Key Insights

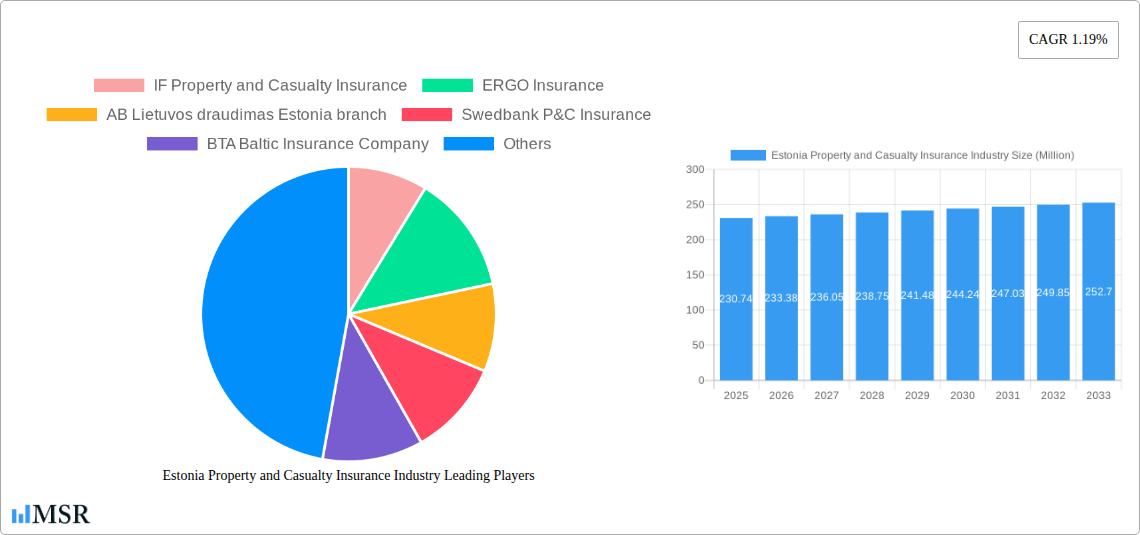

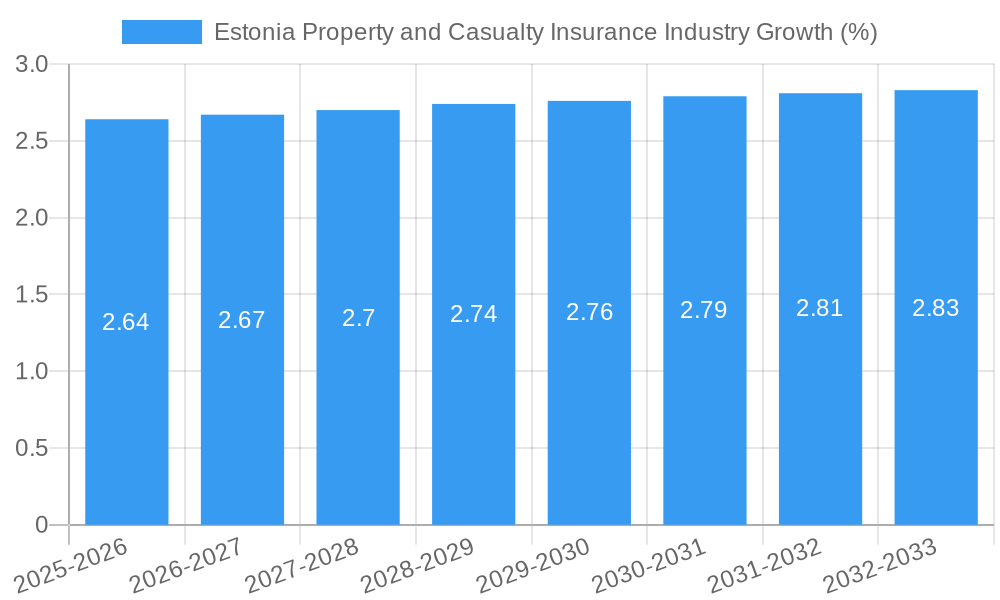

The Estonian property and casualty (P&C) insurance market, valued at €230.74 million in 2025, exhibits moderate growth, reflected in its 1.19% CAGR (2019-2033). This relatively low growth rate suggests a mature market with established players like IF Property and Casualty Insurance, ERGO Insurance, and Swedbank P&C Insurance dominating the landscape. The market's stability likely stems from a combination of factors. Firstly, a relatively stable Estonian economy contributes to consistent demand for insurance products. Secondly, stringent regulatory oversight ensures market stability and consumer protection. However, the market faces challenges. Increased competition from both established and emerging insurers could pressure profit margins. Additionally, evolving customer expectations and the increasing adoption of digital insurance solutions necessitates continuous innovation and adaptation. The market segmentation (data not provided) likely reflects variations in coverage types (e.g., motor, home, commercial), impacting growth across these individual segments. The forecast period (2025-2033) anticipates a continuation of this moderate growth trajectory, with incremental increases year-on-year largely driven by gradual economic expansion and population changes. Further growth opportunities could arise from expanding into niche markets and leveraging technology for improved efficiency and customer experience.

The competitive landscape is characterized by a mix of both domestic and international insurers. The presence of major international players demonstrates the market’s attractiveness despite its relatively small size. However, smaller, local insurers such as LHV Kindlustus and Salva Kindlustus are likely to focus on niche segments or personalized customer service to compete effectively. Future growth will depend on the insurers' ability to adapt to changing consumer preferences, technological advancements, and regulatory changes while maintaining financial stability. The continued adoption of digital channels and data analytics will be crucial for optimizing operations and delivering personalized insurance solutions. This focus on customer experience and technological adoption will differentiate successful players in the coming years.

Estonia Property and Casualty Insurance Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Estonian property and casualty (P&C) insurance market, covering market size, growth drivers, key players, and future trends. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is essential for investors, insurers, and industry stakeholders seeking to understand and navigate this dynamic market.

Estonia Property and Casualty Insurance Industry Market Concentration & Dynamics

The Estonian P&C insurance market exhibits a moderately concentrated structure, with a handful of dominant players alongside numerous smaller insurers. Market share data for 2024 suggests that the top five insurers control approximately xx% of the market, indicating room for both consolidation and competitive disruption. The market is characterized by a relatively mature innovation ecosystem, influenced by both local and international players. Regulatory frameworks are largely aligned with EU standards, ensuring a stable operating environment. Substitute products, such as self-insurance schemes, represent a limited challenge to traditional insurers. End-user trends reflect an increasing demand for digitalization, personalized services, and bundled products.

Key Metrics & Observations:

- Market Concentration: Top 5 players hold approximately xx% market share (2024).

- M&A Activity: A total of xx M&A deals were recorded between 2019 and 2024. Recent examples include Howden's acquisition of KindlustusEst and Smart Kindlustusmaakler in February 2024.

- Innovation Ecosystem: Strong presence of both local and international technology providers supporting digital transformation.

- Regulatory Framework: Largely compliant with EU directives, offering a predictable environment for market participants.

Estonia Property and Casualty Insurance Industry Industry Insights & Trends

The Estonian P&C insurance market is projected to experience steady growth over the forecast period (2025-2033). The market size reached an estimated €xx Million in 2024, and is forecast to reach €xx Million by 2033, representing a CAGR of xx%. Key growth drivers include a growing economy, increasing penetration of insurance products, particularly in the motor and property segments, and a rising awareness of risk mitigation among businesses and individuals. Technological disruptions, such as the adoption of InsurTech solutions and AI-driven pricing models (as exemplified by Swedbank's partnership with Akur8 in March 2024), are reshaping market dynamics. Evolving consumer behaviors, characterized by a preference for digital channels and personalized experiences, further propel market evolution.

Key Markets & Segments Leading Estonia Property and Casualty Insurance Industry

The Estonian P&C insurance market is relatively homogeneous, with no single dominant region or segment significantly outperforming others. However, the motor insurance segment consistently maintains a substantial share, driven by the rising number of vehicles and increasing vehicle values. The commercial property and liability insurance segment also presents significant growth opportunities, fuelled by expanding business activity and government initiatives related to infrastructure development and building codes.

Key Drivers:

- Economic Growth: Steady GDP growth provides a favorable environment for insurance demand.

- Infrastructure Development: Investments in infrastructure create opportunities in construction and property insurance.

- Government Regulations: Increasingly stringent regulations regarding insurance compliance.

Estonia Property and Casualty Insurance Industry Product Developments

Recent product developments in the Estonian P&C insurance market are characterized by the incorporation of InsurTech advancements, offering greater efficiency, convenience, and personalized offerings. AI-powered pricing models and improved claims management systems are examples of such technological integration. Insurers are also focusing on developing tailored product bundles to cater to diverse customer needs, including bundled packages encompassing home, auto, and travel insurance. This strategy aims to improve customer retention and enhance market competitiveness.

Challenges in the Estonia Property and Casualty Insurance Industry Market

The Estonian P&C insurance market faces challenges such as intense competition, particularly from larger international players. Regulatory compliance requirements contribute to operational complexity and administrative costs. The fluctuating economic climate can also significantly impact market performance, especially given external factors including geopolitical developments. These challenges necessitate the adoption of innovative solutions and effective risk management strategies to maintain profitability and sustainability.

Forces Driving Estonia Property and Casualty Insurance Industry Growth

Several factors contribute to the projected growth of the Estonian P&C insurance market. The steady economic growth, combined with increasing disposable incomes, fuels demand for insurance products. The rising penetration of digital technologies and services enhances customer engagement and opens new business avenues. The supportive regulatory environment in Estonia further fosters a favorable market environment for growth and investment.

Long-Term Growth Catalysts in the Estonia Property and Casualty Insurance Industry

Long-term growth will depend on several factors, such as the sustained adoption of technology and innovation in product development and customer service. Strategic partnerships, particularly with fintech companies, will be crucial for streamlining operations and enhancing customer experiences. Expanding into new, niche insurance markets, such as cyber insurance, also holds considerable potential for growth and diversification.

Emerging Opportunities in Estonia Property and Casualty Insurance Industry

The Estonian P&C insurance market presents numerous opportunities for growth. The increasing adoption of telematics and IoT devices opens avenues for developing usage-based insurance products, offering tailored pricing and risk assessment. Focusing on customer segmentation and personalization can significantly improve customer loyalty and retention. Expanding into related sectors, such as health insurance and employee benefits, also provides new avenues for market expansion.

Leading Players in the Estonia Property and Casualty Insurance Industry Sector

- IF Property and Casualty Insurance

- ERGO Insurance

- AB Lietuvos draudimas Estonia branch

- Swedbank P&C Insurance

- BTA Baltic Insurance Company

- Salva Kindlustus

- Compensa Vienna Insurance Group ADB Estonia branch

- LHV Kindlustus

- VIG Group

- Lietuvos Draudimas

- Inges Kindlustus

Key Milestones in Estonia Property and Casualty Insurance Industry Industry

- February 2024: Howden acquires KindlustusEst and Smart Kindlustusmaakler, expanding its market presence.

- March 2024: Swedbank partners with Akur8 to enhance its insurance pricing capabilities using AI.

Strategic Outlook for Estonia Property and Casualty Insurance Industry Market

The Estonian P&C insurance market holds substantial long-term growth potential, driven by technological innovation, economic stability, and supportive regulations. Companies focusing on digital transformation, personalized customer experiences, and strategic partnerships will be best positioned to capture market share and drive future growth within this dynamic sector.

Estonia Property and Casualty Insurance Industry Segmentation

-

1. Product Type

- 1.1. Motor Insurance

- 1.2. Property Insurance

- 1.3. Civil Liability Insurance

- 1.4. Financial Loss Insurance

- 1.5. Others

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agents

- 2.3. Brokers

- 2.4. Other Distribution Channel

Estonia Property and Casualty Insurance Industry Segmentation By Geography

- 1. Estonia

Estonia Property and Casualty Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.19% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Self service insurance through Mobile apps increasing Non-life insurance penetration; Increase in Natural catastrophe driving new business opportunity for P&C insurance

- 3.3. Market Restrains

- 3.3.1. Self service insurance through Mobile apps increasing Non-life insurance penetration; Increase in Natural catastrophe driving new business opportunity for P&C insurance

- 3.4. Market Trends

- 3.4.1. Direct Sales leading P&C Insurance market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Estonia Property and Casualty Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Motor Insurance

- 5.1.2. Property Insurance

- 5.1.3. Civil Liability Insurance

- 5.1.4. Financial Loss Insurance

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agents

- 5.2.3. Brokers

- 5.2.4. Other Distribution Channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Estonia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IF Property and Casualty Insurance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ERGO Insurance

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AB Lietuvos draudimas Estonia branch

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Swedbank P&C Insurance

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BTA Baltic Insurance Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Salva Kindlustus

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Compensa Vienna Insurance Group ADB Estonia branch

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 LHV Kindlustus

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 VIG Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lietuvos Draudimas

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Inges Kindlustus**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 IF Property and Casualty Insurance

List of Figures

- Figure 1: Estonia Property and Casualty Insurance Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Estonia Property and Casualty Insurance Industry Share (%) by Company 2024

List of Tables

- Table 1: Estonia Property and Casualty Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Estonia Property and Casualty Insurance Industry Volume Million Forecast, by Region 2019 & 2032

- Table 3: Estonia Property and Casualty Insurance Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Estonia Property and Casualty Insurance Industry Volume Million Forecast, by Product Type 2019 & 2032

- Table 5: Estonia Property and Casualty Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Estonia Property and Casualty Insurance Industry Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Estonia Property and Casualty Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Estonia Property and Casualty Insurance Industry Volume Million Forecast, by Region 2019 & 2032

- Table 9: Estonia Property and Casualty Insurance Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: Estonia Property and Casualty Insurance Industry Volume Million Forecast, by Product Type 2019 & 2032

- Table 11: Estonia Property and Casualty Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Estonia Property and Casualty Insurance Industry Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Estonia Property and Casualty Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Estonia Property and Casualty Insurance Industry Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Estonia Property and Casualty Insurance Industry?

The projected CAGR is approximately 1.19%.

2. Which companies are prominent players in the Estonia Property and Casualty Insurance Industry?

Key companies in the market include IF Property and Casualty Insurance, ERGO Insurance, AB Lietuvos draudimas Estonia branch, Swedbank P&C Insurance, BTA Baltic Insurance Company, Salva Kindlustus, Compensa Vienna Insurance Group ADB Estonia branch, LHV Kindlustus, VIG Group, Lietuvos Draudimas, Inges Kindlustus**List Not Exhaustive.

3. What are the main segments of the Estonia Property and Casualty Insurance Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 230.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Self service insurance through Mobile apps increasing Non-life insurance penetration; Increase in Natural catastrophe driving new business opportunity for P&C insurance.

6. What are the notable trends driving market growth?

Direct Sales leading P&C Insurance market.

7. Are there any restraints impacting market growth?

Self service insurance through Mobile apps increasing Non-life insurance penetration; Increase in Natural catastrophe driving new business opportunity for P&C insurance.

8. Can you provide examples of recent developments in the market?

In February 2024, Howden acquired the business operations of the corporate portfolio of KindlustusEst Kindlustusmaakler OÜ as well as AS Smart Kindlustusmaakler. Howden expands its footprint in the area by acquiring two prominent insurance agents in Estonia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Estonia Property and Casualty Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Estonia Property and Casualty Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Estonia Property and Casualty Insurance Industry?

To stay informed about further developments, trends, and reports in the Estonia Property and Casualty Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence