Key Insights

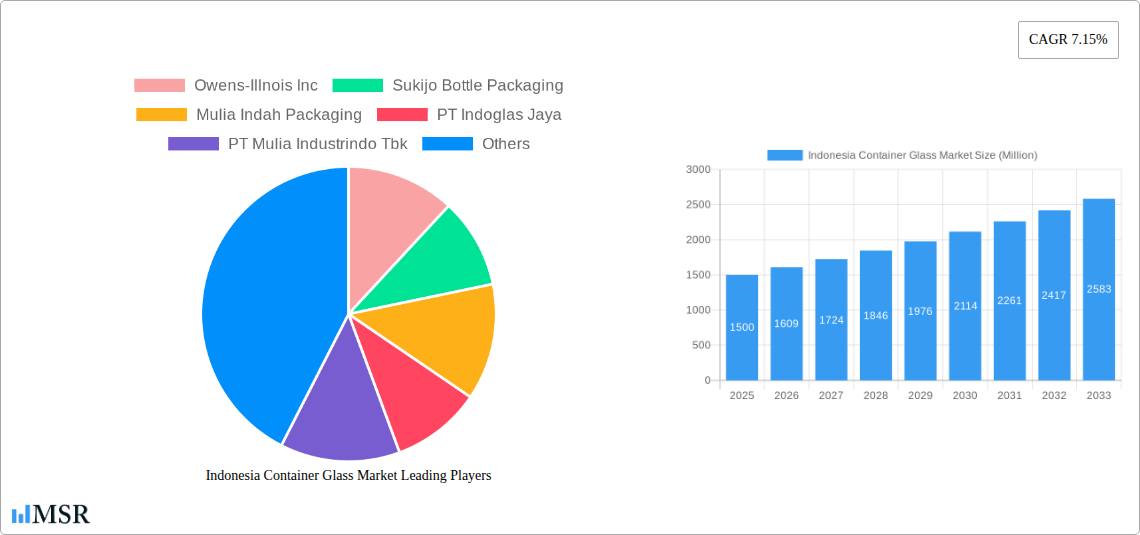

The Indonesian container glass market, exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.15% from 2019 to 2024, presents a significant opportunity for investors and businesses. This growth is fueled by several key factors. The expanding food and beverage industry, particularly within the burgeoning Indonesian consumer market, drives significant demand for glass containers due to their perceived quality, recyclability, and suitability for preserving food and drink. Furthermore, increasing disposable incomes and a shift towards premium packaged goods are contributing to higher consumption of products packaged in glass. The market's segmentation likely reflects diverse applications, including bottles for beverages (alcoholic and non-alcoholic), jars for food preservation, and pharmaceutical containers. While precise segment breakdowns are unavailable, a reasonable assumption based on industry trends suggests that beverage containers dominate the market share. Competition amongst established players like Owens-Illinois Inc, Sukijo Bottle Packaging, and Mulia Indah Packaging, alongside local producers such as PT Indoglas Jaya and PT Mulia Industrindo Tbk, is fostering innovation and competitive pricing. However, challenges such as fluctuations in raw material costs (sand, soda ash, and limestone) and potential environmental concerns regarding glass production and waste management could present headwinds to sustained market expansion.

Indonesia Container Glass Market Market Size (In Billion)

Looking forward, the forecast period (2025-2033) projects continued growth, albeit potentially at a slightly moderated pace. The projected market size in 2025, while not provided, can be reasonably estimated based on the historical CAGR and market trends. Further growth hinges on continued economic development in Indonesia, sustained growth in the food and beverage sector, and successful implementation of sustainable practices within the glass packaging industry to mitigate environmental concerns. Government regulations promoting sustainable packaging solutions could also significantly influence market trajectory. The competitive landscape will continue to shape the market dynamics, with existing players striving for market share and potential new entrants seeking opportunities within specific segments. Understanding these factors is crucial for stakeholders to navigate this dynamic and promising market.

Indonesia Container Glass Market Company Market Share

Indonesia Container Glass Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Indonesia container glass market, offering valuable insights for industry stakeholders, investors, and businesses operating within or planning to enter this dynamic sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. We delve into market size, growth drivers, competitive landscape, and future opportunities, providing actionable intelligence to navigate the complexities of this burgeoning market. The report leverages extensive data analysis and incorporates recent key developments to offer a current and forward-looking perspective. Expect detailed coverage of market segmentation, leading players such as Owens-Illinois Inc, Sukijo Bottle Packaging, Mulia Indah Packaging, PT Indoglas Jaya, PT Mulia Industrindo Tbk, and FrigoGlas, and emerging trends shaping the future of container glass in Indonesia.

Indonesia Container Glass Market Market Concentration & Dynamics

The Indonesian container glass market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Owens-Illinois Inc and PT Mulia Industrindo Tbk are expected to command a combined xx% market share in 2025. The market is characterized by an evolving innovation ecosystem, driven by increasing demand for sustainable packaging solutions. Regulatory frameworks, including those focused on waste management and environmental protection, are playing a crucial role in shaping market dynamics. Substitute products, such as plastic and aluminum containers, pose a competitive challenge, while the rise of e-commerce is driving demand for smaller, lighter glass containers. End-user trends towards premiumization and sustainability are creating new opportunities for innovative glass packaging solutions. M&A activity in the sector has been moderate, with xx deals recorded in the historical period (2019-2024), indicating a consolidating market.

- Market Concentration: Moderately concentrated, with top players holding xx% market share (2025).

- Innovation Ecosystem: Growing focus on sustainable and lightweight glass packaging.

- Regulatory Framework: Increasing emphasis on environmental sustainability and waste management.

- Substitute Products: Competition from plastic and aluminum containers.

- End-User Trends: Growing demand for premium and sustainable packaging solutions.

- M&A Activity: xx deals recorded between 2019 and 2024.

Indonesia Container Glass Market Industry Insights & Trends

The Indonesian container glass market is projected to witness robust growth, driven by increasing demand from the food and beverage, cosmetics, and pharmaceutical sectors. The market size is estimated at xx Million USD in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as advancements in glass manufacturing processes and the adoption of automation, are improving efficiency and reducing production costs. Evolving consumer behaviors, with a growing preference for premium and sustainable packaging, are creating new market opportunities. The expanding middle class and rising disposable incomes further fuel market growth. Increasing urbanization and a shift towards convenience contribute to heightened demand for packaged goods, indirectly boosting the container glass market.

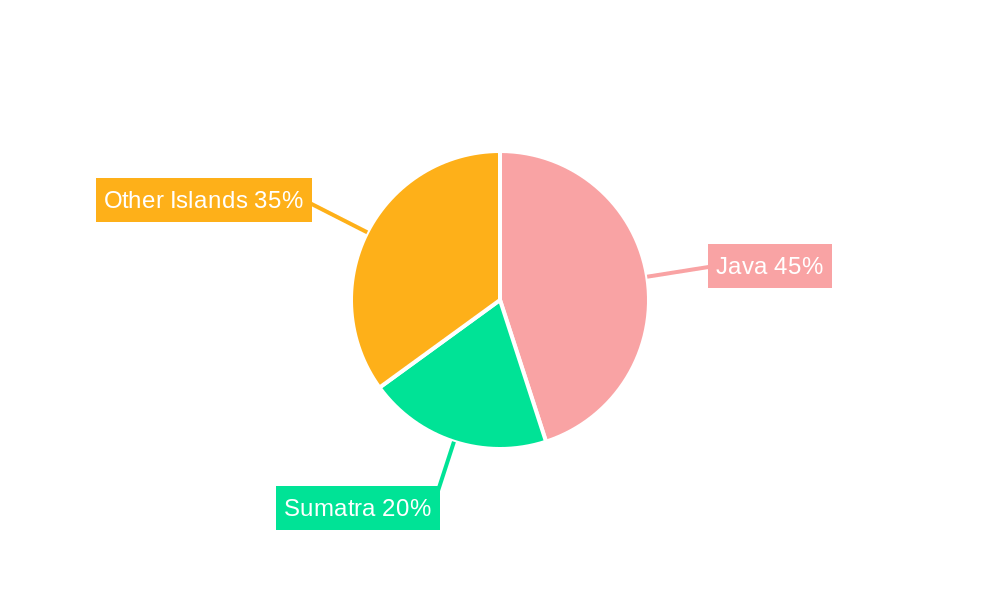

Key Markets & Segments Leading Indonesia Container Glass Market

The Java region dominates the Indonesian container glass market due to its high population density, robust industrial base, and advanced infrastructure. This dominance is further reinforced by the concentration of major manufacturing facilities and key end-users in this region.

- Drivers of Java's Dominance:

- High population density and significant consumer base.

- Well-established industrial infrastructure and logistics networks.

- Concentration of major food and beverage, cosmetics, and pharmaceutical companies.

- Presence of key glass container manufacturers.

The food and beverage segment is the largest contributor to market revenue, driven by the growing popularity of packaged food and beverages. The cosmetics and pharmaceutical segments are experiencing rapid growth, fuelled by increasing demand for premium and aesthetically pleasing packaging. Further detailed analysis on regional and segmental dominance is available within the full report.

Indonesia Container Glass Market Product Developments

Recent product innovations have focused on developing lighter, more sustainable, and aesthetically appealing glass containers. Advancements in glass manufacturing technologies have improved production efficiency and reduced costs. The introduction of innovative designs and surface treatments enhances the appeal of glass packaging across various applications. The focus on circularity, evident in Coca-Cola's reintroduction of its glass bottle, highlights the growing importance of sustainable practices in the industry.

Challenges in the Indonesia Container Glass Market Market

The Indonesian container glass market faces challenges related to fluctuating raw material prices, intense competition from substitute materials (primarily plastics), and potential supply chain disruptions. Regulatory compliance and environmental concerns add to the operational complexities. These factors can impact profitability and market growth, hence thorough risk management is essential for companies operating within this market. The impact of these factors is estimated to reduce market growth by approximately xx% during the forecast period.

Forces Driving Indonesia Container Glass Market Growth

Key growth drivers include rising disposable incomes, a growing middle class, increasing urbanization, and the expanding food and beverage sector. Government initiatives promoting sustainable packaging are also positively influencing market growth. Technological advancements, such as improved manufacturing processes and automation, contribute to enhanced efficiency and reduced costs. The shift towards premiumization in various product categories is driving demand for high-quality glass containers.

Challenges in the Indonesia Container Glass Market Market

Long-term growth will depend on successfully navigating challenges like raw material price volatility and environmental regulations. Strategic partnerships, technological innovations, and the development of new product lines to cater to emerging consumer trends will be crucial for maintaining growth momentum. Focusing on sustainability and developing circular economy strategies will be paramount in building a resilient market.

Emerging Opportunities in Indonesia Container Glass Market

Emerging opportunities include the growing demand for sustainable and eco-friendly glass packaging, the rise of e-commerce, and the increasing popularity of premium products. Opportunities also exist in catering to niche segments, such as the artisanal food and beverage sector, and expanding into new geographic regions within Indonesia. Further exploration of lighter-weight glass packaging can yield cost savings and improved logistical efficiency.

Leading Players in the Indonesia Container Glass Market Sector

- Owens-Illinois Inc (Owens-Illinois Inc)

- Sukijo Bottle Packaging

- Mulia Indah Packaging

- PT Indoglas Jaya

- PT Mulia Industrindo Tbk

- FrigoGlas

Key Milestones in Indonesia Container Glass Market Industry

- June 2024: Judydoll's launch in Indonesia signals growing demand for premium glass packaging in the cosmetics sector.

- October 2024: Coca-Cola's reintroduction of its glass bottle in Indonesia highlights the rising consumer preference for sustainable packaging and the potential for circular economy models in the beverage sector.

Strategic Outlook for Indonesia Container Glass Market Market

The Indonesian container glass market offers significant long-term growth potential, driven by favorable demographic trends, expanding consumer base, and the increasing adoption of sustainable packaging practices. Companies focusing on innovation, sustainability, and efficient supply chain management will be well-positioned to capitalize on emerging opportunities and achieve sustained success in this dynamic market. Strategic partnerships and investments in advanced technologies will be critical to maintain competitiveness and capture market share.

Indonesia Container Glass Market Segmentation

-

1. End-user Industry

-

1.1. Beverage

-

1.1.1. Alcoholic Beverages

- 1.1.1.1. Wines and Spirits

- 1.1.1.2. Beer and Cider

- 1.1.1.3. Other Alcoholic Beverages

-

1.1.2. Non-Alcoholic Beverages

- 1.1.2.1. Carbonated Drinks

- 1.1.2.2. Juices

- 1.1.2.3. Water

- 1.1.2.4. Dairy-Based

- 1.1.2.5. Flavored Drinks

- 1.1.2.6. Other Non-Alcoholic Beverages

-

1.1.1. Alcoholic Beverages

- 1.2. Food

- 1.3. Cosmetics

- 1.4. Pharmaceuticals

- 1.5. Other End user verticals

-

1.1. Beverage

Indonesia Container Glass Market Segmentation By Geography

- 1. Indonesia

Indonesia Container Glass Market Regional Market Share

Geographic Coverage of Indonesia Container Glass Market

Indonesia Container Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Change in Consumer Preferences and Demand for Eco-friendly Packaging; Surging Demand for Glass in Beverage and Pharmaceutical Sectors

- 3.3. Market Restrains

- 3.3.1. Change in Consumer Preferences and Demand for Eco-friendly Packaging; Surging Demand for Glass in Beverage and Pharmaceutical Sectors

- 3.4. Market Trends

- 3.4.1. Cosmetics Industry to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Container Glass Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Beverage

- 5.1.1.1. Alcoholic Beverages

- 5.1.1.1.1. Wines and Spirits

- 5.1.1.1.2. Beer and Cider

- 5.1.1.1.3. Other Alcoholic Beverages

- 5.1.1.2. Non-Alcoholic Beverages

- 5.1.1.2.1. Carbonated Drinks

- 5.1.1.2.2. Juices

- 5.1.1.2.3. Water

- 5.1.1.2.4. Dairy-Based

- 5.1.1.2.5. Flavored Drinks

- 5.1.1.2.6. Other Non-Alcoholic Beverages

- 5.1.1.1. Alcoholic Beverages

- 5.1.2. Food

- 5.1.3. Cosmetics

- 5.1.4. Pharmaceuticals

- 5.1.5. Other End user verticals

- 5.1.1. Beverage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Owens-Illnois Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sukijo Bottle Packaging

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mulia Indah Packaging

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Indoglas Jaya

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Mulia Industrindo Tbk

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FrigoGlas

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Owens-Illnois Inc

List of Figures

- Figure 1: Indonesia Container Glass Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Indonesia Container Glass Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Container Glass Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 2: Indonesia Container Glass Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Indonesia Container Glass Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Indonesia Container Glass Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Container Glass Market?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Indonesia Container Glass Market?

Key companies in the market include Owens-Illnois Inc, Sukijo Bottle Packaging, Mulia Indah Packaging, PT Indoglas Jaya, PT Mulia Industrindo Tbk, FrigoGlas.

3. What are the main segments of the Indonesia Container Glass Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Change in Consumer Preferences and Demand for Eco-friendly Packaging; Surging Demand for Glass in Beverage and Pharmaceutical Sectors.

6. What are the notable trends driving market growth?

Cosmetics Industry to Witness Growth.

7. Are there any restraints impacting market growth?

Change in Consumer Preferences and Demand for Eco-friendly Packaging; Surging Demand for Glass in Beverage and Pharmaceutical Sectors.

8. Can you provide examples of recent developments in the market?

October 2024: According to data published by Minime Insights to enhance circularity, the Coca-Cola Co has reintroduced its Original Glass bottle in Indonesia. Glass packaging champions circularity, allowing glass to be recycled endlessly without compromising quality, thus fostering a closed-loop system. They are primarily targeting food outlets in Jakarta, the beverage giant is offering drinks in a 200ml glass bottle priced at IDR 3,000 (USD 0.19).June 2024: Judydoll, a prominent makeup brand from Shanghai, officially debuted in Indonesia during the Jakarta x Beauty (JxB) 2024 event. The brand showcased over 60 SKUs across various makeup categories, featuring its trending products like Iron Mascara and an extensive range of over 20 blush shades. Judydoll's offerings have catapulted it to global fame, especially on social media platforms. Judydoll stands out as one of the pioneering brands to launch in Indonesia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Container Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Container Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Container Glass Market?

To stay informed about further developments, trends, and reports in the Indonesia Container Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence