Key Insights

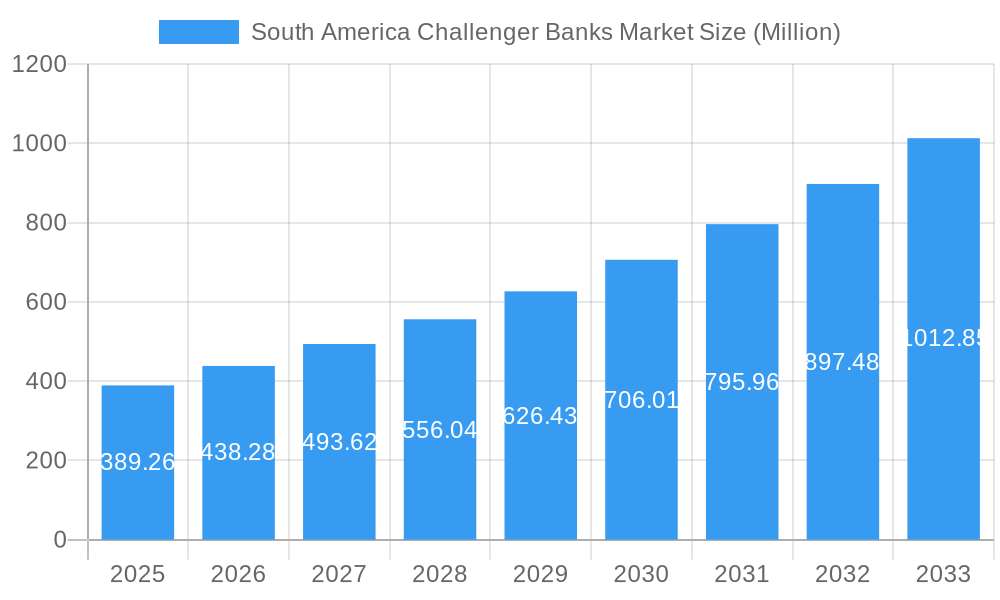

The South American challenger bank market is experiencing robust growth, projected to reach \$389.26 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 12.57% from 2025 to 2033. This expansion is fueled by several key factors. Increasing smartphone penetration and internet access across the region are driving financial inclusion, particularly among underserved populations who are readily adopting digital banking solutions offered by challenger banks. Furthermore, these institutions are often perceived as more customer-centric and technologically advanced than traditional banks, offering competitive pricing and streamlined user experiences. The rise of open banking APIs and the increasing availability of affordable mobile data are also contributing to the sector's growth. However, challenges remain, including regulatory hurdles in certain South American markets, cybersecurity concerns related to digital transactions, and the need for continuous innovation to stay ahead of the competition. The market is highly competitive, with key players like Nubank, Uala, Albo, Nequi, DaviPlata, Banco Inter, Neon, C6 Bank, and Burbank (among others) vying for market share through innovative product offerings and aggressive expansion strategies.

South America Challenger Banks Market Market Size (In Million)

The forecast period (2025-2033) suggests continued substantial growth, driven by the expanding digital economy and the increasing preference for convenient, tech-enabled banking services. While the specific regional breakdown isn't provided, it is reasonable to assume that Brazil, with its large population and relatively high digital adoption, will represent a significant portion of the market. Colombia, Mexico and Argentina are also expected to contribute significantly. Ongoing investment in fintech infrastructure and initiatives to improve financial literacy will further propel this expansion. However, sustained vigilance regarding financial security and maintaining customer trust amidst evolving cybersecurity threats will be crucial for long-term market success.

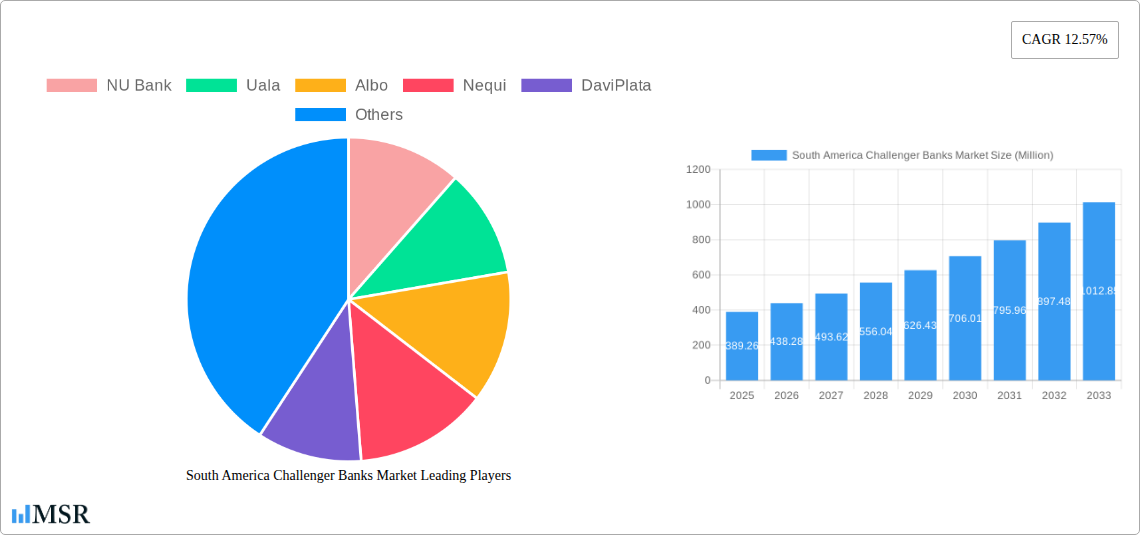

South America Challenger Banks Market Company Market Share

South America Challenger Banks Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic South America challenger banks market, offering invaluable insights for investors, industry stakeholders, and strategic planners. Covering the period 2019-2033, with a base year of 2025, this report meticulously examines market size, growth drivers, competitive landscape, and future opportunities. The study encompasses key players like Nubank, Uala, Albo, Nequi, DaviPlata, Banco Inter, Neon, C6 bank, and Burbank (list not exhaustive), analyzing their strategies and market impact. Expect detailed segmentation, trend analysis, and forecasts to help you navigate this rapidly evolving financial sector.

South America Challenger Banks Market Concentration & Dynamics

The South American challenger bank market exhibits a moderately concentrated landscape, dominated by a few key players, but with significant room for growth and diversification. Market share is dynamic, with aggressive expansion and consolidation shaping the competitive dynamics. The innovation ecosystem is robust, driven by fintech advancements and evolving customer preferences for digital banking solutions. Regulatory frameworks vary across countries, presenting both opportunities and challenges for challenger banks. Substitute products, like traditional banks and mobile payment platforms, exert competitive pressure, while end-user trends favor convenience, accessibility, and personalized financial services. M&A activities have been significant, with deal counts increasing as larger players seek to consolidate their market position. For example, the xx Million worth of M&A deals recorded in 2024 indicate an active market with further consolidation expected in the forecast period (2025-2033).

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Innovation Ecosystem: High, driven by fintech advancements and digital banking adoption.

- Regulatory Framework: Varies across countries, impacting market entry and operations.

- Substitute Products: Traditional banks and mobile payment platforms.

- End-User Trends: Increasing preference for digital and personalized banking experiences.

- M&A Activity: Significant increase in recent years, projected to continue.

South America Challenger Banks Market Industry Insights & Trends

The South American challenger banks market is experiencing robust growth, driven by factors such as increasing smartphone penetration, rising internet connectivity, and a growing young population embracing digital financial services. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Technological disruptions, such as the widespread adoption of open banking APIs and advancements in AI-powered financial solutions, are further fueling market expansion. Evolving consumer behaviors, including a demand for personalized financial products and seamless digital experiences, are shaping the strategic direction of challenger banks. The entry and exit of international players, as exemplified by N26’s departure from Brazil in November 2023, highlight the competitive intensity and strategic shifts within the market. Furthermore, the innovative product offerings by established players, such as Nubank's introduction of over 40 new products and features in October 2023, underscore the ongoing innovation and competition in the space.

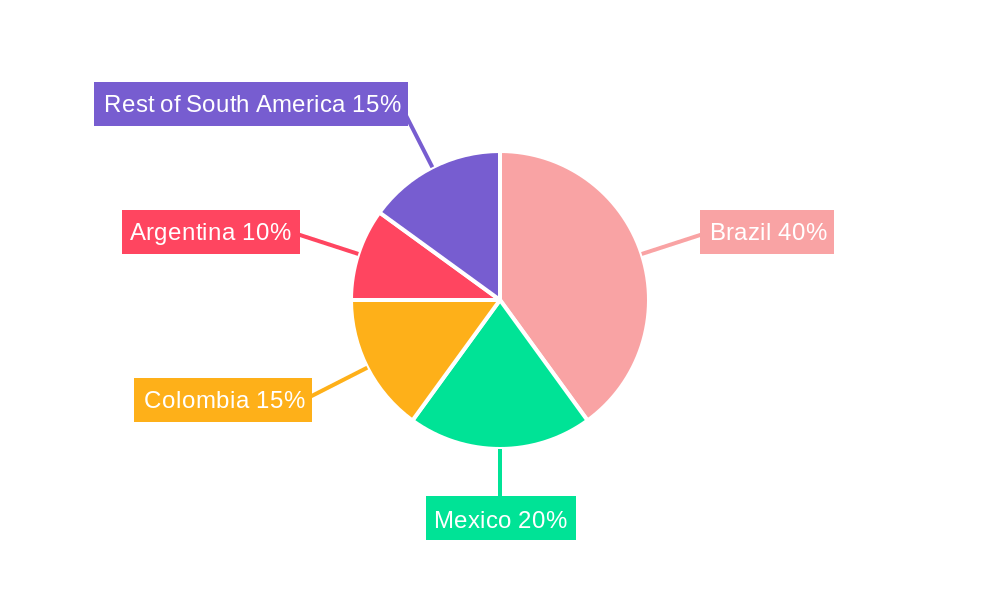

Key Markets & Segments Leading South America Challenger Banks Market

Brazil remains the dominant market for challenger banks in South America, fueled by a large and tech-savvy population, a burgeoning middle class, and favorable regulatory conditions.

- Brazil: Largest market share due to high smartphone penetration, a large young population, and relatively advanced digital infrastructure.

- Mexico: Significant growth potential driven by increasing financial inclusion and government initiatives to promote digital finance.

- Colombia: Rapid adoption of digital banking services, coupled with growing mobile money usage.

- Other Markets: Peru, Chile, Argentina show increasing adoption, although at a slower pace than the leading markets.

Brazil's dominance stems from several factors: a high mobile penetration rate, a sizable young and tech-savvy population actively seeking digital financial services, and a relatively supportive regulatory environment that encourages innovation. The country's robust digital infrastructure further facilitates the growth of challenger banks.

South America Challenger Banks Market Product Developments

Challenger banks are continuously innovating to provide tailored financial products and services, leveraging technological advancements such as AI-powered personalized financial management tools, biometric security features, and seamless mobile payment integrations. These innovations are enhancing customer experience, driving adoption, and creating competitive advantages. The integration of open banking APIs further allows for the creation of innovative financial products and services, leading to improved financial inclusion and accessibility.

Challenges in the South America Challenger Banks Market

The South American challenger bank market faces several challenges, including stringent regulatory hurdles, particularly around licensing and compliance. Supply chain disruptions and cybersecurity risks can also impact operational efficiency and customer trust. Intense competition from established players and other fintech startups also poses a significant challenge. For example, the exit of N26 from Brazil (November 2023) highlights the difficulty of navigating the market and achieving profitability. These challenges often result in a xx% reduction in projected profitability for smaller players.

Forces Driving South America Challenger Banks Market Growth

Key growth drivers include the increasing adoption of smartphones and internet access, fostering a digitally-savvy population receptive to digital banking solutions. Government initiatives promoting financial inclusion and digital transformation are further accelerating market growth. Technological advancements, like AI-powered personalized services and open banking APIs, are transforming customer experiences and driving innovation. Economic growth across several South American countries is generating increased disposable income, fueling demand for financial services.

Long-Term Growth Catalysts in the South America Challenger Banks Market

Long-term growth will be fueled by strategic partnerships with technology providers and telecommunication companies, expanding the reach of digital banking services. Continuous product innovation, including tailored financial solutions for underserved segments, will remain crucial. Expansion into new markets within South America and integration of advanced technologies, such as blockchain and AI, will be key to sustaining long-term growth and maintaining a competitive edge.

Emerging Opportunities in South America Challenger Banks Market

Emerging opportunities include the expansion into underserved markets and the development of financial products tailored to specific consumer segments. The adoption of embedded finance, integrating financial services within non-financial platforms, presents a substantial opportunity for growth. Leveraging innovative technologies, like AI-driven risk assessment and fraud prevention, will create new competitive advantages.

Leading Players in the South America Challenger Banks Market Sector

- NU Bank

- Uala

- Albo

- Nequi

- DaviPlata

- Banco Inter

- Neon

- C6 bank

- Burbank

Key Milestones in South America Challenger Banks Market Industry

- November 2023: N26 exits the Brazilian market after a two-year presence.

- October 2023: Nubank introduces over 40 new products and features.

Strategic Outlook for South America Challenger Banks Market

The South America challenger banks market presents significant long-term growth potential, driven by increasing digital adoption and favorable macroeconomic conditions. Strategic players will need to focus on technological innovation, strategic partnerships, and effective regulatory navigation to capitalize on this growth. Expansion into new market segments, coupled with the development of tailored financial solutions, will be crucial to sustain competitiveness and achieve profitability in this dynamic market.

South America Challenger Banks Market Segmentation

-

1. Service Type

- 1.1. Payments

- 1.2. Savings Products

- 1.3. Current Account

- 1.4. Consumer Credit

- 1.5. Loans

-

2. End-User Type

- 2.1. Business Segment

- 2.2. Personal Segment

South America Challenger Banks Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Challenger Banks Market Regional Market Share

Geographic Coverage of South America Challenger Banks Market

South America Challenger Banks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Fintech Investments in South America Fueling the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Challenger Banks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Payments

- 5.1.2. Savings Products

- 5.1.3. Current Account

- 5.1.4. Consumer Credit

- 5.1.5. Loans

- 5.2. Market Analysis, Insights and Forecast - by End-User Type

- 5.2.1. Business Segment

- 5.2.2. Personal Segment

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NU Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Uala

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Albo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nequi

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DaviPlata

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Banco Inter

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Neon

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 C6 bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Burbank**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 NU Bank

List of Figures

- Figure 1: South America Challenger Banks Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Challenger Banks Market Share (%) by Company 2025

List of Tables

- Table 1: South America Challenger Banks Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: South America Challenger Banks Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 3: South America Challenger Banks Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 4: South America Challenger Banks Market Volume Billion Forecast, by End-User Type 2020 & 2033

- Table 5: South America Challenger Banks Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South America Challenger Banks Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: South America Challenger Banks Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: South America Challenger Banks Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 9: South America Challenger Banks Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 10: South America Challenger Banks Market Volume Billion Forecast, by End-User Type 2020 & 2033

- Table 11: South America Challenger Banks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: South America Challenger Banks Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Brazil South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Brazil South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Argentina South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Argentina South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Chile South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Chile South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Colombia South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Colombia South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Peru South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Peru South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Venezuela South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Venezuela South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Ecuador South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Ecuador South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Bolivia South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Bolivia South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Paraguay South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Paraguay South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Uruguay South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Uruguay South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Challenger Banks Market?

The projected CAGR is approximately 12.57%.

2. Which companies are prominent players in the South America Challenger Banks Market?

Key companies in the market include NU Bank, Uala, Albo, Nequi, DaviPlata, Banco Inter, Neon, C6 bank, Burbank**List Not Exhaustive.

3. What are the main segments of the South America Challenger Banks Market?

The market segments include Service Type, End-User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 389.26 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Fintech Investments in South America Fueling the Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In November 2023, N26, a German challenger bank, announced its exit from Brazil, marking the end of its two-year stint in the South American market. This move aligns with N26's strategic shift in geographical focus. The bank made its foray into Brazil in 2021, having obtained a Sociedade de Crédito Direto (SCD) license from the Banco Central do Brasil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Challenger Banks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Challenger Banks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Challenger Banks Market?

To stay informed about further developments, trends, and reports in the South America Challenger Banks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence