Key Insights

The global student loan market is poised for significant expansion, driven by the escalating costs of higher education worldwide, necessitating increased student borrowing. The proliferation of diverse loan products, including private financing and income-share agreements, is broadening accessibility and catering to varied borrower profiles. Supportive government initiatives, despite occasional policy shifts, generally underpin market growth. Key challenges include managing student debt burdens and mitigating default risks, requiring robust risk management frameworks. Economic volatility can also influence repayment dynamics. The competitive environment is characterized by established institutions and innovative fintech entrants, fostering competition through novel lending approaches and enhanced borrower experiences, thereby promoting greater educational access.

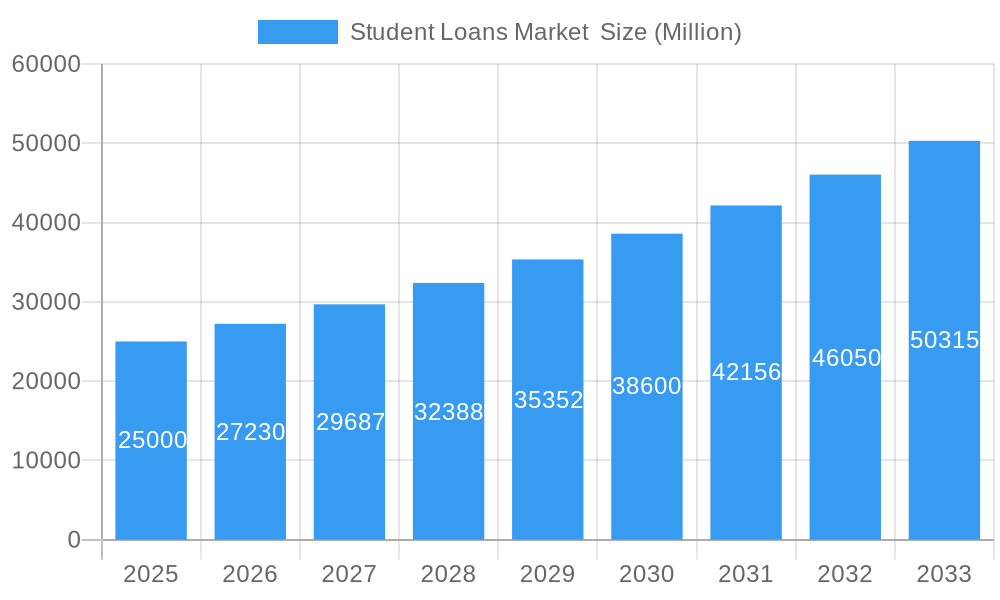

Student Loans Market Market Size (In Million)

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.1% from 2024 to 2033, reaching an estimated market size of $980.8 billion by the end of the forecast period. This sustained growth trajectory is attributed to consistent demand and the ongoing development of lending solutions. Macroeconomic stability, prudent lending practices, and effective regulatory frameworks balancing affordability and accessibility will be critical for this expansion. Market segmentation by loan type, borrower demographics, and repayment structures presents both complexities and opportunities. Significant regional variations in market size and growth are anticipated, reflecting diverse educational expenses, economic conditions, and regulatory landscapes. Comprehensive regional analysis will be vital for strategic planning.

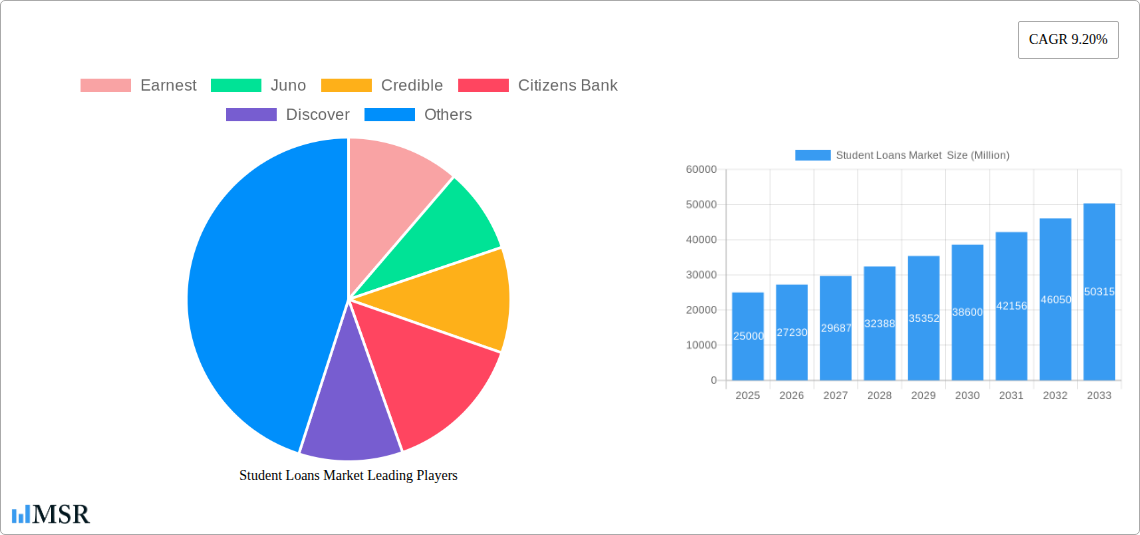

Student Loans Market Company Market Share

Unlock the Potential: A Comprehensive Analysis of the Student Loans Market (2019-2033)

This in-depth report provides a comprehensive analysis of the Student Loans Market, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and opportunities within this dynamic sector. The total market size is estimated at xx Million in 2025, exhibiting a CAGR of xx% during the forecast period.

Student Loans Market Market Concentration & Dynamics

This section analyzes the competitive landscape of the student loan market, evaluating market concentration, innovation, regulations, substitute products, consumer trends, and mergers & acquisitions (M&A) activity.

The market exhibits a moderately concentrated structure, with key players like Sallie Mae and Discover holding significant market share, estimated at xx% and xx% respectively in 2025. However, the emergence of fintech companies like Earnest and Juno is increasing competition and driving innovation.

- Market Share (2025, Estimated): Sallie Mae (xx%), Discover (xx%), Federal Student Aid (xx%), Others (xx%).

- M&A Activity (2019-2024): xx deals, indicating a relatively active market for consolidation and expansion.

- Regulatory Framework: Stringent regulations governing lending practices and consumer protection significantly influence market dynamics.

- Substitute Products: Increased availability of scholarships, grants, and alternative financing options presents competitive pressures.

- End-User Trends: Growing demand for flexible repayment options and personalized financial planning solutions is shaping market offerings.

Student Loans Market Industry Insights & Trends

This section delves into the driving forces behind market growth, exploring technological advancements and evolving consumer preferences. The market size is projected to reach xx Million by 2033, driven by factors like rising higher education costs, increased student enrollment, and the expanding adoption of online lending platforms. Technological advancements, such as AI-powered risk assessment and personalized loan recommendations, are transforming the industry, improving efficiency and accessibility. Consumer behavior is shifting towards greater transparency and personalized financial planning, demanding greater flexibility in repayment options and integrated financial solutions. The increasing adoption of fintech solutions and mobile applications continues to enhance customer experience and streamline processes. Growing awareness of financial literacy is influencing borrowing decisions and driving demand for responsible lending practices.

Key Markets & Segments Leading Student Loans Market

This section identifies the dominant regions and segments within the student loan market.

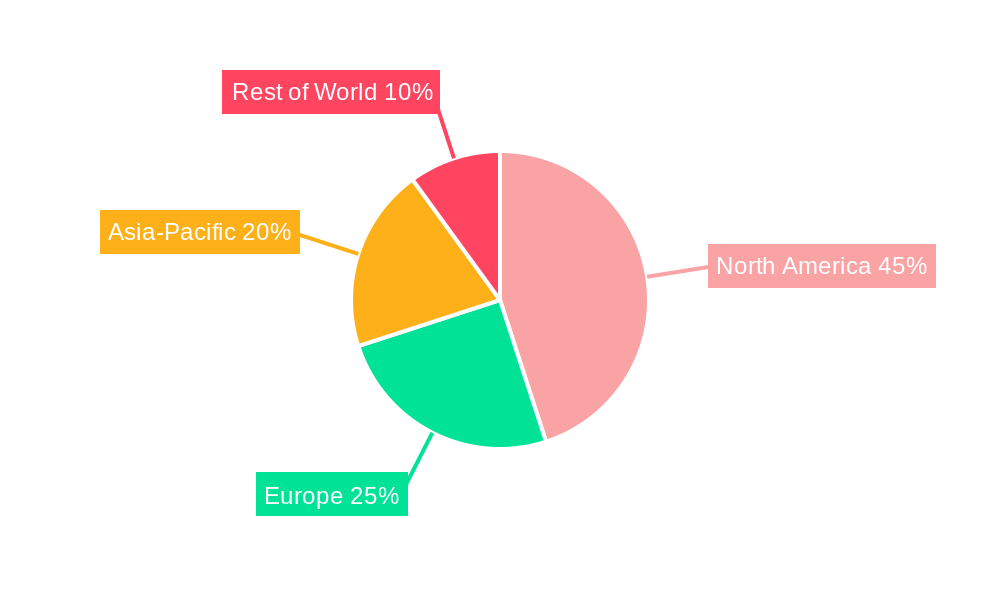

- Dominant Region: The United States currently dominates the global student loans market, driven by high tuition fees and a large student population.

- Key Drivers (United States):

- High Higher Education Costs: Continuously rising tuition fees fuel the demand for student loans.

- Increased Student Enrollment: Growth in higher education enrollment further expands the market.

- Government Support (Federal Student Aid): Government programs play a crucial role in supporting student borrowing.

- Robust Private Lending Sector: A competitive private lending sector caters to diverse borrower needs.

The dominance of the US market is attributed to its high tuition costs, extensive higher education system, and robust private lending sector complemented by significant government involvement. This creates a vast pool of potential borrowers and lenders, making it the largest and most developed student loan market globally. Other regions are experiencing growth, but the US maintains a significant lead in terms of market size and activity.

Student Loans Market Product Developments

Recent product innovations focus on personalized loan offerings, flexible repayment options, and improved digital user experiences. Fintech companies are leading this development, leveraging technology to streamline processes, enhance accessibility, and cater to diverse borrower needs. These advancements aim to improve affordability, transparency, and overall customer satisfaction, creating a competitive advantage in the increasingly saturated student loan landscape.

Challenges in the Student Loans Market Market

The student loan market faces challenges such as stringent regulations, increasing competition, and the potential for economic downturns impacting repayment rates. These factors affect lender profitability and borrower access to credit. The fluctuating economic climate and its effect on repayment rates presents considerable risk. Furthermore, the high volume of student loan debt creates systemic vulnerability and potential financial instability.

Forces Driving Student Loans Market Growth

Key growth drivers include technological advancements, rising higher education costs, and increasing student enrollment. Government policies and initiatives supporting student access to education also play a crucial role. Furthermore, the expanding use of digital platforms and online lending platforms contributes to market growth by expanding accessibility and streamlining the borrowing process.

Long-Term Growth Catalysts in the Student Loans Market

Long-term growth is projected to be fueled by the expansion of online lending, improved risk assessment models, and innovative financial products tailored to specific student needs. Strategic partnerships between lenders and educational institutions will further enhance market reach and accessibility. The development of new technologies and data analytics will allow for more efficient risk assessment and improved loan management.

Emerging Opportunities in Student Loans Market

Emerging opportunities include the expansion of international student loans, the development of income-share agreements (ISAs), and the increasing adoption of personalized financial planning tools. Further expansion into underserved markets and the exploration of innovative financing models will also present significant growth opportunities.

Leading Players in the Student Loans Market Sector

- Earnest

- Juno

- Credible

- Citizens Bank

- Discover

- Mpower

- Prodigy

- Federal Student Aid

- Sallie Mae

- College Ave (List Not Exhaustive)

Key Milestones in Student Loans Market Industry

- October 2023: Discover launched its "Especially for Everyone" brand campaign featuring Jennifer Coolidge, marking its entry into promoting deposit products. This highlights a shift towards broader financial service offerings within the student loan market.

- July 2023: Earnest partnered with Nova Credit to launch International Private Student Loans, expanding access to higher education financing globally. This demonstrates the growing role of fintech in expanding market reach and inclusivity.

Strategic Outlook for Student Loans Market Market

The student loan market is poised for continued growth, driven by technological innovations, evolving consumer preferences, and the ongoing demand for higher education. Strategic partnerships, product diversification, and expansion into new markets will be key to maximizing future market potential. The focus on personalized financial solutions, coupled with improved risk assessment models, will ensure sustainable growth and enhanced market stability.

Student Loans Market Segmentation

-

1. Type

- 1.1. Federal/Government Loan

- 1.2. Private Loan

-

2. Repayment Plan

- 2.1. Standard Repayment Plan

- 2.2. Graduated Repayment Plan

- 2.3. Revised Pay As You Earn (REPAYE)

- 2.4. Income-based (IBR)

- 2.5. Other Repayment Plans

-

3. Age Group

- 3.1. 24 or Younger

- 3.2. 25 to 34

- 3.3. Above 35

-

4. End User

- 4.1. Graduate Students

- 4.2. High School Student

- 4.3. Other End-Users

Student Loans Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Student Loans Market Regional Market Share

Geographic Coverage of Student Loans Market

Student Loans Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives are Driving the Market; Growing Aspirations for International Education is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Initiatives are Driving the Market; Growing Aspirations for International Education is Driving the Market

- 3.4. Market Trends

- 3.4.1. High Education Costs is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Student Loans Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Federal/Government Loan

- 5.1.2. Private Loan

- 5.2. Market Analysis, Insights and Forecast - by Repayment Plan

- 5.2.1. Standard Repayment Plan

- 5.2.2. Graduated Repayment Plan

- 5.2.3. Revised Pay As You Earn (REPAYE)

- 5.2.4. Income-based (IBR)

- 5.2.5. Other Repayment Plans

- 5.3. Market Analysis, Insights and Forecast - by Age Group

- 5.3.1. 24 or Younger

- 5.3.2. 25 to 34

- 5.3.3. Above 35

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Graduate Students

- 5.4.2. High School Student

- 5.4.3. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Student Loans Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Federal/Government Loan

- 6.1.2. Private Loan

- 6.2. Market Analysis, Insights and Forecast - by Repayment Plan

- 6.2.1. Standard Repayment Plan

- 6.2.2. Graduated Repayment Plan

- 6.2.3. Revised Pay As You Earn (REPAYE)

- 6.2.4. Income-based (IBR)

- 6.2.5. Other Repayment Plans

- 6.3. Market Analysis, Insights and Forecast - by Age Group

- 6.3.1. 24 or Younger

- 6.3.2. 25 to 34

- 6.3.3. Above 35

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Graduate Students

- 6.4.2. High School Student

- 6.4.3. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Student Loans Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Federal/Government Loan

- 7.1.2. Private Loan

- 7.2. Market Analysis, Insights and Forecast - by Repayment Plan

- 7.2.1. Standard Repayment Plan

- 7.2.2. Graduated Repayment Plan

- 7.2.3. Revised Pay As You Earn (REPAYE)

- 7.2.4. Income-based (IBR)

- 7.2.5. Other Repayment Plans

- 7.3. Market Analysis, Insights and Forecast - by Age Group

- 7.3.1. 24 or Younger

- 7.3.2. 25 to 34

- 7.3.3. Above 35

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Graduate Students

- 7.4.2. High School Student

- 7.4.3. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Student Loans Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Federal/Government Loan

- 8.1.2. Private Loan

- 8.2. Market Analysis, Insights and Forecast - by Repayment Plan

- 8.2.1. Standard Repayment Plan

- 8.2.2. Graduated Repayment Plan

- 8.2.3. Revised Pay As You Earn (REPAYE)

- 8.2.4. Income-based (IBR)

- 8.2.5. Other Repayment Plans

- 8.3. Market Analysis, Insights and Forecast - by Age Group

- 8.3.1. 24 or Younger

- 8.3.2. 25 to 34

- 8.3.3. Above 35

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Graduate Students

- 8.4.2. High School Student

- 8.4.3. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Student Loans Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Federal/Government Loan

- 9.1.2. Private Loan

- 9.2. Market Analysis, Insights and Forecast - by Repayment Plan

- 9.2.1. Standard Repayment Plan

- 9.2.2. Graduated Repayment Plan

- 9.2.3. Revised Pay As You Earn (REPAYE)

- 9.2.4. Income-based (IBR)

- 9.2.5. Other Repayment Plans

- 9.3. Market Analysis, Insights and Forecast - by Age Group

- 9.3.1. 24 or Younger

- 9.3.2. 25 to 34

- 9.3.3. Above 35

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Graduate Students

- 9.4.2. High School Student

- 9.4.3. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Student Loans Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Federal/Government Loan

- 10.1.2. Private Loan

- 10.2. Market Analysis, Insights and Forecast - by Repayment Plan

- 10.2.1. Standard Repayment Plan

- 10.2.2. Graduated Repayment Plan

- 10.2.3. Revised Pay As You Earn (REPAYE)

- 10.2.4. Income-based (IBR)

- 10.2.5. Other Repayment Plans

- 10.3. Market Analysis, Insights and Forecast - by Age Group

- 10.3.1. 24 or Younger

- 10.3.2. 25 to 34

- 10.3.3. Above 35

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Graduate Students

- 10.4.2. High School Student

- 10.4.3. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Earnest

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Juno

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Credible

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Citizens Bank

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Discover

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mpower

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Prodigy

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Federal Student Aid

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sallie Mae

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 College Ave**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Earnest

List of Figures

- Figure 1: Global Student Loans Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Student Loans Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Student Loans Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Student Loans Market Revenue (billion), by Repayment Plan 2025 & 2033

- Figure 5: North America Student Loans Market Revenue Share (%), by Repayment Plan 2025 & 2033

- Figure 6: North America Student Loans Market Revenue (billion), by Age Group 2025 & 2033

- Figure 7: North America Student Loans Market Revenue Share (%), by Age Group 2025 & 2033

- Figure 8: North America Student Loans Market Revenue (billion), by End User 2025 & 2033

- Figure 9: North America Student Loans Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Student Loans Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Student Loans Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Student Loans Market Revenue (billion), by Type 2025 & 2033

- Figure 13: South America Student Loans Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: South America Student Loans Market Revenue (billion), by Repayment Plan 2025 & 2033

- Figure 15: South America Student Loans Market Revenue Share (%), by Repayment Plan 2025 & 2033

- Figure 16: South America Student Loans Market Revenue (billion), by Age Group 2025 & 2033

- Figure 17: South America Student Loans Market Revenue Share (%), by Age Group 2025 & 2033

- Figure 18: South America Student Loans Market Revenue (billion), by End User 2025 & 2033

- Figure 19: South America Student Loans Market Revenue Share (%), by End User 2025 & 2033

- Figure 20: South America Student Loans Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America Student Loans Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Student Loans Market Revenue (billion), by Type 2025 & 2033

- Figure 23: Europe Student Loans Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Europe Student Loans Market Revenue (billion), by Repayment Plan 2025 & 2033

- Figure 25: Europe Student Loans Market Revenue Share (%), by Repayment Plan 2025 & 2033

- Figure 26: Europe Student Loans Market Revenue (billion), by Age Group 2025 & 2033

- Figure 27: Europe Student Loans Market Revenue Share (%), by Age Group 2025 & 2033

- Figure 28: Europe Student Loans Market Revenue (billion), by End User 2025 & 2033

- Figure 29: Europe Student Loans Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Student Loans Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe Student Loans Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Student Loans Market Revenue (billion), by Type 2025 & 2033

- Figure 33: Middle East & Africa Student Loans Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Middle East & Africa Student Loans Market Revenue (billion), by Repayment Plan 2025 & 2033

- Figure 35: Middle East & Africa Student Loans Market Revenue Share (%), by Repayment Plan 2025 & 2033

- Figure 36: Middle East & Africa Student Loans Market Revenue (billion), by Age Group 2025 & 2033

- Figure 37: Middle East & Africa Student Loans Market Revenue Share (%), by Age Group 2025 & 2033

- Figure 38: Middle East & Africa Student Loans Market Revenue (billion), by End User 2025 & 2033

- Figure 39: Middle East & Africa Student Loans Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East & Africa Student Loans Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa Student Loans Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Student Loans Market Revenue (billion), by Type 2025 & 2033

- Figure 43: Asia Pacific Student Loans Market Revenue Share (%), by Type 2025 & 2033

- Figure 44: Asia Pacific Student Loans Market Revenue (billion), by Repayment Plan 2025 & 2033

- Figure 45: Asia Pacific Student Loans Market Revenue Share (%), by Repayment Plan 2025 & 2033

- Figure 46: Asia Pacific Student Loans Market Revenue (billion), by Age Group 2025 & 2033

- Figure 47: Asia Pacific Student Loans Market Revenue Share (%), by Age Group 2025 & 2033

- Figure 48: Asia Pacific Student Loans Market Revenue (billion), by End User 2025 & 2033

- Figure 49: Asia Pacific Student Loans Market Revenue Share (%), by End User 2025 & 2033

- Figure 50: Asia Pacific Student Loans Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific Student Loans Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Student Loans Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Student Loans Market Revenue billion Forecast, by Repayment Plan 2020 & 2033

- Table 3: Global Student Loans Market Revenue billion Forecast, by Age Group 2020 & 2033

- Table 4: Global Student Loans Market Revenue billion Forecast, by End User 2020 & 2033

- Table 5: Global Student Loans Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Student Loans Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Global Student Loans Market Revenue billion Forecast, by Repayment Plan 2020 & 2033

- Table 8: Global Student Loans Market Revenue billion Forecast, by Age Group 2020 & 2033

- Table 9: Global Student Loans Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Global Student Loans Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Student Loans Market Revenue billion Forecast, by Type 2020 & 2033

- Table 15: Global Student Loans Market Revenue billion Forecast, by Repayment Plan 2020 & 2033

- Table 16: Global Student Loans Market Revenue billion Forecast, by Age Group 2020 & 2033

- Table 17: Global Student Loans Market Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global Student Loans Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Student Loans Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Global Student Loans Market Revenue billion Forecast, by Repayment Plan 2020 & 2033

- Table 24: Global Student Loans Market Revenue billion Forecast, by Age Group 2020 & 2033

- Table 25: Global Student Loans Market Revenue billion Forecast, by End User 2020 & 2033

- Table 26: Global Student Loans Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global Student Loans Market Revenue billion Forecast, by Type 2020 & 2033

- Table 37: Global Student Loans Market Revenue billion Forecast, by Repayment Plan 2020 & 2033

- Table 38: Global Student Loans Market Revenue billion Forecast, by Age Group 2020 & 2033

- Table 39: Global Student Loans Market Revenue billion Forecast, by End User 2020 & 2033

- Table 40: Global Student Loans Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global Student Loans Market Revenue billion Forecast, by Type 2020 & 2033

- Table 48: Global Student Loans Market Revenue billion Forecast, by Repayment Plan 2020 & 2033

- Table 49: Global Student Loans Market Revenue billion Forecast, by Age Group 2020 & 2033

- Table 50: Global Student Loans Market Revenue billion Forecast, by End User 2020 & 2033

- Table 51: Global Student Loans Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Student Loans Market ?

The projected CAGR is approximately 10.1%.

2. Which companies are prominent players in the Student Loans Market ?

Key companies in the market include Earnest, Juno, Credible, Citizens Bank, Discover, Mpower, Prodigy, Federal Student Aid, Sallie Mae, College Ave**List Not Exhaustive.

3. What are the main segments of the Student Loans Market ?

The market segments include Type, Repayment Plan, Age Group, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 980.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives are Driving the Market; Growing Aspirations for International Education is Driving the Market.

6. What are the notable trends driving market growth?

High Education Costs is Driving the Market.

7. Are there any restraints impacting market growth?

Government Initiatives are Driving the Market; Growing Aspirations for International Education is Driving the Market.

8. Can you provide examples of recent developments in the market?

October 2023: Discover unveiled its latest national brand campaign, titled "Especially for Everyone," featuring the acclaimed actress Jennifer Coolidge. In a groundbreaking move, Coolidge will take center stage in nationwide advertising efforts, spotlighting Discover's array of benefits and products. Of notable significance, this campaign marks the company's inaugural foray into promoting a deposit product, specifically highlighting Discover's Cashback Debit Checking Account.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Student Loans Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Student Loans Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Student Loans Market ?

To stay informed about further developments, trends, and reports in the Student Loans Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence