Key Insights

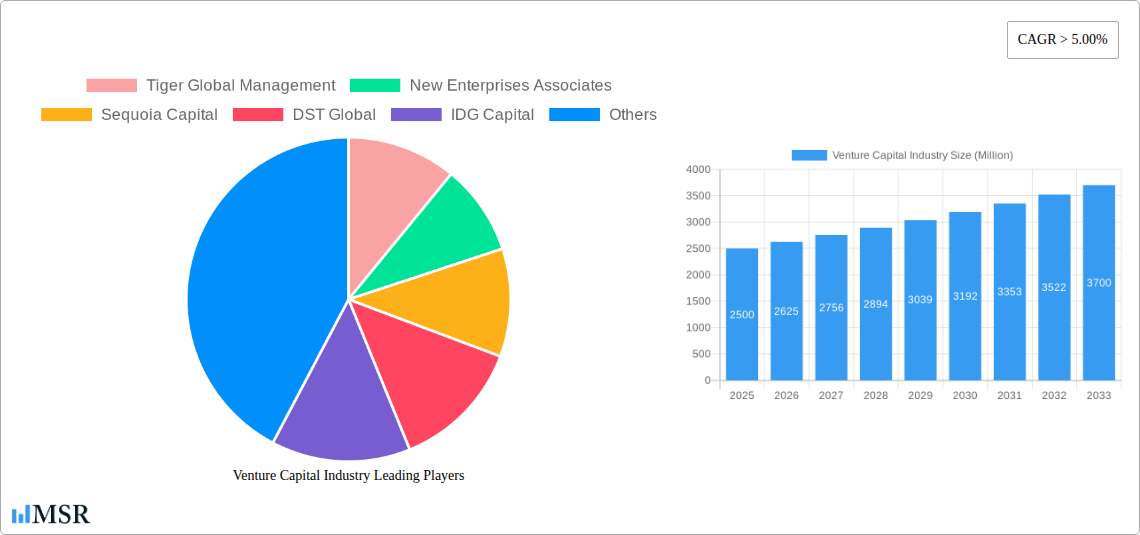

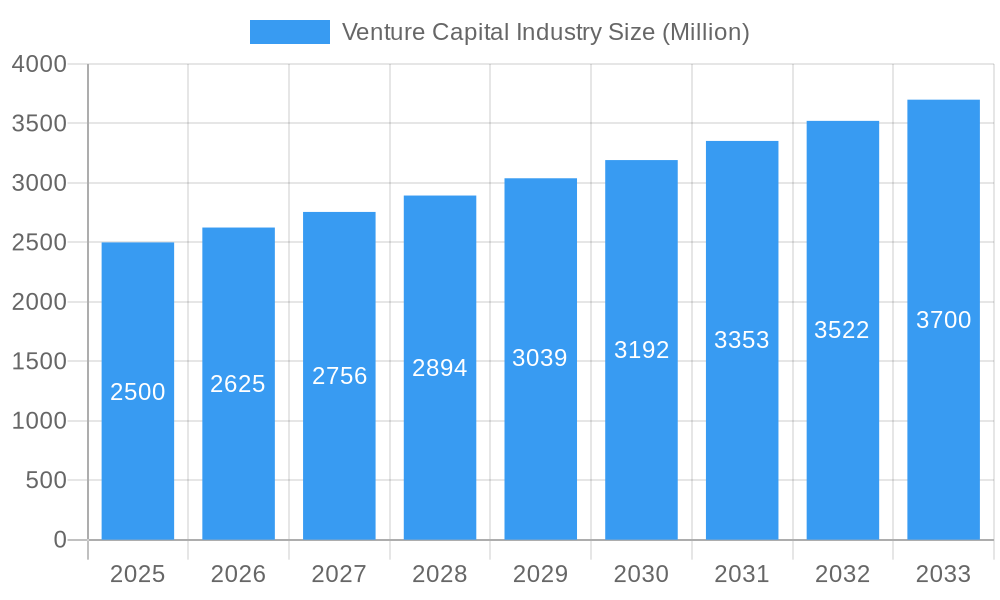

The Venture Capital (VC) industry is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) exceeding 5% from 2019 to 2033. This expansion is fueled by several key drivers. Firstly, the increasing number of innovative startups across various sectors, particularly technology, healthcare, and renewable energy, necessitates significant funding. Secondly, a favorable regulatory environment in many regions, coupled with government initiatives promoting entrepreneurship, further stimulates VC investment. Thirdly, the rise of sophisticated investment strategies, including angel investing and crowdfunding, diversifies funding sources and fuels competition, leading to overall market expansion. Major players like Tiger Global Management, Sequoia Capital, and others aggressively pursue high-growth potential, driving this expansion. However, economic downturns and geopolitical instability pose significant restraints, potentially impacting investor confidence and deal flow. While precise market segmentation data is unavailable, we can assume substantial allocation towards technology, followed by healthcare and potentially renewable energy, based on current industry trends.

Venture Capital Industry Market Size (In Billion)

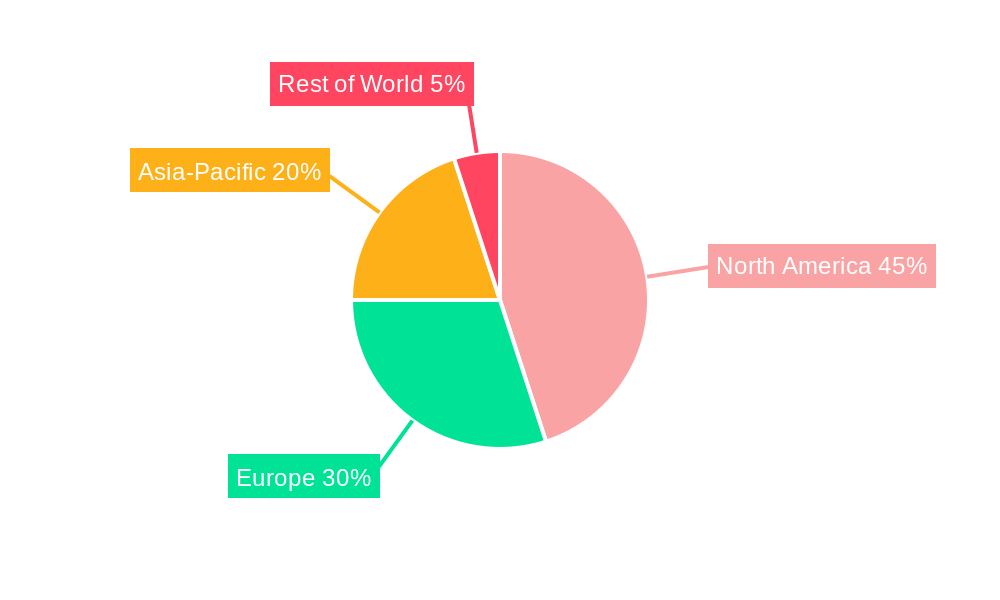

The forecast period (2025-2033) anticipates continued growth, driven by ongoing technological advancements and the maturation of previously funded ventures leading to further rounds of funding. While the base year of 2025 is estimated to be a pivotal year, showcasing the industry's strength, the subsequent years are projected to show a steady upward trajectory, although the rate of growth may fluctuate based on macroeconomic conditions. The geographical distribution of VC investment likely reflects a concentration in North America and Europe, with Asia-Pacific witnessing significant, albeit potentially uneven, growth. The continued involvement of prominent VC firms indicates their confidence in the long-term potential of the sector. Therefore, while challenges remain, the long-term outlook for the VC industry remains positive, demonstrating its vital role in fostering innovation and economic growth.

Venture Capital Industry Company Market Share

Venture Capital Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Venture Capital (VC) industry, offering actionable insights for investors, entrepreneurs, and industry stakeholders. We analyze market dynamics, key trends, leading players, and emerging opportunities, projecting growth from 2019 to 2033, with a focus on the estimated year 2025. The report leverages data from the historical period (2019-2024), the base year (2025), and forecasts the market through 2033. Expect in-depth coverage of key players including Tiger Global Management, New Enterprises Associates, Sequoia Capital, DST Global, IDG Capital, Index Ventures, Healthcare Royalty Partners, GGV Capital, Nanjing Zijin Investment, and Greylock Partners (list not exhaustive). The report covers billions of dollars in investments and deals, revealing the market's concentration, growth drivers, and future potential.

Venture Capital Industry Market Concentration & Dynamics

The Venture Capital industry exhibits a concentrated market structure, with a few dominant players commanding significant market share. While precise market share figures for each firm fluctuate, Sequoia Capital, Tiger Global Management, and Andreessen Horowitz consistently rank among the top firms globally, managing billions of dollars in assets under management (AUM). This concentration is driven by several factors:

- Network Effects: Leading VC firms benefit from strong networks, attracting top-tier entrepreneurs and facilitating subsequent funding rounds.

- Brand Recognition: Established brands attract both investors and entrepreneurs, creating a self-reinforcing cycle of success.

- Expertise and Resources: Top-tier firms possess extensive industry expertise and access to resources, improving their deal sourcing and due diligence capabilities.

The industry’s dynamics are characterized by intense competition, frequent mergers and acquisitions (M&A) activity, and continuous innovation within the investment strategies employed by these firms. In recent years, the number of M&A deals within the VC industry has remained relatively stable at approximately xx deals annually, reflecting a steady consolidation. This consolidation further intensifies market concentration. The regulatory environment, although evolving, generally supports the VC industry's growth, with recent regulatory changes focused on transparency and investor protection rather than significant restrictions. Substitute products, such as angel investors or crowdfunding platforms, cater to different market segments, but do not present a significant challenge to the dominance of major VC firms. End-user trends, such as increased focus on ESG (Environmental, Social, and Governance) investments, are influencing the investment strategies of VC firms, driving innovation within the space.

Venture Capital Industry Industry Insights & Trends

The Venture Capital industry has experienced significant growth, driven by several key factors. Between 2019 and 2024, the global VC market grew at a Compound Annual Growth Rate (CAGR) of xx%, reaching an estimated market size of USD xx billion in 2024. This growth is projected to continue, with a forecasted CAGR of xx% from 2025 to 2033, resulting in a market size of USD xx billion by 2033. Several factors contribute to this growth trajectory:

- Technological Disruptions: Rapid technological advancements, particularly in areas such as artificial intelligence, biotechnology, and fintech, create numerous investment opportunities.

- Increased Availability of Capital: Lower interest rates and increased institutional investor participation have fueled higher levels of investment capital within the sector.

- Evolving Consumer Behaviors: Shifting consumer preferences, such as increased demand for digital services and sustainable products, are driving investment in innovative companies that address these evolving demands.

- Government Initiatives: Many governments have implemented policies to foster innovation and entrepreneurship, which further stimulate VC investment.

Key Markets & Segments Leading Venture Capital Industry

The Americas, particularly the United States, continue to be the dominant region for VC investment, accounting for a significant portion of global investment activity. This dominance is attributable to:

- Strong Innovation Ecosystem: The US boasts a robust ecosystem of universities, research institutions, and established companies that foster innovation and entrepreneurial activity.

- Abundant Capital: Significant capital availability from both domestic and international sources fuels continuous investment.

- Supportive Regulatory Environment: A generally supportive regulatory framework encourages entrepreneurship and investment.

- Deep Talent Pool: The US possesses a significant pool of highly skilled tech talent, attracting startups and VC investment.

Europe is also a significant market for VC investment, experiencing notable growth in recent years. Asia, particularly China and India, have also emerged as major players, but the regulatory environment presents considerable variations and influences. Specific drivers for dominance in key segments are detailed in the full report.

Venture Capital Industry Product Developments

Significant product innovations have been seen in VC investment strategies themselves. The rise of thematic investing, impact investing, and specialized funds catering to specific technological niches represents a key development. These innovations enhance specialization, increase due diligence efficiency, and allow for a sharper focus on emerging investment trends. Furthermore, the use of data analytics and artificial intelligence in investment decision-making processes is gaining traction, enabling more data-driven and potentially higher-return investments. These technological advancements provide VC firms with a significant competitive edge.

Challenges in the Venture Capital Industry Market

Several challenges face the VC industry. Geopolitical instability can significantly impact investment flows and market valuations. Regulatory changes, particularly those concerning data privacy and cybersecurity, impose compliance costs on invested companies. Competition for high-quality deals remains fierce, requiring VC firms to continuously innovate and refine their investment strategies. High valuations in certain sectors create the potential for market corrections, leading to short-term investment losses.

Forces Driving Venture Capital Industry Growth

The VC industry’s long-term growth is driven by continuous technological innovation, generating new investment opportunities across multiple sectors. Furthermore, increasing availability of capital from various sources, including sovereign wealth funds and pension funds, fuels investment expansion. The supportive regulatory environment in many regions, while undergoing changes, generally encourages entrepreneurship and innovation.

Long-Term Growth Catalysts in the Venture Capital Industry

The long-term growth of the VC industry hinges on emerging technologies such as artificial intelligence, quantum computing, and biotechnology. Strategic partnerships between VC firms and large corporations can facilitate technology commercialization and generate further investment opportunities. The expansion into new and emerging markets, particularly in developing economies, offers significant potential for growth.

Emerging Opportunities in Venture Capital Industry

Emerging opportunities lie in sustainable and environmentally conscious investments. Investments in technologies addressing climate change and promoting sustainability are likely to gain momentum in the coming years. Further opportunities exist in frontier technologies like blockchain and the metaverse, driving innovation within the investment space. Investments in healthtech and the development of innovative healthcare solutions are expected to see strong growth.

Leading Players in the Venture Capital Industry Sector

- Tiger Global Management

- New Enterprises Associates

- Sequoia Capital

- DST Global

- IDG Capital

- Index Ventures

- Healthcare Royalty Partners

- GGV Capital

- Nanjing Zijin Investment

- Greylock Partners

Key Milestones in Venture Capital Industry Industry

- 2020 Q4: The Americas accounted for USD 41 billion in VC investment across 2,725 deals, with the US leading at USD 38.8 billion across 2,526 deals. This highlighted the continued dominance of the US market.

- 2020 Q4: Europe recorded a second consecutive quarterly record, with USD 14.3 billion raised across 1,192 deals, demonstrating strong growth in the European VC market.

- 2022: IDG Capital Vietnam's investment in METAIN signals the growing interest in NFT-empowered real estate and its potential to transform the industry. This highlights the adoption of new technologies within the real estate sector.

Strategic Outlook for Venture Capital Industry Market

The Venture Capital industry is poised for continued growth, driven by technological advancements and increased capital availability. Strategic opportunities exist in leveraging data analytics, expanding into new markets, and focusing on sustainable and impact investing. The long-term outlook remains positive, albeit subject to macroeconomic factors and geopolitical events. Further sector-specific analysis is detailed in the full report.

Venture Capital Industry Segmentation

-

1. Type

- 1.1. Local Investors

- 1.2. International Investors

-

2. Industry

- 2.1. Real Estate

- 2.2. Financial Services

- 2.3. Food & Beverages

- 2.4. Healthcare

- 2.5. Transport & Logistics

- 2.6. IT & ITeS

- 2.7. Education

- 2.8. Other Industries

Venture Capital Industry Segmentation By Geography

- 1. North America

- 2. Latin America

- 3. Europe

- 4. Asia Pacific

- 5. Middle East and Africa

Venture Capital Industry Regional Market Share

Geographic Coverage of Venture Capital Industry

Venture Capital Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Distribution of Start-Ups Witnessing Venture Capital Industry Globally

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Venture Capital Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Local Investors

- 5.1.2. International Investors

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Real Estate

- 5.2.2. Financial Services

- 5.2.3. Food & Beverages

- 5.2.4. Healthcare

- 5.2.5. Transport & Logistics

- 5.2.6. IT & ITeS

- 5.2.7. Education

- 5.2.8. Other Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Latin America

- 5.3.3. Europe

- 5.3.4. Asia Pacific

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Venture Capital Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Local Investors

- 6.1.2. International Investors

- 6.2. Market Analysis, Insights and Forecast - by Industry

- 6.2.1. Real Estate

- 6.2.2. Financial Services

- 6.2.3. Food & Beverages

- 6.2.4. Healthcare

- 6.2.5. Transport & Logistics

- 6.2.6. IT & ITeS

- 6.2.7. Education

- 6.2.8. Other Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Latin America Venture Capital Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Local Investors

- 7.1.2. International Investors

- 7.2. Market Analysis, Insights and Forecast - by Industry

- 7.2.1. Real Estate

- 7.2.2. Financial Services

- 7.2.3. Food & Beverages

- 7.2.4. Healthcare

- 7.2.5. Transport & Logistics

- 7.2.6. IT & ITeS

- 7.2.7. Education

- 7.2.8. Other Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Venture Capital Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Local Investors

- 8.1.2. International Investors

- 8.2. Market Analysis, Insights and Forecast - by Industry

- 8.2.1. Real Estate

- 8.2.2. Financial Services

- 8.2.3. Food & Beverages

- 8.2.4. Healthcare

- 8.2.5. Transport & Logistics

- 8.2.6. IT & ITeS

- 8.2.7. Education

- 8.2.8. Other Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Asia Pacific Venture Capital Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Local Investors

- 9.1.2. International Investors

- 9.2. Market Analysis, Insights and Forecast - by Industry

- 9.2.1. Real Estate

- 9.2.2. Financial Services

- 9.2.3. Food & Beverages

- 9.2.4. Healthcare

- 9.2.5. Transport & Logistics

- 9.2.6. IT & ITeS

- 9.2.7. Education

- 9.2.8. Other Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Venture Capital Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Local Investors

- 10.1.2. International Investors

- 10.2. Market Analysis, Insights and Forecast - by Industry

- 10.2.1. Real Estate

- 10.2.2. Financial Services

- 10.2.3. Food & Beverages

- 10.2.4. Healthcare

- 10.2.5. Transport & Logistics

- 10.2.6. IT & ITeS

- 10.2.7. Education

- 10.2.8. Other Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tiger Global Management

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 New Enterprises Associates

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sequoia Capital

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DST Global

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IDG Capital

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Index Ventures

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Healthcare Royalty Partners

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GGV Capital

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nanjing Zijin Investment

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Greylock Partners**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tiger Global Management

List of Figures

- Figure 1: Global Venture Capital Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Venture Capital Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Venture Capital Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Venture Capital Industry Revenue (Million), by Industry 2025 & 2033

- Figure 5: North America Venture Capital Industry Revenue Share (%), by Industry 2025 & 2033

- Figure 6: North America Venture Capital Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Venture Capital Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Latin America Venture Capital Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Latin America Venture Capital Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Latin America Venture Capital Industry Revenue (Million), by Industry 2025 & 2033

- Figure 11: Latin America Venture Capital Industry Revenue Share (%), by Industry 2025 & 2033

- Figure 12: Latin America Venture Capital Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Latin America Venture Capital Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Venture Capital Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Venture Capital Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Venture Capital Industry Revenue (Million), by Industry 2025 & 2033

- Figure 17: Europe Venture Capital Industry Revenue Share (%), by Industry 2025 & 2033

- Figure 18: Europe Venture Capital Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Venture Capital Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Asia Pacific Venture Capital Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Pacific Venture Capital Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Venture Capital Industry Revenue (Million), by Industry 2025 & 2033

- Figure 23: Asia Pacific Venture Capital Industry Revenue Share (%), by Industry 2025 & 2033

- Figure 24: Asia Pacific Venture Capital Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Venture Capital Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Venture Capital Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Venture Capital Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Venture Capital Industry Revenue (Million), by Industry 2025 & 2033

- Figure 29: Middle East and Africa Venture Capital Industry Revenue Share (%), by Industry 2025 & 2033

- Figure 30: Middle East and Africa Venture Capital Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Venture Capital Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Venture Capital Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Venture Capital Industry Revenue Million Forecast, by Industry 2020 & 2033

- Table 3: Global Venture Capital Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Venture Capital Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Venture Capital Industry Revenue Million Forecast, by Industry 2020 & 2033

- Table 6: Global Venture Capital Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Venture Capital Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Venture Capital Industry Revenue Million Forecast, by Industry 2020 & 2033

- Table 9: Global Venture Capital Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Venture Capital Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Venture Capital Industry Revenue Million Forecast, by Industry 2020 & 2033

- Table 12: Global Venture Capital Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Venture Capital Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Venture Capital Industry Revenue Million Forecast, by Industry 2020 & 2033

- Table 15: Global Venture Capital Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Venture Capital Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Venture Capital Industry Revenue Million Forecast, by Industry 2020 & 2033

- Table 18: Global Venture Capital Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Venture Capital Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Venture Capital Industry?

Key companies in the market include Tiger Global Management, New Enterprises Associates, Sequoia Capital, DST Global, IDG Capital, Index Ventures, Healthcare Royalty Partners, GGV Capital, Nanjing Zijin Investment, Greylock Partners**List Not Exhaustive.

3. What are the main segments of the Venture Capital Industry?

The market segments include Type, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Distribution of Start-Ups Witnessing Venture Capital Industry Globally.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In 2022, IDG Capital Vietnam Confirms Investment in METAIN to Lead NFT-Empowered Real Estate Trend in Vietnam. IDG Capital also shows its ambition to lead the NFT Real estate trend and reveals its plan to proactively engage with global investors to attract investment into the Vietnam real estate market. With the high security, instantaneous settlement, transparent, seamless transaction process, blockchain, smart contract, and NFT (Non-fungible token) technology is transforming the real estate industry and will become the key trend in the next decades.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Venture Capital Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Venture Capital Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Venture Capital Industry?

To stay informed about further developments, trends, and reports in the Venture Capital Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence