Key Insights

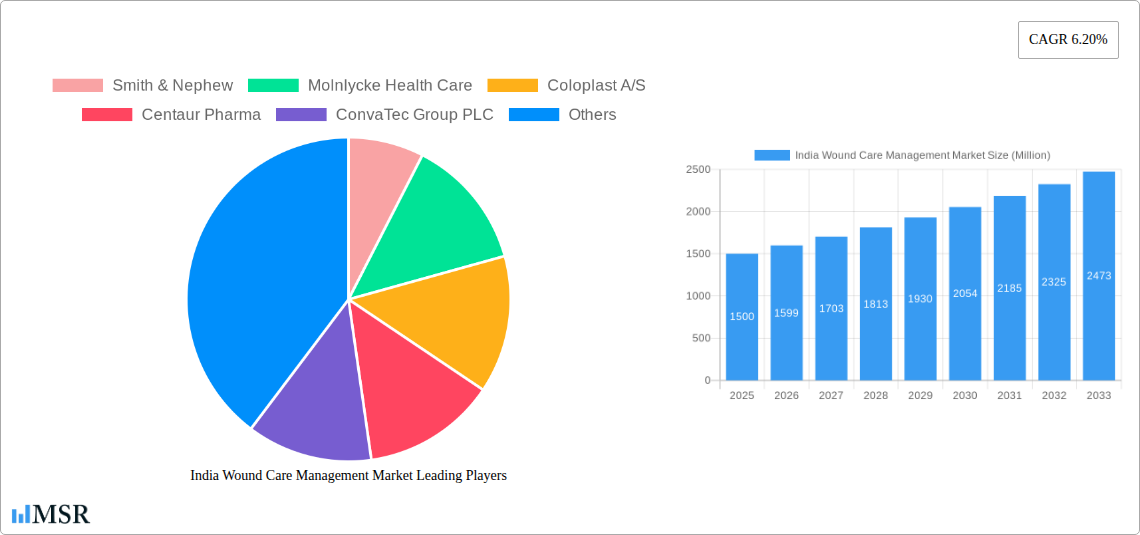

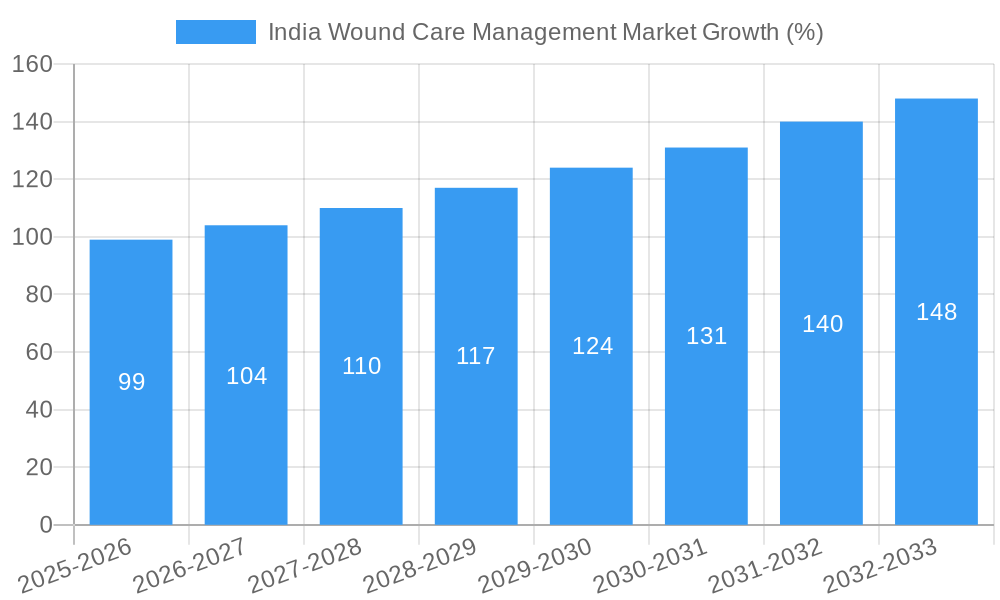

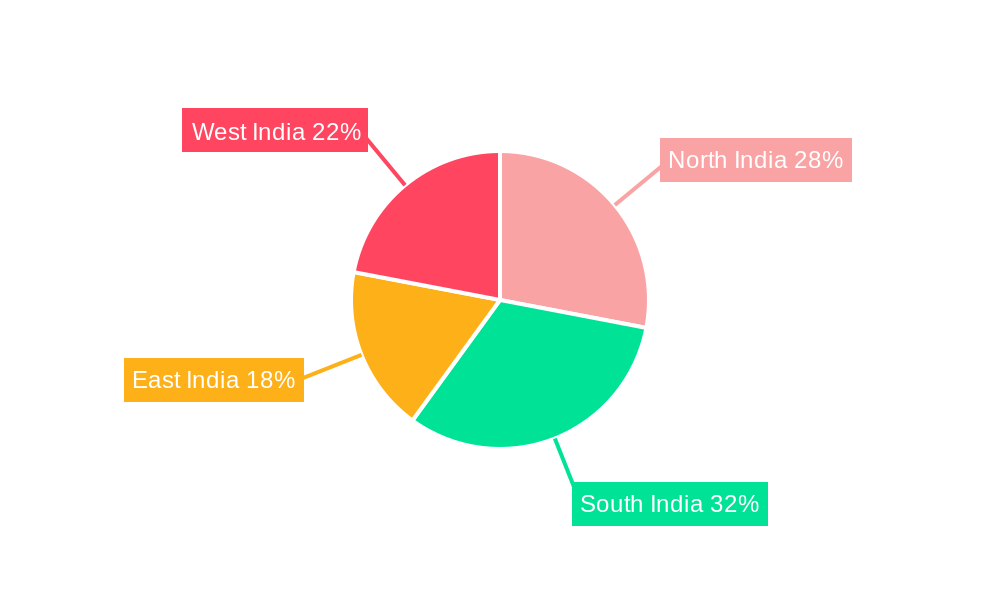

The India Wound Care Management Market is experiencing robust growth, driven by a rising geriatric population, increasing prevalence of chronic diseases like diabetes (a major contributor to diabetic foot ulcers), and a growing awareness of advanced wound care techniques. The market, valued at approximately ₹XX million in 2025 (assuming a logical extrapolation from the provided CAGR of 6.20% and a starting point within the 2019-2024 historical period), is projected to expand significantly over the forecast period (2025-2033). This expansion is fueled by several key factors. The increasing adoption of advanced wound dressings like foam, hydrocolloid, and alginate dressings is replacing traditional methods, leading to faster healing and reduced infection rates. Furthermore, the rising incidence of surgical procedures and traumatic injuries contributes to the demand for acute wound care solutions. Growth is also propelled by the expanding healthcare infrastructure, including specialized clinics and home healthcare services, improving access to quality wound care across diverse geographical regions in India (North, South, East, and West).

However, certain restraints may temper growth. High costs associated with advanced wound care technologies and therapies can limit accessibility, particularly in rural areas. Also, a lack of awareness about appropriate wound care practices among the general population and even some healthcare providers could hinder market penetration. Despite these challenges, the market is expected to maintain a healthy CAGR throughout the forecast period, driven by continued technological advancements, increased government initiatives to improve healthcare access, and a shift towards preventative care. The market segmentation reveals strong growth potential across all product types, wound types (chronic and acute), and end-use sectors, offering lucrative opportunities for established players and new entrants. The competitive landscape is marked by both global and domestic companies, reflecting a dynamic and evolving market.

India Wound Care Management Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Wound Care Management Market, offering invaluable insights for stakeholders across the healthcare industry. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report examines market dynamics, key segments, leading players, and emerging trends, providing a strategic roadmap for future growth. The market is segmented by product type (Advanced Wound Dressing, Surgical Wound Care, Traditional Wound Care, Wound Therapy Devices), wound type (Chronic Wounds, Acute Wounds), and end-use (Hospitals, Specialty Clinics, Home Healthcare, etc.). Key players profiled include Smith & Nephew, Molnlycke Health Care, Coloplast A/S, Centaur Pharma, ConvaTec Group PLC, Axio Biosolutions, Cardinal Health Inc, 3M Company, Medtronic PLC, B Braun Melsungen AG, Paul Hartmann AG, and Integra Lifesciences. The report projects a market size of xx Million by 2025, with a CAGR of xx% during the forecast period.

India Wound Care Management Market Concentration & Dynamics

The India wound care management market exhibits a moderately concentrated landscape, with a few multinational corporations holding significant market share. However, the presence of several domestic players and emerging startups indicates a dynamic competitive environment. Innovation is driven by technological advancements in wound healing materials and therapeutic devices, alongside increasing research and development efforts to address the specific needs of the Indian population. The regulatory framework, while evolving, plays a crucial role in ensuring product safety and efficacy. Substitute products, including traditional remedies, compete with modern wound care solutions, although their effectiveness may be significantly lower. M&A activity in the sector has been relatively moderate, with a focus on expanding product portfolios and geographical reach.

- Market Share: Top 5 players hold an estimated xx% market share (2025).

- M&A Deal Counts: An estimated xx deals were recorded between 2019 and 2024.

- End-User Trends: Increasing prevalence of chronic wounds, rising healthcare expenditure, and growing awareness of advanced wound care solutions are key trends.

India Wound Care Management Market Industry Insights & Trends

The India Wound Care Management Market is experiencing significant growth, driven primarily by the escalating prevalence of chronic wounds like diabetic foot ulcers and pressure ulcers, fueled by factors like increasing diabetes incidence and aging population. Technological advancements, such as the introduction of innovative wound dressings and advanced therapy devices, are transforming the market landscape. Furthermore, changing consumer behavior towards proactive wound management and a preference for minimally invasive procedures is further boosting market expansion. The market size is estimated to reach xx Million in 2025, showcasing substantial growth from xx Million in 2019. The CAGR during the historical period (2019-2024) was xx%, and is projected to remain robust during the forecast period (2025-2033). This growth is fueled by increased healthcare infrastructure, rising disposable incomes, and government initiatives to improve healthcare access.

Key Markets & Segments Leading India Wound Care Management Market

The Indian wound care market is dominated by the chronic wound segment, with diabetic foot ulcers representing a significant portion. Within product types, advanced wound dressings (particularly foam dressings and hydrocolloid dressings) hold the largest share, owing to their efficacy and convenience. Hospitals and specialty clinics constitute the major end-users, although home healthcare is steadily gaining traction. Growth is fueled by several key drivers:

- Economic Growth: Rising disposable incomes and increased healthcare expenditure are driving demand.

- Improved Infrastructure: Enhanced healthcare infrastructure and accessibility are fueling market expansion.

- Government Initiatives: Government programs focused on diabetes management and healthcare access are bolstering market growth.

- Technological Advancements: The introduction of innovative wound care technologies accelerates market growth.

The dominance of chronic wounds is largely due to the high prevalence of diabetes and other lifestyle-related diseases in India. Advanced wound dressings lead the product type segment due to their superior healing properties compared to traditional methods. Hospitals and specialized clinics remain the largest end-users due to their advanced facilities and expertise.

India Wound Care Management Market Product Developments

Recent years have witnessed significant product innovations in the Indian wound care market. Companies are focusing on developing advanced wound dressings with enhanced healing properties, antimicrobial capabilities, and improved comfort. There is a growing demand for minimally invasive and less painful treatment options, leading to the development of advanced wound therapy devices. These advancements are not only improving treatment outcomes but also enhancing patient comfort and reducing healthcare costs. For example, the launch of WOXHeal by Centaur Pharma is a significant step towards addressing the prevalent issue of diabetic foot ulcers.

Challenges in the India Wound Care Management Market

The India wound care market faces challenges including inconsistent healthcare infrastructure across regions, limited awareness about advanced wound care practices among healthcare professionals and patients, and high costs associated with advanced therapies. These factors, coupled with regulatory complexities and supply chain inefficiencies, can hinder market growth. The lack of standardized clinical practice guidelines for wound management also poses a significant hurdle. These challenges, though impacting market expansion, have not stalled overall growth due to the strong underlying drivers mentioned earlier. The projected market impact due to these challenges is a conservative reduction of xx Million in the total market size by 2033.

Forces Driving India Wound Care Management Market Growth

Several factors are driving growth in the Indian wound care market. The rising prevalence of chronic diseases like diabetes and cardiovascular diseases, leading to a higher incidence of chronic wounds, is a primary driver. Technological advancements in wound care products and therapies are further accelerating market growth. Increased government spending on healthcare infrastructure and initiatives aimed at improving access to healthcare are also contributing to market expansion. Finally, rising awareness among healthcare professionals and patients about advanced wound management practices is creating significant growth opportunities.

Long-Term Growth Catalysts in the India Wound Care Management Market

Long-term growth in the Indian wound care market will be fueled by continued technological innovation in wound dressings and therapy devices. Strategic partnerships between domestic and international companies will facilitate the introduction of advanced technologies and expand market access. Government initiatives focused on improving healthcare infrastructure and promoting awareness will play a crucial role in fostering market expansion. The increasing adoption of telehealth and remote patient monitoring for wound care will also contribute significantly to market growth in the coming years.

Emerging Opportunities in India Wound Care Management Market

Emerging opportunities lie in the growing demand for home healthcare solutions for wound care, driven by an aging population and a preference for convenient, at-home treatment. The increasing focus on preventative wound care and the rising adoption of minimally invasive techniques present significant growth opportunities. Expanding into underserved rural areas and enhancing awareness about advanced wound care solutions through education and outreach programs also presents significant potential.

Leading Players in the India Wound Care Management Market Sector

- Smith & Nephew (Smith & Nephew)

- Molnlycke Health Care (Molnlycke Health Care)

- Coloplast A/S (Coloplast A/S)

- Centaur Pharma

- ConvaTec Group PLC (ConvaTec Group PLC)

- Axio Biosolutions

- Cardinal Health Inc (Cardinal Health Inc)

- 3M Company (3M Company)

- Medtronic PLC (Medtronic PLC)

- B Braun Melsungen AG (B Braun Melsungen AG)

- Paul Hartmann AG (Paul Hartmann AG)

- Integra Lifesciences (Integra Lifesciences)

Key Milestones in India Wound Care Management Market Industry

- September 2020: Centaur Pharma launched WOXHeal, a topical solution for diabetic foot ulcers.

- February 2021: Axio Biosolutions received CE Certification for its next-gen wound-care product MaxioCel.

Strategic Outlook for India Wound Care Management Market

The future of the India wound care management market is bright, with strong growth prospects driven by the increasing prevalence of chronic wounds, technological advancements, and supportive government policies. Strategic opportunities exist for companies to focus on developing innovative products, expanding their distribution networks, and collaborating with healthcare providers to enhance awareness and improve patient outcomes. Companies that invest in research and development, adopt digital health technologies, and tailor their offerings to the specific needs of the Indian market are poised for success.

India Wound Care Management Market Segmentation

-

1. Product

-

1.1. Wound Care

- 1.1.1. Dressings

- 1.1.2. Bandages

- 1.1.3. Other Wound Care Products

- 1.2. Wound Closure

-

1.1. Wound Care

-

2. Wound Type

-

2.1. Chronic Wound

- 2.1.1. Diabetic Foot Ulcer

- 2.1.2. Pressure Ulcer

- 2.1.3. Other Chronic Wounds

-

2.2. Acute Wound

- 2.2.1. Surgical Wounds

- 2.2.2. Burns

- 2.2.3. Other Acute Wounds

-

2.1. Chronic Wound

India Wound Care Management Market Segmentation By Geography

- 1. India

India Wound Care Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Incidences of Chronic Wounds

- 3.2.2 Ulcers

- 3.2.3 and Diabetic Ulcers; Increase in the Volume of Surgical Procedures

- 3.2.4 and Product Advancements

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness Regarding Advanced Wound Care; High Treatment Costs

- 3.4. Market Trends

- 3.4.1. Application in Diabetic Foot Ulcer is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Wound Care Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Wound Care

- 5.1.1.1. Dressings

- 5.1.1.2. Bandages

- 5.1.1.3. Other Wound Care Products

- 5.1.2. Wound Closure

- 5.1.1. Wound Care

- 5.2. Market Analysis, Insights and Forecast - by Wound Type

- 5.2.1. Chronic Wound

- 5.2.1.1. Diabetic Foot Ulcer

- 5.2.1.2. Pressure Ulcer

- 5.2.1.3. Other Chronic Wounds

- 5.2.2. Acute Wound

- 5.2.2.1. Surgical Wounds

- 5.2.2.2. Burns

- 5.2.2.3. Other Acute Wounds

- 5.2.1. Chronic Wound

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North India India Wound Care Management Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Wound Care Management Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Wound Care Management Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Wound Care Management Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Smith & Nephew

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Molnlycke Health Care

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Coloplast A/S

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Centaur Pharma

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ConvaTec Group PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Axio Biosolutions

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cardinal Health Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 3M Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Medtronic PLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 B Braun Melsungen AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Paul Hartmann AG

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Integra Lifesciences

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Smith & Nephew

List of Figures

- Figure 1: India Wound Care Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Wound Care Management Market Share (%) by Company 2024

List of Tables

- Table 1: India Wound Care Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Wound Care Management Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: India Wound Care Management Market Revenue Million Forecast, by Wound Type 2019 & 2032

- Table 4: India Wound Care Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Wound Care Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Wound Care Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Wound Care Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Wound Care Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Wound Care Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Wound Care Management Market Revenue Million Forecast, by Product 2019 & 2032

- Table 11: India Wound Care Management Market Revenue Million Forecast, by Wound Type 2019 & 2032

- Table 12: India Wound Care Management Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Wound Care Management Market?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the India Wound Care Management Market?

Key companies in the market include Smith & Nephew, Molnlycke Health Care, Coloplast A/S, Centaur Pharma, ConvaTec Group PLC, Axio Biosolutions, Cardinal Health Inc, 3M Company, Medtronic PLC, B Braun Melsungen AG, Paul Hartmann AG, Integra Lifesciences.

3. What are the main segments of the India Wound Care Management Market?

The market segments include Product, Wound Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Chronic Wounds. Ulcers. and Diabetic Ulcers; Increase in the Volume of Surgical Procedures. and Product Advancements.

6. What are the notable trends driving market growth?

Application in Diabetic Foot Ulcer is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Lack of Awareness Regarding Advanced Wound Care; High Treatment Costs.

8. Can you provide examples of recent developments in the market?

In February 2021, Axio Biosolutions, Karnataka, India, received CE Certification for next-gen wound-care product MaxioCel

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Wound Care Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Wound Care Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Wound Care Management Market?

To stay informed about further developments, trends, and reports in the India Wound Care Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence