Key Insights

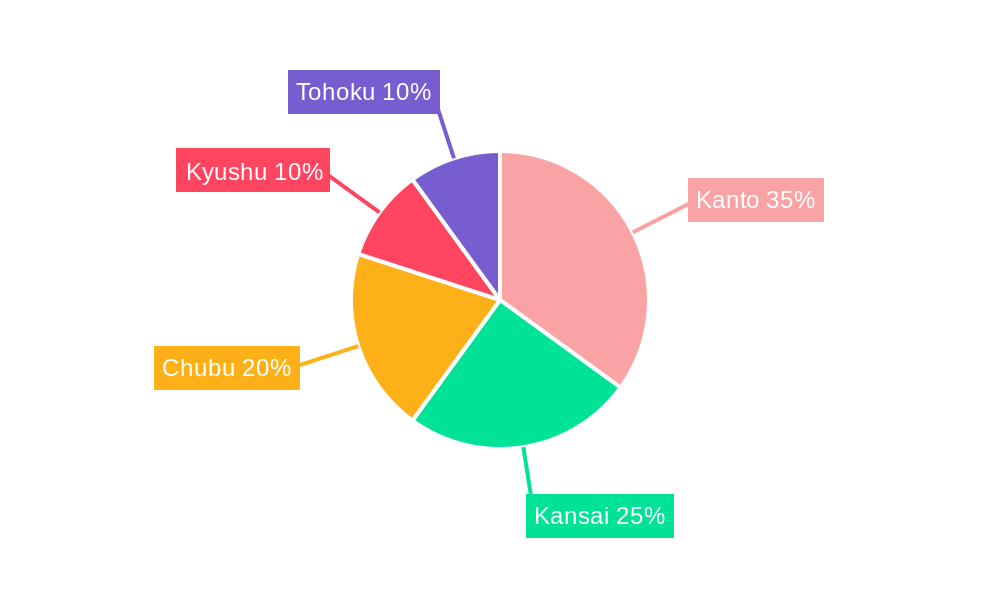

The Japan EV Battery Pack Market is experiencing robust growth, driven by the increasing adoption of electric vehicles (EVs) within the country and supportive government policies aimed at promoting a greener transportation sector. A CAGR of 10.55% from 2019 to 2024 suggests a significant market expansion, and this positive trajectory is expected to continue through 2033. Key drivers include stringent emission regulations, rising environmental concerns among consumers, advancements in battery technology leading to increased energy density and longer lifespans, and substantial investments in EV infrastructure. Market segmentation reveals a diverse landscape, with varying capacity needs across different vehicle types (passenger cars, buses, LCVs, M&HDT) influencing demand for specific battery pack configurations. The preference for specific battery chemistries (like LFP and NCM/NMC) and form factors (cylindrical, pouch, prismatic) also contribute to market dynamism. Leading players like Panasonic Holdings Corporation, CATL, and BYD Company Ltd are actively competing in this dynamic market, investing in research and development, expanding production capacities, and forging strategic partnerships to secure their market share. Regional variations exist within Japan, with Kanto, Kansai, and Chubu regions likely leading the market due to higher EV adoption rates and existing automotive manufacturing hubs.

While the provided data lacks precise market size figures, a reasonable estimation can be made based on the CAGR and the likely market size in 2025. Assuming a 2025 market size of approximately ¥500 million (this is an educated estimation based on the typical size of such regional markets and the provided CAGR), the market is projected to continue its upward trajectory throughout the forecast period. The segments within the market—capacity, battery form, manufacturing method, components, material type, body type, propulsion type, and battery chemistry—offer further insight into the specific needs and trends within the Japanese EV battery pack landscape. Analyzing these segments allows for a more granular understanding of future market opportunities and potential challenges, helping stakeholders make informed decisions and adapt to the evolving market demands.

Japan EV Battery Pack Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Japan EV battery pack market, offering invaluable insights for industry stakeholders. From market size and CAGR projections to key players and emerging trends, this research covers all essential aspects of this rapidly evolving sector. The report uses a robust methodology incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. The study period covers significant market developments and allows for informed decision-making. This report is crucial for understanding the opportunities and challenges shaping the future of the Japan EV battery pack market, worth an estimated xx Million in 2025.

Japan EV Battery Pack Market Market Concentration & Dynamics

The Japan EV battery pack market exhibits a moderately concentrated landscape, with several established players like Panasonic Holdings Corporation and GS Yuasa International Ltd. holding significant market share. However, the influx of international companies like CATL and BYD Company Ltd. is intensifying competition. Market share data for 2024 indicates that Panasonic Holdings Corporation holds approximately xx% market share, followed by GS Yuasa International Ltd. with xx%. The market is characterized by a dynamic innovation ecosystem, driven by continuous advancements in battery chemistry (NCM, NMC, LFP), battery form factors (cylindrical, pouch, prismatic), and manufacturing methods (laser, wire welding). Government regulations promoting EV adoption and stringent emission standards significantly influence market growth. Substitute products, such as fuel cell vehicles, pose a challenge, albeit a limited one given current technological and infrastructural limitations. End-user trends are shifting towards higher energy density batteries to extend vehicle range. M&A activities have been relatively moderate in recent years, with xx major deals recorded between 2019 and 2024. This moderate M&A activity highlights a focus on organic growth and strategic partnerships rather than large-scale acquisitions.

- Key Players: Panasonic Holdings Corporation, GS Yuasa International Ltd., CATL, BYD Company Ltd.

- Market Concentration: Moderately concentrated, with increasing competition.

- M&A Activity: xx major deals between 2019-2024.

- Regulatory Framework: Strong government support for EV adoption.

Japan EV Battery Pack Market Industry Insights & Trends

The Japan EV battery pack market is experiencing robust growth, driven by increasing government incentives for electric vehicle adoption, stringent emission regulations, and rising consumer demand for eco-friendly transportation. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, particularly advancements in battery chemistry (like the rise of LFP batteries) and improved energy density, are key growth catalysts. Consumer preferences are shifting towards longer-range EVs, necessitating higher-capacity battery packs. Furthermore, the increasing focus on battery recycling and sustainable manufacturing processes is shaping market dynamics. The growing adoption of BEVs and PHEVs across passenger cars, LCVs, and buses further fuels market expansion. The development of solid-state batteries and other innovative technologies promises to revolutionize the industry in the coming years, increasing energy density and safety while reducing costs.

Key Markets & Segments Leading Japan EV Battery Pack Market

The passenger car segment dominates the Japan EV battery pack market, accounting for approximately xx% of the total market share in 2024. The 40 kWh to 80 kWh capacity segment also holds a significant share due to its suitability for a wide range of EV models. Prismatic battery form is increasingly preferred due to its high energy density and design flexibility. The use of Lithium, Nickel, Manganese, and Cobalt materials remains prevalent. The dominance of the passenger car segment is primarily driven by growing consumer demand for electric vehicles. This is further fuelled by government policies supporting EV adoption and the increasing availability of charging infrastructure.

Key Growth Drivers:

- Strong government support for EV adoption.

- Rising consumer demand for electric vehicles.

- Advancements in battery technology, resulting in higher energy density and longer range.

- Expansion of charging infrastructure.

- Stringent emission regulations.

Dominant Segments:

- Body Type: Passenger Car

- Capacity: 40 kWh to 80 kWh

- Battery Form: Prismatic

- Material Type: Lithium, Nickel, Manganese, Cobalt

Japan EV Battery Pack Market Product Developments

Significant advancements are being witnessed in battery pack technology, including improvements in energy density, safety features, and thermal management systems. Manufacturers are focusing on developing lighter and more compact battery packs to enhance vehicle performance and range. The integration of advanced battery management systems (BMS) improves battery lifespan and efficiency. These product innovations are key differentiators in the competitive landscape, leading to enhanced performance, safety, and cost-effectiveness. The development of solid-state batteries promises to further revolutionize the market in the near future.

Challenges in the Japan EV Battery Pack Market Market

The Japan EV battery pack market faces several challenges including the high cost of raw materials (especially lithium and cobalt), potential supply chain disruptions, and intense competition from both domestic and international players. Stringent regulatory requirements related to battery safety and performance add to the complexities. Furthermore, concerns about battery lifespan and the environmental impact of battery production and disposal need addressing. These issues collectively impact market growth and profitability, requiring strategic mitigation plans by market participants.

Forces Driving Japan EV Battery Pack Market Growth

Several key factors contribute to the growth of Japan's EV battery pack market. Government incentives and subsidies are incentivizing EV adoption, creating a favorable market environment. Technological advancements in battery technology, particularly in energy density and charging speeds, are driving consumer demand for electric vehicles. Stringent emission regulations necessitate the transition to electric vehicles, indirectly boosting battery pack demand. The development of a robust charging infrastructure, supported by both the public and private sectors, further promotes EV adoption and, consequently, the battery pack market.

Long-Term Growth Catalysts in the Japan EV Battery Pack Market

Long-term growth in the Japan EV battery pack market is predicated on ongoing technological innovation, strategic partnerships, and market expansion. Research and development efforts into solid-state batteries, next-generation battery chemistries, and improved battery management systems promise to unlock significant advancements in performance and safety. Collaborative ventures between battery manufacturers and automotive companies are essential for efficient technology integration and supply chain optimization. Expansion into new vehicle segments and geographical markets will further fuel market growth.

Emerging Opportunities in Japan EV Battery Pack Market

Emerging opportunities include the growing adoption of electric buses and commercial vehicles, the development of second-life battery applications for stationary energy storage, and the increasing focus on sustainable battery manufacturing practices. The rising demand for high-energy-density batteries for long-range EVs presents significant opportunities. Further research into solid-state and other advanced battery technologies will yield new avenues for growth and innovation.

Leading Players in the Japan EV Battery Pack Market Sector

- Prime Planet Energy & Solutions Inc

- Vehicle Energy Japan Inc

- GS Yuasa International Ltd

- Lithium Energy Japan Inc

- TOSHIBA Corp

- Primearth EV Energy Co Ltd

- Contemporary Amperex Technology Co Ltd (CATL)

- BYD Company Ltd

- Maxell Ltd

- Blue Energy Co Ltd

- Panasonic Holdings Corporation

- Envision AESC Japan Co Ltd

Key Milestones in Japan EV Battery Pack Market Industry

- March 2023: Contemporary Amperex Technology Co., Ltd. (CATL) signed a strategic cooperation agreement with Beijing Automotive Group Co., Ltd. (BAIC Group) for business cooperation and advanced technology development, signaling expansion into the Chinese market.

- April 2023: CATL announced the launch of its sodium-ion battery in Chery models and the joint creation of the ENER-Q battery brand, expanding its product portfolio and market reach.

- May 2023: Honda Motor Co., Ltd. and GS Yuasa International Ltd. formed a joint venture, HondaGS Yuasa EV Battery R&D Co., Ltd., to accelerate EV battery R&D and enhance their competitive edge.

Strategic Outlook for Japan EV Battery Pack Market Market

The future of the Japan EV battery pack market looks promising, driven by sustained growth in EV sales, advancements in battery technology, and supportive government policies. Strategic opportunities lie in investing in R&D for next-generation battery technologies, establishing strong supply chains, and focusing on sustainable manufacturing practices. Companies that can successfully navigate the challenges related to raw material costs, supply chain resilience, and competition will be well-positioned to capitalize on the market's immense growth potential. The focus on battery recycling and second-life applications will play a vital role in the long-term sustainability and economic viability of the industry.

Japan EV Battery Pack Market Segmentation

-

1. Body Type

- 1.1. Bus

- 1.2. LCV

- 1.3. M&HDT

- 1.4. Passenger Car

-

2. Propulsion Type

- 2.1. BEV

- 2.2. PHEV

-

3. Battery Chemistry

- 3.1. LFP

- 3.2. NCM

- 3.3. NMC

- 3.4. Others

-

4. Capacity

- 4.1. 15 kWh to 40 kWh

- 4.2. 40 kWh to 80 kWh

- 4.3. Above 80 kWh

- 4.4. Less than 15 kWh

-

5. Battery Form

- 5.1. Cylindrical

- 5.2. Pouch

- 5.3. Prismatic

-

6. Method

- 6.1. Laser

- 6.2. Wire

-

7. Component

- 7.1. Anode

- 7.2. Cathode

- 7.3. Electrolyte

- 7.4. Separator

-

8. Material Type

- 8.1. Cobalt

- 8.2. Lithium

- 8.3. Manganese

- 8.4. Natural Graphite

- 8.5. Nickel

- 8.6. Other Materials

Japan EV Battery Pack Market Segmentation By Geography

- 1. Japan

Japan EV Battery Pack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Travel and Tourism Industry is Driving the Car Rental Market

- 3.3. Market Restrains

- 3.3.1. Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan EV Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Bus

- 5.1.2. LCV

- 5.1.3. M&HDT

- 5.1.4. Passenger Car

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. BEV

- 5.2.2. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Battery Chemistry

- 5.3.1. LFP

- 5.3.2. NCM

- 5.3.3. NMC

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Capacity

- 5.4.1. 15 kWh to 40 kWh

- 5.4.2. 40 kWh to 80 kWh

- 5.4.3. Above 80 kWh

- 5.4.4. Less than 15 kWh

- 5.5. Market Analysis, Insights and Forecast - by Battery Form

- 5.5.1. Cylindrical

- 5.5.2. Pouch

- 5.5.3. Prismatic

- 5.6. Market Analysis, Insights and Forecast - by Method

- 5.6.1. Laser

- 5.6.2. Wire

- 5.7. Market Analysis, Insights and Forecast - by Component

- 5.7.1. Anode

- 5.7.2. Cathode

- 5.7.3. Electrolyte

- 5.7.4. Separator

- 5.8. Market Analysis, Insights and Forecast - by Material Type

- 5.8.1. Cobalt

- 5.8.2. Lithium

- 5.8.3. Manganese

- 5.8.4. Natural Graphite

- 5.8.5. Nickel

- 5.8.6. Other Materials

- 5.9. Market Analysis, Insights and Forecast - by Region

- 5.9.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. Kanto Japan EV Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan EV Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan EV Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan EV Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan EV Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Prime Planet Energy & Solutions Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vehicle Energy Japan Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GS Yuasa International Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lithium Energy Japan Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TOSHIBA Corp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Primearth EV Energy Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Contemporary Amperex Technology Co Ltd (CATL)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BYD Company Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Maxell Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Blue Energy Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Panasonic Holdings Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Envision AESC Japan Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Prime Planet Energy & Solutions Inc

List of Figures

- Figure 1: Japan EV Battery Pack Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan EV Battery Pack Market Share (%) by Company 2024

List of Tables

- Table 1: Japan EV Battery Pack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan EV Battery Pack Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 3: Japan EV Battery Pack Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 4: Japan EV Battery Pack Market Revenue Million Forecast, by Battery Chemistry 2019 & 2032

- Table 5: Japan EV Battery Pack Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 6: Japan EV Battery Pack Market Revenue Million Forecast, by Battery Form 2019 & 2032

- Table 7: Japan EV Battery Pack Market Revenue Million Forecast, by Method 2019 & 2032

- Table 8: Japan EV Battery Pack Market Revenue Million Forecast, by Component 2019 & 2032

- Table 9: Japan EV Battery Pack Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 10: Japan EV Battery Pack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 11: Japan EV Battery Pack Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Kanto Japan EV Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Kansai Japan EV Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Chubu Japan EV Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Kyushu Japan EV Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Tohoku Japan EV Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan EV Battery Pack Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 18: Japan EV Battery Pack Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 19: Japan EV Battery Pack Market Revenue Million Forecast, by Battery Chemistry 2019 & 2032

- Table 20: Japan EV Battery Pack Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 21: Japan EV Battery Pack Market Revenue Million Forecast, by Battery Form 2019 & 2032

- Table 22: Japan EV Battery Pack Market Revenue Million Forecast, by Method 2019 & 2032

- Table 23: Japan EV Battery Pack Market Revenue Million Forecast, by Component 2019 & 2032

- Table 24: Japan EV Battery Pack Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 25: Japan EV Battery Pack Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan EV Battery Pack Market?

The projected CAGR is approximately 10.55%.

2. Which companies are prominent players in the Japan EV Battery Pack Market?

Key companies in the market include Prime Planet Energy & Solutions Inc, Vehicle Energy Japan Inc, GS Yuasa International Ltd, Lithium Energy Japan Inc, TOSHIBA Corp, Primearth EV Energy Co Ltd, Contemporary Amperex Technology Co Ltd (CATL), BYD Company Ltd, Maxell Ltd, Blue Energy Co Ltd, Panasonic Holdings Corporation, Envision AESC Japan Co Ltd.

3. What are the main segments of the Japan EV Battery Pack Market?

The market segments include Body Type, Propulsion Type, Battery Chemistry, Capacity, Battery Form, Method, Component, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Travel and Tourism Industry is Driving the Car Rental Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market.

8. Can you provide examples of recent developments in the market?

May 2023: Honda Motor Co., Ltd. (Honda) and GS Yuasa International Ltd. (GS Yuasa) have signed a joint venture agreement to form the HondaGS Yuasa EV Battery R&D Co., Ltd.April 2023: CATL announced that it will launch its sodium-ion battery in Chery models first. In addition, the two parties will jointly build the new ENER-Q battery brand, covering all application scenarios of all power types and all material systems.March 2023: Contemporary Amperex Technology Co., Ltd. (CATL) announced that it signed a strategic cooperation agreement on business cooperation and advanced technology development with Beijing Automotive Group Co., Ltd. (BAIC Group).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan EV Battery Pack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan EV Battery Pack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan EV Battery Pack Market?

To stay informed about further developments, trends, and reports in the Japan EV Battery Pack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence