Key Insights

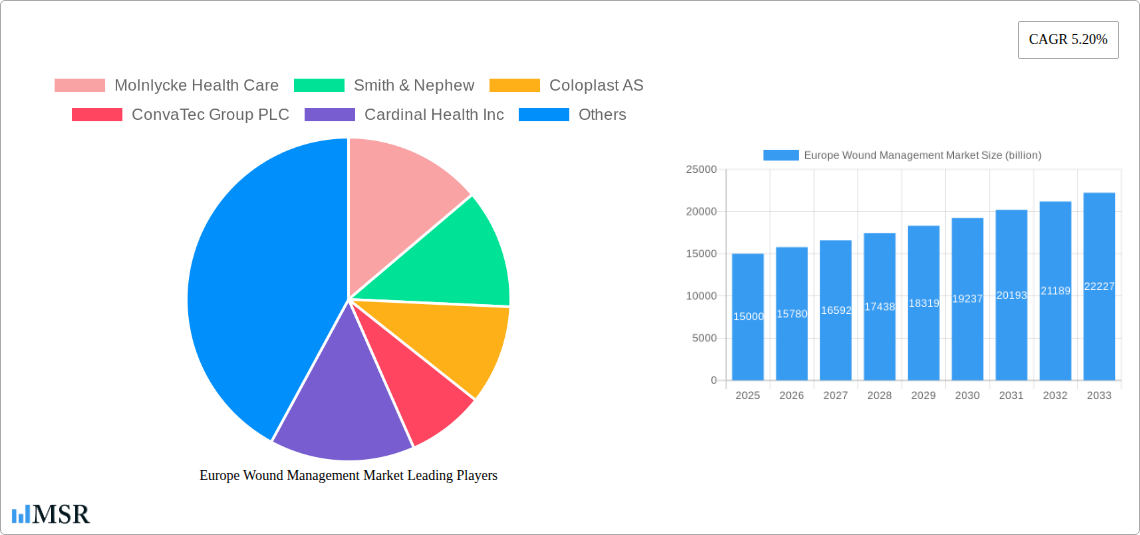

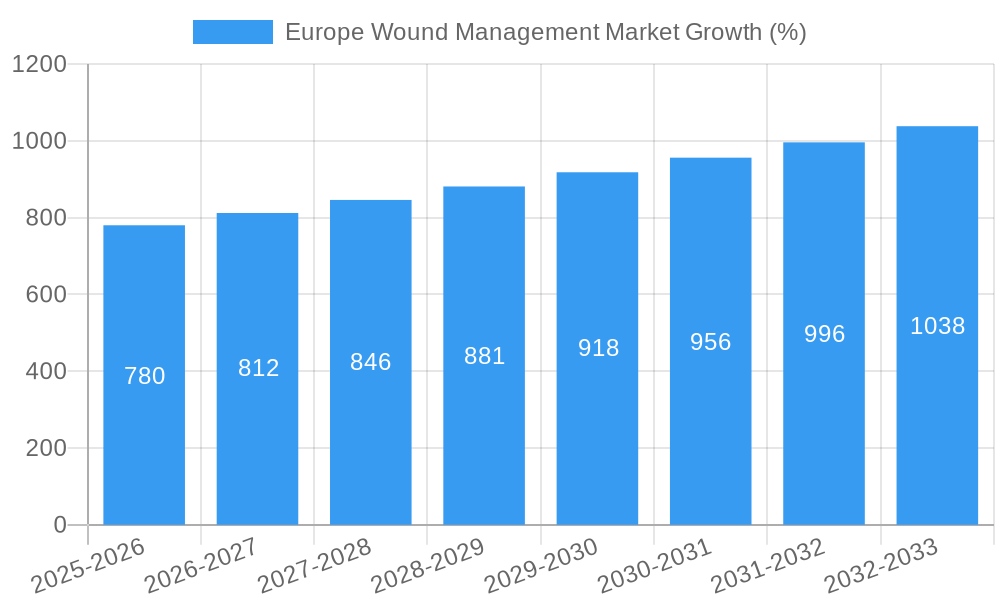

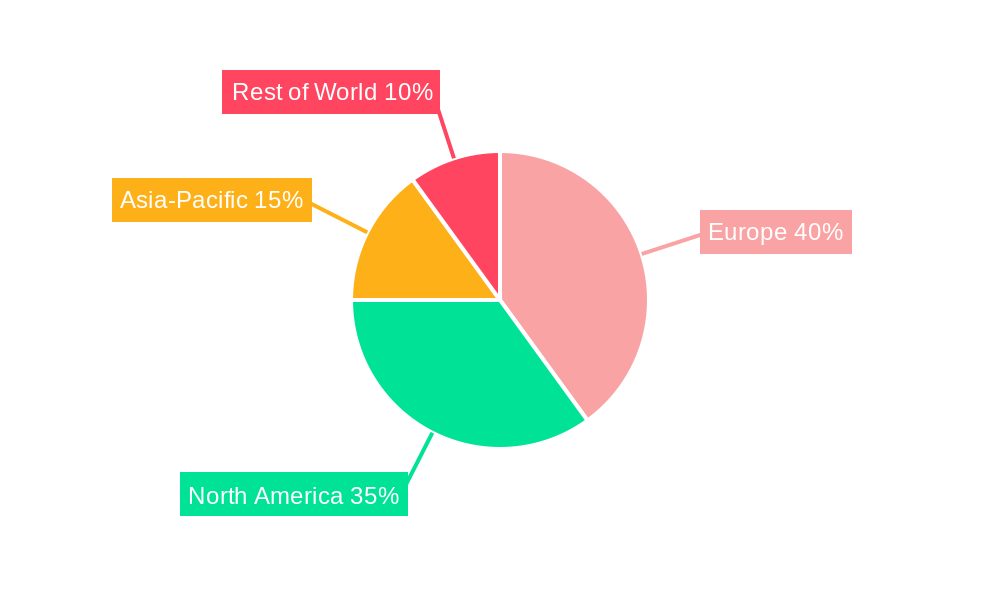

The European wound management market, valued at approximately €X billion in 2025 (estimated based on provided CAGR and market size), is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.20% from 2025 to 2033. This expansion is fueled by several key factors. The rising prevalence of chronic wounds, particularly diabetic foot ulcers and pressure ulcers, driven by an aging population and increasing incidence of diabetes, significantly contributes to market demand. Furthermore, advancements in wound care technologies, such as negative pressure wound therapy and advanced wound dressings (e.g., foam, hydrocolloid, and hydrogel dressings), are improving treatment outcomes and driving adoption. The increasing preference for minimally invasive procedures and outpatient care settings also contributes to market growth. However, the market faces certain restraints, including high treatment costs, particularly for advanced therapies, and the need for skilled healthcare professionals to manage complex wounds effectively. The market is segmented by product type (advanced wound dressings, surgical wound care, traditional wound care, and wound therapy devices), wound type (chronic and acute wounds), and end-use (hospitals, clinics, home healthcare, etc.). Germany, the United Kingdom, France, Italy, and Spain represent significant market segments within Europe, reflecting their larger populations and healthcare infrastructure.

The competitive landscape is characterized by the presence of both large multinational corporations and smaller specialized companies. Key players like Molnlycke Health Care, Smith & Nephew, and ConvaTec Group PLC are actively engaged in research and development, introducing innovative products and expanding their market presence. Strategic partnerships, acquisitions, and the increasing focus on providing comprehensive wound care solutions are shaping the industry dynamics. Future growth will likely depend on the continued innovation in wound care technologies, increasing healthcare spending, improved reimbursement policies, and effective management of chronic diseases associated with wound development. The market’s evolution will be closely tied to technological advancements in wound healing, personalized medicine approaches, and a growing focus on preventative measures to reduce the incidence of chronic wounds. Further market segmentation by specific chronic conditions (e.g., venous leg ulcers) and targeted product development efforts are likely to drive further market differentiation and specialization.

Europe Wound Management Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Wound Management Market, offering invaluable insights for stakeholders across the healthcare industry. Valued at €XX billion in 2025, the market is poised for significant growth, reaching €XX billion by 2033, exhibiting a CAGR of XX%. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and base year 2025. This analysis delves into market dynamics, key segments, leading players, and emerging trends, providing actionable intelligence to navigate this evolving landscape.

Europe Wound Management Market Market Concentration & Dynamics

The European wound management market is moderately concentrated, with several major players holding significant market share. Molnlycke Health Care, Smith & Nephew, Coloplast AS, ConvaTec Group PLC, and 3M Company are among the leading companies, each contributing significantly to the overall market revenue. Market share dynamics are influenced by product innovation, regulatory approvals, and strategic mergers and acquisitions (M&A). The number of M&A deals in this sector has seen a notable increase in recent years, with xx deals recorded between 2020 and 2023, reflecting the consolidation trend within the industry.

The market is shaped by a dynamic interplay of factors:

- Innovation Ecosystem: Continuous innovation in advanced wound dressings, surgical wound care techniques, and wound therapy devices is driving market expansion.

- Regulatory Frameworks: EU regulations regarding medical devices significantly influence market access and product development strategies. Compliance with CE marking is crucial for market entry.

- Substitute Products: The availability of alternative treatment methods and products influences market competition and adoption rates.

- End-User Trends: Increasing prevalence of chronic wounds and the growing aging population are key drivers of market growth. Demand for home healthcare solutions is also increasing.

- M&A Activities: Strategic acquisitions and partnerships are reshaping the competitive landscape, leading to increased market concentration and enhanced product portfolios.

Europe Wound Management Market Industry Insights & Trends

The Europe Wound Management Market is experiencing robust growth, propelled by several key factors. The rising prevalence of chronic wounds, particularly diabetic foot ulcers and pressure ulcers, owing to the aging population and increasing incidence of diabetes, is a major driver. Technological advancements, such as the introduction of AI-powered wound assessment tools and innovative wound dressings, are enhancing treatment efficacy and accelerating market expansion. Furthermore, a shift towards minimally invasive procedures and outpatient care is influencing market demand. The market size is estimated at €XX billion in 2025, with a projected value of €XX billion by 2033. This growth trajectory is indicative of the substantial market opportunity within the European healthcare sector. Changing consumer behavior, focusing on improved patient outcomes and reduced healthcare costs, further contributes to the overall market dynamics. The market demonstrates significant potential for growth fueled by technological advancements, increasing healthcare expenditure, and a growing awareness of effective wound management solutions.

Key Markets & Segments Leading Europe Wound Management Market

The European wound management market is geographically diverse, with Germany, the UK, and France representing major markets. Within the segment breakdown, several areas demonstrate significant dominance:

- Product Type: Advanced wound dressings (foam, hydrocolloid, film, alginate, hydrogel, collagen) hold a significant market share, driven by their superior healing properties and ease of use. The segment is expected to witness substantial growth due to technological advancements in biomaterials and drug delivery systems. Surgical wound care is also a crucial segment, with sutures, staples, and tissue adhesives widely employed.

- Wound Type: Chronic wounds (diabetic foot ulcers, pressure ulcers, venous leg ulcers) constitute a larger share compared to acute wounds, reflecting the increasing prevalence of these conditions.

- End-use: Hospitals and specialty clinics remain major contributors to market revenue, while home healthcare is exhibiting strong growth potential due to rising preference for cost-effective and convenient care options.

Drivers of Market Growth:

- Increasing prevalence of chronic wounds: The aging population and rising incidence of diabetes are major factors.

- Technological advancements: AI-powered wound assessment tools, innovative dressings.

- Growing demand for home healthcare: Convenience and cost-effectiveness.

- Rising healthcare expenditure: Increased investment in healthcare infrastructure and technology.

Europe Wound Management Market Product Developments

Recent years have witnessed significant product innovations, including the introduction of advanced wound dressings with antimicrobial properties, bioengineered skin substitutes, and novel wound therapy devices. These advancements offer improved healing outcomes, reduced infection rates, and enhanced patient comfort. Companies are focusing on developing smart wound dressings with integrated sensors for remote monitoring and personalized treatment strategies, creating a competitive edge in the market. The integration of AI and machine learning in wound care management is also transforming the sector.

Challenges in the Europe Wound Management Market Market

The market faces several challenges:

- Strict regulatory approvals: Obtaining CE marking and navigating complex regulatory pathways can be time-consuming and expensive.

- Supply chain disruptions: Global supply chain issues can impact the availability and cost of raw materials and finished products.

- Competitive pressures: Intense competition among established players and new entrants necessitates continuous innovation and cost-optimization strategies. This competition leads to pricing pressures, limiting profitability margins. The market experienced a XX% drop in average profit margins between 2020 and 2023.

Forces Driving Europe Wound Management Market Growth

Key growth drivers include:

- Technological advancements: AI-powered diagnostics, smart dressings, and advanced wound therapy devices.

- Economic growth: Increased healthcare spending and improved healthcare infrastructure.

- Favorable regulatory environment: Supportive policies promoting innovation and market access.

- Growing awareness of wound care: Improved patient education and public health campaigns promoting early intervention.

Challenges in the Europe Wound Management Market Market

Long-term growth hinges on overcoming challenges and capitalizing on emerging opportunities. Continued innovation, strategic partnerships, and expansion into new markets are critical for sustainable growth. Investment in research and development is crucial to bring new technologies to market and address unmet needs in wound care. Building strong distribution networks and establishing robust supply chains is key to maintain market share.

Emerging Opportunities in Europe Wound Management Market

Emerging opportunities include:

- Personalized wound care: Tailored treatment strategies based on individual patient needs.

- Telehealth and remote monitoring: Improved patient access to care and reduced healthcare costs.

- Expansion into emerging markets: Untapped potential in developing countries with high prevalence of chronic wounds.

- Development of bio-engineered products: Regenerative medicine and tissue engineering are providing cutting-edge alternatives.

Leading Players in the Europe Wound Management Market Sector

- Molnlycke Health Care [link to Molnlycke Health Care website]

- Smith & Nephew [link to Smith & Nephew website]

- Coloplast AS [link to Coloplast website]

- ConvaTec Group PLC [link to ConvaTec website]

- Cardinal Health Inc [link to Cardinal Health website]

- 3M Company [link to 3M website]

- Medtronic PLC [link to Medtronic website]

- B Braun Melsungen AG [link to B. Braun website]

- Paul Hartmann AG [link to Paul Hartmann website]

- Integra Lifesciences [link to Integra Lifesciences website]

Key Milestones in Europe Wound Management Market Industry

- June 2021: Tissue Analytics receives EU Class I(m) CE Mark for its AI-based wound imaging solution, expanding market access within the EU.

- May 2022: SolasCure initiates clinical trials for its novel wound-cleaning technology, demonstrating progress in innovative wound management solutions.

Strategic Outlook for Europe Wound Management Market Market

The Europe Wound Management Market presents significant growth potential driven by increasing prevalence of chronic wounds, technological advancements, and rising healthcare expenditure. Strategic partnerships, focus on innovation, and expansion into new markets are crucial for achieving sustainable growth. Companies that effectively leverage technological advancements and adapt to changing healthcare landscape will be best positioned to capitalize on this market opportunity.

Europe Wound Management Market Segmentation

-

1. Product

-

1.1. By Wound Care

- 1.1.1. Dressings

- 1.1.2. Bandages

- 1.1.3. Topical Agents

- 1.1.4. Wound Care Devices

-

1.2. By Wound Closure

- 1.2.1. Suture

- 1.2.2. Staplers

- 1.2.3. Tissue Adhesive, Sealant, and Glue

-

1.1. By Wound Care

-

2. Wound Type

-

2.1. Chronic Wound

- 2.1.1. Diabetic Foot Ulcer

- 2.1.2. Pressure Ulcer

- 2.1.3. Arterial and Venous Ulcer

- 2.1.4. Other Chronic Wounds

-

2.2. By Acute Wound

- 2.2.1. Surgical Wounds

- 2.2.2. Burns

- 2.2.3. Other Acute Wounds

-

2.1. Chronic Wound

Europe Wound Management Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Wound Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Incidences of Chronic Wounds

- 3.2.2 Ulcers

- 3.2.3 and Diabetic Ulcers; Increase in Volume of Surgical Procedures; Rising Geriatric Population

- 3.3. Market Restrains

- 3.3.1. Reimbursement Issues Associated with Advanced Wound Care Products; High Treatment Costs

- 3.4. Market Trends

- 3.4.1. Surgical staplers (Wound Closure Products) are the largest product segment of the Europe wound management market to witness the highest growth over the forecast period .

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Wound Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Wound Care

- 5.1.1.1. Dressings

- 5.1.1.2. Bandages

- 5.1.1.3. Topical Agents

- 5.1.1.4. Wound Care Devices

- 5.1.2. By Wound Closure

- 5.1.2.1. Suture

- 5.1.2.2. Staplers

- 5.1.2.3. Tissue Adhesive, Sealant, and Glue

- 5.1.1. By Wound Care

- 5.2. Market Analysis, Insights and Forecast - by Wound Type

- 5.2.1. Chronic Wound

- 5.2.1.1. Diabetic Foot Ulcer

- 5.2.1.2. Pressure Ulcer

- 5.2.1.3. Arterial and Venous Ulcer

- 5.2.1.4. Other Chronic Wounds

- 5.2.2. By Acute Wound

- 5.2.2.1. Surgical Wounds

- 5.2.2.2. Burns

- 5.2.2.3. Other Acute Wounds

- 5.2.1. Chronic Wound

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany Europe Wound Management Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. By Wound Care

- 6.1.1.1. Dressings

- 6.1.1.2. Bandages

- 6.1.1.3. Topical Agents

- 6.1.1.4. Wound Care Devices

- 6.1.2. By Wound Closure

- 6.1.2.1. Suture

- 6.1.2.2. Staplers

- 6.1.2.3. Tissue Adhesive, Sealant, and Glue

- 6.1.1. By Wound Care

- 6.2. Market Analysis, Insights and Forecast - by Wound Type

- 6.2.1. Chronic Wound

- 6.2.1.1. Diabetic Foot Ulcer

- 6.2.1.2. Pressure Ulcer

- 6.2.1.3. Arterial and Venous Ulcer

- 6.2.1.4. Other Chronic Wounds

- 6.2.2. By Acute Wound

- 6.2.2.1. Surgical Wounds

- 6.2.2.2. Burns

- 6.2.2.3. Other Acute Wounds

- 6.2.1. Chronic Wound

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. United Kingdom Europe Wound Management Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. By Wound Care

- 7.1.1.1. Dressings

- 7.1.1.2. Bandages

- 7.1.1.3. Topical Agents

- 7.1.1.4. Wound Care Devices

- 7.1.2. By Wound Closure

- 7.1.2.1. Suture

- 7.1.2.2. Staplers

- 7.1.2.3. Tissue Adhesive, Sealant, and Glue

- 7.1.1. By Wound Care

- 7.2. Market Analysis, Insights and Forecast - by Wound Type

- 7.2.1. Chronic Wound

- 7.2.1.1. Diabetic Foot Ulcer

- 7.2.1.2. Pressure Ulcer

- 7.2.1.3. Arterial and Venous Ulcer

- 7.2.1.4. Other Chronic Wounds

- 7.2.2. By Acute Wound

- 7.2.2.1. Surgical Wounds

- 7.2.2.2. Burns

- 7.2.2.3. Other Acute Wounds

- 7.2.1. Chronic Wound

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. France Europe Wound Management Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. By Wound Care

- 8.1.1.1. Dressings

- 8.1.1.2. Bandages

- 8.1.1.3. Topical Agents

- 8.1.1.4. Wound Care Devices

- 8.1.2. By Wound Closure

- 8.1.2.1. Suture

- 8.1.2.2. Staplers

- 8.1.2.3. Tissue Adhesive, Sealant, and Glue

- 8.1.1. By Wound Care

- 8.2. Market Analysis, Insights and Forecast - by Wound Type

- 8.2.1. Chronic Wound

- 8.2.1.1. Diabetic Foot Ulcer

- 8.2.1.2. Pressure Ulcer

- 8.2.1.3. Arterial and Venous Ulcer

- 8.2.1.4. Other Chronic Wounds

- 8.2.2. By Acute Wound

- 8.2.2.1. Surgical Wounds

- 8.2.2.2. Burns

- 8.2.2.3. Other Acute Wounds

- 8.2.1. Chronic Wound

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Italy Europe Wound Management Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. By Wound Care

- 9.1.1.1. Dressings

- 9.1.1.2. Bandages

- 9.1.1.3. Topical Agents

- 9.1.1.4. Wound Care Devices

- 9.1.2. By Wound Closure

- 9.1.2.1. Suture

- 9.1.2.2. Staplers

- 9.1.2.3. Tissue Adhesive, Sealant, and Glue

- 9.1.1. By Wound Care

- 9.2. Market Analysis, Insights and Forecast - by Wound Type

- 9.2.1. Chronic Wound

- 9.2.1.1. Diabetic Foot Ulcer

- 9.2.1.2. Pressure Ulcer

- 9.2.1.3. Arterial and Venous Ulcer

- 9.2.1.4. Other Chronic Wounds

- 9.2.2. By Acute Wound

- 9.2.2.1. Surgical Wounds

- 9.2.2.2. Burns

- 9.2.2.3. Other Acute Wounds

- 9.2.1. Chronic Wound

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Spain Europe Wound Management Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. By Wound Care

- 10.1.1.1. Dressings

- 10.1.1.2. Bandages

- 10.1.1.3. Topical Agents

- 10.1.1.4. Wound Care Devices

- 10.1.2. By Wound Closure

- 10.1.2.1. Suture

- 10.1.2.2. Staplers

- 10.1.2.3. Tissue Adhesive, Sealant, and Glue

- 10.1.1. By Wound Care

- 10.2. Market Analysis, Insights and Forecast - by Wound Type

- 10.2.1. Chronic Wound

- 10.2.1.1. Diabetic Foot Ulcer

- 10.2.1.2. Pressure Ulcer

- 10.2.1.3. Arterial and Venous Ulcer

- 10.2.1.4. Other Chronic Wounds

- 10.2.2. By Acute Wound

- 10.2.2.1. Surgical Wounds

- 10.2.2.2. Burns

- 10.2.2.3. Other Acute Wounds

- 10.2.1. Chronic Wound

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Europe Europe Wound Management Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. By Wound Care

- 11.1.1.1. Dressings

- 11.1.1.2. Bandages

- 11.1.1.3. Topical Agents

- 11.1.1.4. Wound Care Devices

- 11.1.2. By Wound Closure

- 11.1.2.1. Suture

- 11.1.2.2. Staplers

- 11.1.2.3. Tissue Adhesive, Sealant, and Glue

- 11.1.1. By Wound Care

- 11.2. Market Analysis, Insights and Forecast - by Wound Type

- 11.2.1. Chronic Wound

- 11.2.1.1. Diabetic Foot Ulcer

- 11.2.1.2. Pressure Ulcer

- 11.2.1.3. Arterial and Venous Ulcer

- 11.2.1.4. Other Chronic Wounds

- 11.2.2. By Acute Wound

- 11.2.2.1. Surgical Wounds

- 11.2.2.2. Burns

- 11.2.2.3. Other Acute Wounds

- 11.2.1. Chronic Wound

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Germany Europe Wound Management Market Analysis, Insights and Forecast, 2019-2031

- 13. United Kingdom Europe Wound Management Market Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Wound Management Market Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Wound Management Market Analysis, Insights and Forecast, 2019-2031

- 16. Spain Europe Wound Management Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Europe Wound Management Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Molnlycke Health Care

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Smith & Nephew

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Coloplast AS

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 ConvaTec Group PLC

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Cardinal Health Inc

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 3M Company

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Medtronic PLC

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 B Braun Melsungen AG

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Paul Hartmann AG

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Integra Lifesciences

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Molnlycke Health Care

List of Figures

- Figure 1: Europe Wound Management Market Revenue Breakdown (billion, %) by Product 2024 & 2032

- Figure 2: Europe Wound Management Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Wound Management Market Revenue billion Forecast, by Region 2019 & 2032

- Table 2: Europe Wound Management Market Revenue billion Forecast, by Product 2019 & 2032

- Table 3: Europe Wound Management Market Revenue billion Forecast, by Wound Type 2019 & 2032

- Table 4: Europe Wound Management Market Revenue billion Forecast, by Region 2019 & 2032

- Table 5: Europe Wound Management Market Revenue billion Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Wound Management Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 7: United Kingdom Europe Wound Management Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 8: France Europe Wound Management Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Wound Management Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 10: Spain Europe Wound Management Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Wound Management Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 12: Europe Wound Management Market Revenue billion Forecast, by Product 2019 & 2032

- Table 13: Europe Wound Management Market Revenue billion Forecast, by Wound Type 2019 & 2032

- Table 14: Europe Wound Management Market Revenue billion Forecast, by Country 2019 & 2032

- Table 15: Europe Wound Management Market Revenue billion Forecast, by Product 2019 & 2032

- Table 16: Europe Wound Management Market Revenue billion Forecast, by Wound Type 2019 & 2032

- Table 17: Europe Wound Management Market Revenue billion Forecast, by Country 2019 & 2032

- Table 18: Europe Wound Management Market Revenue billion Forecast, by Product 2019 & 2032

- Table 19: Europe Wound Management Market Revenue billion Forecast, by Wound Type 2019 & 2032

- Table 20: Europe Wound Management Market Revenue billion Forecast, by Country 2019 & 2032

- Table 21: Europe Wound Management Market Revenue billion Forecast, by Product 2019 & 2032

- Table 22: Europe Wound Management Market Revenue billion Forecast, by Wound Type 2019 & 2032

- Table 23: Europe Wound Management Market Revenue billion Forecast, by Country 2019 & 2032

- Table 24: Europe Wound Management Market Revenue billion Forecast, by Product 2019 & 2032

- Table 25: Europe Wound Management Market Revenue billion Forecast, by Wound Type 2019 & 2032

- Table 26: Europe Wound Management Market Revenue billion Forecast, by Country 2019 & 2032

- Table 27: Europe Wound Management Market Revenue billion Forecast, by Product 2019 & 2032

- Table 28: Europe Wound Management Market Revenue billion Forecast, by Wound Type 2019 & 2032

- Table 29: Europe Wound Management Market Revenue billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Wound Management Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Europe Wound Management Market?

Key companies in the market include Molnlycke Health Care, Smith & Nephew, Coloplast AS, ConvaTec Group PLC, Cardinal Health Inc, 3M Company, Medtronic PLC, B Braun Melsungen AG, Paul Hartmann AG, Integra Lifesciences.

3. What are the main segments of the Europe Wound Management Market?

The market segments include Product, Wound Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Chronic Wounds. Ulcers. and Diabetic Ulcers; Increase in Volume of Surgical Procedures; Rising Geriatric Population.

6. What are the notable trends driving market growth?

Surgical staplers (Wound Closure Products) are the largest product segment of the Europe wound management market to witness the highest growth over the forecast period ..

7. Are there any restraints impacting market growth?

Reimbursement Issues Associated with Advanced Wound Care Products; High Treatment Costs.

8. Can you provide examples of recent developments in the market?

In June 2021, Pittsburgh established itself as a global provider of artificial intelligence (AI)-based technology for wound care, Tissue Analytics, a Net Health company, announced that it had been awarded the European Union (EU) Class I(m) CE Mark. The highly sought-after designation allows the company to market and sells its mobile wound imaging and analytics solution to healthcare organizations based in EU member countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Wound Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Wound Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Wound Management Market?

To stay informed about further developments, trends, and reports in the Europe Wound Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence