Key Insights

The global investment banking market is projected for robust expansion, reaching an estimated market size of 150.49 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 7.6%. This growth is propelled by escalating Mergers & Acquisitions (M&A) activity across technology and healthcare, alongside strong performance in Debt Capital Markets and Equity Capital Markets. Key drivers include businesses utilizing favorable financing conditions and a healthy IPO pipeline. The "Others" segment, encompassing advisory and restructuring, also contributes to market resilience. Leading institutions such as J.P. Morgan Chase & Co., Goldman Sachs Group Inc., and Morgan Stanley are pivotal in this evolving landscape.

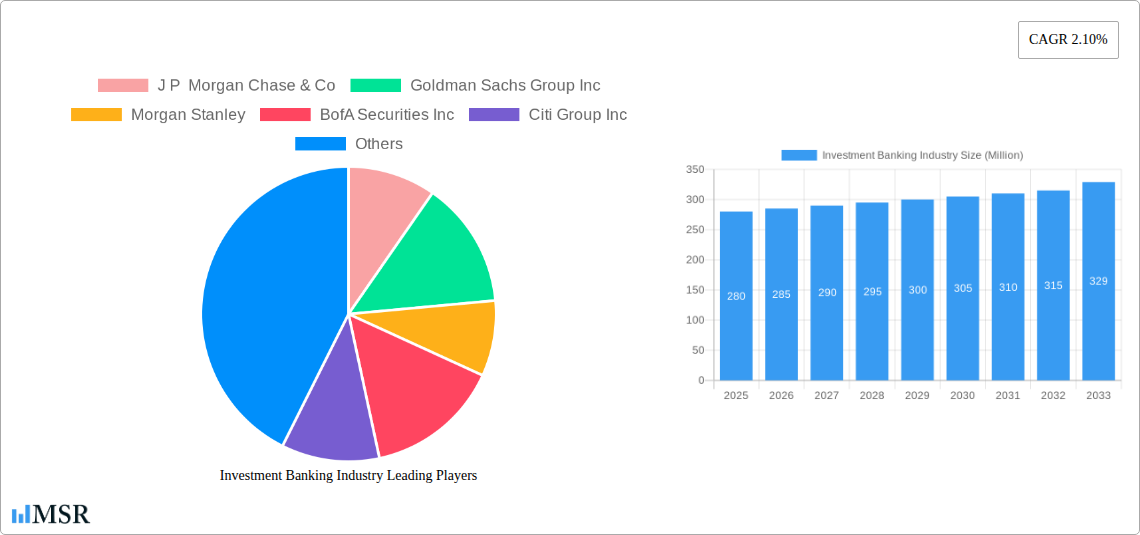

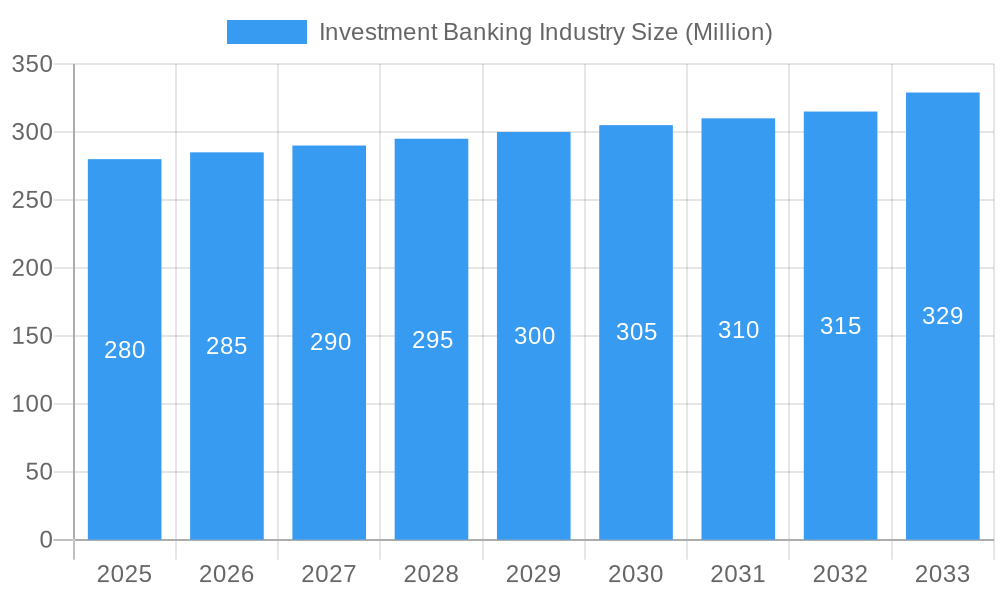

Investment Banking Industry Market Size (In Billion)

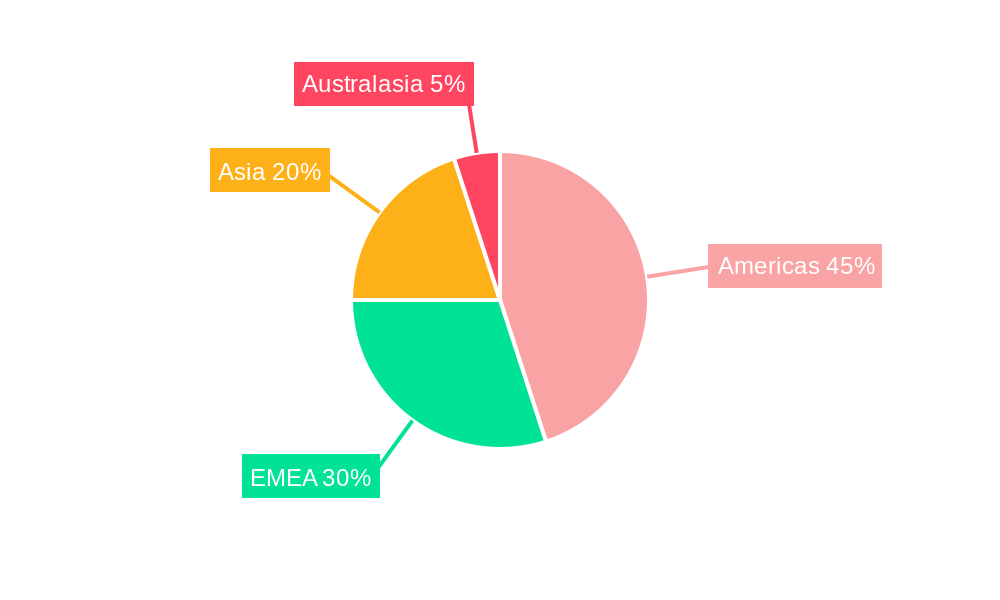

Geographically, the Americas, led by the United States, maintain market dominance due to a strong economy and financial ecosystem. Europe, particularly the UK and Germany, remains a significant region, navigating regulatory and geopolitical influences. Asia, driven by China and Japan, presents substantial growth potential from domestic demand and cross-border investments. Australasia offers stable growth. Key challenges include regulatory intensity, competition from non-traditional entrants, and potential economic volatility. Success hinges on adapting to sustainable finance and digital transformation trends.

Investment Banking Industry Company Market Share

This report offers a comprehensive analysis of the global Investment Banking Industry, covering the historical period of 2019-2024 and forecasting growth through 2033. It provides critical insights into market dynamics, product developments, and emerging opportunities, featuring major players like J.P. Morgan Chase & Co., Goldman Sachs Group Inc., Morgan Stanley, BofA Securities Inc., and Citi Group Inc., alongside regional leaders and specialized firms.

Investment Banking Industry Market Concentration & Dynamics

The global Investment Banking Industry exhibits a moderate to high level of market concentration, with established bulge bracket firms wielding significant influence. Key players such as J.P. Morgan Chase & Co., Goldman Sachs Group Inc., Morgan Stanley, BofA Securities Inc., and Citi Group Inc. collectively command a substantial market share. The innovation ecosystem is driven by FinTech advancements and a constant pursuit of digital transformation, enhancing deal execution efficiency and client advisory services. Regulatory frameworks, including stringent compliance requirements and evolving capital adequacy rules, continue to shape competitive landscapes. Substitute products and services, while present in niche areas, have yet to significantly disrupt the core offerings of mergers & acquisitions, debt capital markets, and equity capital markets. End-user trends are increasingly focused on sustainable finance, digital asset advisory, and cross-border transactions. M&A activities within the industry itself, while fluctuating, are observed as a means of consolidation and talent acquisition. For instance, the industry witnessed approximately 150 M&A deals valued at over $20 Billion in the historical period.

Investment Banking Industry Industry Insights & Trends

The Investment Banking Industry is poised for robust growth, driven by a confluence of factors including global economic recovery, increased corporate activity, and the ongoing digital revolution. Our analysis forecasts the global market size to reach an estimated $2 Trillion in the base year 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033. Technological disruptions, such as AI-powered analytics for deal sourcing and valuation, blockchain for streamlined transaction processes, and advanced data visualization tools for client reporting, are fundamentally reshaping how investment banks operate. Evolving consumer behaviors, particularly among institutional investors and corporations, demand more personalized, data-driven, and technologically advanced advisory services. The increasing complexity of global financial markets and the growing appetite for strategic capital allocation are also significant growth drivers. Furthermore, the rise of private markets and alternative investments presents new avenues for traditional investment banks to expand their service offerings. The industry's ability to adapt to these evolving demands and leverage technological advancements will be crucial for sustained success.

Key Markets & Segments Leading Investment Banking Industry

The Investment Banking Industry landscape is dominated by several key segments and regions. Mergers & Acquisitions (M&A) consistently remains a cornerstone, fueled by strategic imperatives for consolidation, market expansion, and synergy realization. This segment is projected to account for nearly 40% of the total market value in 2025. Debt Capital Markets (DCM) is another significant pillar, driven by corporate demand for financing through bond issuances and other debt instruments. Factors like low interest rate environments historically and the need for capital for infrastructure projects and R&D investments propel DCM growth. Equity Capital Markets (ECM), encompassing Initial Public Offerings (IPOs) and secondary offerings, thrives on periods of market buoyancy and investor confidence, enabling companies to raise substantial capital for growth and shareholder liquidity.

- Dominant Regions: North America, led by the United States, and Europe, particularly London and Frankfurt, are the primary epicenters of investment banking activity due to their well-developed financial infrastructures, strong regulatory environments, and high concentration of corporate headquarters. Asia-Pacific, with its rapidly growing economies and increasing inbound/outbound M&A activity, is a fast-emerging market.

- Segmental Drivers:

- Mergers & Acquisitions: Economic recovery, industry consolidation trends, cross-border expansion strategies, and private equity dry powder.

- Debt Capital Markets: Corporate deleveraging and refinancing needs, infrastructure development financing, and evolving monetary policies.

- Equity Capital Markets: Favorable IPO windows driven by market sentiment, venture capital exits, and the increasing appeal of public markets for tech companies.

- Syndicated Loans: Corporate working capital needs, leveraged buyouts, and project financing for large-scale developments.

Investment Banking Industry Product Developments

Investment banks are continuously innovating their product and service offerings to maintain competitive edges. Key developments include the integration of Artificial Intelligence (AI) for predictive analytics in deal origination and risk assessment, and the application of Machine Learning (ML) for enhanced due diligence processes. The rise of Environmental, Social, and Governance (ESG) focused financial products, such as green bonds and sustainability-linked loans, is a significant trend, aligning financial offerings with global sustainability goals. Furthermore, advancements in digital platforms are enabling more efficient and transparent client interactions, from initial pitch books to post-deal analysis. The development of sophisticated data analytics tools allows for hyper-personalized client advice and the identification of previously unseen investment opportunities.

Challenges in the Investment Banking Industry Market

The Investment Banking Industry faces several significant challenges that could impede growth. Regulatory Hurdles are paramount, with evolving compliance requirements and increased scrutiny from global financial authorities demanding substantial investment in technology and personnel. Intensified Competition from FinTech disruptors and specialized advisory firms necessitates constant adaptation and service differentiation. Cybersecurity Threats pose a constant risk, requiring robust security protocols to protect sensitive client data and financial transactions, with an estimated annual cost of $5 Billion for mitigation. Talent Acquisition and Retention of skilled professionals, particularly in specialized areas like quantitative finance and data science, remains a persistent challenge. Economic Volatility and geopolitical instability can significantly impact deal volumes and market sentiment, leading to unpredictable revenue streams.

Forces Driving Investment Banking Industry Growth

Several key forces are driving the growth of the Investment Banking Industry. Technological Advancements are revolutionizing deal-making, from AI-powered research and predictive analytics to blockchain for secure and transparent transactions. Globalization and Cross-Border Dealmaking continue to expand opportunities as companies seek international growth and market access. Increased Corporate Profitability and Access to Capital post-economic downturns fuel demand for M&A, debt issuance, and equity offerings. The burgeoning FinTech sector, while a competitor, also fosters innovation and necessitates collaboration, leading to hybrid solutions that benefit the entire ecosystem. Furthermore, growing investor appetite for ESG-aligned investments is creating new markets and opportunities for sustainable finance advisory services.

Challenges in the Investment Banking Industry Market

Long-term growth catalysts in the Investment Banking Industry are deeply intertwined with innovation and strategic market expansion. The continuous development and adoption of cutting-edge technologies, such as advanced AI for market forecasting and personalized client solutions, are crucial for maintaining a competitive edge. Strategic partnerships and collaborations, both within the traditional finance sector and with emerging FinTech companies, will unlock new revenue streams and enhance service delivery. Furthermore, expansion into underserved or rapidly growing geographic markets, particularly in emerging economies, presents significant untapped potential. The ability to adapt to evolving regulatory landscapes and proactively shape industry best practices will also be a key determinant of sustained long-term growth.

Emerging Opportunities in Investment Banking Industry

Emerging opportunities in the Investment Banking Industry are abundant and diverse. The rapidly growing Digital Assets and Cryptocurrency Market presents a new frontier for advisory services, including tokenization of assets and crypto-based financing solutions. The increasing focus on Sustainable Finance and ESG Investing is creating significant demand for green bonds, impact investing advisory, and carbon credit trading. The Expansion of Private Markets beyond traditional private equity, such as venture debt and growth equity, offers lucrative avenues for investment banks. Data Analytics and AI-driven Insights are enabling hyper-personalized client services and the discovery of novel investment opportunities. The continued globalization of economies and the need for capital in developing nations also represent substantial long-term growth prospects.

Leading Players in the Investment Banking Industry Sector

- J P Morgan Chase & Co

- Goldman Sachs Group Inc

- Morgan Stanley

- BofA Securities Inc

- Citi Group Inc

- Barclays Investment Bank

- Credit Suisse Group AG

- Deutsche Bank AG

- Wells Fargo & Company

- RBC Capital Markets

- Jefferies Group LLC

- The Blackstone Group Inc

- Cowen Inc

Key Milestones in Investment Banking Industry Industry

- 2019: Increased focus on ESG integration into investment strategies, leading to a surge in sustainable bond issuances.

- 2020: The COVID-19 pandemic accelerated digital transformation, with a significant increase in virtual deal-making and remote collaboration tools.

- 2021: Record-breaking year for M&A activity and IPOs, driven by low interest rates and robust investor appetite.

- 2022: Geopolitical tensions and rising inflation led to a slowdown in deal volumes, prompting a shift towards more defensive strategies.

- 2023: Continued exploration of digital assets and the tokenization of real-world assets, with a growing number of financial institutions investing in the space.

- 2024 (Est.): Anticipated recovery in M&A and ECM activity, supported by a more stable economic outlook and continued technological advancements.

Strategic Outlook for Investment Banking Industry Market

The strategic outlook for the Investment Banking Industry remains overwhelmingly positive, fueled by ongoing technological innovation and evolving global financial demands. Key growth accelerators include the continued integration of AI and machine learning to enhance operational efficiency and client advisory services, leading to an estimated 15% improvement in deal execution time. The expansion of services into emerging areas like digital assets and sustainable finance will unlock new revenue streams, with the ESG finance market projected to grow by over 10% annually. Strategic partnerships with FinTech firms and specialized advisory boutiques will foster a more agile and competitive landscape. Furthermore, focusing on cross-border transaction capabilities and providing integrated solutions for complex global capital needs will be critical for capturing future market potential.

Investment Banking Industry Segmentation

-

1. Product Types

- 1.1. Mergers & Acquisitions

- 1.2. Debt Capital Markets

- 1.3. Equity Capital Markets

- 1.4. Syndicated Loans and Others

Investment Banking Industry Segmentation By Geography

-

1. Americas

- 1.1. United States

- 1.2. Canada

- 1.3. Latin America

-

2. EMEA

- 2.1. Europe

- 2.2. Russia

- 2.3. United Kingdom

- 2.4. Middle East

-

3. Asia

- 3.1. Japan

- 3.2. China

- 3.3. Others

-

4. Australasia

- 4.1. Australia

- 4.2. New Zealand

Investment Banking Industry Regional Market Share

Geographic Coverage of Investment Banking Industry

Investment Banking Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. 2019 - The Year of Mega Deals yet with Lesser M&A Volume

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Types

- 5.1.1. Mergers & Acquisitions

- 5.1.2. Debt Capital Markets

- 5.1.3. Equity Capital Markets

- 5.1.4. Syndicated Loans and Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Americas

- 5.2.2. EMEA

- 5.2.3. Asia

- 5.2.4. Australasia

- 5.1. Market Analysis, Insights and Forecast - by Product Types

- 6. Americas Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Types

- 6.1.1. Mergers & Acquisitions

- 6.1.2. Debt Capital Markets

- 6.1.3. Equity Capital Markets

- 6.1.4. Syndicated Loans and Others

- 6.1. Market Analysis, Insights and Forecast - by Product Types

- 7. EMEA Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Types

- 7.1.1. Mergers & Acquisitions

- 7.1.2. Debt Capital Markets

- 7.1.3. Equity Capital Markets

- 7.1.4. Syndicated Loans and Others

- 7.1. Market Analysis, Insights and Forecast - by Product Types

- 8. Asia Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Types

- 8.1.1. Mergers & Acquisitions

- 8.1.2. Debt Capital Markets

- 8.1.3. Equity Capital Markets

- 8.1.4. Syndicated Loans and Others

- 8.1. Market Analysis, Insights and Forecast - by Product Types

- 9. Australasia Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Types

- 9.1.1. Mergers & Acquisitions

- 9.1.2. Debt Capital Markets

- 9.1.3. Equity Capital Markets

- 9.1.4. Syndicated Loans and Others

- 9.1. Market Analysis, Insights and Forecast - by Product Types

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 J P Morgan Chase & Co

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Goldman Sachs Group Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Morgan Stanley

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 BofA Securities Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Citi Group Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Barclays Investment Bank

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Credit Suisse Group AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Deutsche Bank AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wells Fargo & Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 RBC Capital Markets

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Jefferies Group LLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 The Blackstone Group Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Cowen Inc**List Not Exhaustive

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 J P Morgan Chase & Co

List of Figures

- Figure 1: Global Investment Banking Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Americas Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 3: Americas Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 4: Americas Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: Americas Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: EMEA Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 7: EMEA Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 8: EMEA Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: EMEA Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 11: Asia Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 12: Asia Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australasia Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 15: Australasia Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 16: Australasia Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Australasia Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 2: Global Investment Banking Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 4: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Latin America Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 9: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Russia Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Middle East Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 15: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Japan Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: China Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Others Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 20: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Australia Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: New Zealand Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Investment Banking Industry?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the Investment Banking Industry?

Key companies in the market include J P Morgan Chase & Co, Goldman Sachs Group Inc, Morgan Stanley, BofA Securities Inc, Citi Group Inc, Barclays Investment Bank, Credit Suisse Group AG, Deutsche Bank AG, Wells Fargo & Company, RBC Capital Markets, Jefferies Group LLC, The Blackstone Group Inc, Cowen Inc**List Not Exhaustive.

3. What are the main segments of the Investment Banking Industry?

The market segments include Product Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 150.49 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

2019 - The Year of Mega Deals yet with Lesser M&A Volume.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Investment Banking Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Investment Banking Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Investment Banking Industry?

To stay informed about further developments, trends, and reports in the Investment Banking Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence