Key Insights

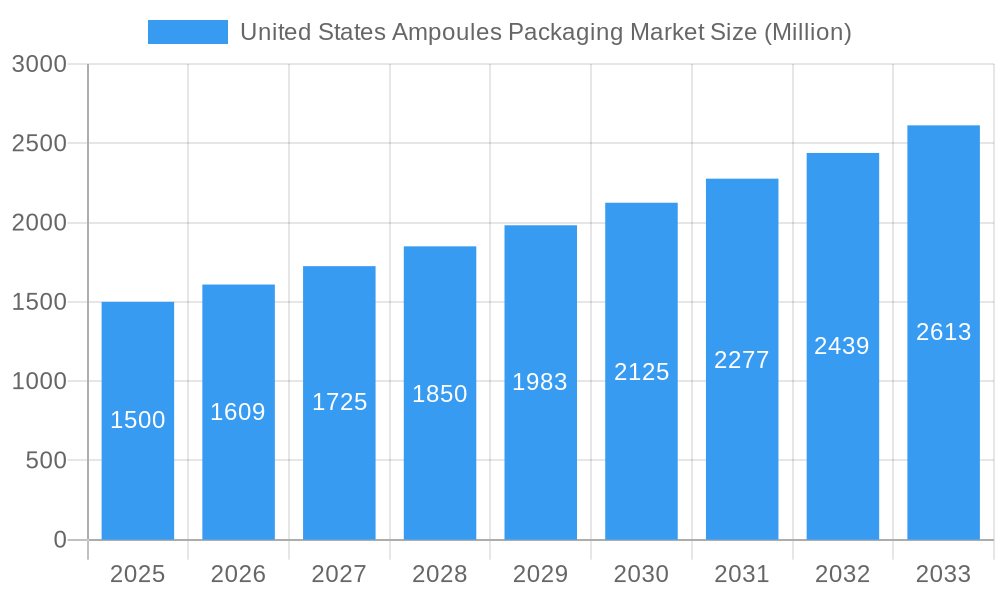

The United States ampoules packaging market is poised for significant expansion, propelled by the robust growth of the pharmaceutical and personal care sectors. Key drivers include escalating demand for injectable drugs, advancements in drug delivery technologies, and a growing preference for sterile, tamper-evident packaging solutions. Glass continues to be the preferred material for its inert properties, ideal for sensitive pharmaceutical products. Concurrently, plastic ampoules are gaining traction due to their cost-effectiveness and lighter weight. The pharmaceutical segment currently leads the market, attributed to high volumes of injectable medications. However, the personal care and cosmetic segments are projected to experience accelerated growth, fueled by the increasing popularity of single-dose serums and beauty-sector injectables. The competitive landscape features established global players and specialized manufacturers. While supply chain volatility and rising raw material costs present challenges, technological innovations in packaging materials and automated filling processes are expected to mitigate these factors. The market is anticipated to achieve a healthy CAGR of 7.6% from the base year 2025 to 2033. With a base year market size of 5.49 billion, steady growth is expected, surpassing current projections.

United States Ampoules Packaging Market Market Size (In Billion)

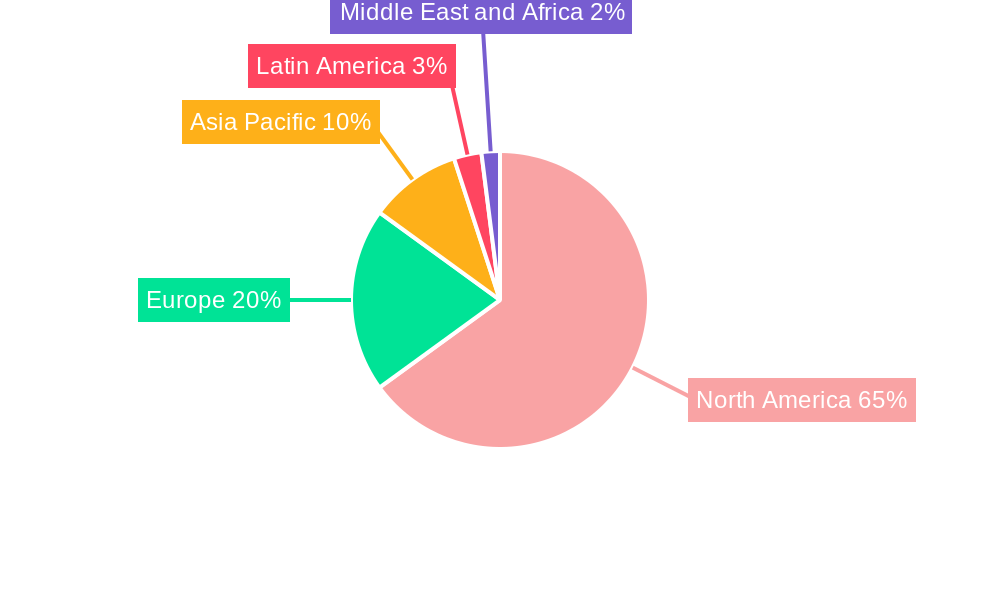

The North American region, led by the United States, dominates the global ampoule packaging market, supported by a strong pharmaceutical industry and advanced healthcare infrastructure. Emerging economies are also demonstrating promising growth potential, driven by increased healthcare expenditure and expanding pharmaceutical manufacturing capabilities. The market's evolution demands continuous innovation, particularly in addressing sustainability concerns. This is prompting a shift towards eco-friendly packaging solutions, including recyclable and biodegradable materials, which will further influence market dynamics. Consequently, the United States ampoules packaging market represents a compelling investment opportunity within the pharmaceutical and related supply chains. Future success will depend on strategic collaborations, technological advancements, and adaptability to evolving regulatory frameworks.

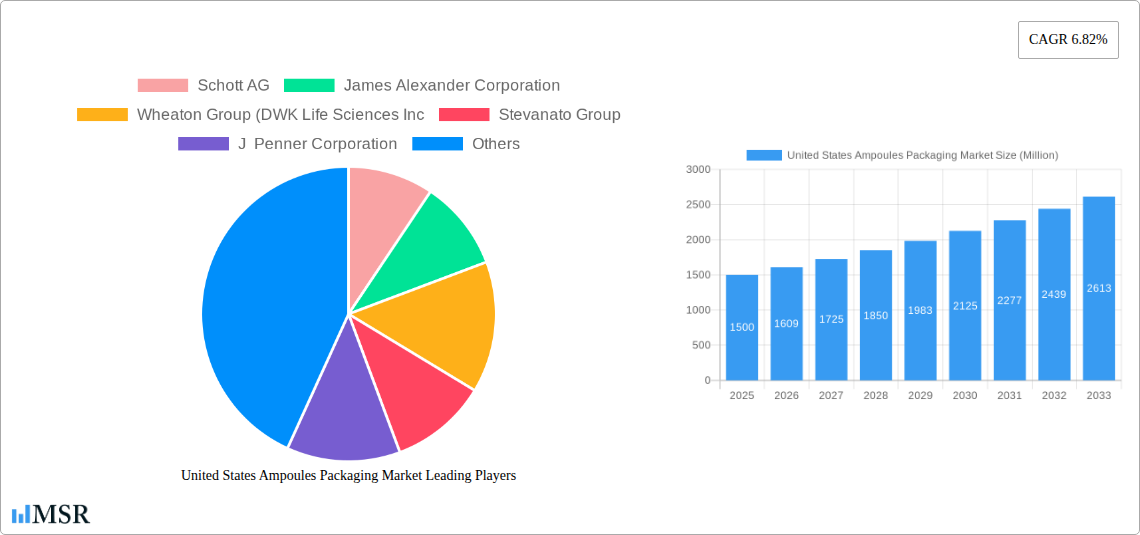

United States Ampoules Packaging Market Company Market Share

United States Ampoules Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States ampoules packaging market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, key segments, leading players, and emerging opportunities. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

United States Ampoules Packaging Market Market Concentration & Dynamics

This section analyzes the competitive landscape, innovation, regulations, and market trends within the US ampoules packaging market. The market exhibits a moderately concentrated structure, with key players holding significant market share. While precise figures are proprietary to the full report, Schott AG, Gerresheimer AG, and Stevanato Group are estimated to hold a combined market share of approximately xx%. The innovation ecosystem is characterized by ongoing R&D efforts focused on enhancing material properties, improving barrier protection, and developing sustainable packaging solutions.

Regulatory frameworks, primarily overseen by the FDA, significantly influence the market, necessitating stringent quality control and compliance. Substitute products, such as pre-filled syringes, present some competitive pressure, but ampoules remain preferred for their single-dose sterility and suitability for sensitive pharmaceuticals. End-user trends towards personalized medicine and increased demand for injectables are driving market growth. M&A activity in the sector has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024. This activity is expected to continue as companies seek to expand their product portfolios and geographic reach.

United States Ampoules Packaging Market Industry Insights & Trends

The US ampoules packaging market is experiencing robust growth, driven by several key factors. The increasing prevalence of chronic diseases necessitates a rise in injectable drug administration, bolstering demand for ampoules. Technological advancements in materials science are leading to the development of more durable, safer, and environmentally friendly packaging options. Furthermore, evolving consumer preferences towards convenience and ease of use are contributing to market expansion.

The pharmaceutical segment is the largest end-user, accounting for approximately xx% of the total market value in 2024. The market exhibits significant regional variations, with the Northeast and West Coast regions displaying higher growth rates due to the concentration of pharmaceutical companies and research institutions. Despite challenges such as supply chain disruptions and raw material price fluctuations, the market is projected to maintain a steady growth trajectory, fueled by continuous innovation and increasing demand for injectable medications.

Key Markets & Segments Leading United States Ampoules Packaging Market

By Material:

- Glass: Remains the dominant material due to its inertness, barrier properties, and suitability for sensitive drug formulations. Drivers include the increasing demand for sterile injectable drugs and the robust existing infrastructure for glass ampoule manufacturing.

- Plastics: While holding a smaller share, the plastic segment is experiencing growth due to its cost-effectiveness and potential for lightweighting and improved handling. However, challenges remain in ensuring the necessary barrier properties and sterility.

By End-user:

- Pharmaceutical: This sector overwhelmingly dominates the market due to the extensive use of ampoules in drug delivery. Growth drivers include the rising prevalence of chronic diseases, increasing demand for biologics, and the ongoing development of new injectable therapies.

- Personal Care and Cosmetic: This segment shows modest growth, with ampoules used for single-use serums and other high-value skincare products. Premiumization and convenience are driving factors in this sector.

The pharmaceutical sector in the Northeast and West Coast regions exhibits particularly strong growth, driven by the presence of major pharmaceutical companies and research and development facilities.

United States Ampoules Packaging Market Product Developments

Recent innovations include the development of ampoules with enhanced barrier properties, improved breakage resistance, and sustainable materials. These advancements address key market needs, offering improved drug stability, enhanced patient safety, and reduced environmental impact. Companies are also focusing on developing customized ampoule designs to meet specific client requirements, fostering a competitive advantage.

Challenges in the United States Ampoules Packaging Market Market

The US ampoules packaging market faces several challenges, including increasing raw material costs, supply chain disruptions impacting delivery timelines, and intense competition from existing and emerging players. Stringent regulatory requirements add to the complexities of manufacturing and distribution, particularly impacting smaller companies. These factors collectively contribute to cost pressures and potentially limit profitability.

Forces Driving United States Ampoules Packaging Market Growth

The market's growth is propelled by several key factors, including the rising prevalence of chronic diseases necessitating injectable medications, technological advancements yielding safer and more efficient packaging solutions, and growing demand for convenient single-dose applications. Favorable regulatory frameworks supporting pharmaceutical innovation further contribute to market expansion.

Challenges in the United States Ampoules Packaging Market Market (Long-Term Growth Catalysts)

Long-term growth hinges on continuous innovation in materials science, fostering more sustainable and efficient packaging solutions. Strategic partnerships and collaborations among manufacturers, pharmaceutical companies, and research institutions will play a crucial role in driving advancements and ensuring market competitiveness. Expanding into emerging markets and exploring new applications for ampoules will also create long-term growth avenues.

Emerging Opportunities in United States Ampoules Packaging Market

Emerging opportunities include the development of biodegradable and recyclable ampoules addressing environmental concerns. Customization options tailored to specific drug formulations and improved track-and-trace capabilities to enhance supply chain security are also key opportunities. The growth of personalized medicine will further drive demand for specialized ampoule packaging formats.

Leading Players in the United States Ampoules Packaging Market Sector

- Schott AG

- James Alexander Corporation

- Wheaton Group (DWK Life Sciences Inc)

- Stevanato Group

- J Penner Corporation

- Nipro Pharma Packaging International NV

- Gerresheimer AG

- Accu-Glass LLC

Key Milestones in United States Ampoules Packaging Market Industry

- July 2022: Vichy Laboratoires recalled LiftActiv Peptide-C Ampoules due to a laceration hazard, highlighting the importance of quality control and safety regulations in the market.

- June 2022: American Regent Inc. and Provepharm Life Solutions launched ProvayBlue injection in a 10 ml single-dose vial, showcasing the ongoing development of new injectable drug formulations and their packaging needs.

Strategic Outlook for United States Ampoules Packaging Market Market

The US ampoules packaging market presents considerable future potential, driven by continuous innovation, rising healthcare expenditure, and the expanding pharmaceutical sector. Strategic opportunities exist in developing sustainable packaging solutions, leveraging advanced technologies for improved product traceability, and fostering collaborative partnerships across the supply chain. Companies that proactively adapt to evolving regulations and consumer preferences will be best positioned to capitalize on future market growth.

United States Ampoules Packaging Market Segmentation

-

1. Material

- 1.1. Glass

- 1.2. Plastics

-

2. End-user

- 2.1. Pharmaceutical

- 2.2. Personal Care and Cosmetic

United States Ampoules Packaging Market Segmentation By Geography

- 1. United States

United States Ampoules Packaging Market Regional Market Share

Geographic Coverage of United States Ampoules Packaging Market

United States Ampoules Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Tamper-proof Pharmaceutical Product Packaging; Commodity Value of Glass Increased with Recyclability

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding Dumping of Used Ampoules

- 3.4. Market Trends

- 3.4.1. High Commodity Value of Glass Resulting in High Recyclability

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Ampoules Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Glass

- 5.1.2. Plastics

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Pharmaceutical

- 5.2.2. Personal Care and Cosmetic

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Schott AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 James Alexander Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wheaton Group (DWK Life Sciences Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stevanato Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 J Penner Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nipro Pharma Packaging International NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gerresheimer AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Accu-Glass LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Schott AG

List of Figures

- Figure 1: United States Ampoules Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Ampoules Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: United States Ampoules Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 2: United States Ampoules Packaging Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: United States Ampoules Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United States Ampoules Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 5: United States Ampoules Packaging Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: United States Ampoules Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Ampoules Packaging Market?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the United States Ampoules Packaging Market?

Key companies in the market include Schott AG, James Alexander Corporation, Wheaton Group (DWK Life Sciences Inc, Stevanato Group, J Penner Corporation, Nipro Pharma Packaging International NV, Gerresheimer AG, Accu-Glass LLC.

3. What are the main segments of the United States Ampoules Packaging Market?

The market segments include Material, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.49 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand for Tamper-proof Pharmaceutical Product Packaging; Commodity Value of Glass Increased with Recyclability.

6. What are the notable trends driving market growth?

High Commodity Value of Glass Resulting in High Recyclability.

7. Are there any restraints impacting market growth?

Concerns Regarding Dumping of Used Ampoules.

8. Can you provide examples of recent developments in the market?

July 2022: Vichy Laboratoires recalled LiftActiv Peptide-C Ampoules due to a laceration hazard. This recall involved Liftactiv Peptide-C Ampoules 1.8 ml (10 pack) and Liftactiv Peptide-C Ampoules 1.8 ml (30 pack), which are facial serums.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Ampoules Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Ampoules Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Ampoules Packaging Market?

To stay informed about further developments, trends, and reports in the United States Ampoules Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence