Key Insights

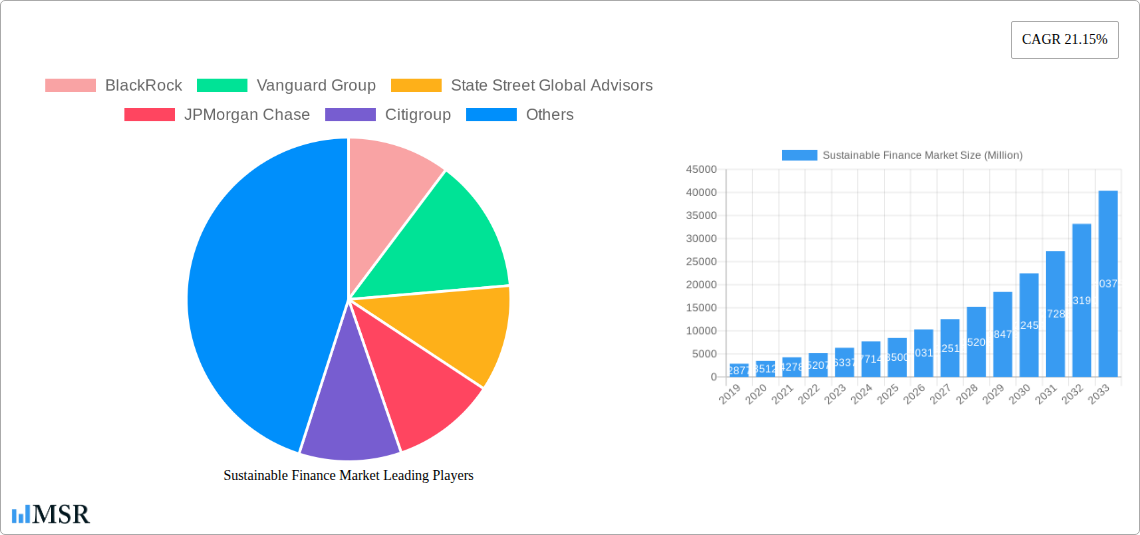

The Sustainable Finance Market is poised for explosive growth, projected to reach a staggering $8.5 million in 2025 and expand at a Compound Annual Growth Rate (CAGR) of 21.15% through 2033. This remarkable trajectory is driven by a confluence of factors, including escalating investor demand for socially responsible and environmentally conscious investments, coupled with increasingly stringent regulatory frameworks that incentivize sustainable practices. Key drivers include the growing awareness of climate change, the need for robust ESG (Environmental, Social, and Governance) reporting, and government initiatives promoting green finance. The market is segmented across various investment types, with Equity and Fixed Income leading the charge, reflecting diverse investor appetites for sustainable assets. Transaction types like Green Bonds, Social Bonds, and Mixed-Sustainability Bonds are gaining significant traction as financial instruments to fund impactful projects. Major industries such as Utilities, Transport and Logistics, Chemicals, and Food and Beverage are actively integrating sustainable finance into their strategies to mitigate risks and capitalize on emerging opportunities.

Sustainable Finance Market Market Size (In Billion)

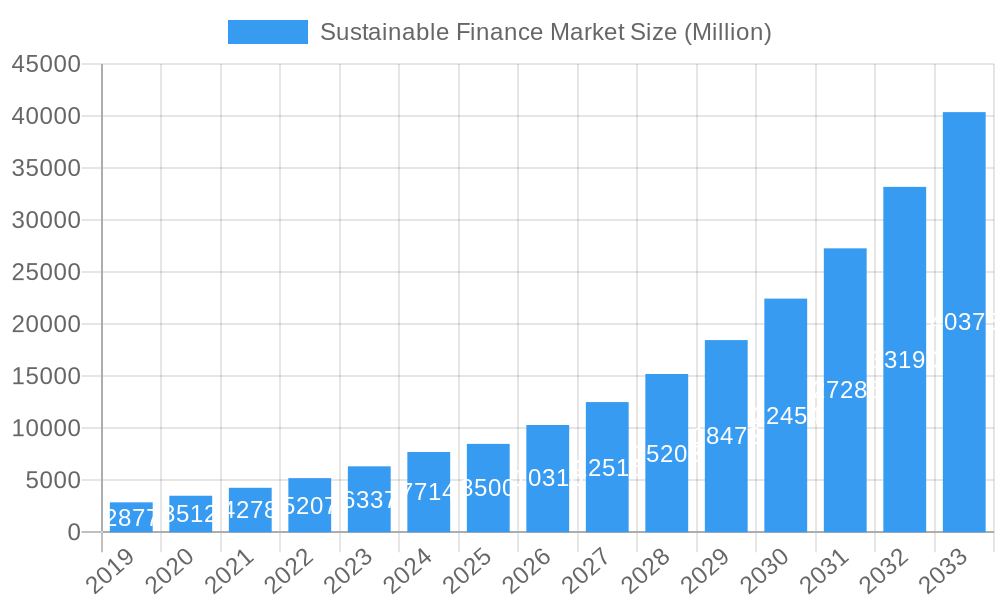

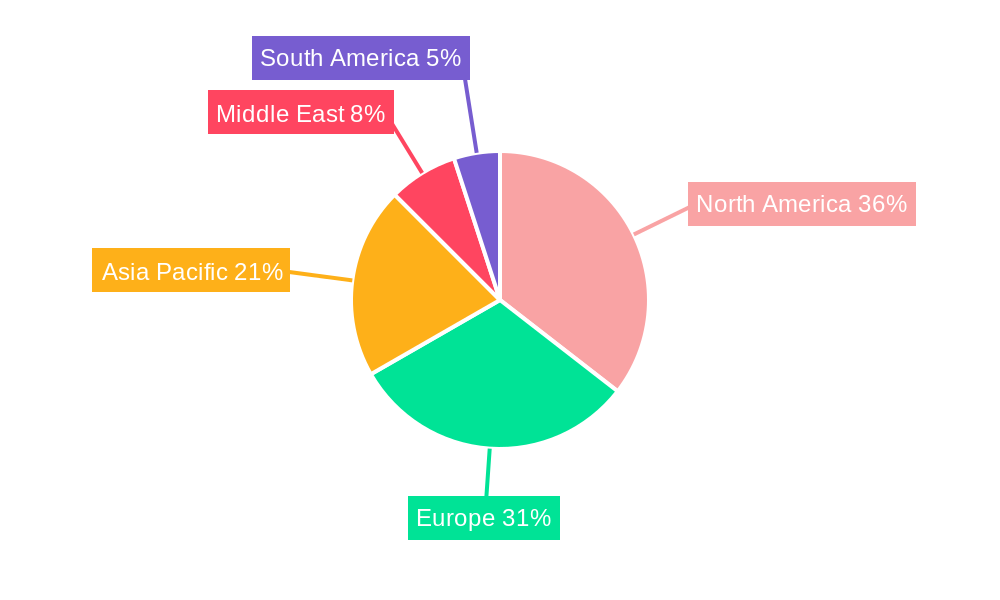

This burgeoning market is witnessing robust activity from leading financial institutions including BlackRock, Vanguard Group, and State Street Global Advisors, who are at the forefront of developing and offering sustainable investment products. Geographically, North America and Europe are currently dominant regions, driven by established ESG policies and investor sophistication. However, the Asia Pacific region, particularly China and India, is emerging as a significant growth frontier, fueled by rapid economic development and a growing commitment to sustainability. Emerging trends include the rise of impact investing, the integration of AI and big data for ESG analysis, and the development of innovative financial products that address specific sustainability challenges. While the market is characterized by immense growth potential, challenges such as greenwashing concerns and the need for standardized ESG metrics require continuous attention and collaboration from stakeholders to ensure the integrity and efficacy of sustainable finance practices.

Sustainable Finance Market Company Market Share

Uncover the burgeoning world of sustainable finance with this in-depth market intelligence report. This comprehensive analysis, spanning the historical period of 2019-2024 and a robust forecast period of 2025-2033, provides invaluable insights for investors, financial institutions, policymakers, and sustainability professionals. Explore the drivers, trends, challenges, and opportunities shaping the global sustainable finance market, valued at an estimated xx Million by 2025.

Sustainable Finance Market Market Concentration & Dynamics

The sustainable finance market is characterized by a dynamic interplay of concentration and innovation. Dominant players like BlackRock, Vanguard Group, and State Street Global Advisors are aggressively expanding their ESG (Environmental, Social, and Governance) offerings, holding an estimated xx% of the market share by Assets Under Management (AUM). However, the landscape is increasingly diversified, with the emergence of specialized firms and a growing number of asset managers integrating sustainability across their portfolios. Innovation ecosystems are flourishing, driven by demand for innovative financial instruments such as green bonds, social bonds, and mixed-sustainability bonds. Regulatory frameworks are rapidly evolving globally, with initiatives like the EU Taxonomy and SFDR (Sustainable Finance Disclosure Regulation) setting new standards and encouraging greater transparency. Substitute products, while still nascent, are appearing in the form of impact investing funds and community development finance. End-user trends reveal a significant shift in investor preferences towards sustainable investments, particularly among institutional investors and retail clients. Mergers and acquisitions (M&A) activity is on the rise, with an estimated xx M&A deals in the past two years, as larger institutions seek to acquire specialized ESG capabilities or expand their sustainable product suites.

Sustainable Finance Market Industry Insights & Trends

The sustainable finance market is experiencing unprecedented growth, projected to reach an impressive xx Million by 2025, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025-2033. This expansion is propelled by a confluence of powerful market growth drivers. Heightened investor awareness regarding climate change and social inequality is a primary catalyst, compelling a move away from traditional investment strategies towards those that prioritize long-term value creation and positive societal impact. Governments worldwide are implementing stringent environmental regulations and offering incentives for green initiatives, further bolstering the demand for sustainable financial products. Technological disruptions, particularly in data analytics and AI, are revolutionizing how ESG risks and opportunities are assessed and integrated into investment decisions. This enables more sophisticated due diligence and the development of innovative financial instruments. Evolving consumer behaviors, with a growing preference for brands and financial services that demonstrate ethical and sustainable practices, are also influencing corporate and investor strategies. The rise of impact investing, which seeks to generate both financial returns and measurable social or environmental impact, is a significant trend. Furthermore, the increasing focus on ESG integration across all asset classes, from equity to fixed income, signifies a fundamental shift in how financial markets operate. The development of robust ESG data providers and rating agencies is crucial in this evolving landscape, offering transparency and comparability for investors navigating the complexities of sustainable finance. The increasing demand for climate-resilient assets and the transition to a low-carbon economy are also key drivers for this robust market expansion.

Key Markets & Segments Leading Sustainable Finance Market

The sustainable finance market is witnessing significant leadership across various geographical regions and specific market segments. North America and Europe currently lead the global adoption of sustainable finance, driven by mature regulatory environments and a strong investor appetite for ESG-aligned products. Within these regions, countries like the United States, Germany, France, and the United Kingdom are at the forefront.

Investment Type Dominance:

- Equity: Sustainable equity funds continue to be a cornerstone of the sustainable finance market, benefiting from growing investor demand for companies demonstrating strong ESG performance. This segment is driven by the desire for long-term capital appreciation and alignment with ethical values.

- Fixed Income: The green bond and social bond markets within fixed income have seen exponential growth. These instruments are crucial for financing specific environmental and social projects, attracting a broad range of investors seeking predictable returns and measurable impact.

- Mixed Allocation: Multi-asset sustainable funds are gaining traction as investors seek diversified portfolios that incorporate ESG principles across various asset classes, offering a balanced approach to risk and return.

Transaction Type Dominance:

- Green Bond: Leading the charge, green bonds are instrumental in funding projects with direct environmental benefits, such as renewable energy, energy efficiency, and clean transportation. Economic growth and infrastructure development are key drivers for this segment.

- Social Bond: Addressing societal challenges, social bonds are financing projects like affordable housing, healthcare, and education. The increasing focus on social equity and community development fuels their expansion.

- Mixed-sustainability Bond: Offering a hybrid approach, these bonds combine environmental and social objectives, appealing to a broader investor base looking for holistic sustainability solutions.

Industry Dominance:

- Utilities: This sector is a major beneficiary and driver of sustainable finance due to the significant investment required for the transition to renewable energy sources and grid modernization.

- Transport and Logistics: Investments in sustainable transportation, including electric vehicles, public transit infrastructure, and efficient logistics, are crucial for decarbonization efforts.

- Chemicals: The chemical industry is increasingly focusing on developing sustainable and circular economy solutions, driving investment in green chemistry and bio-based materials.

- Food and Beverage: This industry is seeing increased investment in sustainable agriculture, reduced food waste, and ethical sourcing practices, aligning with consumer demand for responsible products.

- Government: Governments play a pivotal role by issuing sovereign green and social bonds, setting policy frameworks, and investing in public infrastructure aligned with sustainability goals. Infrastructure development and a commitment to climate targets are critical drivers for this segment.

Sustainable Finance Market Product Developments

Product innovation is a key differentiator in the sustainable finance market. We are witnessing the proliferation of sophisticated ESG-integrated ETFs (Exchange Traded Funds) and mutual funds, offering diversified exposure to companies with strong sustainability credentials. The development of impact investing products, designed to generate measurable social and environmental outcomes alongside financial returns, is gaining momentum. Furthermore, the integration of AI and big data analytics is leading to more granular ESG scoring and the creation of tailored investment solutions that address specific sustainability themes, such as water scarcity or biodiversity loss. The market relevance of these products is directly tied to their ability to meet evolving investor demands for transparency, impact, and competitive financial performance.

Challenges in the Sustainable Finance Market Market

Despite its robust growth, the sustainable finance market faces several challenges. Regulatory fragmentation across different jurisdictions can create complexities for global investors and issuers. The lack of standardized ESG data and reporting frameworks continues to be a significant hurdle, leading to concerns about greenwashing and making it difficult to accurately compare investments. Supply chain issues related to the sourcing of raw materials for green technologies can also impact investment outcomes. Intense competitive pressures among financial institutions to develop and market sustainable products can sometimes lead to a rush to market without adequate due diligence. Quantifiable impacts include potential investor hesitancy due to data inconsistencies and increased compliance costs for financial institutions.

Forces Driving Sustainable Finance Market Growth

The sustainable finance market is propelled by a potent combination of technological advancements, economic imperatives, and supportive regulatory actions. Technological innovations in renewable energy, electric vehicles, and carbon capture are creating new investment opportunities. The economic imperative to mitigate climate change risks and capitalize on the transition to a low-carbon economy is a fundamental driver, fostering long-term value creation. Furthermore, increasing government mandates, incentives for green projects, and evolving investor demands for ethically aligned investments are creating a fertile ground for sustainable finance to flourish, ensuring continued market expansion.

Challenges in the Sustainable Finance Market Market

Long-term growth catalysts for the sustainable finance market are deeply intertwined with ongoing innovation and strategic collaborations. Continued advancements in areas like green hydrogen, sustainable aviation fuel, and circular economy technologies will unlock new investment frontiers. Strategic partnerships between financial institutions, corporations, and technology providers are crucial for scaling up sustainable solutions and driving market adoption. Furthermore, proactive market expansions into emerging economies, coupled with educational initiatives to increase investor understanding and confidence in sustainable investments, will solidify the market's long-term trajectory.

Emerging Opportunities in Sustainable Finance Market

Emerging opportunities in the sustainable finance market are vast and dynamic. The burgeoning demand for climate adaptation finance presents a significant avenue for investment in resilient infrastructure and nature-based solutions. The development of innovative financial instruments tailored for biodiversity conservation and the blue economy (ocean-related activities) are poised for substantial growth. Furthermore, increasing consumer preferences for ethically sourced products and services are driving demand for supply chain finance solutions that promote sustainability throughout the value chain. The digitalization of finance, including the use of blockchain for enhanced transparency in ESG reporting, also presents exciting new avenues for innovation and market expansion.

Leading Players in the Sustainable Finance Market Sector

- BlackRock

- Vanguard Group

- State Street Global Advisors

- JPMorgan Chase

- Citigroup

- Goldman Sachs

- UBS

- Bank of America

- Amundi

- Allianz

Key Milestones in Sustainable Finance Market Industry

- August 2023: Nomura Holdings Inc., a global financial services group, partnered with Angeleno Group LLC for climate solutions, demonstrating a strategic move towards integrating climate action within financial services.

- June 2023: Lombard Odier Investment Management (LOIM), the asset management unit of Lombard Odier, partnered with system change company Systemiq for investments towards a carbon-free global economy, highlighting a commitment to driving systemic change through sustainable investment strategies.

Strategic Outlook for Sustainable Finance Market Market

The sustainable finance market is on an upward trajectory, with a promising strategic outlook driven by accelerating global decarbonization efforts and a deepening commitment to ESG principles. Future market potential is immense, fueled by ongoing policy support, technological advancements in green technologies, and a growing awareness of the financial and societal benefits of sustainable investments. Strategic opportunities lie in the continued development of innovative financial products, the expansion into new impact-focused sectors, and the leveraging of data analytics for enhanced ESG integration and risk management. Collaboration between financial institutions, corporations, and governments will be paramount in unlocking the full potential of this transformative market.

Sustainable Finance Market Segmentation

-

1. Investment Type

- 1.1. Equity

- 1.2. Fixed Income

- 1.3. Mixed Allocation

-

2. Transaction Type

- 2.1. Green Bond

- 2.2. Social Bond

- 2.3. Mixed-sustainability Bond

-

3. Industry

- 3.1. Utilities

- 3.2. Transport and Logistics

- 3.3. Chemicals

- 3.4. Food and Beverage

- 3.5. Government

Sustainable Finance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East

Sustainable Finance Market Regional Market Share

Geographic Coverage of Sustainable Finance Market

Sustainable Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of Corporate Social Responsibility Initiatives; Recognition of the Long-term Financial Benefits of Sustainable Investments

- 3.3. Market Restrains

- 3.3.1. Rise of Corporate Social Responsibility Initiatives; Recognition of the Long-term Financial Benefits of Sustainable Investments

- 3.4. Market Trends

- 3.4.1. Rise in the Issuance of Green Bonds

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sustainable Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investment Type

- 5.1.1. Equity

- 5.1.2. Fixed Income

- 5.1.3. Mixed Allocation

- 5.2. Market Analysis, Insights and Forecast - by Transaction Type

- 5.2.1. Green Bond

- 5.2.2. Social Bond

- 5.2.3. Mixed-sustainability Bond

- 5.3. Market Analysis, Insights and Forecast - by Industry

- 5.3.1. Utilities

- 5.3.2. Transport and Logistics

- 5.3.3. Chemicals

- 5.3.4. Food and Beverage

- 5.3.5. Government

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Investment Type

- 6. North America Sustainable Finance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Investment Type

- 6.1.1. Equity

- 6.1.2. Fixed Income

- 6.1.3. Mixed Allocation

- 6.2. Market Analysis, Insights and Forecast - by Transaction Type

- 6.2.1. Green Bond

- 6.2.2. Social Bond

- 6.2.3. Mixed-sustainability Bond

- 6.3. Market Analysis, Insights and Forecast - by Industry

- 6.3.1. Utilities

- 6.3.2. Transport and Logistics

- 6.3.3. Chemicals

- 6.3.4. Food and Beverage

- 6.3.5. Government

- 6.1. Market Analysis, Insights and Forecast - by Investment Type

- 7. Europe Sustainable Finance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Investment Type

- 7.1.1. Equity

- 7.1.2. Fixed Income

- 7.1.3. Mixed Allocation

- 7.2. Market Analysis, Insights and Forecast - by Transaction Type

- 7.2.1. Green Bond

- 7.2.2. Social Bond

- 7.2.3. Mixed-sustainability Bond

- 7.3. Market Analysis, Insights and Forecast - by Industry

- 7.3.1. Utilities

- 7.3.2. Transport and Logistics

- 7.3.3. Chemicals

- 7.3.4. Food and Beverage

- 7.3.5. Government

- 7.1. Market Analysis, Insights and Forecast - by Investment Type

- 8. Asia Pacific Sustainable Finance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Investment Type

- 8.1.1. Equity

- 8.1.2. Fixed Income

- 8.1.3. Mixed Allocation

- 8.2. Market Analysis, Insights and Forecast - by Transaction Type

- 8.2.1. Green Bond

- 8.2.2. Social Bond

- 8.2.3. Mixed-sustainability Bond

- 8.3. Market Analysis, Insights and Forecast - by Industry

- 8.3.1. Utilities

- 8.3.2. Transport and Logistics

- 8.3.3. Chemicals

- 8.3.4. Food and Beverage

- 8.3.5. Government

- 8.1. Market Analysis, Insights and Forecast - by Investment Type

- 9. South America Sustainable Finance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Investment Type

- 9.1.1. Equity

- 9.1.2. Fixed Income

- 9.1.3. Mixed Allocation

- 9.2. Market Analysis, Insights and Forecast - by Transaction Type

- 9.2.1. Green Bond

- 9.2.2. Social Bond

- 9.2.3. Mixed-sustainability Bond

- 9.3. Market Analysis, Insights and Forecast - by Industry

- 9.3.1. Utilities

- 9.3.2. Transport and Logistics

- 9.3.3. Chemicals

- 9.3.4. Food and Beverage

- 9.3.5. Government

- 9.1. Market Analysis, Insights and Forecast - by Investment Type

- 10. Middle East Sustainable Finance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Investment Type

- 10.1.1. Equity

- 10.1.2. Fixed Income

- 10.1.3. Mixed Allocation

- 10.2. Market Analysis, Insights and Forecast - by Transaction Type

- 10.2.1. Green Bond

- 10.2.2. Social Bond

- 10.2.3. Mixed-sustainability Bond

- 10.3. Market Analysis, Insights and Forecast - by Industry

- 10.3.1. Utilities

- 10.3.2. Transport and Logistics

- 10.3.3. Chemicals

- 10.3.4. Food and Beverage

- 10.3.5. Government

- 10.1. Market Analysis, Insights and Forecast - by Investment Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 BlackRock

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vanguard Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 State Street Global Advisors

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 JPMorgan Chase

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Citigroup

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Goldman Sachs

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 UBS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bank of America

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Amundi

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Allianz**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 BlackRock

List of Figures

- Figure 1: Global Sustainable Finance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Sustainable Finance Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America Sustainable Finance Market Revenue (Million), by Investment Type 2025 & 2033

- Figure 4: North America Sustainable Finance Market Volume (Trillion), by Investment Type 2025 & 2033

- Figure 5: North America Sustainable Finance Market Revenue Share (%), by Investment Type 2025 & 2033

- Figure 6: North America Sustainable Finance Market Volume Share (%), by Investment Type 2025 & 2033

- Figure 7: North America Sustainable Finance Market Revenue (Million), by Transaction Type 2025 & 2033

- Figure 8: North America Sustainable Finance Market Volume (Trillion), by Transaction Type 2025 & 2033

- Figure 9: North America Sustainable Finance Market Revenue Share (%), by Transaction Type 2025 & 2033

- Figure 10: North America Sustainable Finance Market Volume Share (%), by Transaction Type 2025 & 2033

- Figure 11: North America Sustainable Finance Market Revenue (Million), by Industry 2025 & 2033

- Figure 12: North America Sustainable Finance Market Volume (Trillion), by Industry 2025 & 2033

- Figure 13: North America Sustainable Finance Market Revenue Share (%), by Industry 2025 & 2033

- Figure 14: North America Sustainable Finance Market Volume Share (%), by Industry 2025 & 2033

- Figure 15: North America Sustainable Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Sustainable Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 17: North America Sustainable Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Sustainable Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Sustainable Finance Market Revenue (Million), by Investment Type 2025 & 2033

- Figure 20: Europe Sustainable Finance Market Volume (Trillion), by Investment Type 2025 & 2033

- Figure 21: Europe Sustainable Finance Market Revenue Share (%), by Investment Type 2025 & 2033

- Figure 22: Europe Sustainable Finance Market Volume Share (%), by Investment Type 2025 & 2033

- Figure 23: Europe Sustainable Finance Market Revenue (Million), by Transaction Type 2025 & 2033

- Figure 24: Europe Sustainable Finance Market Volume (Trillion), by Transaction Type 2025 & 2033

- Figure 25: Europe Sustainable Finance Market Revenue Share (%), by Transaction Type 2025 & 2033

- Figure 26: Europe Sustainable Finance Market Volume Share (%), by Transaction Type 2025 & 2033

- Figure 27: Europe Sustainable Finance Market Revenue (Million), by Industry 2025 & 2033

- Figure 28: Europe Sustainable Finance Market Volume (Trillion), by Industry 2025 & 2033

- Figure 29: Europe Sustainable Finance Market Revenue Share (%), by Industry 2025 & 2033

- Figure 30: Europe Sustainable Finance Market Volume Share (%), by Industry 2025 & 2033

- Figure 31: Europe Sustainable Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Sustainable Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 33: Europe Sustainable Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Sustainable Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Sustainable Finance Market Revenue (Million), by Investment Type 2025 & 2033

- Figure 36: Asia Pacific Sustainable Finance Market Volume (Trillion), by Investment Type 2025 & 2033

- Figure 37: Asia Pacific Sustainable Finance Market Revenue Share (%), by Investment Type 2025 & 2033

- Figure 38: Asia Pacific Sustainable Finance Market Volume Share (%), by Investment Type 2025 & 2033

- Figure 39: Asia Pacific Sustainable Finance Market Revenue (Million), by Transaction Type 2025 & 2033

- Figure 40: Asia Pacific Sustainable Finance Market Volume (Trillion), by Transaction Type 2025 & 2033

- Figure 41: Asia Pacific Sustainable Finance Market Revenue Share (%), by Transaction Type 2025 & 2033

- Figure 42: Asia Pacific Sustainable Finance Market Volume Share (%), by Transaction Type 2025 & 2033

- Figure 43: Asia Pacific Sustainable Finance Market Revenue (Million), by Industry 2025 & 2033

- Figure 44: Asia Pacific Sustainable Finance Market Volume (Trillion), by Industry 2025 & 2033

- Figure 45: Asia Pacific Sustainable Finance Market Revenue Share (%), by Industry 2025 & 2033

- Figure 46: Asia Pacific Sustainable Finance Market Volume Share (%), by Industry 2025 & 2033

- Figure 47: Asia Pacific Sustainable Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Sustainable Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 49: Asia Pacific Sustainable Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Sustainable Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Sustainable Finance Market Revenue (Million), by Investment Type 2025 & 2033

- Figure 52: South America Sustainable Finance Market Volume (Trillion), by Investment Type 2025 & 2033

- Figure 53: South America Sustainable Finance Market Revenue Share (%), by Investment Type 2025 & 2033

- Figure 54: South America Sustainable Finance Market Volume Share (%), by Investment Type 2025 & 2033

- Figure 55: South America Sustainable Finance Market Revenue (Million), by Transaction Type 2025 & 2033

- Figure 56: South America Sustainable Finance Market Volume (Trillion), by Transaction Type 2025 & 2033

- Figure 57: South America Sustainable Finance Market Revenue Share (%), by Transaction Type 2025 & 2033

- Figure 58: South America Sustainable Finance Market Volume Share (%), by Transaction Type 2025 & 2033

- Figure 59: South America Sustainable Finance Market Revenue (Million), by Industry 2025 & 2033

- Figure 60: South America Sustainable Finance Market Volume (Trillion), by Industry 2025 & 2033

- Figure 61: South America Sustainable Finance Market Revenue Share (%), by Industry 2025 & 2033

- Figure 62: South America Sustainable Finance Market Volume Share (%), by Industry 2025 & 2033

- Figure 63: South America Sustainable Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 64: South America Sustainable Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 65: South America Sustainable Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Sustainable Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East Sustainable Finance Market Revenue (Million), by Investment Type 2025 & 2033

- Figure 68: Middle East Sustainable Finance Market Volume (Trillion), by Investment Type 2025 & 2033

- Figure 69: Middle East Sustainable Finance Market Revenue Share (%), by Investment Type 2025 & 2033

- Figure 70: Middle East Sustainable Finance Market Volume Share (%), by Investment Type 2025 & 2033

- Figure 71: Middle East Sustainable Finance Market Revenue (Million), by Transaction Type 2025 & 2033

- Figure 72: Middle East Sustainable Finance Market Volume (Trillion), by Transaction Type 2025 & 2033

- Figure 73: Middle East Sustainable Finance Market Revenue Share (%), by Transaction Type 2025 & 2033

- Figure 74: Middle East Sustainable Finance Market Volume Share (%), by Transaction Type 2025 & 2033

- Figure 75: Middle East Sustainable Finance Market Revenue (Million), by Industry 2025 & 2033

- Figure 76: Middle East Sustainable Finance Market Volume (Trillion), by Industry 2025 & 2033

- Figure 77: Middle East Sustainable Finance Market Revenue Share (%), by Industry 2025 & 2033

- Figure 78: Middle East Sustainable Finance Market Volume Share (%), by Industry 2025 & 2033

- Figure 79: Middle East Sustainable Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East Sustainable Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 81: Middle East Sustainable Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East Sustainable Finance Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sustainable Finance Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 2: Global Sustainable Finance Market Volume Trillion Forecast, by Investment Type 2020 & 2033

- Table 3: Global Sustainable Finance Market Revenue Million Forecast, by Transaction Type 2020 & 2033

- Table 4: Global Sustainable Finance Market Volume Trillion Forecast, by Transaction Type 2020 & 2033

- Table 5: Global Sustainable Finance Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 6: Global Sustainable Finance Market Volume Trillion Forecast, by Industry 2020 & 2033

- Table 7: Global Sustainable Finance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Sustainable Finance Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 9: Global Sustainable Finance Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 10: Global Sustainable Finance Market Volume Trillion Forecast, by Investment Type 2020 & 2033

- Table 11: Global Sustainable Finance Market Revenue Million Forecast, by Transaction Type 2020 & 2033

- Table 12: Global Sustainable Finance Market Volume Trillion Forecast, by Transaction Type 2020 & 2033

- Table 13: Global Sustainable Finance Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 14: Global Sustainable Finance Market Volume Trillion Forecast, by Industry 2020 & 2033

- Table 15: Global Sustainable Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Sustainable Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 17: United States Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 19: Canada Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 21: Mexico Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 23: Rest of North America Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of North America Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 25: Global Sustainable Finance Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 26: Global Sustainable Finance Market Volume Trillion Forecast, by Investment Type 2020 & 2033

- Table 27: Global Sustainable Finance Market Revenue Million Forecast, by Transaction Type 2020 & 2033

- Table 28: Global Sustainable Finance Market Volume Trillion Forecast, by Transaction Type 2020 & 2033

- Table 29: Global Sustainable Finance Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 30: Global Sustainable Finance Market Volume Trillion Forecast, by Industry 2020 & 2033

- Table 31: Global Sustainable Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Sustainable Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 33: Germany Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Germany Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 35: United Kingdom Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: United Kingdom Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 37: France Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: France Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 39: Russia Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Russia Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 41: Spain Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Spain Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 43: Rest of Europe Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of Europe Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 45: Global Sustainable Finance Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 46: Global Sustainable Finance Market Volume Trillion Forecast, by Investment Type 2020 & 2033

- Table 47: Global Sustainable Finance Market Revenue Million Forecast, by Transaction Type 2020 & 2033

- Table 48: Global Sustainable Finance Market Volume Trillion Forecast, by Transaction Type 2020 & 2033

- Table 49: Global Sustainable Finance Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 50: Global Sustainable Finance Market Volume Trillion Forecast, by Industry 2020 & 2033

- Table 51: Global Sustainable Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: Global Sustainable Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 53: India Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: India Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: China Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: China Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 57: Japan Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Japan Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 59: Rest of Asia Pacific Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Rest of Asia Pacific Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 61: Global Sustainable Finance Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 62: Global Sustainable Finance Market Volume Trillion Forecast, by Investment Type 2020 & 2033

- Table 63: Global Sustainable Finance Market Revenue Million Forecast, by Transaction Type 2020 & 2033

- Table 64: Global Sustainable Finance Market Volume Trillion Forecast, by Transaction Type 2020 & 2033

- Table 65: Global Sustainable Finance Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 66: Global Sustainable Finance Market Volume Trillion Forecast, by Industry 2020 & 2033

- Table 67: Global Sustainable Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 68: Global Sustainable Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 69: Brazil Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Brazil Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 71: Argentina Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Argentina Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 73: Rest of South America Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Rest of South America Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 75: Global Sustainable Finance Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 76: Global Sustainable Finance Market Volume Trillion Forecast, by Investment Type 2020 & 2033

- Table 77: Global Sustainable Finance Market Revenue Million Forecast, by Transaction Type 2020 & 2033

- Table 78: Global Sustainable Finance Market Volume Trillion Forecast, by Transaction Type 2020 & 2033

- Table 79: Global Sustainable Finance Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 80: Global Sustainable Finance Market Volume Trillion Forecast, by Industry 2020 & 2033

- Table 81: Global Sustainable Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 82: Global Sustainable Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 83: United Arab Emirates Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: United Arab Emirates Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 85: Saudi Arabia Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Saudi Arabia Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 87: Rest of Middle East Sustainable Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Rest of Middle East Sustainable Finance Market Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sustainable Finance Market?

The projected CAGR is approximately 21.15%.

2. Which companies are prominent players in the Sustainable Finance Market?

Key companies in the market include BlackRock, Vanguard Group, State Street Global Advisors, JPMorgan Chase, Citigroup, Goldman Sachs, UBS, Bank of America, Amundi, Allianz**List Not Exhaustive.

3. What are the main segments of the Sustainable Finance Market?

The market segments include Investment Type, Transaction Type , Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of Corporate Social Responsibility Initiatives; Recognition of the Long-term Financial Benefits of Sustainable Investments.

6. What are the notable trends driving market growth?

Rise in the Issuance of Green Bonds.

7. Are there any restraints impacting market growth?

Rise of Corporate Social Responsibility Initiatives; Recognition of the Long-term Financial Benefits of Sustainable Investments.

8. Can you provide examples of recent developments in the market?

August 2023: Nomura Holdings Inc., a global financial services group, partnered with Angeleno Group LLC for climate solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sustainable Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sustainable Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sustainable Finance Market?

To stay informed about further developments, trends, and reports in the Sustainable Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence