Key Insights

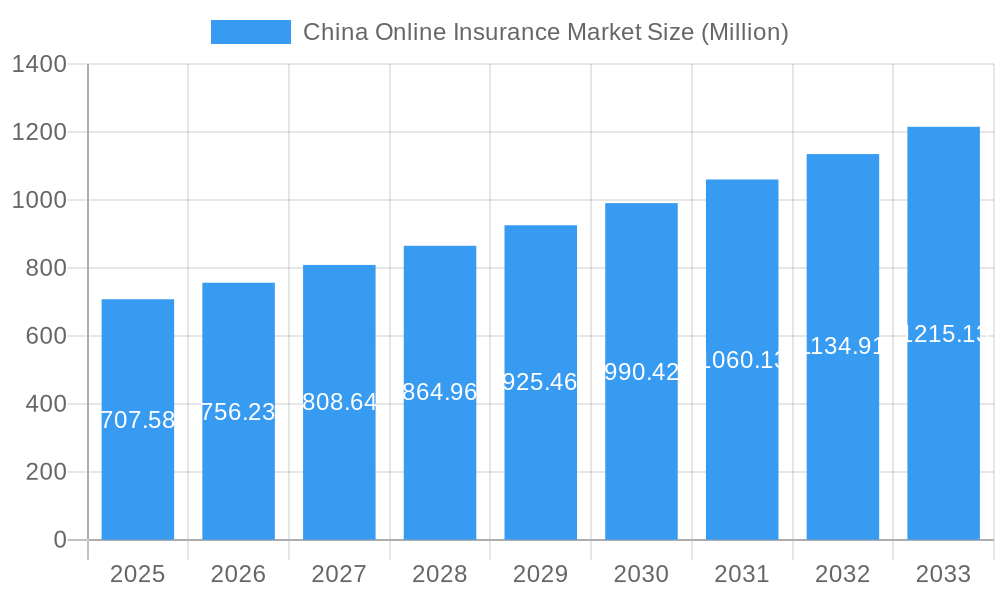

The China online insurance market, valued at $707.58 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.87% from 2025 to 2033. This surge is driven by several factors. Increasing internet and smartphone penetration across China is fueling a significant shift towards digital channels for insurance purchases. Consumers are increasingly drawn to the convenience, transparency, and often lower costs associated with online platforms. Furthermore, the innovative product offerings from online insurers, coupled with aggressive marketing and personalized customer experiences, are driving adoption. Government initiatives promoting financial inclusion and digitalization also play a supporting role, encouraging wider participation in the online insurance market. Key players like ZhongAn Insurance, FWD, and others are leading this transformation, leveraging advanced technologies like AI and big data analytics to personalize offerings and enhance customer service.

China Online Insurance Market Market Size (In Million)

However, challenges remain. While consumer adoption is growing, concerns around data privacy and security continue to exist, requiring robust regulatory frameworks and industry best practices to address. Competition among established players and new entrants is fierce, leading to price wars and the need for continuous innovation to maintain market share. Building trust and overcoming the traditional preference for face-to-face interactions, especially amongst older demographics, presents an ongoing challenge. Despite these hurdles, the long-term outlook for the China online insurance market remains highly positive, fueled by continued technological advancements and expanding consumer adoption of digital services. The market's significant growth potential is expected to attract further investment and innovation, leading to enhanced offerings and improved customer experiences.

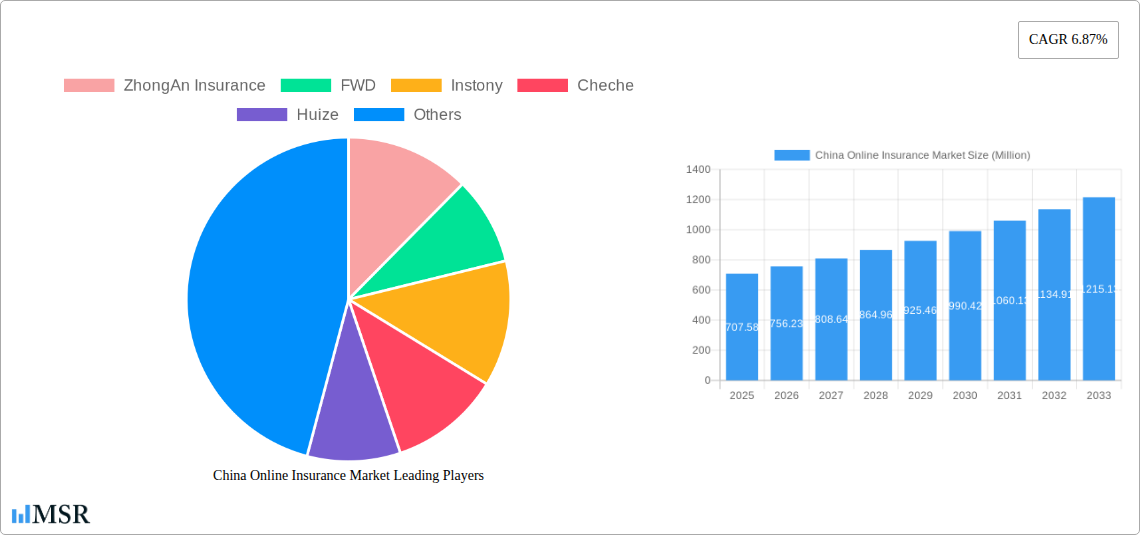

China Online Insurance Market Company Market Share

China Online Insurance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning China online insurance market, offering invaluable insights for industry stakeholders, investors, and strategists. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and opportunities. The report meticulously examines market dynamics, key players, emerging technologies, and regulatory landscapes, providing actionable intelligence for informed decision-making. The market size is predicted to reach xx Million by 2025, showcasing significant growth potential.

China Online Insurance Market Market Concentration & Dynamics

The China online insurance market exhibits a dynamic landscape characterized by increasing concentration amongst key players and a rapidly evolving innovation ecosystem. While precise market share figures for individual companies require further detailed research, leading players like ZhongAn Insurance, FWD, and Huize hold significant market positions. The market's concentration is further influenced by mergers and acquisitions (M&A) activities, with an estimated xx M&A deals recorded between 2019 and 2024. Regulatory frameworks, though evolving, are increasingly focused on consumer protection and data privacy, shaping the competitive dynamics. The emergence of innovative products, such as those leveraging AI and big data analytics, is disrupting traditional insurance models. Consumer trends indicate a growing preference for convenient, digitally-driven insurance solutions, fueling market expansion. Substitute products, such as peer-to-peer lending platforms offering limited insurance features, are also impacting market share for traditional insurers.

China Online Insurance Market Industry Insights & Trends

The China online insurance market experienced significant growth during the historical period (2019-2024), driven by factors such as rising internet penetration, increasing smartphone adoption, and a growing awareness of the benefits of online insurance products. Technological disruptions, primarily in the form of AI, big data analytics, and blockchain technologies, are revolutionizing underwriting processes, claims management, and customer service. This has led to improved efficiency, reduced costs, and personalized customer experiences. Consumer behavior is shifting towards a preference for online platforms offering customized policies, convenient purchasing options, and seamless claims processing. The market size is estimated at xx Million in 2025 and is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, driven by a confluence of factors outlined in the report.

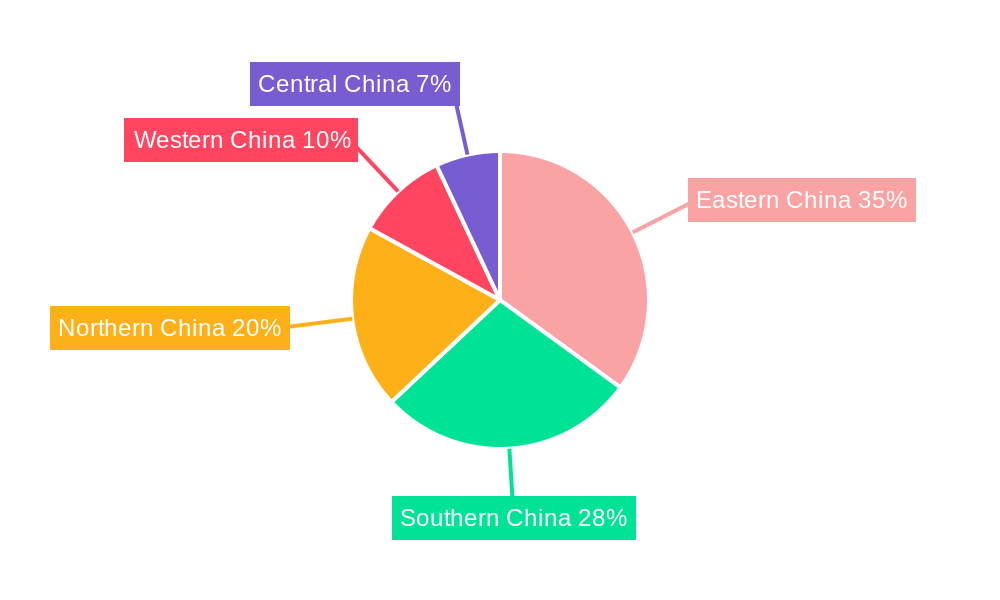

Key Markets & Segments Leading China Online Insurance Market

While a detailed regional breakdown necessitates further in-depth analysis, initial findings suggest that major metropolitan areas in China are the most dominant markets, accounting for a significant portion of the total market share. The growth in these regions is propelled by:

- High Internet Penetration: Ubiquitous access to the internet and mobile devices enables ease of access to online insurance platforms.

- Rising Disposable Incomes: Increasing disposable incomes allow consumers to allocate a larger portion of their budget towards insurance products.

- Improved Infrastructure: Robust digital infrastructure facilitates the smooth operation of online insurance platforms.

These regions benefit from a higher concentration of tech-savvy consumers, leading to greater adoption rates. Further research will delve into specific regional variations and segmentation details.

China Online Insurance Market Product Developments

Recent product developments highlight the integration of AI and big data analytics into online insurance platforms. Innovations include AI-powered underwriting processes that assess risk more efficiently, personalized insurance plans based on individual customer profiles, and chatbot-based customer service. These technological advancements provide a competitive edge, enhancing customer experience and operational efficiency. The integration of blockchain technology for secure data management and transparent claims processing further strengthens the sector's competitive landscape.

Challenges in the China Online Insurance Market Market

The China online insurance market faces several challenges, including stringent regulatory hurdles related to data privacy and security. Supply chain issues related to technology integration and talent acquisition can also impede growth. Intense competition amongst established players and new entrants exerts pressure on pricing and profitability, impacting overall market dynamics. For example, the intense competition has resulted in approximately xx Million in revenue loss due to price wars from 2022 to 2024.

Forces Driving China Online Insurance Market Growth

Key growth drivers for the China online insurance market include the rapid expansion of the internet and mobile penetration across all demographics, increasing consumer awareness of online insurance products and benefits, as well as the government's ongoing support for the digital economy. Technological advancements, including AI and big data analytics, are improving efficiency, reducing operational costs, and personalizing customer experiences. Favorable government regulations are also creating a conducive environment for the growth of the online insurance sector.

Long-Term Growth Catalysts in China Online Insurance Market

Long-term growth hinges on continuous innovation in product offerings, strategic partnerships between technology companies and insurers, and expansion into underserved regions. Innovative solutions such as micro-insurance products targeting specific demographic segments and leveraging new technologies like IoT and wearable devices will be crucial. Increased collaboration between stakeholders, including regulatory bodies and industry participants, is essential to overcome current challenges and foster sustainable growth.

Emerging Opportunities in China Online Insurance Market

Emerging opportunities lie in tapping into the vast potential of underserved rural markets and developing specialized insurance products for specific customer segments (e.g., gig economy workers, elderly). Leveraging technologies like IoT and AI to develop data-driven risk assessment and personalized insurance plans offers significant growth potential. Expanding into emerging insurance sectors such as health and travel insurance will broaden market reach and generate new revenue streams.

Leading Players in the China Online Insurance Market Sector

- ZhongAn Insurance

- FWD

- Instony

- Cheche

- Huize

- eBaoTech

- Bowtie

- Oliver Wyman

- Taikang Online

- Cathay Insurance

Key Milestones in China Online Insurance Market Industry

- October 2023: FWD and Club Care partnered to launch the online insurance platform Club Care, featuring a reward-based system for loyal customers. This signifies a move towards enhanced customer engagement and loyalty programs within the online insurance space.

- June 2023: ZhongAn Insurance and ZhongAn Technology explored generative AI technology, highlighting the potential for AI to become a significant strategic asset for online insurance companies in the future. This underscores the growing importance of AI in shaping the competitive landscape.

Strategic Outlook for China Online Insurance Market Market

The China online insurance market presents significant long-term growth potential, driven by continued technological advancements, expanding internet penetration, and evolving consumer preferences. Strategic opportunities include focusing on innovation, strategic partnerships, and expanding into new market segments. Companies that leverage AI, big data, and other cutting-edge technologies to deliver personalized and efficient services will be well-positioned for success in this dynamic and rapidly evolving market. The focus should be on building a robust, secure, and customer-centric digital platform to maximize market share and profitability in the years to come.

China Online Insurance Market Segmentation

-

1. Insurance Type

- 1.1. Life Insurance

- 1.2. Non-Life Insurance

-

2. Type of Providers

- 2.1. Insurance Companies

- 2.2. Third Party Administrators

- 2.3. Brokers

China Online Insurance Market Segmentation By Geography

- 1. China

China Online Insurance Market Regional Market Share

Geographic Coverage of China Online Insurance Market

China Online Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market; Young Age Population Preferring Online Insurance is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Internet Penetration is Driving the Market; Young Age Population Preferring Online Insurance is Driving the Market

- 3.4. Market Trends

- 3.4.1. The Online Health Insurance is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Online Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life Insurance

- 5.1.2. Non-Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Type of Providers

- 5.2.1. Insurance Companies

- 5.2.2. Third Party Administrators

- 5.2.3. Brokers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ZhongAn Insurance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FWD

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Instony

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cheche

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Huize

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 eBaoTech

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bowtie

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oliver Wyman

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Taikang Online

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cathay Insurance**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ZhongAn Insurance

List of Figures

- Figure 1: China Online Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Online Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: China Online Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 2: China Online Insurance Market Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 3: China Online Insurance Market Revenue Million Forecast, by Type of Providers 2020 & 2033

- Table 4: China Online Insurance Market Volume Billion Forecast, by Type of Providers 2020 & 2033

- Table 5: China Online Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: China Online Insurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: China Online Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 8: China Online Insurance Market Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 9: China Online Insurance Market Revenue Million Forecast, by Type of Providers 2020 & 2033

- Table 10: China Online Insurance Market Volume Billion Forecast, by Type of Providers 2020 & 2033

- Table 11: China Online Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: China Online Insurance Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Online Insurance Market?

The projected CAGR is approximately 6.87%.

2. Which companies are prominent players in the China Online Insurance Market?

Key companies in the market include ZhongAn Insurance, FWD, Instony, Cheche, Huize, eBaoTech, Bowtie, Oliver Wyman, Taikang Online, Cathay Insurance**List Not Exhaustive.

3. What are the main segments of the China Online Insurance Market?

The market segments include Insurance Type, Type of Providers.

4. Can you provide details about the market size?

The market size is estimated to be USD 707.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market; Young Age Population Preferring Online Insurance is Driving the Market.

6. What are the notable trends driving market growth?

The Online Health Insurance is Driving the Market.

7. Are there any restraints impacting market growth?

Internet Penetration is Driving the Market; Young Age Population Preferring Online Insurance is Driving the Market.

8. Can you provide examples of recent developments in the market?

October 2023: FWD and Club Care partnered to launch the online insurance platform Club Care. Club Care is a new online insurance platform that has a reward-based system for its loyal customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Online Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Online Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Online Insurance Market?

To stay informed about further developments, trends, and reports in the China Online Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence