Key Insights

The European neobanking market is projected for substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of 48.9% from 2025 to 2033. This expansion is driven by digitally native consumers (Millennials and Gen Z) embracing convenient, transparent, and cost-effective mobile-first banking. Technological advancements, including fintech innovations and open banking APIs, empower neobanks to deliver superior user experiences with seamless integrations and personalized financial tools. The competitive landscape, featuring established players like Revolut, N26, and Monzo, alongside emerging regional providers, fuels continuous innovation. Key market challenges include navigating regulatory complexities, addressing cybersecurity risks, and mitigating potential market saturation. Market segmentation is anticipated to be diverse across customer demographics, service offerings (personal and business banking), and European regions. While precise 2025 market sizing is constrained by limited historical data, current trends suggest a significant market value, estimated at 210.16 billion by 2025.

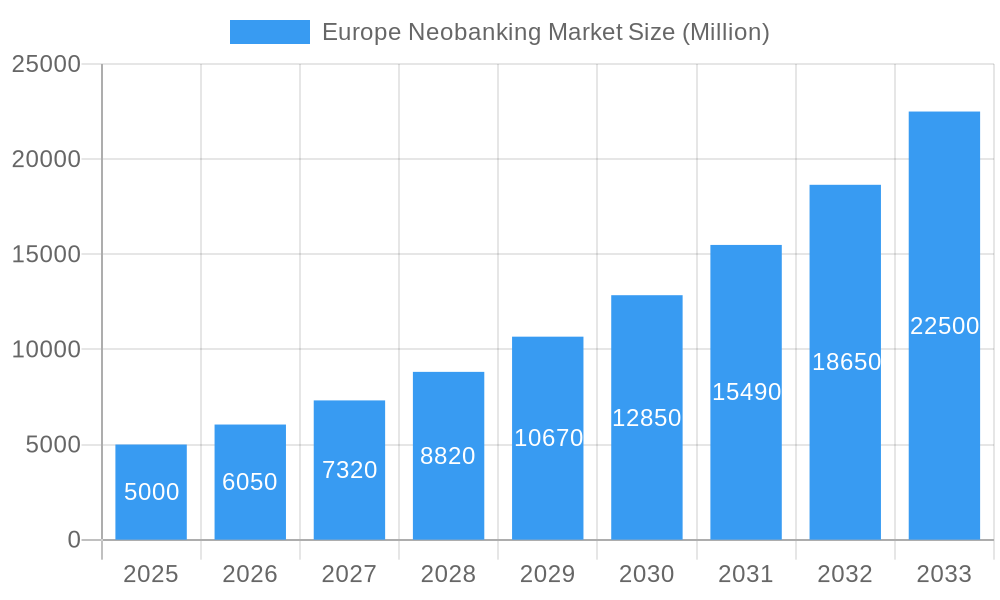

Europe Neobanking Market Market Size (In Billion)

Looking ahead, the European neobanking sector is set for sustained expansion, propelled by technological progress, shifting consumer demands, and evolving regulatory frameworks. The market will likely see a greater emphasis on advanced financial products, such as wealth management, investment solutions, and embedded finance. Neobanks must prioritize security and data privacy to build and maintain customer trust amidst increasing regulatory scrutiny. Strategic collaborations and mergers/acquisitions will be instrumental in shaping the competitive arena and facilitating market consolidation. Success will hinge on balancing innovation, regulatory compliance, and customer-centricity in this vibrant and competitive market.

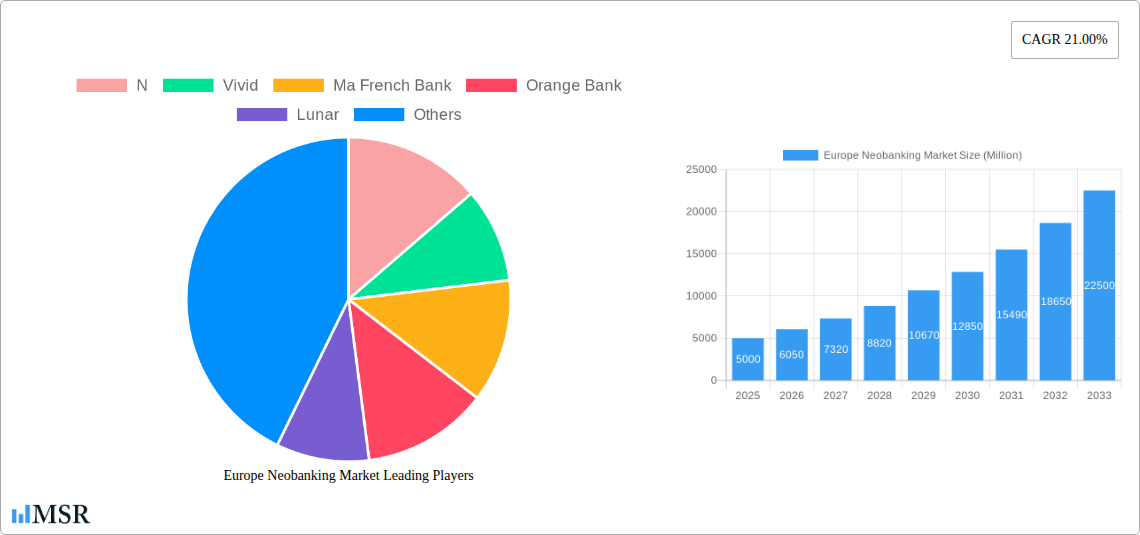

Europe Neobanking Market Company Market Share

Europe Neobanking Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic Europe neobanking market, offering invaluable insights for industry stakeholders, investors, and strategists. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market concentration, growth drivers, emerging opportunities, and key challenges. The report leverages historical data (2019-2024) to project future market trends, offering actionable intelligence to navigate this rapidly evolving landscape. The report includes detailed analysis of key players including but not limited to N26, Revolut, Vivid, Ma French Bank, Orange Bank, Lunar, Bnext, Holvi, Monzo Bank Ltd, Atom Bank Plc, and Bunq.

Europe Neobanking Market Market Concentration & Dynamics

This section analyzes the competitive landscape, innovation ecosystems, regulatory frameworks, and market dynamics within the European neobanking sector. We delve into market share analysis, identifying dominant players and assessing their strategic moves. The report examines the impact of mergers and acquisitions (M&A) activities, quantifying deal counts and assessing their influence on market consolidation. We also explore the evolving regulatory landscape and its impact on market growth.

- Market Concentration: The European neobanking market exhibits a moderately concentrated structure, with a few key players commanding significant market share, while a larger number of smaller players compete for niche segments. The estimated market share of the top 5 players in 2025 is xx%.

- Innovation Ecosystems: A thriving ecosystem of fintech startups, established financial institutions, and technology providers fuels continuous innovation. Collaborations and partnerships are common, driving the development of new products and services.

- Regulatory Frameworks: Regulatory frameworks vary across European countries, creating both opportunities and challenges. Compliance requirements and licensing processes can impact market entry and expansion strategies. Ongoing regulatory changes will influence the competitive dynamics.

- Substitute Products: Traditional banking services and other digital financial solutions remain significant substitute products, impacting market penetration rates.

- End-User Trends: The increasing adoption of mobile banking, coupled with rising demand for personalized financial solutions, fuels market growth. Changing consumer preferences and expectations drive innovation.

- M&A Activities: The number of M&A deals in the European neobanking market has increased significantly in recent years, driven by consolidation and strategic expansion. We project xx M&A deals in 2025.

Europe Neobanking Market Industry Insights & Trends

This section provides a comprehensive overview of the European neobanking market, analyzing market size, growth drivers, technological disruptions, and evolving consumer behaviors. We examine the factors that are driving market expansion and explore potential future trends. The report provides detailed insights into market size and compound annual growth rate (CAGR).

The European neobanking market is experiencing robust growth, fueled by increasing smartphone penetration, the rising adoption of digital financial services, and a growing preference for seamless and personalized banking experiences. Technological advancements, such as open banking and AI-powered solutions, are further accelerating market expansion. The estimated market size in 2025 is xx Million, with a projected CAGR of xx% from 2025 to 2033. The market's growth is also driven by increasing financial inclusion initiatives, particularly targeting underbanked and unbanked populations. Furthermore, the growing adoption of mobile payment solutions and embedded finance is creating new opportunities for neobanks. However, challenges remain, including regulatory uncertainties and the need to address security and privacy concerns.

Key Markets & Segments Leading Europe Neobanking Market

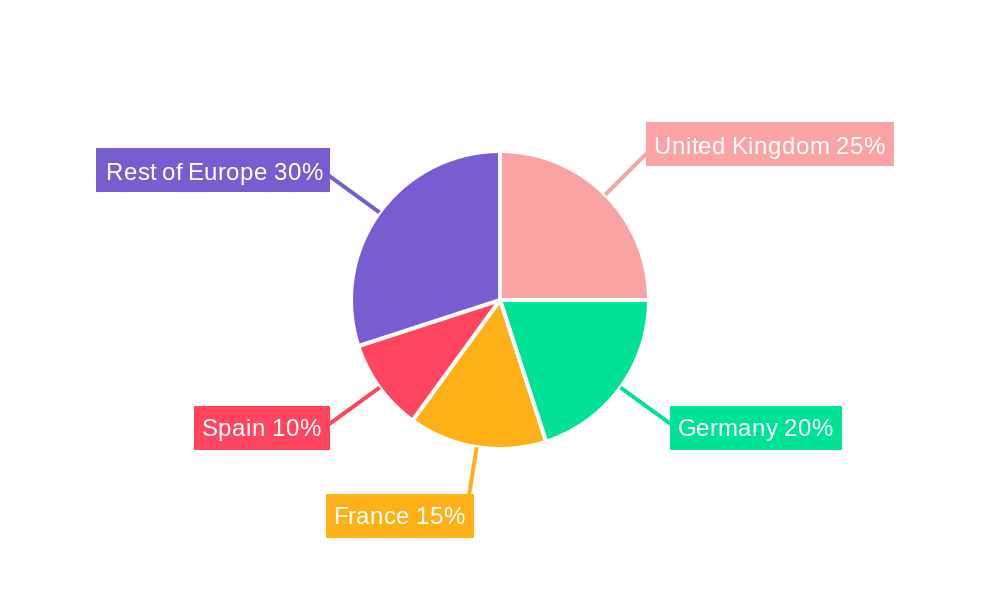

This section identifies the dominant regions, countries, and market segments within the European neobanking market. We analyze factors driving growth in these key areas, providing a granular understanding of market dynamics.

Dominant Region/Country: The UK and Germany currently represent the largest markets for neobanks in Europe, driven by strong digital adoption rates, a vibrant fintech ecosystem, and favorable regulatory environments. However, other countries like France, Spain and the Nordics are also showing significant growth.

Drivers of Dominance:

- High Smartphone Penetration: High smartphone penetration in leading markets creates a fertile ground for mobile-first neobanks.

- Strong Digital Adoption: A digitally savvy population readily embraces innovative financial solutions.

- Favorable Regulatory Environment: Supportive regulatory frameworks encourage innovation and competition.

- Established Fintech Ecosystem: A thriving ecosystem fosters collaboration, investment, and rapid development.

- Economic Growth: Strong economic performance supports greater financial activity and consumer spending, driving demand for financial services.

- Infrastructure: Robust digital infrastructure, including high-speed internet and reliable mobile networks, facilitates access to digital banking services.

Europe Neobanking Market Product Developments

The European neobanking market is characterized by continuous product innovation. Neobanks are constantly developing new features and services to enhance user experience, expand their offerings, and stay ahead of the competition. Recent innovations include advanced personalized financial management tools, AI-powered fraud detection systems, and seamless integration with third-party applications. These advancements provide competitive advantages and cater to evolving customer expectations. Furthermore, the integration of blockchain technology is also being explored to provide improved security and transparency in transactions.

Challenges in the Europe Neobanking Market Market

The European neobanking market faces several challenges that impact its growth and sustainability. These include regulatory hurdles, cybersecurity threats, and intense competition from established banks and other fintech companies. Regulatory compliance costs can be substantial, and the ever-evolving regulatory landscape requires constant adaptation. Cybersecurity remains a critical concern, requiring significant investment in robust security infrastructure and systems. Competition is fierce, putting pressure on margins and requiring constant innovation to differentiate offerings. The estimated impact of these challenges on market growth is xx% in 2025.

Forces Driving Europe Neobanking Market Growth

Several key factors fuel the growth of the European neobanking market. These include technological advancements, favorable economic conditions, and supportive regulatory initiatives. Specifically, the increasing adoption of mobile technology, the rise of open banking APIs, and the growing demand for personalized financial services are creating significant growth opportunities. Furthermore, government initiatives promoting financial inclusion and digitalization are boosting market expansion.

Long-Term Growth Catalysts in Europe Neobanking Market

The long-term growth trajectory of the European neobanking market is expected to remain positive. Continued innovation in areas such as AI-powered financial management tools, blockchain-based security solutions, and embedded finance will drive sustained expansion. Strategic partnerships between neobanks and established financial institutions will create broader market access and enhanced product offerings. Expansion into new markets and the increasing integration of neobanking services within other platforms will further propel long-term growth.

Emerging Opportunities in Europe Neobanking Market

The European neobanking market offers several promising opportunities for growth and innovation. The expansion into underserved markets, particularly in Eastern Europe, presents significant potential. The integration of emerging technologies like artificial intelligence and machine learning can create more efficient and personalized banking experiences. The growing adoption of open banking principles will enable greater collaboration and the development of innovative financial products and services. Finally, the increasing focus on sustainable finance presents new opportunities for neobanks to offer ethical and environmentally conscious banking solutions.

Leading Players in the Europe Neobanking Market Sector

- N26

- Vivid

- Ma French Bank

- Orange Bank

- Lunar

- Revolut

- Bnext

- Holvi

- Monzo Bank Ltd

- Atom Bank Plc

- Bunq

- List Not Exhaustive

Key Milestones in Europe Neobanking Market Industry

- March 2022: Nordic neobank Lunar raises USD 77 Million at a USD 2 Billion valuation, launching a crypto trading platform and B2B payments.

- October 2021: N26 announces a Series E funding round of more than $900 Million.

Strategic Outlook for Europe Neobanking Market Market

The future of the European neobanking market is bright, with significant growth potential driven by technological innovation, changing consumer preferences, and supportive regulatory frameworks. Neobanks that prioritize customer experience, leverage data analytics, and strategically expand their product offerings will be well-positioned to capture significant market share. The focus on sustainable finance and the increasing integration of neobanking services within broader ecosystems will further drive market expansion. The strategic outlook is positive, with continued growth and innovation shaping the future of the sector.

Europe Neobanking Market Segmentation

-

1. Account Type

- 1.1. Business Account

- 1.2. Savings Account

-

2. Services

- 2.1. Mobile Banking

- 2.2. Payments and Money Transfers

- 2.3. Savings Account

- 2.4. Loans

- 2.5. Other Sevices

Europe Neobanking Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Neobanking Market Regional Market Share

Geographic Coverage of Europe Neobanking Market

Europe Neobanking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 48.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing user penetration of Neobanking Apps

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 5.1.1. Business Account

- 5.1.2. Savings Account

- 5.2. Market Analysis, Insights and Forecast - by Services

- 5.2.1. Mobile Banking

- 5.2.2. Payments and Money Transfers

- 5.2.3. Savings Account

- 5.2.4. Loans

- 5.2.5. Other Sevices

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 N

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vivid

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ma French Bank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Orange Bank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lunar

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Revolut

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bnext

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Holvi

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Monzo Bank Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Atom Bank Plc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bunq**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 N

List of Figures

- Figure 1: Europe Neobanking Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Neobanking Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Neobanking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 2: Europe Neobanking Market Revenue billion Forecast, by Services 2020 & 2033

- Table 3: Europe Neobanking Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Neobanking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 5: Europe Neobanking Market Revenue billion Forecast, by Services 2020 & 2033

- Table 6: Europe Neobanking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Neobanking Market?

The projected CAGR is approximately 48.9%.

2. Which companies are prominent players in the Europe Neobanking Market?

Key companies in the market include N, Vivid, Ma French Bank, Orange Bank, Lunar, Revolut, Bnext, Holvi, Monzo Bank Ltd, Atom Bank Plc, Bunq**List Not Exhaustive.

3. What are the main segments of the Europe Neobanking Market?

The market segments include Account Type, Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 210.16 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing user penetration of Neobanking Apps.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In March 2022, Nordic neobank Lunar raises USD 77 Million at a USD 2 Billion valuation, and launches a crypto trading platform and B2B payments for its small and medium business customers. It has now raised EUR 345 million in total, with other past investors including Seed Capital, Greyhound Capital, Socii Capital and Chr. Augustinus Fabrikker.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Neobanking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Neobanking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Neobanking Market?

To stay informed about further developments, trends, and reports in the Europe Neobanking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence