Key Insights

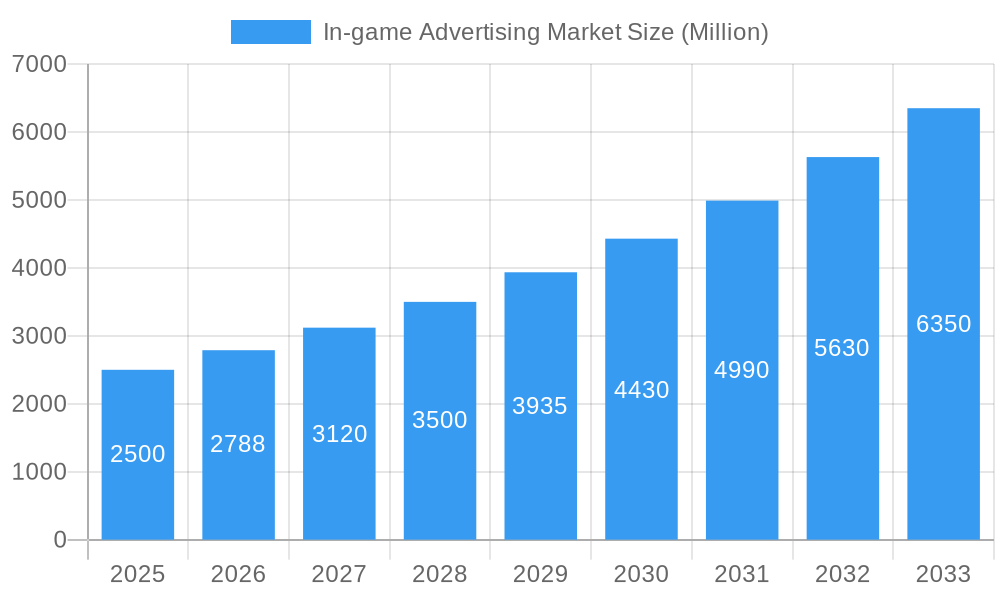

The in-game advertising market is projected for substantial expansion, anticipated to reach $60.6 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 11.1% from the base year 2024. This growth is propelled by the surging popularity of mobile gaming and esports, alongside technological advancements enabling immersive and non-intrusive advertising. The diversification of ad formats, including rewarded video, playable ads, and native integrations, further fuels this market. Influencer marketing within gaming communities also presents new opportunities for brand engagement. While data privacy and gamer ad fatigue are challenges, the industry is innovating with consent-based advertising and improved targeting.

In-game Advertising Market Market Size (In Billion)

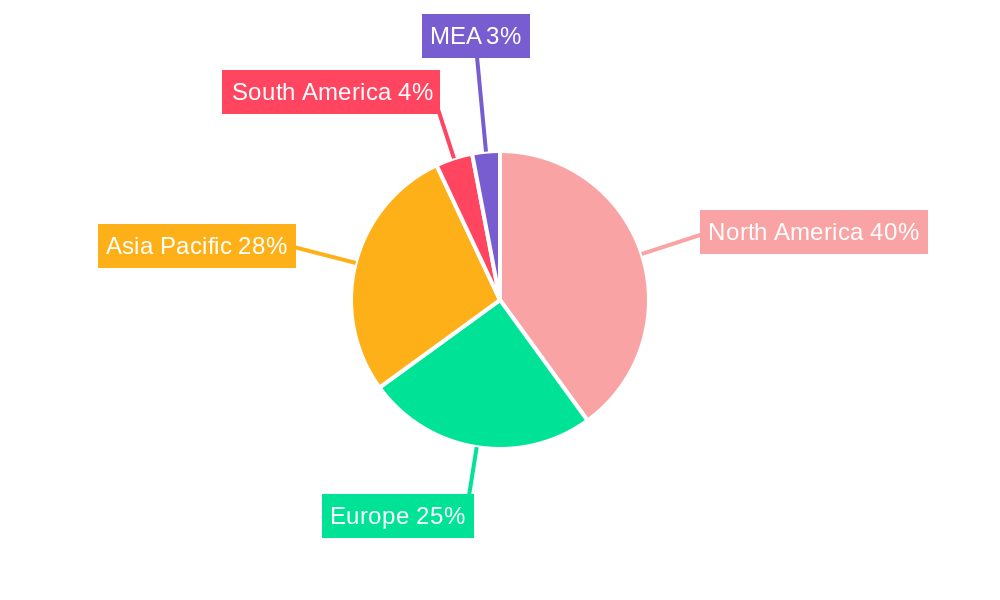

Within market segments, dynamic in-game advertising is poised for the most significant growth due to its personalized and engaging nature. Advergaming, while experiencing notable growth, requires careful balancing of advertising goals with gameplay. Geographically, North America and Asia Pacific lead due to high mobile gaming penetration and ad spending. Emerging markets in South America and MEA show considerable future potential. The competitive landscape is diverse, with established and specialized companies driving innovation. Future success will depend on adapting to trends, developing effective ad formats, and maintaining responsible advertising practices.

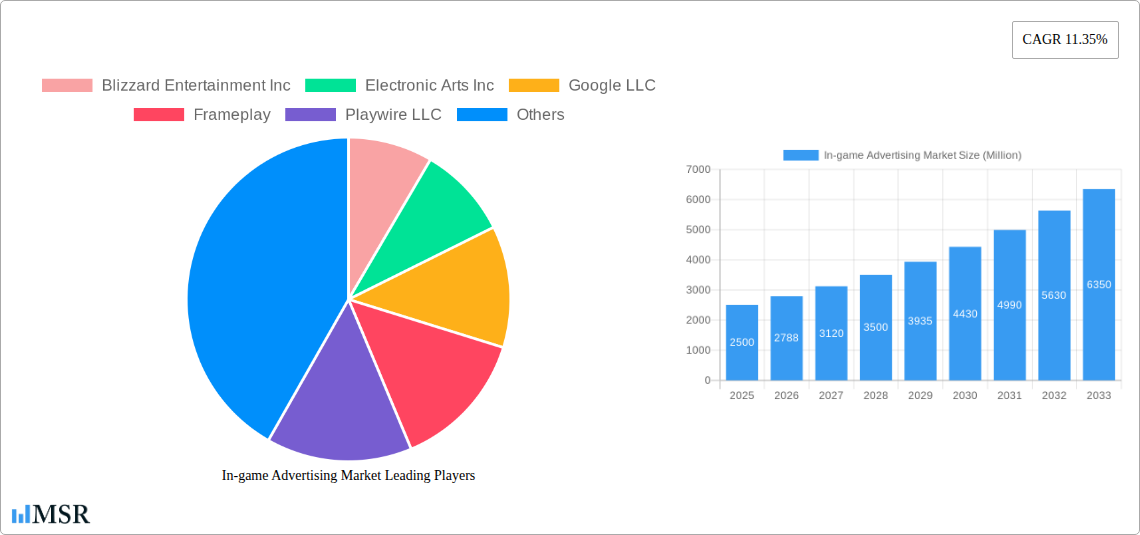

In-game Advertising Market Company Market Share

Unlock Explosive Growth: The Definitive In-Game Advertising Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the In-game Advertising Market, offering invaluable insights for industry stakeholders seeking to capitalize on its explosive growth. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, emerging trends, and future opportunities. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

In-game Advertising Market Concentration & Dynamics

The In-game advertising market is experiencing a dynamic shift, characterized by increasing consolidation and the emergence of innovative ad formats. While a few key players hold significant market share (e.g., Google LLC holds an estimated xx% market share in 2025, followed by Electronic Arts Inc. with xx% and Blizzard Entertainment Inc. with xx%), the market remains relatively fragmented, with numerous smaller companies competing for a slice of the pie. This fragmentation provides opportunities for smaller players to innovate and disrupt the market.

Market Concentration Metrics (2025):

- Top 3 Players Market Share: xx%

- Top 5 Players Market Share: xx%

- Number of M&A Deals (2019-2024): xx

Market Dynamics:

- Innovation Ecosystems: Rapid advancements in game technology are driving the development of more immersive and engaging ad formats, such as dynamic and interactive ads.

- Regulatory Frameworks: Government regulations regarding data privacy and advertising transparency are influencing market practices.

- Substitute Products: Alternative advertising channels, such as social media and streaming platforms, pose competition to In-game advertising.

- End-User Trends: The increasing popularity of mobile gaming and esports is significantly boosting market growth.

- M&A Activities: Strategic mergers and acquisitions are reshaping the competitive landscape, as larger companies seek to consolidate their market position and acquire innovative technologies.

In-game Advertising Market Industry Insights & Trends

The In-game advertising market is experiencing phenomenal growth, driven by several key factors. The global market size reached xx Million in 2024 and is projected to reach xx Million in 2025, exhibiting a significant year-on-year growth. This growth is fueled by the rising popularity of mobile gaming, the increasing adoption of advanced advertising technologies, and the evolving preferences of gamers who are becoming more receptive to relevant and non-intrusive ads. Technological disruptions, such as the integration of artificial intelligence and machine learning, are further enhancing the effectiveness and personalization of in-game advertising. Consumer behavior is also shifting, with gamers increasingly expecting seamless and integrated advertising experiences. This has created an opportunity for dynamic in-game ads that adapt to the game context, and advergaming which blurs the lines between advertising and gameplay creating a more engaging experience for the user. This trend, along with the overall growth of the gaming industry, indicates a long-term upward trajectory for the in-game advertising sector.

Key Markets & Segments Leading In-Game Advertising Market

North America currently dominates the in-game advertising market, driven by high gaming penetration, strong consumer spending, and the presence of major gaming companies and technology providers. However, Asia-Pacific is emerging as a rapidly growing market, fueled by the expanding mobile gaming user base and increasing internet penetration.

Dominant Segment: Dynamic In-game Advertising

Dynamic in-game advertising is gaining significant traction, surpassing Static in-game advertising in market share and revenue. This is because they are more engaging and personalized, allowing advertisers to adapt their content based on real-time game events and player behaviors. Advergaming is also showing potential but lags behind the other two types currently.

Key Drivers:

- North America: High disposable income, established gaming infrastructure, early adoption of new technologies.

- Asia-Pacific: Rapidly expanding mobile gaming market, rising internet penetration, increasing smartphone ownership.

- Europe: Growing popularity of esports, increasing investment in gaming infrastructure.

In-game Advertising Market Product Developments

Recent product innovations in the in-game advertising market focus on enhancing user experience and improving ad targeting. This includes the development of non-intrusive ad formats such as rewarded video ads and interactive ads that seamlessly integrate with gameplay. Advanced analytics and machine learning are being leveraged to optimize ad delivery and measure campaign effectiveness. These advancements are providing advertisers with more control and transparency, creating a more sustainable and beneficial ecosystem for both advertisers and gamers.

Challenges in the In-Game Advertising Market Market

The In-game advertising market faces several challenges, including:

- Regulatory hurdles: Stricter data privacy regulations and increasing scrutiny of advertising practices are creating compliance challenges.

- Supply chain issues: Ensuring effective ad delivery and measurement across diverse game platforms presents logistical complexities.

- Competitive pressures: Competition from other advertising channels and the need for continuous innovation to stay ahead of the curve pressure profitability. The market is also sensitive to economic downturns which can impact consumer spending on games.

Forces Driving In-Game Advertising Market Growth

Several key factors are driving the growth of the in-game advertising market:

- Technological advancements: The development of advanced ad formats and targeting technologies are increasing the effectiveness of in-game advertising.

- Economic factors: The growth of the gaming industry and increasing consumer spending on games are creating a larger addressable market for advertisers.

- Regulatory changes: While presenting some challenges, evolving regulatory frameworks are also leading to increased transparency and consumer trust, creating a more sustainable advertising environment.

Long-Term Growth Catalysts in the In-Game Advertising Market

Long-term growth in the in-game advertising market will be fueled by continued innovation in ad formats, strategic partnerships between game developers and advertisers, and the expansion into new markets, particularly in developing economies with high mobile gaming penetration. The integration of blockchain technology and NFTs also presents exciting opportunities.

Emerging Opportunities in In-Game Advertising Market

Emerging opportunities include:

- Expansion into new game genres: Targeting specific game genres with tailored ad formats will further enhance effectiveness.

- Integration of immersive technologies: The use of VR/AR in advertising offers a more engaging and immersive experience.

- Personalized ad experiences: Leveraging data analytics to create highly personalized ads that resonate with individual gamers.

Leading Players in the In-Game Advertising Market Sector

- Blizzard Entertainment Inc

- Electronic Arts Inc

- Google LLC

- Frameplay

- Playwire LLC

- Motive Interactive Inc

- ironSource Ltd

- RapidFire Inc

- Anzu Virtual Reality Ltd

Key Milestones in In-Game Advertising Market Industry

- 2020: Increased adoption of rewarded video ads.

- 2021: Launch of several new dynamic in-game advertising platforms.

- 2022: Growing focus on data privacy and transparency in in-game advertising.

- 2023: Increased investment in AR/VR in-game advertising.

- 2024: Several significant mergers and acquisitions shaping the market landscape.

Strategic Outlook for In-Game Advertising Market Market

The future of the in-game advertising market looks bright, with significant growth potential driven by technological advancements, evolving consumer preferences, and expanding market reach. Companies that prioritize innovation, data privacy, and user experience will be best positioned to capitalize on this growth. Strategic partnerships and acquisitions will continue to shape the competitive landscape, while the integration of new technologies will further enhance the effectiveness and personalization of in-game advertising.

In-game Advertising Market Segmentation

-

1. Type

- 1.1. Static

- 1.2. Dynamic

- 1.3. Advergaming

In-game Advertising Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. Latin America

In-game Advertising Market Regional Market Share

Geographic Coverage of In-game Advertising Market

In-game Advertising Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Online Gaming; Growth in the Smartphone Penetration

- 3.3. Market Restrains

- 3.3.1. Incremental Advancements in Smartphones

- 3.4. Market Trends

- 3.4.1. Increase in Online Gaming is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global In-game Advertising Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static

- 5.1.2. Dynamic

- 5.1.3. Advergaming

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America In-game Advertising Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Static

- 6.1.2. Dynamic

- 6.1.3. Advergaming

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe In-game Advertising Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Static

- 7.1.2. Dynamic

- 7.1.3. Advergaming

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific In-game Advertising Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Static

- 8.1.2. Dynamic

- 8.1.3. Advergaming

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa In-game Advertising Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Static

- 9.1.2. Dynamic

- 9.1.3. Advergaming

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America In-game Advertising Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Static

- 10.1.2. Dynamic

- 10.1.3. Advergaming

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Blizzard Entertainment Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Electronic Arts Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Google LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Frameplay

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Playwire LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Motive Interactive Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ironSource Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 RapidFire Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Anzu Virtual Reality Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Blizzard Entertainment Inc

List of Figures

- Figure 1: Global In-game Advertising Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America In-game Advertising Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America In-game Advertising Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America In-game Advertising Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America In-game Advertising Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe In-game Advertising Market Revenue (billion), by Type 2025 & 2033

- Figure 7: Europe In-game Advertising Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe In-game Advertising Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe In-game Advertising Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific In-game Advertising Market Revenue (billion), by Type 2025 & 2033

- Figure 11: Asia Pacific In-game Advertising Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific In-game Advertising Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific In-game Advertising Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East and Africa In-game Advertising Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Middle East and Africa In-game Advertising Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East and Africa In-game Advertising Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East and Africa In-game Advertising Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America In-game Advertising Market Revenue (billion), by Type 2025 & 2033

- Figure 19: Latin America In-game Advertising Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Latin America In-game Advertising Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Latin America In-game Advertising Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global In-game Advertising Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global In-game Advertising Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global In-game Advertising Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Global In-game Advertising Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global In-game Advertising Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global In-game Advertising Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global In-game Advertising Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global In-game Advertising Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global In-game Advertising Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global In-game Advertising Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global In-game Advertising Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global In-game Advertising Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the In-game Advertising Market?

The projected CAGR is approximately 11.1%.

2. Which companies are prominent players in the In-game Advertising Market?

Key companies in the market include Blizzard Entertainment Inc, Electronic Arts Inc, Google LLC, Frameplay, Playwire LLC, Motive Interactive Inc, ironSource Ltd, RapidFire Inc, Anzu Virtual Reality Ltd.

3. What are the main segments of the In-game Advertising Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 60.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Online Gaming; Growth in the Smartphone Penetration.

6. What are the notable trends driving market growth?

Increase in Online Gaming is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Incremental Advancements in Smartphones.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "In-game Advertising Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the In-game Advertising Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the In-game Advertising Market?

To stay informed about further developments, trends, and reports in the In-game Advertising Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence