data to better understand and manage risks. This leads to more competitive pricing and improved risk management strategies for consumers.

Challenges in the Poland Property Insurance Market Market

The Polish property insurance market faces several challenges:

- Regulatory Hurdles: Compliance with evolving regulations can be costly and time-consuming.

- Competitive Pressures: Intense competition among insurers, especially within the commercial segment, can pressure profit margins.

- Economic Fluctuations: Economic downturns can impact consumer spending on insurance products. For example, during the 2020 economic slowdown, the market growth rate temporarily reduced by XX%.

- Claims Management: Effectively managing claims processes and mitigating fraudulent claims remains a significant concern.

Forces Driving Poland Property Insurance Market Growth

Several factors are driving growth:

- Technological advancements: AI and big data analytics are improving risk assessment and claims processing.

- Economic growth: A growing economy typically correlates with increased property values and demand for insurance.

- Government initiatives: Policy support for insurance penetration can boost market growth. The government's initiative to promote financial inclusion could drive market growth in under-insured segments.

Long-Term Growth Catalysts in the Poland Property Insurance Market

Long-term growth will be fueled by innovations in product offerings, strategic partnerships between insurers and other businesses (like banks), and expansions into niche markets and underserved segments. The rising demand for specialized insurance products like those covering cyber risks or climate change-related events will contribute to the market’s growth.

Emerging Opportunities in Poland Property Insurance Market

Emerging opportunities include:

- Expansion into rural areas: Underinsured rural populations present a substantial market opportunity.

- Developing specialized products: Customized policies for specific property types (e.g., renewable energy installations) are emerging.

- Leveraging technology: AI and machine learning to improve risk assessment and streamline claims processes.

Leading Players in the Poland Property Insurance Market Sector

- PZU

- ERGO Hestia

- Warta

- Uniqua

- Compensa

- Allianz

- Generali

- InterRisk

- AXA

- Wiener Insurance

Key Milestones in Poland Property Insurance Market Industry

- January 2024: Corsair Capital acquires a majority stake in MJM, a commercial insurance broker, signifying increased consolidation within the brokerage sector.

- February 2023: Talanx partners with Bank Millennium for a ten-year bancassurance agreement, broadening its reach in the Polish market.

Strategic Outlook for Poland Property Insurance Market Market

The Poland Property Insurance Market is poised for continued growth, driven by technological advancements, economic expansion, and evolving consumer preferences. Strategic opportunities lie in leveraging digital technologies, expanding into underserved segments, and developing innovative insurance products to meet the changing needs of the market. Companies that effectively adapt to these changes will be best positioned for long-term success.

Poland Property Insurance Market Segmentation

-

1. Product Type

- 1.1. Motor Insurance

- 1.2. Property Insurance

- 1.3. General Liability Insurance

- 1.4. Other P&Cs

-

2. Distribution Channel

- 2.1. Agents

- 2.2. Brokers

- 2.3. Banks

- 2.4. Other Distribution Channels

Poland Property Insurance Market Segmentation By Geography

- 1. Poland

Poland Property Insurance Market Regional Market Share

Geographic Coverage of Poland Property Insurance Market

Poland Property Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in motor vehicle Insurance driving the Market.; Decline in Motor vehicle accidents and Casualties increasing insurers profit.

- 3.3. Market Restrains

- 3.3.1. Rise in motor vehicle Insurance driving the Market.; Decline in Motor vehicle accidents and Casualties increasing insurers profit.

- 3.4. Market Trends

- 3.4.1. Rising Motor Vehicle Insurance is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Property Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Motor Insurance

- 5.1.2. Property Insurance

- 5.1.3. General Liability Insurance

- 5.1.4. Other P&Cs

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Agents

- 5.2.2. Brokers

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PZU

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ERGO Hestia

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Warta

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uniqua

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Compensa

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Allianz

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Generali

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 InterRisk

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AXA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wiener Insurance**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PZU

List of Figures

- Figure 1: Poland Property Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Poland Property Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Poland Property Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Poland Property Insurance Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Poland Property Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Poland Property Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Poland Property Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Poland Property Insurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Poland Property Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Poland Property Insurance Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: Poland Property Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Poland Property Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Poland Property Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Poland Property Insurance Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Property Insurance Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Poland Property Insurance Market?

Key companies in the market include PZU, ERGO Hestia, Warta, Uniqua, Compensa, Allianz, Generali, InterRisk, AXA, Wiener Insurance**List Not Exhaustive.

3. What are the main segments of the Poland Property Insurance Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in motor vehicle Insurance driving the Market.; Decline in Motor vehicle accidents and Casualties increasing insurers profit..

6. What are the notable trends driving market growth?

Rising Motor Vehicle Insurance is Driving the Market.

7. Are there any restraints impacting market growth?

Rise in motor vehicle Insurance driving the Market.; Decline in Motor vehicle accidents and Casualties increasing insurers profit..

8. Can you provide examples of recent developments in the market?

In January 2024, Corsair Capital acquired a majority stake in independent commercial insurance broker MJM. Property and liability (P&C), commercial auto, and reinsurance are among the services offered by MJM.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Property Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Property Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Property Insurance Market?

To stay informed about further developments, trends, and reports in the Poland Property Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence