Key Insights

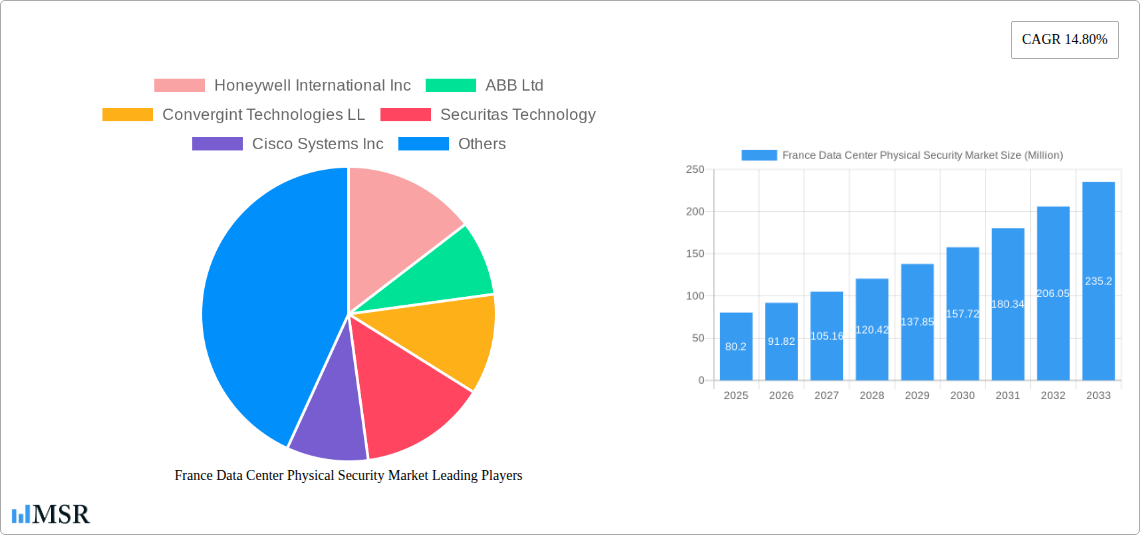

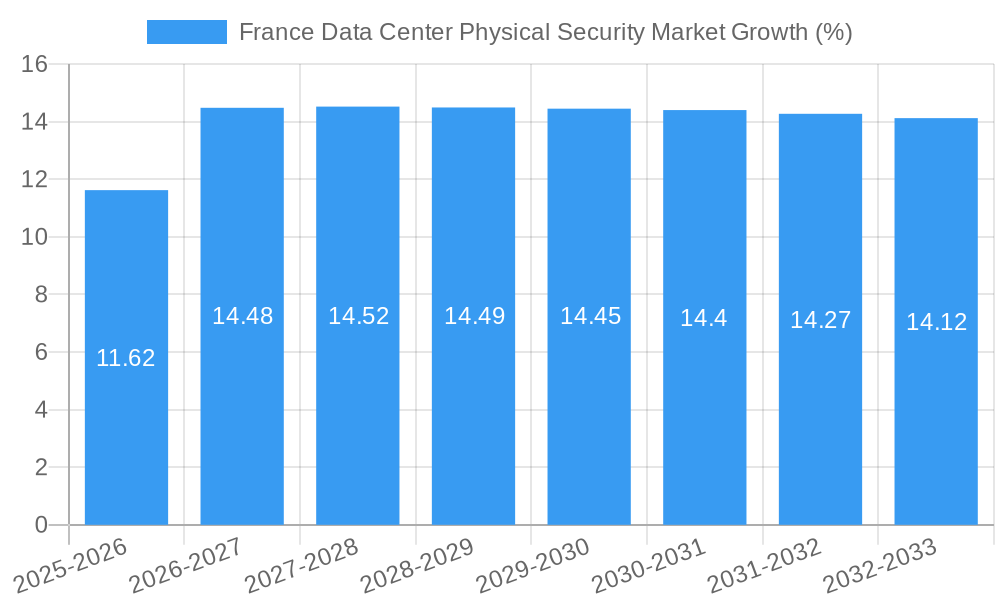

The France data center physical security market, valued at €80.20 million in 2025, is projected to experience robust growth, driven by the increasing adoption of advanced security technologies and a rising need to protect critical infrastructure from cyber threats and physical breaches. The market's Compound Annual Growth Rate (CAGR) of 14.80% from 2025 to 2033 indicates significant expansion potential. Key drivers include the expanding data center infrastructure in France, stringent government regulations mandating robust security measures, and heightened concerns regarding data breaches and physical security incidents. The increasing adoption of video surveillance, access control systems, and integrated security solutions are further fueling market growth. While the specific breakdown of market segments by end-user (IT & Telecommunication, BFSI, Government, Healthcare, Other) and solution/service type (video surveillance, access control, consulting services, etc.) isn't fully detailed, the strong overall growth suggests significant contributions from all segments. The market is highly competitive, with major players like Honeywell, ABB, Cisco, Siemens, and Hikvision vying for market share. The forecast period anticipates a continuous surge in demand, particularly for sophisticated solutions that leverage artificial intelligence and analytics for enhanced threat detection and response.

The market's success depends on factors such as the continuing growth of the French data center industry, advancements in technology, government policies, and the evolving security landscape. While economic downturns could pose a potential restraint, the critical nature of data center security suggests a relatively resilient market even in challenging economic conditions. Future growth will likely be influenced by the increasing demand for cloud-based security solutions, the integration of IoT devices into security systems, and the adoption of advanced analytics for proactive security management. The competition among established players and emerging technology providers will continue to shape the market landscape, driving innovation and potentially leading to price adjustments. Focus on cost-effective solutions and tailored security services catering to specific industry needs will be critical for success.

France Data Center Physical Security Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the France Data Center Physical Security Market, offering invaluable insights for stakeholders across the industry. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, growth drivers, key players, and emerging opportunities. Expect detailed segmentation analysis across end-users (IT & Telecommunication, BFSI, Government, Healthcare, Other), solution types (Video Surveillance, Access Control, Others), and service types (Consulting, Professional, Other). The report leverages extensive data analysis and expert insights to provide a clear picture of this crucial market segment. The total market size is estimated to be XX Million in 2025, projecting a CAGR of xx% from 2025-2033.

France Data Center Physical Security Market Market Concentration & Dynamics

The France Data Center Physical Security Market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Honeywell International Inc, ABB Ltd, and Schneider Electric are among the key players influencing market dynamics. Market share data from 2024 suggests Honeywell holds approximately 15%, ABB at 12%, and Schneider Electric at 10%, while others collectively account for the remaining 63%.

The market’s innovation ecosystem is driven by advancements in video analytics, AI-powered security systems, and biometric access control. Regulatory frameworks, such as GDPR and NIS2, heavily impact data security practices and drive demand for robust physical security solutions. Substitute products, like perimeter fencing and manned guarding, still play a role, but are gradually being replaced by technologically advanced solutions. End-user trends lean toward integrated security systems, offering centralized management and enhanced threat detection.

M&A activities have been moderate in recent years, with approximately 5-7 deals annually. These deals primarily focused on expanding service portfolios and technological capabilities.

France Data Center Physical Security Market Industry Insights & Trends

The France Data Center Physical Security Market is witnessing robust growth, driven primarily by the increasing adoption of cloud computing and the expanding digital infrastructure in the nation. The rising concerns over data breaches and cyberattacks are further fueling demand for advanced security solutions. Technological advancements like AI and IoT are revolutionizing the sector, providing intelligent surveillance and proactive threat mitigation.

The market size was valued at approximately 150 Million in 2024 and is projected to reach XX Million by 2025. The market is expected to experience significant growth throughout the forecast period (2025-2033), driven by increased investments in data center infrastructure, particularly from the IT & Telecommunication sector. This consistent growth underscores the importance of robust physical security measures for data center operations. The increasing adoption of advanced security technologies such as AI-powered video analytics and biometric authentication systems also contributes to market expansion. Furthermore, the increasing awareness of data privacy and security regulations is driving the adoption of more sophisticated security solutions.

Key Markets & Segments Leading France Data Center Physical Security Market

- Dominant End-User Segment: The IT & Telecommunication sector represents the largest segment, accounting for approximately 40% of the market. This is driven by the high concentration of data centers and the critical need for data protection within this sector.

- Dominant Solution Type: Video surveillance systems hold the largest market share (approximately 35%), fueled by the increasing demand for advanced video analytics and improved monitoring capabilities.

- Dominant Service Type: Professional services, including system integration and maintenance, represent a significant portion of the market, reflecting the complexity of modern security systems and the need for specialized expertise.

Drivers for Key Segments:

- IT & Telecommunication: Rapid digital transformation, expanding cloud infrastructure, growing data volumes, stringent regulatory compliance.

- BFSI: Protecting sensitive financial data, complying with strict regulations, preventing fraud.

- Government: Securing critical infrastructure, protecting national data, ensuring public safety.

- Healthcare: Protecting patient data (HIPAA compliance), safeguarding sensitive medical records, maintaining operational continuity.

The dominance of the IT & Telecommunication sector is primarily attributable to the rapid growth in the data center industry, driving significant investment in security infrastructure. The high value of data within this sector necessitates robust physical security measures, thus creating substantial demand.

France Data Center Physical Security Market Product Developments

Recent product innovations include AI-powered video analytics for improved threat detection, enhanced access control systems with biometric authentication, and integrated security platforms that offer centralized management and monitoring. These advancements deliver better threat detection, streamlined security operations, and reduced operational costs. The incorporation of IoT sensors and cloud-based security management systems further improves efficiency and scalability.

Challenges in the France Data Center Physical Security Market Market

Key challenges include high initial investment costs for advanced security systems, the complexity of integrating various security solutions, and the need for skilled professionals to manage and maintain these systems. Supply chain disruptions can also impact the availability of components and lead to project delays. Competitive pressures, particularly from international players, further intensify the challenge. These factors collectively lead to a relatively slow adoption of sophisticated security systems in some sectors.

Forces Driving France Data Center Physical Security Market Growth

The market's growth is propelled by rising cyber threats, increased government regulations around data security, and the expanding data center infrastructure. The adoption of cloud computing and the Internet of Things (IoT) is increasing the volume of sensitive data, demanding enhanced security measures. Furthermore, government initiatives promoting digital infrastructure development contribute significantly to market growth. The development of innovative AI-powered security solutions, such as predictive threat analytics, adds further momentum to this trend.

Long-Term Growth Catalysts in France Data Center Physical Security Market

Long-term growth catalysts include strategic partnerships between security technology providers and data center operators, fostering collaborative innovation and accelerating the adoption of advanced security solutions. Government incentives promoting cybersecurity investment and initiatives streamlining security system implementation further facilitate market expansion. The ongoing evolution of security technologies, integrating AI and automation, ensures continuous market growth and attracts additional investment.

Emerging Opportunities in France Data Center Physical Security Market

Emerging opportunities include the increasing demand for integrated security platforms combining physical and cybersecurity solutions, creating a holistic approach to data protection. The adoption of edge computing and the deployment of 5G networks present opportunities for advanced security solutions that leverage low-latency connectivity and decentralized threat detection. Additionally, the increasing focus on sustainability and energy efficiency in data centers opens avenues for energy-efficient security solutions, attracting environmentally conscious data center operators.

Leading Players in the France Data Center Physical Security Market Sector

- Honeywell International Inc

- ABB Ltd

- Convergint Technologies LL

- Securitas Technology

- Cisco Systems Inc

- Siemens AG

- Johnson Controls

- Schneider Electric

- Hangzhou Hikvision Digital Technology Co Ltd

- Bosch Sicherheitssysteme GmbH

- Axis Communications AB

- Dahua Technology Co Ltd

Key Milestones in France Data Center Physical Security Market Industry

- October 2023: Zwipe partnered with Schneider Electric’s Security Solutions Group to integrate Zwipe Access fingerprint-scanning smart cards into Schneider Electric’s platforms, expanding access control solutions across various sectors, including data centers. This partnership significantly boosts the adoption of biometric security in data centers.

- April 2023: Securitas secured a five-year agreement with Microsoft to provide comprehensive data center security across 31 countries. This substantial deal underscores the growing demand for robust and integrated security solutions from leading cloud providers and highlights Securitas' position as a major player.

Strategic Outlook for France Data Center Physical Security Market Market

The France Data Center Physical Security Market holds significant growth potential, fueled by ongoing digital transformation and increasing concerns regarding data security. Strategic opportunities exist for companies offering integrated, AI-powered, and sustainable security solutions. Partnerships and collaborations will play a crucial role in driving innovation and accelerating market penetration. Focusing on providing comprehensive security solutions that address both physical and cybersecurity threats will be key to success in this rapidly evolving market.

France Data Center Physical Security Market Segmentation

-

1. Solution Type

- 1.1. Video Surveillance

- 1.2. Access Control Solutions

- 1.3. Others

-

2. Service Type

- 2.1. Consulting Services

- 2.2. Professional Services

- 2.3. Other Service Types (System Integration Services)

-

3. End User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Healthcare

- 3.5. Other End User

France Data Center Physical Security Market Segmentation By Geography

- 1. France

France Data Center Physical Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Innovation in Video Surveillance Among the Market Players; Increasing New Construction of Data Centers

- 3.3. Market Restrains

- 3.3.1. The High Costs Associated with Physical Security Infrastructure

- 3.4. Market Trends

- 3.4.1. Video Surveillance is Anticipated to be the Largest Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Video Surveillance

- 5.1.2. Access Control Solutions

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Consulting Services

- 5.2.2. Professional Services

- 5.2.3. Other Service Types (System Integration Services)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Healthcare

- 5.3.5. Other End User

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Convergint Technologies LL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Securitas Technology

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cisco Systems Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Johnson Controls

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Schneider Electric

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bosch Sicherheitssysteme GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Axis Communications AB

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Dahua Technology Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: France Data Center Physical Security Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Data Center Physical Security Market Share (%) by Company 2024

List of Tables

- Table 1: France Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 3: France Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: France Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: France Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: France Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: France Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 8: France Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 9: France Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 10: France Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Data Center Physical Security Market?

The projected CAGR is approximately 14.80%.

2. Which companies are prominent players in the France Data Center Physical Security Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Convergint Technologies LL, Securitas Technology, Cisco Systems Inc, Siemens AG, Johnson Controls, Schneider Electric, Hangzhou Hikvision Digital Technology Co Ltd, Bosch Sicherheitssysteme GmbH, Axis Communications AB, Dahua Technology Co Ltd.

3. What are the main segments of the France Data Center Physical Security Market?

The market segments include Solution Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 80.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Innovation in Video Surveillance Among the Market Players; Increasing New Construction of Data Centers.

6. What are the notable trends driving market growth?

Video Surveillance is Anticipated to be the Largest Segment.

7. Are there any restraints impacting market growth?

The High Costs Associated with Physical Security Infrastructure.

8. Can you provide examples of recent developments in the market?

October 2023: Zwipe partnered with Schneider Electric’s Security Solutions Group. The French-based multinational Schneider Electric plans to introduce the Zwipe Access fingerprint-scanning smart card to its clientele. This card will be integrated with Schneider Electric’s Continuum and Security Expert platforms, serving a client base from sectors including airports, transportation, healthcare, and data centers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Data Center Physical Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Data Center Physical Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Data Center Physical Security Market?

To stay informed about further developments, trends, and reports in the France Data Center Physical Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence