Key Insights

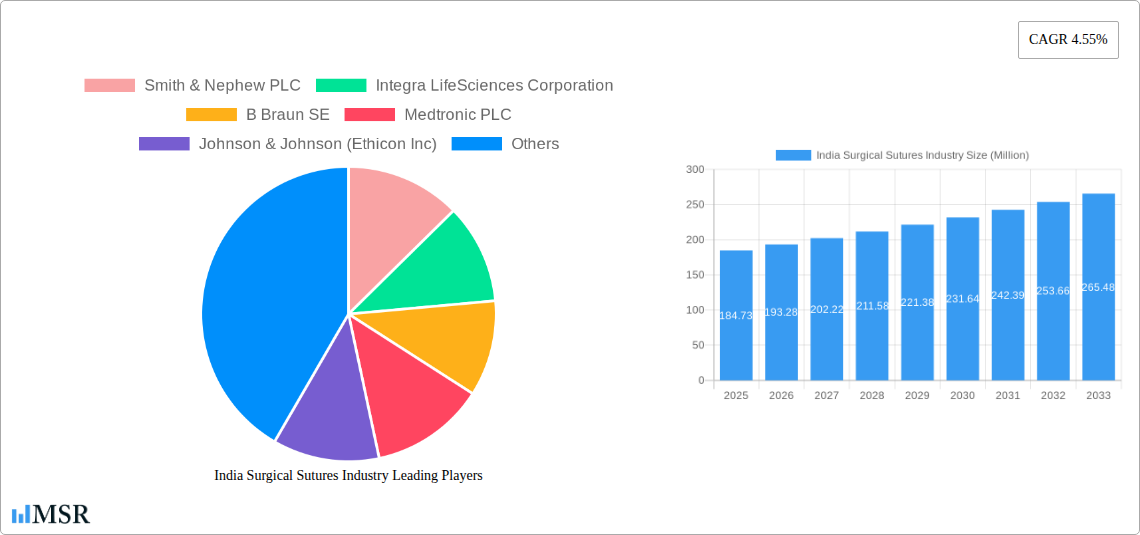

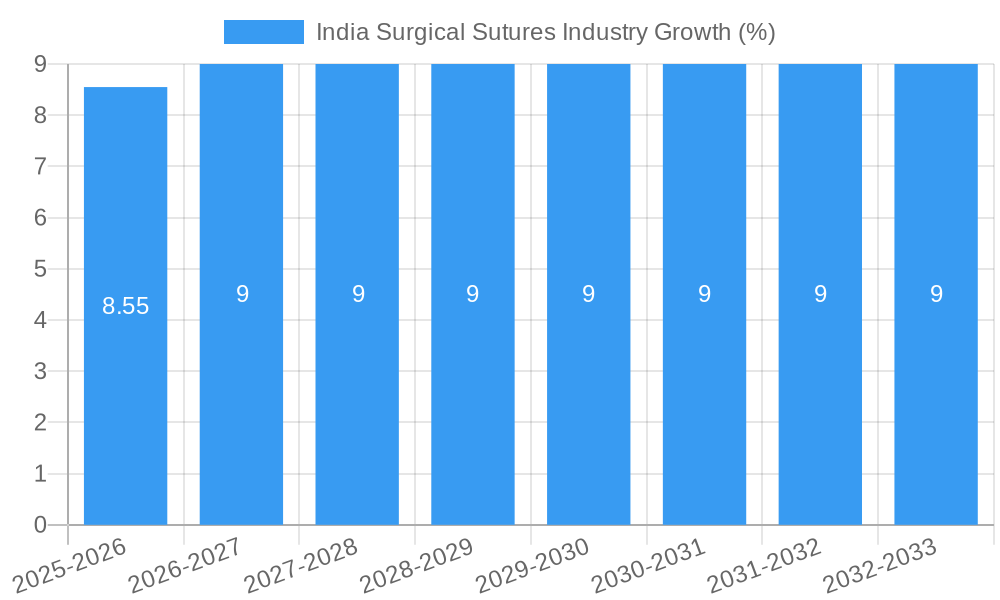

The India surgical sutures market, valued at $184.73 million in 2025, is projected to experience robust growth, driven by a rising prevalence of chronic diseases necessitating surgical interventions, increasing surgical procedures across various specialties (orthopedic, cardiovascular, ophthalmic), and improving healthcare infrastructure. The market's Compound Annual Growth Rate (CAGR) of 4.55% from 2025 to 2033 indicates a steady expansion. Growth is further fueled by technological advancements leading to the development of advanced suture materials with enhanced biocompatibility and strength, minimizing complications and improving patient outcomes. The demand for absorbable sutures is likely to be significant, driven by their convenience and reduced need for suture removal. However, the market may face some restraints including the cost of advanced suture materials, stringent regulatory approvals, and potential price sensitivity in certain market segments. The segmentation by end-user (hospitals/clinics, ambulatory surgical centers) and application (ophthalmic, cardiovascular, orthopedic, neurology surgeries) provides valuable insights into market dynamics, indicating varied growth potentials across different segments. Hospitals and clinics currently dominate the market share, but ambulatory surgical centers are experiencing growth, representing a significant opportunity for suture manufacturers.

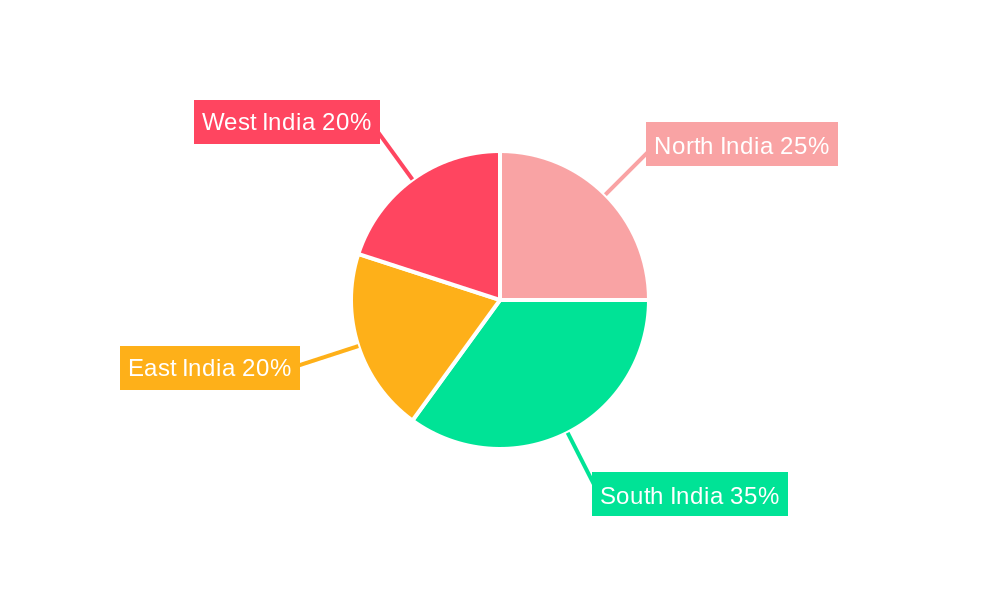

The regional distribution within India (North, South, East, and West) reveals varying market penetration and growth rates, influenced by factors such as healthcare infrastructure development and economic growth in specific regions. South India, with its high concentration of healthcare facilities and a growing middle class, may exhibit higher growth compared to other regions. Key players like Smith & Nephew, Integra LifeSciences, B. Braun, Medtronic, Johnson & Johnson (Ethicon), Boston Scientific, Conmed, Unisur Lifecare, Teleflex, and Lotus Surgicals are actively shaping the market through product innovation, strategic partnerships, and expansions. Competitive intensity is expected to increase as companies strive to enhance their market share and cater to the growing demand for high-quality, cost-effective surgical sutures. The forecast period of 2025-2033 presents substantial opportunities for market expansion, requiring strategic positioning and adaptation to evolving market dynamics.

India Surgical Sutures Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India surgical sutures market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key segments, leading players, and future growth opportunities. The study period is 2019–2033, the base year is 2025, the estimated year is 2025, and the forecast period is 2025–2033, with the historical period spanning 2019–2024. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

India Surgical Sutures Industry Market Concentration & Dynamics

The Indian surgical sutures market exhibits a moderately concentrated landscape, dominated by a mix of multinational corporations (MNCs) and domestic players. Key MNCs like Smith & Nephew PLC, Integra LifeSciences Corporation, B Braun SE, Medtronic PLC, Johnson & Johnson (Ethicon Inc), Boston Scientific Corporation, Conmed Corporation, and Teleflex Incorporated hold significant market share, leveraging their established brands and advanced technologies. However, domestic players like Unisur Lifecare Pvt Ltd and Lotus Surgicals are also making strides, capitalizing on growing local demand and cost advantages.

- Market Share: MNCs hold approximately xx% market share, while domestic players account for xx%. The remaining xx% represents smaller regional players.

- Innovation Ecosystem: The market witnesses moderate innovation, with both MNCs and domestic players introducing new suture materials, designs, and delivery systems.

- Regulatory Framework: The regulatory environment in India, primarily overseen by the Central Drugs Standard Control Organisation (CDSCO), influences product approvals and market entry strategies. Compliance with stringent quality and safety standards is crucial.

- Substitute Products: Alternatives to surgical sutures, such as surgical staples and tissue adhesives, pose limited competition, given sutures' continued preference in various surgical procedures.

- End-User Trends: Growth is propelled by the increasing number of surgical procedures, rising disposable incomes, and improved healthcare infrastructure. Hospitals/clinics remain the largest end-users, followed by ambulatory surgical centers.

- M&A Activities: The past five years have witnessed xx merger and acquisition (M&A) deals in the Indian surgical sutures market, primarily involving smaller companies being acquired by larger players to expand their portfolios or gain market access.

India Surgical Sutures Industry Industry Insights & Trends

The Indian surgical sutures market is experiencing robust growth driven by several key factors. The rising prevalence of chronic diseases necessitating surgical interventions, expanding healthcare infrastructure, and increasing affordability of healthcare services are primary contributors. Technological advancements, such as the development of minimally invasive surgical techniques and bioabsorbable sutures, further fuel market expansion. Consumer behavior is shifting toward preference for advanced, high-quality sutures, especially in urban areas, impacting product demand. The market's expansion is further fueled by rising government initiatives to improve healthcare access and quality across the country. The increasing adoption of advanced surgical techniques, particularly in minimally invasive procedures, contributes to heightened demand for specialized sutures. Furthermore, the growing awareness of hygiene and infection control is influencing the market towards the wider adoption of sterile and high-quality suture products.

Key Markets & Segments Leading India Surgical Sutures Industry

The Indian surgical sutures market is geographically diverse, with significant demand across various regions. However, urban centers, particularly in the major metropolitan areas, demonstrate higher growth rates due to improved healthcare infrastructure and increased surgical procedures.

- By End User: Hospitals/clinics are the dominant segment, capturing approximately xx% of the market share, driven by the high volume of surgeries performed in these settings. Ambulatory surgical centers are also showing significant growth due to the rising adoption of outpatient procedures.

- By Product Type: Absorbable sutures, offering convenience and reduced risks of infection, account for xx% of the market share. Synthetic non-absorbable sutures maintain a significant share, catering to specific surgical needs.

- By Application: Cardiovascular surgery and orthopedic surgery collectively drive a large portion of the market due to the high volume and complex nature of procedures performed. Ophthalmic surgery, neurology surgery and other applications contribute to overall growth.

Drivers:

- Economic Growth: Rising disposable incomes are fueling demand for better healthcare services, including advanced surgical techniques.

- Healthcare Infrastructure Development: Government initiatives to expand healthcare facilities and improve healthcare access are promoting market growth.

- Technological Advancements: Introduction of innovative suture materials and delivery systems is enhancing surgical outcomes and market demand.

India Surgical Sutures Industry Product Developments

Recent years have witnessed significant product innovations in the Indian surgical sutures market. Companies are focusing on developing advanced suture materials with enhanced biocompatibility, strength, and ease of use. Bioabsorbable sutures with improved degradation profiles and minimally invasive suture delivery systems are gaining popularity. The development of sutures with antimicrobial properties is also a major area of focus to combat surgical site infections. These innovations provide competitive edges by offering superior surgical outcomes and improved patient experiences.

Challenges in the India Surgical Sutures Industry Market

The Indian surgical sutures market faces several challenges, including stringent regulatory requirements that can delay product approvals and increase costs. Supply chain disruptions, particularly related to raw material sourcing, can impact production and delivery timelines. Intense competition from established MNCs and emerging domestic players, creates price pressure and necessitates strategic pricing and product differentiation. The market also faces challenges in terms of uneven distribution network reaching remote areas and a lack of skilled surgeons in certain regions. These factors collectively impose constraints on overall market expansion.

Forces Driving India Surgical Sutures Industry Growth

Several key factors are driving the growth of the Indian surgical sutures market. Technological advancements such as the development of minimally invasive surgical techniques and bioabsorbable sutures are improving surgical outcomes. Favorable government policies aimed at improving healthcare access and infrastructure are providing a supportive environment. Economic growth and rising disposable incomes are increasing the affordability of surgical interventions. These factors create an environment conducive to market expansion.

Challenges in the India Surgical Sutures Industry Market

Long-term growth in the Indian surgical sutures market is fueled by continuous innovation in suture materials, designs, and delivery systems. Strategic collaborations between MNCs and domestic players can facilitate technology transfer and market penetration. Expansion into underserved regions and developing new market applications for specialized sutures will unlock further growth potential.

Emerging Opportunities in India Surgical Sutures Industry

The Indian surgical sutures market presents significant opportunities for growth. Expanding into untapped regional markets, particularly in rural areas, offers considerable potential. The increasing demand for minimally invasive surgeries presents opportunities for specialized suture products. Capitalizing on the growing preference for advanced suture materials with enhanced biocompatibility and antimicrobial properties will create a competitive edge.

Leading Players in the India Surgical Sutures Industry Sector

- Smith & Nephew PLC

- Integra LifeSciences Corporation

- B Braun SE

- Medtronic PLC

- Johnson & Johnson (Ethicon Inc)

- Boston Scientific Corporation

- Conmed Corporation

- Unisur Lifecare Pvt Ltd

- Teleflex Incorporated

- Lotus Surgicals

Key Milestones in India Surgical Sutures Industry Industry

- August 2023: Healthium Medtech launched TRUMAS, a range of sutures designed to address challenges faced during suturing in minimal-access surgeries. This launch signifies a focus on innovation within the minimally invasive surgery segment, potentially increasing market share.

- December 2022: Healthium Medtech Ltd. (formerly Sutures India) sold a stake in its Clinisupplies to private equity firm KKR. This divestment suggests a strategic shift towards strengthening its core surgical suture business and expanding into related areas.

Strategic Outlook for India Surgical Sutures Industry Market

The Indian surgical sutures market exhibits immense growth potential driven by several factors. Continuous innovation in suture materials, technological advancements in surgical techniques, and favorable government policies will create a positive environment for market expansion. Strategic partnerships, market diversification, and a focus on patient-centric solutions will be crucial for success in this dynamic market. The long-term outlook remains positive, with significant growth prospects for both domestic and international players.

India Surgical Sutures Industry Segmentation

-

1. Product Type

-

1.1. Absorbable Sutures

- 1.1.1. Natural Sutures

- 1.1.2. Synthetic Sutures

-

1.2. Non-absorbable Sutures

- 1.2.1. Nylon

- 1.2.2. Prolene

- 1.2.3. Other Non-absorbable Sutures

-

1.1. Absorbable Sutures

-

2. Application

- 2.1. Ophthalmic Surgery

- 2.2. Cardiovascular Surgery

- 2.3. Orthopedic Surgery

- 2.4. Neurology Surgery

- 2.5. Other Applications

-

3. End User

- 3.1. Hospitals/Clinics

- 3.2. Ambulatory Surgical Centers

India Surgical Sutures Industry Segmentation By Geography

- 1. India

India Surgical Sutures Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Surgeries Owing to Unhealthy Lifestyles and Chronic Diseases; Technological Advances in Suture Design and Applications; Favorable Government Regulations

- 3.3. Market Restrains

- 3.3.1. Needle-related Infections; Increasing Preference Toward Minimally Invasive Surgeries

- 3.4. Market Trends

- 3.4.1. Orthopedic Surgery Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Surgical Sutures Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Absorbable Sutures

- 5.1.1.1. Natural Sutures

- 5.1.1.2. Synthetic Sutures

- 5.1.2. Non-absorbable Sutures

- 5.1.2.1. Nylon

- 5.1.2.2. Prolene

- 5.1.2.3. Other Non-absorbable Sutures

- 5.1.1. Absorbable Sutures

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Ophthalmic Surgery

- 5.2.2. Cardiovascular Surgery

- 5.2.3. Orthopedic Surgery

- 5.2.4. Neurology Surgery

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals/Clinics

- 5.3.2. Ambulatory Surgical Centers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North India India Surgical Sutures Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Surgical Sutures Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Surgical Sutures Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Surgical Sutures Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Smith & Nephew PLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Integra LifeSciences Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 B Braun SE

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Medtronic PLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Johnson & Johnson (Ethicon Inc)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Boston Scientific Corporat

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Conmed Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Unisur Lifecare Pvt Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Teleflex Incorporated*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Lotus Surgicals

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Smith & Nephew PLC

List of Figures

- Figure 1: India Surgical Sutures Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Surgical Sutures Industry Share (%) by Company 2024

List of Tables

- Table 1: India Surgical Sutures Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Surgical Sutures Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: India Surgical Sutures Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: India Surgical Sutures Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: India Surgical Sutures Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Surgical Sutures Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Surgical Sutures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Surgical Sutures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Surgical Sutures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Surgical Sutures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Surgical Sutures Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: India Surgical Sutures Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 13: India Surgical Sutures Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 14: India Surgical Sutures Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Surgical Sutures Industry?

The projected CAGR is approximately 4.55%.

2. Which companies are prominent players in the India Surgical Sutures Industry?

Key companies in the market include Smith & Nephew PLC, Integra LifeSciences Corporation, B Braun SE, Medtronic PLC, Johnson & Johnson (Ethicon Inc), Boston Scientific Corporat, Conmed Corporation, Unisur Lifecare Pvt Ltd, Teleflex Incorporated*List Not Exhaustive, Lotus Surgicals.

3. What are the main segments of the India Surgical Sutures Industry?

The market segments include Product Type, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 184.73 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Surgeries Owing to Unhealthy Lifestyles and Chronic Diseases; Technological Advances in Suture Design and Applications; Favorable Government Regulations.

6. What are the notable trends driving market growth?

Orthopedic Surgery Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Needle-related Infections; Increasing Preference Toward Minimally Invasive Surgeries.

8. Can you provide examples of recent developments in the market?

August 2023: Healthium Medtech launched TRUMAS, a range of sutures designed to address challenges faced during suturing in minimal-access surgeries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Surgical Sutures Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Surgical Sutures Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Surgical Sutures Industry?

To stay informed about further developments, trends, and reports in the India Surgical Sutures Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence