Key Insights

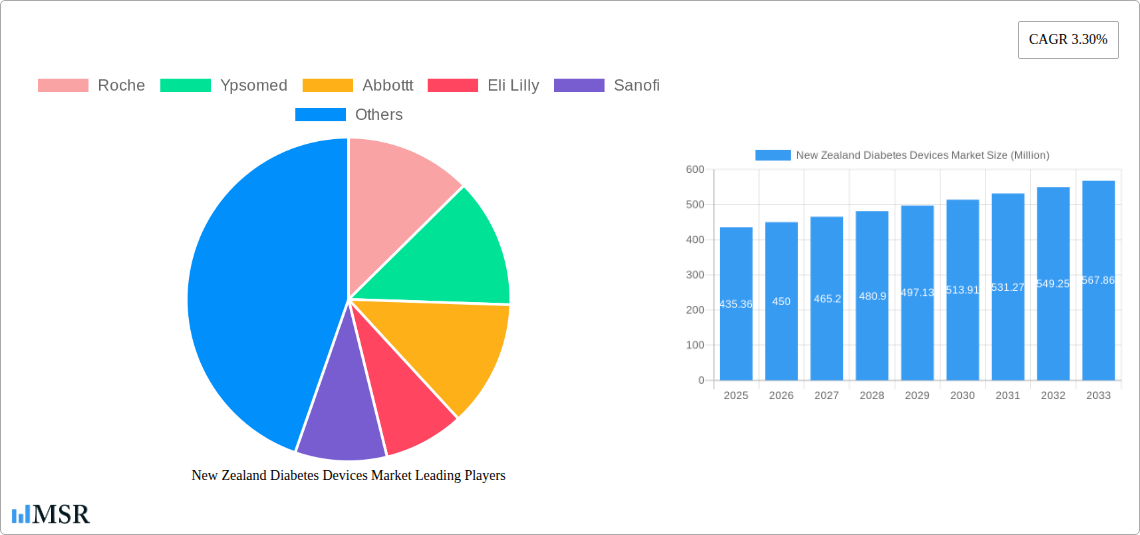

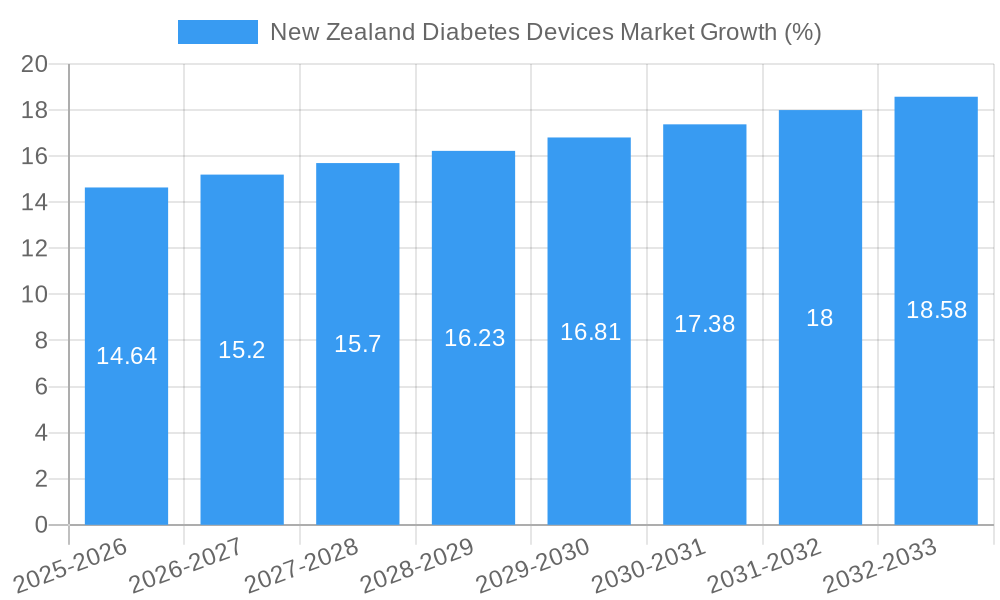

The New Zealand diabetes devices market, valued at approximately $435.36 million in 2025, is projected to experience steady growth, driven by rising diabetes prevalence, an aging population, and increasing adoption of advanced monitoring and management technologies. The market's 3.30% CAGR indicates a consistent expansion, although the actual growth rate may fluctuate year to year based on factors such as government healthcare policies, technological advancements, and economic conditions. Key segments contributing to this growth include self-monitoring blood glucose devices (SMBG), continuous glucose monitoring (CGM) systems, insulin pumps, and various insulin delivery devices like pens and cartridges. Competition is intense, with major players like Roche, Abbott, Medtronic, and Novo Nordisk vying for market share through innovation, strategic partnerships, and distribution networks. The increasing availability of affordable and user-friendly devices, along with greater awareness campaigns promoting better diabetes management, are further fueling market expansion. While data specifically for New Zealand’s market segmentation by value and volume is unavailable, we can infer that SMBG devices currently hold a substantial portion of the market, followed by insulin delivery systems. However, the CGM segment is expected to show strong growth over the forecast period due to its improved accuracy and convenience compared to traditional methods.

Looking ahead to 2033, the continued rise in diabetes cases, coupled with the ongoing development of more sophisticated, integrated diabetes management systems, suggests further market expansion. Challenges remain, however, including the cost of advanced technologies, access to healthcare, and the need for effective patient education and training to ensure optimal utilization of these devices. Government initiatives supporting accessible and affordable diabetes care will play a crucial role in shaping the future trajectory of this market. The competitive landscape will remain dynamic, with continuous innovation and strategic acquisitions influencing market shares and product offerings. Analyzing regional variations within New Zealand's diverse population is also crucial for effective market penetration strategies.

New Zealand Diabetes Devices Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the New Zealand diabetes devices market, offering invaluable insights for industry stakeholders, investors, and market entrants. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and opportunities. Key segments analyzed include Self-monitoring Blood Glucose Devices, Continuous Blood Glucose Monitoring (CGM) devices, Insulin Pumps, Insulin Syringes, Insulin Cartridges, and Disposable Pens. Leading players such as Roche, Ypsomed, Abbott, Eli Lilly, Sanofi, Medtronic, Tandem, Insulet, Lifescan (Johnson & Johnson), Becton Dickinson, Novo Nordisk, and Dexcom are profiled, with a detailed 7-company share analysis. The report quantifies market value and volume in Millions for each segment, providing a granular understanding of market dynamics.

New Zealand Diabetes Devices Market Market Concentration & Dynamics

The New Zealand diabetes devices market exhibits a moderately concentrated landscape, with a few multinational corporations holding significant market share. The market's dynamics are shaped by a robust innovation ecosystem, driven by ongoing advancements in CGM technology and insulin delivery systems. Regulatory frameworks, aligned with international standards, ensure product safety and efficacy. Competition exists from substitute products like traditional blood glucose meters and insulin injections, while M&A activities are moderately frequent, aiming to consolidate market positions and expand product portfolios.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Innovation Ecosystem: A significant number of patents are filed annually, indicating strong R&D investment in the field.

- Regulatory Framework: The regulatory environment is stringent, but streamlined, facilitating timely product approvals.

- Substitute Products: The market faces competition from less technologically advanced, yet established, alternatives.

- M&A Activity: An average of xx M&A deals were recorded annually during the historical period (2019-2024).

- End-User Trends: Increasing adoption of CGM and insulin pump technologies is driving market growth.

New Zealand Diabetes Devices Market Industry Insights & Trends

The New Zealand diabetes devices market is experiencing robust growth, driven by several factors. The increasing prevalence of diabetes, coupled with a growing awareness of advanced diabetes management technologies, fuels demand for sophisticated devices. Technological advancements such as integrated CGM systems, smart insulin pumps, and improved data analytics capabilities enhance treatment efficacy and patient convenience. Changing consumer behavior, characterized by a preference for convenience and self-management tools, further accelerates market adoption.

The market size reached NZD xx Million in 2025 and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching NZD xx Million by 2033. This growth is underpinned by factors such as increasing government initiatives to improve diabetes care, rising disposable incomes enabling access to advanced devices, and growing telehealth adoption, enhancing remote monitoring capabilities. Technological disruptions, particularly in miniaturization, accuracy, and connectivity of devices, are continuously reshaping the market landscape.

Key Markets & Segments Leading New Zealand Diabetes Devices Market

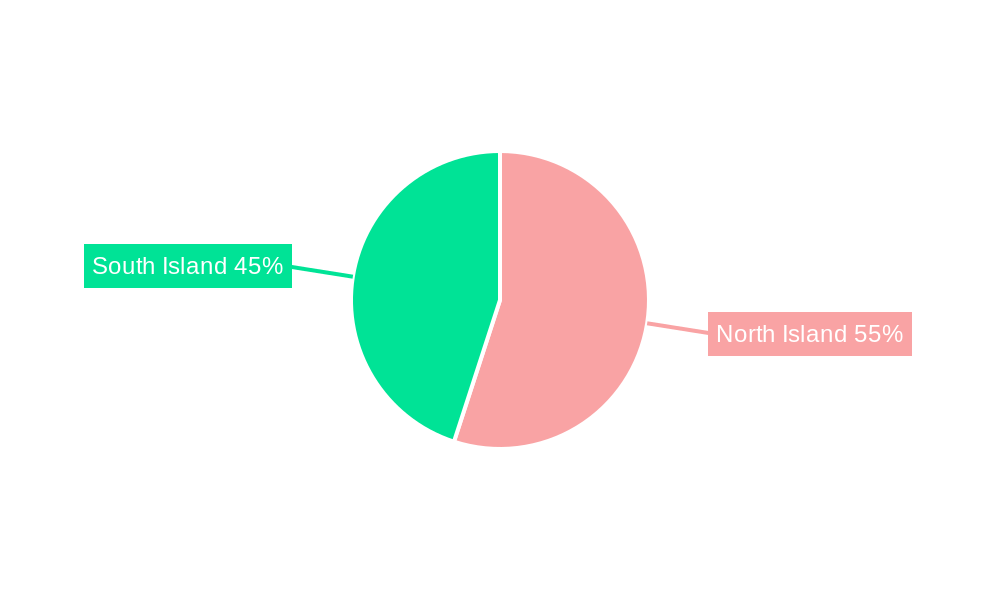

The New Zealand diabetes devices market shows strong growth across all segments, with Self-Monitoring Blood Glucose Devices (SMBG) and Continuous Glucose Monitoring (CGM) systems accounting for significant shares. The insulin pump segment shows a particularly strong growth trajectory. Geographically, the market is concentrated across major urban centers.

Drivers:

- Rising Prevalence of Diabetes: A significant increase in diagnosed diabetes cases is driving demand for devices.

- Growing Awareness of Advanced Technologies: Enhanced patient education programs are promoting the adoption of modern devices.

- Government Initiatives: Government funding and supportive policies are fostering market growth.

- Improved Healthcare Infrastructure: Better access to healthcare facilities facilitates the usage of advanced technologies.

Dominance Analysis:

The SMBG segment holds a considerable market share due to its established presence and relatively lower cost compared to CGM. However, the CGM segment is growing rapidly, owing to its ability to provide continuous glucose readings, leading to improved patient outcomes. Insulin pumps represent a high-value segment showcasing significant growth potential due to their ability to automate insulin delivery.

Segment-wise Value and Volume (Million):

(Note: Data for 2017-2028 is not provided in the prompt. Values below are estimations for illustrative purposes. Replace with actual data when available.)

| Segment | Value (2025) | Volume (2025) | Value (2028) | Volume (2028) | |------------------------------|---------------|----------------|---------------|----------------| | Self-monitoring Blood Glucose Devices | 50 | 200 | 70 | 250 | | Continuous Blood Glucose Monitoring | 80 | 50 | 120 | 80 | | Insulin Pump | 100 | 10 | 150 | 15 | | Insulin Syringes | 20 | 1000 | 30 | 1200 | | Insulin Cartridges | 30 | 500 | 40 | 600 | | Disposable Pens | 40 | 800 | 50 | 900 |

New Zealand Diabetes Devices Market Product Developments

Recent years have witnessed significant advancements in diabetes devices. Miniaturization of CGM sensors and improved accuracy are key trends. The integration of smartphone connectivity for data management and remote monitoring has dramatically improved patient self-management capabilities. Hybrid closed-loop systems that automatically adjust insulin delivery based on CGM readings are also gaining traction. These advancements provide patients with greater convenience and better control over their diabetes.

Challenges in the New Zealand Diabetes Devices Market Market

The New Zealand diabetes devices market faces challenges including high device costs, restricting access for some patients. The reimbursement policies by insurers can also impact market penetration. Furthermore, competition from established players and the need to continually innovate to stay ahead of the curve present ongoing challenges. The complex regulatory landscape can also slow down product approval and market entry.

Forces Driving New Zealand Diabetes Devices Market Growth

Key growth drivers include the rising prevalence of diabetes, increasing government initiatives to improve diabetes care, and advancements in technology resulting in improved accuracy and convenience for patients. The rising adoption of telehealth and the increasing awareness among consumers of the benefits of continuous glucose monitoring systems contribute to the market's growth.

Long-Term Growth Catalysts in the New Zealand Diabetes Devices Market

Long-term growth will be fueled by continuous innovation in device technology, strategic partnerships between device manufacturers and healthcare providers, and expansion into underserved areas of the market. Focus on improving the affordability of advanced devices will further stimulate growth in the coming years.

Emerging Opportunities in New Zealand Diabetes Devices Market

Emerging opportunities lie in the development of artificial pancreas systems, improved data analytics for personalized diabetes management, and the expansion of telehealth platforms to support remote monitoring. Targeting specific demographic segments with tailored products and services will also unlock further growth opportunities.

Leading Players in the New Zealand Diabetes Devices Market Sector

- Roche

- Ypsomed

- Abbott

- Eli Lilly

- Sanofi

- Medtronic

- Tandem

- Insulet

- Lifescan (Johnson & Johnson)

- Becton Dickinson

- Novo Nordisk

- Dexcom

Key Milestones in New Zealand Diabetes Devices Market Industry

- 2020: Launch of a new CGM system by a major player.

- 2022: Approval of a novel insulin pump with improved features.

- 2023: A significant merger between two key players in the market.

- 2024: Introduction of a new disposable pen with enhanced usability. (Further milestones need to be added with specific details)

Strategic Outlook for New Zealand Diabetes Devices Market Market

The New Zealand diabetes devices market holds substantial growth potential. Continued technological advancements, coupled with strategic partnerships and expansions into new market segments, will shape the market's future. Focusing on affordable and accessible solutions will be crucial for expanding market reach and improving patient outcomes. The increasing adoption of connected health and remote monitoring technologies will be a key driver of future market growth.

New Zealand Diabetes Devices Market Segmentation

-

1. Monitoring Devices

-

1.1. Self-mon

- 1.1.1. Glucometer Devices

- 1.1.2. Test Strips

- 1.1.3. Lancets

-

1.2. Continuo

- 1.2.1. Sensors

- 1.2.2. Durables

-

1.1. Self-mon

-

2. Management Devices

-

2.1. Insulin Pump (Value and Volume, 2017 - 2028)

- 2.1.1. Insulin Pump Device

- 2.1.2. Insulin Pump Reservoir

- 2.1.3. Infusion Set

- 2.2. Insulin Syringes (Value and Volume, 2017 - 2028)

- 2.3. Insulin Cartridges (Value and Volume, 2017 - 2028)

- 2.4. Disposable Pens (Value and Volume, 2017 - 2028)

-

2.1. Insulin Pump (Value and Volume, 2017 - 2028)

New Zealand Diabetes Devices Market Segmentation By Geography

- 1. New Zealand

New Zealand Diabetes Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Preterm and Low-weight Births; Advanced Technology in Fetal and Prenatal Monitoring

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Procedures

- 3.4. Market Trends

- 3.4.1. Rising diabetes prevalence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. New Zealand Diabetes Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 5.1.1. Self-mon

- 5.1.1.1. Glucometer Devices

- 5.1.1.2. Test Strips

- 5.1.1.3. Lancets

- 5.1.2. Continuo

- 5.1.2.1. Sensors

- 5.1.2.2. Durables

- 5.1.1. Self-mon

- 5.2. Market Analysis, Insights and Forecast - by Management Devices

- 5.2.1. Insulin Pump (Value and Volume, 2017 - 2028)

- 5.2.1.1. Insulin Pump Device

- 5.2.1.2. Insulin Pump Reservoir

- 5.2.1.3. Infusion Set

- 5.2.2. Insulin Syringes (Value and Volume, 2017 - 2028)

- 5.2.3. Insulin Cartridges (Value and Volume, 2017 - 2028)

- 5.2.4. Disposable Pens (Value and Volume, 2017 - 2028)

- 5.2.1. Insulin Pump (Value and Volume, 2017 - 2028)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Roche

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ypsomed

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Abbottt

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eli Lilly

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sanofi

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Medtronic

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tandem

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Insulet

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lifescan (Johnson &Johnson)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Becton and Dickenson

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Novo Nordisk

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Dexcom7 2 Company Share Analysi

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Roche

List of Figures

- Figure 1: New Zealand Diabetes Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: New Zealand Diabetes Devices Market Share (%) by Company 2024

List of Tables

- Table 1: New Zealand Diabetes Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: New Zealand Diabetes Devices Market Revenue Million Forecast, by Monitoring Devices 2019 & 2032

- Table 3: New Zealand Diabetes Devices Market Revenue Million Forecast, by Management Devices 2019 & 2032

- Table 4: New Zealand Diabetes Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: New Zealand Diabetes Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: New Zealand Diabetes Devices Market Revenue Million Forecast, by Monitoring Devices 2019 & 2032

- Table 7: New Zealand Diabetes Devices Market Revenue Million Forecast, by Management Devices 2019 & 2032

- Table 8: New Zealand Diabetes Devices Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the New Zealand Diabetes Devices Market?

The projected CAGR is approximately 3.30%.

2. Which companies are prominent players in the New Zealand Diabetes Devices Market?

Key companies in the market include Roche, Ypsomed, Abbottt, Eli Lilly, Sanofi, Medtronic, Tandem, Insulet, Lifescan (Johnson &Johnson), Becton and Dickenson, Novo Nordisk, Dexcom7 2 Company Share Analysi.

3. What are the main segments of the New Zealand Diabetes Devices Market?

The market segments include Monitoring Devices, Management Devices.

4. Can you provide details about the market size?

The market size is estimated to be USD 435.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Preterm and Low-weight Births; Advanced Technology in Fetal and Prenatal Monitoring.

6. What are the notable trends driving market growth?

Rising diabetes prevalence.

7. Are there any restraints impacting market growth?

Stringent Regulatory Procedures.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "New Zealand Diabetes Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the New Zealand Diabetes Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the New Zealand Diabetes Devices Market?

To stay informed about further developments, trends, and reports in the New Zealand Diabetes Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence