Key Insights

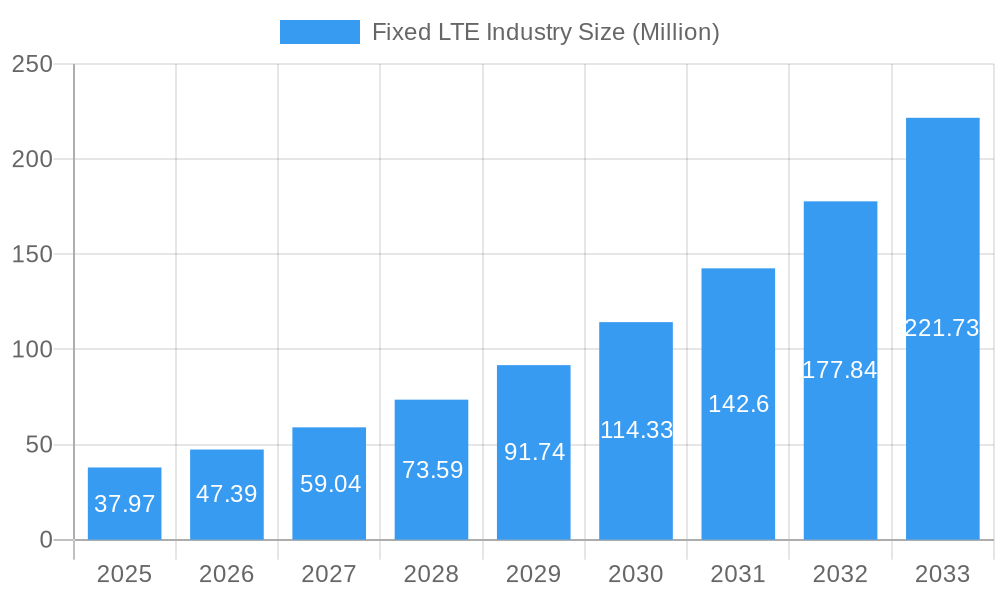

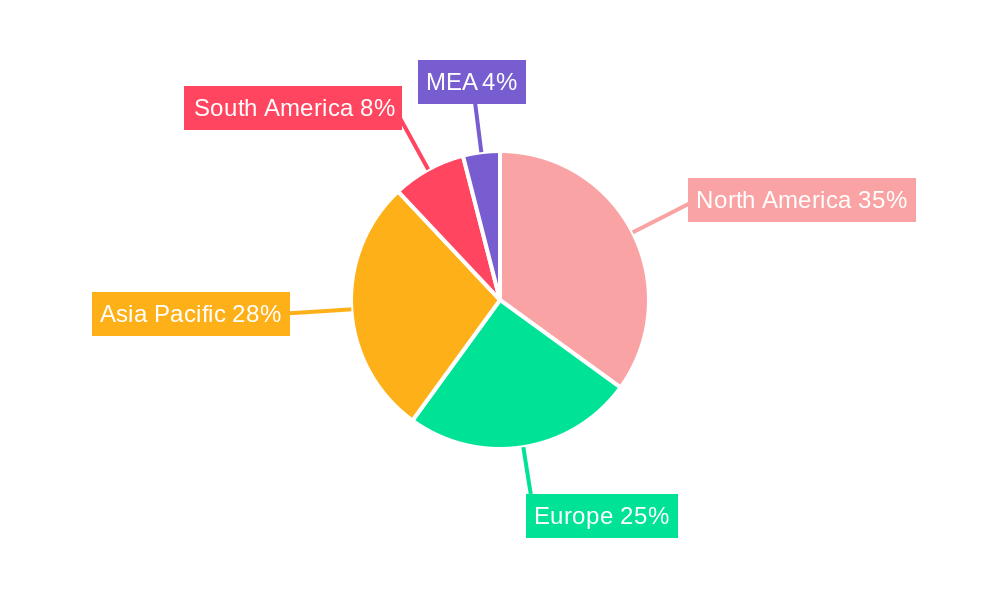

The Fixed LTE market, valued at $37.97 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 24.97% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for high-speed internet access in both residential and commercial sectors fuels the adoption of Fixed LTE solutions, particularly in areas with limited or insufficient fiber optic infrastructure. The rise of smart homes and businesses, coupled with the growing reliance on bandwidth-intensive applications like video streaming and online gaming, further propels market growth. Furthermore, technological advancements leading to improved network performance, enhanced security features, and cost-effective solutions contribute significantly to market expansion. The market is segmented by user type (residential and commercial) and solution type (LTE infrastructure and other solutions like indoor and outdoor CPEs). Competition is fierce, with major players like Motorola Solutions, Samsung, and Huawei actively vying for market share through innovation and strategic partnerships. The North American market currently holds a significant share, but the Asia-Pacific region is expected to witness substantial growth due to rapid urbanization and increasing internet penetration.

Fixed LTE Industry Market Size (In Million)

Despite the promising growth trajectory, the Fixed LTE market faces certain challenges. High initial infrastructure costs can be a barrier to entry for smaller service providers, while regulatory hurdles and spectrum availability issues in certain regions can impede market expansion. Competition from other broadband technologies like fiber optics and 5G also presents a challenge. However, the continued focus on providing affordable and reliable high-speed internet access, coupled with ongoing technological innovation, is likely to mitigate these restraints and ensure sustained growth in the Fixed LTE market over the forecast period. The market's future success hinges on strategic partnerships, technological advancements focused on improving network efficiency and affordability, and proactive regulatory frameworks that facilitate broader deployment.

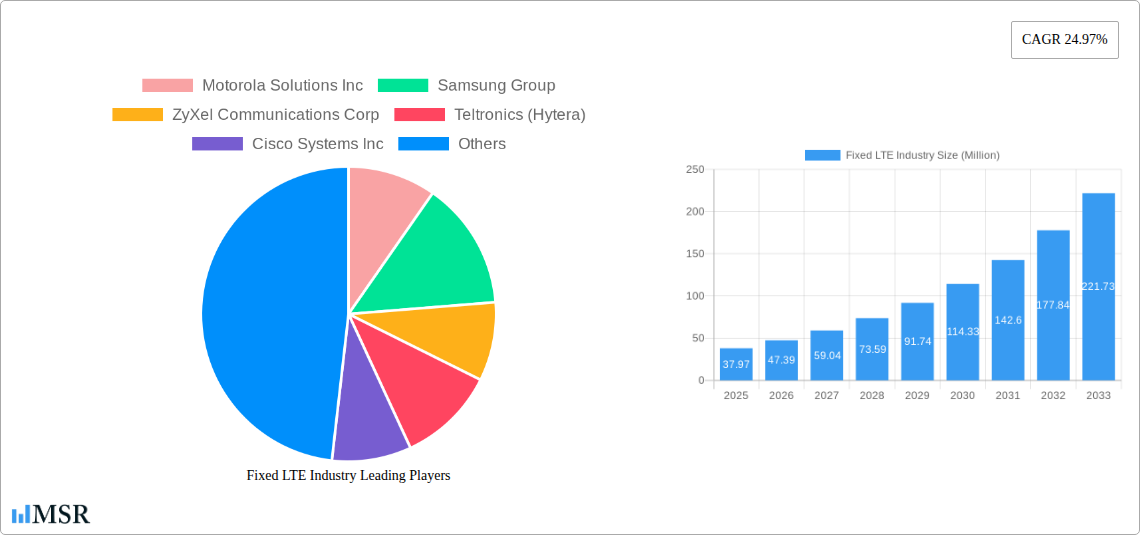

Fixed LTE Industry Company Market Share

Fixed LTE Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Fixed LTE industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a focus on market dynamics, technological advancements, and key players, this report projects a robust future for the Fixed LTE sector, encompassing a market size exceeding $XX Million by 2033. The study period covers 2019-2033, with 2025 serving as the base and estimated year.

Fixed LTE Industry Market Concentration & Dynamics

The Fixed LTE market exhibits a moderately concentrated landscape, with key players like Motorola Solutions Inc, Samsung Group, ZyXel Communications Corp, and Huawei Technologies Co Ltd holding significant market share. However, the presence of numerous smaller players and the ongoing entry of new entrants contribute to a dynamic competitive environment. Market share data for 2024 reveals that the top 5 players collectively hold approximately xx% of the market, indicating room for growth for both established and emerging companies.

Innovation is a key driver, with ongoing advancements in LTE infrastructure, CPE (Customer Premises Equipment) technology, and software solutions. Regulatory frameworks play a crucial role, influencing deployment strategies and market access. Substitute products, such as fiber optics and satellite internet, pose some competitive pressure, although Fixed LTE's advantages in cost and deployment flexibility remain significant.

End-user trends, particularly the increasing demand for high-speed internet in residential and commercial sectors, fuel market growth. M&A activity in the sector has been moderate in recent years, with an estimated xx merger and acquisition deals completed between 2021 and 2024. This suggests ongoing consolidation and strategic realignment within the industry.

Fixed LTE Industry Industry Insights & Trends

The Fixed LTE market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching an estimated market value of $XX Million. Several key factors are driving this expansion. Firstly, the increasing penetration of broadband internet across both residential and commercial sectors fuels demand for high-speed and reliable connectivity solutions. Secondly, advancements in LTE technology, particularly in the areas of speed, capacity, and coverage, enhance the attractiveness of Fixed LTE as a competitive solution. Lastly, favorable government policies and investments in infrastructure development create a supportive environment for Fixed LTE deployment in many regions. Technological disruptions, such as the emergence of 5G, pose both a challenge and an opportunity. While 5G adoption gradually increases, Fixed LTE continues to provide a cost-effective solution for widespread connectivity. Evolving consumer behaviors, such as the increasing reliance on streaming media and remote work, also contribute to the growth in demand for robust internet access.

Key Markets & Segments Leading Fixed LTE Industry

The Fixed LTE market is experiencing significant growth across various regions and segments.

Dominant Regions/Countries: The market is witnessing rapid expansion in developing economies, driven by rising disposable income and increased smartphone penetration. While North America and Europe maintain significant market presence, Asia-Pacific and Latin America are emerging as key growth drivers.

Dominant Segments:

By Type of User: The Commercial segment currently dominates the Fixed LTE market, representing xx% of total revenue in 2024. High demand from businesses, SMEs, and industrial applications (e.g., the STI port example in Chile) drives this significant share. The Residential segment is projected to experience accelerated growth in the forecast period, driven by increasing urbanization and the shift to work-from-home models.

By Type of Solution: LTE Infrastructure accounts for the largest revenue share, with xx% of the market in 2024. However, Other Solution Types, specifically Indoor and Outdoor CPE, are exhibiting strong growth, driven by the rising need for reliable connectivity in various environments. The increasing adoption of these CPE solutions across residential, commercial, and industrial segments fuels this positive growth trajectory.

Drivers:

- Economic Growth: Increased disposable income in many developing regions fuels higher demand for broadband internet services.

- Infrastructure Development: Government investments in telecommunications infrastructure create a favorable environment for Fixed LTE deployment.

- Technological Advancements: Continuous improvements in LTE technology enhance speed, capacity, and coverage, making Fixed LTE a more attractive solution.

Fixed LTE Industry Product Developments

Recent years have witnessed significant product innovations in the Fixed LTE sector, with manufacturers focusing on enhanced performance, cost reduction, and wider applications. Advancements in antenna technologies, modem designs, and software optimization contribute to increased speeds, reduced latency, and improved network stability. Furthermore, the development of more energy-efficient CPE devices is enhancing the environmental sustainability and overall operational efficiency of Fixed LTE systems. These innovations provide a competitive edge, allowing providers to offer more attractive packages and cater to diverse market demands.

Challenges in the Fixed LTE Industry Market

The Fixed LTE industry faces several key challenges. Regulatory hurdles, including licensing requirements and spectrum allocation policies, can impede market expansion. Supply chain disruptions, particularly concerning semiconductor components, can affect production and pricing. Intense competition from alternative technologies, such as fiber optics and 5G, presents another significant challenge. These factors can collectively impact the industry's growth trajectory and profitability.

Forces Driving Fixed LTE Industry Growth

Technological advancements such as increased bandwidth and improved energy efficiency are major growth drivers. Furthermore, strong economic growth in developing nations fuels demand. Supportive government policies, including investments in infrastructure, create a favorable regulatory environment. For example, the South African example shows private sector adoption of Fixed LTE to serve the SME market.

Long-Term Growth Catalysts in the Fixed LTE Industry

The long-term growth of the Fixed LTE industry will be driven by continued innovation in LTE technology, strategic partnerships between equipment manufacturers and service providers, and expansion into underserved markets. These initiatives promise to extend the lifespan and relevance of Fixed LTE, even in the face of emerging technologies like 5G.

Emerging Opportunities in Fixed LTE Industry

Emerging opportunities include the expansion into rural and underserved areas using cost-effective solutions. The Internet of Things (IoT) presents a significant growth avenue, with Fixed LTE providing reliable connectivity for various smart devices and sensors. Furthermore, partnerships with satellite internet providers could offer hybrid solutions, enhancing coverage and reliability.

Leading Players in the Fixed LTE Industry Sector

- Motorola Solutions Inc

- Samsung Group

- ZyXel Communications Corp

- Teltronics (Hytera)

- Cisco Systems Inc

- L-com Global Connectivity

- Netgear Inc

- Sagemcom SAS

- Telenet Systems Pvt Ltd

- Huawei Technologies Co Ltd

- ZTE Corporation

- Aztech Group Ltd

- Arris International PLC

- Telrad Networks Ltd

- Shenzhen Zoolan Technology Co Ltd

- AT&T Inc

- Technicolor SA

- Datang Telecom Technology & Industry Group

- Telefonica SA

Key Milestones in Fixed LTE Industry Industry

- December 2022: South African-based Huge group launches Fixed LTE services for SMEs, significantly expanding market reach within the business sector.

- November 2022: Chile's STI port adopts Nokia's industrial-grade LTE network, showcasing Fixed LTE's capabilities in high-demand industrial applications.

- October 2022: Nxtdigital launches NXTSkyFi, a broadband-over-satellite solution, demonstrating innovative approaches to expanding Fixed LTE connectivity in geographically challenging areas.

Strategic Outlook for Fixed LTE Industry Market

The Fixed LTE market possesses significant future potential, driven by the ongoing demand for reliable and affordable broadband internet. Strategic opportunities include focusing on specialized applications like Industrial IoT and expanding into underserved regions. Partnerships and collaborations are crucial for accelerating market penetration and fostering innovation within the sector. Continued investment in network infrastructure and technological advancements will be key to sustaining long-term growth and competitiveness.

Fixed LTE Industry Segmentation

-

1. Type of User

- 1.1. Residential

- 1.2. Commercial

-

2. Type of Solution

- 2.1. LTE Infrastructure

- 2.2. Other Solution Types (Indoor CPE, Outdoor CPE)

Fixed LTE Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of the Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of the Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Fixed LTE Industry Regional Market Share

Geographic Coverage of Fixed LTE Industry

Fixed LTE Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Adoption of Public Safety LTE.; Growing Demand For High Speed BroadBand In Rural Areas; Positive Outlook of Fixed LTE Compared to DSL

- 3.2.2 Fiber and Cable

- 3.3. Market Restrains

- 3.3.1. Network Performance Concerns

- 3.4. Market Trends

- 3.4.1. Residential Type of User Expected to Account for Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fixed LTE Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of User

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Type of Solution

- 5.2.1. LTE Infrastructure

- 5.2.2. Other Solution Types (Indoor CPE, Outdoor CPE)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of User

- 6. North America Fixed LTE Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of User

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Type of Solution

- 6.2.1. LTE Infrastructure

- 6.2.2. Other Solution Types (Indoor CPE, Outdoor CPE)

- 6.1. Market Analysis, Insights and Forecast - by Type of User

- 7. Europe Fixed LTE Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of User

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Type of Solution

- 7.2.1. LTE Infrastructure

- 7.2.2. Other Solution Types (Indoor CPE, Outdoor CPE)

- 7.1. Market Analysis, Insights and Forecast - by Type of User

- 8. Asia Pacific Fixed LTE Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of User

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Type of Solution

- 8.2.1. LTE Infrastructure

- 8.2.2. Other Solution Types (Indoor CPE, Outdoor CPE)

- 8.1. Market Analysis, Insights and Forecast - by Type of User

- 9. Latin America Fixed LTE Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of User

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Type of Solution

- 9.2.1. LTE Infrastructure

- 9.2.2. Other Solution Types (Indoor CPE, Outdoor CPE)

- 9.1. Market Analysis, Insights and Forecast - by Type of User

- 10. Middle East and Africa Fixed LTE Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of User

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Type of Solution

- 10.2.1. LTE Infrastructure

- 10.2.2. Other Solution Types (Indoor CPE, Outdoor CPE)

- 10.1. Market Analysis, Insights and Forecast - by Type of User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Motorola Solutions Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Samsung Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ZyXel Communications Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Teltronics (Hytera)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cisco Systems Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 L-com Global Connectivity

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Netgear Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sagemcom SAS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Telenet Systems Pvt Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Huawei Technologies Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ZTE Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Aztech Group Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Arris International PLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Telrad Networks Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Shenzhen Zoolan Technology Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 AT&T Inc

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Technicolor SA

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Datang Telecom Technology & Industry Group*List Not Exhaustive

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Telefonica SA

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Motorola Solutions Inc

List of Figures

- Figure 1: Global Fixed LTE Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Fixed LTE Industry Revenue (Million), by Type of User 2025 & 2033

- Figure 3: North America Fixed LTE Industry Revenue Share (%), by Type of User 2025 & 2033

- Figure 4: North America Fixed LTE Industry Revenue (Million), by Type of Solution 2025 & 2033

- Figure 5: North America Fixed LTE Industry Revenue Share (%), by Type of Solution 2025 & 2033

- Figure 6: North America Fixed LTE Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Fixed LTE Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Fixed LTE Industry Revenue (Million), by Type of User 2025 & 2033

- Figure 9: Europe Fixed LTE Industry Revenue Share (%), by Type of User 2025 & 2033

- Figure 10: Europe Fixed LTE Industry Revenue (Million), by Type of Solution 2025 & 2033

- Figure 11: Europe Fixed LTE Industry Revenue Share (%), by Type of Solution 2025 & 2033

- Figure 12: Europe Fixed LTE Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Fixed LTE Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Fixed LTE Industry Revenue (Million), by Type of User 2025 & 2033

- Figure 15: Asia Pacific Fixed LTE Industry Revenue Share (%), by Type of User 2025 & 2033

- Figure 16: Asia Pacific Fixed LTE Industry Revenue (Million), by Type of Solution 2025 & 2033

- Figure 17: Asia Pacific Fixed LTE Industry Revenue Share (%), by Type of Solution 2025 & 2033

- Figure 18: Asia Pacific Fixed LTE Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Fixed LTE Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Fixed LTE Industry Revenue (Million), by Type of User 2025 & 2033

- Figure 21: Latin America Fixed LTE Industry Revenue Share (%), by Type of User 2025 & 2033

- Figure 22: Latin America Fixed LTE Industry Revenue (Million), by Type of Solution 2025 & 2033

- Figure 23: Latin America Fixed LTE Industry Revenue Share (%), by Type of Solution 2025 & 2033

- Figure 24: Latin America Fixed LTE Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Fixed LTE Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Fixed LTE Industry Revenue (Million), by Type of User 2025 & 2033

- Figure 27: Middle East and Africa Fixed LTE Industry Revenue Share (%), by Type of User 2025 & 2033

- Figure 28: Middle East and Africa Fixed LTE Industry Revenue (Million), by Type of Solution 2025 & 2033

- Figure 29: Middle East and Africa Fixed LTE Industry Revenue Share (%), by Type of Solution 2025 & 2033

- Figure 30: Middle East and Africa Fixed LTE Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Fixed LTE Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fixed LTE Industry Revenue Million Forecast, by Type of User 2020 & 2033

- Table 2: Global Fixed LTE Industry Revenue Million Forecast, by Type of Solution 2020 & 2033

- Table 3: Global Fixed LTE Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Fixed LTE Industry Revenue Million Forecast, by Type of User 2020 & 2033

- Table 5: Global Fixed LTE Industry Revenue Million Forecast, by Type of Solution 2020 & 2033

- Table 6: Global Fixed LTE Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Fixed LTE Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Fixed LTE Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Fixed LTE Industry Revenue Million Forecast, by Type of User 2020 & 2033

- Table 10: Global Fixed LTE Industry Revenue Million Forecast, by Type of Solution 2020 & 2033

- Table 11: Global Fixed LTE Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Fixed LTE Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Fixed LTE Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Fixed LTE Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of the Europe Fixed LTE Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Fixed LTE Industry Revenue Million Forecast, by Type of User 2020 & 2033

- Table 17: Global Fixed LTE Industry Revenue Million Forecast, by Type of Solution 2020 & 2033

- Table 18: Global Fixed LTE Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Fixed LTE Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Fixed LTE Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Fixed LTE Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of the Asia Pacific Fixed LTE Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Fixed LTE Industry Revenue Million Forecast, by Type of User 2020 & 2033

- Table 24: Global Fixed LTE Industry Revenue Million Forecast, by Type of Solution 2020 & 2033

- Table 25: Global Fixed LTE Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Fixed LTE Industry Revenue Million Forecast, by Type of User 2020 & 2033

- Table 27: Global Fixed LTE Industry Revenue Million Forecast, by Type of Solution 2020 & 2033

- Table 28: Global Fixed LTE Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fixed LTE Industry?

The projected CAGR is approximately 24.97%.

2. Which companies are prominent players in the Fixed LTE Industry?

Key companies in the market include Motorola Solutions Inc, Samsung Group, ZyXel Communications Corp, Teltronics (Hytera), Cisco Systems Inc, L-com Global Connectivity, Netgear Inc, Sagemcom SAS, Telenet Systems Pvt Ltd, Huawei Technologies Co Ltd, ZTE Corporation, Aztech Group Ltd, Arris International PLC, Telrad Networks Ltd, Shenzhen Zoolan Technology Co Ltd, AT&T Inc, Technicolor SA, Datang Telecom Technology & Industry Group*List Not Exhaustive, Telefonica SA.

3. What are the main segments of the Fixed LTE Industry?

The market segments include Type of User, Type of Solution.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Adoption of Public Safety LTE.; Growing Demand For High Speed BroadBand In Rural Areas; Positive Outlook of Fixed LTE Compared to DSL. Fiber and Cable.

6. What are the notable trends driving market growth?

Residential Type of User Expected to Account for Significant Share.

7. Are there any restraints impacting market growth?

Network Performance Concerns.

8. Can you provide examples of recent developments in the market?

December 2022 - South African-based Huge group formed a new business group to offer Fixed LTE services to SMEs (Small and Small-Medium Enterprises). The company has designed smaller internet packages suitable for work-from-home scenarios and large packages to serve big organizations. The group already has a combined customer base of 19000 19 000 businesses and SMEs and plans to expand this further.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fixed LTE Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fixed LTE Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fixed LTE Industry?

To stay informed about further developments, trends, and reports in the Fixed LTE Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence