Key Insights

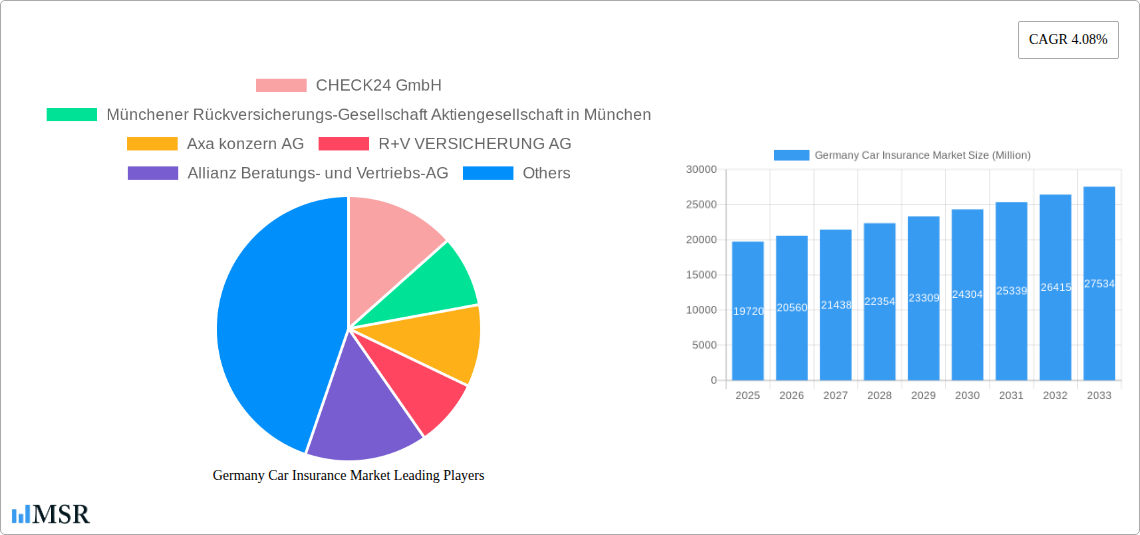

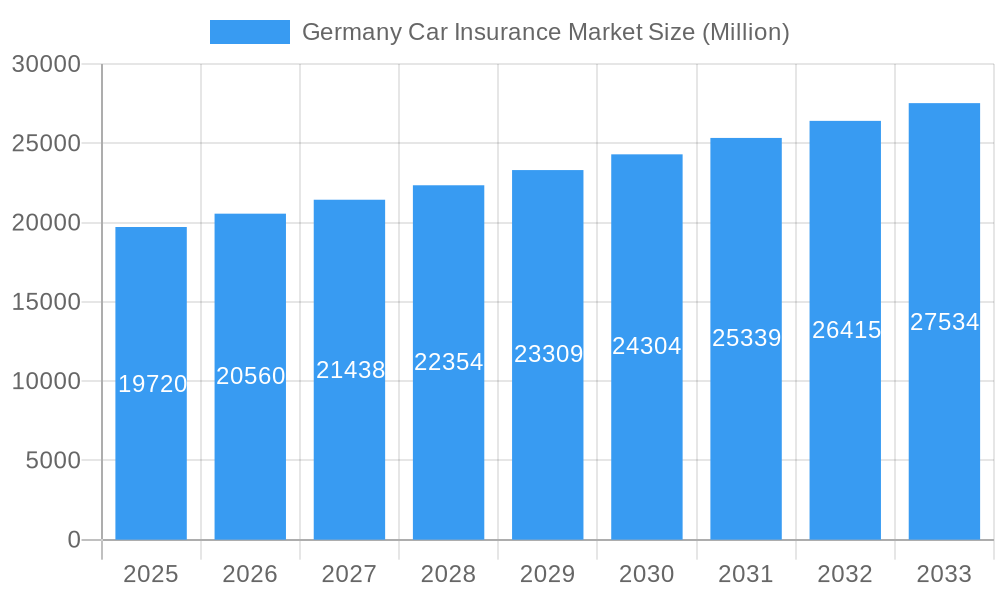

The German car insurance market, valued at €19.72 billion in 2025, is projected to experience steady growth, driven by a rising number of vehicles on the road, increasing awareness of comprehensive coverage options, and the expanding adoption of digital distribution channels. The market's Compound Annual Growth Rate (CAGR) of 4.08% from 2025 to 2033 indicates a consistent upward trajectory, fueled by factors such as rising disposable incomes leading to greater affordability of insurance, and stricter government regulations emphasizing comprehensive car insurance. The market is segmented by coverage type (third-party liability, collision/comprehensive, and other optional coverages), vehicle type (personal and commercial), and distribution channel (direct sales, agents, brokers, banks, and online platforms). Competition is fierce amongst major players such as Allianz, AXA, and others, leading to innovative product offerings and price competitiveness. The increasing popularity of online platforms and telematics-based insurance is reshaping the distribution landscape, while challenges like fluctuating fuel prices and economic uncertainty may influence purchasing behavior. Growth is expected to be particularly strong in segments offering comprehensive coverage and utilizing digital sales strategies.

Germany Car Insurance Market Market Size (In Billion)

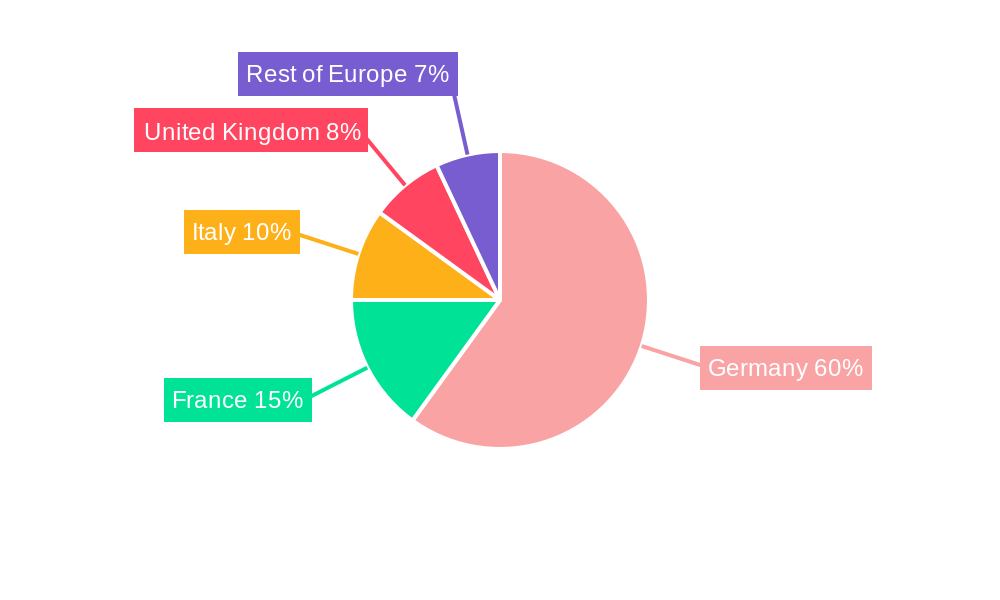

The regional analysis reveals Germany as the largest market within Europe, followed by other key markets like France, Italy, and the UK. The strong presence of established insurers and a relatively high car ownership rate contributes significantly to Germany's market dominance. However, increasing regulatory scrutiny regarding pricing transparency and data protection poses a constraint. The ongoing trend towards bundled insurance packages and personalized offerings, driven by data analytics and sophisticated risk assessment models, will likely shape the market's future. Further, the increasing integration of telematics to monitor driving behavior and offer usage-based insurance is expected to drive innovation and efficiency. The forecast period of 2025-2033 promises a dynamic market landscape with opportunities for both established players and innovative entrants.

Germany Car Insurance Market Company Market Share

Germany Car Insurance Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Germany car insurance market, offering invaluable insights for industry stakeholders, investors, and strategists. Covering the period from 2019 to 2033, with a base year of 2025, this study meticulously examines market dynamics, key segments, leading players, and future growth prospects. The report leverages detailed data analysis to forecast market size and CAGR, providing actionable intelligence for informed decision-making.

Germany Car Insurance Market Concentration & Dynamics

The German car insurance market exhibits a moderately concentrated structure, with several large players commanding significant market share. CHECK24 GmbH, Allianz Beratungs- und Vertriebs-AG, Axa konzern AG, R+V VERSICHERUNG AG, and Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München are among the dominant players, collectively holding an estimated xx% of the market in 2025. However, the market also accommodates numerous smaller insurers and online providers, fostering competition.

The market's innovation ecosystem is dynamic, with continuous technological advancements driving efficiency and customer experience improvements. Regulatory frameworks, largely established by the German Federal Financial Supervisory Authority (BaFin), influence pricing, product offerings, and distribution strategies. Substitute products, such as peer-to-peer insurance platforms, are emerging, presenting a potential challenge to established players. End-user trends indicate increasing demand for digitalization, personalized services, and flexible insurance plans. The M&A activity in the sector has been moderate over the past five years, with an estimated xx M&A deals recorded during the 2019-2024 period.

- Market Share (2025): Allianz: xx%; Axa: xx%; R+V: xx%; Munich Re: xx%; CHECK24: xx%; Others: xx%

- M&A Deal Count (2019-2024): xx

- Key Regulatory Body: BaFin

Germany Car Insurance Market Industry Insights & Trends

The German car insurance market is projected to experience substantial growth during the forecast period (2025-2033), driven by several key factors. Rising vehicle ownership, particularly among younger demographics, coupled with increasing disposable incomes, fuels demand for insurance coverage. Technological advancements, such as telematics and AI-powered risk assessment, are revolutionizing the industry, enabling more precise pricing and personalized products. The increasing adoption of online platforms and digital distribution channels further contributes to market expansion. Consumer behavior is evolving, with a greater emphasis on convenience, transparency, and personalized offerings.

The market size is estimated to reach €xx Million in 2025 and is forecast to reach €xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Technological disruptions, including the rise of Insurtech companies and the integration of IoT devices, are reshaping the competitive landscape. Evolving consumer preferences towards flexible, subscription-based models and personalized services are also significantly influencing market dynamics.

Key Markets & Segments Leading Germany Car Insurance Market

The German car insurance market is segmented by coverage type (Third-Party Liability, Collision/Comprehensive/Other Optional), vehicle type (Personal, Commercial), and distribution channel (Direct Sales, Agents, Brokers, Banks, Online, Others). The personal vehicle segment dominates the market, accounting for the largest share of overall premium volume. Third-Party Liability Coverage remains the most prevalent type of coverage, driven by legal requirements. The online distribution channel is experiencing rapid growth, propelled by increasing digital adoption and the convenience it offers.

- Dominant Segment: Personal Vehicles (Third-Party Liability Coverage)

- Fastest-Growing Segment: Online Distribution Channel

- Key Drivers:

- Increasing vehicle ownership

- Rising disposable incomes

- Growing adoption of digital technologies

- Stringent regulatory requirements for minimum liability coverage

Germany Car Insurance Market Product Developments

Recent product innovations in the German car insurance market focus on leveraging technology to enhance customer experience and risk assessment accuracy. Telematics-based insurance products, utilizing data from connected car devices, offer personalized pricing and usage-based insurance options. AI-powered risk assessment models improve pricing accuracy and fraud detection. These advancements enable insurers to provide more competitive and tailored offerings, fostering greater customer engagement.

Challenges in the Germany Car Insurance Market Market

The German car insurance market faces several challenges. Intense competition among established players and emerging Insurtech companies puts pressure on pricing and profitability. Strict regulatory requirements and compliance costs represent significant operational hurdles. Fluctuations in the cost of claims, particularly due to rising vehicle repair costs, can impact profitability. Supply chain disruptions, particularly concerning the availability of spare parts, can affect the speed and efficiency of claims processing.

Forces Driving Germany Car Insurance Market Growth

Several factors drive the growth of the German car insurance market. Technological advancements, particularly the use of telematics and AI, enhance efficiency and personalization. Economic growth and rising disposable incomes contribute to increased demand for insurance coverage. Government regulations promoting road safety and minimum liability coverage support market expansion.

Challenges in the Germany Car Insurance Market Market

Long-term growth will be fueled by strategic partnerships between traditional insurers and Insurtech firms, leading to innovative product offerings and improved customer experiences. Market expansion into niche segments, such as specialized insurance for electric vehicles, also holds significant potential. Investments in data analytics and AI will further refine risk assessment and pricing strategies, enabling sustainable growth.

Emerging Opportunities in Germany Car Insurance Market

Emerging opportunities include the growing market for usage-based insurance (UBI) powered by telematics, catering to individual driving behaviours and rewarding safe drivers. The increasing adoption of electric vehicles presents a new niche requiring specialized insurance products. Expansion into personalized and bundled insurance offerings, combining car insurance with other products, offers significant potential for growth.

Leading Players in the Germany Car Insurance Market Sector

- CHECK24 GmbH

- Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München

- Axa konzern AG

- R+V VERSICHERUNG AG

- Allianz Beratungs- und Vertriebs-AG

- VHV Vereinigte Hannoversche Versicherung a G

- Debeka Lebensversicherungsverein auf Gegenseitigkeit Sitz Koblenz am Rhein

- GOTHAER Versicherungsbank VVaG

- Versicherungskammer Bayern Versicherungsanstalt des öffentlichen Rechts

- SIGNAL IDUNA Lebensversicherung a G

Key Milestones in Germany Car Insurance Market Industry

- July 2023: Wrisk partners with Mobilize Financial Services, launching a flexible monthly car insurance subscription. This signifies a growing trend towards flexible, usage-based insurance models, impacting the competitive landscape.

- January 2023: Signal Iduna partners with Google Cloud to develop cloud-based insurance products and services. This highlights the increasing adoption of cloud technology and data analytics to improve efficiency and customer experience.

Strategic Outlook for Germany Car Insurance Market Market

The German car insurance market presents significant growth potential over the next decade. Strategic opportunities include focusing on innovative product development, leveraging technology to enhance customer experience and operational efficiency, and exploring new distribution channels. Expanding into niche segments, like electric vehicle insurance, and strategically partnering with technology companies will be crucial for long-term success. The market's shift towards personalized, data-driven insurance products will shape future competitiveness.

Germany Car Insurance Market Segmentation

-

1. Coverage

- 1.1. Third-Party Liability Coverage

- 1.2. Collision/Comprehensive/Other Optional Coverage

-

2. Application

- 2.1. Personal Vehicles

- 2.2. Commercial Vehicles

-

3. Distribution Channel

- 3.1. Direct Sales

- 3.2. Individual Agents

- 3.3. Brokers

- 3.4. Banks

- 3.5. Online

- 3.6. Other Distribution Channels

Germany Car Insurance Market Segmentation By Geography

- 1. Germany

Germany Car Insurance Market Regional Market Share

Geographic Coverage of Germany Car Insurance Market

Germany Car Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.08% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Cars in Germany Drives The Market; Increase in Road Traffic Accidents Drives The Market

- 3.3. Market Restrains

- 3.3.1. Increase in Cost of Claims Made; Increase in False Claims and Scams

- 3.4. Market Trends

- 3.4.1. Increasing Focus Towards Digitalization In Car Insurance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Car Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Third-Party Liability Coverage

- 5.1.2. Collision/Comprehensive/Other Optional Coverage

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal Vehicles

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct Sales

- 5.3.2. Individual Agents

- 5.3.3. Brokers

- 5.3.4. Banks

- 5.3.5. Online

- 5.3.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CHECK24 GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Axa konzern AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 R+V VERSICHERUNG AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Allianz Beratungs- und Vertriebs-AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 VHV Vereinigte Hannoversche Versicherung a G

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Debeka Lebensversicherungsverein auf Gegenseitigkeit Sitz Koblenz am Rhein

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GOTHAER Versicherungsbank VVaG* *List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Versicherungskammer Bayern Versicherungsanstalt des öffentlichen Rechts

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SIGNAL IDUNA Lebensversicherung a G

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CHECK24 GmbH

List of Figures

- Figure 1: Germany Car Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Car Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 2: Germany Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Germany Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Germany Car Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Germany Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 6: Germany Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Germany Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Germany Car Insurance Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Car Insurance Market?

The projected CAGR is approximately 4.08%.

2. Which companies are prominent players in the Germany Car Insurance Market?

Key companies in the market include CHECK24 GmbH, Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München, Axa konzern AG, R+V VERSICHERUNG AG, Allianz Beratungs- und Vertriebs-AG, VHV Vereinigte Hannoversche Versicherung a G, Debeka Lebensversicherungsverein auf Gegenseitigkeit Sitz Koblenz am Rhein, GOTHAER Versicherungsbank VVaG* *List Not Exhaustive, Versicherungskammer Bayern Versicherungsanstalt des öffentlichen Rechts, SIGNAL IDUNA Lebensversicherung a G.

3. What are the main segments of the Germany Car Insurance Market?

The market segments include Coverage , Application , Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Cars in Germany Drives The Market; Increase in Road Traffic Accidents Drives The Market.

6. What are the notable trends driving market growth?

Increasing Focus Towards Digitalization In Car Insurance.

7. Are there any restraints impacting market growth?

Increase in Cost of Claims Made; Increase in False Claims and Scams.

8. Can you provide examples of recent developments in the market?

July 2023: Wrisk, an intermediary insurance provider, entered into a partnership with Mobilize Financial Services, which provides customers with a fully flexible car insurance experience, offering a genuine monthly rolling subscription policy that is aligned to the car subscription contract term.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Car Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Car Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Car Insurance Market?

To stay informed about further developments, trends, and reports in the Germany Car Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence