Key Insights

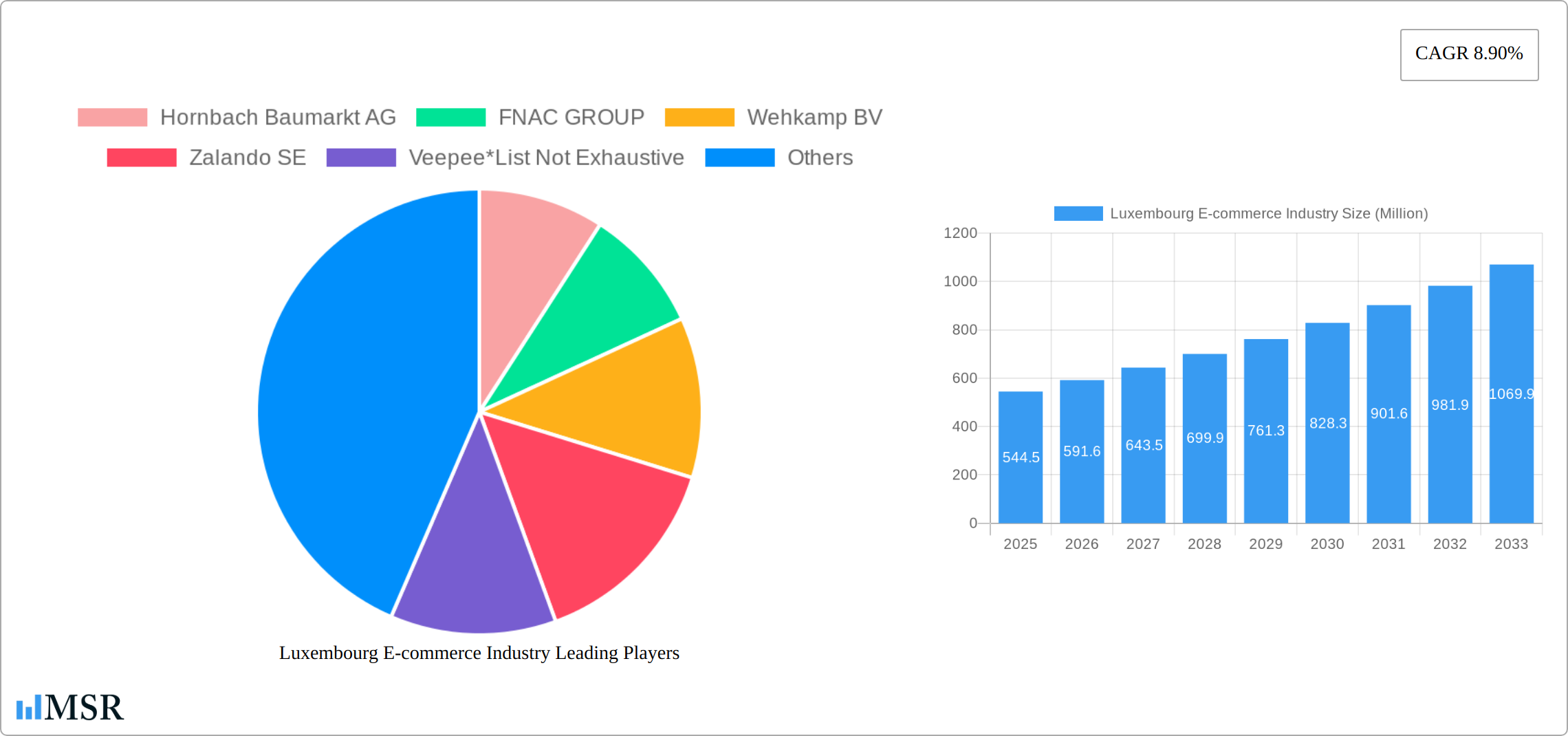

The Luxembourg e-commerce market, while relatively small compared to larger European economies, exhibits robust growth potential. With a reported CAGR of 8.90% from 2019-2033, the sector is projected to experience significant expansion over the forecast period (2025-2033). This growth is fueled by increasing internet and smartphone penetration, a young and digitally savvy population, and a rising preference for online shopping convenience. Key drivers include improved logistics infrastructure, a growing selection of online retailers offering diverse products, and the increasing adoption of digital payment methods. While the exact 2025 market size is not provided, considering the 8.90% CAGR and assuming a reasonable base year (e.g., €500 million in 2024), we can estimate the 2025 market size to be approximately €544.5 million. Major players, including international giants like Amazon and Alibaba, as well as established European players such as Zalando and FNAC, are actively competing in the Luxembourgish market. The market is segmented by application (e.g., fashion, electronics, groceries), with opportunities across various sectors.

However, challenges remain. Constraints on growth could include relatively high shipping costs for smaller retailers, concerns about data privacy and security, and the ongoing preference for physical shopping experiences for certain product categories. To overcome these, retailers need to enhance logistics efficiencies, improve customer trust through robust security measures, and integrate omnichannel strategies for a seamless shopping journey. The market's future trajectory relies on effective addressal of these restraints and the continued development of a supportive regulatory and technological environment. Furthermore, competition from neighboring countries with larger e-commerce markets may impact Luxembourg’s ability to fully capture its growth potential. Therefore, targeted marketing and a focus on niche products may be beneficial.

Luxembourg E-commerce Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Luxembourg e-commerce industry, offering invaluable insights for businesses, investors, and stakeholders. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report utilizes data from the historical period of 2019-2024, revealing key trends and predicting future growth. The Luxembourg e-commerce market, valued at xx Million in 2024, is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Luxembourg E-commerce Industry Market Concentration & Dynamics

The Luxembourg e-commerce landscape exhibits a dynamic mix of multinational giants and local players. Market concentration is moderate, with several key players commanding significant shares, but also leaving room for smaller businesses to thrive. The market share of the top 5 players is estimated at xx%, with Hornbach Baumarkt AG, FNAC GROUP, Wehkamp BV, Zalando SE, and Veepee among the prominent participants. Other notable players include Luxcaddy, Amazon com Inc, Alibaba Group, Next Germany GMBH, and Auchan Retail.

- Market Concentration: Moderate, with a top 5 market share of xx%.

- Innovation Ecosystems: Strong presence of technology providers and startups supporting innovation.

- Regulatory Frameworks: Relatively favorable, though evolving to address data privacy and consumer protection.

- Substitute Products: Traditional brick-and-mortar retail remains a significant competitor.

- End-User Trends: Increasing mobile commerce adoption and preference for omnichannel experiences.

- M&A Activities: xx M&A deals recorded between 2019 and 2024, indicating consolidation and strategic expansion.

Luxembourg E-commerce Industry Industry Insights & Trends

The Luxembourg e-commerce market is experiencing robust growth, driven by several factors. The increasing penetration of internet and smartphone usage, coupled with rising disposable incomes and a shift in consumer preferences towards online shopping, are key growth drivers. The market size, which stood at xx Million in 2024, is projected to reach xx Million by 2033, reflecting a significant expansion. Technological advancements, including improved logistics and payment gateways, are further fueling the industry’s expansion. Changing consumer behaviors, characterized by a preference for convenience, personalized experiences, and seamless omnichannel shopping, are also shaping market dynamics. The adoption of innovative technologies, such as Artificial Intelligence (AI) for personalized recommendations and Big Data analytics for improved business decisions, is continuously reshaping the competitive landscape. The increasing adoption of social commerce platforms also presents a notable emerging trend.

Key Markets & Segments Leading Luxembourg E-commerce Industry

Market Segmentation - by Application: The report analyzes various application segments within the Luxembourg e-commerce market. Specific data on segment dominance is unavailable and requires further investigation to obtain accurate figures for this report, therefore xx will be used as a placeholder for the time being. The analysis would include a detailed breakdown of market share for each segment, as well as growth projections for the forecast period.

Drivers of Dominance:

- Economic Growth: A strong and stable economy fosters consumer spending and encourages online shopping.

- Infrastructure: Robust digital infrastructure, including reliable internet connectivity and logistics networks, supports e-commerce growth.

- Government Initiatives: Supportive government policies and initiatives aimed at promoting digital commerce.

Luxembourg E-commerce Industry Product Developments

Recent product innovations in the Luxembourg e-commerce market focus on enhancing the customer experience through personalized recommendations, improved user interfaces, and seamless integration with other digital platforms. Technological advancements such as AI-powered chatbots and virtual assistants are improving customer service and support. The integration of augmented reality (AR) and virtual reality (VR) technologies is creating immersive shopping experiences, while blockchain technology is enhancing security and transparency in transactions. These innovations are creating competitive advantages and shaping the future of the industry.

Challenges in the Luxembourg E-commerce Industry Market

The Luxembourg e-commerce market faces several challenges, including stringent regulatory frameworks related to data protection and consumer rights. Supply chain disruptions and rising logistics costs can impact profitability and efficiency. Intense competition from both established players and new entrants presents a significant hurdle, particularly from international giants. Addressing these challenges requires strategic planning, investment in technology, and a focus on innovation. These factors can impact the overall market growth by approximately xx% annually.

Forces Driving Luxembourg E-commerce Industry Growth

Several factors are driving the growth of the Luxembourg e-commerce industry. Technological advancements, particularly in mobile commerce and digital payment systems, are enhancing consumer experience and expanding market reach. Favorable economic conditions and increasing disposable incomes are fueling consumer spending. Government initiatives aimed at promoting digitalization and supporting e-commerce businesses are creating a favorable regulatory environment. The growing adoption of omnichannel strategies by businesses is further accelerating market expansion.

Long-Term Growth Catalysts in the Luxembourg E-commerce Industry

Long-term growth in the Luxembourg e-commerce sector is anticipated due to continuous technological innovation, particularly in areas such as artificial intelligence (AI) and machine learning (ML), which will enhance personalization and customer service. Strategic partnerships between e-commerce businesses and logistics providers will streamline delivery processes and reduce costs. Expanding into new market segments, such as cross-border e-commerce and specialized niche markets, will unlock further growth potential. These factors will drive sustainable long-term expansion.

Emerging Opportunities in Luxembourg E-commerce Industry

Emerging opportunities include the growth of mobile commerce, the increasing adoption of social commerce platforms, and the rise of personalized shopping experiences driven by AI and big data. The expansion of cross-border e-commerce and the development of specialized niche markets present significant growth potential. The adoption of sustainable and ethical practices within the e-commerce sector is gaining traction and represents a significant opportunity for businesses to attract environmentally conscious consumers.

Leading Players in the Luxembourg E-commerce Industry Sector

- Hornbach Baumarkt AG

- FNAC GROUP

- Wehkamp BV

- Zalando SE

- Veepee

- Luxcaddy

- Amazon com Inc

- Alibaba Group

- Next Germany GMBH

- Auchan Retail

Key Milestones in Luxembourg E-commerce Industry Industry

- June 2022: Orange launched a click-to-call service to enhance online sales and customer service. This initiative improved customer engagement and order management.

- November 2022: EY and Shopify partnered to boost online businesses. This collaboration provided Shopify with valuable resource planning, CRM, and inventory management support, enhancing efficiency and growth.

Strategic Outlook for Luxembourg E-commerce Industry Market

The Luxembourg e-commerce market presents significant growth potential. Strategic opportunities include investing in technological innovation, expanding into new market segments, fostering strategic partnerships, and focusing on enhancing the customer experience. By capitalizing on these opportunities, businesses can achieve significant market share gains and drive sustainable growth in the coming years. The market's future hinges on the continued adoption of technological advancements, adapting to evolving consumer preferences, and proactively navigating the challenges associated with a dynamic and competitive landscape.

Luxembourg E-commerce Industry Segmentation

-

1. B2C ecommerce

- 1.1. Market size (GMV) for the period of 2017-2027

-

1.2. Market Segmentation - by Application

- 1.2.1. Beauty & Personal Care

- 1.2.2. Consumer Electronics

- 1.2.3. Fashion & Apparel

- 1.2.4. Food & Beverage

- 1.2.5. Furniture & Home

- 1.2.6. Others (Toys, DIY, Media, etc.)

- 2. Market size (GMV) for the period of 2017-2027

-

3. Application

- 3.1. Beauty & Personal Care

- 3.2. Consumer Electronics

- 3.3. Fashion & Apparel

- 3.4. Food & Beverage

- 3.5. Furniture & Home

- 3.6. Others (Toys, DIY, Media, etc.)

- 4. Beauty & Personal Care

- 5. Consumer Electronics

- 6. Fashion & Apparel

- 7. Food & Beverage

- 8. Furniture & Home

- 9. Others (Toys, DIY, Media, etc.)

-

10. B2B ecommerce

- 10.1. Market size for the period of 2017-2027

Luxembourg E-commerce Industry Segmentation By Geography

- 1. Luxembourg

Luxembourg E-commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased adoption of Digital Solutions; Range of payments to serve diverse and underbanked shoppers

- 3.3. Market Restrains

- 3.3.1. High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity

- 3.4. Market Trends

- 3.4.1. Increased adoption of Digital Solutions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Luxembourg E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by B2C ecommerce

- 5.1.1. Market size (GMV) for the period of 2017-2027

- 5.1.2. Market Segmentation - by Application

- 5.1.2.1. Beauty & Personal Care

- 5.1.2.2. Consumer Electronics

- 5.1.2.3. Fashion & Apparel

- 5.1.2.4. Food & Beverage

- 5.1.2.5. Furniture & Home

- 5.1.2.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Market size (GMV) for the period of 2017-2027

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Beauty & Personal Care

- 5.3.2. Consumer Electronics

- 5.3.3. Fashion & Apparel

- 5.3.4. Food & Beverage

- 5.3.5. Furniture & Home

- 5.3.6. Others (Toys, DIY, Media, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Beauty & Personal Care

- 5.5. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.6. Market Analysis, Insights and Forecast - by Fashion & Apparel

- 5.7. Market Analysis, Insights and Forecast - by Food & Beverage

- 5.8. Market Analysis, Insights and Forecast - by Furniture & Home

- 5.9. Market Analysis, Insights and Forecast - by Others (Toys, DIY, Media, etc.)

- 5.10. Market Analysis, Insights and Forecast - by B2B ecommerce

- 5.10.1. Market size for the period of 2017-2027

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. Luxembourg

- 5.1. Market Analysis, Insights and Forecast - by B2C ecommerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hornbach Baumarkt AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FNAC GROUP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wehkamp BV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zalando SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Veepee*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Luxcaddy

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amazon com Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alibaba Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Next Germany GMBH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Auchan Retail

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hornbach Baumarkt AG

List of Figures

- Figure 1: Luxembourg E-commerce Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Luxembourg E-commerce Industry Share (%) by Company 2024

List of Tables

- Table 1: Luxembourg E-commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Luxembourg E-commerce Industry Revenue Million Forecast, by B2C ecommerce 2019 & 2032

- Table 3: Luxembourg E-commerce Industry Revenue Million Forecast, by Market size (GMV) for the period of 2017-2027 2019 & 2032

- Table 4: Luxembourg E-commerce Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Luxembourg E-commerce Industry Revenue Million Forecast, by Beauty & Personal Care 2019 & 2032

- Table 6: Luxembourg E-commerce Industry Revenue Million Forecast, by Consumer Electronics 2019 & 2032

- Table 7: Luxembourg E-commerce Industry Revenue Million Forecast, by Fashion & Apparel 2019 & 2032

- Table 8: Luxembourg E-commerce Industry Revenue Million Forecast, by Food & Beverage 2019 & 2032

- Table 9: Luxembourg E-commerce Industry Revenue Million Forecast, by Furniture & Home 2019 & 2032

- Table 10: Luxembourg E-commerce Industry Revenue Million Forecast, by Others (Toys, DIY, Media, etc.) 2019 & 2032

- Table 11: Luxembourg E-commerce Industry Revenue Million Forecast, by B2B ecommerce 2019 & 2032

- Table 12: Luxembourg E-commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 13: Luxembourg E-commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Luxembourg E-commerce Industry Revenue Million Forecast, by B2C ecommerce 2019 & 2032

- Table 15: Luxembourg E-commerce Industry Revenue Million Forecast, by Market size (GMV) for the period of 2017-2027 2019 & 2032

- Table 16: Luxembourg E-commerce Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Luxembourg E-commerce Industry Revenue Million Forecast, by Beauty & Personal Care 2019 & 2032

- Table 18: Luxembourg E-commerce Industry Revenue Million Forecast, by Consumer Electronics 2019 & 2032

- Table 19: Luxembourg E-commerce Industry Revenue Million Forecast, by Fashion & Apparel 2019 & 2032

- Table 20: Luxembourg E-commerce Industry Revenue Million Forecast, by Food & Beverage 2019 & 2032

- Table 21: Luxembourg E-commerce Industry Revenue Million Forecast, by Furniture & Home 2019 & 2032

- Table 22: Luxembourg E-commerce Industry Revenue Million Forecast, by Others (Toys, DIY, Media, etc.) 2019 & 2032

- Table 23: Luxembourg E-commerce Industry Revenue Million Forecast, by B2B ecommerce 2019 & 2032

- Table 24: Luxembourg E-commerce Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxembourg E-commerce Industry?

The projected CAGR is approximately 8.90%.

2. Which companies are prominent players in the Luxembourg E-commerce Industry?

Key companies in the market include Hornbach Baumarkt AG, FNAC GROUP, Wehkamp BV, Zalando SE, Veepee*List Not Exhaustive, Luxcaddy, Amazon com Inc, Alibaba Group, Next Germany GMBH, Auchan Retail.

3. What are the main segments of the Luxembourg E-commerce Industry?

The market segments include B2C ecommerce, Market size (GMV) for the period of 2017-2027, Application, Beauty & Personal Care, Consumer Electronics, Fashion & Apparel, Food & Beverage, Furniture & Home, Others (Toys, DIY, Media, etc.), B2B ecommerce.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased adoption of Digital Solutions; Range of payments to serve diverse and underbanked shoppers.

6. What are the notable trends driving market growth?

Increased adoption of Digital Solutions.

7. Are there any restraints impacting market growth?

High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity.

8. Can you provide examples of recent developments in the market?

June 2022: To promote its online sales, Orange, the telecommunications retailer, introduced a click-to-call service on its website. Through this service, the brand's telesales team will arrange a callback to answer customer queries and manage orders.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxembourg E-commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxembourg E-commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxembourg E-commerce Industry?

To stay informed about further developments, trends, and reports in the Luxembourg E-commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence