Key Insights

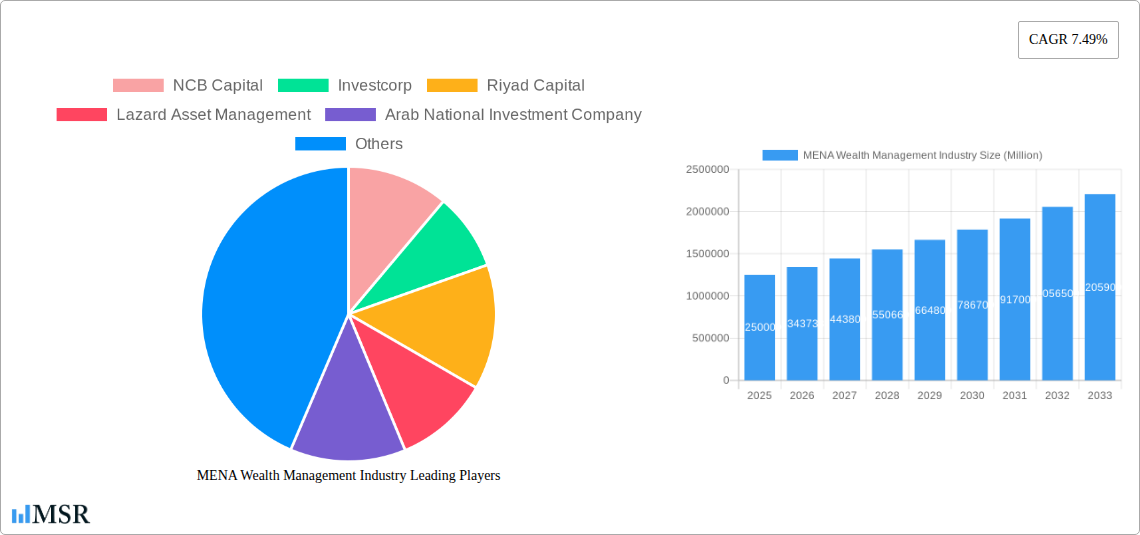

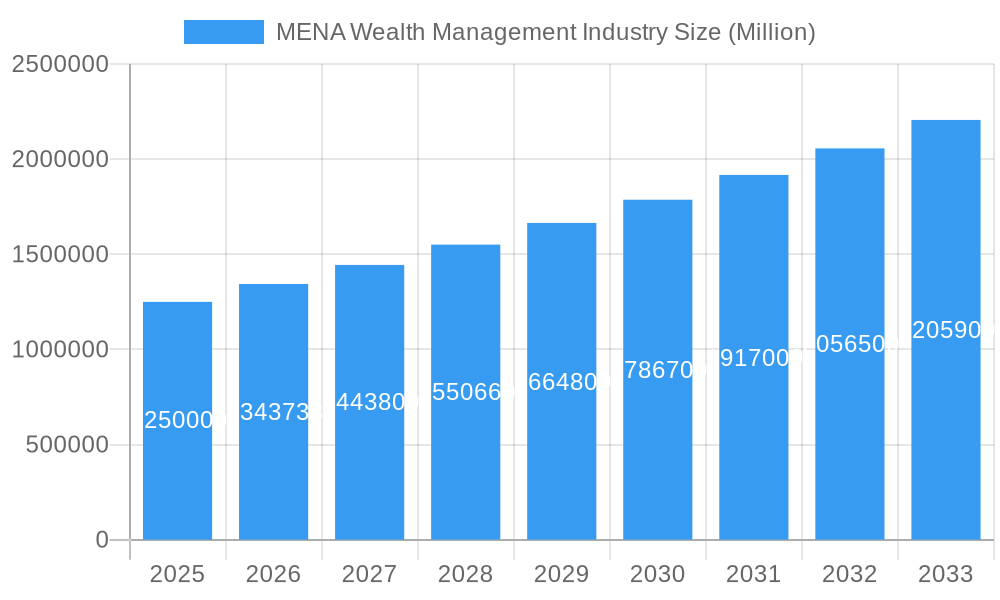

The MENA (Middle East and North Africa) wealth management industry is experiencing robust growth, projected to reach a market size of $1.25 trillion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 7.49% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, a burgeoning high-net-worth individual (HNWI) population across the region is driving increased demand for sophisticated wealth management services. Secondly, economic diversification initiatives in several MENA countries are fostering greater financial stability and attracting foreign investment, further stimulating the wealth management sector. Thirdly, technological advancements, such as the adoption of fintech solutions and digital platforms, are enhancing efficiency and accessibility of wealth management services, attracting a wider client base. Finally, increased regulatory oversight and improved market transparency are building investor confidence and promoting sustainable growth within the industry.

MENA Wealth Management Industry Market Size (In Million)

However, certain restraints remain. Geopolitical instability in some parts of the region can impact investor sentiment and investment flows. Furthermore, competition among established players and emerging fintech companies is intensifying, requiring wealth management firms to continuously innovate and adapt to stay ahead. The increasing demand for personalized and specialized wealth management solutions also presents a challenge, requiring firms to build robust capabilities and expertise in areas like impact investing, sustainable finance, and family office services. Despite these challenges, the long-term outlook for the MENA wealth management industry remains positive, driven by the region's economic growth trajectory and evolving investor needs. Key players like NCB Capital, Investcorp, Riyad Capital, and others are well-positioned to capitalize on these opportunities, and the industry is expected to see significant consolidation and strategic partnerships in the coming years.

MENA Wealth Management Industry Company Market Share

MENA Wealth Management Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the MENA (Middle East and North Africa) wealth management industry, covering market dynamics, key players, growth drivers, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for investors, industry stakeholders, and strategic decision-makers. The report leverages data from the historical period (2019-2024) and provides estimated values for 2025.

MENA Wealth Management Industry Market Concentration & Dynamics

The MENA wealth management market exhibits a moderately concentrated landscape, with a few major players commanding significant market share. NCB Capital, Investcorp, Riyad Capital, and Lazard Asset Management are among the leading firms, collectively accounting for an estimated xx% of the market in 2025. However, the presence of numerous regional and boutique firms fosters competition and innovation. The market's dynamics are shaped by several factors:

- Innovation Ecosystems: The industry is witnessing increased adoption of fintech solutions, including robo-advisors and digital platforms, driving efficiency and expanding accessibility.

- Regulatory Frameworks: Regulatory changes and compliance requirements, while promoting stability, can also impact operational costs and market entry for new players. The evolving regulatory landscape across different MENA countries needs careful consideration.

- Substitute Products: Alternative investment options, such as real estate and commodities, present competition to traditional wealth management services.

- End-User Trends: Growing affluence, particularly among younger demographics, and a rising demand for personalized wealth management solutions are significant market drivers.

- M&A Activities: The number of M&A deals in the MENA wealth management sector averaged xx per year during 2019-2024, suggesting ongoing consolidation and strategic expansion by established players. Major deals included [Insert details of significant M&A activity if available, otherwise state "Data unavailable"].

MENA Wealth Management Industry Industry Insights & Trends

The MENA wealth management industry is experiencing robust growth, driven by several key factors. The market size reached an estimated $xx Million in 2025, with a CAGR of xx% projected from 2025 to 2033. Key growth drivers include:

- Increasing Disposable Incomes: Economic growth across several MENA countries fuels higher disposable incomes, leading to increased demand for wealth management services.

- Expanding Middle Class: The burgeoning middle class in the region represents a significant and expanding target market for wealth management providers.

- Technological Advancements: The integration of fintech solutions, such as AI-powered portfolio management tools and digital advisory platforms, is transforming the industry. This leads to enhanced customer experience and operational efficiency.

- Government Initiatives: Supportive government policies and initiatives aimed at boosting financial inclusion and market development contribute positively to industry expansion.

- Shifting Consumer Behavior: A growing preference for digital channels and personalized investment advice necessitates continuous adaptation by wealth management firms.

Key Markets & Segments Leading MENA Wealth Management Industry

The UAE and Saudi Arabia are currently the dominant markets within the MENA region, accounting for an estimated xx% of the total market share in 2025. Their dominance stems from various factors:

- Strong Economic Growth: High GDP growth in these countries translates directly into increased wealth and demand for wealth management.

- Robust Financial Infrastructure: Well-developed financial markets and regulatory frameworks in these nations create a favorable environment for wealth management activities.

- High Concentration of High-Net-Worth Individuals (HNWIs): The presence of a substantial HNWIs population drives demand for sophisticated and tailored wealth management solutions.

Drivers for Dominance:

- Developed Financial Infrastructure: Mature stock exchanges, robust regulatory bodies, and a deep pool of financial talent.

- Government Support: Initiatives to promote financial development and attract foreign investment.

- High Concentration of HNWIs: Significant wealth concentrated in these countries leads to high demand for wealth management services.

- Strategic Location: These nations serve as regional hubs for business and finance, attracting investment and talent.

Further analysis reveals a significant segment focusing on high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs), demanding complex portfolio management and wealth preservation strategies. Another sizable segment is the growing middle class, actively seeking investment guidance and financial planning services.

MENA Wealth Management Industry Product Developments

Recent product innovations include the introduction of Sharia-compliant investment products tailored to the religious preferences of a significant portion of the MENA population. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into portfolio management systems enhances investment strategies and personalization. The increasing use of digital platforms for client onboarding and service delivery boosts efficiency and accessibility. This reflects a clear competitive edge for firms embracing these advancements.

Challenges in the MENA Wealth Management Industry Market

Significant challenges facing the MENA wealth management industry include stringent regulatory compliance requirements, increasing competitive pressures from both established players and fintech startups, and fluctuating geopolitical conditions that can impact investor sentiment and market volatility. These factors can lead to increased operational costs and uncertainty in investment strategies. The lack of financial literacy among a portion of the population also hinders widespread market penetration. Furthermore, cybersecurity risks and data privacy concerns necessitate robust security measures.

Forces Driving MENA Wealth Management Industry Growth

The MENA wealth management industry is propelled by several key factors. Technological advancements, including the rise of fintech and digital platforms, enhance efficiency and accessibility. Strong economic growth in certain regions directly translates to higher disposable incomes and increased demand. Furthermore, supportive government initiatives aimed at fostering financial inclusion and market development play a pivotal role in driving industry expansion. Increased foreign direct investment also fuels market growth.

Long-Term Growth Catalysts in the MENA Wealth Management Industry

Long-term growth is expected to be driven by continued technological innovation, strategic partnerships between traditional wealth management firms and fintech companies, and expansion into new markets within the MENA region and beyond. The development of tailored financial products catering to specific demographics and risk profiles will further enhance market potential.

Emerging Opportunities in MENA Wealth Management Industry

The increasing adoption of sustainable and ethical investment strategies presents significant opportunities. Furthermore, the growing demand for personalized financial planning and wealth preservation services, especially among younger generations, offers fertile ground for expansion. The increasing use of big data analytics in investment decision-making will play a crucial role in maximizing returns and minimizing risks.

Leading Players in the MENA Wealth Management Industry Sector

- NCB Capital

- Investcorp

- Riyad Capital

- Lazard Asset Management

- Arab National Investment Company

- Aljazira Capital

- Emirates NBD Asset Management

- Waha Capital

- Fippar Holdings

- Orange Asset Management

List Not Exhaustive

Key Milestones in MENA Wealth Management Industry Industry

- January 2023: Emirates NBD Securities partnered with the Abu Dhabi Securities Exchange (ADX), enhancing trading accessibility and digital onboarding. This significantly improves the efficiency of trading operations and customer experience.

- January 2023: Emirates NBD successfully priced its inaugural AED 1 Billion dirham-denominated bonds, signifying strong investor confidence and market stability. This successful bond issuance boosts Emirates NBD's financial strength and enhances its market position.

Strategic Outlook for MENA Wealth Management Industry Market

The future of the MENA wealth management industry is bright, with substantial growth potential driven by increasing wealth, technological advancements, and supportive regulatory frameworks. Strategic partnerships, innovation in product offerings, and expansion into underserved segments will be key for success. Firms adapting to evolving consumer preferences and embracing digital transformation will be best positioned to capitalize on emerging opportunities.

MENA Wealth Management Industry Segmentation

-

1. Client Type

- 1.1. HNWIs

- 1.2. Retail/ Individuals

- 1.3. Mass Affluents

- 1.4. Other Client Types

-

2. Provider Type

- 2.1. Private Bankers

- 2.2. Fintech Advisors

- 2.3. Family Offices

- 2.4. Other Provider Types

MENA Wealth Management Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. Algeria

- 3. Egypt

- 4. United Arab Emirates

- 5. Rest of MENA Region

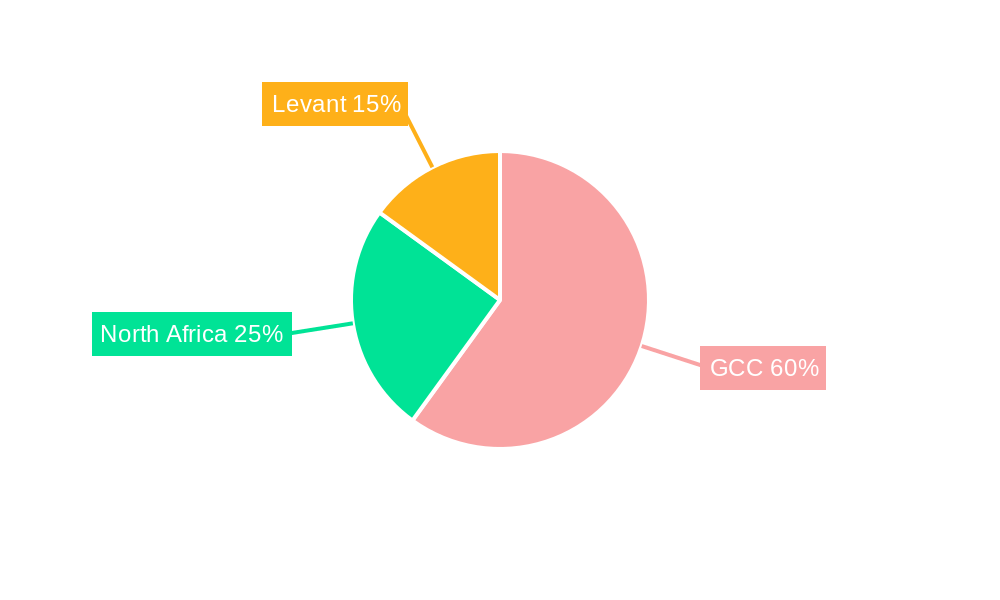

MENA Wealth Management Industry Regional Market Share

Geographic Coverage of MENA Wealth Management Industry

MENA Wealth Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of New Age Digital Platforms by Millenials; Increasing HNWI in MENA Region

- 3.3. Market Restrains

- 3.3.1. Adoption of New Age Digital Platforms by Millenials; Increasing HNWI in MENA Region

- 3.4. Market Trends

- 3.4.1. Saudi Arabia Asset Under Management Trend Shows Growth in Wealth Management Industry on MENA Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 5.1.1. HNWIs

- 5.1.2. Retail/ Individuals

- 5.1.3. Mass Affluents

- 5.1.4. Other Client Types

- 5.2. Market Analysis, Insights and Forecast - by Provider Type

- 5.2.1. Private Bankers

- 5.2.2. Fintech Advisors

- 5.2.3. Family Offices

- 5.2.4. Other Provider Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. Algeria

- 5.3.3. Egypt

- 5.3.4. United Arab Emirates

- 5.3.5. Rest of MENA Region

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 6. Saudi Arabia MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 6.1.1. HNWIs

- 6.1.2. Retail/ Individuals

- 6.1.3. Mass Affluents

- 6.1.4. Other Client Types

- 6.2. Market Analysis, Insights and Forecast - by Provider Type

- 6.2.1. Private Bankers

- 6.2.2. Fintech Advisors

- 6.2.3. Family Offices

- 6.2.4. Other Provider Types

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 7. Algeria MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 7.1.1. HNWIs

- 7.1.2. Retail/ Individuals

- 7.1.3. Mass Affluents

- 7.1.4. Other Client Types

- 7.2. Market Analysis, Insights and Forecast - by Provider Type

- 7.2.1. Private Bankers

- 7.2.2. Fintech Advisors

- 7.2.3. Family Offices

- 7.2.4. Other Provider Types

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 8. Egypt MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 8.1.1. HNWIs

- 8.1.2. Retail/ Individuals

- 8.1.3. Mass Affluents

- 8.1.4. Other Client Types

- 8.2. Market Analysis, Insights and Forecast - by Provider Type

- 8.2.1. Private Bankers

- 8.2.2. Fintech Advisors

- 8.2.3. Family Offices

- 8.2.4. Other Provider Types

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 9. United Arab Emirates MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 9.1.1. HNWIs

- 9.1.2. Retail/ Individuals

- 9.1.3. Mass Affluents

- 9.1.4. Other Client Types

- 9.2. Market Analysis, Insights and Forecast - by Provider Type

- 9.2.1. Private Bankers

- 9.2.2. Fintech Advisors

- 9.2.3. Family Offices

- 9.2.4. Other Provider Types

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 10. Rest of MENA Region MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 10.1.1. HNWIs

- 10.1.2. Retail/ Individuals

- 10.1.3. Mass Affluents

- 10.1.4. Other Client Types

- 10.2. Market Analysis, Insights and Forecast - by Provider Type

- 10.2.1. Private Bankers

- 10.2.2. Fintech Advisors

- 10.2.3. Family Offices

- 10.2.4. Other Provider Types

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NCB Capital

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Investcorp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Riyad Capital

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lazard Asset Management

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Arab National Investment Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aljazira Capital

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Emirates NBD Asset Management

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Waha Capital

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fippar Holdings

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Orange Asset Management**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 NCB Capital

List of Figures

- Figure 1: MENA Wealth Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: MENA Wealth Management Industry Share (%) by Company 2025

List of Tables

- Table 1: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 2: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 3: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 4: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 5: MENA Wealth Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: MENA Wealth Management Industry Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 8: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 9: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 10: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 11: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 14: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 15: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 16: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 17: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 19: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 20: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 21: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 22: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 23: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 26: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 27: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 28: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 29: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 31: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 32: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 33: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 34: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 35: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MENA Wealth Management Industry?

The projected CAGR is approximately 7.49%.

2. Which companies are prominent players in the MENA Wealth Management Industry?

Key companies in the market include NCB Capital, Investcorp, Riyad Capital, Lazard Asset Management, Arab National Investment Company, Aljazira Capital, Emirates NBD Asset Management, Waha Capital, Fippar Holdings, Orange Asset Management**List Not Exhaustive.

3. What are the main segments of the MENA Wealth Management Industry?

The market segments include Client Type, Provider Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of New Age Digital Platforms by Millenials; Increasing HNWI in MENA Region.

6. What are the notable trends driving market growth?

Saudi Arabia Asset Under Management Trend Shows Growth in Wealth Management Industry on MENA Region.

7. Are there any restraints impacting market growth?

Adoption of New Age Digital Platforms by Millenials; Increasing HNWI in MENA Region.

8. Can you provide examples of recent developments in the market?

January 2023: Emirates NBD Securities, a leading brokerage firm in the UAE, partnered with Abu Dhabi Securities Exchange (ADX) to provide traders with instant access to the exchange's listed companies, enabling it to offer instant trading account opening and digital onboarding to another UAE stock exchange.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MENA Wealth Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MENA Wealth Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MENA Wealth Management Industry?

To stay informed about further developments, trends, and reports in the MENA Wealth Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence