Key Insights

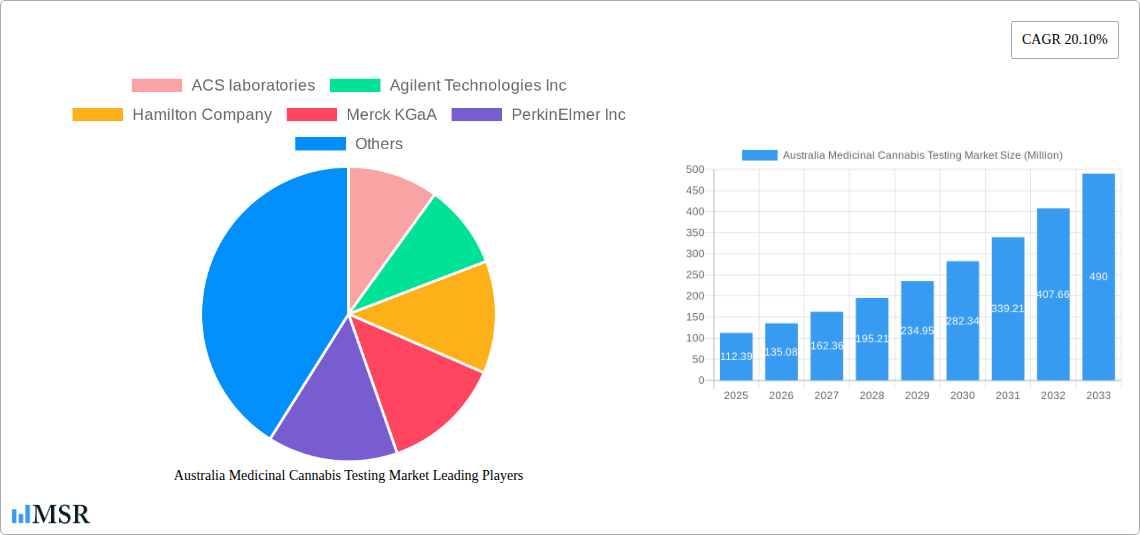

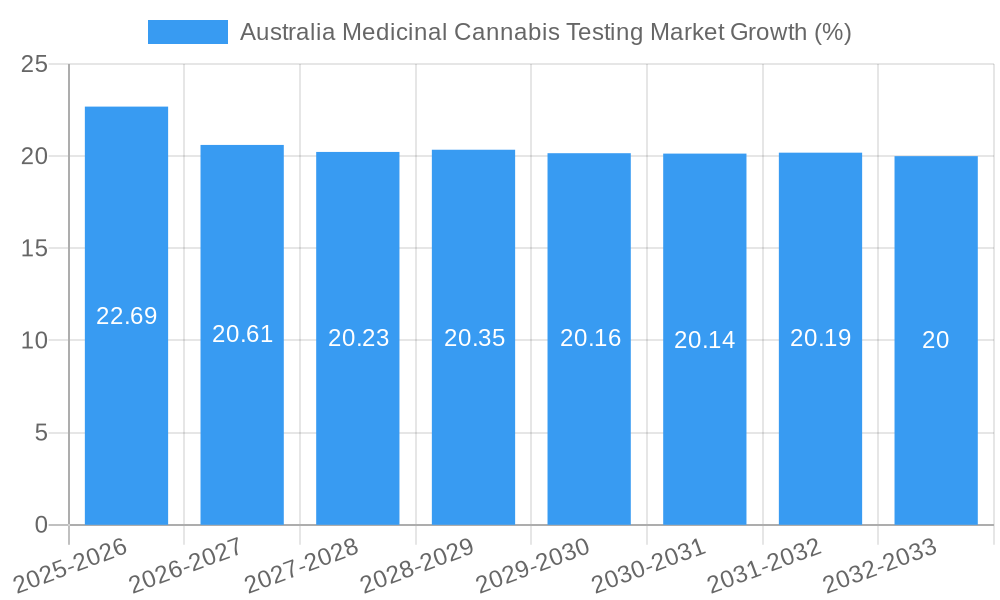

The Australian medicinal cannabis testing market is experiencing robust growth, projected to reach \$112.39 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 20.10% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing legalization and acceptance of medicinal cannabis across the country fuels higher demand for rigorous quality control and testing procedures to ensure product safety and efficacy. Secondly, growing research and development efforts in the field are leading to an improved understanding of cannabis's therapeutic potential, further stimulating the market. Stringent regulatory frameworks mandating comprehensive testing before market entry are another significant driver. This includes testing for potency, pesticides, heavy metals, and microbial contamination, creating substantial demand for sophisticated testing services. Finally, the presence of established players like Thermo Fisher Scientific, Agilent Technologies, and Eurofins Scientific, alongside specialized cannabis testing labs like ACS Laboratories and Quantum Analytics, signifies a competitive landscape with a capacity for innovation and expansion.

The market segmentation, while not explicitly provided, can be reasonably inferred. Key segments likely include testing services for potency, purity, and contaminants; different types of cannabis products (e.g., oils, flowers, edibles); and the various stages of the production chain (cultivation, processing, finished goods). While restraints might include initial high capital investment for advanced testing equipment and skilled personnel, and potential regulatory challenges, the overall market trajectory remains overwhelmingly positive. The forecast period from 2025-2033 suggests continued growth, indicating significant opportunities for market entrants and established players alike. This positive outlook underscores the considerable potential of the Australian medicinal cannabis testing market as the industry continues its expansion.

Australia Medicinal Cannabis Testing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Australia Medicinal Cannabis Testing Market, offering invaluable insights for industry stakeholders, investors, and researchers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a holistic view of market dynamics, trends, and future projections. The market is estimated to be worth xx Million in 2025, exhibiting a CAGR of xx% during the forecast period.

Australia Medicinal Cannabis Testing Market Concentration & Dynamics

The Australian medicinal cannabis testing market exhibits a moderately concentrated landscape, with several key players holding significant market share. However, the market is also characterized by a dynamic competitive environment, driven by ongoing innovation, evolving regulatory frameworks, and strategic mergers and acquisitions (M&A). The xx Million market size in 2025 underscores the significant growth potential.

Market Concentration: The top five players currently hold an estimated xx% market share, with ACS Laboratories, Agilent Technologies Inc, and Thermo Fisher Scientific among the leading companies. However, smaller, specialized testing labs are also emerging, increasing competition.

Innovation Ecosystem: Significant investment in research and development is driving innovation in analytical techniques, including advancements in chromatography, mass spectrometry, and genomics, improving accuracy and efficiency of testing.

Regulatory Framework: The evolving regulatory landscape, while presenting challenges, also provides opportunities for companies meeting stringent quality and safety standards. The Therapeutic Goods Administration (TGA) plays a crucial role in shaping market dynamics.

Substitute Products: Limited substitute products currently exist for testing, reinforcing the importance of accurate and reliable cannabis testing.

End-User Trends: Increased demand for medical cannabis products and growing patient awareness are significant market drivers, fueling the need for reliable testing services.

M&A Activities: The past five years have witnessed xx M&A deals in the Australian medicinal cannabis testing sector, indicating consolidation and growth aspirations. This trend is expected to continue as larger companies seek to expand their market presence.

Australia Medicinal Cannabis Testing Market Industry Insights & Trends

The Australian medicinal cannabis testing market is experiencing robust growth, fueled by several key factors. The market's expansion is driven by the increasing legalization and acceptance of medicinal cannabis, a rising number of patients seeking cannabis-based therapies, and continuous technological advancements in testing methodologies. The rising prevalence of chronic diseases is also contributing to the market's growth. Strict regulatory requirements, however, necessitate high-quality testing, leading to a continuous demand for advanced analytical techniques and reliable laboratories.

Key Markets & Segments Leading Australia Medicinal Cannabis Testing Market

The Australian medicinal cannabis testing market is primarily driven by the significant demand for testing services in major urban centers, particularly in New South Wales and Victoria. These states have witnessed a greater adoption of medicinal cannabis due to their relatively advanced healthcare infrastructure and regulatory frameworks. The high concentration of medical cannabis companies in these regions also contributes to this dominance.

- Drivers for Market Dominance in NSW and Victoria:

- Established Healthcare Infrastructure: NSW and Victoria possess robust healthcare systems capable of supporting the increased demand for medicinal cannabis and its testing.

- Progressive Regulatory Environment: These states are at the forefront of medicinal cannabis regulation, making them attractive locations for both cultivators and testing laboratories.

- Higher Patient Base: A larger patient population seeking medicinal cannabis exists in these areas compared to other Australian states.

- Concentration of Medical Cannabis Companies: A significant number of cultivation facilities and related businesses are located in these states, creating a local demand for testing services.

The market is further segmented by testing type (purity, potency, pesticides, heavy metals, etc.) and end-users (cultivators, manufacturers, researchers, and regulatory bodies).

Australia Medicinal Cannabis Testing Market Product Developments

Recent product developments in the Australian medicinal cannabis testing market emphasize increased automation, higher throughput capabilities, and enhanced analytical sensitivity. New technologies are enabling faster and more comprehensive testing, covering a wider range of contaminants and ensuring product quality and patient safety. This leads to better compliance with stringent regulatory requirements. This is crucial for companies aiming to maintain a competitive edge within the industry.

Challenges in the Australia Medicinal Cannabis Testing Market Market

The Australian medicinal cannabis testing market faces several challenges. Stringent regulatory requirements increase the cost of compliance for testing laboratories. Supply chain issues, particularly the availability of specialized equipment and reagents, also pose challenges. Finally, intense competition among established and emerging players necessitates continuous innovation and cost optimization. The estimated impact of these challenges on market growth is xx Million annually.

Forces Driving Australia Medicinal Cannabis Testing Market Growth

Several factors contribute to the ongoing growth of the Australian medicinal cannabis testing market. Technological advancements in testing methodologies, increasing legalization and acceptance of medical cannabis, rising patient numbers seeking alternative therapies, and supportive government policies are crucial drivers. Furthermore, the growing awareness of potential therapeutic benefits and increased research activities are further bolstering market expansion.

Long-Term Growth Catalysts in the Australia Medicinal Cannabis Testing Market

Long-term growth will be fueled by strategic partnerships between testing labs and cannabis cultivators, further technological advancements leading to faster and more accurate testing capabilities, and continued expansion of the medicinal cannabis market into new therapeutic areas. Investment in research and development to ensure compliance with evolving regulatory requirements is also a significant growth catalyst.

Emerging Opportunities in Australia Medicinal Cannabis Testing Market

Emerging opportunities include the expansion into new market segments such as veterinary cannabis testing and the development of novel testing methodologies to detect emerging contaminants. Furthermore, increased demand for comprehensive testing and the potential for personalized medicine using cannabis therapies presents significant growth opportunities.

Leading Players in the Australia Medicinal Cannabis Testing Market Sector

- ACS Laboratories

- Agilent Technologies Inc

- Hamilton Company

- Merck KGaA

- PerkinElmer Inc

- Quantum Analytics

- Shimadzu Scientific Instruments

- Thermo Fisher Scientific

- Eurofins Scientific

- Pharmalytics

Key Milestones in Australia Medicinal Cannabis Testing Market Industry

- June 2024: Tilray Medical launched Broken Coast EU-GMP-certified medical cannabis products in Australia, increasing demand for compliant testing services.

- October 2023: Victoria's Transport Legislation Amendment Bill 2023 enabled studies on medicinal cannabis and road safety, potentially impacting future testing requirements.

- February 2023: Launch of the CraftPlant medical cannabis brand by Aurora Cannabis Inc. and MedReleaf Australia increased the volume of products requiring testing.

Strategic Outlook for Australia Medicinal Cannabis Testing Market Market

The Australian medicinal cannabis testing market presents substantial long-term growth potential, driven by technological advancements, increased demand for quality-assured products, and supportive regulatory frameworks. Strategic opportunities exist for companies focusing on innovation, cost-efficiency, and expanding into new market segments. The market is poised for significant expansion, exceeding xx Million by 2033.

Australia Medicinal Cannabis Testing Market Segmentation

-

1. Product and Software/Service

- 1.1. Analytical Instruments

- 1.2. Spectroscopy Instruments

- 1.3. Consumables

- 1.4. Cannabis Testing Software and Services

-

2. Service

- 2.1. Potency Testing

- 2.2. Terpene Profiling

- 2.3. Residual Solvent Screening

- 2.4. Heavy Metal Testing

- 2.5. Mycotoxin Testing

- 2.6. Other Types

-

3. End User

- 3.1. Laboratories

- 3.2. Cannabis Drug Manufacturers and Dispensaries

- 3.3. Other End Users

Australia Medicinal Cannabis Testing Market Segmentation By Geography

- 1. Australia

Australia Medicinal Cannabis Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 20.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Approvals for Medicinal Cannabis; Increase in Cannabis-based Prescription by Healthcare Practisioners; Growing Prevalence of Chronic Pain

- 3.3. Market Restrains

- 3.3.1. Rise in Approvals for Medicinal Cannabis; Increase in Cannabis-based Prescription by Healthcare Practisioners; Growing Prevalence of Chronic Pain

- 3.4. Market Trends

- 3.4.1. The Potency Testing Segment is Anticipated to Hold a Major Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Medicinal Cannabis Testing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product and Software/Service

- 5.1.1. Analytical Instruments

- 5.1.2. Spectroscopy Instruments

- 5.1.3. Consumables

- 5.1.4. Cannabis Testing Software and Services

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Potency Testing

- 5.2.2. Terpene Profiling

- 5.2.3. Residual Solvent Screening

- 5.2.4. Heavy Metal Testing

- 5.2.5. Mycotoxin Testing

- 5.2.6. Other Types

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Laboratories

- 5.3.2. Cannabis Drug Manufacturers and Dispensaries

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product and Software/Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ACS laboratories

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Agilent Technologies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hamilton Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Merck KGaA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PerkinElmer Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Quantum Analytics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shimadzu Scientific Instruments

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thermo Fisher Scientific

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Eurofins Scientific

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pharmalytics*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ACS laboratories

List of Figures

- Figure 1: Australia Medicinal Cannabis Testing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Medicinal Cannabis Testing Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Medicinal Cannabis Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Medicinal Cannabis Testing Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Australia Medicinal Cannabis Testing Market Revenue Million Forecast, by Product and Software/Service 2019 & 2032

- Table 4: Australia Medicinal Cannabis Testing Market Volume Million Forecast, by Product and Software/Service 2019 & 2032

- Table 5: Australia Medicinal Cannabis Testing Market Revenue Million Forecast, by Service 2019 & 2032

- Table 6: Australia Medicinal Cannabis Testing Market Volume Million Forecast, by Service 2019 & 2032

- Table 7: Australia Medicinal Cannabis Testing Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Australia Medicinal Cannabis Testing Market Volume Million Forecast, by End User 2019 & 2032

- Table 9: Australia Medicinal Cannabis Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Australia Medicinal Cannabis Testing Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Australia Medicinal Cannabis Testing Market Revenue Million Forecast, by Product and Software/Service 2019 & 2032

- Table 12: Australia Medicinal Cannabis Testing Market Volume Million Forecast, by Product and Software/Service 2019 & 2032

- Table 13: Australia Medicinal Cannabis Testing Market Revenue Million Forecast, by Service 2019 & 2032

- Table 14: Australia Medicinal Cannabis Testing Market Volume Million Forecast, by Service 2019 & 2032

- Table 15: Australia Medicinal Cannabis Testing Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Australia Medicinal Cannabis Testing Market Volume Million Forecast, by End User 2019 & 2032

- Table 17: Australia Medicinal Cannabis Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Australia Medicinal Cannabis Testing Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Medicinal Cannabis Testing Market?

The projected CAGR is approximately 20.10%.

2. Which companies are prominent players in the Australia Medicinal Cannabis Testing Market?

Key companies in the market include ACS laboratories, Agilent Technologies Inc, Hamilton Company, Merck KGaA, PerkinElmer Inc, Quantum Analytics, Shimadzu Scientific Instruments, Thermo Fisher Scientific, Eurofins Scientific, Pharmalytics*List Not Exhaustive.

3. What are the main segments of the Australia Medicinal Cannabis Testing Market?

The market segments include Product and Software/Service, Service, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 112.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Approvals for Medicinal Cannabis; Increase in Cannabis-based Prescription by Healthcare Practisioners; Growing Prevalence of Chronic Pain.

6. What are the notable trends driving market growth?

The Potency Testing Segment is Anticipated to Hold a Major Share of the Market.

7. Are there any restraints impacting market growth?

Rise in Approvals for Medicinal Cannabis; Increase in Cannabis-based Prescription by Healthcare Practisioners; Growing Prevalence of Chronic Pain.

8. Can you provide examples of recent developments in the market?

June 2024: Tilray Medical, a division of Tilray Brands Inc. and a global leader in medical cannabis, launched Broken Coast EU-GMP-certified medical cannabis products in Australia.October 2023: Victoria’s Transport Legislation Amendment Bill 2023 amended nine Acts, including the Road Safety Act 1986. This amendment allows a study of medicinal cannabis and road safety and is sufficiently broad to enable the state government to conduct similar studies in relation to other drugs.February 2023: Aurora Cannabis Inc., the Canadian company, and MedReleaf Australia launched a new medical cannabis brand, CraftPlant, for patients in the Australian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Medicinal Cannabis Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Medicinal Cannabis Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Medicinal Cannabis Testing Market?

To stay informed about further developments, trends, and reports in the Australia Medicinal Cannabis Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence