Key Insights

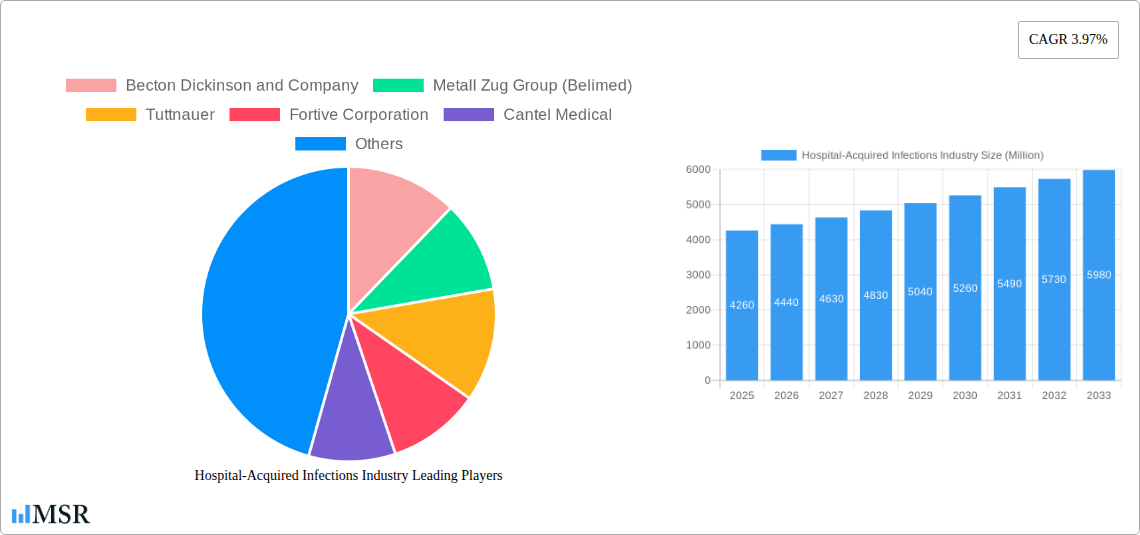

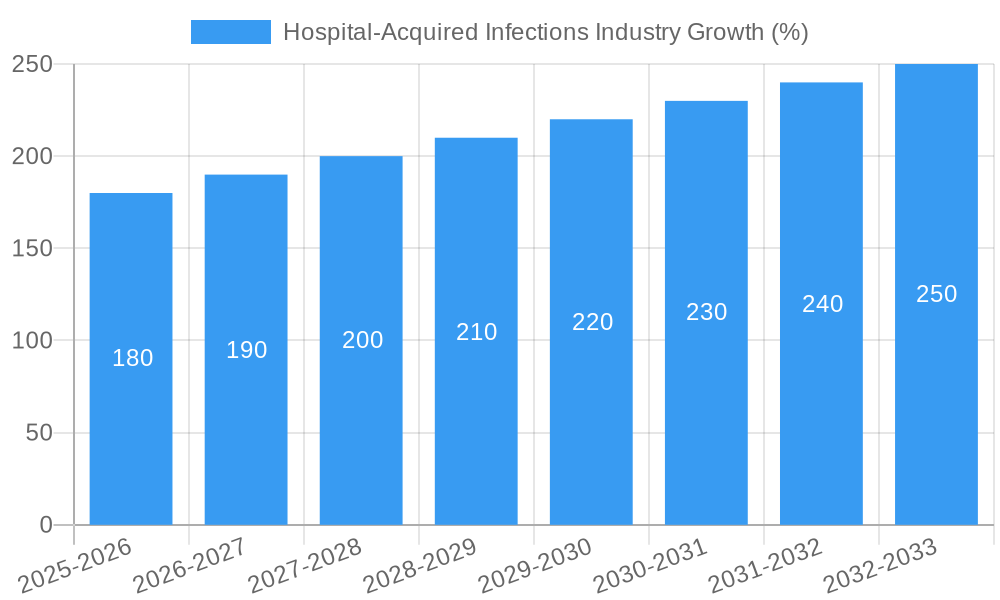

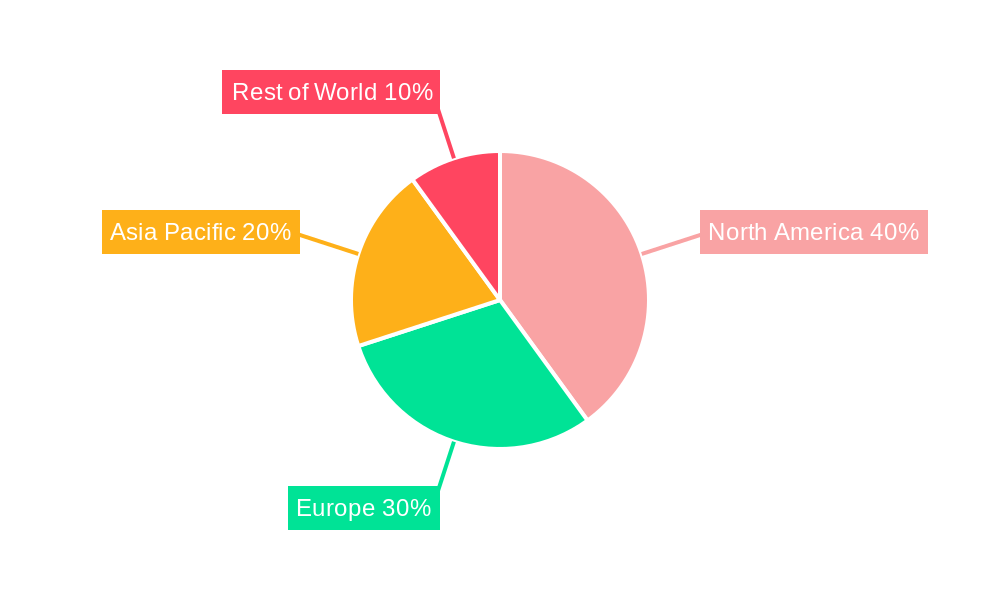

The global market for Hospital-Acquired Infection (HAI) prevention and control is experiencing steady growth, projected to reach \$4.26 billion in 2025 and expand at a Compound Annual Growth Rate (CAGR) of 3.97% from 2025 to 2033. This growth is driven by several key factors. The increasing prevalence of HAIs globally, coupled with rising healthcare costs associated with treating these infections, necessitates robust preventative measures. Stringent regulatory frameworks mandating infection control protocols in healthcare facilities further fuel market expansion. Technological advancements, including the development of sophisticated disinfection equipment and innovative infection control solutions, contribute significantly. The market is segmented by type (equipment, services, consumables) and end-user (hospitals & intensive care units, ambulatory surgical centers, nursing homes). The equipment segment, encompassing sterilization systems, disinfection devices, and air purification technologies, holds a significant share, driven by the continuous need for advanced technologies to eliminate pathogens effectively. The services segment, which includes consulting, training, and infection control program development, is also growing steadily as healthcare providers increasingly prioritize proactive infection prevention strategies. The consumables segment comprises disinfectants, antiseptics, and personal protective equipment (PPE), exhibiting consistent demand due to their essential role in infection control. Geographically, North America currently dominates the market due to advanced healthcare infrastructure and higher adoption of infection control technologies, followed by Europe and Asia-Pacific. However, the Asia-Pacific region exhibits strong growth potential driven by expanding healthcare infrastructure and increasing awareness of HAI prevention.

The restraining factors to market growth include the high cost associated with advanced infection control technologies and the potential for resistance to disinfectants. Moreover, challenges in implementing and maintaining effective infection control programs across all healthcare settings, particularly in resource-constrained regions, present some limitations. However, ongoing research and development in novel antimicrobial technologies, coupled with increasing awareness of the economic and public health burden of HAIs, are expected to mitigate these constraints. Key players in the market are continually innovating and expanding their product portfolios to cater to the evolving needs of healthcare providers. Strategic collaborations, acquisitions, and technological advancements are reshaping the competitive landscape, furthering the growth trajectory of the HAI prevention and control market.

Deep Dive into the Hospital-Acquired Infections Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Hospital-Acquired Infections (HAI) industry, offering critical insights for stakeholders, investors, and industry professionals. The study period covers 2019-2033, with 2025 as the base and estimated year. The report projects a market size of xx Million by 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). The report analyzes key market segments, leading players, and emerging trends, providing actionable intelligence for strategic decision-making.

Hospital-Acquired Infections Industry Market Concentration & Dynamics

The Hospital-Acquired Infections (HAI) industry is characterized by a moderately concentrated market structure, with a handful of multinational corporations holding significant market share. The top ten players, including Becton Dickinson and Company, Metall Zug Group (Belimed), Tuttnauer, Fortive Corporation, Cantel Medical, 3M Company, Getinge AB, S C Johnson & Son Inc, Sotera Health, and STERIS PLC, collectively account for approximately xx% of the global market in 2025. Market share is determined by factors like technological innovation, product portfolio breadth, geographical reach, and strategic acquisitions.

The industry's innovation ecosystem is highly dynamic, driven by continuous advancements in infection prevention technologies. Regulatory frameworks, such as those set by the FDA and other regional health authorities, play a significant role in shaping product development and market entry. Substitute products, like improved hygiene practices and alternative disinfection methods, pose a degree of competitive pressure. End-user trends, particularly the increasing demand for advanced infection control solutions in hospitals and ambulatory care centers, are major growth drivers.

Mergers and acquisitions (M&A) activity within the HAI industry has been relatively robust in recent years, with xx M&A deals recorded between 2019 and 2024. These activities are driven by the need to expand product portfolios, enhance technological capabilities, and gain access to new markets. Larger players are actively seeking acquisitions of smaller, specialized companies to strengthen their market position and broaden their service offerings.

Hospital-Acquired Infections Industry Industry Insights & Trends

The global HAI market is experiencing robust growth, fueled by several key factors. The rising prevalence of healthcare-associated infections (HAIs) worldwide, coupled with increasing awareness of infection control, is a significant market driver. Technological advancements, including the development of more effective disinfectants and sterilization technologies, are further propelling market expansion. Changes in healthcare infrastructure, such as the growth of ambulatory surgical centers and the increasing adoption of infection prevention protocols, also contribute to market growth. The rise in antibiotic-resistant bacteria poses a significant challenge, but simultaneously fuels demand for innovative solutions. The market size is expected to reach xx Million by 2033, reflecting the continuous need for effective infection control measures. Changing consumer preferences towards minimally invasive procedures and enhanced patient safety are indirectly contributing to the expansion of this market. The market faces ongoing evolution, driven by technological disruption in areas like advanced robotics for sterilization and AI-driven infection surveillance systems, resulting in a continuously evolving landscape.

Key Markets & Segments Leading Hospital-Acquired Infections Industry

The Hospitals and Intensive Care Units segment dominates the HAI market, accounting for approximately xx% of the total market value in 2025. This is driven by the high prevalence of HAIs in these settings and the stringent infection control requirements. The Consumables segment, including disinfectants, wipes, and personal protective equipment, holds the largest share within the “By Type” segment. This is due to the continuous and high demand for these consumables in healthcare settings.

Drivers for Hospital and ICU segment dominance:

- High prevalence of HAIs

- Stringent infection control regulations

- Increased patient volume

- High investment in advanced technologies

Drivers for Consumables segment dominance:

- Continuous need for replacement

- Relatively lower cost compared to equipment

- Wide range of applications

The North American region currently leads the global market, primarily due to high healthcare expenditure, stringent regulatory frameworks, and advanced healthcare infrastructure. However, developing economies in Asia-Pacific are experiencing significant growth due to rising healthcare spending and increasing awareness of infection prevention. European markets also contribute significantly, with strong emphasis on infection control protocols and advanced healthcare technologies.

Hospital-Acquired Infections Industry Product Developments

Recent years have witnessed significant advancements in HAI prevention technologies. This includes the introduction of novel disinfectants with enhanced efficacy against multi-drug resistant organisms, development of automated sterilization systems that improve efficiency and reduce human error, and innovative personal protective equipment (PPE) designed for improved comfort and safety. These advancements are providing healthcare providers with more effective tools to combat HAIs and contribute to enhanced patient outcomes. Companies are focusing on developing products with longer shelf life, improved ease of use, and enhanced safety profiles.

Challenges in the Hospital-Acquired Infections Industry Market

The HAI market faces several challenges, including stringent regulatory requirements that increase product development costs and time to market. Supply chain disruptions can affect the availability of critical components and materials, leading to production delays and price volatility. Intense competition among established players and emerging companies further increases the challenges faced by individual market players. These factors, collectively, impact market growth and profitability. For instance, stringent regulations have increased the development cost of new disinfectants by approximately xx Million annually.

Forces Driving Hospital-Acquired Infections Industry Growth

Several factors drive the growth of the HAI market. The increasing prevalence of HAIs is a primary driver, coupled with the rise in antibiotic-resistant bacteria. Technological advancements are improving the efficacy and efficiency of infection prevention methods, reducing the spread of HAIs. Government initiatives and healthcare policies emphasizing infection control further fuel market growth. For example, the increased funding towards infection control research has led to the development of xx new disinfectants in the past five years.

Long-Term Growth Catalysts in the Hospital-Acquired Infections Industry

Long-term growth in the HAI market will be fueled by continued innovation in disinfection and sterilization technologies. Strategic partnerships between technology providers and healthcare institutions will facilitate the adoption of advanced solutions. Market expansion into emerging economies with growing healthcare infrastructure will create substantial growth opportunities. Investment in research and development of novel antimicrobial agents and improved infection prevention strategies will also contribute to long-term growth.

Emerging Opportunities in Hospital-Acquired Infections Industry

Emerging opportunities include the development of personalized infection prevention strategies based on individual patient risk profiles, the integration of AI and big data analytics for early detection and prevention of HAIs, and the expansion of telehealth and remote patient monitoring to reduce the risk of infections in home healthcare settings. The increasing focus on antimicrobial stewardship and the development of novel antimicrobial agents present significant opportunities for market growth. The growing acceptance of robotic-assisted surgery is another aspect that expands the market.

Leading Players in the Hospital-Acquired Infections Industry Sector

- Becton Dickinson and Company

- Metall Zug Group (Belimed)

- Tuttnauer

- Fortive Corporation

- Cantel Medical

- 3M Company

- Getinge AB

- S C Johnson & Son Inc

- Sotera Health

- STERIS PLC

Key Milestones in Hospital-Acquired Infections Industry Industry

June 2022: Sonoma Pharmaceuticals, Inc. and the MicroSafe Group DMCC announced that Nanocyn hospital-grade disinfectant was added to the EPA's List N of COVID-19 disinfectants. This significantly boosted the market share of Nanocyn and increased the demand for hospital-grade disinfectants.

March 2022: PDI launched new germicidal wipes and spray, expanding its product portfolio and strengthening its market position in the fight against HAIs and COVID-19. This launch stimulated innovation within the industry, increasing competition and forcing existing market players to innovate further.

Strategic Outlook for Hospital-Acquired Infections Industry Market

The HAI market is poised for continued growth, driven by technological innovation, expanding healthcare infrastructure, and increasing awareness of infection prevention. Strategic opportunities exist for companies that can develop and deliver innovative, cost-effective, and user-friendly solutions to combat HAIs. Focus on emerging markets and strategic partnerships will be key to capitalizing on future growth potential. The market is expected to witness significant expansion, providing lucrative opportunities for investors and market players alike.

Hospital-Acquired Infections Industry Segmentation

-

1. Product

-

1.1. Sterilants

- 1.1.1. Heat Sterilization Equipment

- 1.1.2. Low Temperature Sterilization Equipment

- 1.1.3. Radiation Sterilization Equipment

- 1.1.4. Steam Sterilization

- 1.1.5. Other Sterilants

- 1.2. Disinfectants

- 1.3. Other Products

-

1.1. Sterilants

-

2. Indication

- 2.1. Hospital Acquired Pneumonia

- 2.2. Bloodstream Infections

- 2.3. Surgical Site Infections

- 2.4. Gastrointestinal Infections

- 2.5. Urinary Tract Infections

- 2.6. Other Indications

-

3. End User

- 3.1. Hospitals and Intensive Care Units

- 3.2. Ambulatory Surgical and Diagnostic Centers

- 3.3. Nursing Homes and Maternity Centers

Hospital-Acquired Infections Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Hospital-Acquired Infections Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Hospital Stay Due to Chronic Diseases and Surgeries; Rise in the Incidences of Different Types of Hospital Acquired Infections; Innovative Technologies Implemented in Devices that Control Infection

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness Regarding Hospital Acquired Infection; Stringent Regulatory Requirements

- 3.4. Market Trends

- 3.4.1. Disinfectant Segment is Expected to Hold Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospital-Acquired Infections Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Sterilants

- 5.1.1.1. Heat Sterilization Equipment

- 5.1.1.2. Low Temperature Sterilization Equipment

- 5.1.1.3. Radiation Sterilization Equipment

- 5.1.1.4. Steam Sterilization

- 5.1.1.5. Other Sterilants

- 5.1.2. Disinfectants

- 5.1.3. Other Products

- 5.1.1. Sterilants

- 5.2. Market Analysis, Insights and Forecast - by Indication

- 5.2.1. Hospital Acquired Pneumonia

- 5.2.2. Bloodstream Infections

- 5.2.3. Surgical Site Infections

- 5.2.4. Gastrointestinal Infections

- 5.2.5. Urinary Tract Infections

- 5.2.6. Other Indications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals and Intensive Care Units

- 5.3.2. Ambulatory Surgical and Diagnostic Centers

- 5.3.3. Nursing Homes and Maternity Centers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Hospital-Acquired Infections Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Sterilants

- 6.1.1.1. Heat Sterilization Equipment

- 6.1.1.2. Low Temperature Sterilization Equipment

- 6.1.1.3. Radiation Sterilization Equipment

- 6.1.1.4. Steam Sterilization

- 6.1.1.5. Other Sterilants

- 6.1.2. Disinfectants

- 6.1.3. Other Products

- 6.1.1. Sterilants

- 6.2. Market Analysis, Insights and Forecast - by Indication

- 6.2.1. Hospital Acquired Pneumonia

- 6.2.2. Bloodstream Infections

- 6.2.3. Surgical Site Infections

- 6.2.4. Gastrointestinal Infections

- 6.2.5. Urinary Tract Infections

- 6.2.6. Other Indications

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals and Intensive Care Units

- 6.3.2. Ambulatory Surgical and Diagnostic Centers

- 6.3.3. Nursing Homes and Maternity Centers

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Hospital-Acquired Infections Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Sterilants

- 7.1.1.1. Heat Sterilization Equipment

- 7.1.1.2. Low Temperature Sterilization Equipment

- 7.1.1.3. Radiation Sterilization Equipment

- 7.1.1.4. Steam Sterilization

- 7.1.1.5. Other Sterilants

- 7.1.2. Disinfectants

- 7.1.3. Other Products

- 7.1.1. Sterilants

- 7.2. Market Analysis, Insights and Forecast - by Indication

- 7.2.1. Hospital Acquired Pneumonia

- 7.2.2. Bloodstream Infections

- 7.2.3. Surgical Site Infections

- 7.2.4. Gastrointestinal Infections

- 7.2.5. Urinary Tract Infections

- 7.2.6. Other Indications

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals and Intensive Care Units

- 7.3.2. Ambulatory Surgical and Diagnostic Centers

- 7.3.3. Nursing Homes and Maternity Centers

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Hospital-Acquired Infections Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Sterilants

- 8.1.1.1. Heat Sterilization Equipment

- 8.1.1.2. Low Temperature Sterilization Equipment

- 8.1.1.3. Radiation Sterilization Equipment

- 8.1.1.4. Steam Sterilization

- 8.1.1.5. Other Sterilants

- 8.1.2. Disinfectants

- 8.1.3. Other Products

- 8.1.1. Sterilants

- 8.2. Market Analysis, Insights and Forecast - by Indication

- 8.2.1. Hospital Acquired Pneumonia

- 8.2.2. Bloodstream Infections

- 8.2.3. Surgical Site Infections

- 8.2.4. Gastrointestinal Infections

- 8.2.5. Urinary Tract Infections

- 8.2.6. Other Indications

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals and Intensive Care Units

- 8.3.2. Ambulatory Surgical and Diagnostic Centers

- 8.3.3. Nursing Homes and Maternity Centers

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Hospital-Acquired Infections Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Sterilants

- 9.1.1.1. Heat Sterilization Equipment

- 9.1.1.2. Low Temperature Sterilization Equipment

- 9.1.1.3. Radiation Sterilization Equipment

- 9.1.1.4. Steam Sterilization

- 9.1.1.5. Other Sterilants

- 9.1.2. Disinfectants

- 9.1.3. Other Products

- 9.1.1. Sterilants

- 9.2. Market Analysis, Insights and Forecast - by Indication

- 9.2.1. Hospital Acquired Pneumonia

- 9.2.2. Bloodstream Infections

- 9.2.3. Surgical Site Infections

- 9.2.4. Gastrointestinal Infections

- 9.2.5. Urinary Tract Infections

- 9.2.6. Other Indications

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals and Intensive Care Units

- 9.3.2. Ambulatory Surgical and Diagnostic Centers

- 9.3.3. Nursing Homes and Maternity Centers

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Hospital-Acquired Infections Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Sterilants

- 10.1.1.1. Heat Sterilization Equipment

- 10.1.1.2. Low Temperature Sterilization Equipment

- 10.1.1.3. Radiation Sterilization Equipment

- 10.1.1.4. Steam Sterilization

- 10.1.1.5. Other Sterilants

- 10.1.2. Disinfectants

- 10.1.3. Other Products

- 10.1.1. Sterilants

- 10.2. Market Analysis, Insights and Forecast - by Indication

- 10.2.1. Hospital Acquired Pneumonia

- 10.2.2. Bloodstream Infections

- 10.2.3. Surgical Site Infections

- 10.2.4. Gastrointestinal Infections

- 10.2.5. Urinary Tract Infections

- 10.2.6. Other Indications

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals and Intensive Care Units

- 10.3.2. Ambulatory Surgical and Diagnostic Centers

- 10.3.3. Nursing Homes and Maternity Centers

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North Americ Hospital-Acquired Infections Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. South America Hospital-Acquired Infections Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Brazil

- 12.1.2 Mexico

- 12.1.3 Rest of South America

- 13. Europe Hospital-Acquired Infections Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Italy

- 13.1.5 Spain

- 13.1.6 Rest of Europe

- 14. Asia Pacific Hospital-Acquired Infections Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 14.1.5 Taiwan

- 14.1.6 Australia

- 14.1.7 Rest of Asia-Pacific

- 15. MEA Hospital-Acquired Infections Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Middle East

- 15.1.2 Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Becton Dickinson and Company

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Metall Zug Group (Belimed)

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Tuttnauer

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Fortive Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Cantel Medical

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 3M Company

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Getinge AB

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 S C Johnson & Son Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Sotera Health

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 STERIS PLC

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Hospital-Acquired Infections Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North Americ Hospital-Acquired Infections Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North Americ Hospital-Acquired Infections Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: South America Hospital-Acquired Infections Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: South America Hospital-Acquired Infections Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Hospital-Acquired Infections Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe Hospital-Acquired Infections Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Asia Pacific Hospital-Acquired Infections Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Asia Pacific Hospital-Acquired Infections Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: MEA Hospital-Acquired Infections Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: MEA Hospital-Acquired Infections Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Hospital-Acquired Infections Industry Revenue (Million), by Product 2024 & 2032

- Figure 13: North America Hospital-Acquired Infections Industry Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America Hospital-Acquired Infections Industry Revenue (Million), by Indication 2024 & 2032

- Figure 15: North America Hospital-Acquired Infections Industry Revenue Share (%), by Indication 2024 & 2032

- Figure 16: North America Hospital-Acquired Infections Industry Revenue (Million), by End User 2024 & 2032

- Figure 17: North America Hospital-Acquired Infections Industry Revenue Share (%), by End User 2024 & 2032

- Figure 18: North America Hospital-Acquired Infections Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Hospital-Acquired Infections Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Hospital-Acquired Infections Industry Revenue (Million), by Product 2024 & 2032

- Figure 21: Europe Hospital-Acquired Infections Industry Revenue Share (%), by Product 2024 & 2032

- Figure 22: Europe Hospital-Acquired Infections Industry Revenue (Million), by Indication 2024 & 2032

- Figure 23: Europe Hospital-Acquired Infections Industry Revenue Share (%), by Indication 2024 & 2032

- Figure 24: Europe Hospital-Acquired Infections Industry Revenue (Million), by End User 2024 & 2032

- Figure 25: Europe Hospital-Acquired Infections Industry Revenue Share (%), by End User 2024 & 2032

- Figure 26: Europe Hospital-Acquired Infections Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Hospital-Acquired Infections Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Hospital-Acquired Infections Industry Revenue (Million), by Product 2024 & 2032

- Figure 29: Asia Pacific Hospital-Acquired Infections Industry Revenue Share (%), by Product 2024 & 2032

- Figure 30: Asia Pacific Hospital-Acquired Infections Industry Revenue (Million), by Indication 2024 & 2032

- Figure 31: Asia Pacific Hospital-Acquired Infections Industry Revenue Share (%), by Indication 2024 & 2032

- Figure 32: Asia Pacific Hospital-Acquired Infections Industry Revenue (Million), by End User 2024 & 2032

- Figure 33: Asia Pacific Hospital-Acquired Infections Industry Revenue Share (%), by End User 2024 & 2032

- Figure 34: Asia Pacific Hospital-Acquired Infections Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Hospital-Acquired Infections Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Hospital-Acquired Infections Industry Revenue (Million), by Product 2024 & 2032

- Figure 37: Middle East and Africa Hospital-Acquired Infections Industry Revenue Share (%), by Product 2024 & 2032

- Figure 38: Middle East and Africa Hospital-Acquired Infections Industry Revenue (Million), by Indication 2024 & 2032

- Figure 39: Middle East and Africa Hospital-Acquired Infections Industry Revenue Share (%), by Indication 2024 & 2032

- Figure 40: Middle East and Africa Hospital-Acquired Infections Industry Revenue (Million), by End User 2024 & 2032

- Figure 41: Middle East and Africa Hospital-Acquired Infections Industry Revenue Share (%), by End User 2024 & 2032

- Figure 42: Middle East and Africa Hospital-Acquired Infections Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Hospital-Acquired Infections Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: South America Hospital-Acquired Infections Industry Revenue (Million), by Product 2024 & 2032

- Figure 45: South America Hospital-Acquired Infections Industry Revenue Share (%), by Product 2024 & 2032

- Figure 46: South America Hospital-Acquired Infections Industry Revenue (Million), by Indication 2024 & 2032

- Figure 47: South America Hospital-Acquired Infections Industry Revenue Share (%), by Indication 2024 & 2032

- Figure 48: South America Hospital-Acquired Infections Industry Revenue (Million), by End User 2024 & 2032

- Figure 49: South America Hospital-Acquired Infections Industry Revenue Share (%), by End User 2024 & 2032

- Figure 50: South America Hospital-Acquired Infections Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: South America Hospital-Acquired Infections Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 4: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Brazil Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Mexico Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of South America Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Germany Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: France Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Italy Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Spain Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: India Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Korea Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Taiwan Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Australia Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Asia-Pacific Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Middle East Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Africa Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 33: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 34: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 35: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Canada Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 40: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 41: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 42: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Germany Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 50: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 51: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 52: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 60: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 61: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 62: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: GCC Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: South Africa Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East and Africa Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 67: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 68: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 69: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Brazil Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Argentina Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of South America Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospital-Acquired Infections Industry?

The projected CAGR is approximately 3.97%.

2. Which companies are prominent players in the Hospital-Acquired Infections Industry?

Key companies in the market include Becton Dickinson and Company, Metall Zug Group (Belimed), Tuttnauer, Fortive Corporation, Cantel Medical, 3M Company, Getinge AB, S C Johnson & Son Inc, Sotera Health, STERIS PLC.

3. What are the main segments of the Hospital-Acquired Infections Industry?

The market segments include Product, Indication, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Hospital Stay Due to Chronic Diseases and Surgeries; Rise in the Incidences of Different Types of Hospital Acquired Infections; Innovative Technologies Implemented in Devices that Control Infection.

6. What are the notable trends driving market growth?

Disinfectant Segment is Expected to Hold Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Awareness Regarding Hospital Acquired Infection; Stringent Regulatory Requirements.

8. Can you provide examples of recent developments in the market?

In June 2022, Sonoma Pharmaceuticals, Inc. and the MicroSafe Group DMCC reported that Nanocyn hospital-grade disinfectant has been added to the list of COVID-19 disinfectants maintained by the United States Environmental Protection Agency's List N.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospital-Acquired Infections Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospital-Acquired Infections Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospital-Acquired Infections Industry?

To stay informed about further developments, trends, and reports in the Hospital-Acquired Infections Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence