Key Insights

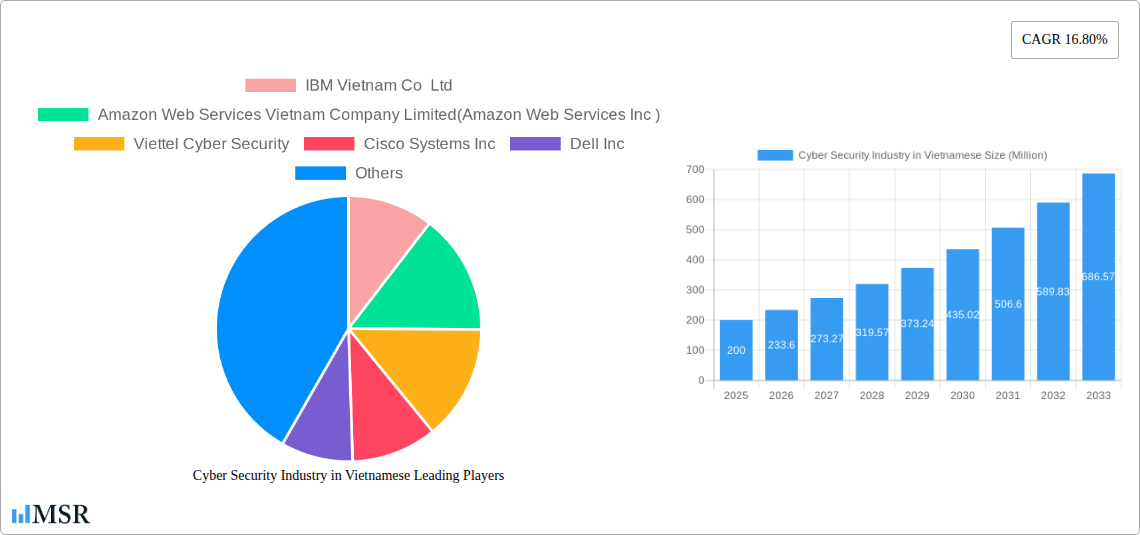

The Vietnamese cybersecurity market, exhibiting a robust Compound Annual Growth Rate (CAGR) of 16.80% from 2019 to 2024, is poised for significant expansion. Driven by increasing digital adoption across sectors like BFSI (Banking, Financial Services, and Insurance), healthcare, and manufacturing, coupled with government initiatives to bolster national cybersecurity infrastructure, the market is projected to experience substantial growth through 2033. The cloud deployment model is gaining traction, fueled by its scalability and cost-effectiveness, while the demand for sophisticated security solutions is driving growth in the security type offering segment. Key players like IBM Vietnam, Amazon Web Services Vietnam, Viettel Cyber Security, and FPT Corporation are actively shaping the market landscape, offering a mix of on-premise and cloud-based solutions and services catering to diverse end-user needs. However, the market faces challenges such as a shortage of skilled cybersecurity professionals and the evolving sophistication of cyber threats, necessitating continuous investment in talent development and advanced security technologies.

The significant market growth is attributed to several factors, including rising digital transactions, increasing awareness of cyber risks, and stringent government regulations mandating enhanced cybersecurity measures. The preference for cloud-based solutions is further accelerating market expansion, simplifying security management and reducing capital expenditure for businesses of all sizes. While the on-premise model still holds relevance for specific applications requiring stringent data control, the overall trend points toward a dominant role for cloud-based cybersecurity in the foreseeable future. The competitive landscape is dynamic, characterized by both international giants and strong domestic players, driving innovation and service diversification to meet the escalating cybersecurity needs of Vietnam's rapidly evolving digital economy. Future market development will hinge on successful strategies to address the talent gap, proactively adapt to evolving threat landscapes, and effectively bridge the cybersecurity awareness gap amongst individuals and businesses.

Báo cáo Thị trường An ninh mạng Việt Nam: Triển vọng 2019-2033

Mô tả: Báo cáo này cung cấp cái nhìn toàn diện về thị trường an ninh mạng Việt Nam, dự báo tăng trưởng từ năm 2019 đến năm 2033. Chúng tôi phân tích sâu rộng về sự tập trung thị trường, xu hướng công nghệ, phân khúc chính, các công ty hàng đầu như IBM Việt Nam, Amazon Web Services Việt Nam, Viettel Cyber Security, Cisco, Dell, HPT, FPT, CMC và Microsoft Việt Nam (danh sách không đầy đủ), cũng như các thách thức và cơ hội nổi bật. Báo cáo bao gồm dữ liệu thị trường chi tiết, phân tích SWOT, và dự báo tăng trưởng, giúp các bên liên quan trong ngành hiểu rõ hơn về tiềm năng và hướng phát triển của thị trường an ninh mạng Việt Nam, với quy mô thị trường dự kiến đạt hàng triệu đô la Mỹ.

Tập trung và Động lực Thị trường An ninh Mạng Việt Nam

Báo cáo đánh giá sự tập trung thị trường, hệ sinh thái đổi mới, khung pháp lý, sản phẩm thay thế, xu hướng người dùng cuối và hoạt động M&A trong ngành an ninh mạng Việt Nam. Thị trường được đặc trưng bởi sự cạnh tranh gay gắt giữa các công ty trong nước và quốc tế, với sự hiện diện đáng kể của các tập đoàn công nghệ lớn toàn cầu. Tỷ lệ thị phần cụ thể của từng công ty sẽ được phân tích chi tiết trong báo cáo đầy đủ. Số lượng giao dịch M&A trong giai đoạn 2019-2024 ước tính là xx giao dịch, cho thấy sự gia tăng hoạt động sáp nhập và mua lại nhằm mở rộng thị phần và năng lực công nghệ. Việt Nam đang đẩy mạnh xây dựng khung pháp lý về an ninh mạng, tạo ra cả cơ hội và thách thức cho các doanh nghiệp. Sự gia tăng các cuộc tấn công mạng và nhận thức về an ninh dữ liệu đang thúc đẩy nhu cầu về các giải pháp an ninh mạng, tạo điều kiện cho sự phát triển nhanh chóng của thị trường.

- Sự tập trung thị trường: xx%

- Số lượng giao dịch M&A (2019-2024): xx

- Xu hướng người dùng cuối: Tăng cường đầu tư vào an ninh mạng bởi các ngành BFSI, Chính phủ & Quốc phòng.

Triển vọng và Xu hướng Ngành An ninh Mạng Việt Nam

Thị trường an ninh mạng Việt Nam đang chứng kiến tốc độ tăng trưởng mạnh mẽ, với CAGR ước tính là xx% trong giai đoạn 2025-2033. Quy mô thị trường năm 2025 ước tính đạt xx triệu USD. Sự gia tăng các thiết bị kết nối internet, sự phát triển của thương mại điện tử và chuyển đổi số, cùng với sự gia tăng các mối đe dọa an ninh mạng là những động lực chính thúc đẩy tăng trưởng. Sự phát triển của công nghệ đám mây (Cloud Computing) và trí tuệ nhân tạo (AI) cũng đóng góp đáng kể vào sự đổi mới trong ngành. Hành vi người tiêu dùng đang chuyển dịch từ các giải pháp an ninh truyền thống sang các giải pháp an ninh mạng tiên tiến hơn, tích hợp nhiều tính năng và bảo mật cao hơn.

Thị trường và Phân khúc Chính trong Ngành An ninh Mạng Việt Nam

- Theo triển khai: Phân khúc đám mây (Cloud) đang dẫn đầu với tốc độ tăng trưởng nhanh nhất, do sự gia tăng nhu cầu lưu trữ và xử lý dữ liệu trên nền tảng đám mây. Phân khúc On-premise vẫn chiếm thị phần đáng kể, đặc biệt trong các ngành có yêu cầu cao về bảo mật dữ liệu.

- Theo người dùng cuối: Ngành BFSI (Tài chính – Ngân hàng – Bảo hiểm), Chính phủ & Quốc phòng, và IT & Viễn thông là những phân khúc chiếm tỷ trọng lớn nhất trên thị trường. Sự tăng trưởng mạnh mẽ của các ngành này thúc đẩy nhu cầu về các giải pháp an ninh mạng ngày càng cao.

- Theo loại hình dịch vụ: Các dịch vụ an ninh quản lý (Managed Security Services) và các giải pháp bảo mật điểm cuối (Endpoint Security) đang rất được ưa chuộng.

Động lực tăng trưởng:

- Tăng trưởng kinh tế mạnh mẽ.

- Sự phát triển cơ sở hạ tầng CNTT.

- Tăng cường nhận thức về an ninh mạng.

- Chính phủ thúc đẩy chuyển đổi số.

Phát triển Sản phẩm trong Ngành An ninh Mạng Việt Nam

Sự đổi mới sản phẩm tập trung vào việc tích hợp AI, Machine Learning và các công nghệ tiên tiến khác để tăng cường khả năng phát hiện và phản ứng trước các mối đe dọa an ninh mạng. Các giải pháp an ninh mạng thế hệ mới tập trung vào việc bảo vệ đa lớp, tự động hóa và khả năng tích hợp cao.

Thách thức trong Thị trường An ninh Mạng Việt Nam

Các thách thức chính bao gồm thiếu nhân lực có kỹ năng cao trong lĩnh vực an ninh mạng, sự phức tạp của khung pháp lý, và cạnh tranh gay gắt từ các đối thủ trong và ngoài nước. Thiếu hụt nhân lực chuyên môn dẫn đến chi phí tuyển dụng và đào tạo cao.

Động lực thúc đẩy tăng trưởng ngành An ninh Mạng Việt Nam

Sự phát triển nhanh chóng của công nghệ, tăng trưởng kinh tế mạnh mẽ, và sự chú trọng của Chính phủ vào an ninh mạng quốc gia là những động lực chính thúc đẩy tăng trưởng ngành.

Thách thức lâu dài trong ngành An ninh Mạng Việt Nam

Sự thay đổi nhanh chóng của môi trường an ninh mạng đòi hỏi các doanh nghiệp phải liên tục cập nhật và nâng cấp giải pháp để thích ứng.

Cơ hội nổi bật trong Ngành An ninh Mạng Việt Nam

Sự phát triển của IoT, 5G, và Cloud computing tạo ra nhiều cơ hội mới cho các doanh nghiệp an ninh mạng.

Các công ty hàng đầu trong Ngành An ninh Mạng Việt Nam

- IBM Vietnam Co Ltd

- Amazon Web Services Vietnam Company Limited (Amazon Web Services Inc)

- Viettel Cyber Security

- Cisco Systems Inc

- Dell Inc

- HPT Vietnam Corporation

- FPT Corporation

- CMC Corporation

- Microsoft Vietnam

Các mốc quan trọng trong Ngành An ninh Mạng Việt Nam

- Tháng 8 năm 2022: Kasikornbank (KBank) của Thái Lan đầu tư hơn 75 triệu USD vào mở rộng mạng lưới dịch vụ tại Việt Nam.

- Tháng 7 năm 2022: Amazon Web Services (AWS) mở rộng hoạt động tại Việt Nam, song đối mặt với áp lực từ chính phủ về việc lưu trữ dữ liệu trong nước.

Triển vọng Chiến lược cho Thị trường An ninh Mạng Việt Nam

Thị trường an ninh mạng Việt Nam dự kiến sẽ tiếp tục tăng trưởng mạnh mẽ trong những năm tới, nhờ sự thúc đẩy của chuyển đổi số, tăng cường nhận thức về an ninh mạng và sự đầu tư mạnh mẽ từ cả Chính phủ và khu vực tư nhân. Các cơ hội chiến lược tập trung vào việc phát triển các giải pháp an ninh mạng tiên tiến, đáp ứng nhu cầu ngày càng cao của các doanh nghiệp và cơ quan chính phủ.

Cyber Security Industry in Vietnamese Segmentation

-

1. Offering

- 1.1. Security Type

- 1.2. Services

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. End User

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Manufacturing

- 3.4. Government & Defense

- 3.5. IT and Telecommunication

- 3.6. Other End Users

Cyber Security Industry in Vietnamese Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cyber Security Industry in Vietnamese REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Digitalization and Scalable IT Infrastructure; Growing IoT Connections Demanding Strengthened Cybersecurity in Enterprises

- 3.3. Market Restrains

- 3.3.1. Lack of Cybersecurity Professionals and Outdated Cybersecurity Technology

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Digitalization and Scalable IT Infrastructure

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cyber Security Industry in Vietnamese Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Security Type

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Manufacturing

- 5.3.4. Government & Defense

- 5.3.5. IT and Telecommunication

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America Cyber Security Industry in Vietnamese Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Security Type

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Cloud

- 6.2.2. On-premise

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. BFSI

- 6.3.2. Healthcare

- 6.3.3. Manufacturing

- 6.3.4. Government & Defense

- 6.3.5. IT and Telecommunication

- 6.3.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. South America Cyber Security Industry in Vietnamese Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Security Type

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Cloud

- 7.2.2. On-premise

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. BFSI

- 7.3.2. Healthcare

- 7.3.3. Manufacturing

- 7.3.4. Government & Defense

- 7.3.5. IT and Telecommunication

- 7.3.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Europe Cyber Security Industry in Vietnamese Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Security Type

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Cloud

- 8.2.2. On-premise

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. BFSI

- 8.3.2. Healthcare

- 8.3.3. Manufacturing

- 8.3.4. Government & Defense

- 8.3.5. IT and Telecommunication

- 8.3.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Middle East & Africa Cyber Security Industry in Vietnamese Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Security Type

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Cloud

- 9.2.2. On-premise

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. BFSI

- 9.3.2. Healthcare

- 9.3.3. Manufacturing

- 9.3.4. Government & Defense

- 9.3.5. IT and Telecommunication

- 9.3.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Asia Pacific Cyber Security Industry in Vietnamese Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 10.1.1. Security Type

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Cloud

- 10.2.2. On-premise

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. BFSI

- 10.3.2. Healthcare

- 10.3.3. Manufacturing

- 10.3.4. Government & Defense

- 10.3.5. IT and Telecommunication

- 10.3.6. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 IBM Vietnam Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amazon Web Services Vietnam Company Limited(Amazon Web Services Inc )

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Viettel Cyber Security

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cisco Systems Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dell Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HPT Vietnam Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FPT Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CMC Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Microsoft Vietnam*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 IBM Vietnam Co Ltd

List of Figures

- Figure 1: Global Cyber Security Industry in Vietnamese Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Vietnam Cyber Security Industry in Vietnamese Revenue (Million), by Country 2024 & 2032

- Figure 3: Vietnam Cyber Security Industry in Vietnamese Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Cyber Security Industry in Vietnamese Revenue (Million), by Offering 2024 & 2032

- Figure 5: North America Cyber Security Industry in Vietnamese Revenue Share (%), by Offering 2024 & 2032

- Figure 6: North America Cyber Security Industry in Vietnamese Revenue (Million), by Deployment 2024 & 2032

- Figure 7: North America Cyber Security Industry in Vietnamese Revenue Share (%), by Deployment 2024 & 2032

- Figure 8: North America Cyber Security Industry in Vietnamese Revenue (Million), by End User 2024 & 2032

- Figure 9: North America Cyber Security Industry in Vietnamese Revenue Share (%), by End User 2024 & 2032

- Figure 10: North America Cyber Security Industry in Vietnamese Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Cyber Security Industry in Vietnamese Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America Cyber Security Industry in Vietnamese Revenue (Million), by Offering 2024 & 2032

- Figure 13: South America Cyber Security Industry in Vietnamese Revenue Share (%), by Offering 2024 & 2032

- Figure 14: South America Cyber Security Industry in Vietnamese Revenue (Million), by Deployment 2024 & 2032

- Figure 15: South America Cyber Security Industry in Vietnamese Revenue Share (%), by Deployment 2024 & 2032

- Figure 16: South America Cyber Security Industry in Vietnamese Revenue (Million), by End User 2024 & 2032

- Figure 17: South America Cyber Security Industry in Vietnamese Revenue Share (%), by End User 2024 & 2032

- Figure 18: South America Cyber Security Industry in Vietnamese Revenue (Million), by Country 2024 & 2032

- Figure 19: South America Cyber Security Industry in Vietnamese Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Cyber Security Industry in Vietnamese Revenue (Million), by Offering 2024 & 2032

- Figure 21: Europe Cyber Security Industry in Vietnamese Revenue Share (%), by Offering 2024 & 2032

- Figure 22: Europe Cyber Security Industry in Vietnamese Revenue (Million), by Deployment 2024 & 2032

- Figure 23: Europe Cyber Security Industry in Vietnamese Revenue Share (%), by Deployment 2024 & 2032

- Figure 24: Europe Cyber Security Industry in Vietnamese Revenue (Million), by End User 2024 & 2032

- Figure 25: Europe Cyber Security Industry in Vietnamese Revenue Share (%), by End User 2024 & 2032

- Figure 26: Europe Cyber Security Industry in Vietnamese Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Cyber Security Industry in Vietnamese Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa Cyber Security Industry in Vietnamese Revenue (Million), by Offering 2024 & 2032

- Figure 29: Middle East & Africa Cyber Security Industry in Vietnamese Revenue Share (%), by Offering 2024 & 2032

- Figure 30: Middle East & Africa Cyber Security Industry in Vietnamese Revenue (Million), by Deployment 2024 & 2032

- Figure 31: Middle East & Africa Cyber Security Industry in Vietnamese Revenue Share (%), by Deployment 2024 & 2032

- Figure 32: Middle East & Africa Cyber Security Industry in Vietnamese Revenue (Million), by End User 2024 & 2032

- Figure 33: Middle East & Africa Cyber Security Industry in Vietnamese Revenue Share (%), by End User 2024 & 2032

- Figure 34: Middle East & Africa Cyber Security Industry in Vietnamese Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa Cyber Security Industry in Vietnamese Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Cyber Security Industry in Vietnamese Revenue (Million), by Offering 2024 & 2032

- Figure 37: Asia Pacific Cyber Security Industry in Vietnamese Revenue Share (%), by Offering 2024 & 2032

- Figure 38: Asia Pacific Cyber Security Industry in Vietnamese Revenue (Million), by Deployment 2024 & 2032

- Figure 39: Asia Pacific Cyber Security Industry in Vietnamese Revenue Share (%), by Deployment 2024 & 2032

- Figure 40: Asia Pacific Cyber Security Industry in Vietnamese Revenue (Million), by End User 2024 & 2032

- Figure 41: Asia Pacific Cyber Security Industry in Vietnamese Revenue Share (%), by End User 2024 & 2032

- Figure 42: Asia Pacific Cyber Security Industry in Vietnamese Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific Cyber Security Industry in Vietnamese Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Offering 2019 & 2032

- Table 3: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Offering 2019 & 2032

- Table 8: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Deployment 2019 & 2032

- Table 9: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Offering 2019 & 2032

- Table 15: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Deployment 2019 & 2032

- Table 16: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by End User 2019 & 2032

- Table 17: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Brazil Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Argentina Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of South America Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Offering 2019 & 2032

- Table 22: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Deployment 2019 & 2032

- Table 23: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by End User 2019 & 2032

- Table 24: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Kingdom Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Germany Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: France Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Spain Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Russia Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Benelux Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Nordics Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Offering 2019 & 2032

- Table 35: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Deployment 2019 & 2032

- Table 36: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by End User 2019 & 2032

- Table 37: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Offering 2019 & 2032

- Table 45: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Deployment 2019 & 2032

- Table 46: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by End User 2019 & 2032

- Table 47: Global Cyber Security Industry in Vietnamese Revenue Million Forecast, by Country 2019 & 2032

- Table 48: China Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: India Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Korea Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: ASEAN Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Oceania Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Cyber Security Industry in Vietnamese Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cyber Security Industry in Vietnamese?

The projected CAGR is approximately 16.80%.

2. Which companies are prominent players in the Cyber Security Industry in Vietnamese?

Key companies in the market include IBM Vietnam Co Ltd, Amazon Web Services Vietnam Company Limited(Amazon Web Services Inc ), Viettel Cyber Security, Cisco Systems Inc, Dell Inc, HPT Vietnam Corporation, FPT Corporation, CMC Corporation, Microsoft Vietnam*List Not Exhaustive.

3. What are the main segments of the Cyber Security Industry in Vietnamese?

The market segments include Offering, Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Digitalization and Scalable IT Infrastructure; Growing IoT Connections Demanding Strengthened Cybersecurity in Enterprises.

6. What are the notable trends driving market growth?

Increasing Demand for Digitalization and Scalable IT Infrastructure.

7. Are there any restraints impacting market growth?

Lack of Cybersecurity Professionals and Outdated Cybersecurity Technology.

8. Can you provide examples of recent developments in the market?

August 2022 - Kasikornbank (KBank) of Thailand is pushing ahead with intentions to become a regional digital bank with an expansion drive in Vietnam. KBank intends to invest more than 2.7 billion baht (about USD 75 million) in strengthening its service network throughout AEC+3 (ASEAN plus Japan, China, and the Republic of Korea) to serve clients across all sectors with digital services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cyber Security Industry in Vietnamese," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cyber Security Industry in Vietnamese report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cyber Security Industry in Vietnamese?

To stay informed about further developments, trends, and reports in the Cyber Security Industry in Vietnamese, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence